North America Closed System Transfer Devices Market

Market Size in USD Million

CAGR :

%

USD

635.23 Million

USD

2,606.50 Million

2024

2032

USD

635.23 Million

USD

2,606.50 Million

2024

2032

| 2025 –2032 | |

| USD 635.23 Million | |

| USD 2,606.50 Million | |

|

|

|

|

Closed System Transfer Devices Market Size

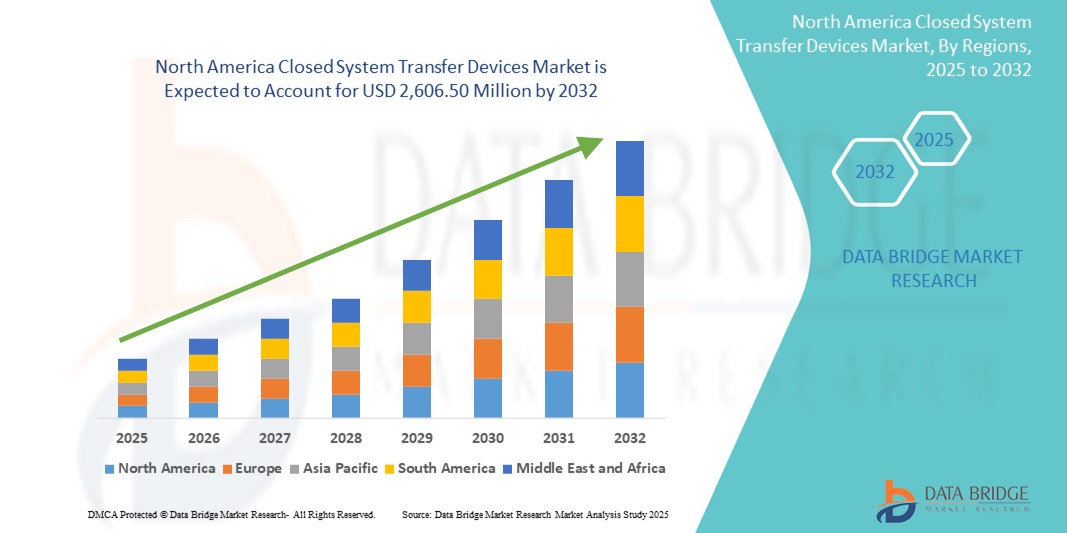

- The North America closed system transfer devices market size was valued at USD 635.23 million in 2024 and is expected to reach USD 2,606.50 million by 2032, at a CAGR of 19.30% during the forecast period

- The market growth is largely fueled by the increasing implementation of stringent occupational safety standards and the rising incidence of hazardous drug exposure among healthcare workers, particularly in oncology departments across North America. The region's focus on patient and worker safety has catalyzed the adoption of closed system transfer devices (CSTDs) in hospitals, cancer centers, and specialty clinics

- Furthermore, rising regulatory enforcement by agencies such as the U.S. Occupational Safety and Health Administration (OSHA) and recommendations from the National Institute for Occupational Safety and Health (NIOSH) are driving healthcare facilities to implement CSTDs as a standard practice to minimize exposure to cytotoxic drugs. These factors are accelerating the uptake of Closed System Transfer Device solutions, thereby significantly boosting the industry's growth across North America

Closed System Transfer Devices Market Analysis

- Closed system transfer devices, designed to minimize the risk of exposure to hazardous drugs, are increasingly vital components of modern healthcare safety protocols, particularly in oncology, pharmacy compounding, and hospital environments. These devices play a crucial role in protecting healthcare workers by preventing the escape of drug vapors and aerosols during preparation and administration

- The escalating demand for closed system transfer devices is primarily fueled by the growing emphasis on occupational safety in healthcare settings, increasing adoption of hazardous drug handling guidelines (such as USP <800> in the U.S.), and rising cancer prevalence globally that is driving the use of cytotoxic medications

- U.S. dominated the North America closed system transfer devices market with the largest revenue share of 82.3% in 2024, owing to early regulatory enforcement through USP <800> compliance measures, high healthcare expenditure, and a strong presence of key market players. The country experienced substantial growth in Closed System Transfer Devices deployment, particularly across hospitals, oncology clinics, and compounding pharmacies, driven by stringent safety mandates and the rising incidence of hazardous drug handling in cancer treatment settings

- Canada is expected to be the fastest growing country in the in North America closed system transfer devices market during the forecast period, supported by rising awareness of healthcare worker safety and the expansion of cancer treatment programs across various provinces. Regulatory efforts from Health Canada and the integration of occupational safety standards in both hospital and homecare settings have significantly driven the adoption of Closed System Transfer Devices in the country

- The Needle-Free Closed System Transfer Devices segment dominated with a 58.7% revenue share in 2024, owing to its widespread adoption in reducing needlestick injuries and contamination risk

Report Scope and Closed System Transfer Devices Market Segmentation

|

Attributes |

Closed System Transfer Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Closed System Transfer Devices Market Trends

“Rising Demand for Seamless and Intelligent Drug Containment Solutions”

- A prominent and accelerating trend in the North America closed system transfer devices (CSTDs) market is the growing emphasis on safety, efficiency, and integration of automated handling protocols in hazardous drug administration environments such as oncology wards, pharmacies, and chemotherapy units

- For instance, many hospitals across the U.S. and Canada have implemented diaphragm- and filtration-based CSTDs that help eliminate the release of harmful vapors and aerosols. These devices enhance operational safety by ensuring a secure, leak-proof interface during drug transfer, aligning with USP <800> compliance mandates

- Modern CSTD solutions now come equipped with smart safety features like color-to-color alignment systems and click-to-lock mechanisms, which simplify usage while reducing the risk of contamination or user error. Their intuitive design allows for faster staff training and higher procedural compliance in busy clinical settings

- Hospitals and oncology centers are also increasingly integrating CSTDs into broader automated compounding systems and electronic health record (EHR) platforms, facilitating better traceability and inventory management for high-risk medications

- Pharmaceutical safety protocols in North America are rapidly evolving, with regulatory agencies such as NIOSH and OSHA reinforcing the need for containment technologies in healthcare. This regulatory push is fueling demand for advanced, user-friendly CSTDs capable of integrating into existing treatment workflows without disrupting efficiency

- Consequently, manufacturers are continuously innovating to deliver solutions that improve workflow integration, user convenience, and patient safety. Companies like ICU Medical, BD, and Simplivia are leading this transformation by introducing novel systems that minimize exposure risks while meeting the needs of a rapidly growing oncology patient population

Closed System Transfer Devices Market Dynamics

Driver

“Growing Need Due to Rising Chemotherapy Exposure Risks and Drug Safety Protocols”

- The increasing emphasis on safety among healthcare professionals handling hazardous drugs, especially in oncology settings, is a major driver for the closed system transfer devices (CSTDs) market. With rising awareness of occupational exposure risks and regulatory pressure, CSTDs are gaining rapid adoption globally

- For instance, in March 2024, ICU Medical, Inc. announced the expansion of its ChemoLock CSTD product line to better support compliance with USP <800> standards, aimed at minimizing hazardous drug exposure during drug preparation and administration. Such product innovations from leading players are expected to accelerate market growth

- Healthcare providers are increasingly opting for CSTDs due to their ability to prevent the escape of drug vapors and aerosols, thereby protecting staff from unintentional contact. This is especially relevant in hospitals, oncology centers, and infusion clinics

- The growing number of cancer cases and expanding use of chemotherapeutic drugs are further fueling the demand for these devices, as CSTDs are seen as essential components of safe drug-handling protocols

- In addition, favorable reimbursement policies, increased investments in healthcare infrastructure, and rising demand for patient and worker safety are boosting CSTD adoption. These factors, combined with rising awareness and training on the benefits of CSTDs, are expected to significantly contribute to market expansion over the coming years

Restraint/Challenge

“High Cost and Operational Complexity May Hinder Adoption”

- One of the key challenges facing the closed system transfer devices market is the relatively high cost of these devices compared to traditional drug transfer methods. Hospitals and smaller clinics, particularly in developing regions, may be reluctant to invest in CSTDs due to tight budgets

- For instance, while CSTDs improve safety and reduce contamination risks, their higher unit cost and the need for staff training can deter rapid implementation across all healthcare settings

- Moreover, operational complexity and compatibility issues with existing drug vials or infusion systems can create workflow disruptions, limiting the appeal of CSTDs in fast-paced environments

- Despite growing support from regulatory agencies, including the NIOSH and FDA, limited awareness in low-income regions and lack of standardization across different systems continue to act as barriers to widespread adoption

- To overcome these challenges, manufacturers are increasingly focusing on the development of cost-effective, user-friendly CSTDs that ensure compliance while minimizing disruption to existing practices. Continuous education and training programs will also be essential to drive long-term adoption

Closed System Transfer Devices Market Scope

The market is segmented on the basis of type, component, closing mechanism, technology, end user, and distribution channel.

- By Type

On the basis of type, the closed system transfer devices market is segmented into membrane-to-membrane systems and needle-free closed system transfer devices. The Needle-Free closed system transfer devices segment dominated with a 58.7% revenue share in 2024, owing to its widespread adoption in reducing needlestick injuries and contamination risk.

The membrane-to-membrane systems segment is projected to grow at the fastest CAGR of 19.3% from 2025 to 2032, driven by its enhanced containment capabilities and increasing usage in chemotherapy drug transfers.

- By Component

On the basis of component, the closed system transfer devices market is segmented into devices and accessories. The devices segment held the largest share of 67.4% in 2024, due to being the core part of drug transfer operations, especially in hospital settings.

The accessories segment is expected to grow at the fastest CAGR of 17.8% during 2025–2032, fueled by growing demand for connectors, vial adaptors, and additional parts used in tandem with CSTDs.

- By Closing Mechanism

On the basis of closing mechanism, the market is segmented into push-to-turn systems, color-to-color alignment systems, luer-lock system, and click-to-lock systems. The Luer-Lock System segment captured the largest market share of 42.9% in 2024, attributed to its strong compatibility with IV equipment and secure drug transfer mechanism.

The Click-To-Lock Systems segment is projected to witness the fastest CAGR of 18.6% during the forecast period, favored for its intuitive use and tamper-evident features.

- By Technology

On the basis of technology, the closed system transfer devices market is segmented into diaphragm-based devices, compartmentalized devices, and air cleaning/filtration devices. The diaphragm-based devices segment dominated with a 47.2% market share in 2024, due to its reliability and effective isolation of hazardous drugs during transfers.

The air cleaning/filtration devices segment is expected to grow at the highest CAGR of 20.4% from 2025 to 2032, driven by increasing adoption in cleanroom environments and oncology labs.

- By End User

On the basis of end user, the closed system transfer devices market is segmented into hospitals, oncology centers & clinics, ambulatory surgical centers (ASCs), and academic & research institutes. The hospitals segment accounted for the largest market share of 59.3% in 2024, supported by high usage of chemotherapy drugs and strict regulatory compliance.

The oncology centers & clinics segment is anticipated to expand at the fastest CAGR of 21.1% during the forecast period, due to rising outpatient chemotherapy procedures and increasing safety protocols.

- By Distribution Channel

On the basis of distribution channel, the closed system transfer devices market is segmented into direct tender and retail sales. The direct tender segment led the market with a 74.6% revenue share in 2024, as hospitals and health systems prefer bulk procurement via government and institutional tenders.

The retail sales segment is projected to grow at a CAGR of 16.9% from 2025 to 2032, driven by increasing online availability of CSTDs and third-party distribution channels.

Closed System Transfer Devices Market Regional Analysis

- North America dominated the closed system transfer devices market with the largest revenue share of 40.01% in 2024, driven by rising demand for safe drug handling in oncology and hospital settings, stringent regulatory frameworks (such as USP <800>), and the widespread presence of key manufacturers and healthcare facilities adopting these systems

- The region’s strong healthcare infrastructure, high awareness of occupational safety, and investment in advanced medical technologies further support CSTDs adoption, particularly in the U.S.

- In addition, growing cancer incidence and increasing chemotherapy drug usage in both outpatient and inpatient settings are accelerating demand for safe, closed drug transfer mechanisms

U.S. Closed System Transfer Devices Market Insight

The U.S. closed system transfer devices market captured the largest revenue share of 82.3% in 2024 within North America, owing to the early adoption of USP <800> compliance measures and the rising incidence of cancer treatments requiring hazardous drug administration. Hospitals and oncology centers in the U.S. are actively integrating CSTDs to reduce healthcare worker exposure and maintain regulatory compliance. Furthermore, increasing clinical awareness, favorable reimbursement models, and strategic initiatives by companies like ICU Medical and Becton, Dickinson and Company are fueling continuous innovation and penetration of CSTDs in hospital pharmacies and infusion clinics nationwide.

Canada Closed System Transfer Devices Market Insight

The Canada closed system transfer devices market accounted for 10.7% of the North American market share in 2024, supported by growing awareness of healthcare worker safety and expanding cancer treatment programs across provinces. Regulatory initiatives from Health Canada and integration of occupational safety standards in healthcare settings have driven adoption of CSTDs in hospital and homecare environments. The market is further supported by collaborative procurement strategies between hospitals and provincial health systems aiming to improve chemotherapy safety protocols, along with increasing investment in oncology infrastructure.

Mexico Closed System Transfer Devices Market Insight

The Mexico closed system transfer devices market held a 7.0% share of the North American market in 2024, with growth primarily driven by increasing investments in healthcare infrastructure and a rising burden of chronic illnesses, including cancer. Although adoption is slower compared to the U.S. and Canada, initiatives aimed at improving hospital safety and compliance with international standards are gradually boosting the uptake of CSTDs. Rising awareness campaigns by international non-governmental organizations (NGOs), combined with local distributor partnerships with global CSTD manufacturers, are anticipated to further expand market access and implementation across oncology departments in the coming years.

Closed System Transfer Devices Market Share

The closed system transfer devices industry is primarily led by well-established companies, including:

- B. Braun SE (U.S.)

- ICU Medical (U.S.)

- BD (U.S.)

- EQUASHIELD (U.S.)

- Simplivia (Israel)

- Corvida Medical (U.S.)

- YUKON MEDICAL (U.S.)

- Caragen Ltd. (Canada)

- Baxter (U.S.)

- JMS North America Corporation (U.S.)

- Vygon (France)

- Epic Medical (U.S.)

Latest Developments in North America Closed System Transfer Devices Market

- In May 2022, Pulse NeedleFree Systems introduced a disposable line of needle-free livestock vaccination devices. These products leverage the advantages of needle-free technology while providing plug-and-play operational simplicity, all at a cost similar to traditional syringes and needles

- In February 2022, Zydus Cadila started supplying its needle-free anti-Covid vaccine, ZyCoV-D, to the Indian government

- In May 2025, Equashielda leading U.S.-based CSTD provider, was ranked the #1 Closed System Transfer Device in U.S. pharmacies for the 7th consecutive year, highlighting its sustained dominance in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.