North America Coagulationhemostasis Analyzer Market

Market Size in USD Billion

CAGR :

%

USD

1.51 Billion

USD

3.13 Billion

2025

2033

USD

1.51 Billion

USD

3.13 Billion

2025

2033

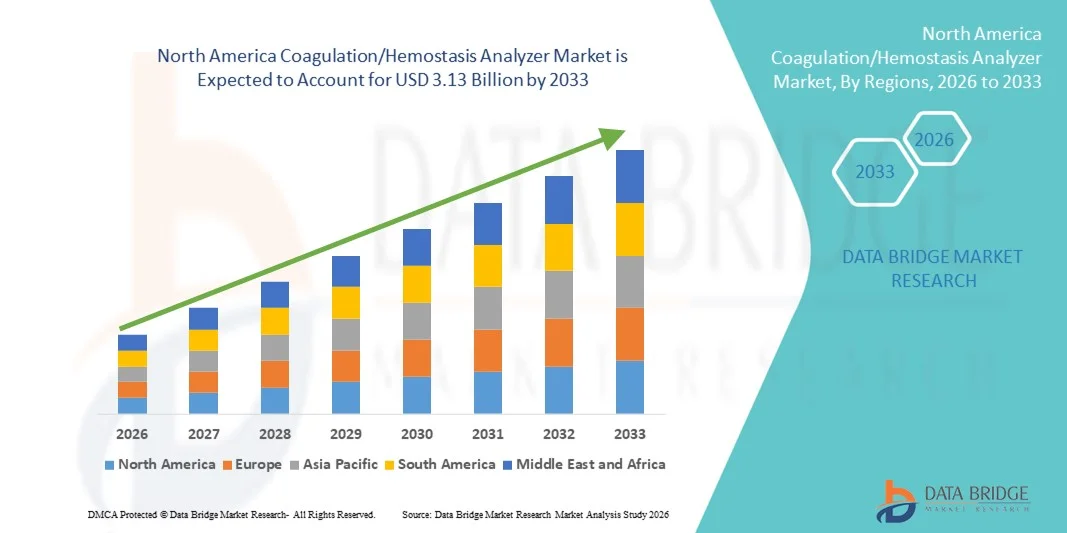

| 2026 –2033 | |

| USD 1.51 Billion | |

| USD 3.13 Billion | |

|

|

|

|

North America Coagulation/Hemostasis Analyzer Market Size

- The North America coagulation/hemostasis analyzer market size was valued at USD 1.51 billion in 2025 and is expected to reach USD 3.13 billion by 2033, at a CAGR of 9.55% during the forecast period

- The market growth is largely fueled by strong healthcare infrastructure, rising prevalence of blood clotting and cardiovascular disorders, and increasing clinical adoption of advanced diagnostic platforms in hospitals and clinical labs across the U.S. and Canada

- Furthermore, rapid technological advancements in automated and point‑of‑care hemostasis testing, growing demand for faster and more accurate diagnostics, and rising patient awareness of coagulation health are establishing coagulation and hemostasis analyzers as essential diagnostic tools in modern healthcare settings, significantly accelerating regional uptake and boosting industry growth

North America Coagulation/Hemostasis Analyzer Market Analysis

- Coagulation and hemostasis analyzers, providing automated or semi-automated assessment of blood clotting parameters, are increasingly essential in modern diagnostic laboratories, hospitals, and point-of-care settings due to their high accuracy, rapid testing capabilities, and seamless integration with laboratory information systems

- The escalating demand for coagulation/hemostasis analyzers is primarily fueled by the rising prevalence of cardiovascular and bleeding disorders, increasing clinical adoption of advanced diagnostic tools, and the growing need for faster, more reliable patient testing

- The United States dominated the North America coagulation/hemostasis analyzer market with the largest revenue share of 75.3% in 2025, driven by strong healthcare infrastructure, high healthcare expenditure, early adoption of advanced laboratory technologies, and the presence of key industry players

- Canada is expected to be the fastest-growing country in the North America market during the forecast period due to rising healthcare investments, increasing awareness of coagulation disorders, and expanding clinical laboratory networks

- The APTT segment dominated the market in 2025 with a market share of 38.9%, driven by its widespread clinical use for routine monitoring of coagulation status and therapeutic management of anticoagulant treatments

Report Scope and North America Coagulation/Hemostasis Analyzer Market Segmentation

|

Attributes |

North America Coagulation/Hemostasis Analyzer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Coagulation/Hemostasis Analyzer Market Trends

Automation and AI-Enabled Diagnostics

- A significant and accelerating trend in the North America coagulation/hemostasis analyzer market is the growing integration of automation and AI-enabled diagnostics in both clinical laboratories and point-of-care settings, enhancing testing speed, accuracy, and workflow efficiency

- For instance, advanced automated analyzers from companies such as Sysmex and Instrumentation Laboratory incorporate AI algorithms to reduce manual intervention, enabling faster turnaround times and minimizing human errors in coagulation testing

- AI integration enables features such as predictive risk analysis, identification of abnormal clotting patterns, and intelligent flagging of critical results. For instance, certain ACL TOP analyzers use AI to optimize test calibration and alert clinicians of potential anomalies in patient samples

- The seamless integration of analyzers with laboratory information systems and electronic health records facilitates centralized patient data management, allowing clinicians to monitor coagulation status and treatment response from a single interface

- The trend toward remote monitoring capabilities is gaining traction, enabling clinicians to access real-time coagulation results from multiple locations. For instance, cloud-connected analyzers from Siemens Healthineers allow remote supervision of test results across hospital networks

- This trend toward more automated, intelligent, and integrated diagnostic platforms is fundamentally reshaping laboratory operations, prompting companies such as Siemens Healthineers to develop AI-enhanced analyzers that streamline workflow while maintaining high accuracy and reliability

- The demand for AI-enabled coagulation and hemostasis analyzers is growing rapidly across hospitals, diagnostic centers, and specialized clinics, as healthcare providers increasingly prioritize efficiency, reliability, and comprehensive patient monitoring

North America Coagulation/Hemostasis Analyzer Market Dynamics

Driver

Increasing Demand Due to Rising Cardiovascular and Bleeding Disorders

- The rising prevalence of cardiovascular diseases, thrombotic conditions, and bleeding disorders, coupled with increasing awareness of coagulation health, is a significant driver for the growing adoption of coagulation/hemostasis analyzers

- For instance, in March 2025, Instrumentation Laboratory launched an updated ACL TOP analyzer series with advanced testing capabilities for APTT and PT, highlighting innovations that support rapid diagnosis and monitoring of coagulation disorders

- As healthcare providers seek faster, more accurate, and reliable diagnostic results, coagulation/hemostasis analyzers offer automated testing, real-time data reporting, and integration with hospital information systems, providing a compelling alternative to manual testing methods

- Furthermore, the expanding adoption of point-of-care testing solutions in emergency rooms, surgical centers, and outpatient clinics is making these analyzers essential for timely clinical decision-making

- The ability to monitor anticoagulant therapy, track patient response, and manage blood clotting risks efficiently is driving market growth, with user-friendly analyzers supporting both hospital and decentralized clinical environments

- Increasing investments by hospitals and diagnostic chains in modern laboratory infrastructure is further propelling the demand. For instance, U.S. hospital networks are upgrading labs with automated coagulation analyzers to enhance throughput and reduce human error

- Rising collaborations between analyzer manufacturers and healthcare IT providers to offer integrated diagnostic solutions is also a key driver. For instance, cloud-enabled analyzers allow seamless reporting to electronic health record systems for better patient management

- Growing awareness and proactive management of perioperative and critical care coagulation disorders among clinicians are encouraging rapid adoption of advanced analyzers in high-volume healthcare settings

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high cost of advanced coagulation/hemostasis analyzers compared to traditional testing methods is a significant challenge, limiting adoption in smaller laboratories and price-sensitive healthcare settings

- For instance, sophisticated analyzers with AI-assisted diagnostics or fully automated systems can cost multiple times more than conventional coagulation instruments, making initial investment a barrier for some hospitals and clinics

- Regulatory compliance and quality control requirements, including FDA approvals and adherence to ISO standards, also pose challenges for manufacturers and laboratories, potentially delaying product launches or implementation

- Limited availability of trained personnel to operate and maintain advanced analyzers can hinder adoption in smaller or remote clinical facilities. For instance, some hospitals require specialized staff to manage AI-enabled systems and ensure accurate testing

- Data privacy and cybersecurity concerns related to connected analyzers pose an additional challenge, as patient coagulation data must be securely transmitted and stored. For instance, network-connected analyzers must comply with HIPAA and other regional regulations

- Addressing these challenges through more cost-effective analyzer models, streamlined regulatory support, and clear operator training programs will be vital for sustained market growth and broader adoption in the North America region

- Developing service and maintenance networks to support advanced analyzers in smaller or decentralized labs is also essential to enhance adoption and ensure reliability

North America Coagulation/Hemostasis Analyzer Market Scope

The market is segmented on the basis of type of test, product, technology, and end use.

- By Type of Test

On the basis of type of test, the market is segmented into ACT, APTT, D-Dimer testing, platelet function test, prothrombin time testing, anti-factor XA test, heparin, protamine dose-response test, fibrinogen testing, and others. The APTT testing segment dominated the market with the largest revenue share of 38.9% in 2025, driven by its critical role in monitoring intrinsic and common coagulation pathways and anticoagulant therapy, particularly heparin treatment. Hospitals and clinical laboratories heavily rely on APTT testing due to its accuracy in detecting coagulation abnormalities, ensuring patient safety, and guiding therapy decisions. Its widespread clinical adoption in both routine and emergency care makes it a preferred choice among healthcare providers. The segment benefits from high automation in laboratory analyzers, reducing manual errors and improving throughput. In addition, APTT tests are compatible with a wide range of analyzer technologies, making them suitable for both centralized labs and point-of-care setups. Its integration with electronic health records and laboratory information systems enhances workflow efficiency and patient data management.

The D-Dimer testing segment is expected to witness the fastest growth during 2026–2033, fueled by increasing awareness and early diagnosis of thrombotic disorders, including deep vein thrombosis (DVT) and pulmonary embolism (PE). D-Dimer testing is crucial for ruling out venous thromboembolism in emergency and outpatient settings, which drives demand in hospitals and diagnostic labs. The rising prevalence of cardiovascular disorders and postoperative complications is further boosting its adoption. Advancements in point-of-care D-Dimer analyzers are enabling faster turnaround times, supporting immediate clinical decisions. Integration with automated analyzers and AI-assisted predictive analysis is improving test accuracy and efficiency. Moreover, growing research applications in monitoring fibrinolytic therapy and coagulation management contribute to the segment’s rapid growth trajectory.

- By Product

On the basis of product, the market is segmented into Point-of-Care (POC) testing analyzers and clinical laboratory analyzers. The Clinical Laboratory Analyzer segment dominated the market in 2025 with the largest revenue share of 60%, driven by its high throughput, precision, and ability to perform multiple coagulation and hemostasis tests simultaneously. These analyzers are widely adopted in hospitals, diagnostic laboratories, and specialized coagulation centers due to their reliability and integration with laboratory information systems. Clinical analyzers support automation and advanced testing protocols such as APTT, PT, and Anti-Factor Xa assays, making them indispensable in high-volume healthcare settings. Their adoption is further supported by regulatory approvals, validated performance, and compatibility with standardized reagents. The segment benefits from strong demand in the U.S., where healthcare infrastructure and investment in modern laboratories are extensive. In addition, the ability to handle complex testing requirements for critical patients reinforces its dominance.

The POC Testing Analyzer segment is expected to witness the fastest growth from 2026 to 2033 due to the rising need for rapid, bedside coagulation testing in emergency departments, operating rooms, and outpatient clinics. POC analyzers enable immediate clinical decision-making and reduce the delay in treatment caused by central laboratory testing. Technological advancements have improved portability, ease-of-use, and result accuracy in POC devices, encouraging broader adoption. The growing prevalence of cardiovascular disorders and anticoagulant therapy monitoring drives demand for decentralized testing. Integration with cloud-based systems and mobile applications allows remote monitoring and patient management, further boosting growth. The convenience and speed of POC analyzers make them particularly attractive in critical care and surgical settings.

- By Technology

On the basis of technology, the market is segmented into electrochemical, optical, and mechanical. The Optical technology segment dominated the market in 2025 with the largest revenue share of 52%, driven by its high accuracy, reliability, and ability to provide real-time monitoring of clot formation, clot strength, and fibrinolysis. Optical coagulation analyzers are widely preferred in clinical laboratories and POC settings for APTT, PT, and D-Dimer testing due to precise photometric detection of coagulation reactions. Their compatibility with automated analyzers and integration with laboratory information systems makes them ideal for high-volume testing. Optical technology also supports multiple test formats, including endpoint and kinetic assays, enhancing versatility. Healthcare providers value the reproducibility and sensitivity offered by optical systems for critical patient care. Furthermore, manufacturers continue to innovate optical analyzers with AI-assisted algorithms for predictive and enhanced diagnostic insights.

The Electrochemical technology segment is expected to witness the fastest growth from 2026 to 2033 due to increasing demand for miniaturized, portable, and point-of-care devices that deliver rapid coagulation results. Electrochemical sensors allow compact analyzer designs, enabling bedside testing and outpatient use. This technology supports integration with digital health platforms for remote monitoring and patient data tracking. Its growing adoption is fueled by demand for personalized anticoagulation therapy management and decentralized healthcare solutions. Advancements in sensor sensitivity, stability, and automation are further accelerating growth. Electrochemical analyzers also offer cost-effective solutions for smaller clinics and laboratories. The ability to deliver rapid, accurate results in non-laboratory settings is a key factor driving adoption.

- By End Use

On the basis of end use, the market is segmented into clinical laboratories and point-of-care (POC). The Clinical Laboratories segment dominated the market in 2025 with a revenue share of 65%, driven by its capacity to perform high-throughput, multi-test coagulation analysis with greater accuracy and reproducibility. Hospitals and specialized laboratories rely on clinical laboratory analyzers for routine testing, complex coagulation studies, and therapeutic monitoring. Automation, integration with electronic health records, and validated testing protocols enhance operational efficiency. The segment benefits from significant adoption in the United States, where advanced healthcare infrastructure supports sophisticated laboratory setups. Regulatory compliance, standardized testing procedures, and availability of skilled personnel reinforce the segment’s dominance. Clinical laboratories are also central to research and clinical trials, further boosting analyzer demand.

The Point-of-Care (POC) segment is expected to witness the fastest growth from 2026 to 2033 due to the increasing need for rapid bedside testing in emergency departments, operating rooms, and outpatient clinics. POC analyzers enable immediate clinical decision-making, reduce treatment delays, and improve patient outcomes. The rising prevalence of cardiovascular disorders and anticoagulation therapy is driving demand for portable, easy-to-use devices. Integration with mobile applications and cloud-based systems allows remote monitoring and data management. Technological advancements in miniaturization, automation, and connectivity are accelerating adoption. Growing awareness among clinicians and patients regarding the benefits of rapid testing contributes to the segment’s high growth potential.

North America Coagulation/Hemostasis Analyzer Market Regional Analysis

- The United States dominated the North America coagulation/hemostasis analyzer market with the largest revenue share of 75.3% in 2025, driven by strong healthcare infrastructure, high healthcare expenditure, early adoption of advanced laboratory technologies, and the presence of key industry players

- Healthcare providers in the region prioritize accuracy, rapid turnaround, and integration with laboratory information systems, making coagulation and hemostasis analyzers essential in hospitals, diagnostic centers, and specialized coagulation clinics

- This widespread adoption is further supported by high healthcare expenditure, the presence of key market players, and growing demand for point-of-care testing and automated analyzers, establishing these devices as a preferred solution for both clinical laboratories and bedside patient monitoring

The U.S. Coagulation/Hemostasis Analyzer Market Insight

The U.S. coagulation/hemostasis analyzer market captured the largest revenue share of 75.3% in 2025 within North America, fueled by widespread adoption of advanced diagnostic technologies and robust healthcare infrastructure. Hospitals and clinical laboratories are increasingly prioritizing rapid, accurate, and automated coagulation testing to manage cardiovascular and bleeding disorders. Growing demand for point-of-care testing and AI-enabled analyzers further propels the market. Moreover, the integration of laboratory information systems and electronic health records enhances workflow efficiency and patient management, supporting the expansion of coagulation and hemostasis analyzers across both inpatient and outpatient settings.

Canada Coagulation/Hemostasis Analyzer Market Insight

The Canada coagulation/hemostasis analyzer market is expected to grow at a significant CAGR during the forecast period, driven by rising healthcare expenditure, government initiatives to improve diagnostic capabilities, and growing awareness of coagulation disorders. The adoption of automated and point-of-care analyzers is increasing in hospitals, diagnostic centers, and specialized clinics. Furthermore, the focus on improving patient outcomes through faster, reliable testing is fueling market growth. Integration with electronic health systems and the expansion of laboratory networks across major cities is supporting the adoption of coagulation testing solutions.

Mexico Coagulation/Hemostasis Analyzer Market Insight

The Mexico market for coagulation/hemostasis analyzers is anticipated to expand steadily due to improvements in healthcare infrastructure, increasing prevalence of cardiovascular and thrombotic disorders, and growing demand for reliable diagnostic testing. Hospitals and clinical laboratories are investing in automated analyzers to improve testing accuracy and efficiency. The rising trend of private healthcare facilities and diagnostic chains is further propelling market growth. In addition, awareness campaigns on coagulation health and government support for modernizing laboratories are encouraging adoption. Emerging point-of-care testing solutions are also contributing to market expansion in both urban and semi-urban regions.

North America Coagulation/Hemostasis Analyzer Market Share

The North America Coagulation/Hemostasis Analyzer industry is primarily led by well-established companies, including:

- Sysmex America, Inc. (U.S.)

- Helena Laboratories Corporation (U.S.)

- Werfen (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- HemoSonics, LLC (U.S.)

- Abbott (U.S.)

- International Technidyne Corporation (U.S.)

- Diagnostica Stago, Inc. (France)

- Siemens Healthineers AG (Germany)

- F. Hoffmann La Roche Ltd (Switzerland)

- NIHON KOHDEN CORPORATION (Japan)

- HORIBA, Ltd. (Japan)

- Medtronic (Ireland)

- BIOMÉRIEUX (France)

- Danaher Corporation (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Trivitron Healthcare (India)

- Biosynex SA (France)

- Universal Biosensors Pty Ltd (Australia)

What are the Recent Developments in North America Coagulation/Hemostasis Analyzer Market?

- In September 2025, HemoSonics received expanded FDA 510(k) clearance to use its Quantra® Hemostasis System for obstetric procedures, making it the first and only FDA‑cleared viscoelastic testing platform for managing postpartum hemorrhage and delivering real‑time coagulation insights at the point of care

- In June 2025, Sysmex America announced that its Automated Blood Coagulation Analyzer CN‑6000™ received U.S. FDA 510(k) clearance, covering key hemostasis reagents for tests including PT/INR, APTT, fibrinogen, antithrombin, and D‑dimer enabling high‑throughput, fully automated testing and positioning the CN‑6000 for launch in North American clinical labs

- In March 2025, Werfen commercialized its ACL TOP® Family 70 Series Hemostasis Testing Systems in North America following FDA 510(k) clearance and Health Canada licensure, offering a next‑generation portfolio that enhances workflow automation, centralized quality control, and integrated data management across hospital laboratories

- In April 2024, Haemonetics Corporation received U.S. FDA 510(k) clearance for its new TEG® 6s Global Hemostasis‑HN assay cartridge, extending the capabilities of its TEG 6s hemostasis analyzer system to serve fully heparinized patients in adult cardiovascular surgeries, procedures, and liver transplant applications, enabling comprehensive laboratory and point‑of‑care viscoelastic testing

- In June 2023, the FDA granted 510(k) clearance (K231031) for the ACL TOP Family 70 Series coagulation analyzers from Instrumentation Laboratory (Werfen), enabling regulatory support for the line’s commercialization and adoption in North American clinical settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.