North America Cold Chain Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

85.60 Billion

USD

153.50 Billion

2025

2032

USD

85.60 Billion

USD

153.50 Billion

2025

2032

| 2026 –2032 | |

| USD 85.60 Billion | |

| USD 153.50 Billion | |

|

|

|

|

North America Cold Chain Monitoring Market Size

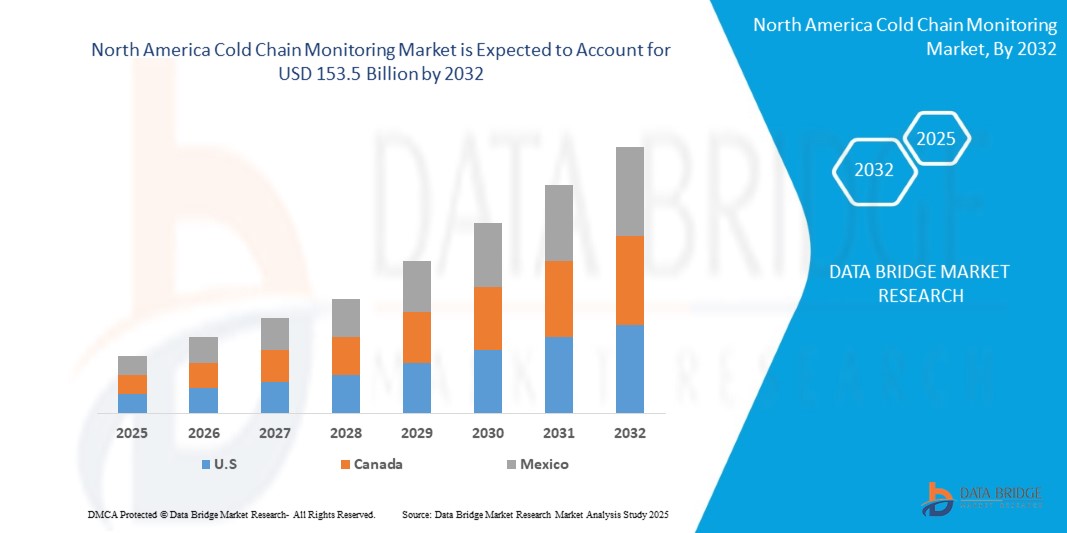

- The North America cold chain monitoring market size was valued at USD 85.6 billion in 2025 and is expected to reach USD 153.5 billion by 2032, at a CAGR of 8.7% during the forecast period.

- The market growth is primarily driven by the increasing need for real-time visibility and control over temperature-sensitive products, coupled with stringent regulatory requirements for product safety and quality across various industries.

- Furthermore, the rising demand for perishable goods, biologics, and vaccines, along with the growing adoption of IoT and cloud-based solutions for enhanced supply chain efficiency, is accelerating the demand for robust cold chain monitoring systems in the region.

North America Cold Chain Monitoring Market Analysis

- Cold chain monitoring systems, offering continuous tracking and management of temperature-sensitive goods during transit and storage, are increasingly vital across North America, particularly for pharmaceuticals, food & beverages, and chemicals, due to their critical role in ensuring product integrity and regulatory compliance.

- The escalating demand for these systems is primarily fueled by stringent regulations set by agencies such as the FDA and USDA, a growing emphasis on reducing product spoilage and waste, and the expansion of complex supply chains requiring precise temperature control.

- The U.S. dominates the North America cold chain monitoring market with the largest revenue share, characterized by its advanced logistics infrastructure, high volume of pharmaceutical and food product shipments, and strong focus on supply chain transparency. Canada and Mexico are also experiencing substantial growth due to increasing cross-border trade and investment in cold chain logistics.

- The Pharmaceuticals & Healthcare segment is expected to dominate the market, driven by the critical need for temperature control for vaccines, biopharmaceuticals, and other healthcare products, alongside evolving regulatory frameworks.

Report Scope and North America Cold Chain Monitoring Market Segmentation

|

Attributes |

North America Cold Chain Monitoring Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

The The continuous evolution of IoT, AI, and cloud computing technologies is fueling investment in advanced digital cold chain monitoring platforms. Companies capable of offering real-time visibility, predictive analytics, and automated alert systems through scalable, integrated solutions will benefit from the growing need for enhanced supply chain efficiency, proactive risk management, and data-driven decisions in temperature-controlled environments |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Cold Chain Monitoring Market Trends

“Emphasis on Real-time Visibility and Predictive Analytics”

- A significant and accelerating trend in the North America cold chain monitoring market is the increasing adoption of real-time monitoring solutions integrated with advanced analytics, including AI and machine learning. This shift enables stakeholders to gain immediate insights into the conditions of their temperature-sensitive shipments, moving beyond traditional data logging.

- For instance, companies like Sensitech are offering cloud-based platforms that provide live data on temperature, humidity, and location, allowing for proactive intervention if deviations occur. Furthermore, Verigo's wireless temperature monitoring solutions provide instant access to data via mobile devices, streamlining compliance and quality control.

- The integration of AI in cold chain monitoring facilitates predictive analytics, allowing businesses to anticipate potential temperature excursions or supply chain disruptions before they happen. This helps in optimizing routes, minimizing spoilage, and ensuring product efficacy. For example, some platforms can analyze historical data to predict optimal shipping conditions or identify at-risk segments of the supply chain.

- This trend towards more intelligent, connected, and proactive monitoring systems is fundamentally reshaping how temperature-sensitive goods are transported and stored across North America. Consequently, there's a growing demand for solutions that offer not just data, but actionable insights to improve operational efficiency and reduce waste.

- The seamless integration of monitoring devices with cloud platforms and enterprise resource planning (ERP) systems facilitates centralized control and data management, creating a unified and automated cold chain environment.

North America Cold Chain Monitoring market Dynamics

Driver

“Strict Regulatory Compliance and Growing Demand for Perishable Goods”

- The increasing stringency of regulations from bodies like the FDA for pharmaceuticals and biologics, and the USDA for food products, is a significant driver for the heightened demand for cold chain monitoring solutions across North America. Compliance with these regulations mandates precise temperature control and detailed record-keeping throughout the supply chain to ensure product safety, quality, and efficacy.

- For instance, the FDA's guidelines for good distribution practices (GDP) for pharmaceutical products necessitate robust temperature monitoring systems to prevent spoilage and maintain drug integrity. Similarly, the growing consumer demand for fresh, organic, and exotic food products, alongside the expansion of e-commerce for groceries, places immense pressure on the food industry to maintain an unbroken cold chain.

- The expansion of the biologics and vaccine markets, which are inherently temperature-sensitive, further amplifies the need for reliable monitoring. The COVID-19 pandemic, for example, highlighted the critical importance of ultra-low temperature monitoring for vaccine distribution, spurring innovation and investment in advanced cold chain technologies.

- This dual pressure from regulatory mandates and evolving consumer preferences for high-quality perishable goods is propelling the adoption of advanced cold chain monitoring systems in both traditional and emerging distribution channels.

Restraint/Challenge

“High Initial Investment and Data Management Complexities”

- Concerns surrounding the high initial capital expenditure required for implementing comprehensive cold chain monitoring systems, particularly for smaller and medium-sized enterprises (SMEs), pose a significant challenge to broader market penetration. The cost includes not only the monitoring hardware (sensors, loggers, RFID) but also software platforms, integration with existing IT infrastructure, and training.

- For instance, deploying a sophisticated real-time monitoring system across a large fleet of refrigerated vehicles or a vast network of cold storage facilities can involve substantial upfront costs, which may deter businesses with limited budgets. Additionally, the ongoing maintenance and calibration of monitoring devices add to the operational expenses.

- Furthermore, the complexities associated with managing and analyzing the vast amounts of data generated by cold chain monitoring systems can be a restraint. Without robust data analytics capabilities and trained personnel, businesses can struggle to derive meaningful insights from the data, leading to underutilization of the monitoring infrastructure.

- Addressing these challenges through more affordable, scalable, and user-friendly solutions, along with robust data management and visualization tools, will be vital for sustained market growth. Education on the long-term ROI of cold chain monitoring, including reduced spoilage and enhanced compliance, is also crucial.

North America Cold Chain Monitoring Market Scope

The market is segmented on the basis of component, application, temperature type, and end-user.

- By Component

On the basis of component, the North America cold chain monitoring market is segmented into hardware (sensors, RFID devices, telematics, data loggers, others), software, and services. The hardware segment dominates the largest market revenue share, driven by the increasing deployment of various sensing and tracking devices across the cold chain. Sensors and data loggers are fundamental for real-time temperature and humidity monitoring, while RFID and telematics enhance visibility and asset tracking.

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for sophisticated analytics, predictive capabilities, and cloud-based platforms to manage and interpret data efficiently. Software solutions offer real-time insights, alert management, and comprehensive reporting, crucial for operational efficiency and regulatory compliance.

- By Application

On the basis of application, the North America cold chain monitoring market is segmented into pharmaceuticals & healthcare, food & beverages, chemicals, agriculture, and others. The pharmaceuticals & healthcare segment accounted for the largest market revenue share in 2024, driven by the critical need for maintaining specific temperature ranges for vaccines, biologics, and other life-saving drugs. Stringent regulatory mandates and the high value of these products necessitate precise and continuous monitoring.

The food & beverages segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing consumer demand for fresh and perishable foods, rising concerns over food safety, and expanding e-commerce for groceries. Effective cold chain monitoring in this sector helps minimize spoilage, reduce waste, and ensure product quality from farm to fork.

- By Temperature Type

On the basis of temperature type, the North America cold chain monitoring market is segmented into frozen, chilled, and ambient. The chilled segment held the largest market revenue share in 2025, driven by the extensive transportation and storage requirements for fresh produce, dairy products, and certain pharmaceuticals that need to be kept above freezing but below ambient temperatures. This segment accounts for a significant volume of perishable goods.

The frozen segment is expected to witness a significant CAGR from 2025 to 2032, propelled by the growing demand for frozen foods, ice cream, and ultra-low temperature requirements for certain vaccines and specialized biologics. The complexity and energy intensity of maintaining frozen conditions necessitate robust monitoring solutions.

- By End-User

On the basis of end-user, the North America cold chain monitoring market is segmented into pharmaceutical companies, hospitals & clinics, food & beverage companies, retail & supermarkets, logistics & distribution companies, and others. The logistics & distribution companies segment accounted for the largest market revenue share in 2024, as they are central to the movement and storage of temperature-sensitive goods across various industries. These companies invest heavily in monitoring solutions to provide end-to-end visibility and ensure compliance for their clients.

The pharmaceutical companies segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the high value and extreme temperature sensitivity of their products, coupled with increasing regulatory scrutiny on pharmaceutical supply chain integrity. Investments in robust monitoring solutions are crucial for maintaining drug efficacy and patient safety.

North America Cold Chain Monitoring Market Regional Analysis

- The U.S. dominates the North America cold chain monitoring market with the largest revenue share, driven by its well-established pharmaceutical and food industries, stringent regulatory environment, and high adoption rate of advanced supply chain technologies. The country's extensive logistics network and significant investments in smart cold chain solutions further contribute to its leading position.

- Consumers and businesses in the U.S. highly value real-time visibility, advanced analytics, and seamless integration offered by cold chain monitoring systems for ensuring product quality and compliance. This widespread adoption is supported by a technologically mature market and a strong focus on risk mitigation in temperature-sensitive supply chains.

U.S. Cold Chain Monitoring Market Insight

U.S. cold chain monitoring market captured the largest revenue share within North America, fueled by the rapid expansion of its pharmaceutical and biotech sectors, coupled with an increasing emphasis on food safety and waste reduction. The country's robust regulatory framework (e.g., FDA regulations) mandates precise temperature control and traceability for sensitive products, driving the adoption of sophisticated monitoring technologies. Furthermore, the growing prevalence of omnichannel retail and the increasing complexity of supply chains necessitate advanced monitoring solutions to maintain product integrity from production to the end consumer. The market also benefits from a strong ecosystem of technology providers and logistics companies investing in cutting-edge cold chain infrastructure.

Canada Cold Chain Monitoring Market Insight

The Canadian cold chain monitoring market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing cross-border trade with the U.S., a growing pharmaceutical manufacturing base, and rising consumer demand for fresh and imported food products. The country's vast geography and challenging climate conditions make robust cold chain management essential. Investments in modernized logistics infrastructure and the adoption of IoT-enabled monitoring solutions are key factors contributing to market growth. Additionally, government initiatives to enhance food safety and drug security are further accelerating the demand for comprehensive cold chain monitoring systems.

Mexico Cold Chain Monitoring Market Insight

The Mexican cold chain monitoring market is expected to expand at a considerable CAGR during the forecast period, fueled by growing foreign direct investment in its manufacturing sector, particularly in pharmaceuticals and processed foods, and its strategic position as a trade hub between North and South America. The increasing sophistication of its logistics industry, coupled with rising awareness of international quality and safety standards, is driving the adoption of cold chain monitoring technologies. Furthermore, the expansion of modern retail formats and the e-commerce sector for perishable goods are creating significant opportunities for market growth in Mexico.

North America Cold Chain Monitoring Market share

The competitive landscape of the precision harvesting market is characterized by a blend of established agricultural machinery manufacturers and innovative agri-tech startups. Market share is predominantly shaped by a company's ability to offer comprehensive, "full-stack" solutions that effectively integrate hardware, software, and advanced analytics. Key competitive advantages include extensive distribution networks, a strong global presence, strategic collaborations, and a persistent focus on R&D and platform integration capabilities.

The following companies are recognized as major players in the Content Marketing Software market:

- Sensitech (U.S.)

- ELPRO (Switzerland)

- Verigo (U.S.)

- ORBCOMM (U.S.)

- Carrier Global Corporation (U.S.)

- Emerson Electric Co. (U.S.)

- Monnit Corporation (U.S.)

- Tempmate (Germany)

- Controlant (Iceland)

- LogiTag Systems (Israel)

- TrakCel (U.K.)

- Oceasoft (France)

- KRYO.sys (Germany)

- Roambee (U.S.)

- Dicor (U.S.)

- Savik Global (U.S.)

- Cold Chain Technologies (U.S.)

- Berlinger & Co. AG (Switzerland)

- Testo SE & Co. KGaA (Germany)

- Securecell AG (Switzerland)

Latest Developments in North America Cold Chain Monitoring Market

- In January 2024, Sensitech, a leading provider of supply chain visibility solutions, announced the expansion of its real-time monitoring capabilities for pharmaceutical shipments, offering enhanced traceability and temperature excursion management for critical biologics and vaccines across North America. This development aims to further support pharmaceutical companies in meeting stringent regulatory requirements and ensuring product integrity.

- In November 2023, ORBCOMM, a global provider of IoT solutions, launched new cold chain telematics devices tailored for temperature-controlled transportation in North America. These devices offer improved sensor accuracy, longer battery life, and seamless integration with existing logistics platforms, allowing carriers to optimize efficiency and compliance.

- In July 2023, Verigo, a U.S.-based developer of wireless cold chain monitoring solutions, partnered with a major food distributor in Canada to deploy its real-time temperature loggers across their fresh produce supply chain. This collaboration aims to minimize spoilage and enhance food safety for consumers throughout Canada.

- In April 2023, Carrier Global Corporation announced the acquisition of a leading North American cold chain software provider, strengthening its digital offerings in refrigeration and temperature-controlled logistics. This acquisition is set to enhance Carrier’s ability to provide integrated hardware and software solutions for end-to-end cold chain management.

- In February 2023, Monnit Corporation introduced a new line of industrial-grade wireless sensors specifically designed for harsh cold storage environments in North America, catering to sectors like pharmaceuticals and specialized chemicals. These sensors offer extended range and durability for critical temperature monitoring applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Cold Chain Monitoring Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Cold Chain Monitoring Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Cold Chain Monitoring Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.