North America Cold Sore Treatment Market

Market Size in USD Billion

CAGR :

%

USD

446.54 Billion

USD

690.51 Billion

2022

2030

USD

446.54 Billion

USD

690.51 Billion

2022

2030

| 2023 –2030 | |

| USD 446.54 Billion | |

| USD 690.51 Billion | |

|

|

|

North America Cold Sore Treatment (for HSV 1 Virus) Market Analysis and Insights

Increasing prevalence and incidences of cold sore infections have enhanced the market demand. The rising healthcare expenditure for better health services also contributes to market growth. The major market players focus on various service launches and approvals during this crucial period. In addition, the increase in investments in pharmaceutical R&D and life sciences research also contributes to the rising demand for cold sore treatment.

The North America cold sore treatment (for HSV 1 virus) market is expected to grow in the forecast year due to the rise in market players and the availability of advanced services. Along with this, manufacturers are engaged in R&D activities for launching novel products in the market. The proliferation in modes of transmission of HSV is further boosting market growth. However, a dearth of awareness about the onset and symptoms of cold sore and its treatment might hamper the market growth in the forecast period.

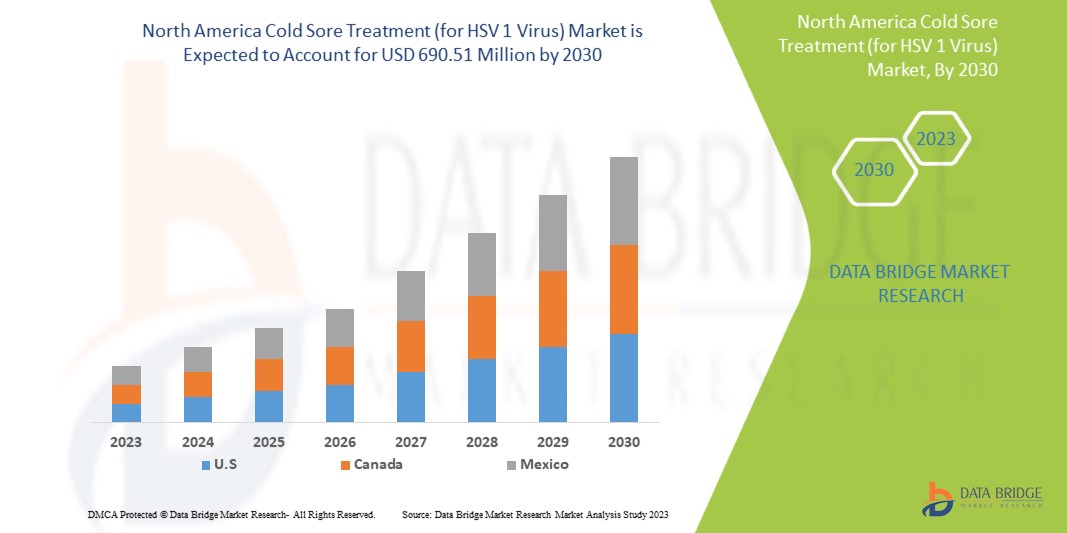

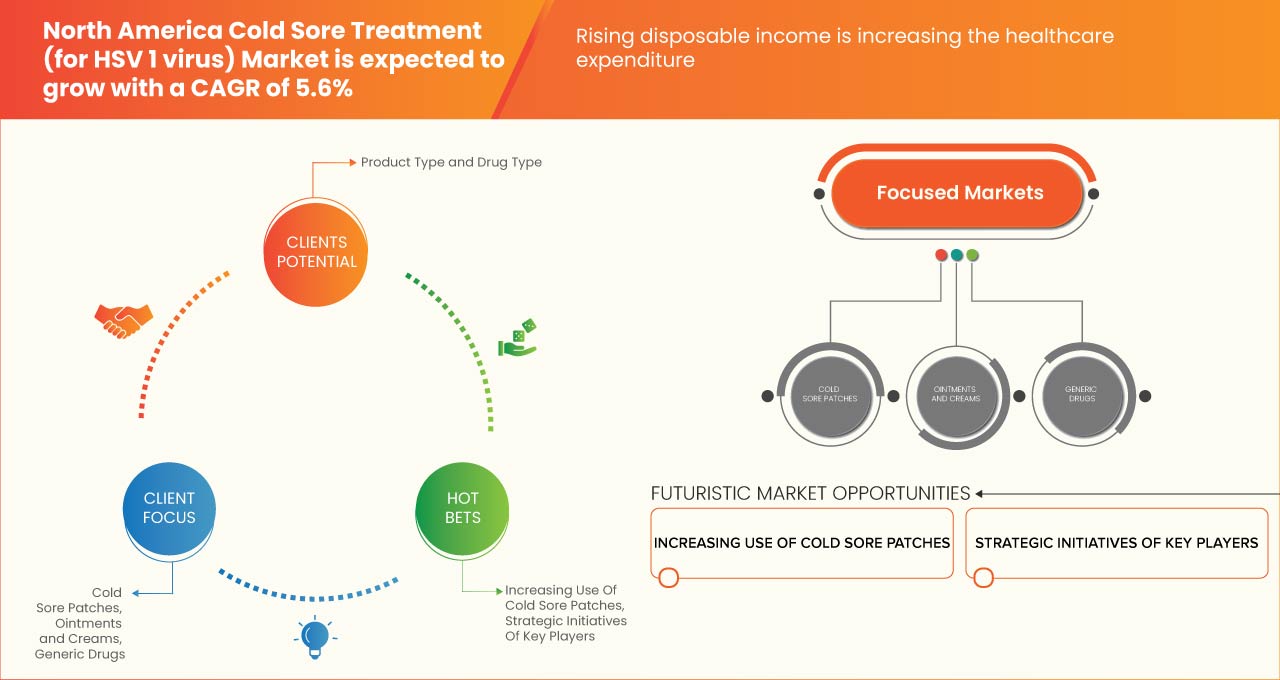

The North America cold sore treatment (for HSV 1 virus) market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing with a CAGR of 5.6% in the forecast period of 2023 to 2030 and is expected to reach USD 690.51 million by 2030 from USD 446.54 million in 2022.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Medications, Ointments, Creams, Medicated Lip Balms, Cold Sore Patches, and Non-Medicated Products), Route of Administration (Oral, Topical, and Others), Type (Prescription Drugs and Over The Counter (OTC) Drugs), Gender (Male and Female), Drug Type (Branded and Generics), End User (Hospitals, Specialty Clinics, Homecare Setting, and Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

The major companies which are dealing in the market are GSK plc, Novartis AG, Viatris Inc., Hikma Pharmaceuticals PLC, HRA Pharma, Quantum Health, URGO, Apotex Inc., Church & Dwight Co., Inc., Bausch Health Companies Inc., Zydus Pharmaceuticals Inc., Haleon Group of Companies, Amparo medical Technologies, Teva Pharmaceuticals USA Inc., Carma Labs Inc., and Blistex Inc. among others |

Market Definition

Cold sores or oral herpes are small blisters-like abrasions that occur due to the infection caused by the Herpes Simplex Virus (HSV). Cold sores generally occur on the face, around the lips, chin, cheeks, and nostrils. They generally cause pain and itching before they burst. HSV is one of the most common viruses found to affect the global population and it is endemic throughout the world. Up to 90% of people around the world have at least one form of HSV. It generally infects the pediatric population worldwide, but according to WHO, people aged 30-49 are at higher risk now for catching the virus, and the prevalence of HSV increases with age.

North America Cold Sore Treatment (for HSV 1 Virus) Market Dynamics

DRIVERS

-

Growing Prevalence of Cold Sore Infection

A group of small, hurting blisters caused by the Herpes Simplex Virus (HSV) is called cold sores. They are also called fever blisters or oral herpes. HSV is one of the most common viruses found to affect the global population and is endemic worldwide.

For instance,

-

According to WHO, people under 50 infected with HSV-1 are estimated to be more than 3.7 billion globally (67%)

-

According to the Centers for Disease Control and Prevention (CDC), data from the National Health and Nutrition Examination Survey showed that the prevalence of HSV-1 is found to be more in women as compared to men globally. The prevalence of HSV also increases with age.

-

According to CDC, HSV-1 prevalence in the U.S. among people aged 0-49 in 2012 includes 178 million women, which means 49% of women population

With these instances, we can conclude that the growing prevalence of cold sore infections is driving the market growth.

-

Proliferation in Modes of Transmission of Herpes Simplex Virus

An infectious virus can be transmitted in different modes, from its natural reservoir to a susceptible host. The spread of HSV infection relies on the intimate, personal interaction of a susceptible person with someone who excretes HSV transmission modes have different classifications, which include direct and indirect transmission.

HSV is commonly transmitted through direct transmission, including direct contact or droplet spread. The primary mode of HSV-1 transmission is via oral-to-oral contact inducing infection with oral herpes, by contact with the HSV in saliva, sores, and surfaces in or around the mouth. Also, unhygienic practices, unprotected sexual intercourse, and oral sex are the major modes coming up which are increasing the transmission of HSV among people. Moreover, HSV can be transmitted via contact, such as kissing, eating from the same utensils, sharing cups, towels, or from toilet seats, and sharing lip balm. Thus, the increase in infectious disease transmission modes is anticipated to drive market growth.

OPPORTUNITY

-

Increasing Use of Cold Sore Patches

The increasing cases of cold sores have created numerous opportunities for the market players and potentially surged the demand for treatment options required to treat the HSV-1 infection or associated disease. Due to this reason, various key market players are investing more in HSV research to come up with novel treatment options.

Several technological advancements are taking place for the treatment of cold sores, including all medical research aimed at introducing new technologies (vaccines, therapy, drugs, and patches) for the treatment of cold sores. Patches are consistently in demand for their effectiveness against cold sores.

Also, the strategic initiatives taken by key market players will provide structural integrity and future opportunities for market growth in the forecast period of 2023-2030.

RESTRAINT/CHALLENGE

- The Dearth of Awareness about the Onset and Symptoms of Cold Sore and its Treatment

The dearth of awareness about the onset and symptoms of cold sore and the patent termination of some of the marketed drugs will impede the market growth rate. Additionally, side effects associated with medications used for treating cold sores will further challenge the market growth.

Recent Developments

- In October 2022, GSK plc. and Tempus, a U.S.-based precision medicine company, entered into a three-year collaboration agreement that provides GSK with access to Tempus’ AI-enabled platform, including its library of de-identified patient data. Through its leading Artificial Intelligence and Machine Learning (AI/ML) capability, GSK will work together with Tempus to improve clinical trial design, speed up enrolment, and identify drug targets. This will contribute to GSK’s R&D success rate and provide patients with more personalized treatment faster.

- In July 2022, Haleon Group of Companies announced the completion of the spin-off of the healthcare business from GSK Group to Haleon Group. Haleon is the world's leading consumer health company, with brands trusted by millions of consumers worldwide. Its product range includes five main categories- oral health, pain relief, respiratory health, digestive health, and others, as well as vitamins, minerals, and dietary supplements (VMS). Its long-standing brands such as Advil, Sensodyne, Panadol, Voltaren, Theraflu, Otrivin, Polident, Parodontax, and Centrum are based on sound science, innovation, and a deep understanding of people.

North America Cold Sore Treatment (for HSV 1 Virus) Market Scope

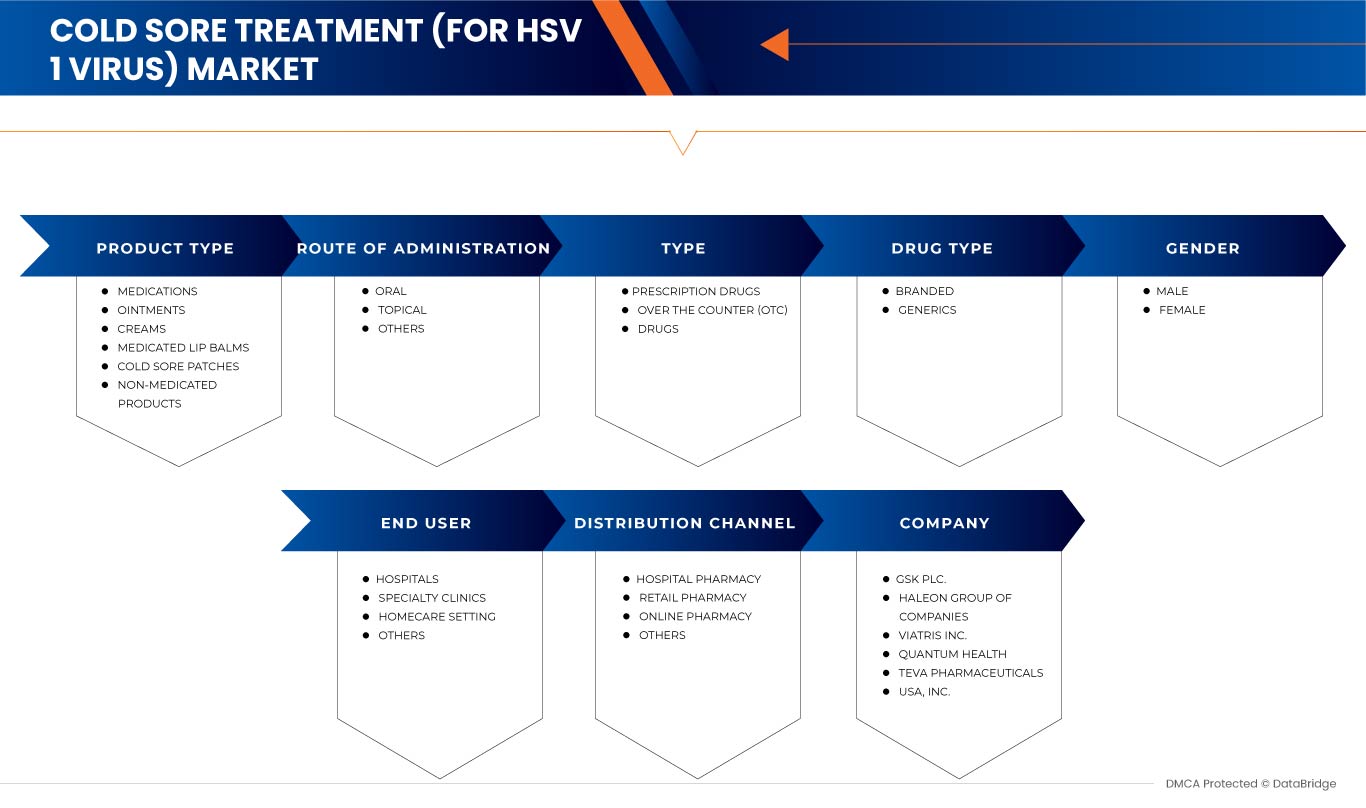

The North America cold sore treatment (for HSV 1 virus) market is segmented into product type, route of administration, type, gender, drug type, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Medications

- Ointments

- Creams

- Medicated Lip Balms

- Cold Sore Patches

- Non-Medicated Products

Based on product type, the market is segmented into medications, ointments, creams, medicated lip balms, cold sore patches, and non-medicated products.

Route of Administration

- Oral

- Topical

- Others

Based on route of administration, the market is segmented into oral, topical, and others.

Type

- Prescription Drugs

- Over The Counter (OTC) Drugs

Based on type, the market is segmented into prescription drugs and Over The Counter (OTC) drugs.

Gender

- Male

- Female

Based on gender, the market is segmented into male and female.

Drug Type

- Branded

- Generics

Based on drug type, the market is segmented into branded and generics.

End User

- Hospitals

- Specialty Clinics

- Homecare Setting

- Others

Based on end user, the market is segmented into hospitals, specialty clinics, homecare setting, and others.

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Based on distribution channel, the market is segmented into hospital pharmacy, online pharmacy, retail pharmacy and others.

North America Cold Sore Treatment (for HSV 1 Virus) Market Regional Analysis/Insights

The North America cold sore treatment (for HSV 1 virus) market is analyzed and market size insights and trends are provided by country, product type, route of administration, type, gender, drug type, end user, and distribution channel as referenced above.

The U.S. is dominating the market in North America in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the high prevalence of cold sore infections in the region and rapid R&D, which is boosting market growth.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and the challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Cold Sore Treatment (for HSV 1 Virus) Market Share Analysis

North America cold sore treatment (for HSV 1 virus) market competitive landscape provides details of the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the North America cold sore treatment (for HSV 1 virus) market are GSK plc., Novartis AG, Viatris Inc., Hikma Pharmaceuticals PLC, HRA Pharma, Quantum Health, URGO, Apotex Inc., Church & Dwight Co., Inc., Bausch Health Companies Inc., Zydus Pharmaceuticals Inc., Haleon Group of Companies, Amparo medical Technologies, Teva Pharmaceuticals USA, Inc., Carma Labs Inc., and Blistex Inc. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of NORTH AMERICA Cold Sore Treatment MARKET

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- THERAPEUTICS LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- MARKET drug type COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- Pipeline analysis

- Epidemiology

- market overview

- drivers

- Growing prevalence of cold sore infection

- Proliferation in modes of transmission of herpes simplex virus

- Increasing awareness about sexually transmitted diseases

- Availability of generic drugs

- Rising rate of HSV infection among women

- RESTRAINTS

- Patent termination of marketed drugs

- Risks of other diseases associated with cold sore

- Dearth of awareness about the onset and symptoms of cold sore treatment

- OPPORTUNITIES

- Increasing disposable income

- Strategic Initiatives by market players

- Increasing research and Development

- Increasing use of cold sore patches

- CHALLENGES

- Rise in alternative treatments

- Emergence of drugs resistant to acyclovir

- Side effects Associated with medications used for treating cold sore

- COVID-19 IMPACT ON COLD SORE TREATMENT MARKET

- impact on price

- Impact on demand

- IMPACT ON SUPPLY CHAIN

- strategic decisions for manufacturers

- CONCLUSION

- north america COLD SORE TREATMENT MARKET, BY strain TYPE

- overview

- HERPES SIMPLEX TYPE 1 VIRUS

- HERPES SIMPLEX TYPE 2 VIRUS

- north america COLD SORE TREATMENT MARKET, BY therapeutics

- overview

- ANTIVIRAL AGENTS

- Acyclovir

- Famciclovir

- Penciclovir

- Valacyclovir

- Docosanol

- ANALGESIC AGENTS

- Carmex

- Herpecin

- others

- others

- north america COLD SORE TREATMENT MARKET, BY drug type

- overview

- generics

- otc

- prescription

- branded

- prescription

- otc

- north america COLD SORE TREATMENT MARKET, BY dosage type

- overview

- Oral

- Tablets

- Pills

- TOPICAL

- cream

- Ointments

- Gel

- spray

- others

- North america COLD SORE TREATMENT MARKET, BY end user

- overview

- HOme care

- HOspitals

- SPECIALTY CLINICS

- OTHERS

- north america COLD SORE TREATMENT MARKET, BY DISTRIBUTION CHANNEL

- overview

- Hospitals Pharmacy

- online Pharmacy

- RETAIL Pharmacy

- north america Cold sore treatment market, by country

- overview

- U.S.

- CANADA

- MEXICO

- north america Cold Sore Treatment Market: COMPANY landscape

- company share analysis: north america

- SWOT

- company profile

- GLAXOSMITHKLINE PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ORTHO DERMATOLOGICS’ (A DIVISION OF BAUSCH HEALTH COMPANIES INC.)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- FOUNDATION CONSUMER HEALTHCARE

- COMPANY SNAPSHOT

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- NOVARTIS AG

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- TEVA PHARMACEUTICALS USA, INC. (A SUBSIDIARY OF TEVA PHARMACEUTICAL INDUSTRIES LTD.)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AMNEAL PHARMACEUTICALS LLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- APOTEX INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AUROBINDO PHARMA USA (A SUBSIDIARY OF AUROBINDO PHARMA)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- CIPLA LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GLENMARK PHARMACEUTICALS, INC., USA (A SUBSIDIARY OF GLENMARK PHARMACEUTICAL LTD.)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HIKMA PHARMACEUTICALS PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HRA PHARMA

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- JUBILANT CADISTA (A SUBSIDIARY OF JUBILANT LIFE SCIENCES LIMITED)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- MERIX PHARMACEUTICAL CORP.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SQAUREX

- 17.15.1 COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- SUN PHARMACEUTICAL INDUSTRIES LTD.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- VIATRIS INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Zydus Pharmaceuticals, Inc. (a subsidiary of Zydus Cadila)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reportS

List of Table

TABLE 1 COLD SORE TREATMENT Market, pipeline analysis

TABLE 2 GENERIC DRUGS USED FOR THE TREATMENT OF HSV (COLD SORES)

TABLE 3 north america COLD SORE TREATMENT Market, By strain TYPE 2019-2028 (USD Million)

TABLE 4 north america COLD SORE TREATMENT Market, By THERAPEUTICS 2019-2028 (USD Million)

TABLE 5 north america ANTIVIRAL AGENTS in COLD SORE TREATMENT Market, By therapeutics, 2019-2028 (USD Million)

TABLE 6 north america Analgesic AGENTS in COLD SORE TREATMENT Market, By Therapeutics, 2019-2028 (USD Million)

TABLE 7 north america COLD SORE TREATMENT Market, By drug type 2019-2028 (USD Million)

TABLE 8 north america generics in COLD SORE TREATMENT Market, By drug type, 2019-2028 (USD Million)

TABLE 9 north america branded in COLD SORE TREATMENT Market, By drug type, 2019-2028 (USD Million)

TABLE 10 north america COLD SORE TREATMENT Market, By dosage type 2019-2028 (USD Million)

TABLE 11 north america Oral segment in COLD SORE TREATMENT Market, By dosage type, 2019-2028 (USD Million)

TABLE 12 north america TOPICAL segment in COLD SORE TREATMENT Market, By dosage type, 2019-2028 (USD Million)

TABLE 13 north america COLD SORE TREATMENT Market, By END USER 2019-2028 (USD Million)

TABLE 14 north america COLD SORE TREATMENT Market, By distribution channel 2019-2028 (USD Million)

TABLE 15 north america cold sore treatment market, country, 2021-2028 (USD Million)

TABLE 16 U.S. cold sore treatment market, By strain type , 2021-2028 (USD MILLION )

TABLE 17 U.S. cold sore treatment market, By THERAPEUTICS, 2021-2028 (Usd million )

TABLE 18 U.S. anti-viral agents in cold sore treatment market, By THERAPEUTICS, 2021-2028 (USD MILLION )

TABLE 19 U.S. analgesics agents in cold sore treatment market, By THERAPEUTICS , 2021-2028 (USD Million)

TABLE 20 U.S. cold sore treatment market, By drug Type, 2021-2028 (USD Million)

TABLE 21 U.S. Generics in cold sore treatment market, By drug type, 2021-2028 (USD Million)

TABLE 22 U.S. branded in cold sore treatment market, By drug type , 2021-2028 (USD Million)

TABLE 23 U.S. cold sore treatment market, By dosage type , 2021-2028 (USD Million)

TABLE 24 U.S. oral in cold sore treatment market, By dosage type , 2021-2028 (USD Million)

TABLE 25 U.S. topical in cold sore treatment market, By dosage type, 2018-2027 (USD Million)

TABLE 26 U.S. cold sore treatment market, By end user, 2021-2028 (USD Million)

TABLE 27 U.S. cold sore treatment market, By distribution channel, 2021-2028 (USD Million)

TABLE 28 CANADA cold sore treatment market, By testing Type, 2021-2028 (USD MILLION )

TABLE 29 CANADA cold sore treatment market, By THERAPEUTICS, 2021-2028 (Usd million )

TABLE 30 CANADA anti-viral agents in cold sore treatment market, By THERAPEUTICS, 2021-2028 (USD MILLION )

TABLE 31 CANADA analgesics in cold sore treatment market, By THERAPEUTICS , 2021-2028 (USD Million)

TABLE 32 CANADA cold sore treatment market, By drug type , 2021-2028 (USD Million)

TABLE 33 CANADA generics in cold sore treatment market, By drug type Type, 2021-2028 (USD Million)

TABLE 34 CANADA branded in cold sore treatment market, By drug type, 2021-2028 (USD Million)

TABLE 35 CANADA cold sore treatment market, By dosage type , 2021-2028 (USD Million)

TABLE 36 CANADA oral in cold sore treatment market, By dosage type , 2021-2028 (USD Million)

TABLE 37 CANADA topical in cold sore treatment market, By dosage type , 2021-2028 (USD Million)

TABLE 38 canada cold sore treatment market, By end user, 2021-2028 (USD Million)

TABLE 39 CANADA cold sore treatment market, By distribution channel, 2021-2028 (USD Million)

TABLE 40 MEXICO cold sore treatment market, By strain Type, 2021-2028 (USD MILLION )

TABLE 41 MEXICO Cold sore treatment market, By THERAPEUTICS, 2021-2028 (Usd million )

TABLE 42 MEXICO anti-viral agents in cold sore treatment market, By THERAPEUTICS, 2021-2028 (USD MILLION )

TABLE 43 MEXICO analgesics in cold sore treatment market, By THERAPEUTICS , 2021-2028 (USD Million)

TABLE 44 MEXICO cold sore treatment market, By drug type , 2021-2028 (USD Million)

TABLE 45 MEXICO generics in cold sore treatment market, By drug Type, 2021-2028 (USD Million)

TABLE 46 MEXICO branded in cold sore treatment market, By drug type, 2021-2028 (USD Million)

TABLE 47 MEXICO cold sore treatment market, By dosage type , 2021-2028 (USD Million)

TABLE 48 MEXICO oral in cold sore treatment market, By dosage type , 2021-2028 (USD Million)

TABLE 49 MEXICO topical in cold sore treatment market, By dosage type , 2021-2028 (USD Million)

TABLE 50 Mexico cold sore treatment market, By end user, 2021-2028 (USD Million)

TABLE 51 MEXICO cold sore treatment market, By distribution type, 2021-2028 (USD Million)

List of Figure

FIGURE 1 NORTH AMERICA COLD SORE TREATMENT MARKET: SEGMENTATION

FIGURE 2 north america COLD SORE TREATMENT MARKET : DATA TRIANGULATION

FIGURE 3 north america Cold Sore Treatment Market: DROC ANALYSIS

FIGURE 4 north america Cold Sore Treatment market: north america VS country MARKET ANALYSIS

FIGURE 5 north america Cold Sore Treatment Market: COMPANY RESEARCH ANALYSIS

FIGURE 6 north america Cold Sore Treatment MARKET: MULTIVARIATE MODELLING

FIGURE 7 north america Cold Sore Treatment MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 north america COLD SORE TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 north america COLD SORE TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 north america Cold Sore Treatment MARKET: MARKET drug type COVERAGE GRID

FIGURE 11 north america Cold Sore Treatment market: SEGMENTATION

FIGURE 12 Growing PREVALENCE OF COLD SORE TREATMENT, AND PROLIFERATION IN MODES OF TRANSMISSION of herpes simplex virus (hsv), and increasing awareness about sexually transmitted diseases are DRIVing THE north america Cold Sore treatment market IN THE FORECAST PERIOD OF 2021 to 2028

FIGURE 13 HERPES SIMPLEX TYPE 1 VIRUS SEGMENT is expected to account for the largest share of the north america COLD SORE TREATMENT MARKET in 2021 & 2028

FIGURE 14 u.s. is the fastest growing market FOR the Cold Sore Treatment MANUFACTURERS IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COLD SORE TREATMENT MARKET

FIGURE 16 PREVALENCE OF HERPES SIMPLEX VIRUS TYPE 1, AMONG PERSONS AGED 14-49 YEARS, BY AGE GROUP: IN THE U.S. 2015–2016

FIGURE 17 PREVALENCE OF HERPES SIMPLEX VIRUS TYPE 1, BY RACE AND HISPANIC ORIGIN: U.S. 2015–2016

FIGURE 18 north america COLD SORE TREATMENT market: BY strain TYPE, 2020

FIGURE 19 north america COLD SORE TREATMENT market: BY strain TYPE, 2020-2028 (USD Million)

FIGURE 20 north america COLD SORE TREATMENT market: BY strain TYPE, CAGR (2021-2028)

FIGURE 21 north america COLD SORE TREATMENT market: BY strain TYPE, LIFELINE CURVE

FIGURE 22 north america COLD SORE TREATMENT market: BY THERAPEUTICS, 2020

FIGURE 23 north america COLD SORE TREATMENT market: BY THERAPEUTICS , 2020-2028 (USD Million)

FIGURE 24 north america COLD SORE TREATMENT market: BY THERAPEUTICS, CAGR (2021-2028)

FIGURE 25 north america COLD SORE TREATMENT market: BY THERAPEUTICS, LIFELINE CURVE

FIGURE 26 north america COLD SORE TREATMENT market: BY drug type, 2020

FIGURE 27 north america COLD SORE TREATMENT market: BY drug type 2020-2028 (USD Million)

FIGURE 28 north america COLD SORE TREATMENT market: BY drug type, CAGR (2021-2028)

FIGURE 29 north america COLD SORE TREATMENT market: BY drug type, LIFELINE CURVE

FIGURE 30 north america COLD SORE TREATMENT market: BY dosage type, 2020

FIGURE 31 north america COLD SORETREATMENT market: BY dosage type 2020-2028 (USD Million)

FIGURE 32 north america COLD SORETREATMENT market: BY dosage type, CAGR (2021-2028)

FIGURE 33 north america COLD SORETREATMENT market: BY dosage type, LIFELINE CURVE

FIGURE 34 north america COLD SORE TREATMENT market: BY END USER, 2020

FIGURE 35 north america COLD SORE TREATMENT market: BY END USER 2020-2028 (USD Million)

FIGURE 36 north america COLD SORE TREATMENT market: BY END USER, CAGR (2021-2028)

FIGURE 37 north america COLD SORE TREATMENT market: BY END USER, LIFELINE CURVE

FIGURE 38 north america COLD SORE TREATMENT market: BY distribution channel, 2020

FIGURE 39 north america COLD SORE TREATMENT market: BY distribution channel 2020-2028 (USD Million)

FIGURE 40 north america COLD SORE TREATMENT market: BY distribution channel, CAGR (2021-2028)

FIGURE 41 north america COLD SORE TREATMENT market: BY distribution channel, LIFELINE CURVE

FIGURE 42 NORTH AMERICA cold sore treatment market: SNAPSHOT (2020)

FIGURE 43 NORTH AMERICA cold sore treatment market: BY country (2020)

FIGURE 44 NORTH AMERICA cold sore treatment market: BY country (2021 & 2028)

FIGURE 45 NORTH AMERICA cold sore treatment market: BY country (2021 & 2028)

FIGURE 46 NORTH AMERICA cold sore treatment market: BY strain type (2021-2028)

FIGURE 47 north america cold sore treatment market: company share 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.