North America Color Concentrates Market

Market Size in USD Billion

CAGR :

%

USD

5.70 Billion

USD

9.43 Billion

2024

2032

USD

5.70 Billion

USD

9.43 Billion

2024

2032

| 2025 –2032 | |

| USD 5.70 Billion | |

| USD 9.43 Billion | |

|

|

|

|

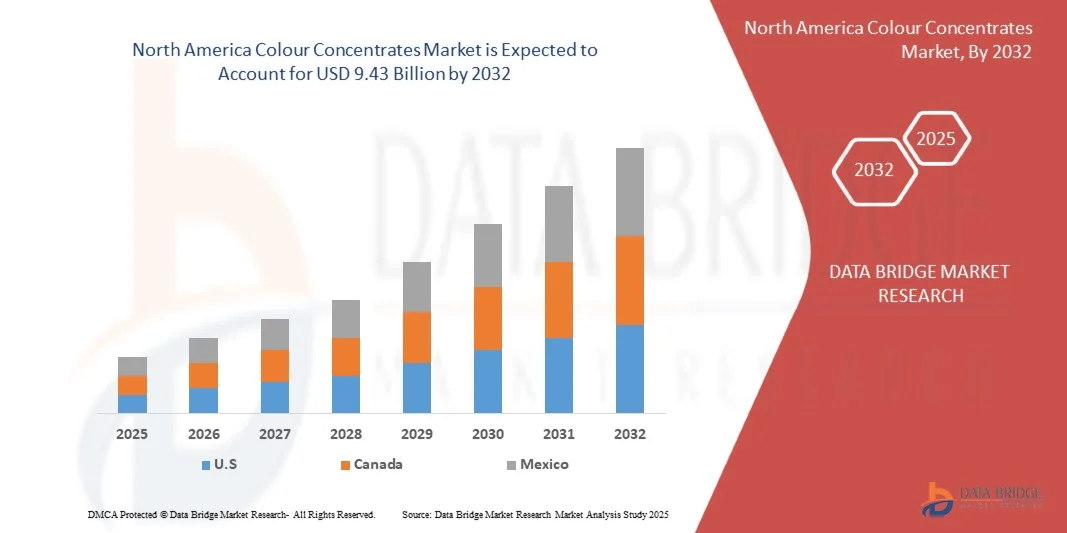

North America Colour Concentrates Market Size

- The North America colour concentrates market size was valued at USD 5.7 billion in 2024 and is expected to reach USD 9.43 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fuelled by the increasing demand from packaging, consumer goods, automotive, and electronics industries, driven by the need for vibrant, consistent, and high-performance coloration solutions that enhance product aesthetics and brand differentiation

- The rising focus on sustainable and recyclable materials is also propelling the adoption of eco-friendly colour concentrates that align with global environmental regulations and circular economy initiatives

North America Colour Concentrates Market Analysis

- The market expansion is supported by the rising use of plastics in various end-use sectors and the advantages offered by colour concentrates such as cost efficiency, ease of handling, and uniform dispersion

- Technological advancements in pigment dispersion, digital colour matching, and sustainable formulation development are contributing to improved product performance and increased adoption across industries

- U.S. colour concentrates market captured the largest revenue share in 2024 within North America, fueled by increasing use of polymers in packaging, automotive, and consumer goods applications. Manufacturers are prioritizing solid and liquid concentrates that offer consistent colour dispersion and high-performance functionality

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America colour concentrates market due to increasing industrialization, growing demand from the packaging sector, and rising adoption of advanced polymer products

- The solid segment held the largest market revenue share in 2024, driven by its ease of handling, storage stability, and widespread use in various polymer processing applications. Solid colour concentrates offer consistent colour dispersion, reduced contamination risk, and longer shelf life, making them a preferred choice for large-scale manufacturing operations.

Report Scope and North America Colour Concentrates Market Segmentation

|

Attributes |

North America Colour Concentrates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Colour Concentrates Market Trends

“Rise of Sustainable and Functional Colour Concentrates”

- The growing shift toward sustainable and functional colour concentrates is transforming the plastics and packaging industries by enabling eco-friendly, high-performance coloration solutions. The use of renewable materials and additives that enhance durability and UV resistance allows manufacturers to meet consumer and regulatory demands while improving product appeal. These concentrates are increasingly being integrated into a wide range of applications, from packaging to automotive, driving adoption across multiple sectors. Their versatility also supports innovation in product design and material performance, further strengthening market growth

- The high demand for versatile and multifunctional colour concentrates is accelerating the adoption of advanced formulations that offer properties such as antimicrobial, flame retardant, and heat-stable features. These solutions are particularly effective in reducing post-processing steps and improving manufacturing efficiency. By combining multiple functional properties in a single concentrate, manufacturers can streamline production, reduce costs, and achieve consistent performance across diverse polymer matrices, enhancing overall product value

- The affordability and ease of use of modern colour concentrates are making them attractive for routine production and product customization, allowing manufacturers to maintain consistent colour quality across different polymer matrices. Their ready-to-use formulations simplify handling, reduce preparation time, and minimize errors during processing. This ease of integration into existing production lines encourages more frequent usage, enabling manufacturers to experiment with new colour variants and improve overall efficiency

- For instance, in 2023, several plastic manufacturers reported improved product consistency and reduced waste after integrating advanced colour concentrates with enhanced dispersion technologies. These concentrates enabled more uniform colouring, improved material performance, and reduced production costs. Manufacturers also observed higher throughput and fewer batch rejections, leading to improved profitability and more sustainable operations, while meeting customer demand for higher-quality, visually appealing products

- While sustainable and functional colour concentrates are accelerating innovation and product differentiation, their impact depends on continued development, regulatory compliance, and cost-effectiveness. Manufacturers must focus on scalable production and performance optimization to fully capitalize on this growing demand. Strategic investments in R&D and process automation are crucial to balance sustainability goals with operational efficiency, ensuring long-term competitiveness and alignment with market trends

North America Colour Concentrates Market Dynamics

Driver

“Growing Demand for Sustainable and High-Performance Colour Solutions”

- The rising awareness of environmental sustainability and product functionality is pushing manufacturers to adopt eco-friendly and multifunctional colour concentrates. These solutions reduce environmental impact while maintaining high-quality aesthetics. Companies are leveraging these trends to enhance brand image and meet the growing expectations of environmentally conscious consumers, which in turn supports premium pricing and market differentiation

- Companies are increasingly seeking solutions that improve processing efficiency, reduce waste, and deliver consistent colour across various polymer types. This demand is supporting continuous R&D investment in advanced additives and formulations. Improved processing reliability also minimizes production delays and lowers energy consumption, aligning with both cost-saving and sustainability objectives

- Regulatory frameworks promoting environmentally safe materials and renewable resources are further encouraging the adoption of sustainable colour concentrates. Governments and industry bodies are increasingly mandating compliance with eco-friendly standards, incentivizing manufacturers to innovate while avoiding penalties. These regulations create long-term growth opportunities for players who proactively align with environmental and safety standards

- For instance, in 2022, several packaging companies implemented colour concentrates with bio-based and low-VOC formulations to comply with environmental standards, boosting market demand for sustainable alternatives. These initiatives also led to improved corporate sustainability reporting, positive stakeholder perception, and expanded market access in environmentally regulated regions, further supporting adoption across the supply chain

- While sustainability and performance requirements are driving market growth, there is still a need for cost-effective, scalable solutions and continuous innovation to maintain widespread adoption. Manufacturers must invest in optimizing raw material sourcing, production processes, and formulation technologies to deliver high-quality, functional products at competitive prices while meeting evolving market expectations

Restraint/Challenge

“High Production Costs and Regulatory Compliance”

- The high production cost of advanced and eco-friendly colour concentrates makes them less accessible for small-scale manufacturers and low-margin operations. These costs remain a key barrier to market penetration. High-priced raw materials, specialized equipment, and complex formulation processes increase capital and operational expenditure, making it challenging for smaller players to compete effectively

- In many cases, specialized manufacturing processes and additives require skilled personnel and infrastructure, which increases operational complexity and limits adoption. Training requirements, quality control measures, and process optimization demand significant time and financial investment. This complexity can lead to delays in production scaling and constrain market expansion for new entrants or mid-sized manufacturers

- Supply chain limitations for high-quality pigments and additives can disrupt consistent availability and raise prices. Dependence on a limited number of suppliers, fluctuations in raw material costs, and geopolitical factors can impact production schedules. These challenges can lead to higher product pricing, delayed deliveries, and difficulties in meeting customer demand consistently

- For instance, in 2023, several manufacturers reported delays and increased costs due to limited access to sustainable raw materials, affecting production schedules and profitability. Companies also faced challenges in balancing environmental compliance with operational efficiency, highlighting the critical need for resilient sourcing strategies and alternative material development

- While technological innovation continues to enhance performance and sustainability, addressing cost, regulatory, and supply chain challenges is critical for unlocking long-term market growth. Manufacturers need to adopt scalable, automated processes, strategic partnerships, and robust R&D pipelines to maintain competitiveness and ensure continuous supply of high-quality, eco-friendly colour concentrates

North America Colour Concentrates Market Scope

The market is segmented on the basis of form, carrier, and end user

• By Form

On the basis of form, the North America colour concentrates market is segmented into solid and liquid. The solid segment held the largest market revenue share in 2024, driven by its ease of handling, storage stability, and widespread use in various polymer processing applications. Solid colour concentrates offer consistent colour dispersion, reduced contamination risk, and longer shelf life, making them a preferred choice for large-scale manufacturing operations.

The liquid segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior blending capabilities, precise colour adjustment, and compatibility with automated dosing systems. Liquid colour concentrates allow manufacturers to achieve uniform colour distribution in complex polymer matrices and are increasingly adopted in applications requiring high precision and rapid production cycles.

• By Carrier

On the basis of carrier, the market is segmented into polyethylene, polypropylene, PC, polystyrene, EVA, ABS, and others. The polypropylene segment dominated the market in 2024, owing to its extensive usage in packaging, automotive, and consumer goods applications. Polypropylene-based concentrates provide excellent compatibility, cost efficiency, and thermal stability, which makes them suitable for high-volume production processes.

The ABS segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their application in high-performance plastics for electronics, automotive interiors, and durable consumer products. These carriers allow the integration of advanced functional additives along with colour concentrates, enhancing product performance and appeal.

• By End User

On the basis of end user, the market is segmented into packaging, automotive, electronics, healthcare, consumer goods, textile, building and construction, and others. The packaging segment held the largest market revenue share in 2024, supported by the growing demand for visually appealing and sustainable packaging solutions. Colour concentrates are widely used to improve aesthetic appeal, brand differentiation, and recyclability of packaging materials.

The automotive is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of coloured polymer components, customization trends, and the need for functional additives in interiors, exteriors, and electronic housings. These sectors leverage colour concentrates to achieve precise colour matching, durability, and enhanced performance in finished products.

North America Colour Concentrates Market Regional Analysis

- U.S. colour concentrates market captured the largest revenue share in 2024 within North America, fueled by increasing use of polymers in packaging, automotive, and consumer goods applications. Manufacturers are prioritizing solid and liquid concentrates that offer consistent colour dispersion and high-performance functionality

- The growing demand for sustainable formulations, combined with innovations in multifunctional additives such as UV stabilizers, flame retardants, and antimicrobial agents, is driving rapid market expansion

- In addition, the integration of automated processing systems and advanced compounding technologies is enhancing production efficiency and product quality

Canada Colour Concentrates Market Insight

The Canada colour concentrates market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of eco-friendly and high-performance polymer solutions in packaging, automotive, and consumer goods sectors. Liquid concentrates are gaining popularity due to their precise dosing capabilities and compatibility with automated production lines. The market growth is further supported by strong government regulations promoting sustainable materials, investments in advanced polymer processing, and rising demand for customizable coloured polymers across multiple applications.

North America Colour Concentrates Market Share

The North America colour concentrates industry is primarily led by well-established companies, including:

- Ampacet Corporation (U.S.)

- BASF Corporation (U.S.)

- Cabot Corporation (U.S.)

- Clariant Corporation (U.S.)

- Colortech Inc. (U.S.)

- Ferro Corporation (U.S.)

- Hudson Color Concentrates (U.S.)

- Penn Color Inc. (U.S.)

- PolyOne Corporation (U.S.)

- Primex Color, Compounding & Additives (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Color Concentrates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Color Concentrates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Color Concentrates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.