North America Colorants Market

Market Size in USD Billion

CAGR :

%

USD

13.11 Billion

USD

18.82 Billion

2024

2032

USD

13.11 Billion

USD

18.82 Billion

2024

2032

| 2025 –2032 | |

| USD 13.11 Billion | |

| USD 18.82 Billion | |

|

|

|

|

Colorants Market Size

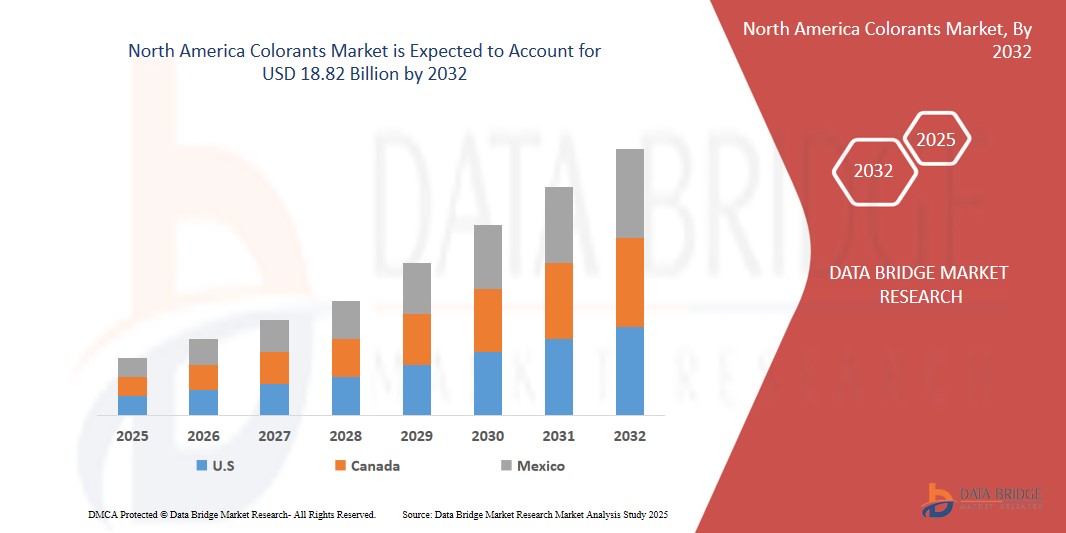

- The North America Colorants Market size was valued at USD 13.11 Billion in 2024 and is expected to reach USD 18.82 Billion by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is largely fueled by the rise in the demand from various end-user industries such as packaging, textiles, food and beverages

- Furthermore, favourable government regulations for eco-friendly initiatives, rapid urbanization and consumer spending on packaged food products and fashionable garments is further anticipated to propel the growth of the colorants market.

Colorants Market Analysis

- Colorants are defined as substances which are utilized in modifying the surface of a material. They are used for painting, printing and for colouring various materials such as plastics and food. Most colorants are classified as pigments and dyes.

- Dyes are referred to soluble coloured organic compounds used for textiles in water and pigments are insoluble compounds which are used in printing inks, paints and plastics. Colorants are the vital ingredients in foods including desserts, confectionery, drinks and snacks

- U.S. dominates the colorants market with the largest revenue share of 72.41% in 2025, characterized by the rise in the need for the pigment and dye and the rise in technological advancement.

- Canada is expected to be the fastest growing region in the colorants market during the forecast period due to expanding industries such as packaging, textiles, and construction, supported by strong environmental policies favoring bio-based and low-VOC colorants.

- Synthetic colour segment is expected to dominate the Colorants market with a market share of 58.4% in 2025, driven by its wide application across industrial manufacturing processes, superior stability, and consistent colour delivery

Report Scope and Colorants Market Segmentation

|

Attributes |

Colorants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Colorants Market Trends

“Technological Advancements and Sustainable Innovations”

- There is a growing demand for eco-friendly and sustainable colorants derived from natural sources. Companies are investing in research and development to create bio-based dyes and pigments that meet environmental regulations and consumer preferences.

- The North America Colorants Market is witnessing a surge in the adoption of artificial intelligence (AI) and machine learning (ML) to optimize color formulations, predict trends, and enhance product quality. These technologies enable manufacturers to develop customized solutions efficiently.

- The market is expanding due to increased applications in various industries such as textiles, packaging, automotive, and construction. The need for vibrant and durable colorants in these sectors is driving innovation and product development.

Colorants Market Dynamics

Driver

“Rising Demand in Packaging and Textile Industries”

- The booming e-commerce sector and consumer preference for aesthetically appealing packaging are propelling the demand for colorants. Manufacturers are focusing on developing colorants that offer high printability and visual appeal.

- Technological advancements in textile manufacturing, including digital printing and sustainable dyeing processes, are increasing the adoption of innovative colorants that offer superior performance and environmental benefits.

- There is a rising trend of personalized and customized products, especially in fashion and home décor. This trend is encouraging manufacturers to develop a wide range of colorants to meet diverse consumer preferences.

Restraint/Challenge

“Environmental Regulations and Raw Material Price Volatility”

- The colorants industry faces challenges due to strict environmental regulations aimed at reducing pollution and promoting sustainability. Compliance with these regulations requires significant investment in cleaner production technologies.

- The volatility in the prices of raw materials used in colorant production, such as petrochemicals and natural dyes, affects the overall cost structure and profitability of manufacturers.

- The market faces competition from low-cost alternatives, especially from emerging economies. This competition pressures North American manufacturers to innovate and offer high-quality, value-added products to maintain market share.

Colorants Market Scope

The market is segmented on the basis of colour, product, and end-user.

- By Colour

On the basis of colour, the North America Colorants Market is segmented into natural colour and synthetic colour. The synthetic colour segment dominates the largest market revenue share of 58.4% in 2025, driven by its wide application across industrial manufacturing processes, superior stability, and consistent colour delivery. Synthetic colours are favored in packaging, textiles, and automotive coatings due to their high-performance attributes and cost-effectiveness in large-scale production. Continued innovation in non-toxic synthetic colourants also supports their market dominance, especially for outdoor and high-temperature applications.

The natural colour segment is anticipated to witness the fastest growth rate of 20.6% from 2025 to 2032, driven by rising consumer demand for eco-friendly and sustainable solutions. Natural colours, derived from plants, minerals, and other organic sources, are gaining popularity in packaging and printing, particularly in food-safe and biodegradable materials. Regulatory support for natural additives and expanding clean-label trends across industries further fuel this segment’s rapid growth.

- By Product

On the basis of product, the North America Colorants Market is segmented into pigments, dyes, colour concentrates, and master batches. The pigments segment held the largest market revenue share in 2025, driven by its versatility, lightfastness, and chemical stability. Pigments are widely used across paints, plastics, and inks due to their opaque nature and resistance to fading, making them essential in construction, automotive, and textile industries.

The colour concentrates segment is expected to witness the fastest CAGR from 2025 to 2032, driven by demand for customized colouring in plastic manufacturing and packaging. Colour concentrates enable precise colour control and are easily blended into base polymers, offering advantages in speed, quality, and formulation flexibility, especially in the consumer goods and electronics packaging sectors.

- By End-User

On the basis of end-user, the North America Colorants Market is segmented into packaging, paper and printing, textiles, building and construction, automotive, consumer goods, and others. The packaging segment accounted for the largest market revenue share in 2025, driven by the surge in e-commerce, innovation in sustainable packaging materials, and brand differentiation through vibrant colourants. Colourants enhance shelf appeal, support recyclable packaging trends, and are tailored for food safety compliance in this sector.

The textiles segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by renewed fashion cycles, demand for performance fabrics, and growth in digital textile printing. Colourants in textiles are now being reformulated to meet eco-label requirements, and technological advancements allow for greater customization, wash resistance, and fabric compatibility.

Colorants Market Regional Analysis

- U.S. dominates the Colorants Market with the largest revenue share of 72.41% in 2024, driven by its advanced manufacturing infrastructure, high consumption across packaging, textiles, and plastics industries, and strong emphasis on R&D and sustainable innovation.

- The presence of major players such as Dow, Huntsman, and PPG Industries further boosts market growth.

- Additionally, regulatory support for eco-friendly formulations and the growing trend toward customization and high-performance colorants contribute to the U.S.'s dominant position.

Mexico Colorants Market Insight

The Mexico colorants market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding automotive, packaging, and textile industries. Increasing industrialization and consumer demand for vibrant, durable colours fuel market growth. The rise in domestic manufacturing and exports boosts demand for both synthetic and natural colorants. However, regulatory compliance and raw material price fluctuations pose challenges. Investments in sustainable, eco-friendly colorants and advanced manufacturing processes offer opportunities. Mexico is expected to witness moderate CAGR, supported by trade agreements and growing end-use sectors.

Canada Colorants Market Insight

The Canada Colorants market is poised to grow at the fastest CAGR of over 17.33% in 2025, driven by expanding industries such as packaging, textiles, and construction, supported by strong environmental policies favoring bio-based and low-VOC colorants. Government incentives for sustainable manufacturing and a robust focus on research and innovation are encouraging the adoption of eco-friendly colorant solutions, positioning Canada as a leader in sustainable pigment and dye technologies.

Colorants Market Share

The Colorants industry is primarily led by well-established companies, including:

- DIC CORPORATION (Japan)

- ColorChem International Corp. (U.S.)

- BASF SE (Germany)

- Clariant (Switzerland)

- Cathay Industries (Hong Kong)

Latest Developments in North America Colorants Market

- In July 2022, Symrise AG introduced SymClariol, a new cosmetic ingredient designed to enhance product efficacy and skin benefits, reinforcing their position in the personal care industry with innovative formulations.

- In June 2022, Symrise AG developed natural blueberry-derived ingredients aimed at food, beverage, and health products, meeting consumer demand for clean-label and plant-based options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Colorants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Colorants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Colorants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.