North America Commercial Dishwashers Market

Market Size in USD Million

CAGR :

%

USD

682.03 Million

USD

877.49 Million

2024

2032

USD

682.03 Million

USD

877.49 Million

2024

2032

| 2025 –2032 | |

| USD 682.03 Million | |

| USD 877.49 Million | |

|

|

|

|

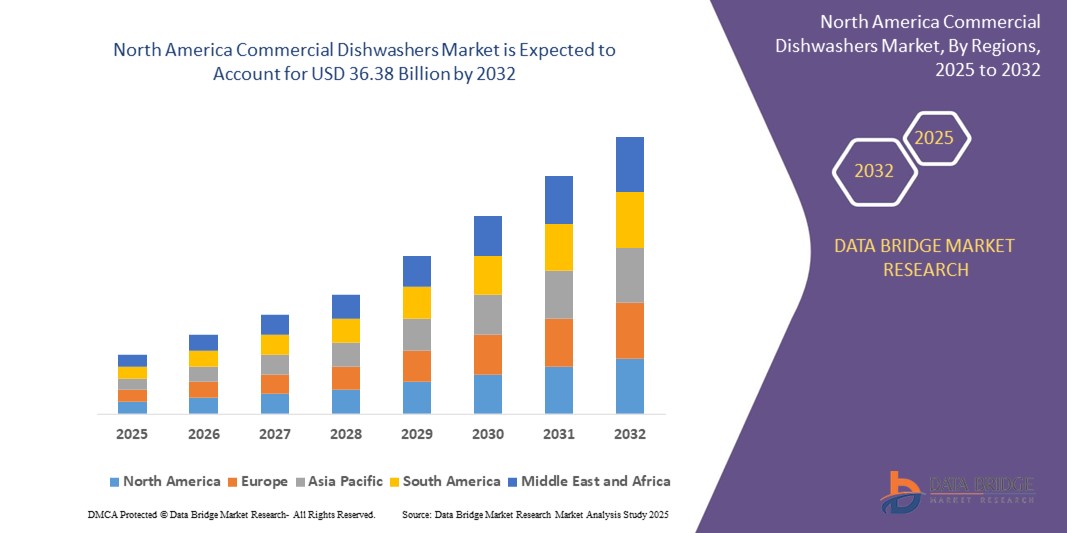

What is the North America Commercial Dishwashers Market Size and Growth Rate?

- The North America commercial dishwashers market size was valued at USD 682.03 million in 2024 and is expected to reach USD 877.49million by 2032, at a CAGR of 3.90% during the forecast period

- The hospitality sector stands as a primary application for the commercial dishwashers market. Fueled by the rising number of restaurants, cafes, and small-scale food establishments, these dishwashers cater to the sector's demand for efficient and time-saving solutions

- The industry's busy nature and emphasis on hygiene amplify the need for commercial dishwashers, while the adoption of energy-efficient appliances aligns with sustainability goals

What are the Major Takeaways of Commercial Dishwashers Market?

- The integration of cutting-edge technologies, such as IoT-enabled devices and smart automation, enhances the performance and functionality of commercial dishwashers. These advancements improve washing capabilities and contribute to resource optimization, reduced energy consumption, and streamlined operations

- Businesses in the region increasingly prioritize state-of-the-art dishwashing technologies, fostering a competitive market landscape and catering to the evolving demands of the hospitality sector

- U.S. dominated North America’s commercial dishwashers market with a 54.6% share in 2024, driven by stringent hygiene regulations, high demand across foodservice sectors, and strong replacement cycles in restaurants and hotels

- Canada commercial dishwashers market is expected to register the fastest CAGR in North America from 2025 to 2032, due to increasing investments in hospitality infrastructure, rising eco-consciousness, and demand for low-water-consumption appliances

- The Restaurants segment dominated the market with the largest revenue share of 52.4% in 2024, fueled by the growing number of quick-service and full-service restaurants globally requiring high-capacity, energy-efficient dishwashing systems

Report Scope and Commercial Dishwashers Market Segmentation

|

Attributes |

Commercial Dishwashers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Commercial Dishwashers Market?

“Smart Automation and Sustainable Design Redefining Commercial Dishwashers”

- A prominent trend in the commercial dishwashers market is the integration of AI-driven automation and eco-friendly materials to enhance operational efficiency and sustainability

- Leading manufacturers such as Electrolux Professional and Winterhalter are embedding AI and IoT into machines to monitor usage patterns, optimize water and energy consumption, and predict maintenance

- Smart dishwashers are enabling remote diagnostics, reducing downtime, and improving machine lifespan in commercial kitchens

- Eco-conscious design, including low-emission cycles, biodegradable detergents, and recyclable components, is becoming a selling point for foodservice operators facing stricter environmental regulations

- The demand for low-noise, high-efficiency dishwashers in hospitals, hotels, and QSRs (Quick Service Restaurants) is pushing innovation around compact and modular systems

- As sustainability and automation converge, brands that offer connected, low-footprint dishwashing solutions are gaining a competitive edge globally

What are the Key Drivers of Commercial Dishwashers Market?

- Rising demand for efficient kitchen operations in hotels, restaurants, and institutional facilities is driving the adoption of commercial dishwashers

- Increasing labor costs and hygiene regulations especially after COVID-19 are encouraging foodservice providers to automate cleaning processes

- For instance, Miele and Hoshizaki have reported growing demand from the hospitality sector for high-capacity, energy-efficient models that meet NSF/ANSI sanitation standards.

- Government policies in Europe, Japan, and the U.S. are promoting water- and energy-efficient appliances through certification programs such as ENERGY STAR and EU EcoLabe

- The growth of cloud kitchens and the catering industry is expanding the customer base for compact, high-speed dishwashers

- In addition, rising awareness about cross-contamination in manual cleaning has made automated dishwashing essential in food safety protocols

Which Factor is challenging the Growth of the Commercial Dishwashers Market?

- High initial costs of commercial dishwashers, especially smart or AI-enabled models, deter small and mid-sized enterprises from adoption

- Installation constraints, such as space limitations and drainage requirements, restrict market growth in older buildings and mobile kitchens

- According to Statista, the average commercial dishwasher installation costs 20%–30% more than traditional models due to specialized plumbing and electrical needs

- Maintenance and repair complexities particularly in IoT-integrated systems pose operational challenges for businesses without technical support staff

- In addition, inconsistent water pressure and hard water conditions in emerging markets affect dishwasher performance and lead to customer dissatisfaction

- To scale efficiently, manufacturers must focus on cost-effective models, modular retrofits, and after-sales service networks in developing regions

How is the Commercial Dishwashers Market Segmented?

The market is segmented on the basis of application, category, product, and distribution channel.

- By Application

On the basis of application, the commercial dishwashers market is segmented into Hotels, Restaurants, and Others. The Restaurants segment dominated the market with the largest revenue share of 52.4% in 2024, fueled by the growing number of quick-service and full-service restaurants globally requiring high-capacity, energy-efficient dishwashing systems.

The Hotels segment is expected to grow at the fastest CAGR, driven by rising investments in hospitality infrastructure and increasing emphasis on hygiene compliance in the post-pandemic era.

- By Product

On the basis of product, the market is segmented into Undercounter, Door or Hood Type, Rack/Conveyor, and Glasswasher. The Rack/Conveyor segment held the largest market share of 39.7% in 2024, owing to its suitability for high-volume operations in institutional kitchens and large commercial settings.

The Undercounter segment is projected to witness strong growth due to space-saving designs, ease of installation, and increasing adoption among cafes and small food outlets.

- By Category

On the basis of category, the market is segmented into Free-Standing and Built-In. The Free-Standing segment led the market with a dominant share of 58.6% in 2024, supported by its flexibility, ease of relocation, and preference among small- to mid-sized foodservice establishments.

The Built-In segment is anticipated to gain traction in premium hospitality projects and commercial kitchens that prioritize aesthetic integration and space optimization.

- By Distribution Channel

On the basis of distribution channel, the market is divided into Offline and Online. The Offline segment dominated the market with a revenue share of 64.2% in 2024, attributed to strong relationships with commercial kitchen equipment dealers, service support, and physical product inspection before purchase.

The Online segment is projected to grow rapidly, driven by the expansion of e-commerce platforms, digital product comparison tools, and discounts on bulk commercial orders.

Which Region Holds the Largest Share of the Commercial Dishwashers Market?

- U.S. dominated North America’s commercial dishwashers market with a 54.6% share in 2024, driven by stringent hygiene regulations, high demand across foodservice sectors, and strong replacement cycles in restaurants and hotels

- Rapid adoption of energy-efficient and high-capacity dishwashers, backed by rebate programs and sustainability incentives, further strengthens U.S. market dominance

- Leading manufacturers, strong distribution networks, and high commercial kitchen density make the U.S. a key revenue contributor in the global market

Canada Commercial Dishwashers Market Insight

Canada’s commercial dishwashers market is experiencing accelerated growth, supported by increasing investments in hospitality infrastructure, rising eco-consciousness, and demand for low-water-consumption appliances. Rebates for ENERGY STAR-rated equipment, growing institutional demand from hospitals and schools, and interest in automated kitchen solutions are fueling market expansion.

Mexico Commercial Dishwashers Market Insight

Mexico’s market is growing steadily, bolstered by rapid urbanization, expansion of foodservice franchises, and greater emphasis on hygiene standards in commercial kitchens. Supportive government health initiatives, tourism growth, and increased imports of commercial kitchen equipment are driving adoption, particularly in mid-tier restaurants and hotels.

Which are the Top Companies in Commercial Dishwashers Market?

The commercial dishwashers industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Huangshan Xingwei Reflectorized Material Co., Ltd. (China)

- HOSHIZAKI CORPORATION (South Korea)

- MagnaColours (U.K.)

- Champion Industries (U.S.)

- Insinger Machine Company (U.S.)

- FAGOR Professional (Spain)

- Veetsan (Turkey)

- LG Electronics (South Korea)

- JLA Limited (U.K.)

- Electrolux Professional (Sweden)

- Blakeslee Inc. (U.S.)

- COMENDA-ALI GROUP (Italy)

- ASKO (Sweden)

- Whirlpool (U.S.)

- MVP Group Corp (Canada)

- Washtech Limited (New Zealand)

- Winterhalter India Pvt. Ltd. (Germany)

- AGA Rangemaster Limited (U.K.)

- KAFF Appliances (India)

- Miele (Germany)

- SAMSUNG (South Korea)

What are the Recent Developments in North America Commercial Dishwashers Market?

- In March 2024, Miele Professional, a global leader in premium commercial appliances, launched the MasterLine series of dishwashers, designed to meet the diverse needs of residential and commercial users. The new line emphasizes hygiene, efficiency, and ease of use, featuring dual-level cleaning, fast cycle times, and a wide selection of optional accessories. This launch strengthens Miele’s position in the professional-grade dishwasher segment by aligning innovation with customer expectations

- In February 2024, LG Electronics Inc. introduced the 14-person LG Dios Objet Collection Dishwasher, crafted to enhance space efficiency and user convenience. Available in three variants two built-in options with 10 cm and 15 cm height from the kitchen floor, and a freestanding model it removes the need for separate installation, offering flexibility in kitchen design. This product expansion enhances LG’s market appeal through space-saving designs and personalized offerings

- In September 2023, at IFA 2023, Midea showcased its Matter-certified dishwasher, reflecting its commitment to interoperability and intelligent home integration. The smart appliance includes app-based controls, allowing users to remotely operate and maintain the unit through timely alerts and remote access. This innovation highlights Midea’s focus on smart connectivity and user-centric convenience in modern dishwashing solutions

- In March 2023, Swedish appliance maker ASKO launched its DW60 dishwasher series, merging high-end design with long-lasting performance. Made with stainless steel instead of plastic for better durability and sustainability, it features the Flexi Racks system for easier loading and Turbo Combi Drying for superior drying efficiency. This reinforces ASKO’s commitment to sustainable innovation and luxury kitchen design

- In February 2021, Robert Bosch GmbH and BSH Household Appliances announced a strategic investment of €100 million (over Rs 870 crore) in India's home appliances sector. The initiative aims to enhance personalization, brand visibility, technological innovation, and user experience research over the next 3–4 years. This move marks a significant push by Bosch to expand its footprint in the fast-growing Indian market through localized solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.