North America Compressed Natural Gas Cng Market

Market Size in USD Billion

CAGR :

%

USD

16.32 Billion

USD

21.16 Billion

2024

2032

USD

16.32 Billion

USD

21.16 Billion

2024

2032

| 2025 –2032 | |

| USD 16.32 Billion | |

| USD 21.16 Billion | |

|

|

|

|

North America Compressed Natural Gas (CNG) Market Size

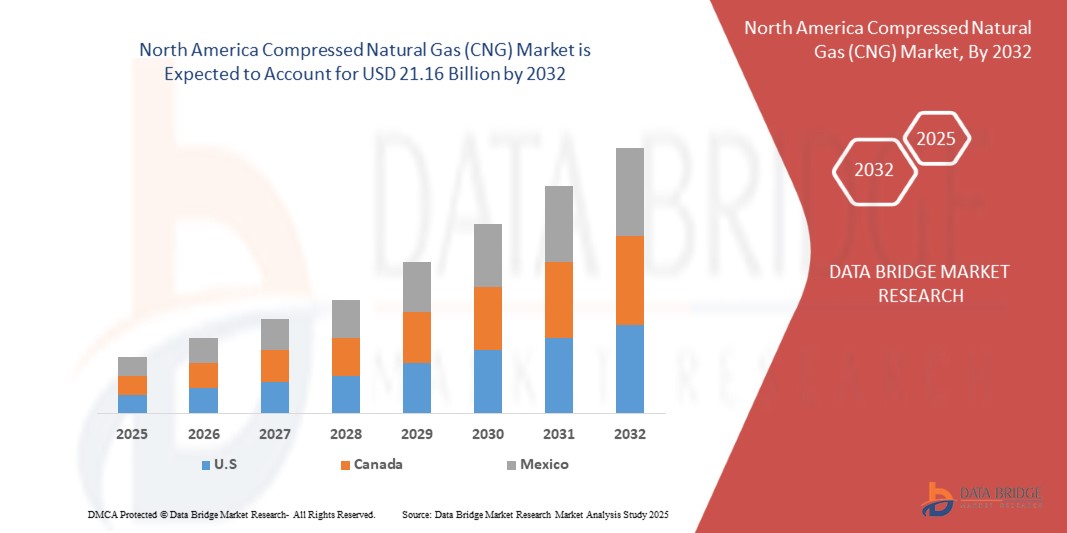

- The North America compressed natural gas (CNG) market was valued at USD 16.32 billion in 2024 and is projected to reach USD 21.16 billion by 2032, growing at a CAGR of 3.30% during the forecast period

- Growth is being driven by rising demand for cleaner transportation fuels, government subsidies for natural gas vehicles (NGVs), and expanding compressed natural gas refueling infrastructure across the U.S. and Canada

- Increasing adoption of fleet-based compressed natural gas vehicles, especially in logistics, public transport, and ride-hailing services, is further boosting demand

- Regulatory support, including low-emission vehicle mandates and carbon reduction targets, strengthens the case for compressed natural gas over gasoline and diesel

- The presence of large-scale natural gas reserves and ongoing investments in renewable natural gas (RNG) integration are expected to significantly support long-term growth

North America Compressed Natural Gas (CNG) Market Analysis

- The North America compressed natural gas market is witnessing strong adoption due to economic advantages, as compressed natural gas fuel is generally 30–40% cheaper than gasoline or diesel in the region

- Heavy-duty applications such as buses, long-haul trucks, and municipal fleets represent the most promising growth segments

- Market competition is intensifying with energy companies, automotive OEMs, and RNG suppliers collaborating to expand availability and reliability of compressed natural gas solutions

- The U.S. holds the largest share of 69.32& the North America compressed natural gas market, fuelled by its vast shale gas reserves, well-developed infrastructure, and strong government initiatives to promote alternative fuels

- Mexico is emerging as a fast-growing market with CAGR of 12.02% within North America, largely driven by its government’s push to diversify fuel sources and reduce dependency on imported gasoline and diesel

- The non-associated gas segment dominated the market with the largest revenue share of 57.8% in 2024, driven by its widespread availability, cost efficiency, and suitability for large-scale energy and fuel applications

Report Scope and North America Compressed Natural Gas (CNG)Market Segmentation

|

Attributes |

North America Compressed Natural Gas (CNG)Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer surveys, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE analysis, Porter’s Five Forces analysis, and regulatory framework. |

North America Compressed Natural Gas (CNG) Market Trends

Rising Adoption of CNG Vehicles Driven by Infrastructure Expansion

- A major trend shaping the North America compressed natural gas market is the growing deployment of public and private compressed natural gas refueling stations, significantly enhancing the accessibility and convenience of compressed natural gas as a transportation fuel

- For instance, in the U.S., several energy companies are partnering with logistics providers to establish corridors of compressed natural gas fueling stations along major interstate highways, reducing range anxiety for fleet operators

- Technological advancements in lightweight composite storage cylinders are increasing fuel storage capacity while improving vehicle performance and reducing overall weight

- Another trend is the integration of renewable natural gas (RNG) with conventional compressed natural gas, enabling the transportation sector to reduce lifecycle greenhouse gas emissions even further

- Automotive OEMs are expanding their dedicated compressed natural gas vehicle offerings, while after-market retrofitting kits are becoming increasingly advanced, reliable, and cost-efficient

- The fleet electrification narrative is also influencing the compressed natural gas market, with many governments promoting dual-fuel hybrid models that combine compressed natural gas with electric drivetrains, making the shift toward sustainability more flexible

- Collectively, these advancements are driving the perception of compressed natural gas as a bridge fuel in North America’s transition toward net-zero transportation systems

North America Compressed Natural Gas (CNG) Market Dynamics

Driver

Government Support and Rising Focus on Emission Reduction

- Increasing government initiatives, subsidies, and policy frameworks aimed at reducing dependence on conventional fossil fuels and minimizing carbon footprints are a key driver of the North America compressed natural gas market

- For instance, regulatory policies across the U.S. and Canada are offering tax incentives for compressed natural gas adoption, encouraging both OEM production and fleet conversions to natural gas vehicles

- Compressed natural gas vehicles emit 20–30% fewer greenhouse gases compared to diesel, making them highly attractive in meeting corporate sustainability goals

- The growing affordability of natural gas compared to oil-based fuels is further enhancing cost competitiveness, encouraging logistics, public transport, and private fleet operators to transition toward compressed natural gas -powered vehicles

- Expansion of infrastructure, coupled with strong partnerships between utility providers, fleet operators, and technology innovators, is accelerating adoption across multiple vehicle categories

Restraint/Challenge

Infrastructure Gaps and High Initial Conversion Costs

- Despite rapid expansion, limited compressed natural gas fueling infrastructure across certain regions of North America remains a major barrier, restricting long-distance adoption outside of urban or industrial clusters

- The high upfront cost of compressed natural gas vehicles and retrofitting kits compared to conventional vehicles creates hesitancy among individual consumers and small fleet operators.

- Ongoing challenges around storage system maintenance, cylinder replacement, and safety regulations add to operational expenses, particularly in commercial fleets

- Inconsistent government incentives across states and provinces lead to fragmented market adoption, with some areas seeing faster penetration while others lag behind

- Competition from emerging alternatives, such as electric vehicles and hydrogen fuel cell vehicles, is also a challenge, as companies weigh long-term investments in compressed natural gas against other clean fuel technologies

- Overcoming these obstacles requires strategic infrastructure development, technological standardization, and financial incentives, which will play a pivotal role in sustaining market momentum

North America Compressed Natural Gas (CNG) Market Scope

The market is segmented on the basis of source, kit, distribution type and end user.

• By Source

On the basis of source, the market is segmented into associated gas and non-associated gas. The non-associated gas segment dominated the market with the largest revenue share of 57.8% in 2024, driven by its widespread availability, cost efficiency, and suitability for large-scale energy and fuel applications. Non-associated gas, extracted independently of crude oil, offers a reliable supply chain for meeting rising energy demands while supporting decarbonization strategies. Its scalability makes it the preferred choice for both industrial and automotive uses.

The associated gas segment is projected to witness the fastest CAGR from 2025 to 2032, as advancements in gas recovery technologies improve efficiency and reduce flaring losses. With increasing focus on sustainability and regulatory measures to minimize waste, associated gas utilization is expected to expand rapidly. This trend positions associated gas as an emerging source to meet global energy transition goals.

• By Kits

On the basis of kits, the market is segmented into sequential and venturi. The sequential kits segment accounted for the largest revenue share of 61.3% in 2024, driven by their higher efficiency, precision in fuel injection, and reduced emissions compared to traditional systems. Sequential kits are increasingly adopted in light and medium vehicles due to their ability to deliver better mileage, performance, and compliance with stringent emission norms. Their widespread use across developed and emerging markets underpins their dominance.

The venturi kits segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by their lower installation cost and suitability for older vehicle models in price-sensitive markets. Venturi kits, though less sophisticated, remain attractive for fleet operators and consumers seeking economical fuel conversion solutions. The growing adoption in developing economies ensures their steady expansion despite the dominance of sequential kits.

• By Distribution Type

On the basis of distribution type, the market is segmented into cylinders/tanks, accumulators, composite manifolds, and others. The cylinders/tanks segment dominated the market with the largest revenue share of 49.5% in 2024, supported by their established infrastructure, safety certifications, and widespread use in both light and heavy vehicles. Their durability and compatibility with existing refueling stations make them the standard choice for gas storage and distribution.

The composite manifolds segment is projected to record the fastest CAGR from 2025 to 2032, owing to their lightweight nature, improved safety features, and capacity to store higher volumes of gas at optimized pressures. With increasing focus on vehicle weight reduction and fuel efficiency, composite manifolds are emerging as the next-generation solution for automotive gas distribution systems. Their rapid adoption in advanced vehicle fleets strengthens their growth trajectory.

• By End Use

On the basis of end use, the market is segmented into light motor vehicles, medium motor vehicles, and heavy motor vehicles. The light motor vehicles segment held the largest market share of 54.1% in 2024, fueled by rising demand for cost-efficient, eco-friendly personal and commercial mobility solutions. Urbanization, ride-sharing growth, and consumer inclination toward affordable fuel alternatives further strengthen this segment’s dominance.

The heavy motor vehicles segment is expected to witness the fastest CAGR from 2025 to 2032, as logistics, freight, and long-haul transport increasingly adopt gas-based systems to reduce operating costs and carbon footprints. With stricter emission norms and growing infrastructure for alternative fuel refueling, heavy-duty fleets are transitioning rapidly toward gas adoption, making this segment a vital driver of future growth.

North America Compressed Natural Gas (CNG) Market Regional Analysis

- The U.S. holds the largest share of 69.32& the North America compressed natural gas market, fuelled by its vast shale gas reserves, well-developed infrastructure, and strong government initiatives to promote alternative fuels

- The country is witnessing significant adoption of compressed natural gas in both commercial and public transport fleets, particularly in metropolitan regions where emission regulations are stringent

- In addition, technological advancements in sequential kits and composite manifolds are improving vehicle efficiency and adoption. Major players such as Clean Energy Fuels, Trillium, and utility-backed projects are further driving growth

Canada Compressed Natural Gas (CNG) Market Insight

The Canada compressed natural gas market is expanding steadily, supported by its focus on sustainable transportation and climate commitments. Although the infrastructure is not as extensive as in the U.S., government-led initiatives are promoting the use of compressed natural gas in buses, municipal fleets, and logistics. Rising fuel costs and cross-border trade with the U.S. are also encouraging fleet operators to adopt compressed natural gas as a cost-effective solution. The demand for medium and heavy motor vehicles powered by compressed natural gas is particularly strong in urban centers such as Toronto and Vancouver, where emission standards are more stringent.

Mexico Compressed Natural Gas (CNG) Market Insight

Mexico is emerging as a fast-growing market with CAGR of 12.02% within North America, largely driven by its government’s push to diversify fuel sources and reduce dependency on imported gasoline and diesel. The availability of affordable compressed natural gas, combined with increasing investment in fuelling infrastructure, is encouraging adoption across taxis, buses, and delivery fleets. Sequential kits are gaining strong traction in urban transportation, while heavy motor vehicles are gradually transitioning due to cost benefits. Mexico’s strategic position as a logistics hub in Latin America further enhances demand for compressed natural gas as a sustainable and economical alternative fuel.

The North America compressed natural gas industry is primarily led by well-established companies, including:

- Clean Energy Fuels Corp. (U.S.)

- Cummins Inc. (U.S.)

- Hexagon Agility (U.S.)

- Westport Fuel Systems Inc. (Canada)

- Natural Gas Vehicle Company (U.S.)

- Quantum Fuel Systems LLC (U.S.)

- NGV Global Group (U.S.)

- Chart Industries, Inc. (U.S.)

- Luxfer Gas Cylinders (U.S.)

Latest Developments in North America Compressed Natural Gas (CNG) Market

- In February 2025, Clean Energy Fuels (U.S.) announced the opening of 25 new CNG fueling stations across California and Texas, aimed at supporting heavy-duty truck fleets transitioning away from diesel. The expansion strengthens the company’s leadership in sustainable transport and supports state-level decarbonization initiatives

- In November 2024, Trillium Energy Solutions (U.S.) partnered with Love’s Travel Stops to deploy advanced CNG refueling infrastructure along key freight corridors. The initiative focuses on enabling long-haul trucking companies to access reliable CNG supply, improving cost efficiency and reducing emissions across interstate logistics

- In September 2024, FortisBC (Canada) launched a fleet conversion program for municipal buses in British Columbia, introducing high-capacity sequential CNG kits. This move is part of Canada’s broader Clean Fuel Standard compliance strategy and is expected to reduce fleet emissions by over 25% annually

- In June 2024, Hexagon Agility (U.S./Canada) unveiled its next-generation lightweight composite CNG tanks for medium and heavy-duty vehicles. The new technology improves fuel storage efficiency, reduces vehicle weight, and increases driving range, making CNG adoption more attractive for logistics operators

- In April 2024, GAIL Global (Mexico division) announced its investment in developing 50 new CNG stations across major metropolitan areas, including Mexico City and Monterrey. The project supports Mexico’s transition toward cleaner fuels and enhances accessibility for both commercial and passenger vehicles

- In December 2023, Chesapeake Utilities Corporation (U.S.) expanded its CNG distribution through its subsidiary Marlin Gas Services, introducing mobile CNG fueling units for rural and underserved regions. This development improves accessibility and ensures reliable supply where permanent infrastructure is limited

- In October 2023, Enbridge Gas (Canada) partnered with Cummins to advance CNG adoption in long-haul trucking fleets. The partnership involves supplying upgraded CNG engines and kits, targeting fleets looking to comply with stricter emission standards in Ontario and Quebec

- In August 2023, Naturgy Mexico introduced a subsidy scheme for taxi and ride-sharing fleets converting to sequential CNG kits. The incentive program has already accelerated adoption across urban transport, particularly in Mexico City, where demand for cost-efficient and clean mobility solutions is rising

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Compressed Natural Gas Cng Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Compressed Natural Gas Cng Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Compressed Natural Gas Cng Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.