North America Construction Management Software Market

Market Size in USD Billion

CAGR :

%

USD

1.73 Billion

USD

3.08 Billion

2024

2032

USD

1.73 Billion

USD

3.08 Billion

2024

2032

| 2025 –2032 | |

| USD 1.73 Billion | |

| USD 3.08 Billion | |

|

|

|

|

North America Construction Management Software Market Size

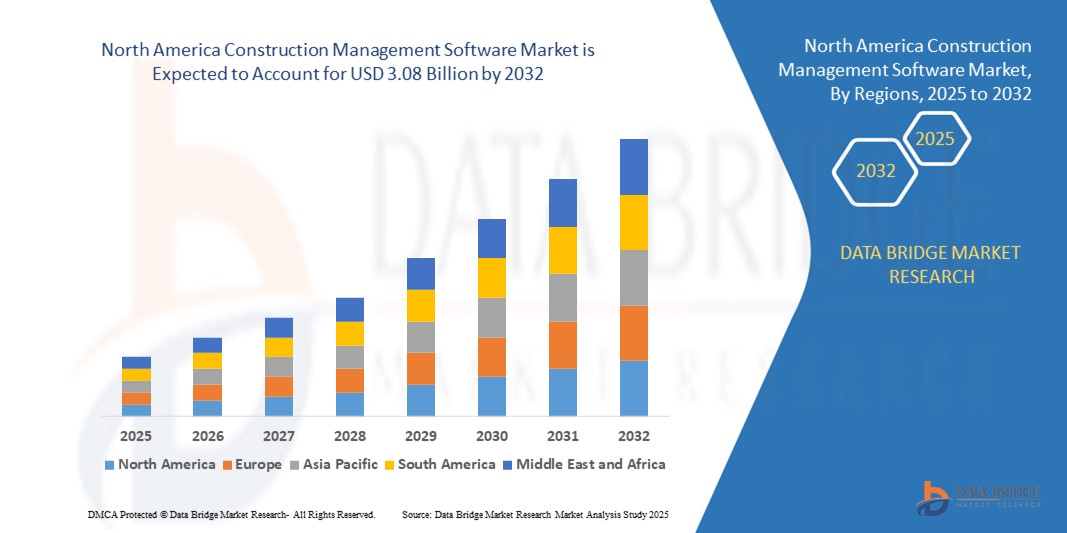

- The North America construction management software market size was valued at USD 1.73 billion in 2024 and is expected to reach USD 3.08 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the expanding construction sector and increasing adoption of digital project planning tools across North America, driven by rapid urbanization, infrastructure modernization projects, and rising demand for cost-efficient, time-bound construction processes. The shift toward digital platforms in construction is being accelerated by government investments in smart cities, public infrastructure, and housing developments, particularly in the U.S. and Canada

- Furthermore, rising contractor and developer demand for cloud-based, collaborative, and real-time data tracking platforms is establishing construction management software as a core operational necessity in the region. These converging factors are accelerating the uptake of advanced Construction Management Software solutions, thereby significantly boosting the industry's growth across both public and private construction projects in North America

North America Construction Management Software Market Analysis

- North America construction management software solutions are becoming increasingly vital for ensuring efficient project execution, cost control, and regulatory compliance across residential, commercial, and infrastructure projects. These platforms enable real-time collaboration, resource management, scheduling, and documentation—key for streamlining construction workflows and minimizing delays

- The region’s growing emphasis on digital transformation in the construction sector, coupled with rising infrastructure investments, labor shortages, and the need for centralized data platforms, is driving the adoption of construction management software across both public and private sectors

- U.S. dominated the North America construction management software market with the largest revenue share of 40.2% in 2024, supported by the presence of major software vendors, rapid urban development, and widespread implementation of cloud-based project management tools across contractors, architects, and project managers

- Canada is projected to be the fastest-growing country in the North America construction management software market, expected to register a CAGR of 9.85% during 2025–2032, driven by increasing infrastructure modernization efforts, adoption of BIM (Building Information Modeling), and public-private partnerships in transportation, energy, and housing sectors

- The subscription-based segment dominated the North America construction management software market in 2024 with a revenue share of 69.4%, driven by its affordability for SMEs and the trend of SaaS models that offer continuous updates and customer support

Report Scope and North America Construction Management Software Market Segmentation

|

Attributes |

North America Construction Management Software Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Construction Management Software Market Trends

Rising Integration of Digital Automation and Compliance Technologies in the North America Construction Management Software Market

- A significant trend shaping the North America construction management software market is the rapid integration of automation, cloud-based platforms, and regulatory compliance tools into construction workflows. These technologies are transforming how construction firms manage complex projects, enhance productivity, and meet industry standards

- Cloud-based construction management software is gaining popularity for enabling real-time collaboration across multiple teams, improving project visibility, and reducing paperwork. These platforms help stakeholders monitor timelines, budgets, materials, and labor remotely—enhancing operational efficiency across large-scale infrastructure projects in the U.S. and Canada

- IoT and AI-powered solutions are increasingly being embedded into construction platforms to monitor jobsite conditions, track equipment usage, and detect potential delays or hazards. This proactive use of real-time data allows companies to respond swiftly and optimize resource allocation

- The adoption of Building Information Modeling (BIM) integration with construction management software is also on the rise. This synergy allows for improved 3D modeling, clash detection, and planning accuracy, which are vital for complex urban developments and public infrastructure projects across North America

- To comply with OSHA, LEED, and local regulatory frameworks, construction firms are deploying compliance management modules within software platforms to track permits, inspections, labor safety certifications, and environmental benchmarks

- Automated workflows and mobile-friendly platforms are streamlining functions such as RFI (Request for Information) processing, change order tracking, punch lists, and daily reporting—reducing administrative burdens and speeding up decision-making

- Construction companies are also leveraging integrated financial and contract management tools within these platforms to ensure accountability, prevent cost overruns, and comply with local and federal audit standards

- This convergence of automation, cloud computing, compliance, and real-time reporting is reshaping the construction industry’s digital landscape in North America, positioning the region for continued technological growth and improved project outcomes through 2032

North America Construction Management Software Market Dynamics

Driver

Growing Demand Due to Expanding Infrastructure Projects and Digital Construction Needs

- The North America construction management software market is witnessing strong growth driven by rising infrastructure development, increasing complexity of construction projects, and the need for real-time collaboration and compliance tracking across large-scale builds

- With significant investments being channeled into transportation, healthcare, commercial, and residential projects—particularly under the U.S. Infrastructure Investment and Jobs Act—contractors and project owners are prioritizing the adoption of cloud-based and integrated construction management platforms to improve cost control, documentation, and on-site efficiency

- The growing need for digital project delivery, including Building Information Modeling (BIM) integration, is fueling the deployment of software tools that streamline scheduling, budgeting, resource allocation, and regulatory compliance

- Canada and the U.S. are leading the charge in smart city development and green building initiatives, requiring enhanced coordination among architects, engineers, and contractors—something made possible by centralized platforms for workflow automation, inspection logs, RFI handling, and progress tracking

- Moreover, growing labor shortages and rising raw material costs are pushing contractors to adopt AI-enabled forecasting, predictive analytics, and mobile field management tools—making digital transformation a strategic necessity rather than a choice

Restraint/Challenge

High Software Costs and Implementation Barriers for Smaller Contractors

- Despite the clear benefits, the North America construction management software market faces limitations, especially among small to mid-sized firms, due to high upfront software licensing fees, training costs, and resistance to workflow change

- Legacy practices like spreadsheets and manual processes remain prevalent among smaller general contractors who lack the budget or technical expertise to implement fully integrated platforms

- Customization and scalability also remain concerns, with some off-the-shelf platforms being too rigid or overly complex for projects with limited scope or non-standard processes

- In rural and remote construction sites, connectivity issues continue to hamper the effective use of cloud-based tools and real-time data access, limiting full digital adoption

- To mitigate these restraints, software vendors are increasingly offering modular, subscription-based pricing models, mobile-first designs, and easy-to-integrate APIs, enabling gradual digital onboarding without disrupting core operations

North America Construction Management Software Market Scope

The market is segmented on the basis of offering, device type, building type, deployment type, pricing model, application, and vertical.

- By Offering

On the basis of offering, the North America construction management software market is segmented into solution and services. The solution segment dominated the market with the largest revenue share of 58.7% in 2024, owing to the high demand for integrated construction software that can manage multiple workflows such as scheduling, budgeting, and documentation in real-time. These platforms help firms streamline operations, improve collaboration, and reduce project delays.

The services segment is projected to witness the fastest CAGR of 11.6% from 2025 to 2032, driven by the increasing need for training, consulting, and post-deployment support among small and medium-sized construction companies adopting digital tools for the first time.

- By Device Type

On the basis of device type, the North America construction management software market is segmented into smartphone and computer. The computer segment accounted for the largest market share of 64.3% in 2024, driven by its widespread usage among architects and project managers for detailed design, reporting, and analytics tasks.

The smartphone segment is anticipated to grow at the fastest CAGR of 13.2% from 2025 to 2032, supported by the rising trend of mobile-first solutions that allow field workers and site supervisors to access and update project information remotely and in real-time.

- By Building Type

On the basis of building type, the North America construction management software market is segmented into commercial buildings and residential buildings. The commercial buildings segment held the highest market revenue share of 61.5% in 2024, due to high investments in infrastructure, office spaces, retail centers, and industrial buildings where complex project planning and coordination is critical.

The residential buildings segment is expected to witness the fastest CAGR of 10.9% from 2025 to 2032, fueled by increasing urban housing projects, demand for modular homes, and rising adoption of construction tech in residential architecture and planning.

- By Deployment Type

On the basis of deployment type, the North America construction management software market is segmented into cloud and on-premises. The cloud segment dominated the market with a share of 67.1% in 2024, attributed to the flexibility, lower upfront costs, and ease of access offered by cloud-based platforms, especially for geographically dispersed project teams.

The on-premises segment is projected to grow steadily from 2025 to 2032, favored by large enterprises seeking high customization and enhanced data control within secured in-house systems.

- By Pricing Model

On the basis of pricing model, the North America construction management software market is segmented into license-based and subscription-based. The subscription-based segment led the market in 2024 with a revenue share of 69.4%, driven by its affordability for SMEs and the trend of SaaS models that offer continuous updates and customer support.

The license-based segment is expected to see modest growth from 2025 to 2032, primarily used by large contractors and firms that prefer one-time purchases and extensive control over their software usage.

- By Application

On the basis of application, the North America construction management software market is segmented into preconstruction, project management and scheduling, resource management, financial management, customer relationship management software, safety and reporting, field service management, cost accounting, project design, and others. The project management and scheduling segment held the largest market share of 29.3% in 2024, driven by the growing complexity of construction projects and the need for efficient task allocation, timeline adherence, and milestone tracking.

The field service management segment is forecasted to register the highest CAGR of 12.7% from 2025 to 2032, due to increased focus on real-time site data collection, workforce management, and equipment monitoring.

- By Vertical

On the basis of vertical, the North America construction management software market is segmented into builders and contractors, construction companies, engineer, architect, and others. The builders and contractors segment dominated the market with a share of 37.6% in 2024, driven by growing adoption of digital tools for budgeting, subcontractor coordination, and site operations.

The engineer and architect segment is expected to grow at the fastest CAGR of 11.8% from 2025 to 2032, as these professionals increasingly rely on software platforms for BIM integration, structural analysis, and collaborative design.

North America Construction Management Software Market Regional Analysis

- North America accounted for 33% of the global construction management software market revenue in 2024, fueled by increasing infrastructure investments, the rapid digitization of construction workflows, and the rising adoption of cloud-based project management tools across the U.S., Canada, and Mexico

- Construction management software systems are playing an increasingly vital role in optimizing planning, cost control, document management, and real-time collaboration across public and private infrastructure projects in the region

- The demand is being driven by large-scale infrastructure modernization programs, stringent building code regulations, and the growing need for efficient stakeholder coordination in complex, multi-phase construction developments

U.S. North America Construction Management Software Market Insight

The U.S. global construction management software market dominated the North America market with the largest revenue share of 40.2% in 2024, supported by the presence of major software vendors, fast-paced urban development, and widespread implementation of cloud-based construction solutions. High adoption of BIM (Building Information Modeling), mobile field apps, and AI-powered analytics tools is transforming how U.S.-based contractors manage cost estimation, scheduling, subcontractor coordination, and compliance tracking. Government-backed investments under the Infrastructure Investment and Jobs Act (IIJA) are further accelerating the shift toward digitized construction project execution.

Canada North America Construction Management Software Market Insight

The Canada global construction management software market is projected to be the fastest-growing country in the North America, registering a CAGR of 9.85% during 2025–2032, driven by nationwide efforts in infrastructure modernization, particularly in transit, housing, and renewable energy. The adoption of BIM standards, increasing emphasis on sustainable and green buildings, and cross-sector collaboration between public authorities and private developers are fueling the adoption of integrated project delivery (IPD) platforms across the country. Federal and provincial infrastructure programs are encouraging the use of digital tools to improve transparency, cost efficiency, and project traceability.

Mexico North America Construction Management Software Market Insight

The Mexico global construction management software market is emerging as a growing market for construction management software, supported by infrastructure development in transportation, logistics hubs, and industrial parks—particularly near the U.S.–Mexico border. Growth is also fueled by an expanding base of general contractors and engineering firms embracing digital tools for scheduling, material tracking, and project bidding to stay competitive. Mexico is expected to witness a steady CAGR of 7.1% from 2025 to 2032, aided by foreign direct investments in construction and rising demand for cloud-based and mobile-first project management platforms.

North America Construction Management Software Market Share

The North America construction management software market industry is primarily led by well-established companies, including:

- Bentley Systems, Incorporated (U.S.)

- Autodesk Inc. (U.S.)

- Nexvia (Australia)

- Fortive (U.S.)

- Intuit Inc. (U.S.)

- Contractor Foreman (U.S.)

- Oracle Corporation (U.S.)

- Procore Technologies, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- BPA Solutions (Switzerland)

- Trimble Inc. (U.S.)

- Constellation Software Inc. (Canada)

- SAP SE (Germany)

- Vectorworks, Inc. (U.S.)

- Sage Group plc (U.K.)

- RIB Software SE (Germany)

Latest Developments in North America Construction Management Software Market

- In November 2022, Bentley Systems launched phase 2 of the architecture metaverse at its infrastructure conference in London. This advancement addresses gaps between data processes in IT, OT, and ET, improving collaboration and workflow handoff in the construction management software market. Bentley's enhancements aim to streamline design, construction, and operation workflows, marking a significant step forward in integrating technology for more efficient and cohesive infrastructure project management

- In November 2022, Trimble Inc. introduced a software solution enhancing project productivity, efficiency, and communication within the construction management software market. This innovation enables contractors to track tools and assign tasks through an interface integrating Hilti Group's ON! Track asset management system with Trimble's Viewpoint Vista ERP and Construction One suite. The integration streamlines data use, reduces waste, and fosters improved collaboration among team members, offering a comprehensive project management solution

- In May 2022, Oracle's collaboration with Deloitte aims to enhance Oracle applications, including those relevant to the construction management software market. This strategic partnership focuses on advancing cloud and application technologies, aiming to provide an improved solution portfolio for customers. Through leveraging Deloitte's expertise, Oracle seeks to elevate its brand value and deliver more robust and innovative offerings to meet the evolving needs of the construction management software sector

- In May 2022, Procore Technologies, Inc. achieved Top Rated Construction Product status by TrustRadius, elevating its standing in the construction management software market. This recognition enhances the company's brand value and builds trust among customers, contributing to increased market credibility. The acknowledgment as a top-rated product is poised to accelerate sales growth, emphasizing Procore's commitment to delivering high-quality technology solutions within the construction management sector

- In June 2024, Procore Technologies unveiled major advancements at its Innovation Summit 2024, introducing Procore Copilot AI, AI‑powered Scheduling, and Procore Maps. These tools enhance collaboration across the construction lifecycle by embedding AI-driven context into team workflows, fostering smarter and more coordinated project delivery

- In November 2024, at Groundbreak 2024, Procore launched its Resource Management module—an integrated tool for managing labor, materials, and equipment in a unified platform. The solution directly connects resource planning with financials, scheduling, and risk analysis, aiming to boost productivity and forecasting accuracy

- In December 2024, Procore expanded its 360 Reporting tool, offering enhanced visibility into payment workflows, recipient tracking, and financial analytics. This upgrade delivers deeper insights into project costs and approvals, addressing contractor demand for transparent financial management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.