North America Construction Product Certification Market

Market Size in USD Billion

CAGR :

%

USD

32.43 Billion

USD

59.59 Billion

2025

2033

USD

32.43 Billion

USD

59.59 Billion

2025

2033

| 2026 –2033 | |

| USD 32.43 Billion | |

| USD 59.59 Billion | |

|

|

|

|

North America Construction Product Certification Market Size

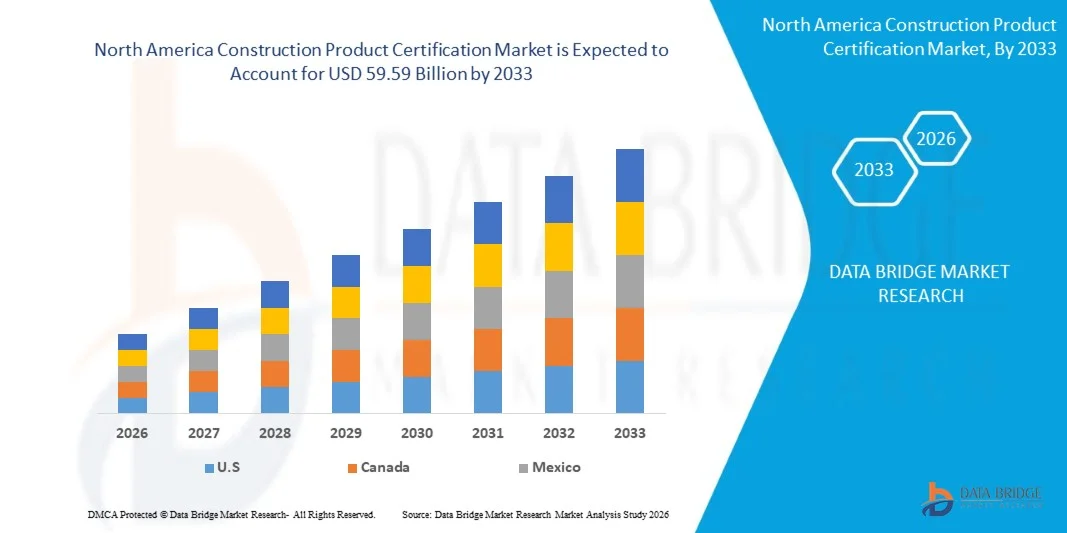

- The North America Construction Product Certification Market size was valued at USD 32.43 billion in 2025 and is projected to reach USD 59.59 billion by 2033, growing at a CAGR of 7.90% during the forecast period.

- The market expansion is primarily driven by increasing regulatory requirements and standards for building safety, quality, and sustainability, prompting widespread adoption of certified construction products across residential and commercial projects.

- In addition, rising awareness among consumers and developers about the benefits of certified materials, including enhanced durability, energy efficiency, and compliance with green building initiatives, is fueling demand. These combined trends are accelerating market adoption and significantly contributing to the sector’s growth.

North America Construction Product Certification Market Analysis

- Construction product certification, ensuring compliance with safety, quality, and sustainability standards, is increasingly essential for modern residential and commercial projects due to rising regulatory requirements, enhanced building performance expectations, and growing emphasis on green and resilient construction practices.

- The escalating demand for certified construction products is primarily driven by stricter building codes, increasing adoption of sustainable and energy-efficient materials, and growing awareness among developers and consumers regarding long-term cost savings and structural safety.

- U.S. dominated the Construction Product Certification Market with the largest revenue share of 33% in 2025, characterized by stringent regulatory frameworks, high construction activity, and a strong presence of key certification bodies and industry players, with the U.S. experiencing substantial growth in certified products adoption across commercial buildings, residential developments, and infrastructure projects, driven by innovations in sustainable materials and advanced construction technologies.

- Canada is expected to be the fastest-growing region in the Construction Product Certification Market during the forecast period due to rapid urbanization, rising construction investments, and increasing focus on international standards compliance.

- The Construction and Building Products segment dominated the market with the largest revenue share of 38.7% in 2025, driven by the growing demand for certified structural materials, sustainable construction solutions, and compliance with stringent building codes.

Report Scope and North America Construction Product Certification Market Segmentation

|

Attributes |

North America Construction Product Certification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America Construction Product Certification Market Trends

“Enhanced Building Safety and Sustainability Through Advanced Certification Technologies”

- A significant and accelerating trend in the North America Construction Product Certification Market is the growing adoption of advanced certification technologies that streamline compliance verification, sustainability assessments, and performance tracking for construction products. This integration is significantly enhancing building safety, efficiency, and long-term value.

- For instance, digital certification platforms allow real-time verification of building materials, enabling architects, contractors, and developers to ensure compliance with energy efficiency and safety standards without delays in project timelines. Similarly, cloud-based certification systems enable centralized management of documentation for multiple projects across regions.

- Advanced technologies in certification processes, such as AI-driven compliance checks and predictive analytics, help identify potential risks, optimize material selection, and improve quality assurance. For example, some platforms use AI to flag non-compliant products automatically or suggest alternative certified materials that meet both regulatory and sustainability requirements.

- The integration of certification systems with building information modeling (BIM) and smart construction platforms facilitates a unified approach to project management, enabling developers to monitor certified materials, track sustainability metrics, and ensure regulatory compliance from a single interface.

- This trend toward more intelligent, transparent, and automated certification solutions is fundamentally reshaping industry expectations for construction quality and sustainability. Consequently, companies such as UL, Intertek, and Bureau Veritas are expanding AI-enabled certification services, including automated compliance reporting, digital product passports, and sustainability scoring for materials.

- The demand for construction products certified through advanced, technology-driven platforms is growing rapidly across both residential and commercial sectors, as developers and end-users increasingly prioritize safety, regulatory compliance, and sustainable building practices.

North America Construction Product Certification Market Dynamics

Driver

“Growing Need Due to Rising Regulatory Requirements and Safety Awareness”

- The increasing focus on building safety, sustainability, and regulatory compliance, coupled with rapid urbanization and expanding construction activities, is a significant driver for the heightened demand for construction product certification.

- For instance, in 2025, UL and Intertek expanded their digital certification platforms to provide real-time compliance verification for energy-efficient building materials, helping developers meet stricter building codes and green construction standards. Such initiatives by key companies are expected to drive market growth in the forecast period.

- As developers, architects, and contractors become more aware of potential risks associated with substandard materials and non-compliance, certified construction products offer verified safety, durability, and performance, providing a compelling value proposition over uncertified alternatives.

- Furthermore, the growing emphasis on sustainable construction and green building certifications is making certified materials an integral component of modern construction projects, enabling seamless compliance with standards such as LEED, WELL, and local building codes.

- The assurance of product reliability, compliance with environmental regulations, and traceable quality documentation are key factors propelling the adoption of certified construction products across residential, commercial, and infrastructure projects. Increasing demand for digital tools and platforms that simplify certification processes also contributes to market growth.

Restraint/Challenge

“Concerns Regarding Compliance Costs and Complexity of Certification Processes”

- High costs associated with certification, including testing, documentation, and compliance audits, pose a significant challenge to broader market penetration, particularly for small and mid-sized construction firms.

- For instance, smaller developers may be hesitant to invest in fully certified materials due to upfront costs, even though long-term savings and risk reduction are clear.

- Addressing these challenges through streamlined digital certification processes, automated compliance verification, and tiered pricing models is crucial for encouraging wider adoption. Companies such as Bureau Veritas and CSA Group are increasingly offering integrated platforms that reduce administrative burdens and simplify certification for end-users.

- Additionally, navigating the complex landscape of regional, national, and international building standards can be a barrier for developers and manufacturers, requiring specialized knowledge and resources.

- Overcoming these challenges through greater digital integration, user education on compliance benefits, and development of cost-effective certification solutions will be vital for sustained growth in the North America Construction Product Certification Market.

North America Construction Product Certification Market Scope

The market is segmented on the basis of product, application, and end-user.

• By Product

On the basis of product, the North America Construction Product Certification Market is segmented into Construction and Building Products, Power Generation and Energy Storage, Industrial and Hazardous Location Equipment, Information and Communications Technology, Lighting Products, Medical and Laboratory Equipment, Personal Protective Equipment, Tools and Outdoor Equipment, and others. The Construction and Building Products segment dominated the market with the largest revenue share of 38.7% in 2025, driven by the growing demand for certified structural materials, sustainable construction solutions, and compliance with stringent building codes. Certified construction products provide assurance of durability, safety, and energy efficiency, making them the preferred choice for residential and commercial developers.

The Medical and Laboratory Equipment segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, fueled by increased healthcare infrastructure investments, regulatory requirements, and rising adoption of certified equipment to ensure safety and performance standards in hospitals and laboratories.

• By Application

On the basis of application, the North America Construction Product Certification Market is segmented into Interior Finishing, Insulation, Exterior Siding, Roofing, and others. The Interior Finishing segment held the largest market revenue share of 41.2% in 2025, supported by the growing emphasis on quality materials in flooring, wall panels, ceilings, and other finishes. Certified interior finishing products ensure compliance with fire safety, durability, and sustainability standards, which are increasingly mandated in modern residential and commercial projects.

The Insulation segment is expected to record the fastest CAGR of 20.5% from 2026 to 2033, driven by rising demand for energy-efficient buildings, stricter building energy codes, and the adoption of certified thermal and acoustic insulation materials that reduce energy consumption and enhance occupant comfort. Rising awareness of sustainable construction practices further supports the rapid adoption of certified insulation solutions.

• By End-User

On the basis of end-user, the North America Construction Product Certification Market is segmented into Industrial, Commercial, and Residential. The Commercial segment dominated the market with a revenue share of 42.5% in 2025, owing to increasing adoption of certified products in offices, retail, hospitality, and institutional buildings to meet safety, quality, and sustainability requirements. Certification provides businesses with assurance of long-term performance, regulatory compliance, and reduced maintenance costs.

The Residential segment is projected to witness the fastest CAGR of 21.0% from 2026 to 2033, driven by the growing trend of smart homes, sustainable construction, and rising consumer preference for certified building materials that enhance safety, energy efficiency, and overall home quality. The surge in residential real estate development and renovations further accelerates demand for certified products in this segment.

North America Construction Product Certification Market Regional Analysis

- U.S. dominated the North America Construction Product Certification Market with the largest revenue share of 33% in 2025, driven by increasing demand for certified construction materials, rising awareness of building safety and sustainability standards, and stringent regulatory requirements across residential, commercial, and industrial projects.

- The region’s construction and real estate sectors emphasize compliance with building codes and certifications to ensure safety, durability, and environmental sustainability, boosting the adoption of certified products.

- Widespread adoption is further supported by high construction activity, strong infrastructure investments, and the presence of leading certification bodies and key industry players in the U.S. and Canada. Additionally, growing awareness among developers, contractors, and end-users regarding the benefits of certified products—such as reduced maintenance risk, improved quality assurance, and eligibility for green building incentives—reinforces North America’s position as a dominant market for construction product certification.

U.S. Construction Product Certification Market Insight

The U.S. construction product certification market captured the largest revenue share of 82% in 2025 within North America, driven by rising demand for certified building materials and growing awareness of safety, quality, and sustainability standards. Developers and contractors increasingly prioritize certified products to ensure compliance with stringent building codes, environmental regulations, and fire safety requirements. The expansion of residential, commercial, and infrastructure projects, coupled with government incentives for green buildings, is accelerating market growth. Additionally, the presence of leading certification bodies and prominent industry players ensures widespread adoption of certified products across various construction segments.

Canada Construction Product Certification Market Insight

The Canadian market is anticipated to expand at a notable CAGR during the forecast period, fueled by growing infrastructure projects, urbanization, and emphasis on sustainable construction practices. Certified construction products are highly valued for ensuring compliance with national safety standards, energy efficiency requirements, and durability benchmarks. Residential, commercial, and industrial developments are increasingly integrating certified materials to meet local building codes and green certification requirements. Government initiatives promoting energy-efficient and environmentally friendly construction further support market adoption.

Mexico Construction Product Certification Market Insight

The Mexican market is expected to witness steady growth during the forecast period due to increasing urbanization, industrialization, and modern construction practices. The adoption of certified products is driven by the need to comply with national and international building standards, enhance safety, and improve the quality of residential and commercial projects. The rise of large-scale infrastructure and commercial development projects in metropolitan regions is contributing to market expansion, while awareness of the benefits of certified materials, such as reduced maintenance costs and long-term durability, is encouraging further adoption.

North America Construction Product Certification Market Share

The Construction Product Certification industry is primarily led by well-established companies, including:

- UL (U.S.)

- Intertek Group plc (U.K.)

- CSA Group (Canada)

- Bureau Veritas (France)

- SGS (Switzerland)

- TÜV SÜD (Germany)

- TÜV Rheinland (Germany)

- Intertek ETL (U.S.)

- Underwriters Laboratories of Canada (Canada)

- FM Approvals (U.S.)

- DEKRA (Germany)

- Lloyd’s Register (U.K.)

- Kiwa (Netherlands)

- ICF (U.S.)

- National Fire Protection Association – NFPA (U.S.)

- ASTM International (U.S.)

- National Institute of Standards and Technology – NIST (U.S.)

- Canadian Standards Association – CSA International (Canada)

- Eurofins Scientific (Luxembourg)

- Applus+ (Spain)

What are the Recent Developments in North America Construction Product Certification Market?

- In April 2025, UL (Underwriters Laboratories) expanded its North American operations by launching an advanced certification program for construction and building products, aimed at enhancing safety, quality, and compliance across residential and commercial projects. This initiative underscores UL’s commitment to supporting manufacturers, builders, and developers with globally recognized certification standards, ensuring safer and more reliable construction practices while reinforcing its leadership in the North America Construction Product Certification Market.

- In March 2025, Intertek Group plc introduced a new comprehensive testing and certification service for energy-efficient and sustainable building materials. Designed to support both commercial and residential construction projects, this program enables developers to achieve compliance with evolving green building standards and local regulatory requirements. The initiative highlights Intertek’s focus on promoting sustainable construction and advancing industry best practices.

- In March 2025, CSA Group successfully launched a regional certification initiative for industrial and hazardous location equipment in North America. By applying rigorous safety, performance, and durability testing protocols, CSA Group aims to enhance construction site safety and operational reliability, demonstrating the growing importance of certified products in high-risk environments and strengthening its position in the market.

- In February 2025, SGS North America partnered with multiple construction associations to create a streamlined certification and compliance program for building products. This collaboration is designed to facilitate regulatory approvals, ensure product quality, and simplify procurement processes for builders, architects, and contractors, highlighting SGS’s commitment to innovation and operational efficiency in the construction sector.

- In January 2025, Bureau Veritas unveiled an advanced certification solution for construction and building products at the North America BuildTech Expo 2025. This program focuses on integrating sustainability, safety, and performance standards, enabling manufacturers and developers to ensure compliance with evolving building codes. The launch underscores Bureau Veritas’s dedication to leveraging cutting-edge technology to enhance safety, quality, and reliability across construction projects in the region.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Construction Product Certification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Construction Product Certification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Construction Product Certification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.