North America Contract Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

65.00 Billion

USD

110.02 Billion

2024

2032

USD

65.00 Billion

USD

110.02 Billion

2024

2032

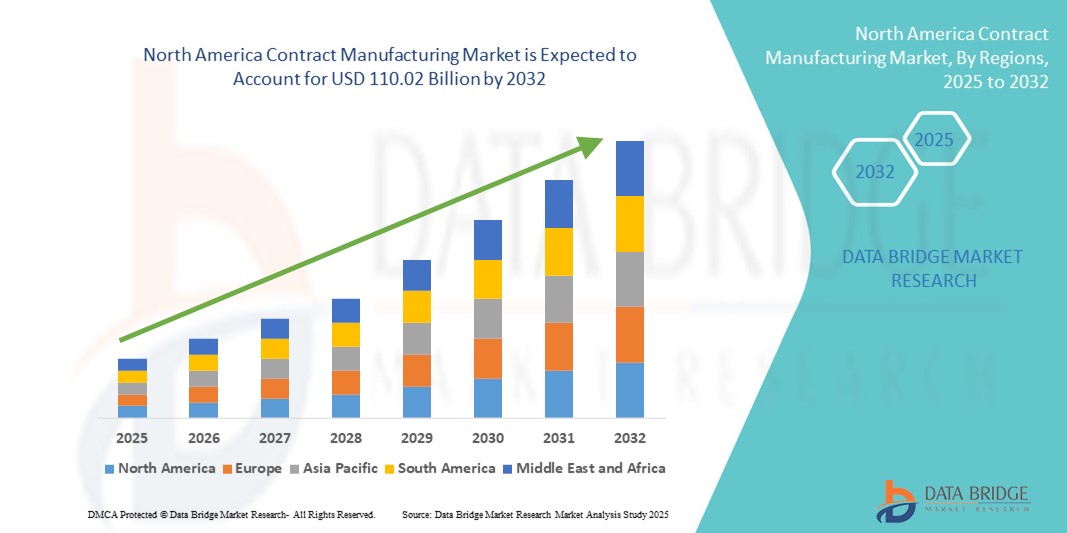

| 2025 –2032 | |

| USD 65.00 Billion | |

| USD 110.02 Billion | |

|

|

|

|

North America Contract Manufacturing Market Size

- The North America contract manufacturing market size was valued at USD 65.00 billion in 2024 and is expected to reach USD 110.02 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market expansion is primarily driven by the increasing trend of outsourcing manufacturing activities across various sectors such as pharmaceuticals, electronics, and consumer goods to enhance cost-efficiency and operational flexibility

- In addition, heightened demand for high-quality, customized products and the need for rapid time-to-market are prompting businesses to rely on contract manufacturers. These evolving business dynamics are accelerating the growth of the contract manufacturing sector, reinforcing its critical role in North America's industrial landscape

North America Contract Manufacturing Market Analysis

- Contract manufacturing, involving third-party production services for branded goods, plays a crucial role in North America’s industrial strategy, enabling companies across sectors to enhance operational efficiency, reduce capital expenditure, and focus on core competencies such as R&D and marketing

- The growing reliance on contract manufacturing is primarily driven by rising demand for cost-effective, scalable production in the pharmaceutical and medical device sectors, along with increasing product complexity and the need for regulatory compliance

- U.S. dominated the North America contract manufacturing market with the largest revenue share of 69.2% in 2024, supported by its advanced manufacturing infrastructure, presence of global pharmaceutical and biotech companies, and strong outsourcing trends in life sciences and medical technology

- Canada is expected to be the fastest growing country in the North American contract manufacturing market during the forecast period, driven by favorable government policies, expanding pharmaceutical investments, and growing demand for biologics and advanced therapies

- Pharmaceutical products manufacturing segment dominated the North America contract manufacturing market with a 59.8% share in 2024, due to increasing outsourcing of drug development and production by pharmaceutical and biopharma companies seeking efficiency and compliance with regulatory standards

Report Scope and North America Contract Manufacturing Market Segmentation

|

Attributes |

North America Contract Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Contract Manufacturing Market Trends

Shift Toward High-Value, Specialized Manufacturing Services

- A prominent and evolving trend in the North America contract manufacturing market is the shift toward offering high-value, specialized manufacturing services, particularly in sectors such as pharmaceuticals, biotechnology, and medical devices. This transition reflects increasing client demand for advanced technical capabilities, regulatory expertise, and end-to-end service offerings

- For instance, Thermo Fisher Scientific has significantly expanded its CDMO services in biologics manufacturing, while Catalent continues to invest in advanced drug delivery technologies and biologic fill-finish capabilities to meet growing client needs

- Specialized manufacturing services now often include support for highly potent APIs, complex sterile injectables, and gene and cell therapies. These offerings are critical for biopharma companies navigating challenging product formulations and stringent regulatory environments

- In the medical device sector, contract manufacturers are incorporating advanced technologies such as 3D printing, automation, and precision robotics to support clients in producing increasingly complex devices

- This trend toward specialization is also driven by clients’ expectations for integrated solutions that span development, scale-up, and commercial manufacturing. Contract manufacturers that can provide flexible, technology-driven, and regulatory-compliant services across the product lifecycle are seeing a competitive advantage

- As a result, the market is witnessing a clear move from traditional low-cost, volume-focused production toward long-term strategic partnerships focused on quality, speed-to-market, and innovation in high-growth therapeutic and device categories

North America Contract Manufacturing Market Dynamics

Driver

Rising Outsourcing by Pharma and Biotech Companies to Optimize Efficiency

- The increasing tendency of pharmaceutical and biotechnology companies to outsource their manufacturing processes is a major driver of the North America contract manufacturing market. Outsourcing enables these companies to reduce capital expenditures, streamline operations, and accelerate time-to-market for complex and highly regulated products

- For instance, in February 2024, Lonza expanded its capacity for commercial biologics manufacturing in the U.S. to meet rising demand from mid-to-large biopharma clients. Similarly, Recipharm continues to secure long-term manufacturing contracts for complex drug formulations in North America

- The growth of the biologics and biosimilars market, combined with the complexity and high cost of setting up GMP-compliant facilities, is further pushing companies toward contract manufacturing solutions

- In addition, the demand for CDMOs offering integrated services including R&D support, clinical trial manufacturing, and commercial-scale production is expanding rapidly, especially as smaller biotech startups seek partners with end-to-end capabilities

- This driver is particularly significant in North America, where a large number of emerging and established life sciences companies are focused on innovation but prefer to avoid the financial and operational burden of maintaining in-house production facilities

Restraint/Challenge

Regulatory Complexity and Quality Compliance Requirements

- One of the main challenges in the North America contract manufacturing market is navigating the highly complex regulatory landscape, particularly in sectors such as pharmaceuticals and medical devices. Meeting evolving FDA guidelines, cGMP standards, and other regulatory requirements adds substantial operational burden for contract manufacturers

- For instance, changes in FDA inspection protocols or increased scrutiny of supply chain integrity can lead to production delays or increased compliance costs. These issues can affect a contract manufacturer's reputation and ability to secure repeat business

- Moreover, the pressure to maintain consistently high quality across large-scale and multi-site operations often necessitates significant investment in quality control systems, data management infrastructure, and personnel training

- Failures to meet compliance standards can result in costly recalls, contract losses, or reputational damage, particularly in high-stakes industries such as biopharma

- To overcome these challenges, contract manufacturers are increasingly investing in advanced digital tools such as electronic batch records, real-time quality monitoring, and AI-powered compliance analytics. Nevertheless, the evolving regulatory environment remains a critical hurdle that requires continuous vigilance and adaptation for long-term success

North America Contract Manufacturing Market Scope

The market is segmented on the basis of product, end user, and distribution channel.

- By Product

On the basis of product, the North America contract manufacturing market is segmented into pharmaceutical products manufacturing and medical device manufacturing. The pharmaceutical products manufacturing segment dominated the market with the largest revenue share of 59.8% in 2024. This dominance is driven by the increased outsourcing of drug manufacturing by pharmaceutical and biopharma companies, especially for complex formulations, biologics, and generic drugs. Regulatory compliance requirements and the rising demand for cost-efficient production solutions have further pushed companies to rely on contract manufacturing partners for large-scale and high-quality pharmaceutical production.

The medical device manufacturing segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to growing demand for innovative and miniaturized medical devices, as well as the need for precision-engineered components. Increasing technological complexity and the rising number of medical device startups are encouraging firms to outsource device manufacturing to specialized contract manufacturers with expertise in compliance, prototyping, and precision manufacturing.

- By End User

On the basis of end user, the North America contract manufacturing market is segmented into pharmaceutical companies, biotechnology companies, biopharma companies, medical device companies, original equipment manufacturers (OEMs), and research institutes. Pharmaceutical companies held the largest market revenue share of 38.7% in 2024. This is attributed to their extensive use of contract manufacturing organizations (CMOs) to reduce production costs, increase flexibility, and scale up manufacturing capabilities without investing in in-house facilities. Established pharma companies increasingly rely on CMOs for both small-molecule and biologic drug manufacturing, driving consistent demand across the region.

Biopharma companies are expected to witness the fastest growth over the forecast period due to increasing development of cell and gene therapies, which require specialized manufacturing capabilities. The complexity of these therapies and the need for regulatory-aligned production processes make outsourcing a preferred choice for emerging and mid-sized biopharma firms.

- By Distribution Channel

On the basis of distribution channel, the North America contract manufacturing market is segmented into direct tender, retail sales, and others. The direct tender segment accounted for the largest share of 46.5% in 2024. Government agencies, public health organizations, and large healthcare institutions typically procure pharmaceutical and medical products in bulk through tender-based agreements. This channel ensures competitive pricing, regulatory transparency, and long-term supply reliability, making it a dominant mode of distribution in North America.

The retail sales segment is expected to grow at a steady pace during forecast period, particularly in the medical device segment, where increased availability of consumer-facing medical products through pharmacies and online platforms is driving demand.

North America Contract Manufacturing Market Regional Analysis

- U.S. dominated the North America contract manufacturing market with the largest revenue share of 69.2% in 2024, supported by its advanced manufacturing infrastructure, presence of global pharmaceutical and biotech companies, and strong outsourcing trends in life sciences and medical technology

- The region benefits from a robust ecosystem of contract development and manufacturing organizations (CDMOs) with advanced technical capabilities, compliance expertise, and capacity to support complex manufacturing needs across drug and device categories

- This widespread adoption is further supported by the presence of global pharmaceutical headquarters, a mature healthcare infrastructure, and favorable regulatory environments, positioning North America as a preferred hub for high-quality, outsourced manufacturing solutions across life sciences and healthcare industries

The U.S. Contract Manufacturing Market Insight

The U.S. contract manufacturing market captured the largest revenue share of 69.2% in 2024 within North America, driven by its well-established pharmaceutical and medical device industries and the presence of leading CDMOs offering end-to-end solutions. The country’s strong regulatory framework, robust healthcare infrastructure, and significant R&D investments have encouraged companies to outsource complex manufacturing processes. The growing trend toward biologics, gene therapies, and personalized medicine further amplifies the need for specialized contract manufacturing capabilities in the U.S., solidifying its dominance in the region.

Canada Contract Manufacturing Market Insight

The Canada contract manufacturing market is projected to grow at a strong CAGR throughout the forecast period, supported by favorable government policies, increasing investment in the pharmaceutical and biotech sectors, and growing demand for advanced manufacturing capabilities. Canada's emphasis on innovation, combined with its access to skilled labor and proximity to the U.S. market, positions it as an attractive destination for contract manufacturing. In addition, Canada's expanding role in clinical trials and drug development enhances opportunities for CDMOs offering flexible and compliant manufacturing solutions.

Mexico Contract Manufacturing Market Insight

The Mexico contract manufacturing market is anticipated to grow at a considerable CAGR during the forecast period, driven by its cost-effective manufacturing environment and strategic location near the U.S. market. Mexico’s growing capabilities in pharmaceutical and medical device production, combined with favorable trade agreements such as the USMCA, are attracting multinational companies seeking efficient and scalable contract manufacturing partners. The country’s expanding industrial base, government support for manufacturing investments, and growing demand for healthcare products are further bolstering market growth.

North America Contract Manufacturing Market Share

The North America contract manufacturing industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Catalent, Inc. (U.S.)

- Lonza Group AG (Switzerland)

- Jubilant HollisterStier LLC (U.S.)

- Recipharm AB (Sweden)

- Samsung Biologics Co., Ltd. (South Korea)

- Patheon Inc. (U.S.)

- Baxter International Inc. (U.S.)

- AbbVie Contract Manufacturing (U.S.)

- PCI Pharma Services (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Boehringer Ingelheim BioXcellence (Germany)

- BD (U.S.)

- Medix Biochemica Group (Finland)

- WuXi AppTec Co., Ltd. (China)

- Alcami Corporation, Inc. (U.S.)

- Aenova Group GmbH (Germany)

- Evonik Industries AG (Germany)

- Cambrex Corporation (U.S.)

- Ajinomoto Bio-Pharma Services (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.