North America Corneal Transplant Market

Market Size in USD Million

CAGR :

%

USD

219.85 Million

USD

355.74 Million

2024

2032

USD

219.85 Million

USD

355.74 Million

2024

2032

| 2025 –2032 | |

| USD 219.85 Million | |

| USD 355.74 Million | |

|

|

|

|

North America Corneal Transplant Market Size

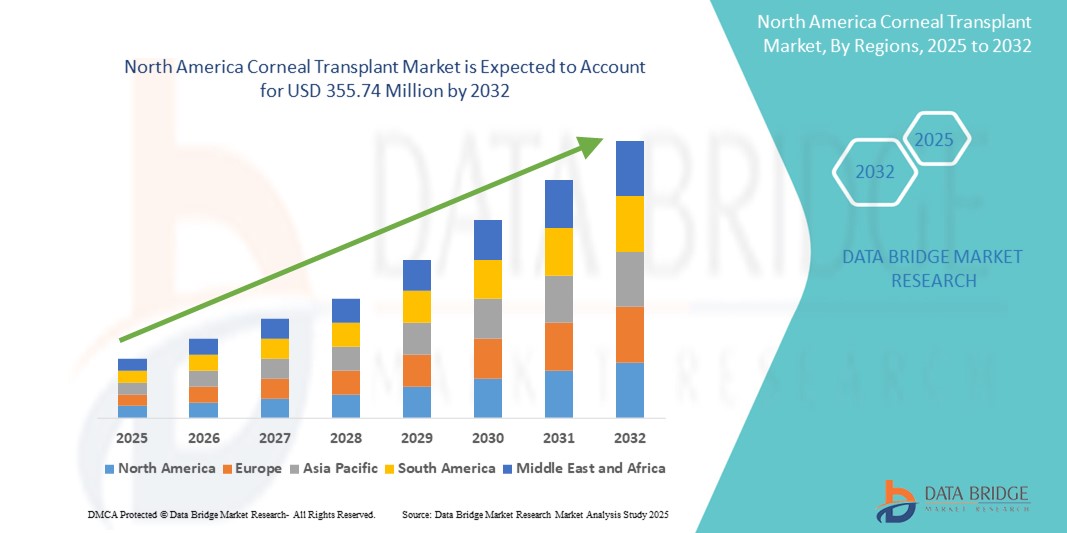

- The North America corneal transplant market size was valued at USD 219.85 million in 2024 and is expected to reach USD 355.74 million by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of corneal disorders, advancements in transplant techniques, and improved availability of donor tissues across the region

- Furthermore, rising awareness about eye health, supportive reimbursement structures, and growing adoption of minimally invasive surgical procedures are establishing corneal transplantation as a preferred treatment for restoring vision. These converging factors are accelerating the adoption of corneal transplant procedures, thereby significantly boosting the region’s market growth

North America Corneal Transplant Market Analysis

- Corneal transplants, involving the replacement of damaged or diseased corneal tissue with healthy donor tissue, are increasingly vital procedures within ophthalmic care across both public and private healthcare settings due to their effectiveness in restoring vision and improving patient quality of life

- The escalating demand for corneal transplants is primarily fueled by a rising prevalence of corneal diseases such as keratoconus and Fuchs’ dystrophy, along with advancements in surgical techniques and enhanced donor tissue availability

- U.S. dominated the North America corneal transplant market with the largest revenue share of 42.8% in 2024, characterized by a well-developed healthcare infrastructure, supportive reimbursement policies, and the presence of leading eye banks and transplant centers. The country is witnessing strong procedural volumes driven by awareness initiatives and innovations in endothelial keratoplasty techniques

- Canada is expected to be the fastest growing country in the North America corneal transplant market during the forecast period due to expanding access to specialized eye care and increasing investments in ophthalmic surgical technologies

- Penetrating keratoplasty segment dominated the North America corneal transplant market with a market share of 47.2% in 2024, driven by its widespread use, established clinical outcomes, and ability to treat full-thickness corneal damage

Report Scope and North America Corneal Transplant Market Segmentation

|

Attributes |

North America Corneal Transplant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Corneal Transplant Market Trends

“Technological Advancements in Keratoplasty Techniques”

- A significant and accelerating trend in the North America corneal transplant market is the shift toward advanced and minimally invasive keratoplasty techniques such as Descemet's Membrane Endothelial Keratoplasty (DMEK) and Descemet's Stripping Endothelial Keratoplasty (DSEK). These procedures offer improved visual outcomes, faster recovery times, and reduced complication risks compared to traditional full-thickness transplants

- For instance, U.S.-based transplant centers are increasingly adopting DMEK for treating endothelial dysfunction, supported by advances in surgical instrumentation and donor tissue preparation by specialized eye banks

- These newer techniques preserve more of the patient’s corneal structure, contributing to better long-term graft survival and reducing the such likelihood of immune rejection. Moreover, improvements in intraoperative visualization and laser-assisted procedures further enhance surgical precision and success rates

- The trend is also reinforced by growing surgeon preference for techniques that offer faster rehabilitation and fewer postoperative complications. As a result, the demand for pre-stripped and pre-loaded tissue from eye banks such as Lions Eye Institute for Transplant & Research is rising

- This movement toward next-generation corneal transplant procedures is reshaping clinical practices and setting new benchmarks in ophthalmic care across North America. Consequently, medical device companies and donor tissue banks are investing in training programs and advanced infrastructure to support widespread adoption

- The increasing availability of specialized surgical training, improved donor tissue logistics, and healthcare system readiness is expected to further solidify this trend as a cornerstone of the evolving corneal transplant landscape in the U.S. and Canada

North America Corneal Transplant Market Dynamics

Driver

“Increasing Prevalence of Corneal Diseases and Improved Access to Donor Tissue”

- The growing incidence of corneal conditions such as keratoconus, Fuchs’ endothelial dystrophy, and corneal scarring is a major driver for the expanding corneal transplant market in North America

- For instance, the Eye Bank Association of America (EBAA) reported over 80,000 corneal transplants performed in the U.S. in 2023, highlighting robust procedural demand

- Enhanced donor tissue availability, supported by a well-organized network of eye banks and donation awareness campaigns, ensures timely access to quality grafts, significantly improving transplant outcomes

- In addition, strong reimbursement frameworks and increased insurance coverage for ophthalmic procedures in the U.S. and Canada are making corneal transplants more accessible to a broader patient base

- Public and private sector initiatives to promote early diagnosis and timely treatment of corneal diseases further contribute to the increasing uptake of transplant procedures, particularly in urban centers with advanced healthcare facilities

Restraint/Challenge

“Shortage of Skilled Surgeons and Regional Disparities in Access”

- Despite technological progress, a shortage of ophthalmic surgeons trained in advanced keratoplasty techniques poses a challenge to the widespread adoption of modern corneal transplant procedures across North America

- For instance, rural areas in both the U.S. and Canada often face limited access to specialist care, resulting in longer wait times and fewer surgical options for patients in underserved regions

- Moreover, while urban hospitals may be well-equipped, disparities in funding and medical infrastructure across provinces and states hinder uniform access to high-quality care

- Ensuring wider surgeon training, increasing funding for ophthalmic services in remote areas, and strengthening inter-regional tissue sharing networks will be essential to overcoming these constraints and ensuring equitable access to corneal transplant care

- While corneal transplants are covered by insurance in many cases, the total cost—including preoperative evaluations, advanced surgical tools, donor tissue processing, and postoperative care can be high

- The financial burden is particularly significant for procedures involving cutting-edge techniques such as DMEK or femtosecond laser-assisted keratoplasty. For patients without comprehensive insurance or those in regions with limited reimbursement policies, cost becomes a critical barrier to access

North America Corneal Transplant Market Scope

The market is segmented on the basis of procedure type, type, donor type, graft type, surgery type, indication, gender, age group, and end user.

- By Procedure Type

On the basis of procedure type, the North America corneal transplant market is segmented into endothelial keratoplasty, penetrating keratoplasty, anterior lamellar keratoplasty (ALK), corneal limbal stem cell transplant, artificial cornea transplant, and others. The penetrating keratoplasty segment dominated the market with the largest market revenue share of 47.2% in 2024, owing to its long-established clinical utility and effectiveness in treating full-thickness corneal diseases. It continues to be widely adopted for severe corneal scarring and keratoconus cases.

The endothelial keratoplasty segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by advancements in surgical techniques such as DMEK and DSAEK. These approaches offer better visual recovery, reduced complications, and growing surgeon preference in treating endothelial disorders such as Fuchs’ dystrophy.

- By Type

On the basis of type, the North America corneal transplant market is segmented into human cornea and synthetic. The human cornea segment held the largest market revenue share in 2024, supported by the strong presence of eye banks and widespread use of donor tissue in transplantation procedures. High graft survival rates and availability through national donation systems contribute to the dominance of this segment.

The synthetic segment is expected to expand at a steady pace from 2025 to 2032, driven by innovation in artificial corneal implants for patients with multiple graft rejections or those unsuitable for human corneal grafts. Increased research into biocompatible materials is also supporting this growth.

- By Donor Type

On the basis of donor type, the North America corneal transplant market is segmented into autograft and allograft. The allograft segment accounted for the largest market revenue share in 2024, owing to its widespread application using cadaveric donor tissue in both full and partial thickness procedures.

The autograft segment is anticipated to witness moderate growth during the forecast period, particularly in niche applications such as limbal stem cell transplants and ocular surface reconstruction where patient-derived tissue is utilized.

- By Graft Type

On the basis of graft type, the North America corneal transplant market is segmented into partial thickness grafts (lamellar) and full thickness grafts (penetrating). The full thickness grafts segment dominated the market in 2024, primarily due to the continued reliance on penetrating keratoplasty for advanced corneal degeneration and trauma cases.

The partial thickness grafts segment is expected to grow at the fastest rate from 2025 to 2032, driven by the increasing adoption of endothelial and anterior lamellar techniques that offer better post-operative outcomes and lower rejection rates.

- By Surgery Type

On the basis of surgery type, the North America corneal transplant market is segmented into conventional surgery and laser-assisted surgery. The conventional surgery segment held the largest market revenue share in 2024 due to its longstanding use, cost-effectiveness, and broad accessibility across general ophthalmic surgical centers.

The laser-assisted surgery segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of femtosecond laser technology that enhances precision, reduces operative time, and improves graft-host interface alignment.

- By Indication

On the basis of indication, the North America corneal transplant market is segmented into Fuch's endothelial dystrophy, infectious keratitis, bullous keratopathy, keratoconus, regraft procedures, corneal scarring, corneal ulcers, and others. The Fuch’s endothelial dystrophy segment dominated the market in 2024, due to its high prevalence among the aging population and increasing preference for endothelial keratoplasty techniques.

The keratoconus segment is projected to grow at the fastest rate from 2025 to 2032, supported by early disease detection, rising awareness, and a growing number of selective lamellar graft procedures in younger patient groups.

- By Gender

On the basis of gender, the North America corneal transplant market is segmented into male and female. The male segment held the largest market revenue share in 2024, primarily due to higher incidence of trauma-related corneal injuries and occupational exposure to eye hazards.

The female segment is expected to register notable growth during forecast period, supported by the increasing diagnosis of Fuch’s dystrophy among older women and rising awareness of eye health.

- By Age Group

On the basis of age group, the North America corneal transplant market is segmented into geriatric, adult, and pediatric. The adult segment accounted for the largest market revenue share in 2024, as most transplant procedures are performed in this demographic, driven by keratoconus and infectious keratitis.

The geriatric segment is projected to grow at the fastest rate from 2025 to 2032, attributed to the higher prevalence of endothelial dysfunctions and degenerative eye diseases in aging populations, particularly across the U.S. and Canada.

- By End User

On the basis of end user, the North America corneal transplant market is segmented into hospitals, eye clinics, ambulatory surgical centers, academic & research institutes, and others. The hospitals segment dominated the market with the largest market revenue share in 2024, driven by the presence of advanced ophthalmic surgical setups and high patient inflow for full-service care.

The ambulatory surgical centers segment is expected to grow at the fastest pace during the forecast period, owing to shorter procedure times, cost efficiency, and increased patient preference for outpatient surgical interventions in ophthalmology.

North America Corneal Transplant Market Regional Analysis

- The U.S. dominated the North America corneal transplant market with the largest revenue share of 42.8% in 2024, characterized by a well-developed healthcare infrastructure, supportive reimbursement policies, and the presence of leading eye banks and transplant centers

- U.S. patients benefit from streamlined access to donor corneal tissue, the availability of highly skilled ophthalmic surgeons, and increasing public awareness about vision-restoring procedures such as DMEK and DSAEK

- This leadership position is further supported by favorable insurance coverage, rising investments in ophthalmic care, and widespread adoption of innovative transplant techniques, positioning the U.S. as a central hub for corneal transplant procedures in the region

U.S. Corneal Transplant Market Insight

The U.S. corneal transplant market captured the largest revenue share in 2024 within North America, driven by the rising prevalence of corneal disorders and the strong presence of eye banks and specialized surgical centers. The country’s advanced healthcare infrastructure, coupled with widespread availability of donor tissues and high-volume transplant procedures, supports robust market performance. In addition, growing adoption of endothelial keratoplasty techniques such as DMEK and DSAEK, along with favorable reimbursement frameworks, further accelerates the market. Continuous innovations in corneal graft processing and increasing patient awareness contribute significantly to sustained growth.

Canada Corneal Transplant Market Insight

The Canada corneal transplant market is projected to expand at a notable CAGR during the forecast period, supported by improvements in healthcare delivery, government-funded ophthalmic services, and expanding access to vision care in both urban and remote areas. Increased national focus on eye health, combined with growing surgical training programs and collaborations with U.S.-based eye banks, is enhancing procedural capacity. Rising demand for minimally invasive transplant options, public awareness initiatives, and growing investment in ophthalmic research are contributing to steady market advancement across Canada.

Mexico Corneal Transplant Market Insight

The Mexico corneal transplant market is anticipated to grow steadily during the forecast period, driven by increasing public and private investments in eye care services, rising prevalence of corneal blindness, and gradual improvement in healthcare accessibility. Government programs promoting organ and tissue donation, along with the expansion of ophthalmic surgical capabilities in urban hospitals, are supporting market development. While access to donor corneas remains a challenge in some regions, international collaborations and nonprofit initiatives are helping bridge gaps in tissue availability and surgical training. As awareness and healthcare infrastructure improve, Mexico is poised to witness sustained growth in corneal transplant procedures.

North America Corneal Transplant Market Share

The North America corneal transplant industry is primarily led by well-established companies, including:

- CorneaGen, Inc. (U.S.)

- KeraLink International (U.S.)

- SightLife (U.S.)

- Eversight (U.S.)

- Lions Eye Institute for Transplant & Research (U.S.)

- Bausch + Lomb (U.S.)

- Alcon Inc. (Switzerland)

- Aurolab (India)

- Tissue Banks International (U.S.)

- The Eye-Bank for Sight Restoration (U.S.)

- San Diego Eye Bank (U.S.)

- Lions VisionGift (U.S.)

- Wills Eye Hospital (U.S.)

- New World Medical, Inc. (U.S.)

- AJL Ophthalmic S.A. (Spain)

- Eye Bank for Sight Restoration (U.S.)

- DIOPTEX GmbH (Austria)

- Network for Pancreatic Organ Sharing (U.S.)

- Keramed, Inc. (U.S.)

- Stryker (U.S.)

What are the Recent Developments in North America Corneal Transplant Market?

- In May 2024, the Eye Bank Association of America (EBAA) launched a national awareness campaign across the U.S. to promote corneal donation and educate the public about the life-changing impact of transplants. The initiative aims to address the growing demand for donor tissues and enhance donation rates. By collaborating with hospitals, transplant centers, and advocacy groups, the campaign reinforces the importance of corneal health and strengthens the donor supply chain for transplantation procedures

- In April 2024, the University of British Columbia in Canada announced the successful clinical application of a novel bioengineered corneal implant, developed in collaboration with international researchers. This innovation offers a promising alternative for patients with low access to donor tissues, particularly those with advanced keratoconus. The breakthrough represents a significant step forward in regenerative ophthalmology and expands future possibilities for synthetic corneal transplantation in North America

- In March 2024, CorneaGen, Inc., a U.S.-based corneal tissue supply and innovation company, expanded its distribution network across Canada and Mexico, aiming to streamline access to pre-stripped and pre-loaded tissues for endothelial keratoplasty. This move enhances procedural efficiency and supports ophthalmic surgeons with ready-to-use grafts, further standardizing high-quality transplant care throughout North America

- In February 2024, the Toronto Western Hospital launched a dedicated Advanced Corneal Surgery Center, focusing on training ophthalmologists in cutting-edge techniques such as DMEK and DALK. This initiative addresses the shortage of specialized surgeons in Canada and reinforces regional efforts to improve outcomes through surgical excellence and education

- In January 2024, SightLife, a global nonprofit eye bank headquartered in the U.S., entered into a partnership with Mexico’s Ministry of Health to strengthen the national cornea donation framework. The program includes technical training, public awareness efforts, and quality assurance systems for tissue handling—marking a significant step toward improving transplant infrastructure and outcomes in underserved regions of North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.