North America Crane And Hoist Market

Market Size in USD Billion

CAGR :

%

USD

4.01 Billion

USD

5.89 Billion

2024

2032

USD

4.01 Billion

USD

5.89 Billion

2024

2032

| 2025 –2032 | |

| USD 4.01 Billion | |

| USD 5.89 Billion | |

|

|

|

|

North America Crane and Hoist Market Size

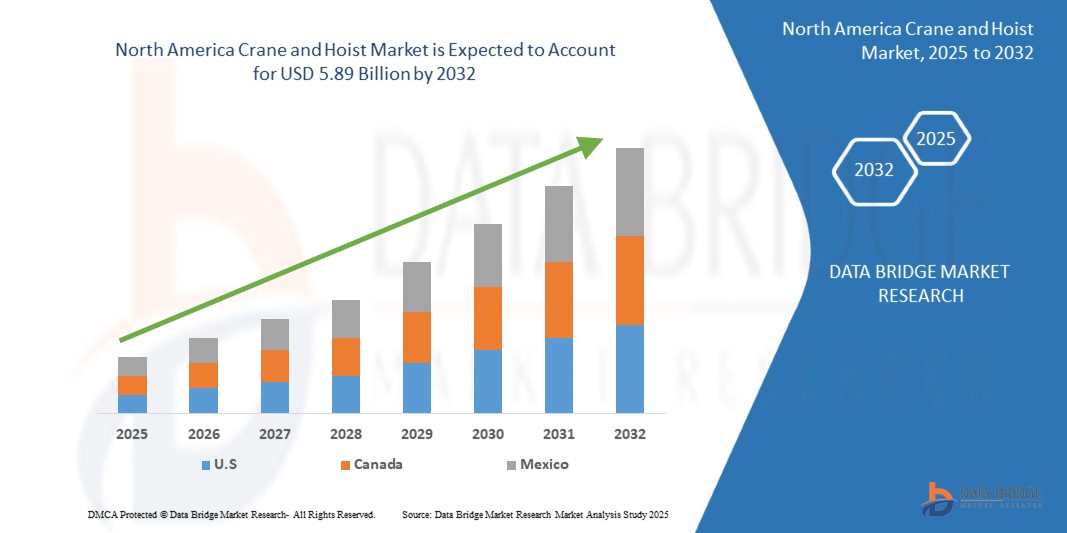

- The North America crane and hoist market size was valued at USD 4.01 billion in 2024 and is expected to reach USD 5.89 billion by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is largely fuelled by the rising demand for advanced lifting equipment across construction, manufacturing, and logistics sectors, coupled with increasing investments in infrastructure modernization across the region

- The growing trend of automation in material handling processes and the integration of Internet of Things (IoT) in lifting equipment are further contributing to the market expansion across North America

North America Crane and Hoist Market Analysis

- Rapid industrialization in the U.S. and Canada has significantly boosted the need for efficient material handling systems, thereby accelerating the demand for cranes and hoists

- Technological advancements, such as automation and integration of smart sensors, are transforming traditional crane and hoist systems, allowing for improved safety, real-time diagnostics, and operational efficiency

- U.S. crane and hoist market accounted for the largest revenue share of 78% in 2024 within North America, driven by robust infrastructure development and the revival of construction and manufacturing sectors

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America crane and hoist market due to rising construction activity, modernization of existing industrial facilities, and increased emphasis on workplace safety

- The mobile cranes segment accounted for the largest market revenue share in 2024, driven by their flexibility, ease of transport, and suitability for varied terrain across construction and infrastructure projects. These cranes are widely used in outdoor sites where fixed installations are impractical, such as roadworks and bridge building. The high utility of mobile cranes in short-term, high-capacity lifting makes them a preferred choice for contractors

Report Scope and North America Crane and Hoist Market Segmentation

|

Attributes |

North America Crane and Hoist Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Crane and Hoist Market Trends

“Integration of Automation and Smart Technologies in Crane Systems”

- Cranes and hoists are increasingly being integrated with automation systems such as programmable logic controllers (PLCs) and remote diagnostics to enhance operational efficiency and real-time control

- Manufacturers are adopting Internet of Things (IoT)-enabled hoists that can collect data on load, usage hours, and performance to support predictive maintenance strategies

- Smart cranes with anti-collision sensors, overload alerts, and wireless communication are gaining popularity across logistics, automotive, and manufacturing facilities

- The shift toward Industry 4.0 is accelerating demand for intelligent lifting systems capable of seamless coordination with other automated infrastructure

- For instance, Columbus McKinnon has introduced Magnetek-brand crane controls that provide remote monitoring and advanced safety diagnostics in U.S. steel processing plants

North America Crane and Hoist Market Dynamics

Driver

“Surge in Infrastructure Modernization and Industrial Expansion Projects”

- The increasing number of government infrastructure investments in roads, bridges, and ports is driving large-scale deployment of cranes and hoists across North America

- Rapid industrialization in sectors such as automotive, aerospace, and oil & gas is boosting the demand for high-capacity lifting and handling systems

- Construction of smart cities and large housing complexes is elevating the use of tower cranes and overhead hoists for efficient material handling

- Growth in the warehousing and logistics industry, driven by e-commerce, is increasing the installation of cranes for inventory management and order fulfillment

- For instance, major Amazon distribution centers in the U.S. use electric overhead traveling cranes for internal material handling operations

Restraint/Challenge

“High Installation and Maintenance Costs of Advanced Cranes”

- Advanced crane systems, especially those integrated with automation, require a high initial investment that may deter small and medium enterprises

- Ongoing maintenance, including inspections, lubrication, and calibration, results in high lifecycle costs for operators

- Limited availability of skilled technicians to install, operate, and maintain modern cranes can delay projects and raise labor expenses

- Volatility in the cost of raw materials such as steel and electronic components can impact the affordability of crane solutions

- For instance, a logistics firm in Texas delayed warehouse crane upgrades due to a 20% rise in steel prices and maintenance service contracts

North America Crane and Hoist Market Scope

The market is segmented on the basis of type, operations, industry, and application.

• By Type

On the basis of type, the North America crane and hoist market is segmented into mobile cranes and fixed cranes. The mobile cranes segment accounted for the largest market revenue share in 2024, driven by their flexibility, ease of transport, and suitability for varied terrain across construction and infrastructure projects. These cranes are widely used in outdoor sites where fixed installations are impractical, such as roadworks and bridge building. The high utility of mobile cranes in short-term, high-capacity lifting makes them a preferred choice for contractors.

The fixed cranes segment is expected to witness a fastest growth rate from 2025 to 2032, supported by rising investments in permanent industrial facilities. Fixed cranes offer stability, precision, and high load capacity, making them ideal for manufacturing plants, warehouses, and shipyards that require routine lifting operations with minimal mobility.

• By Operations

Based on operations, the market is segmented into hydraulic, electric, and hybrid. The electric segment led the market in 2024 due to its energy efficiency, lower emissions, and ease of control in indoor and regulated environments. Electric cranes are especially prevalent in factories and warehouses, where sustainability goals and automation integration are major priorities.

The hybrid segment is expected to witness a fastest growth rate from 2025 to 2032, owing to rising demand for environmentally friendly equipment without compromising on power. Hybrid cranes combine electric and hydraulic systems to offer enhanced fuel economy and flexibility in diverse operating conditions, particularly in sectors such as mining and oil & gas.

• By Industry

By industry, the market is segmented into shipping and material handling, aerospace and defence, automotive and railway, energy and power, and others. The shipping and material handling segment held the highest revenue share in 2024, fuelled by the expanding port infrastructure and logistics facilities in the region. Cranes and hoists are integral to container handling, cargo movement, and bulk material transport across terminals and warehouses.

The energy and power segment is expected to witness a fastest growth rate from 2025 to 2032, due to the ongoing transition to renewable energy infrastructure, where cranes are used in the installation of wind turbines, solar panels, and power equipment.

• By Application

On the basis of application, the market is segmented into construction, transportation and logistics, marine, oil and gas, mining, agriculture, and others. The construction segment dominated the market in 2024, backed by increasing residential and commercial construction activities across the U.S. and Canada. Cranes are essential for material handling, structural lifting, and assembling large prefabricated components.

The transportation and logistics segment is expected to witness a fastest growth rate from 2025 to 2032, supported by the rise of e-commerce and the development of modern warehousing and distribution centers that rely on cranes and hoists for efficient inventory movement.

North America Crane and Hoist Market Regional Analysis

- U.S. crane and hoist market accounted for the largest revenue share of 78% in 2024 within North America, driven by robust infrastructure development and the revival of construction and manufacturing sectors

- The ongoing expansion of urban projects, warehouses, and industrial facilities is creating strong demand for advanced lifting equipment

- In addition, the adoption of electric and hybrid cranes for enhanced operational efficiency and lower emissions is accelerating market growth

- The rising focus on safety and automation in material handling, along with increased investments in smart manufacturing, further supports the proliferation of technologically advanced cranes and hoists across key industries such as construction, automotive, and logistics

Canada Crane and Hoist Market Insight

The Canada crane and hoist market is expected to witness a fastest growth rate from 2025 to 2032, supported by sustained investments in public infrastructure, mining, and energy projects. The country’s extensive mining and natural resource operations, particularly in provinces such as Alberta and British Columbia, drive consistent demand for heavy-duty lifting solutions. In addition, government-backed infrastructure upgrades, including transportation networks and public utilities, are boosting the adoption of mobile and fixed cranes. The increasing emphasis on workplace safety and automation is also encouraging industries to invest in modern, efficient hoist systems. Canada's focus on sustainability and electrification further contributes to the growth of energy-efficient and low-emission crane and hoist technologies.

North America Crane and Hoist Market Share

The North America Crane and Hoist industry is primarily led by well-established companies, including:

• Terex Corporation (U.S.)

• The Manitowoc Company, Inc. (U.S.)

• Columbus McKinnon Corporation (U.S.)

• Konecranes, Inc. (U.S.)

• Ingersoll Rand Inc. (U.S.)

• American Crane & Equipment Corporation (U.S.)

• Gorbel Inc. (U.S.)

• Shuttlelift, LLC (U.S.)

Latest Developments in North America Crane and Hoist Market

- In November 2023, Konecranes, a material handling solutions provider, delivered two Generation-6 mobile harbor cranes for a port expansion in Brazil, strengthening local container handling operations. This significant investment underscores the company's strategic positioning within the global crane and hoist market

- In February 2023, ACE launched an electric crane with a 180-ton lifting capacity, marking a milestone in the integration of electric vehicles (EVs) into the construction equipment sector. This innovation reflects a growing trend towards sustainability within the crane and hoist market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.