North America Cryo Electron Microscopy Market

Market Size in USD Million

CAGR :

%

USD

522.12 Million

USD

1,071.29 Million

2024

2032

USD

522.12 Million

USD

1,071.29 Million

2024

2032

| 2025 –2032 | |

| USD 522.12 Million | |

| USD 1,071.29 Million | |

|

|

|

|

North America Cryo-Electron Microscopy Market Size

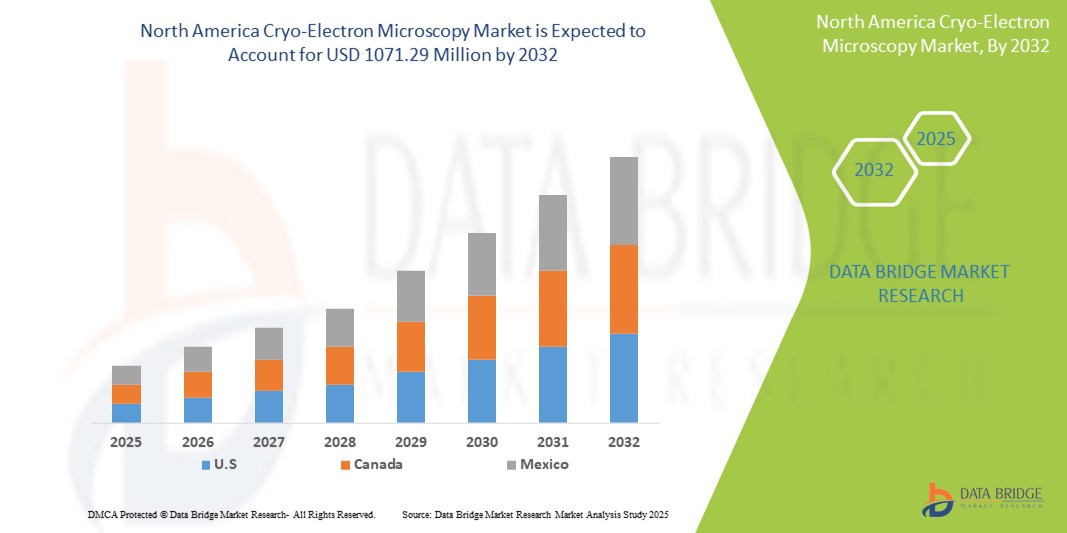

- The North America cryo-electron microscopy market size was valued at USD 522.12 million in 2024 and is expected to reach USD 1071.29 million by 2032, at a CAGR of 9.40% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within cryo-electron microscopy technologies, leading to increased digitalization and precision in both academic and commercial research laboratories

- Furthermore, rising demand for high-resolution imaging in structural biology, drug discovery, and virology is establishing cryo-electron microscopy as the preferred technique for visualizing complex biomolecules and cellular structures at near-atomic resolution. These converging factors are accelerating the uptake of cryo-electron microscopy solutions, thereby significantly boosting the industry's growth

North America Cryo-Electron Microscopy Market Analysis

- Cryo-Electron Microscopy (Cryo-EM), a cutting-edge imaging technology, has become an essential tool in structural biology and drug discovery due to its ability to visualize biomolecules at near-atomic resolution without the need for crystallization

- The accelerating demand for Cryo-EM is driven by its expanding applications in academic research, biopharmaceutical development, and precision medicine, supported by continuous technological advancements in electron detectors, sample preparation, and image processing software

- U.S. dominated the cryo-electron microscopy market with the largest revenue share of 81% in 2024, driven by high R&D investment, the presence of leading universities and research institutes, and robust adoption of advanced imaging technologies in both academic and industrial settings

- Canada is expected to be the fastest-growing country in the cryo-electron microscopy market during the forecast period, projected to register a strong CAGR due to increasing government funding for biomedical research, expansion of advanced Cryo-EM facilities, and growing adoption of Cryo-EM in pharmaceutical and structural biology applications

- The hardware segment dominated the cryo-electron microscopy market with the largest revenue share of 61.3% in 2024, driven by growing investments in advanced cryo-EM equipment including electron microscopes, detectors, and sample holders

Report Scope and Cryo-Electron Microscopy Market Segmentation

|

Attributes |

Cryo-Electron Microscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Cryo-Electron Microscopy Market Trends

Enhanced Capabilities and Expanding Applications in Structural Biology

- A significant and accelerating trend in the U.S. cryo-electron microscopy market is the growing adoption of high-resolution imaging technologies across academic research, biopharmaceutical development, and precision medicine. This expansion is enhancing structural insights into biomolecules and accelerating drug discovery pipelines

- For instance, leading research institutions and pharmaceutical companies are increasingly installing advanced Cryo-EM systems that offer superior resolution and faster imaging capabilities, enabling the detailed study of protein complexes, viruses, and cellular structures

- Technological improvements in electron detectors, sample preparation techniques, and automated image processing are making Cryo-EM more accessible and efficient, allowing researchers to achieve near-atomic resolution with reduced sample sizes and shorter imaging times

- The integration of Cryo-EM with complementary computational and structural biology tools is facilitating more accurate modeling of complex biomolecular structures, supporting rational drug design and therapeutic innovation

- This trend towards advanced imaging, higher throughput, and more precise structural analysis is reshaping expectations for research outcomes in structural biology and drug discovery

- Consequently, institutions in the U.S. are expanding Cryo-EM facilities, while Canada is emerging as the fastest-growing market due to increasing government funding, growing research infrastructure, and rising adoption in pharmaceutical and academic laboratories

- The demand for Cryo-EM systems that provide detailed structural information and robust imaging capabilities is expected to continue growing rapidly, driven by the expanding scope of molecular research and the need for innovative therapeutic solutions

North America Cryo-Electron Microscopy Market Dynamics

Driver

Growing Need Due to Increasing Demand for High-Resolution Structural Analysis

- The North America Cryo-Electron Microscopy market is witnessing accelerated growth due to the increasing need for high-resolution structural analysis in biological, pharmaceutical, and nanotechnology research. The demand for detailed visualization of biomolecules, viruses, and complex proteins is driving the adoption of Cryo-EM systems across research laboratories, academic institutions, and biotechnology companies

- For instance, in April 2024, major research facilities in the U.S. reported the integration of next-generation Cryo-EM systems capable of enhanced imaging resolution, enabling faster and more accurate structural studies. Such technological advancements by leading players are expected to significantly propel market growth over the forecast period

- Researchers are increasingly leveraging Cryo-EM for drug discovery, vaccine development, and structural biology applications, where conventional imaging techniques often fall short. The technique’s ability to visualize specimens in near-native conditions without crystallization enhances its applicability in cutting-edge life sciences research

- Furthermore, the growing prevalence of biotech and pharmaceutical R&D initiatives in North America, coupled with increasing funding for advanced microscopy platforms, is driving the expansion of Cryo-EM adoption

- The demand for user-friendly Cryo-EM solutions that offer automation, high throughput, and integration with data analytics software is rising, enabling researchers to streamline workflows, reduce experiment times, and improve data accuracy

Restraint/Challenge

High Initial Costs and Technical Complexity

- Despite strong growth, the Cryo-Electron Microscopy (Cryo-EM) market faces notable challenges stemming from the substantial capital investment required to procure advanced Cryo-EM systems. The high acquisition cost can be a barrier for smaller research facilities, emerging biotechnology firms, and universities with limited budgets, thereby slowing the pace of adoption across certain segments

- In addition to the upfront cost, the operation of Cryo-EM systems demands highly specialized expertise in microscopy, sample preparation, and data interpretation. This technical complexity can pose a challenge for institutions lacking trained personnel, increasing reliance on external support or partnerships

- Maintenance and operational requirements add to the overall burden, as Cryo-EM platforms need controlled environments that minimize vibrations, maintain precise temperature stability, and reduce electromagnetic interference. These infrastructural requirements often necessitate additional investment in laboratory modification, which can further hinder adoption

- The high cost of consumables, such as grids, cryogens, and imaging software, along with the need for routine calibration and technical support, contributes to the ongoing operational expenses. Institutions must carefully balance these costs against the anticipated research benefits

- Addressing these challenges requires a combination of training programs, development of more user-friendly and automated Cryo-EM systems, and cost-optimization strategies such as leasing models or shared facility access

- Companies are increasingly focusing on integrating advanced software solutions and automation to simplify operations, reduce dependence on highly skilled operators, and make Cryo-EM platforms more accessible to a broader range of researchers

- Although the initial financial and technical hurdles are significant, the long-term advantages of high-resolution imaging, accelerated structural biology research, and enhanced drug discovery capabilities continue to drive strategic investments in Cryo-EM technologies

- Overcoming these restraints through innovation, training, and infrastructure optimization will be essential to ensure sustained growth and broader adoption of Cryo-Electron Microscopy solutions in North America

North America Cryo-Electron Microscopy Market Scope

The market is segmented on the basis of product type, method type, nano formulations, technology, mounting technique, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the cryo-electron microscopy market is segmented into hardware and software. The hardware segment dominated the market with the largest revenue share of 61.3% in 2024, driven by growing investments in advanced cryo-EM equipment including electron microscopes, detectors, and sample holders. Hardware is essential for achieving high-resolution imaging, precision, and reproducibility across diverse applications in structural biology, materials science, and nanotechnology. Increasing demand from research laboratories, pharmaceutical companies, and academic institutions supports this dominance. Technological advancements such as improved electron sources, automated stages, and high-sensitivity detectors have enhanced performance and reliability. The segment benefits from long product lifecycles and continuous R&D. Procurement is often backed by government grants and institutional funding. High durability, precision, and performance make hardware indispensable for modern cryo-EM workflows.

The software segment is expected to witness the fastest CAGR of 9.2% from 2025 to 2032, fueled by the increasing need for data processing, 3D reconstruction, and visualization tools. Software enables automated particle picking, high-throughput analysis, and detailed structural reconstruction. Research institutes are investing in sophisticated software for structural biology, drug discovery, and materials research. AI-assisted image processing and cloud-based platforms accelerate efficiency and analytical accuracy. The growth is further supported by collaborations between hardware manufacturers and software developers. Enhanced compatibility with multiple hardware systems boosts usability. Continuous updates and feature-rich solutions drive adoption. Increasing training programs and institutional support also contribute to software segment growth.

- By Method Type

On the basis of method type, the cryo-electron microscopy market is segmented into electron crystallography, single particle analysis, cryo-electron tomography, and others. The single particle analysis segment dominated the market with a revenue share of 44.7% in 2024, due to its crucial role in determining the structure of proteins, viruses, and macromolecules at near-atomic resolution. It eliminates the need for crystallization and allows imaging of heterogeneous and flexible samples. Widespread adoption in structural biology, vaccine research, and pharmaceutical R&D drives dominance. Continuous advancements in sample preparation, automated data collection, and high-sensitivity detectors enhance throughput and accuracy. The method is scalable and compatible with advanced imaging workflows. Research funding from government and private institutions supports adoption. Strong reproducibility and reliability make it the method of choice for high-end research applications.

The cryo-electron tomography segment is expected to register the fastest CAGR of 8.8% from 2025 to 2032, driven by growing applications in studying cellular architectures, organelles, and complex biological assemblies. Cryo-electron tomography enables high-resolution 3D imaging in near-native conditions. Advances in tilt-series acquisition, alignment, and reconstruction algorithms have improved precision and reliability. Increasing use in virology, microbiology, and nanomaterials research accelerates adoption. Rising interest in in-situ imaging and high-resolution structural studies further supports growth. Growing government and private funding in biomedical research boosts deployment. Training programs and enhanced software tools expand accessibility. Cross-disciplinary applications in biology and materials science enhance market uptake.

- By Nano Formulations

On the basis of nano formulations, the cryo-electron microscopy market is segmented into lipid nanoparticle formulations (LNPs), metal oxide formulations, metal formulations, and others. The lipid nanoparticle formulations (LNPs) segment dominated the market with a revenue share of 48.5% in 2024, owing to its vital role in mRNA vaccine delivery and therapeutic applications. Cryo-EM is extensively used to analyze LNPs for size, morphology, and encapsulation efficiency. Pharmaceutical and biotechnology companies heavily invest in LNP research for vaccine and gene therapy development. Advanced imaging ensures quality control and structural verification, essential for regulatory compliance. Continuous innovation in lipid chemistry and formulation optimization strengthens this segment. Public-private partnerships and government funding further support LNP research. LNP dominance is reinforced by the success of mRNA vaccines globally.

The metal oxide formulations segment is expected to witness the fastest CAGR of 7.9% from 2025 to 2032, driven by increasing applications in catalysis, electronics, and energy storage. Cryo-EM provides precise imaging of particle size, morphology, and distribution at the nanoscale. Industrial and academic research increasingly relies on metal oxide nanoparticles for advanced applications. Innovations in sample preparation and imaging resolution enhance adoption. Government funding for nanotechnology accelerates research. Detailed structural characterization aids material optimization. Interdisciplinary collaborations between chemists, physicists, and engineers fuel growth. Expansion in renewable energy and electronic devices further boosts the segment.

- By Technology

On the basis of technology, the cryo-electron microscopy market is segmented into transmission electron microscopy (TEM), scanning electron microscopy (SEM), and nuclear magnetic resonance (NMR) microscopy. The transmission electron microscopy (TEM) segment dominated the market with a revenue share of 52.6% in 2024, owing to its ability to provide high-resolution, near-atomic structural details of biomolecules, viruses, and nanoparticles. TEM is widely used in structural biology, materials science, and nanotechnology research. Its dominance is supported by advancements in direct electron detectors, phase plates, and automated data acquisition systems. The technique’s compatibility with single-particle analysis and cryo-electron tomography further strengthens its market position. Researchers rely on TEM for structural verification, quality control, and high-resolution 3D reconstructions. Institutional funding, including grants from NIH and other agencies, drives procurement in North America. The growing demand for precision imaging in pharmaceutical and biotech R&D continues to reinforce TEM dominance.

The scanning electron microscopy (SEM) segment is expected to witness the fastest CAGR of 8.5% from 2025 to 2032, due to its increasing applications in material science, nanotechnology, and surface characterization. SEM provides detailed surface topography, compositional analysis, and particle size distribution at the nanoscale. Innovations in high-resolution detectors, low-voltage imaging, and environmental SEM have expanded its applicability. Adoption is rising in academic, industrial, and pharmaceutical research sectors. SEM is increasingly used in combination with TEM for comprehensive structural analysis. Government and private funding support its expansion. The technique is crucial for developing novel materials, studying cellular structures, and quality control. SEM’s versatility and relative ease of sample preparation drive its rapid growth.

- By Mounting Technique

On the basis of mounting technique, the cryo-electron microscopy market is segmented into surface mounting, edge mounting, film emulsion mounting, rivet mounting, and others. The surface mounting segment dominated the market with a revenue share of 46.2% in 2024, due to its efficiency in preparing high-quality, stable specimens for imaging. Surface mounting allows uniform distribution of samples, minimal beam-induced damage, and high reproducibility. It is widely used in structural biology, nanotechnology, and material science. Compatibility with automated TEM workflows enhances efficiency. Surface mounting supports advanced imaging techniques like single-particle analysis and tomography. Research institutions and pharmaceutical labs prioritize surface-mounted samples for accurate structural determination. Strong reproducibility and minimized sample loss reinforce its dominance. Investments in advanced grids and coating technologies further strengthen market adoption.

The film emulsion mounting segment is expected to register the fastest CAGR of 7.8% from 2025 to 2032, driven by its growing applications in biological and nanomaterial imaging. Film emulsion techniques offer high contrast, improved particle adherence, and stability during imaging. Innovations in thin-film preparation and cryo-protection enhance sample quality. Its adoption is increasing in research labs for vaccine development, protein structure analysis, and nanoparticle studies. Educational and government research institutions support growth through funding and grants. Improved imaging outcomes and compatibility with high-resolution detectors drive market uptake. Growing interest in advanced microscopy techniques accelerates adoption.

- By Application

On the basis of application, the cryo-electron microscopy market is segmented into biological science, material science, nanotechnology, life sciences, medical, semiconductors, and others. The biological science segment dominated the market with a revenue share of 55.4% in 2024, owing to its critical role in structural biology, drug discovery, and understanding protein complexes and viruses. Cryo-EM provides near-atomic resolution imaging essential for mapping macromolecular assemblies. Its widespread adoption is driven by the development of vaccines, therapeutics, and molecular biology research. Government grants, research funding, and private investments further support its dominance. Cryo-EM in biological science enables precise modeling of cellular structures and contributes to academic and industrial research. Increasing collaborations between universities and biotech companies enhance utilization. The segment’s reliability and high-resolution output solidify its leading position.

The nanotechnology segment is expected to witness the fastest CAGR of 8.6% from 2025 to 2032, fueled by rising research in nanoparticles, nanomaterials, and nanoengineering. Cryo-EM enables detailed imaging of particle morphology, aggregation states, and structural characterization. Industrial and academic labs increasingly use Cryo-EM for material design, drug delivery systems, and electronic components. Advancements in sample preparation, imaging, and reconstruction software support segment growth. Government-funded nanotechnology programs accelerate adoption. Its application spans electronics, catalysis, and energy storage. Enhanced imaging precision and demand for high-resolution 3D reconstruction drive market expansion.

- By End User

On the basis of end user, the cryo-electron microscopy market is segmented into research laboratories and institutes, forensic and diagnostic laboratories, pharmaceutical and biotechnology companies, contract research organizations, and others. The research laboratories and institutes segment dominated the market with a revenue share of 57.1% in 2024, driven by the high adoption of Cryo-EM for academic research, structural biology, and nanomaterials studies. These institutions invest in high-end microscopy equipment, data processing software, and skilled personnel to enable advanced research. Access to government grants, public funding, and collaborations with pharmaceutical companies reinforces the segment’s leading position. Research labs utilize Cryo-EM for both fundamental and applied studies, including drug discovery and vaccine development. The widespread availability of infrastructure and technical expertise supports continuous growth. Institutional research programs and high-throughput imaging demands further strengthen dominance.

The pharmaceutical and biotechnology companies segment is expected to witness the fastest CAGR of 9.0% from 2025 to 2032, fueled by increasing adoption for drug discovery, protein structure analysis, and biologics development. Cryo-EM enables precise characterization of macromolecules and facilitates rational drug design. Biopharma companies are investing heavily in automated Cryo-EM systems for high-throughput analysis. Growing demand for vaccines, therapeutics, and biologics drives adoption. Collaborations with research institutes and government support further accelerate deployment. Advances in imaging software and automated data processing enhance efficiency. The segment benefits from regulatory support and increasing R&D budgets, enabling rapid expansion.

- By Distribution Channel

On the basis of distribution channel, the cryo-electron microscopy market is segmented into direct tenders, third-party distribution, and others. The direct tenders segment dominated the market with a revenue share of 54.3% in 2024, owing to institutional procurement strategies for research laboratories, universities, and large biotech firms. Direct tenders ensure reliable supply, compliance with technical specifications, and long-term maintenance agreements. Governments and major institutions prefer direct procurement to guarantee quality and access to service support. Bulk purchasing and centralized contracts further enhance market penetration. Manufacturers provide training, installation, and post-sale support under direct tender agreements. High-value instrumentation like Cryo-EM benefits from vendor oversight and dedicated service packages. Strong institutional relationships reinforce dominance.

The third-party distribution segment is expected to register the fastest CAGR of 10.2% from 2025 to 2032, driven by the increasing availability of Cryo-EM equipment through distributors and resellers. Third-party channels improve accessibility for small-scale labs, startups, and private institutions. The expansion of online platforms, reseller networks, and authorized distributors accelerates adoption. It offers competitive pricing, faster delivery, and localized support. Rapid growth in biotech startups and smaller research facilities fuels market uptake. Technological support and service contracts through distributors strengthen adoption. Increasing awareness of advanced Cryo-EM applications drives segment expansion. Flexibility in procurement and cost optimization enhances growth potential.

North America Cryo-Electron Microscopy Market Regional Analysis

- North America dominated the cryo-electron microscopy market with the largest revenue share in 2024, driven by substantial investments in research and development, the presence of premier universities, advanced research institutes, and the growing adoption of state-of-the-art imaging technologies across academic and industrial settings

- The market expansion is supported by the increasing application of Cryo-EM in structural biology, pharmaceutical research, and biomedical studies, where high-resolution imaging is critical for drug discovery and protein analysis

- North America’s strong research infrastructure, access to skilled personnel, and supportive government funding for scientific and technological innovation have reinforced its position as the leading hub for Cryo-Electron Microscopy adoption

U.S. Cryo-Electron Microscopy Market Insight

The U.S. cryo-electron microscopy market captured the largest revenue share of 81% in 2024 within North America, fueled by extensive R&D investment, the concentration of top-tier research universities, and early adoption of cutting-edge imaging technologies in both industrial and academic applications. The market growth is significantly driven by the demand for Cryo-EM in drug development, structural biology, and biotechnology research, complemented by favorable funding and regulatory policies that encourage the deployment of advanced microscopy systems.

Canada Cryo-Electron Microscopy Market Insight

Canada cryo-electron microscopy market is expected to be the fastest-growing country in the Cryo-Electron Microscopy market during the forecast period, projected to register a strong CAGR. This growth is propelled by increasing government investment in biomedical research, the establishment of advanced Cryo-EM facilities, and rising adoption in pharmaceutical and structural biology applications. Collaborations with global research organizations, along with training programs for specialized technical expertise, are further enhancing Canada’s market development in this sector.

North America Cryo-Electron Microscopy Market Share

The cryo-electron microscopy industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Olympus Corporation (Japan)

- JEOL Ltd. (Japan)

- Leica Microsystems (Germany)

- KEYENCE CORPORATION (Japan)

- ZEISS International (Germany)

- Molecular Devices, LLC (U.S.)

- Nikon Instruments Inc. (Japan)

- Caliber Imaging & Diagnostics (U.S.)

- Lasertec Corporation (Japan)

- Thorlabs, Inc. (U.S.)

- Oxford Instruments (U.K.)

- Hamamatsu Photonics K.K. (Japan)

- HORIBA, Ltd. (Japan)

- Labomed, Inc. (U.S.)

- Creative Biostructure (U.S.)

- Gatan, Inc. (U.S.)

- Hitachi High-Tech Corporation (Japan)

Latest Developments in North America Cryo-Electron Microscopy Market

- In March 2024, JEOL USA introduced the CRYO-FIB-SEM, a Focused Ion Beam milling specimen preparation tool specifically designed for creating thin, frozen samples for Cryo-Electron Microscopy. This system incorporates a liquid nitrogen cooling stage and a cryocooled specimen transfer mechanism for frozen specimens, enabling the preparation of TEM specimens such as biopolymer

- In January 23, 2025, UCLA announced the installation of the Thermo Fisher Scientific Krios G4 cryo-electron microscope, one of the first of its kind at a U.S. university. This advanced microscope allows researchers to observe atomic details smaller than the wavelength of visible light, offering insights into dynamic structures of viral proteins

- In June 2023, Generate Biomedicines unveiled a state-of-the-art Cryo-EM laboratory in Andover, Massachusetts. The facility, featuring new electron microscopes from Thermo Fisher Scientific and JEOL, aims to accelerate drug discovery and development by providing detailed 3D protein structures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.