North America Cryogenic Insulation Market

Market Size in USD Billion

CAGR :

%

USD

6.25 Billion

USD

4.37 Billion

2024

2032

USD

6.25 Billion

USD

4.37 Billion

2024

2032

| 2025 –2032 | |

| USD 6.25 Billion | |

| USD 4.37 Billion | |

|

|

|

|

North America Cryogenic Insulation Market Size

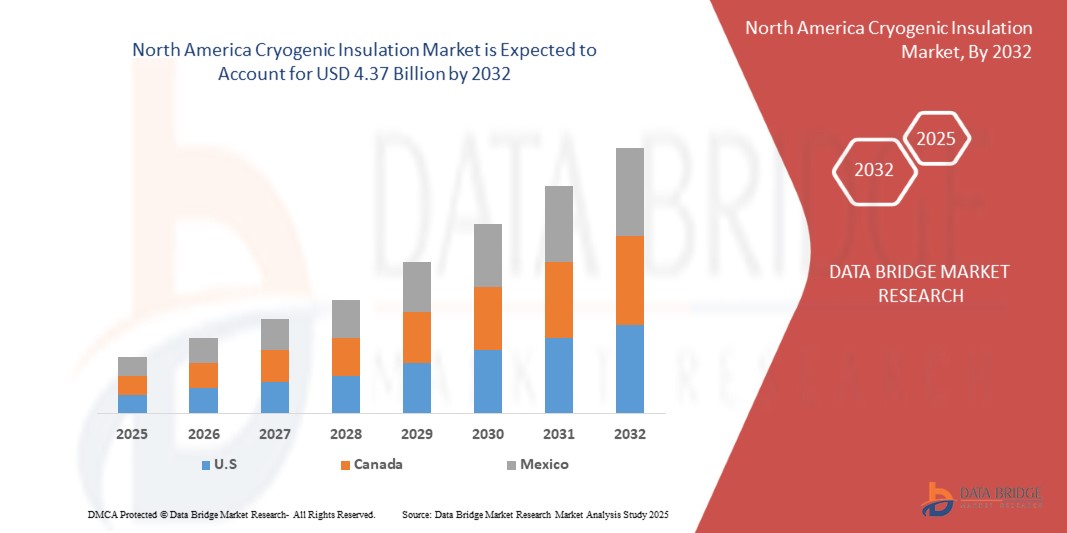

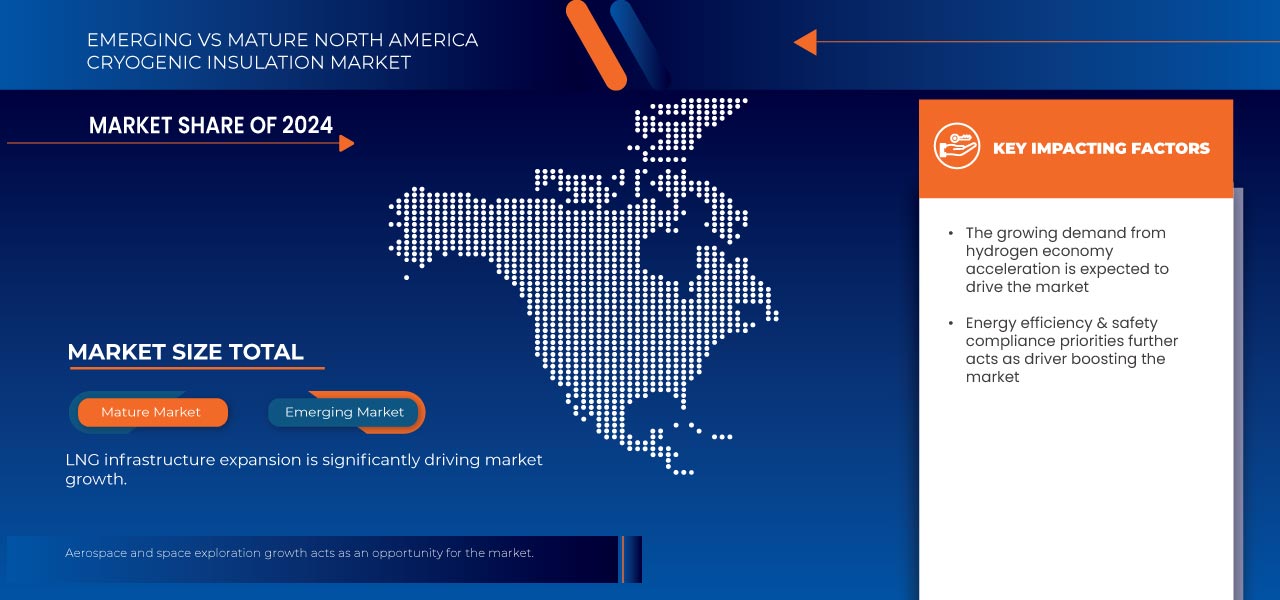

- The North America Cryogenic Insulation Market size was valued at USD 6.25 Billion in 2024 and is expected to reach USD 4.37 Billion by 2032, at a CAGR of 4.7% during the forecast period

- The market growth is largely fueled by the ling infrastructure expansion

- Furthermore, Cryogenic Insulation hydrogen economy acceleration. These converging factors are accelerating the uptake of Cryogenic Insulation solutions, thereby significantly boosting the industry's growth

North America Cryogenic Insulation Market Analysis

- Cryogenic insulation is increasingly critical across energy transport and storage infrastructure—particularly for LNG export terminals, storage tanks, ships, and pipe systems. Segments like PU & PIR, cellular glass, perlite, fiberglass, and multilayer/or reflective systems (e.g. multilayer insulation or MLI) are widely used because of their lightweight, high thermal efficiency, flexibility, and structural integrit.

- These materials are essential to minimize heat ingress, maintain sub-zero temperature integrity, and support safe, energy-efficient transport and storage of cryogens (e.g., LNG, liquid hydrogen). Their adoption is bolstered by their cost-effectiveness relative to specialized metal components, combined with chemical and thermal resistance—paralleling your value points about engineering plastics.

- U.S. dominates the North America Cryogenic Insulation Market in 2025 with 51.69% share, supported by oil & gas sector—particularly LNG infrastructure—dominates end-use demand, with significant contributions from healthcare, pharmaceuticals, and energy sectors.

- Service segment leads the market with 58.08% share in 2025, followed by energy efficiency & safety compliance priorities.

Report Scope and North America Cryogenic Insulation Market Segmentation

|

Attributes |

Cryogenic Insulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Cryogenic Insulation Market Trends

LNG Infrastructure Expansion

- A major driving force behind the North America Cryogenic Insulation Market is the rapid expansion of liquefied natural gas (LNG) infrastructure. Rising global demand for cleaner fuels, combined with the region’s abundant natural gas reserves, has spurred large-scale investments in LNG liquefaction plants, regasification terminals, storage tanks, pipelines, and transportation facilities. Cryogenic insulation is vital in maintaining LNG at temperatures below –160°C, ensuring operational efficiency, safety, and cost-effectiveness throughout the supply chain.

- For instance, in September 2024, according to Reuters, Rystad Energy estimated that around 400 additional LNG vessels will be required to meet the U.S.’s current export capacity, underscoring the scale of LNG infrastructure expansion and its implications for global shipping. Similarly, in February 2023, a peer-reviewed article in Fluids by Ildar Shammazov and Ekaterina Karyakina used ANSYS Fluent to simulate LNG flow in a 10 m pipeline with three insulation types. They found that polyurethane foam resulted in the highest temperature rise (from 113 K to 113.61 K), while vacuum-insulated pipes provided the best performance by minimizing LNG warming.

- In the LNG value chain, advanced insulation materials such as polyurethane foams, aerogels, and multilayer composites are gaining prominence. These materials can withstand extreme thermal stresses while reducing boil-off gas losses, making them indispensable for applications in LNG tanks, pipelines, vessels, and terminals. Additionally, the growing adoption of LNG fueling stations for heavy-duty trucks and marine vessels is creating fresh demand for reliable cryogenic insulation systems.

- Meanwhile, both the U.S. and Canada are emerging as leading LNG exporters, with new projects coming online to meet the energy needs of Europe and Asia as countries transition away from coal and oil. This export-driven growth not only strengthens North America’s energy leadership but also accelerates the need for innovative cryogenic insulation solutions to support a safe, efficient, and sustainable LNG supply chain.

- The rising LNG export capacity, coupled with clean energy adoption, shipping demand, and large-scale project development, is significantly boosting the North America Cryogenic Insulation Market. As insulation technologies advance to enhance thermal performance and durability, they are cementing their role as a cornerstone of LNG infrastructure expansion and global energy transition.

North America Cryogenic Insulation Market Dynamics

Driver

Hydrogen Economy Acceleration

- The growing demand for Cryogenic Insulation is strongly driven by the rapid acceleration of the hydrogen economy in North America. As governments and industries pursue decarbonization, hydrogen is being positioned as a clean, versatile energy carrier for power generation, transportation, and industrial applications. Both the U.S. Department of Energy’s Hydrogen Shot initiative and Canada’s national hydrogen strategy have spurred large-scale investments in hydrogen production, storage, and distribution, directly boosting demand for advanced insulation technologies.

- For instance, in August 2025, according to Times Union, Plug Power received a USD 2 million grant from New York State to develop hydrogen distribution trailers using cryo-compression technology, enhancing the safety, efficiency, and accessibility of hydrogen storage for small and mid-sized businesses. Similarly, in June 2025, as per Taylor-Wharton’s news platform, GenH2 partnered with Taylor-Wharton to showcase its zero-loss liquid hydrogen storage system at the Hydrogen Technology Expo North America, leveraging NASA’s IRaS technology to eliminate boil-off and transfer losses.

- Cryogenic insulation materials such as vacuum-insulated panels, polyurethane foams, aerogels, and multilayer composites are becoming indispensable in hydrogen liquefaction plants, refueling stations, and long-haul transport systems. These solutions ensure safe storage at –253°C, minimize product losses, and enable the scalability of hydrogen-powered applications ranging from heavy-duty trucks and buses to emerging aviation prototypes.

- The surging adoption of hydrogen projects across North America, backed by federal funding and private sector participation, is accelerating demand for next-generation insulation systems capable of withstanding extreme thermal stresses while complying with safety and efficiency standards. As hydrogen infrastructure scales up, cryogenic insulation is positioned as a critical enabler of North America’s clean energy transition and global hydrogen competitiveness.

Restraint/Challenge

High Capital And Maintenance Costs

- The North America Cryogenic Insulation Market faces significant challenges from high capital investment requirements and recurring maintenance costs. Large-scale LNG and hydrogen infrastructure projects demand specialized tanks, pipelines, and transfer systems that rely on advanced insulation materials. However, cost escalations in construction, labor, and equipment have driven up project budgets, directly impacting the affordability and adoption of cryogenic insulation systems.

- For instance, in September 2024, according to Reuters, Kiewit Energy reported that shortages of key equipment—such as generators, electric motors, and transformers—combined with rising wages and material costs, have pushed LNG plant construction costs in the U.S. up by 25% to 30% over the past five years. Similarly, in November 2024, Reuters highlighted that Venture Global LNG’s second export plant in Louisiana is running approximately USD 2.35 billion over budget, with total projected costs reaching USD 21–22 billion, underscoring the scale of capital escalation in cryogenic projects.

- Beyond upfront investments, maintenance expenses add long-term financial burdens. Cryogenic systems operate at extreme temperatures (–160 °C for LNG and –253 °C for hydrogen), where insulation degradation can cause boil-off gas losses, efficiency drops, and safety risks. To prevent failures, infrastructure operators must conduct frequent inspections, employ specialized technicians, and replace materials—costs that can exceed several hundred thousand dollars annually for a single LNG storage tank.

- The combined impact of rising capital costs and high maintenance requirements poses a barrier to broader adoption of advanced cryogenic insulation technologies. These financial hurdles disproportionately affect mid-tier operators, slowing modernization efforts and limiting uptake in next-generation LNG and hydrogen infrastructure across North America.

North America Cryogenic Insulation Market Scope

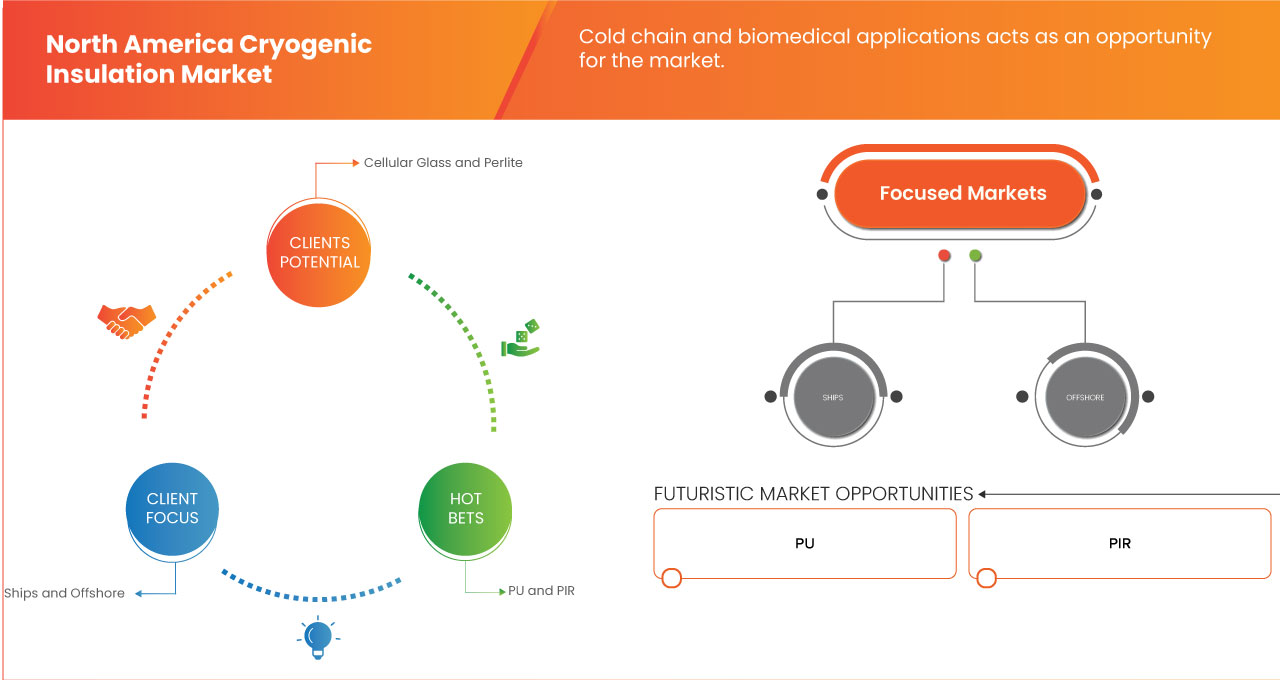

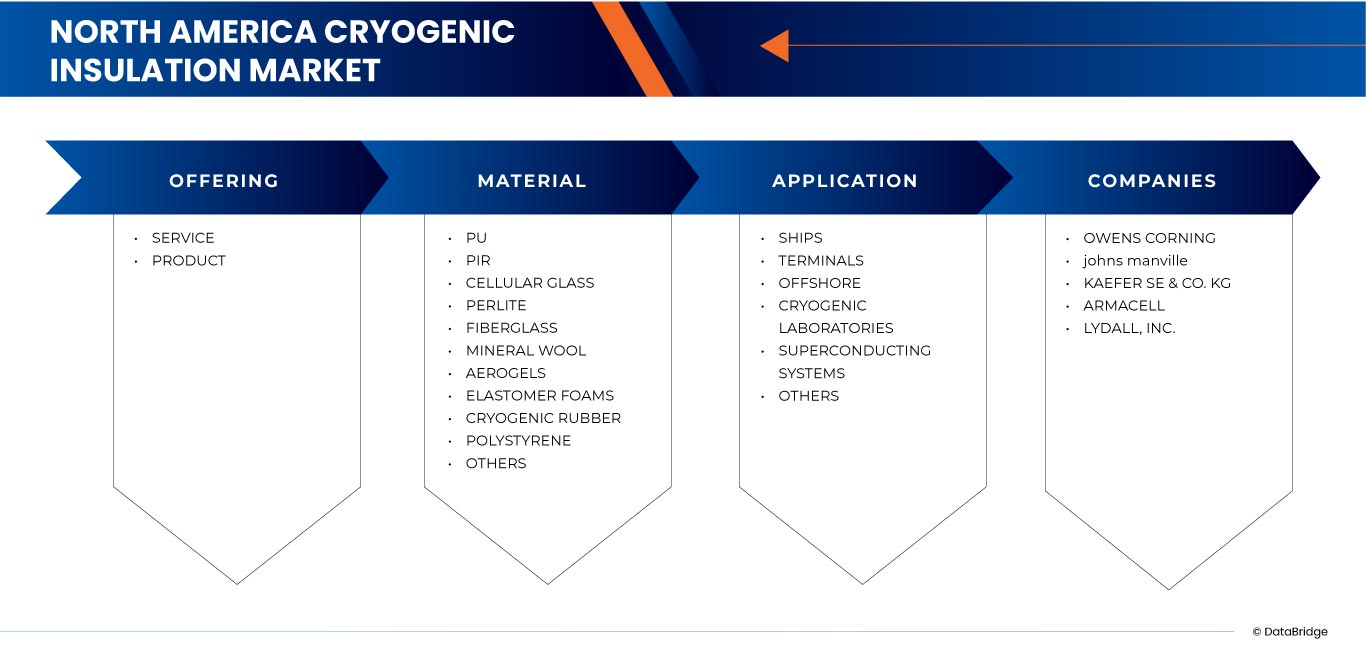

The market is segmented on the basis of offering, material, and application.

- By Offering

On the basis of offering, the market is segmented into service and product. In 2025, the Storage Services segment will dominate the North America Cryogenic Insulation Market with a significant share, driven by their critical role in maintaining operational efficiency, safety, and compliance. Services such as installation, inspection, maintenance, and repair are indispensable, given the extreme operating conditions of LNG (–160 °C) and liquid hydrogen (–253 °C). The recurring need for specialized technicians, periodic performance assessments, and insulation replacements ensures steady demand. As infrastructure expands, particularly in LNG terminals and hydrogen refueling networks, the service segment benefits from long-term contracts and regulatory requirements that prioritize reliability and safety.

The Products segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption of polyurethane foams, aerogels, vacuum-insulated panels, and multilayer composites. These products offer superior thermal efficiency, reduced boil-off gas losses, and the ability to withstand extreme thermal stress, making them essential for LNG shipping vessels, hydrogen storage systems, and aerospace applications. Technological advances—such as zero-loss liquid hydrogen storage systems and aerogel-enhanced blankets—along with the growing scale of clean energy projects, are accelerating their market penetration. Increasing emphasis on energy efficiency, safety, and sustainability is expected to further strengthen demand for next-generation cryogenic insulation products across North America.

- By Material

On the basis of material, the market is segmented into PU, PIR, cellular glass, perlite, fiberglass, mineral wool, aerogels, elastomer foams, cryogenic rubber, polystyrene and others. In 2025, the PU segment will dominate the North America Cryogenic Insulation Market with a significant share, driven by its excellent thermal insulation properties, lightweight design, and versatility across LNG and hydrogen applications. PU insulation is widely utilized in storage tanks, pipelines, and transportation systems, where maintaining consistent low temperatures is critical. Its low thermal conductivity, cost-effectiveness, and adaptability into rigid foams and panels further reinforce its adoption across large-scale LNG terminals and industrial gas infrastructure projects.

The PIR segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its superior fire resistance, lower smoke emissions, and higher thermal stability compared to conventional PU insulation. PIR’s increasing use in LNG liquefaction facilities, hydrogen storage systems, and cryogenic shipbuilding is supported by the industry’s demand for safer, more durable insulation materials. Advances in PIR foam technologies and its ability to withstand extreme thermal cycling without significant degradation are further accelerating its penetration in both LNG and hydrogen infrastructure across North America.

- By Application

On the basis of application, the market is segmented into Ships, Terminals, Offshore, Cryogenic Laboratories, Superconducting Systems and Others. In 2025, the Ships segment will dominate the North America Cryogenic Insulation Market with a significant share, driven by the rapid expansion of LNG shipping capacity and the region’s role as a leading exporter of natural gas. LNG carriers require highly specialized insulation systems to maintain cryogenic temperatures (below –160 °C) during long-haul transport, ensuring minimal boil-off losses and operational efficiency. Advanced materials such as polyurethane foams, perlite, and multilayer composites are increasingly deployed in ship containment systems to deliver both thermal performance and structural stability. The surge in U.S. LNG exports to Europe and Asia, alongside rising global demand for clean energy, strongly supports the adoption of cryogenic insulation in maritime transport.

The Terminals segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by large-scale investments in liquefaction and regasification facilities across the U.S. and Canada. Terminals act as critical hubs in the LNG value chain, where efficient insulation in storage tanks, pipelines, and transfer systems ensures safety, reduces energy losses, and supports cost-effective operations. Increasing construction of export terminals along the U.S. Gulf Coast, coupled with Canada’s emerging LNG terminal projects, is driving demand for advanced insulation materials such as aerogels, cellular glass, and vacuum-insulated panels. The expansion of hydrogen refueling and storage terminals further amplifies growth, as next-generation insulation solutions are required to withstand ultra-low temperatures near –253 °C while meeting stringent safety and efficiency standards.

North America Cryogenic Insulation Market Regional Analysis

- North America is emerging as a dominant market for Cryogenic Insulation, holding a significant revenue share in 2025 and projected to grow at a healthy CAGR of around 4.7% from 2025 to 2032. The region’s growth is driven by the rapid expansion of LNG export infrastructure, increasing investments in hydrogen storage and distribution networks, and rising demand from healthcare, aerospace, and industrial gas sectors. With the U.S. and Canada positioned as leading LNG exporters, the region is witnessing large-scale adoption of cryogenic insulation in storage tanks, pipelines, shipping vessels, and terminals to ensure efficiency, safety, and compliance.

- North America benefits from strong government-led energy transition initiatives such as the U.S. Department of Energy’s Hydrogen Shot and Canada’s National Hydrogen Strategy, which encourage clean energy adoption, innovation in insulation technologies, and large-scale investments in hydrogen liquefaction and fueling infrastructure. Strategic collaborations between global players and regional manufacturers, along with advancements in aerogels, vacuum-insulated panels, and multilayer composites, are further accelerating the development of high-performance cryogenic insulation systems.

- Countries such as the U.S. and Canada lead the market, supported by their abundant natural gas reserves, strong energy export capacity, and rising clean energy investments. Their robust LNG export projects, hydrogen mobility pilots, and circular economy initiatives are expected to further strengthen the adoption of cryogenic insulation across industries.

U.S. North America Cryogenic Insulation Market Insight

The U.S. accounted for the largest market revenue share in North America in 2025, driven by its leadership in LNG exports, extensive pipeline networks, and large-scale investments in liquefaction and regasification terminals. Federal initiatives supporting hydrogen infrastructure development, such as the Hydrogen Shot program, are further boosting insulation demand in hydrogen storage, transport, and fueling stations. Rapid growth in LNG fueling stations for heavy-duty trucks, coupled with high demand from aerospace and healthcare sectors, reinforces the U.S.’s dominant position in the regional North America Cryogenic Insulation Market.

Canada North America Cryogenic Insulation Market Insight

Canada represents a fast-growing market for cryogenic insulation in 2025, supported by emerging LNG terminal projects, rising hydrogen production capacity, and strong sustainability commitments. The country’s National Hydrogen Strategy and investments in clean fuel supply chains are accelerating demand for advanced insulation materials across liquefaction plants, storage tanks, and transport systems. With growing infrastructure development and industrial gas applications, Canada is positioning itself as a key growth hub in North America’s cryogenic insulation landscape.

Mexico North America Cryogenic Insulation Market Insight

Mexico is emerging as a promising market for cryogenic insulation in 2025, fueled by expanding industrial gas demand, infrastructure modernization, and growth in food & beverage cold storage. Government initiatives to strengthen energy and manufacturing capabilities, along with rising trade integration under the USMCA, are supporting insulation adoption in storage and logistics applications. Mexico’s strategic location as a trade and energy corridor between North and South America further enhances its potential in LNG and hydrogen-related insulation markets..

North America Cryogenic Insulation Market Share

The Cryogenic Insulation industry is primarily led by well-established companies, including:

- Owens Corning (U.S.)

- Johns Manville (U.S.)

- KAEFER SE & CO. KG (Germany)

- ARMACELL (Luxembourg)

- DUNMORE (U.S.)

- Aspen Aerogels,Inc. (U.S.)

- Dicalite Management Group LLC (U.S.)

- Irex Contracting Group (U.S.)

- Lydall, Inc. (U.S.)

- Superior Insulation (U.S.)

- Tetrad Insulation (Canada)

Latest Developments in North America Cryogenic Insulation Market

- In April 2025, Armacell launched the ArmaGel XGC, a next-generation flexible aerogel insulation blanket engineered for cryogenic and dual-temperature applications. This product enhances thermal performance and acoustic attenuation, making it particularly suitable for industries such as oil and gas, petrochemical, and power generation.

- In January 2025, Aspen Aerogels announced that it reached a settlement with AMA S.p.A. and AMA Composites S.r.l. in Italy, resolving a patent dispute over infringing aerogel insulation materials in Europe. The company emphasized its commitment to protecting intellectual property and ensuring fair competition while continuing to innovate in energy-efficient solutions.

- In May 2022, Dicalite Management Group has partnered with Vêneto Mercantil as its new distributor in Brazil, expanding access to perlite, diatomaceous earth, and vermiculite. With strong infrastructure, technical expertise, and a large customer base across food, beverage, pharmaceutical, and chemical industries, Vêneto will enhance supply availability and customer support for essential minerals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 COMPETITIVE RIVALRY – HIGH

4.1.2 THREAT OF NEW ENTRANTS – MODERATE

4.1.3 BARGAINING POWER OF BUYERS – HIGH

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.5 THREAT OF SUBSTITUTES – LOW TO MODERATE

4.2 PATENT ANALYSIS –

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 LICENSING AND COLLABORATIONS

4.2.4 REGION PATENT LANDSCAPE

4.2.5 IP STRATEGY AND MANAGEMENT

4.3 PRICING ANALYSIS

4.4 BRAND OUTLOOK

4.4.1 PRODUCT VS BRAND OVERVIEW

4.4.2 PRODUCT OVERVIEW

4.4.3 BRAND OVERVIEW

4.5 CONSUMER BUYING BEHAVIOR

4.5.1 INSTITUTIONAL AND B2B DECISION-MAKING PROCESS

4.5.2 KEY BUYING CRITERIA

4.5.3 TRENDS SHAPING BUYING BEHAVIOR

4.5.4 PURCHASE CHANNELS

4.5.5 REGIONAL BUYING BEHAVIOR VARIATIONS (WITHIN NORTH AMERICA)

4.5.6 POST-PURCHASE BEHAVIOR

4.6 COST ANALYSIS BREAKDOWN: NORTH AMERICA CRYOGENIC INSULATION MARKET

4.6.1 MATERIAL COSTS

4.6.2 LABOR AND INSTALLATION COSTS

4.6.3 OPERATIONAL AND MAINTENANCE COSTS

4.6.4 ENERGY EFFICIENCY AND LONG-TERM SAVINGS

4.6.5 REGULATORY COMPLIANCE AND SAFETY CONSIDERATIONS

4.6.6 TOTAL COST OF OWNERSHIP (TCO)

4.6.7 CONCLUSION

4.7 IMPORT EXPORT SCENARIO

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 PROFIT MARGINS SCENARIO

4.1 RAW MATERIAL COVERAGE – NORTH AMERICA CRYOGENIC INSULATION MARKET

4.10.1 INTRODUCTION TO RAW MATERIALS IN CRYOGENIC INSULATION

4.10.2 OVERVIEW OF KEY RAW MATERIALS IN CRYOGENIC INSULATION

4.10.3 ADDITIVES AND PROCESSING AGENTS

4.10.4 RAW MATERIAL SUPPLY CHAIN AND SOURCING DYNAMICS

4.10.5 IMPACT OF MARKET TRENDS ON RAW MATERIAL DEMAND

4.10.6 COMPETITIVE LANDSCAPE OF RAW MATERIAL SUPPLIERS

4.10.7 CONCLUSION

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTICS COST SCENARIO (NORTH AMERICA)

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS (LSPS)

4.12 TECHNOLOGICAL ADVANCEMENTS

4.12.1 ADVANCED MATERIALS AND INSULATION TECHNOLOGIES

4.12.2 DIGITAL MONITORING AND SMART INSULATION SYSTEMS

4.12.3 ENVIRONMENTALLY SUSTAINABLE AND ENERGY-EFFICIENT SOLUTIONS

4.12.4 ENHANCED MANUFACTURING TECHNIQUES AND CUSTOMIZATION

4.12.5 THE HYDROGEN ECONOMY AND CRYOGENIC INNOVATION

4.13 VALUE CHAIN ANALYSIS

4.13.1 RAW MATERIAL SUPPLIERS: FOUNDATIONS OF THERMAL EFFICIENCY

4.13.2 INSULATION MANUFACTURERS: TRANSFORMING MATERIALS INTO FUNCTIONAL SYSTEMS

4.13.3 ENGINEERING AND SYSTEM INTEGRATORS: DELIVERING APPLICATION-SPECIFIC SOLUTIONS

4.13.4 DISTRIBUTORS AND LOGISTICS PROVIDERS: BRIDGING PRODUCTION AND DEPLOYMENT

4.13.5 END-USERS AND APPLICATION SECTORS: DRIVING MARKET INNOVATION AND ADOPTION

4.13.6 REGULATORY AUTHORITIES AND SAFETY STANDARDS: DEFINING OPERATIONAL BOUNDARIES

4.13.7 RESEARCH INSTITUTIONS AND INDUSTRY ALLIANCES: ACCELERATING MATERIAL INNOVATION

4.14 VENDOR SELECTION CRITERIA

4.14.1 VENDOR SELECTION CRITERIA FOR CRYOGENIC INSULATION MATERIALS

4.14.2 QUALITY AND CONSISTENCY

4.14.3 TECHNICAL EXPERTISE

4.14.4 SUPPLY CHAIN RELIABILITY

4.14.5 COMPLIANCE AND SUSTAINABILITY

4.14.6 COST AND PRICING STRUCTURE

4.14.7 FINANCIAL STABILITY

4.14.8 FLEXIBILITY AND CUSTOMIZATION

4.14.9 RISK MANAGEMENT AND CONTINGENCY PLANS

5 TARIFFS AND THEIR IMPACT ON MARKET

5.1 CURRENT TARIFF RATES IN TOP-3 NORTH AMERICAN MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE FOR THE NORTH AMERICA CRYOGENIC INSULATION MARKET

6.1 GLOBAL OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 LNG INFRASTRUCTURE EXPANSION

7.1.2 HYDROGEN ECONOMY ACCELERATION

7.1.3 ENERGY EFFICIENCY & SAFETY COMPLIANCE PRIORITIES

7.2 RESTRAINTS

7.2.1 HIGH CAPITAL AND MAINTENANCE COSTS

7.2.2 SUPPLY CHAIN VOLATILITY OF RAW MATERIALS

7.3 OPPORTUNITY

7.3.1 AEROSPACE AND SPACE EXPLORATION GROWTH

7.3.2 COLD CHAIN AND BIOMEDICAL APPLICATIONS

7.4 CHALLENGE

7.4.1 SKILLED WORKFORCE SHORTAGE AND INSTALLATION COMPLEXITY

7.4.2 TECHNICAL CHALLENGES AND MATERIAL LIMITATIONS

8 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY OFFERING

8.1 OVERVIEW

8.2 SERVICE

8.3 PRODUCT

9 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY MATERIALS

9.1 OVERVIEW

9.2 PU

9.3 PIR

9.4 CELLULAR GLASS

9.5 PERLITE

9.6 FIBERGLASS

9.7 MINERAL WOOL

9.8 AEROGELS

9.9 ELASTOMER FOAMS

9.1 CRYOGENIC RUBBER

9.11 POLYSTYRENE

9.12 OTHERS

10 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SHIPS

10.2.1 SHIPS, BY APPLICATION

10.3 TERMINALS

10.3.1 TERMINALS, BY APPLICATION

10.4 OFFSHORE

10.4.1 OFFSHORE, BY APPLICATION

10.5 CRYOGENIC LABORATORIES

10.6 SUPERCONDUCTING SYSTEMS

10.7 OTHERS

11 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY COUNTRY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA CRYOGENIC INSULATION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 OWENS CORNING

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 JOHNS MANVILLE

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 KAEFER SE & CO. KG

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT/NEWS

14.4 ARMACELL

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVEOPMENT

14.5 DUNMORE

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVEOPMENT

14.6 ASPEN AEROGELS,INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 RECENT FINANCIALS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DICALITE MANAGEMENT GROUP LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 IREX CONTRACTING GROUP

14.8.1 COMPANY SNAPSHOT

14.8.2 SERVICES PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 LYDALL, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 SUPERIOR INSULATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 TETRAD INSULATION

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICES PORTFOLIO

14.11.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 NUMBER OF PATENTS PER YEAR

TABLE 2 TOP PATENT APPLICANTS.

TABLE 3 KEY BUYING CRITERIA

TABLE 4 REGULATORY COVERAGE

TABLE 5 GLOBAL CRYOGENIC INSULATION MARKET, 2018-2032

TABLE 6 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY OFFERING, 2018-2032 (USD MILLION)

TABLE 7 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (KILO TONS)

TABLE 9 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA SHIPS IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA TERMINALS IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA OFFSHORE IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 15 U.S. CRYOGENIC INSULATION MARKET, BY OFFERING, 2018-2032 (USD MILLION)

TABLE 16 U.S. CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (USD MILLION)

TABLE 17 U.S. CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (KILO TONS)

TABLE 18 U.S. CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (ASP)

TABLE 19 U.S. CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 20 U.S. SHIPS IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 21 U.S. TERMINALS IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 22 U.S. OFFSHORE IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 23 CANADA CRYOGENIC INSULATION MARKET, BY OFFERING, 2018-2032 (USD MILLION)

TABLE 24 CANADA CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (USD MILLION)

TABLE 25 CANADA CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (KILO TONS)

TABLE 26 CANADA CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (ASP)

TABLE 27 CANADA CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 28 CANADA SHIPS IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 29 CANADA TERMINALS IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 30 CANADA OFFSHORE IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 31 MEXICO CRYOGENIC INSULATION MARKET, BY OFFERING, 2018-2032 (USD MILLION)

TABLE 32 MEXICO CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (USD MILLION)

TABLE 33 MEXICO CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (KILO TONS)

TABLE 34 MEXICO CRYOGENIC INSULATION MARKET, BY MATERIALS, 2018-2032 (ASP)

TABLE 35 MEXICO CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 36 MEXICO SHIPS IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 37 MEXICO TERMINALS IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 38 MEXICO OFFSHORE IN CRYOGENIC INSULATION MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA CRYOGENIC INSULATION MARKET

FIGURE 2 NORTH AMERICA CRYOGENIC INSULATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CRYOGENIC INSULATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CRYOGENIC INSULATION MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CRYOGENIC INSULATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CRYOGENIC INSULATION MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA CRYOGENIC INSULATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA CRYOGENIC INSULATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA CRYOGENIC INSULATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA CRYOGENIC INSULATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA CRYOGENIC INSULATION MARKET: SEGMENTATION

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 TWO SEGMENTS COMPRISE THE NORTH AMERICA CRYOGENIC INSULATION MARKET, BY OFFERING

FIGURE 15 LNG INFRASTRUCTURE EXPANSION TO DRIVE THE NORTH AMERICA CRYOGENIC INSULATION MARKET IN THE FORECAST PERIOD

FIGURE 16 SERVICE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CRYOGENIC INSULATION MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IPC CODE V/S NUMBER OF PATENTS

FIGURE 19 NUMBER OF PATENTS PER YEAR

FIGURE 20 NUMBER OF PATENTS PER REGION/COUNTRY

FIGURE 21 TOP PATENT APPLICANTS.

FIGURE 22 NORTH AMERICA CRYOGENIC INSULATION MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 23 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 24 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 25 COMPANY EVALUATION QUADRANT

FIGURE 26 VENDOR SELECTION CRITERIA

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES NORTH AMERICA CRYOGENIC INSULATION MARKET

FIGURE 28 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY OFFERING, 2024

FIGURE 29 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY MATERIALS, 2024

FIGURE 30 NORTH AMERICA CRYOGENIC INSULATION MARKET, BY APPLICATION, 2024

FIGURE 31 NORTH AMERICA CRYOGENIC INSULATION MARKET: SNAPSHOT (2024)

FIGURE 32 NORTH AMERICA CRYOGENIC INSULATION MARKET: COMPANY SHARE 2024 (%)

North America Cryogenic Insulation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Cryogenic Insulation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Cryogenic Insulation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.