North America Dark Fiber Networks Market

Market Size in USD Billion

CAGR :

%

USD

2.32 Billion

USD

5.66 Billion

2025

2033

USD

2.32 Billion

USD

5.66 Billion

2025

2033

| 2026 –2033 | |

| USD 2.32 Billion | |

| USD 5.66 Billion | |

|

|

|

|

North America Dark Fiber Networks Market Size

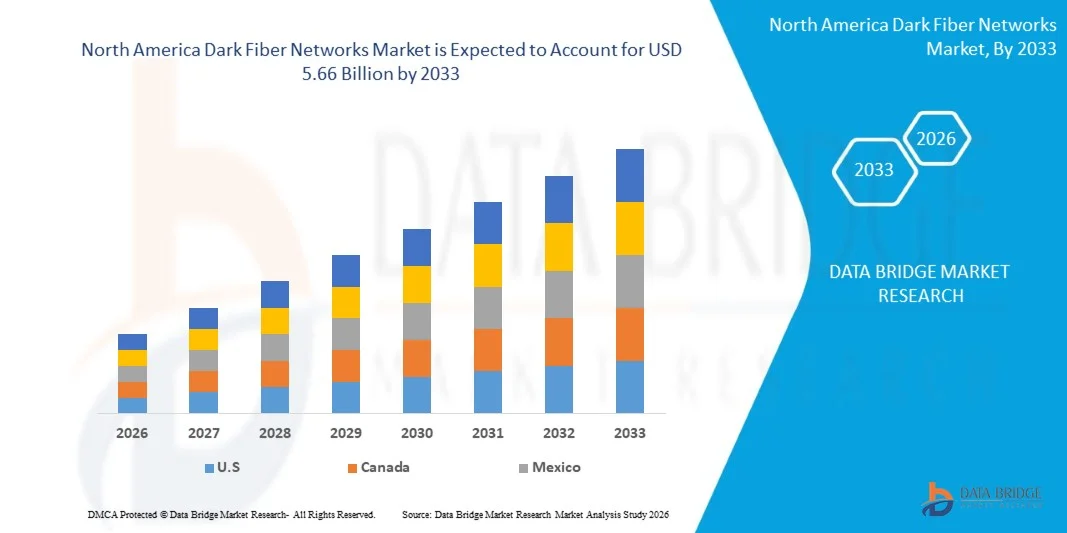

- The North America Dark Fiber Networks Market size was valued at USD 2.32 billion in 2025 and is expected to reach USD 5.66 billion by 2033, at a CAGR of 11.9% during the forecast period

- The market growth is primarily driven by the rising demand for Multi-Mode Fiber (MMF) and Single-Mode Fiber (SMF) across key industries such as BFSI, IT & telecommunication, government & public sector and healthcare. Expanding investments in high-speed connectivity, increasing deployment of 5G infrastructures, and the rapid growth of data centers are further boosting the adoption of dark fiber. Additionally, rising enterprise digital transformation and the growing need for secure, scalable, and low-latency network environments are strengthening the overall demand for dark fiber networks regionally.

- Increasing consumer preference for metro dark fiber and long-haul dark fiber is strengthening the position of dark fiber networks. This shift is driven by escalating bandwidth requirements, surge in cloud-based applications, and the need for dedicated private network routes for mission-critical operations. As organizations prioritize resilient, future-proof connectivity, dark fiber is increasingly viewed as a strategic asset, accelerating its deployment across telecom operators, hyperscalers, enterprises, and smart city projects, thereby significantly contributing to the regional expansion of the North America Dark Fiber Networks Market.

North America Dark Fiber Networks Market Analysis

- Dark fiber networks, unused, unlit optical fiber infrastructure leased or owned by telecom operators, data centers, and enterprises—are becoming increasingly vital across multiple industries, including IT & Telecommunications, BFSI, healthcare, media & entertainment, , and government networks. Their inherent advantages, such as high bandwidth capacity, ultra-low latency, enhanced security, and scalability make them essential for supporting modern digital applications like 5G backhaul, IoT ecosystems, cloud computing, and edge data processing.

- The escalating demand for dark fiber networks is primarily driven by surging data consumption, rapid digital transformation across enterprises, expansion of hyperscale data centers, and the rising need for secure, dedicated, and high-performance network routes. Additionally, increasing investments in 5G infrastructure, regulatory encouragement for high-speed broadband rollout, and industry-wide pressure to ensure network reliability, redundancy, and operational continuity are accelerating the adoption of dark fiber across regional markets.

- U.S. dominates the North America Dark Fiber Networks Market, accounting for 81.25% of the total revenue in 2025, driven by strong investments in fiber infrastructure, rapid 5G expansion, high concentration of hyperscale data centers, and increasing adoption of private fiber networks by technology firms and cloud service providers.

- Canada is expected to be the fastest-growing region in the North America Dark Fiber Networks Market during the forecast period, driven by the rapid expansion of data centers, extensive 5G rollout, increasing cloud adoption, and strong investments by telecom operators and hyperscale companies. The region benefits from advanced network infrastructure, rising enterprise demand for private and secure connectivity, and significant government support for broadband modernization. The United States and Canada are leading contributors, owing to high bandwidth consumption, dense metro fiber deployments, and the presence of major technology firms and large-scale cloud service providers.

- The Multi-Mode Fiber (MMF) segment is projected to dominate the market with a 63.15% share in 2026, owing to its cost-effectiveness, high bandwidth capability over short distances, and increasing deployment in data centers, enterprise LANs, and campus networks where multimode fiber supports scalable and economical high-speed connectivity.

Report Scope and North America Dark Fiber Networks Market Segmentation

|

Attributes |

North America Dark fiber networks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America Dark Fiber Networks Market Trends

“Accelerating Digital Traffic is Fueling the Shift Toward High-Capacity Dark Fiber Infrastructure”

- A major and fast-emerging trend in the North America Dark Fiber Networks Market is the rapid expansion of high-capacity optical infrastructure, driven by accelerating digital traffic worldwide. Explosive growth in video streaming, cloud workloads, enterprise digitalization, and real-time data applications is pushing operators and enterprises to adopt dark fiber routes that deliver scalable bandwidth, ultra-low latency, and resilient long-haul performance.

- Leading regional providers—including Zayo Group, Lumen Technologies, Colt Technology Services, Verizon, and several regional carriers—are intensifying investments in terabit-scale optical transport, open DWDM systems, AI-enhanced provisioning tools, and capacity-on-demand solutions. The rise of intelligent traffic orchestration, automated route optimization, and predictive network monitoring is enabling operators to accommodate fast-growing data loads seamlessly while minimizing congestion and latency fluctuations.

- Metro, regional, and international dark fiber deployments are accelerating, supported by multi-terabit backbone upgrades, diverse route expansions, and highly redundant fiber architectures. This growth is being fueled by rising bandwidth demand from hyperscale data centers, 5G densification initiatives, cross-border cloud connectivity requirements, and enterprise workloads such as AI model training, big-data analytics, IoT telemetry, and edge computing.

- AI-driven optical systems—featuring adaptive wavelength tuning, intelligent amplifiers, self-adjusting modulation formats, and real-time signal optimization are rapidly becoming essential for managing escalating data throughput. These systems enhance spectral efficiency and ensure consistent network performance without frequent manual intervention, making them critical for future-ready dark fiber ecosystems.

- Dark fiber is increasingly integrating with edge facilities, private enterprise networks, industrial IoT environments, and mission-critical sectors such as BFSI, healthcare, manufacturing, media, and smart infrastructure. Its ability to support fast data transport, localized processing, and uninterrupted high-volume operations is becoming indispensable as digital workloads intensify.

- This shift toward AI-optimized, bandwidth-rich, and expansion-ready dark fiber infrastructure is transforming market dynamics—moving the industry from traditional static leasing models to intelligent, scalable, and programmable optical networks. With digital traffic growing at unprecedented rates, operators are accelerating investments in future-proof dark fiber systems designed to support the world’s escalating need for high-capacity, high-speed data transmission.

North America Dark Fiber Networks Market Dynamics

Driver

“Rising Data Consumption is Driving Demand for High-Capacity Networks”

- Explosive data consumption is one of the strongest drivers of the North America Dark Fiber Networks Market . With the rapid growth of cloud computing, video streaming, AI/ML workloads, IoT devices, and real-time applications, data traffic has surged exponentially. Enterprises and service providers now require massive bandwidth, ultra-low latency, and high-capacity connections that traditional lit services often struggle to deliver. Dark fiber enables users to “light” their own fiber infrastructure with advanced optical equipment, allowing them to scale bandwidth freely and handle large data volumes without relying on shared networks. This makes dark fiber highly attractive for data-intensive industries such as hyperscale data centers, telecom operators, financial services, and media companies.

- Additionally, the shift toward digital transformation, remote work, and cloud-first strategies further amplifies the pressure on network capacity. As applications become more data-heavy, ranging from 4K/8K streaming to AI model training, edge computing, and massive IoT deployments—organizations need dedicated, secure, high-performance connectivity. Dark fiber provides the ideal foundation for supporting these growing and fluctuating data demands, delivering superior scalability, future-proof capacity, and operational control. As a result, explosive data growth continues to be a core force accelerating dark fiber adoption worldwide.

- For instance, in 2024, according to the ITU, regional internet traffic reached zettabyte scale, with fixed broadband networks carrying an estimated 6 zettabytes (ZB) of data, up from about 5.1 ZB in 2023, while mobile broadband traffic surpassed 1 ZB for the first time in 2023. This unprecedented surge highlights how data-intensive usage is increasingly shifting toward fixed, high-capacity networks that support streaming, cloud services, and AI workloads. As fixed networks shoulder the majority of regional traffic, dark fiber has become essential for operators and enterprises seeking scalable, high-bandwidth, and low-latency infrastructure

Restraint/Challenge

“High Capital Expenditure (CAPEX) Requires a Large Upfront Investment”

- High Capital Expenditure (CapEx) represents a significant barrier to entry in the North America Dark Fiber Networks Market. Establishing dark fiber infrastructure involves substantial upfront investments in laying fiber optic cables, acquiring rights of way, purchasing network equipment, and implementing supporting technologies. These initial costs can run into millions of dollars, making it challenging for new players or smaller companies to enter the market without substantial financial backing. As a result, companies may be hesitant to commit resources, slowing the expansion of dark fiber networks despite the growing demand for high-speed, reliable connectivity.

- Moreover, the long payback period associated with dark fiber investments further accentuates this restraint. Unlike active network services, dark fiber typically generates revenue only when leased to third parties, which may take several years to recoup the initial investment. This financial risk discourages investments, especially in regions with uncertain demand or regulatory hurdles. Consequently, high CapEx requirements limit market growth by restricting the number of players willing or able to invest in large-scale dark fiber deployment projects regionally.

- For instance in July 2024, the Financial Express published an article on tower fiberisation in Indian telecom, reporting that an estimated INR 2–3 trillion (INR 2–3 lakh crore) would be required to fully fiberise telecom towers across the country. Such a substantial capital expenditure underscores that scaling up dark fiber and backhaul infrastructure—critical for 5G and high-speed connectivity—is highly capital-intensive, often deterring operators from rapid expansion.

North America Dark Fiber Networks Market Scope

The North America Dark Fiber Networks Market is segmented into six notable segments based on the fiber type, network type, material, application, end user, and sales channel.

- By Fiber Type

On the basis of fiber type, the North America Dark Fiber Networks Market is segmented into Single-Mode Fiber (SMF) and Multi-Mode Fiber (MMF). In 2026, the Multi-Mode Fiber (MMF) is expected to dominate the market with a 63.15% market share due to its cost-effectiveness, high bandwidth capability over short distances, and increasing deployment in data centers, enterprise LANs, and campus networks where multimode fiber supports scalable and economical high-speed connectivity.

The Single-Mode Fiber (SMF) segment is the fastest-growing, registering a CAGR of 12.2% during the forecast period of 2026 to 2033, due to its ability to support long-distance, high-bandwidth transmission with minimal signal loss.

- By Network Type

On the basis of network type, the North America Dark Fiber Networks Market is segmented into metro dark fiber and long-haul dark fiber. In 2026, metro dark fiber is expected to dominate the market with a 58.56% market share due to rapid urban digitalization, densification of 5G small-cell networks, rising enterprise demand for high-capacity metro connectivity, and increasing need for low-latency fiber routes within metropolitan areas.

The metro dark fiber segment is the fastest-growing, registering a CAGR of 12.1% during the forecast period of 2026 to 2033, due to rising demand for high-capacity, low-latency connectivity across urban networks.

- By Material

On the basis of material, the North America Dark Fiber Networks Market is segmented into glass fiber and Plastic Optical Fiber (POF). In 2026, glass fiber is expected to dominate the market with a 62.41% market share due to its superior transmission performance, low attenuation, high durability, and widespread use in long-haul, metro, and high-capacity data center networks where reliability and signal integrity are critical.

The glass fiber segment is the fastest-growing, registering a CAGR of 12.2% during the forecast period of 2026 to 2033, due to its superior bandwidth capacity, low signal loss, and increasing adoption in high-speed communication networks.

- By Application

On the basis of application, the North America Dark Fiber Networks Market is segmented into backhaul connectivity, Data Center Interconnect (DCI), Enterprise & private networks, long-haul transport, redundancy & network resiliency and others. In 2026, backhaul connectivity is expected to dominate the market with a 38.65% due to surging demand for high-speed mobile transport networks, expansion of 5G rollouts, growing traffic from IoT and cloud services, and the need for low-latency, high-capacity backhaul infrastructure by telecom operators and enterprises.

The backhaul connectivity segment is the fastest-growing, registering a CAGR of 12.3% during the forecast period of 2026 to 2033, due to the increasing deployment of 5G networks and the rising need for high-capacity data transport.

- By End User

On the basis of end user, the North America Dark Fiber Networks Market is segmented into BFSI, it & telecommunication, government & public sector, healthcare, universities & research institutes, media & entertainment, industrial & manufacturing and others. In 2026, IT & telecommunications is expected to dominate the market with a 46.74% market due to the exponential rise in data traffic, increased investment in 5G and cloud infrastructure, and the need for secure, scalable, and high-bandwidth fiber connectivity for telecom carriers, hyperscalers, and internet service providers.

The IT & telecommunications segment is the fastest-growing, registering a CAGR of 12.4% during the forecast period of 2026 to 2033, due to increasing digitalization, rising data traffic, and expanding adoption of advanced communication technologies.

- By Sales Channel

On the basis of sales channel, the North America Dark Fiber Networks Market is segmented into direct sales and indirect sales. In 2026, direct sales is expected to dominate the market with a 60.30% market share due to large-scale fiber procurement by telecom operators, cloud providers, and enterprises, who prefer direct agreements for customized dark fiber routes, long-term leases, and enhanced control over network performance and security.

The direct sales segment is the fastest-growing, registering a CAGR of 12.1% during the forecast period of 2026 to 2033, due to the increasing preference for personalized customer engagement and higher conversion efficiency.

North America Dark Fiber Networks Market Insight

North America is growing at a robust CAGR of 11.9%. The region’s growth is experiencing steady and strong growth, driven by strong investments in fiber infrastructure, rapid 5G expansion, high concentration of hyperscale data centers, and increasing adoption of private fiber networks by technology firms and cloud service providers.

U.S. North America Dark Fiber Networks Market Insight

The U.S. is the dominant force in the North American North America Dark Fiber Networks Market projected to expand at a strong CAGR of 12.1% from 2026 to 2033. This growth is driven by rapid expansion of data-intensive applications, increasing cloud and colocation demand, large-scale 5G rollout, and ongoing investments from telecom operators and hyperscale data centers. Additionally, rising requirements for high-capacity, secure, and low-latency networks—particularly across enterprise, IT services, BFSI, healthcare, government, and media & entertainment sectors, continue to accelerate market adoption.

North America Dark Fiber Networks Market Share

The dark fiber networks industry is primarily led by well-established companies, including:

- Lumen Technologies (U.S.)

- Crown Castle (U.S.)

- Zayo Group, LLC (U.S.)

- Charter Communications (U.S.)

- CIRION (U.S.)

- Cogent Communications (U.S.)

- DQE Communications (U.S.)

- Everstream Solutions, LLC (U.S.)

- Fiber Light, LLC (U.S.)

- First Light Fiber, Inc (U.S.)

- Frontier Communications Parent, Inc. (U.S.)

- LIGHTPATH (U.S.)

- PS Lightwave LLC (U.S.)

- Segra (U.S.)

- Stealth Communications Services, LLC. (U.S.)

- Uniti Corporation (U.S.)

- Verizon (U.S.)

Latest Developments in North America Dark Fiber Networks Market

- In July 2025, Lumen Technologies announced it will provide the terrestrial dark fiber backhaul for the JUNO trans-Pacific cable system, linking Japan and the U.S. Lumen’s network connects the JUNO cable at Grover Beach, California, to major PoPs in San Jose and Los Angeles, enabling high-capacity, private network transport into key U.S. cloud hubs and enterprise networks. The partnership supports JUNO’s 350 Tbps capacity across 20 fiber pairs, leveraging SDM technology, and aims to facilitate next-generation AI, data-driven innovation, and seamless trans-Pacific connectivity for global enterprises

- In May 2025, Cirion expanded its network capacity by adding over 1,580 km of long-haul and 447 km of metro fiber routes in Latin America, boosting terrestrial optical network capacity to 668 Tb/s and enhancing data center interconnection and peering capabilities

- In March 2025, Crown Castle finalized an agreement to sell its Fiber Solutions business to Zayo Group Holdings Inc. for approximately USD 4.25 billion as part of a broader USD 8.5 billion deal that also involved selling its small cell business to EQT Active Core Infrastructure fund. This divestiture represents Crown Castle’s strategic refocus on its core tower infrastructure business while enabling Zayo to expand its fiber footprint and enhance connectivity solutions essential for supporting 5G, AI growth, cloud services, and enterprise customers across key U.S. metro areas

- In February 2025, LuxConnect signed a significant Indefeasible Right of Use (IRU) agreement with LuxNetwork, enabling LuxNetwork to extend its national network by over 400 km using LuxConnect's dark fiber infrastructure. This agreement guarantees service for 10 years and supports next-generation connectivity at 400 Gbps, enhancing Luxembourg’s digital infrastructure and European interconnections

- In January 2023, Global Connect Carrier partnered with ConnectiviTree to deliver Dark Fiber, Long Haul, and Access services across Northern Europe, with ConnectiviTree providing value-added services. The collaboration enables multiple-redundant routes, high-security, and low-latency connectivity, while also supporting future data center projects and geographic expansion. This partnership will strengthen Global Connect Carrier’s international network reach and solidify its position as a leading carrier in the Nordics.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DARK FIBER NETWORKS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 FIBER TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPANY COMPETITIVE ANALYSIS – NORTH AMERICA DARK FIBER NETWORKS MARKET (DETAILED VERSION)

4.2 COMPETITOR PRICING STRATEGIES IN THE NORTH AMERICA DARK FIBER MARKET

4.3 PENETRATION AND GROWTH PROSPECT MAPPING – NORTH AMERICA DARK FIBRE NETWORKS MARKET

4.4 TECHNOLOGY ANALYSIS — NORTH AMERICA DARK FIBER NETWORKS MARKET

4.5 FUNDING DETAILS—INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR:

4.6 USED CASES & THEIR ANALYSIS

4.7 GROSSE POINTE PUBLIC SCHOOL SYSTEM DARK FIBER DEPLOYMENT:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DATA CONSUMPTION IS DRIVING DEMAND FOR HIGH-CAPACITY NETWORKS

5.1.2 DEPLOYMENT OF 5G NETWORKS BOOSTS DARK FIBER DEMAND

5.1.3 GROWTH OF HYPERSCALE DATA CENTERS AND CLOUD INFRASTRUCTURE

5.1.4 INCREASING NEED FOR SECURE AND PRIVATE NETWORK

5.2 RESTRAINTS

5.2.1 HIGH CAPITAL EXPENDITURE (CAPEX) REQUIRES A LARGE UPFRONT INVESTMENT

5.2.2 SHORTAGE OF TECHNICAL EXPERTISE

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR ENTERPRISE PRIVATE NETWORKS

5.3.2 EXPANSION OF CROSS-BORDER AND LONG-HAUL CONNECTIVITY

5.3.3 THE EXPANSION OF SMART CITIES AND IOT

5.4 CHALLENGES

5.4.1 MARKET COMPETITION AND PRICING PRESSURE

5.4.2 REGULATORY & RIGHT-OF-WAY (ROW) CHALLENGES

6 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY FIBER TYPE.

6.1 OVERVIEW

6.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY FIBER TYPE, 2018-2033 (USD THOUSAND)

6.2.1 MULTI-MODE FIBER (MMF)

6.2.2 SINGLE-MODE FIBER (SMF)

6.3 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

6.3.1 OM3/OM4 FIBER

6.3.2 OM5 FIBER

6.3.3 OM2 FIBER

6.3.4 OM1 FIBER

6.4 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.5 NORTH AMERICA SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

6.5.1 OS2 FIBER

6.5.2 OS1 FIBER

6.6 NORTH AMERICA SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.7 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

6.7.1 METRO DARK FIBER

6.7.2 LONG-HAUL DARK FIBER

6.8 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

6.8.1 URBAN CONNECTIVITY

6.8.2 5G BACKHAUL

6.8.3 CAMPUS NETWORKS

6.9 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.1 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

6.10.1 INTER-CITY NETWORKS

6.10.2 TRANS-REGIONAL/INTER-COUNTRY NETWORKS

6.10.3 SUBMARINE FIBER NETWORKS

6.11 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY MATERIAL.

7.1 OVERVIEW

7.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

7.2.1 GLASS FIBER

7.2.2 PLASTIC OPTICAL FIBER (POF)

7.3 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

7.3.1 DOPED SILICA FIBER

7.3.2 PURE SILICA CORE

7.4 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.5 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

7.5.1 STEP-INDEX POF

7.5.2 GRADED-INDEX POF

7.6 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY END USER.

8.1 OVERVIEW

8.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

8.2.1 IT & TELECOMMUNICATIONS

8.2.2 BFSI

8.2.3 GOVERNMENT & PUBLIC SECTOR

8.2.4 HEALTHCARE

8.2.5 UNIVERSITIES & RESEARCH INSTITUTES

8.2.6 INDUSTRIAL & MANUFACTURING

8.2.7 MEDIA & ENTERTAINMENT

8.2.8 OTHERS

8.3 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.3.1 BACKHAUL CONNECTIVITY

8.3.2 DATA CENTER INTERCONNECT (DCI)

8.3.3 ENTERPRISE & PRIVATE NETWORKS

8.3.4 LONG-HAUL TRANSPORT

8.3.5 REDUNDANCY & NETWORK RESILIENCY

8.3.6 OTHERS

8.4 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 MOBILE BACKHAUL

8.4.2 ENTERPRISE BACKHAUL

8.4.3 METRO BACKHAUL

8.5 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.5.1 2G/3G/4G NETWORKS

8.5.2 5G SMALL-CELL NETWORKS

8.5.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.6 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 INTRA-CITY DCI

8.6.2 INTER-CITY DCI

8.6.3 CLOUD PROVIDER NETWORKS

8.7 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 PRIVATE WAN/LAN NETWORKS

8.7.2 CAMPUS NETWORKS

8.7.3 INDUSTRIAL IOT NETWORKS

8.8 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 INTER-CITY NETWORKS

8.8.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.9 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.9.1 DISASTER RECOVERY NETWORKS

8.9.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.9.3 CARRIER REDUNDANCY

8.1 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.11 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.11.1 BACKHAUL CONNECTIVITY

8.11.2 DATA CENTER INTERCONNECT (DCI)

8.11.3 ENTERPRISE & PRIVATE NETWORKS

8.11.4 LONG-HAUL TRANSPORT

8.11.5 REDUNDANCY & NETWORK RESILIENCY

8.11.6 OTHERS

8.12 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.12.1 ENTERPRISE BACKHAUL

8.12.2 MOBILE BACKHAUL

8.12.3 METRO BACKHAUL

8.13 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.13.1 2G/3G/4G NETWORKS

8.13.2 5G SMALL-CELL NETWORKS

8.13.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.14 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 INTRA-CITY DCI

8.14.2 INTER-CITY DCI

8.14.3 CLOUD PROVIDER NETWORKS

8.15 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 PRIVATE WAN/LAN NETWORKS

8.15.2 CAMPUS NETWORKS

8.15.3 INDUSTRIAL IOT NETWORKS

8.16 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.16.1 INTER-CITY NETWORKS

8.16.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.17 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.17.1 DISASTER RECOVERY NETWORKS

8.17.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.17.3 CARRIER REDUNDANCY

8.18 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.19 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.19.1 BACKHAUL CONNECTIVITY

8.19.2 DATA CENTER INTERCONNECT (DCI)

8.19.3 ENTERPRISE & PRIVATE NETWORKS

8.19.4 LONG-HAUL TRANSPORT

8.19.5 REDUNDANCY & NETWORK RESILIENCY

8.19.6 OTHERS

8.2 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.20.1 MOBILE BACKHAUL

8.20.2 ENTERPRISE BACKHAUL

8.20.3 METRO BACKHAUL

8.21 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.21.1 2G/3G/4G NETWORKS

8.21.2 5G SMALL-CELL NETWORKS

8.21.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.22 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.22.1 INTRA-CITY DCI

8.22.2 INTER-CITY DCI

8.22.3 CLOUD PROVIDER NETWORKS

8.23 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.23.1 PRIVATE WAN/LAN NETWORKS

8.23.2 CAMPUS NETWORKS

8.23.3 INDUSTRIAL IOT NETWORKS

8.24 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.24.1 INTER-CITY NETWORKS

8.24.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.25 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.25.1 DISASTER RECOVERY NETWORKS

8.25.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.25.3 CARRIER REDUNDANCY

8.26 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.27 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.27.1 BACKHAUL CONNECTIVITY

8.27.2 DATA CENTER INTERCONNECT (DCI)

8.27.3 ENTERPRISE & PRIVATE NETWORKS

8.27.4 LONG-HAUL TRANSPORT

8.27.5 REDUNDANCY & NETWORK RESILIENCY

8.27.6 OTHERS

8.28 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.28.1 ENTERPRISE BACKHAUL

8.28.2 MOBILE BACKHAUL

8.28.3 METRO BACKHAUL

8.29 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.29.1 2G/3G/4G NETWORKS

8.29.2 5G SMALL-CELL NETWORKS

8.29.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.3 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.30.1 INTRA-CITY DCI

8.30.2 INTER-CITY DCI

8.30.3 CLOUD PROVIDER NETWORKS

8.31 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.31.1 PRIVATE WAN/LAN NETWORKS

8.31.2 CAMPUS NETWORKS

8.31.3 INDUSTRIAL IOT NETWORKS

8.32 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.32.1 INTER-CITY NETWORKS

8.32.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.33 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.33.1 DISASTER RECOVERY NETWORKS

8.33.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.33.3 CARRIER REDUNDANCY

8.34 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.35 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.35.1 BACKHAUL CONNECTIVITY

8.35.2 DATA CENTER INTERCONNECT (DCI)

8.35.3 ENTERPRISE & PRIVATE NETWORKS

8.35.4 LONG-HAUL TRANSPORT

8.35.5 REDUNDANCY & NETWORK RESILIENCY

8.35.6 OTHERS

8.36 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.36.1 MOBILE BACKHAUL

8.36.2 ENTERPRISE BACKHAUL

8.36.3 METRO BACKHAUL

8.37 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.37.1 2G/3G/4G NETWORKS

8.37.2 5G SMALL-CELL NETWORKS

8.37.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.38 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.38.1 INTRA-CITY DCI

8.38.2 INTER-CITY DCI

8.38.3 CLOUD PROVIDER NETWORKS

8.39 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.39.1 PRIVATE WAN/LAN NETWORKS

8.39.2 CAMPUS NETWORKS

8.39.3 INDUSTRIAL IOT NETWORKS

8.4 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.40.1 INTER-CITY NETWORKS

8.40.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.41 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.41.1 DISASTER RECOVERY NETWORKS

8.41.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.41.3 CARRIER REDUNDANCY

8.42 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.43 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.43.1 BACKHAUL CONNECTIVITY

8.43.2 DATA CENTER INTERCONNECT (DCI)

8.43.3 ENTERPRISE & PRIVATE NETWORKS

8.43.4 LONG-HAUL TRANSPORT

8.43.5 REDUNDANCY & NETWORK RESILIENCY

8.43.6 OTHERS

8.44 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.44.1 ENTERPRISE BACKHAUL

8.44.2 MOBILE BACKHAUL

8.44.3 METRO BACKHAUL

8.45 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.45.1 2G/3G/4G NETWORKS

8.45.2 5G SMALL-CELL NETWORKS

8.45.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.46 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.46.1 INTRA-CITY DCI

8.46.2 INTER-CITY DCI

8.46.3 CLOUD PROVIDER NETWORKS

8.47 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.48 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.48.1 INTER-CITY NETWORKS

8.48.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.49 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.49.1 DISASTER RECOVERY NETWORKS

8.49.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.49.3 CARRIER REDUNDANCY

8.5 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.51 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.51.1 BACKHAUL CONNECTIVITY

8.51.2 DATA CENTER INTERCONNECT (DCI)

8.51.3 ENTERPRISE & PRIVATE NETWORKS

8.51.4 LONG-HAUL TRANSPORT

8.51.5 REDUNDANCY & NETWORK RESILIENCY

8.51.6 OTHERS

8.52 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.52.1 ENTERPRISE BACKHAUL

8.52.2 MOBILE BACKHAUL

8.52.3 METRO BACKHAUL

8.53 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.53.1 2G/3G/4G NETWORKS

8.53.2 5G SMALL-CELL NETWORKS

8.53.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.54 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.54.1 INTRA-CITY DCI

8.54.2 INTER-CITY DCI

8.54.3 CLOUD PROVIDER NETWORKS

8.55 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.55.1 PRIVATE WAN/LAN NETWORKS

8.55.2 CAMPUS NETWORKS

8.55.3 INDUSTRIAL IOT NETWORKS

8.56 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.56.1 INTER-CITY NETWORKS

8.56.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.57 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.57.1 DISASTER RECOVERY NETWORKS

8.57.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.57.3 CARRIER REDUNDANCY

8.58 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.59 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.59.1 BACKHAUL CONNECTIVITY

8.59.2 DATA CENTER INTERCONNECT (DCI)

8.59.3 ENTERPRISE & PRIVATE NETWORKS

8.59.4 LONG-HAUL TRANSPORT

8.59.5 REDUNDANCY & NETWORK RESILIENCY

8.59.6 OTHERS

8.6 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.60.1 MOBILE BACKHAUL

8.60.2 ENTERPRISE BACKHAUL

8.60.3 METRO BACKHAUL

8.61 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.61.1 2G/3G/4G NETWORKS

8.61.2 5G SMALL-CELL NETWORKS

8.61.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.62 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.62.1 INTRA-CITY DCI

8.62.2 INTER-CITY DCI

8.62.3 CLOUD PROVIDER NETWORKS

8.63 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.63.1 PRIVATE WAN/LAN NETWORKS

8.63.2 CAMPUS NETWORKS

8.63.3 INDUSTRIAL IOT NETWORKS

8.64 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.64.1 INTER-CITY NETWORKS

8.64.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.65 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.65.1 DISASTER RECOVERY NETWORKS

8.65.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.65.3 CARRIER REDUNDANCY

8.66 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY SALES CHANNEL.

9.1 OVERVIEW

9.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

9.2.1 DIRECT SALES

9.2.2 INDIRECT SALES

9.3 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 TELECOM OPERATORS & NETWORK PROVIDERS

9.3.2 DATA CENTER & CLOUD PROVIDERS

9.3.3 ENTERPRISE & CORPORATE DIRECT SALES

9.3.4 OTHERS

9.4 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.5.1 SYSTEM INTEGRATORS (SIS)

9.5.2 MANAGED SERVICE PROVIDERS (MSPS)

9.5.3 VALUE-ADDED RESELLERS (VARS)

9.6 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE

10.1 OVERVIEW

10.2 METRO DARK FIBER

10.3 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE

10.3.1 URBAN CONNECTIVITY

10.3.2 5G BACKHAUL

10.3.3 CAMPUS NETWORKS

10.4 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 LONG-HAUL DARK FIBER

10.5 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE

10.5.1 INTER-CITY NETWORKS

10.5.2 TRANS-REGIONAL/INTER-COUNTRY NETWORKS

10.5.3 SUBMARINE FIBER NETWORKS

10.6 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY APPLICATION

11.2.1 BACKHAUL CONNECTIVITY

11.3 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE

11.3.1 MOBILE BACKHAUL

11.3.2 ENTERPRISE BACKHAUL

11.3.3 METRO BACKHAUL

11.4 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE

11.4.1 2G/3G/4G NETWORKS

11.4.2 5G SMALL-CELL NETWORKS

11.4.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

11.5 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY REGION

11.5.1 DATA CENTER INTERCONNECT (DCI)

11.6 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE

11.6.1 INTRA-CITY DCI

11.6.2 INTER-CITY DCI

11.6.3 CLOUD PROVIDER NETWORKS

11.7 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY REGION

11.7.1 ENTERPRISE & PRIVATE NETWORKS

11.8 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE

11.8.1 CAMPUS NETWORKS

11.8.2 PRIVATE WAN/LAN NETWORKS

11.8.3 INDUSTRIAL IOT NETWORKS

11.9 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY REGION

11.9.1 LONG-HAUL TRANSPORT

11.1 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE

11.10.1 INTER-CITY NETWORKS

11.10.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

11.11 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY REGION

11.11.1 REDUNDANCY & NETWORK RESILIENCY

11.12 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE

11.12.1 DISASTER RECOVERY NETWORKS

11.12.2 HIGH AVAILABILITY ENTERPRISE LINKS

11.12.3 CARRIER REDUNDANCY

11.13 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY REGION

11.14 OTHERS

11.15 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY REGION

12 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA DARK FIBER NETWORKS MARKET: COMPANY LANDSCAPE

13.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 LUMEN TECHNOLOGIES

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 CROWN CASTLE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ZAYO GROUP, LLC

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 COLT TECHNOLOGY SERVICES GROUP LIMITED

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 CHARTER COMMUNICATIONS.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ARELION.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 CIRION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 COGENT COMMUNICATIONS

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DQE COMMUNICATIONS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 EUNETWORKS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EUROFIBER

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EVERSTREAM SOLUTIONS, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EXA INFRASTRUCTURE.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FIBERLIGHT, LLC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 FIRSTLIGHT FIBER, INC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 FRONTIER COMMUNICATIONS PARENT, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 GLOBALCONNECT GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 LIGHTPATH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 LUXCONNECT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 LYNTIA NETWORKS.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 PS LIGHTWAVE LLC

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 RELINED B.V.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 RETELIT S.P.A.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 RETN NETWORKS LTD.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 SEGRA.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 STEALTH COMMUNICATIONS SERVICES, LLC.

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 STERLITE POWER

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENT

15.28 UFINET

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 UNITI CORPORATION

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 VERIZON

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY FIBER TYPE, 2018-2033 (USD THOUSAND)

TABLE 4 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 NORTH AMERICA SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 13 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 19 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 27 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 43 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 51 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 59 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 66 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 67 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 75 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 83 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 85 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 87 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 90 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 92 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 93 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 96 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 98 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 100 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 102 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 104 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 105 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 106 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY FIBER TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 NORTH AMERICA SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 113 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 116 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 123 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 124 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 131 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 138 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 145 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 152 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 159 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 166 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 173 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 180 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 U.S. DARK FIBER NETWORKS MARKET, BY FIBER TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 U.S. MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 U.S. SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 U.S. DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 U.S. METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 U.S. LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 U.S. DARK FIBER NETWORKS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 189 U.S. GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 U.S. PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 U.S. DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 192 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 U.S. DARK FIBER NETWORKS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 199 U.S. IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 200 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 U.S. BFSI IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 207 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 U.S. GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 214 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 U.S. HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 221 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 U.S. UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 228 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 U.S. INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 235 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 U.S. MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 242 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 247 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 U.S. OTHERS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 249 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 U.S. DARK FIBER NETWORKS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 256 U.S. DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 U.S. INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 CANADA DARK FIBER NETWORKS MARKET, BY FIBER TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 CANADA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 CANADA SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 CANADA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 CANADA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 CANADA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 CANADA DARK FIBER NETWORKS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 265 CANADA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 CANADA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 CANADA DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 268 CANADA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 CANADA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 CANADA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 CANADA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 CANADA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 CANADA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 274 CANADA DARK FIBER NETWORKS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 275 CANADA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)