North America Deep Learning Neural Networks Dnns Market

Market Size in USD Billion

CAGR :

%

USD

12.50 Billion

USD

38.77 Billion

2024

2032

USD

12.50 Billion

USD

38.77 Billion

2024

2032

| 2025 –2032 | |

| USD 12.50 Billion | |

| USD 38.77 Billion | |

|

|

|

|

Deep Learning Neural Networks (DNNs) Market Size

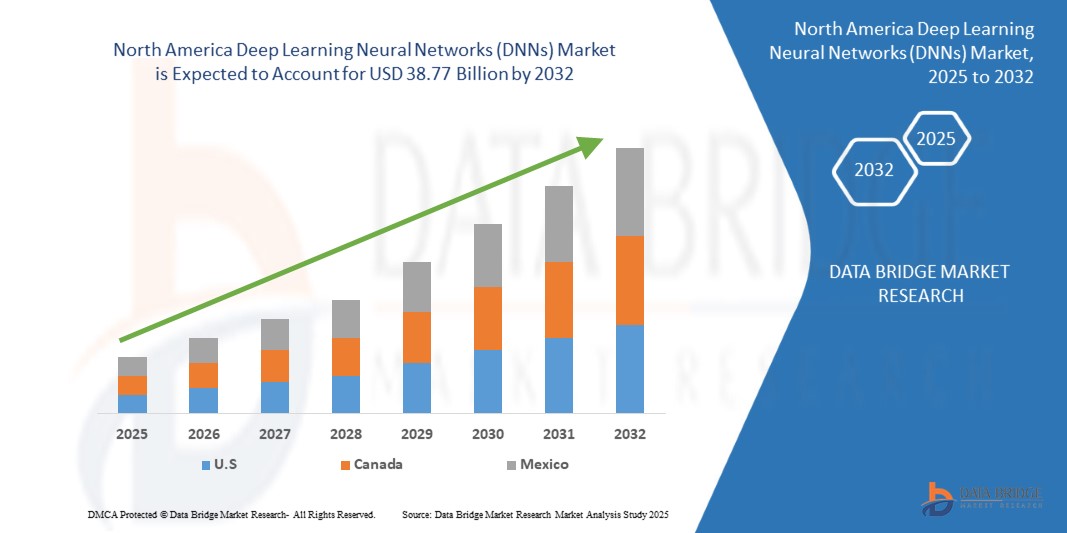

- The North America Deep Learning Neural Networks (DNNs) market size was valued at USD 12.50 billion in 2024 and is expected to reach USD 38.77 billion by 2032, at a CAGR of 15.2% during the forecast period

- This substantial growth is primarily driven by the widespread adoption of artificial intelligence (AI) technologies, increasing investments in machine learning infrastructure, and the rising demand for advanced data analytics across industries such as healthcare, automotive, finance, and retail. The proliferation of big data, coupled with advancements in computational power, is further accelerating market expansion.

- The region’s leadership in technological innovation, supported by significant research and development (R&D) investments, government initiatives promoting AI adoption, and a strong presence of leading tech companies, is a key contributor to the market’s upward trajectory. Additionally, the growing integration of DNNs in autonomous systems, smart manufacturing, and personalized consumer services is driving significant demand for deep learning solutions across North America.

Deep Learning Neural Networks (DNNs) Market Analysis

- Deep Learning Neural Networks (DNNs) are advanced AI algorithms designed to mimic human brain processes, enabling machines to process vast datasets, recognize patterns, and make data-driven decisions. These systems, including software platforms, hardware accelerators like GPUs and TPUs, and professional services, are critical for applications in healthcare diagnostics, autonomous vehicles, financial modeling, retail personalization, and manufacturing automation.

- The market is significantly fueled by North America’s dominance in AI innovation, with the region accounting for over 40% of global AI R&D spending in 2023, led by the United States. The rapid adoption of autonomous vehicles, with over 1.2 million self-driving cars projected to be on U.S. roads by 2027, drives demand for DNNs in real-time image and sensor data processing.

- Technological advancements, such as transformer-based models and generative AI, are enhancing DNN capabilities, enabling applications in natural language processing (NLP), computer vision, and predictive analytics. The U.S. government’s AI initiatives, such as the National AI Research Resource (NAIRR), are fostering innovation and supporting market growth.

- The United States dominates the market with a commanding 82.3% revenue share in 2024, valued at USD 10.29 billion, driven by its robust tech ecosystem, presence of key players like NVIDIA and Google, and significant investments in AI infrastructure. Canada is expected to witness the fastest growth rate, with a projected CAGR of 16.8% from 2025 to 2032, propelled by government support for AI research and growing adoption in healthcare and automotive sectors.

- Among product types, the software platforms segment held the largest market share of 48.7% in 2024, valued at USD 6.09 billion, attributed to the widespread use of deep learning frameworks like TensorFlow and PyTorch in enterprise and research applications.

Report Scope and Deep Learning Neural Networks (DNNs) Market Segmentation

|

Attributes |

Deep Learning Neural Networks (DNNs) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Deep Learning Neural Networks (DNNs) Market Trends

“Generative AI, Transformer Models, Edge Computing, and Sustainable AI Solutions”

- The adoption of generative AI and transformer-based models is a prominent trend, with over 30% of new DNN deployments in 2024 leveraging these technologies for applications in NLP, image generation, and creative content production, enhancing user experiences in retail and media.

- The rise of edge computing, with 25% of new DNN solutions in 2024 designed for on-device processing, is gaining traction in autonomous vehicles and IoT applications, reducing latency and improving real-time decision-making.

- Increasing focus on sustainable AI solutions, with 15% of new hardware accelerators in 2024 certified for energy efficiency, aligning with North America’s green technology initiatives and reducing the environmental impact of AI computing.

- The adoption of cloud-based DNN platforms is growing rapidly, with a 20% increase in adoption rates in 2024, driven by scalable and flexible solutions offered by providers like AWS, Microsoft Azure, and Google Cloud.

- Integration of DNNs with IoT ecosystems, particularly in smart manufacturing and healthcare, is expanding, with 18% of new solutions in 2024 designed for real-time data analytics and automation in these sectors.

- Growing consumer demand for personalized AI-driven services, such as recommendation systems in retail and predictive diagnostics in healthcare, is driving innovation in DNN applications across North America.

Deep Learning Neural Networks (DNNs) Market Dynamics

Driver

“AI Adoption, Big Data Proliferation, Autonomous Systems, Government Support, and Technological Advancements”

- Widespread adoption of AI technologies across industries, with North America’s AI market projected to reach USD 200 billion by 2027, drives significant demand for DNNs in applications like healthcare diagnostics, autonomous driving, and financial modeling.

- The proliferation of big data, with North American enterprises generating over 2.5 exabytes of data daily in 2023, fuels the need for advanced DNNs to process and analyze complex datasets for actionable insights.

- The rapid expansion of autonomous vehicle development, with over 1.2 million self-driving cars projected to be on U.S. roads by 2027, increases demand for DNNs in real-time image processing, sensor fusion, and decision-making algorithms.

- Government initiatives, such as the U.S. National AI Initiative and Canada’s Pan-Canadian AI Strategy, provide substantial funding and regulatory support for AI research, fostering innovation and adoption of DNNs across industries.

- Advancements in hardware accelerators, such as NVIDIA’s A100 GPUs and Google’s TPUs, enhance DNN performance, enabling faster training and inference for complex models in data centers and edge devices.

- The growing demand for personalized consumer experiences, with 65% of North American retailers adopting AI-driven recommendation systems in 2023, drives the integration of DNNs in retail, e-commerce, and customer service applications.

Restraint/Challenge

“High Development Costs, Data Privacy Concerns, Skill Shortages, Energy Consumption, and Regulatory Complexities”

- The high cost of developing and deploying DNNs, particularly for custom hardware accelerators and large-scale AI models, poses a challenge to adoption among small and medium enterprises, limiting market scalability in cost-sensitive segments.

- Data privacy concerns, driven by regulations like the California Consumer Privacy Act (CCPA) and Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA), increase compliance costs and complexity for DNN providers handling sensitive data.

- Skill shortages in AI and deep learning expertise, with a projected deficit of 250,000 AI professionals in North America by 2026, pose challenges to implementation, maintenance, and innovation in DNN technologies.

- High energy consumption of DNN training and inference processes, with large-scale models consuming up to 500 MWh annually, raises concerns about sustainability and operational costs, particularly in data centers.

- Rapid technological obsolescence, driven by continuous advancements in AI algorithms and hardware, pressures companies to invest heavily in R&D, reducing profitability for smaller players and limiting long-term innovation.

- Regulatory complexities, such as varying AI governance frameworks across the U.S., Canada, and Mexico, create challenges for standardized DNN deployment and compliance, increasing operational overhead for providers.

Deep Learning Neural Networks (DNNs) Market Scope

The North America Deep Learning Neural Networks (DNNs) Market is segmented based on product type, technology, application, deployment, end-user to provide a comprehensive understanding of market dynamics and growth opportunities.

- By Product Type

On the basis of product type, the market is segmented into software platforms, hardware accelerators, and services. The software platforms segment dominated with a 48.7% revenue share in 2024, valued at USD 6.09 billion, driven by the widespread use of frameworks like TensorFlow, PyTorch, and Keras in enterprise and research applications. The services segment is expected to grow at the fastest CAGR of 16.5% from 2025 to 2032, fueled by demand for AI consulting and implementation services.

By Technology

On the basis of technology, the market is segmented into Convolutional Neural Networks (CNNs), Recurrent Neural Networks (RNNs), Generative Adversarial Networks (GANs), Transformers, and others. The CNN segment held the largest share of 40.2% in 2024, driven by its use in image recognition and autonomous vehicles. The Transformers segment is expected to grow at the fastest CAGR of 17.1% from 2025 to 2032, fueled by advancements in NLP and generative AI.

By Application

On the basis of application, the market is segmented into healthcare diagnostics, autonomous vehicles, financial services, retail and e-commerce, manufacturing automation, and others. The healthcare diagnostics segment accounted for the largest revenue share of 35.6% in 2024, driven by AI-powered medical imaging and predictive diagnostics. The autonomous vehicles segment is expected to grow at the fastest CAGR of 18.3% from 2025 to 2032, fueled by self-driving car development.

By Deployment

On the basis of Deployment, the market is segmented into cloud-based and on-premise. The cloud-based segment held a significant share of 60.8% in 2024, driven by scalable solutions offered by AWS, Azure, and Google Cloud. The cloud-based segment is expected to grow at the fastest CAGR of 16.9% from 2025 to 2032, fueled by demand for flexible and cost-effective AI deployment.

By End-User

On the basis of End User, the market is segmented into enterprises, healthcare providers, automotive manufacturers, financial institutions, government agencies, and others. The enterprises segment dominated with a 42.1% revenue share in 2024, driven by AI adoption in business analytics. The healthcare providers segment is expected to grow at the fastest CAGR of 17.4% from 2025 to 2032, fueled by AI-driven diagnostics and personalized medicine.

Deep Learning Neural Networks (DNNs) Market Regional Analysis

U.S. Deep Learning Neural Networks (DNNs) Market Insight

The United States led the market with a commanding 82.3% revenue share in 2024, valued at USD 10.29 billion, driven by its robust tech ecosystem, presence of key players like NVIDIA, Google, and Microsoft, and significant investments in AI infrastructure. The country’s leadership in autonomous vehicles, healthcare AI, and financial services, coupled with government support through the National AI Initiative, solidifies its dominance.

Canada Deep Learning Neural Networks (DNNs) Market Insight

Canada is poised to grow at the fastest CAGR of 16.8% from 2025 to 2032, driven by government initiatives like the Pan-Canadian AI Strategy, which supports AI research and adoption in healthcare, automotive, and manufacturing sectors. Canada accounted for 12.1% of the market in 2024, with growing adoption of DNNs in smart cities and medical diagnostics.

Mexico Deep Learning Neural Networks (DNNs) Market Insight

Mexico held a 5.6% market share in 2024, driven by its growing automotive and manufacturing sectors, which are increasingly adopting AI for automation and quality control. Government efforts to promote Industry 4.0 and partnerships with U.S.-based tech firms support market growth in Mexico.

Deep Learning Neural Networks (DNNs) Market Share

- The Deep Learning Neural Networks (DNNs) industry is primarily led by well-established companies, including:

- NVIDIA Corporation (United States)

- Google LLC (United States)

- Microsoft Corporation (United States)

- Amazon Web Services, Inc. (United States)

- Intel Corporation (United States)

- IBM Corporation (United States)

- Advanced Micro Devices, Inc. (AMD) (United States)

- Meta AI (United States)

- Qualcomm Incorporated (United States)

- Oracle Corporation (United States)

- SAS Institute Inc. (United States)

- Palantir Technologies Inc. (United States)

- H2O.ai (United States)

- DataRobot, Inc. (United States)

- Cerebras Systems Inc. (United States)

- xAI (United States)

Latest Developments in North America Deep Learning Neural Networks (DNNs) Market

- In October 2023, NVIDIA unveiled the H200 Tensor Core GPU, its next-generation processor designed to accelerate deep neural network (DNN) training and inference. The H200 delivers up to 20% better performance for generative AI workloads compared to its predecessors. It is optimized for large-scale AI models such as transformers and diffusion models, crucial for applications in NLP and computer vision. Major cloud providers, including AWS and Azure, have already adopted the H200 to power their AI platforms, enhancing capabilities in both enterprise and research environments.

- In January 2024, Google Cloud launched Vertex AI Vision, a new addition to its Vertex AI platform, aimed at real-time image and video analysis using deep learning. This cloud-based solution supports use cases across retail (e.g., smart checkout, inventory tracking) and manufacturing (e.g., defect detection). It offers a 15% improvement in processing speed, driven by optimized model deployment and inference performance. Vertex AI Vision integrates easily with existing Google Cloud services, helping developers scale computer vision applications faster and more efficiently.

- In March 2024, Microsoft expanded its collaboration with OpenAI by embedding advanced transformer-based models into the Azure AI platform. This integration significantly enhances natural language processing (NLP) capabilities for enterprise users. Applications include automated customer service, language translation, content generation, and document summarization. Over 100 companies in the U.S. have already adopted these capabilities, leveraging Azure’s infrastructure to implement intelligent automation at scale.

- In April 2024, Elon Musk’s xAI introduced an enhanced version of its Grok platform, integrating more advanced DNNs to deliver improved analytical reasoning and data interpretation. The updated Grok system is designed for enterprise applications in areas such as predictive modeling, business intelligence, and strategic forecasting. With a focus on real-time insights and better performance, Grok now serves as a powerful tool for data-driven decision-making and enterprise-level AI deployment.

- In June 2024, Intel launched the Gaudi 3 AI accelerator, engineered to deliver energy-efficient, high-throughput DNN training. Compared to its predecessor, the Gaudi 3 reduces power consumption by 25%, while enhancing memory bandwidth and compute performance. The chip is positioned as a cost-effective solution for AI training and inference in large-scale data center environments. Adoption has already begun among major data infrastructure providers across North America.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.