North America Dental Diagnostic Surgical Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.89 Billion

USD

8.09 Billion

2024

2032

USD

3.89 Billion

USD

8.09 Billion

2024

2032

| 2025 –2032 | |

| USD 3.89 Billion | |

| USD 8.09 Billion | |

|

|

|

|

Dental Diagnostic and Surgical Equipment Market Size

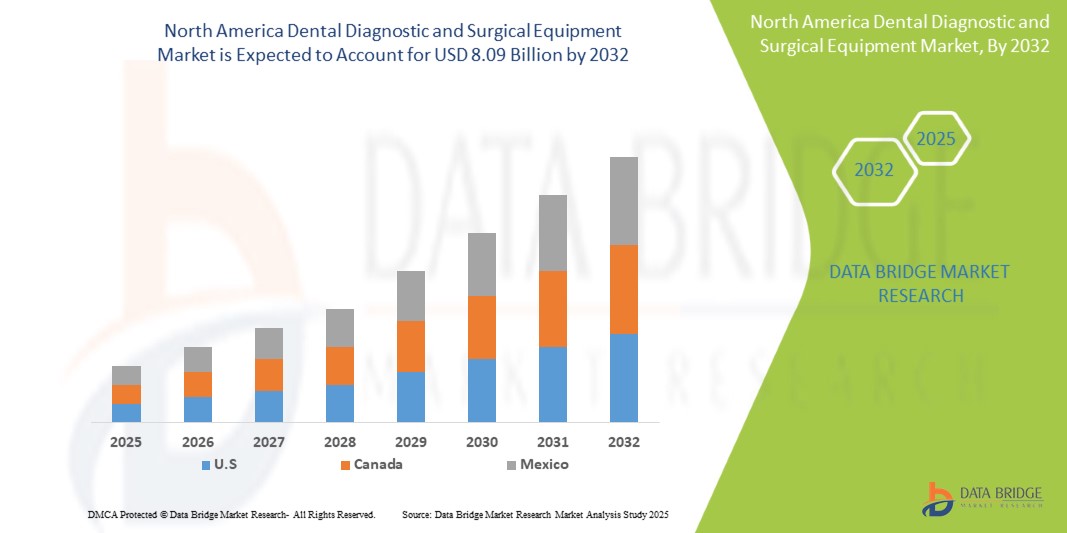

- The North America Dental Diagnostic and Surgical Equipment market size was valued at USD 3.89 billion in 2024 and is expected to reach USD 8.09 billion by 2032, at a CAGR of 9.6% during the forecast period

- This growth is largely fueled by the rising awareness about oral health, the increasing emphasis on preventive care, and the growing demand for advanced diagnostic and therapeutic tools.

- Furthermore, innovations in dental technology, such as digital dentistry, CAD/CAM systems, and 3D printing, are significantly transforming dental care, providing improved accuracy and efficiency in procedures, thereby boosting industry growth.

Dental Diagnostic and Surgical Equipment Market Analysis

- The North America dental diagnostic and surgical equipment market encompasses a wide range of instruments and technologies used by dental professionals for the examination, diagnosis, treatment, and restoration of teeth and surrounding oral structures. This includes items such as dental radiology equipment, dental lasers, CAD/CAM systems, and various surgical instruments.

- The escalating demand for dental diagnostic and surgical equipment is primarily driven by the increasing prevalence of dental disorders, a growing geriatric population, and the rising demand for cosmetic dentistry procedures.

- U.S. dominates the Dental Diagnostic and Surgical Equipment market with a significant revenue share in 2024 due to its advanced healthcare infrastructure, the leadership of prominent dental equipment companies, and high uptake of advanced dental technology.

- The U.S. dominates the Dental Diagnostic and Surgical Equipment market with the largest revenue share of 52.89% in 2025, driven by the rising demand for cosmetic dentistry, growing awareness of preventive dental care, increased investments in dental clinics and specialty centers equipped with advanced tools, and strong reimbursement policies.

- The dental systems & segment held the largest market share of 32.5% in 2025, as it includes essential components like dental chairs, handpieces, and CAD/CAM systems, which are integral to the core operations of dental clinics.

Report Scope and Dental Diagnostic and Surgical Equipment Market Segmentation

|

Attributes |

Dental Diagnostic and Surgical Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Diagnostic and Surgical Equipment Market Trends

“Integration of Artificial Intelligence (AI) and Digital Technologies"

- A significant trend shaping the North America Dental Diagnostic and Surgical Equipment market is the rapid integration of artificial intelligence (AI) and digital technologies into dental imaging systems and surgical workflows. This enhances diagnostic speed, accuracy, and decision-making capabilities for dental professionals.

- For instance, AI algorithms are being used for automated caries detection, periodontal disease assessment, and even for predicting treatment outcomes, leading to more precise diagnoses and personalized treatment plans.

- Furthermore, advancements in digital dentistry, including CAD/CAM systems, 3D printing, and intraoral scanning, are revolutionizing the design and fabrication of dental prosthetics and surgical guides, improving efficiency and patient comfort.

- The adoption of these technologies is not only streamlining dental practices but also improving patient engagement through enhanced visualization and more predictable results. This ongoing digital transformation is a key driver for market growth.

Dental Diagnostic and Surgical Equipment Market Dynamics

Driver

“"Increasing Prevalence of Oral Health Disorders and Aging Population”

- The rising incidence of dental disorders such as cavities, periodontal diseases, and oral cancers, coupled with the increasing geriatric population in North America, is a significant driver for the heightened demand for dental diagnostic and surgical equipment.

- For instance, according to the WHO, oral diseases affect billions globally, with a significant prevalence in various age groups. As the population ages, the susceptibility to these conditions increases, requiring more frequent and advanced diagnostic and therapeutic interventions.

- The need for early detection and effective treatment of these conditions directly translates to a greater demand for sophisticated diagnostic tools like digital X-rays, CBCT, and intraoral cameras, as well as surgical instruments for various procedures.

- Furthermore, growing awareness about oral health and the importance of regular dental check-ups among the general population is also contributing to the market's expansion.

Restraint/Challenge

“High Capital Investment and Limited Reimbursement Policies”

A major challenge restraining the growth of the North America Dental Diagnostic and Surgical Equipment market is the high capital investment required to purchase and maintain advanced imaging systems and surgical tools.

- For instance, sophisticated equipment such as Cone Beam Computed Tomography (CBCT) machines, dental lasers, and advanced CAD/CAM units represent a significant financial outlay for dental clinics and practices, especially for smaller or solo practices. This high cost can limit their adoption, particularly in regions with budget constraints or for dentists with limited financial resources.

- Furthermore, the complexities and variations in reimbursement policies across different insurance providers for advanced dental procedures and the associated equipment can create financial barriers for patients and practitioners alike.

- The lack of comprehensive dental insurance coverage for many elective or advanced procedures can deter patients from seeking treatment and clinics from investing in expensive equipment. Addressing these cost and reimbursement issues through more favorable policies and financing options is crucial for wider market penetration.

Dental Diagnostic and Surgical Equipment Market Scope

The market is segmented on the basis of product, treatment, and end-user.

By Product

On the basis of product, the North America dental diagnostic and surgical equipment market is segmented into dental radiology equipment, dental lasers, systems & parts, hygiene maintenance devices, and other equipment. The dental systems & segment held the largest market share of 32.5% in 2025, as it includes essential components like dental chairs, handpieces, and CAD/CAM systems, which are integral to the core operations of dental clinics.

The dental radiology equipment segment segment is expected to witness the fastest growth of 16.1% from 2025 to 2032, driven by advancements in imaging technologies such as CBCT and digital X-rays, which offer enhanced diagnostic capabilities.

By Treatment

On the basis of treatment, the North America dental diagnostic and surgical equipment market is segmented into orthodontic, endodontic, periodontic, and prosthodontic. The prosthodontic segment is expected to hold the largest market share during the forecast period, due to the high demand for restorative solutions like crowns, bridges, and implants, particularly among the aging population.

The orthodontic segment is anticipated to witness the fastest growth rate from 2025, propelled by increasing awareness of aesthetic dentistry and advancements in clear aligner technology.

By End-User

On the basis of end-user, the North America dental diagnostic and surgical equipment market is segmented into hospitals & clinics, dental laboratories, research & academic institutes, solo practices, DSO/group practices, and other facilities. The hospitals & clinics segment holds the largest market revenue share in 2024, due to the high volume of critical care, diagnostic, and surgical procedures performed in these settings.

The DSO/group practices segment is projected to witness the fastest growth from 2025, driven by the increasing trend of dental service organization consolidation, offering centralized management and advanced equipment access.

Dental Diagnostic and Surgical Equipment Market Regional Analysis

- U.S. dominates the Dental Diagnostic and Surgical Equipment market with the largest revenue share of 52.89 % in 2024, driven by a well-established dental infrastructure, high dental expenditure per capita, favorable reimbursement scenarios, and a robust presence of key industry players.

- This strong market position is further supported by the country's early adoption of technologically advanced diagnostic and surgical solutions.

Canada Dental Diagnostic and Surgical Equipment Market Insight

The Canada Dental Diagnostic and Surgical Equipment market is projected to expand at a substantial CAGR throughout the forecast period, driven by factors such as the rising geriatric population, increasing awareness of oral health, and the availability of advanced dental care services. The Canadian healthcare system, with its emphasis on quality and accessibility, supports the adoption of modern dental diagnostic and surgical techniques.

Mexico Dental Diagnostic and Surgical Equipment Market Insight

The Mexico Dental Diagnostic and Surgical Equipment market is anticipated to grow at a noteworthy CAGR during the forecast period driven by improving healthcare infrastructure, increasing dental tourism, and rising disposable incomes. The growing awareness of the importance of oral health and the increasing demand for advanced dental treatments are fueling market growth in Mexico.

Dental Diagnostic and Surgical Equipment Market Share

The Dental Diagnostic and Surgical Equipment industry is primarily led by well-established companies, including:

- Danaher Corporation (U.S.)

- Dentsply Sirona Inc. (U.S.)

- Straumann Group (Switzerland)

- Henry Schein, Inc. (U.S.)

- 3M Company (U.S.)

- A-dec Inc. (U.S.)

- Planmeca Oy (Finland)

- GC Corporation (Japan)

- Midmark Corporation (U.S.)

- Envista Holdings Corporation (U.S.)

- BIOLASE Inc. (U.S.)

- Carestream Health (U.S.)

- Ivoclar Vivadent AG (Liechtenstein)

- Zimmer Biomet (U.S.)

- Patterson Companies, Inc. (U.S.)

- Osstem Implant Co., Ltd. (South Korea)

- Align Technology, Inc. (U.S.)

- Zolar Dental Laser (Germany)

- NSK Ltd. (Japan)

- Young Innovations, Inc. (U.S.)

- American Medicals (U.S.)

- SSI Electronics (U.S.)

- TE Connectivity (Switzerland)

Latest Developments in North America Dental Diagnostic and Surgical Equipment Market

- In August 2023, Dentylec, an Israeli tech company, announced its launch of transformative solutions with the potential to revolutionize dental diagnostics. Dentylec will provide clearer insights into patients’ oral health and have a positive impact on it. Diagnostic technologies will be integrated with artificial intelligence to provide a clear and comprehensive view of patient’s oral health.

- In November 2023, DEXIS, a leading company in dental imaging technologies, announced a demonstration of its new technologies: DEXIS OP 3D LX and DEXassist Solution. The company claimed that both of these technologies would be extremely beneficial in the dental diagnostic market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.