North America Dental Infection Control Market

Market Size in USD Million

CAGR :

%

USD

609.60 Million

USD

935.55 Million

2025

2033

USD

609.60 Million

USD

935.55 Million

2025

2033

| 2026 –2033 | |

| USD 609.60 Million | |

| USD 935.55 Million | |

|

|

|

|

North America Dental Infection Control Market Size

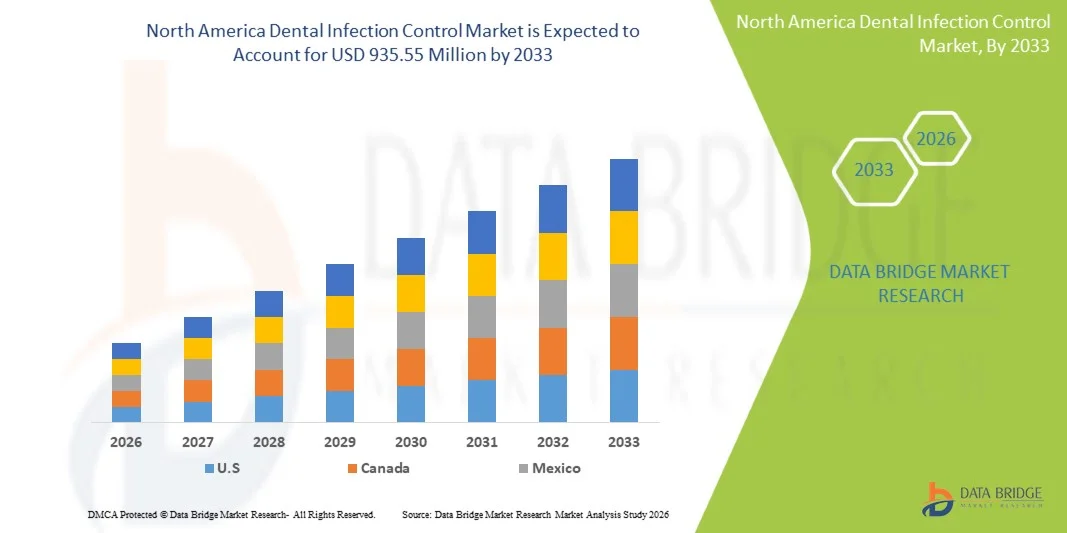

- The North America dental infection control market size was valued at USD 609.60 million in 2025 and is expected to reach USD 935.55 million by 2033, at a CAGR of 5.5% during the forecast period

- The market growth is primarily driven by increasing awareness of infection prevention in dental practices, stringent regulatory guidelines, and the rising adoption of advanced sterilization and disinfection technologies across dental clinics and hospitals

- In addition, growing patient safety concerns, coupled with the integration of innovative infection control products and systems, are encouraging dental professionals to adopt comprehensive infection control solutions, thereby accelerating the market expansion in the region

North America Dental Infection Control Market Analysis

- Dental infection control, encompassing sterilization, disinfection, and hygiene solutions, is becoming an essential component of modern dental practices in both clinics and hospitals due to its critical role in patient safety and regulatory compliance

- The growing demand for advanced infection control solutions is primarily fueled by heightened awareness of cross-contamination risks, stringent government and health authority regulations, and the adoption of innovative sterilization and disinfection technologies

- The United States dominated the North America dental infection control market with the largest revenue share of 78.2% in 2025, driven by the presence of leading dental product manufacturers, high healthcare expenditure, and well-established regulatory frameworks; U.S. dental practices are rapidly adopting automated sterilization systems, single-use disposables, and integrated infection control protocols

- Canada is expected to be the fastest-growing country in the North America market during the forecast period, supported by rising dental awareness, increasing investments in dental clinics, and government initiatives promoting infection control practices

- Consumables segment dominated the market with a share of 46.7% in 2025, owing to their essential role in routine infection control procedures and widespread adoption across dental hospitals and clinics

Report Scope and North America Dental Infection Control Market Segmentation

|

Attributes |

North America Dental Infection Control Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Dental Infection Control Market Trends

“Digitalization and Automation in Infection Control”

- A significant and accelerating trend in the North America dental infection control market is the increasing adoption of digital and automated sterilization and disinfection systems, enhancing efficiency and compliance in dental practices

- For instance, dental clinics are implementing automated autoclaves and UV-C disinfection units that streamline sterilization procedures, reduce human error, and ensure consistent infection control standards

- Integration with digital tracking systems enables dental professionals to monitor sterilization cycles, track equipment usage, and maintain regulatory compliance more effectively

- These automated systems allow centralized management of infection control processes, reducing manual oversight and improving overall patient safety

- This trend towards digital and automated infection control is reshaping operational standards, prompting companies such as Dentsply Sirona to develop IoT-enabled sterilization units and smart monitoring systems

- The demand for technologically advanced infection control solutions is rising across both dental hospitals and clinics, as professionals increasingly prioritize efficiency, safety, and compliance. For instance, some dental laboratories are now using connected disinfection units that provide real-time status updates to practitioners, minimizing downtime and ensuring timely treatment cycles

- The shift towards AI-assisted monitoring and predictive maintenance in sterilization equipment is further enhancing reliability, operational efficiency, and compliance across North American dental facilities

North America Dental Infection Control Market Dynamics

Driver

“Rising Awareness and Regulatory Compliance Requirements”

- The increasing awareness of cross-contamination risks and stringent infection control regulations are significant drivers for the heightened adoption of advanced dental infection control solutions

- For instance, in March 2025, Envista Holdings Corporation introduced an integrated sterilization and disinfection workflow system for dental clinics to comply with updated CDC and ADA guidelines

- As dental professionals recognize the importance of patient safety and practice hygiene, automated sterilization and single-use consumables are becoming essential in modern dental operations

- Furthermore, government and health authority mandates are encouraging clinics and hospitals to invest in advanced infection control equipment and consumables

- The growing demand for efficient workflow management, minimized infection risks, and compliance with regulatory standards is driving adoption in dental hospitals, clinics, and laboratories. For instance, dental associations are increasingly organizing training programs and certification courses to ensure that practitioners are updated with the latest infection control protocols

- Innovation in consumables such as single-use barriers, gloves, and masks with antimicrobial properties is also driving adoption, reducing cross-contamination risks and enhancing patient safety

Restraint/Challenge

“High Cost and Training Requirements”

- The relatively high initial cost of advanced infection control equipment and consumables poses a challenge to widespread adoption, particularly for smaller clinics and budget-conscious practices

- For instance, high-end autoclaves, UV disinfection units, and IoT-enabled sterilization systems may require significant investment, limiting accessibility for some dental facilities

- In addition, proper use of these advanced systems requires specialized staff training, which can be time-consuming and adds operational costs

- Inadequate training or misuse of equipment may lead to ineffective sterilization, compromising patient safety and increasing liability risks

- Overcoming these challenges through cost-effective solutions, training programs, and leasing options is crucial to encourage broader adoption and ensure sustained market growth. For instance, smaller clinics may opt for shared sterilization services or portable disinfection units to manage costs while maintaining compliance

- Regulatory variations across states in the U.S. and provinces in Canada can also create complexity, requiring clinics to invest in multiple compliance strategies, which may hinder adoption

North America Dental Infection Control Market Scope

The market is segmented on the basis of product and end user.

- By Product

On the basis of product, the North America dental infection control market is segmented into consumables and equipment. The Consumables segment dominated the market with the largest market revenue share of 46.7% in 2025, driven by the essential role of disposable items such as gloves, masks, barrier films, and disinfectant wipes in daily dental procedures. Dental hospitals and clinics rely heavily on consumables to maintain strict infection control protocols and minimize cross-contamination risks. The segment benefits from high replacement frequency and regulatory requirements mandating single-use or sterilized materials. In addition, ongoing innovations in consumables, such as antimicrobial coatings and ergonomically designed gloves, are boosting adoption. Strong awareness among dental professionals about patient safety and compliance also sustains demand. For instance, dental chains and hospital networks often establish bulk procurement agreements to ensure a consistent supply of high-quality consumables.

The Equipment segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of automated sterilization units, UV-C disinfection systems, and advanced autoclaves in dental hospitals and clinics. Equipment provides long-term solutions for consistent sterilization and hygiene, reducing human error and enhancing workflow efficiency. Integration with digital tracking and IoT-enabled systems further increases operational efficiency by monitoring sterilization cycles and equipment status. Government initiatives and updated CDC and ADA guidelines are encouraging clinics to invest in equipment to meet regulatory compliance. For instance, dental research institutes and laboratories are increasingly adopting advanced equipment for precise sterilization and disinfection protocols. The growing focus on high-quality infection control standards across North America is driving the sustained growth of this segment.

- By End User

On the basis of end user, the market is segmented into dental hospitals, dental clinics, dental research institutes and academics, and dental laboratories. The Dental Clinics segment dominated the market in 2025, owing to their large numbers and frequent patient interactions that demand strict infection control practices. Clinics widely use both consumables and equipment to ensure compliance with health regulations while providing safe treatment environments. The high patient turnover in clinics drives consistent replenishment of consumables and creates demand for compact, easy-to-use sterilization equipment. In addition, clinics are increasingly investing in automated solutions to enhance operational efficiency and reduce manual sterilization errors. For instance, multi-specialty clinics often implement integrated infection control protocols to maintain high standards of patient safety. Awareness campaigns and professional training programs further reinforce adoption of infection control solutions in clinics.

The Dental Research Institutes and Academics segment is expected to be the fastest-growing end user from 2026 to 2033, driven by increased research activities, educational programs, and adoption of state-of-the-art infection control equipment in laboratory settings. These institutes require advanced sterilization and disinfection systems to ensure accuracy and safety during experimental and clinical research. Furthermore, investments in teaching hospitals and dental colleges are promoting the integration of modern infection control technologies. For instance, academic dental programs are emphasizing hands-on training using automated sterilization units and consumables that mimic real-world clinical practices. The growing focus on research, innovation, and regulatory compliance in academic settings is fueling rapid growth in this segment.

North America Dental Infection Control Market Regional Analysis

- The United States dominated the North America dental infection control market with the largest revenue share of 78.2% in 2025, driven by the presence of leading dental product manufacturers, high healthcare expenditure, and well-established regulatory frameworks; U.S. dental practices are rapidly adopting automated sterilization systems, single-use disposables, and integrated infection control protocols

- Dental hospitals and clinics in the region prioritize patient safety, compliance, and workflow efficiency, leading to widespread use of both consumables and automated equipment for infection control

- This adoption is further supported by well-established healthcare infrastructure, high healthcare expenditure, and strong presence of key dental product manufacturers, establishing advanced infection control solutions as the preferred choice across residential and commercial dental practices

U.S. Dental Infection Control Market Insight

The U.S. dental infection control market captured the largest revenue share of 78.2% in 2025 within North America, fueled by the rising awareness of cross-contamination risks and strict adherence to CDC and ADA guidelines. Dental hospitals and clinics are increasingly prioritizing patient safety through the adoption of advanced sterilization equipment and single-use consumables. The growing trend of digital and automated infection control systems, combined with integrated workflow monitoring, further propels market growth. Moreover, the high healthcare expenditure, strong regulatory framework, and the presence of leading dental product manufacturers are significantly contributing to market expansion. The widespread adoption of infection control protocols across routine dental procedures ensures consistent demand for both consumables and equipment.

Canada Dental Infection Control Market Insight

The Canada dental infection control market is expected to be the fastest-growing country in North America during the forecast period, driven by increasing investments in dental clinics, rising patient awareness, and government initiatives promoting dental hygiene and infection control. Dental hospitals and clinics are rapidly implementing advanced sterilization units and consumables to comply with evolving regulatory standards. The growth is further supported by technological adoption, including automated disinfection systems and IoT-enabled monitoring, which enhance operational efficiency and patient safety. Furthermore, collaborative programs between dental associations and educational institutes are fostering best practices in infection control. The country’s growing focus on healthcare quality and infection prevention is accelerating the uptake of innovative solutions across all end users.

Mexico Dental Infection Control Market Insight

The Mexico dental infection control market is witnessing steady growth due to increasing investments in healthcare infrastructure and rising awareness of infection prevention in dental practices. Dental clinics and hospitals are gradually adopting sterilization equipment and disposable consumables to meet regulatory and patient safety standards. Government initiatives to promote oral health and the modernization of dental facilities are driving demand for advanced infection control solutions. In addition, collaboration with international dental product manufacturers is facilitating the availability of quality equipment and consumables. The integration of digital tracking systems for sterilization cycles is gradually improving operational efficiency in Mexican dental practices. The market is expanding across both urban and semi-urban regions, supporting long-term growth potential.

North America Dental Infection Control Market Share

The North America Dental Infection Control industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- 3M (U.S.)

- SciCan Ltd (Canada)

- Hu-Friedy Mfg. Co., LLC. (U.S.)

- W&H Group (Austria)

- A-dec Inc. (U.S.)

- Midmark Corporation (U.S.)

- COLTENE Corporation (Switzerland)

- Danaher (U.S.)

- Kerr Corporation (U.S.)

- Young Innovations, Inc. (U.S.)

- Crosstex International, Inc. (U.S.)

- Planmeca Oy (Finland)

- Ivoclar Vivadent (Liechtenstein)

- Euronda SpA - P. (Italy)

- Matachana (Spain)

- GC America Inc. (U.S.)

- Biotrol (U.S.)

- Dentisan (U.S.)

- DENTALEZ, Inc (U.S.)

What are the Recent Developments in North America Dental Infection Control Market?

- In April 2025, the American Dental Association (ADA) reported that nearly 94 % of dentists in private practice in the U.S. indicated they were still using many of the enhanced infection‑control measures put in place during the COVID‑19 pandemic—such as N95 masks, air purifiers and frequent disinfection of surfaces

- In March 2025, the Canadian federal government via Health Canada announced publicly that it would provide updates on the country’s upcoming dental‑care initiative (the Canadian Dental Care Plan), signalling increased governmental focus on oral health infrastructure and potentially infection‑control funding

- In March 2025, the Association for Dental Safety announced the launch of its new ADS Institute for Dental Safety and Science, a nonprofit dedicated to developing updated national guidelines for dental infection prevention

- In February 2025, at the Chicago Dental Society Midwinter Meeting, W&H Dentalwerk International showcased its new “Lexa Mini” rapid sterilizer and emphasised its infection‑control education programme, signalling increased investment in advanced sterilisation equipment and training for North American dental practices

- In June 2024, the American Dental Association (ADA) released results of a study showing that while 85 % of dental professionals surveyed recognised the importance of dental‑unit water‑line (DUWL) infection control, significant knowledge and practice gaps remain one‑third of respondents were uncertain if their facility complied with Centers for Disease Control and Prevention (CDC) water‑line guidelines, and nearly half said their practice lacked a designated infection‑control coordinator

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.