Market Analysis and Insights : North America Dental Intraoral Camera Market

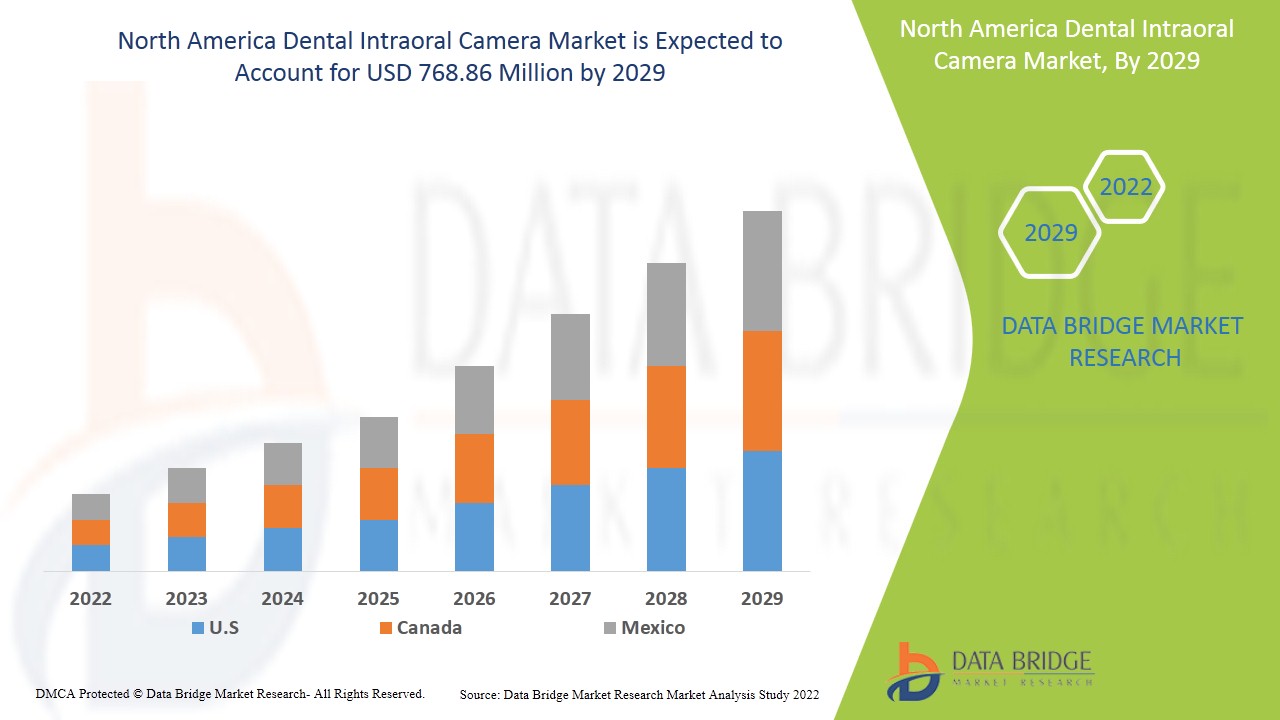

North America dental intraoral camera market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.3% in the forecast period of 2022 to 2029 and is expected to reach USD 768.86 million by 2029. Growth of R&D in the healthcare industry and increasing imaging diagnosis practices for periodontal diseases are the major drivers which propelled the demand of the market in the forecast period.

Orthodontics and implants both have less than 10% market penetration globally. Increased awareness of the importance of oral health maintenance and growing consumer focus on cosmetic dentistry is a significant growth driver for the global dental industry.

However, the high cost of dental intraoral cameras, which increases the treatment cost, may hinder the market.

The dental intraoral camera market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Dental intraoral Camera Market Scope and Market Size

Dental intraoral camera market is segmented on the based on the basis of technology, product, software, application and end users. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

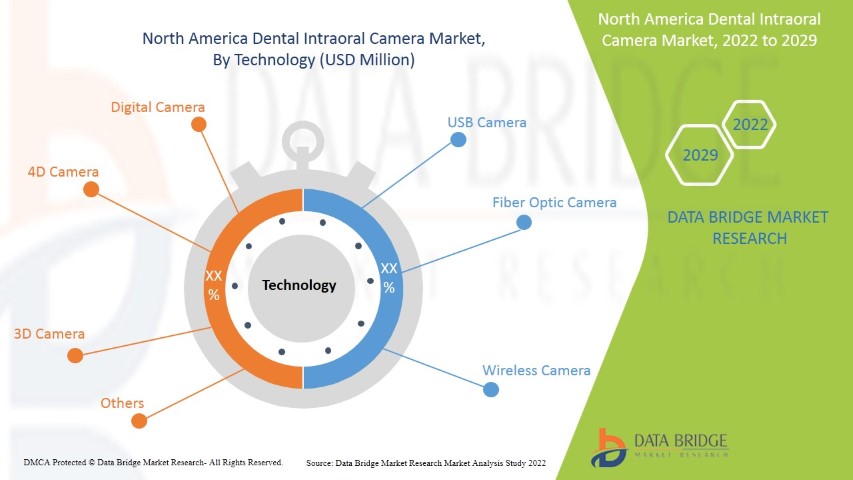

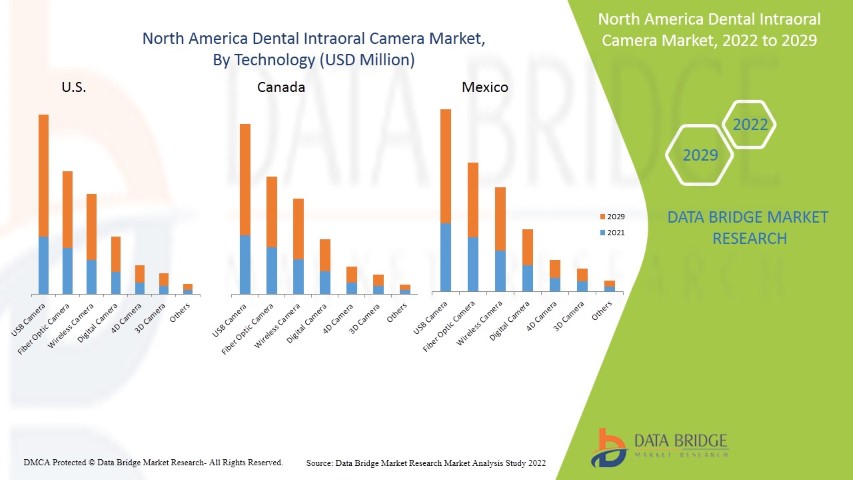

- On the basis of technology, the North America dental intraoral camera market is segmented into USB camera, fiber optic camera, wireless camera, digital camera, 4D camera, 3D camera and others. In 2022, USB camera segment is expected to dominate the market as it has connectivity functions as to others.

- On the basis of product, the North America dental intraoral camera market is segmented into intraoral wand, single lens reflex and others. In 2022, intraoral wand segment is expected to dominate the market for its user friendly features and advancements with digital software integrations.

- On the basis of software, the North America dental intraoral camera market is segmented into X-RAY software, button capture software and others. In 2022, X-RAY software segment is expected to dominate the market as X-ray scans along with imaging technology provides better diagnosis for patient oral hygiene.

- On the basis of application, the North America dental intraoral camera market is segmented into oral & maxillofacial surgery, orthodontics, endodontics, implantology and others. In 2022, the oral & maxillofacial surgery segment is expected to dominate the North America dental intraoral camera market due to the advent of various dental diseases that require early and accurate diagnosis with the help of an intraoral camera. The growing geriatric population is another reason for its growth.

- On the basis of end users, the North America dental intraoral camera market is segmented into dental hospital & clinics, dental diagnostics centers, dental academic & research institutes and others. In 2022, the dental hospital & clinics segment is expected to dominate the North America dental intraoral camera market growing due to the growing geriatric population and dental problems among people that raise healthcare expenditure.

North America Dental Intraoral Camera Market Country Level Analysis

The dental intraoral camera market is analyzed and market size information is provided on the basis of technology, product, software, application and end user.

The countries covered in the dental intraoral camera market report are the U.S., Canada, and Mexico.

Dental intraoral camera segment in North America region is expected to grow with the highest growth rate in the forecast period of 2022 to 2029 because of the growing geriatric population and dental problems among people that raise healthcare expenditure. U.S. is leading the growth of the North America dental intraoral camera market and USB camera segment is dominating in this country due to rising demand.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increase in Geriatric Population with Chronic Diseases and Rising Demand for Maintaining a Healthier Lifestyle are Boosting the Market Growth of Dental intraoral Camera

Dental intraoral camera market also provides you with detailed market analysis for every country growth in Dental intraoral camera industry with Dental intraoral camera sales, impact of advancement in the Dental intraoral camera technology and changes in regulatory scenarios with their support for the Dental intraoral camera market. The data is available for historic period 2010 to 2019

- In North America dental intraoral camera market U.S. is dominating the market with the presence of major market players as well as increasing geriatric population. Mexico is growing in the market with the increase in the number of dental problems and rising healthcare expenditure in the country. Increasing number of dental hospitals and clinics in Canada is promoting the dental intraoral camera market.

Competitive Landscape and Dental Intraoral Camera Market Share Analysis

Dental intraoral camera market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Dental intraoral camera market.

The major companies which are dealing in the North America dental intraoral camera market are DENTSPLY SIRONA, Envista, Carestream Dental LLC. , Ashtel Dental, SOTA Imaging, Air Techniques, Inc., ACTEON, Lensiora, Owandy Radiology, MouthWatch, LLC, TPC Advanced Technology, Inc., Digital Doc LLC, Video Dental, POLAROID, DENTAMERICA INC., GoodDrs., Denterprise Internationals, Flight Dental System among others.

Many product launch and agreement are also initiated by the companies’ worldwide which are also accelerating the dental intraoral camera market.

For instance,

- In March 2019, GoodDrs USA announced the launch of 5M, a five-megapixel intraoral camera that features a lightweight metal body and advanced liquid optic lens technology. This has increased company’s product portfolio

- In December 2021, Air Techniques, Inc., announced that they are presenting their products including new SensorX Intraoral Sensor and ScanX Duo Touch Scanner at CDA Presents in San Francisco, CA. This has increased company’s wide presence of product across the world

Collaboration, product launch, business expansion, award and recognition, joint ventures and other strategies by the market player is enhancing the company market in the Dental intraoral camera market which also provides the benefit for organization to improve their offering for Dental intraoral camera.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TECHNOLOGY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRIAL INSIGHTS:

4.2 CONCLUSION

5 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: REGULATIONS

5.1 REGULATION IN THE U.S.

5.2 GUIDELINES FOR DENTAL INTRAORAL CAMERA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING GERIATRIC POPULATION

6.1.2 INCREASING IMAGING DIAGNOSIS PRACTICES FOR PERIODONTAL DISEASES

6.1.3 RISING COSMETIC DENTISTRY

6.1.4 RISING NUMBER OF DENTISTS

6.1.5 GROWING MEDICAL TOURISM FOR DENTAL PROCEDURES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DENTAL INTRAORAL CAMERA

6.2.2 HIGH COMPETITION IN THE INTRAORAL CAMERA MARKET

6.3 OPPORTUNITIES

6.3.1 RISING HEALTHCARE EXPENDITURE WITH DIGITAL CONNECTIVITY

6.3.2 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.3.3 INCREASING TECHNOLOGICAL ADVANCEMENTS

6.4 CHALLENGES

6.4.1 RISING COMPETITION AMONG MARKET PLAYERS

6.4.2 STRINGENT REGULATORY FRAMEWORK

6.4.3 EMERGENCE OF COVID-19

7 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 USB CAMERA

7.3 FIBER OPTIC CAMERA

7.4 WIRELESS CAMERA

7.5 DIGITAL CAMERA

7.6 4D CAMERA

7.7 3D CAMERA

7.8 OTHERS

8 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 INTRAORAL WAND

8.3 SINGLE LENS REFLEX

8.4 OTHERS

9 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY SOFTWARE

9.1 OVERVIEW

9.2 X-RAY SOFTWARE

9.3 BUTTON CAPTURE SOFTWARE

9.4 OTHERS

10 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ORAL & MAXILLOFACIAL SURGERY

10.3 ORTHODONTICS

10.4 ENDODONTICS

10.5 IMPLANTOLOGY

10.6 OTHERS

11 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY END USER

11.1 OVERVIEW

11.2 DENTAL HOSPITAL & CLINICS

11.3 DENTAL DIAGNOSTICS CENTERS

11.4 DENTAL ACADEMIC & RESEARCH INSTITUTES

11.5 OTHERS

12 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY COUNTRY

12.1 U.S.

12.2 CANADA

12.3 MEXICO

13 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 HENRY SCHEIN, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.1.4.1 GRANT

15.2 DENTSPLY SIRONA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.2.4.1 NEW SOLUTION

15.3 ENVISTA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.3.4.1 PARTNERSHIP

15.3.4.2 PARTNERSHIP

15.3.4.3 PARTNERSHIP

15.4 CARESTREAM DENTAL LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.4.3.1 CONFERENCE

15.4.3.2 PARTNERSHIP

15.5 ASHTEL DENTAL

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.5.3.1 EVENT

15.6 ACTEON

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.6.3.1 PRODUCT LAUNCH

15.7 AIR TECHNIQUES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.3.1 EVENT

15.7.3.2 PARTNERSHIP

15.8 DIGITAL DOC, LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.8.3.1 CONFERENCE

15.9 DENTAMERICA INC

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.9.3.1 CONFERENCE

15.1 DENTERPRISE INTERNATIONALS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 FLIGHT DENTAL SYSTEM

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.11.3.1 PARTNERSHIP

15.11.3.2 PRODUCT LAUNCH

15.12 GOODDRS USA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.12.3.1 AGGREMENT

15.12.3.2 PRODUCT LAUNCH

15.13 LENSIORA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MOUTHWATCH, LLC

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 EVENT

15.15 OWANDY RADIOLOGY

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 POLAROID

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SOTA IMAGING

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.17.3.1 EVENT

15.18 TPC ADVANCED TECHNOLOGY, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.18.3.1 CONFERENCE

15.19 VIDEO DENTAL

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.19.3.1 SOFTWARE INTRODUCTION

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY SOFTWARE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY, 2020-2029 (VOLUME)

TABLE 9 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT, 2020-2029 (VOLUME)

TABLE 11 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY SOFTWARE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 14 U.S. DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 U.S. DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY, 2020-2029 (VOLUME)

TABLE 16 U.S. DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 17 U.S. DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT, 2020-2029 (VOLUME)

TABLE 18 U.S. DENTAL INTRAORAL CAMERA MARKET, BY SOFTWARE, 2020-2029 (USD MILLION)

TABLE 19 U.S. DENTAL INTRAORAL CAMERA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 U.S. DENTAL INTRAORAL CAMERA MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 CANADA DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 22 CANADA DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY, 2020-2029 (VOLUME)

TABLE 23 CANADA DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 24 CANADA DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT, 2020-2029 (VOLUME)

TABLE 25 CANADA DENTAL INTRAORAL CAMERA MARKET, BY SOFTWARE, 2020-2029 (USD MILLION)

TABLE 26 CANADA DENTAL INTRAORAL CAMERA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 CANADA DENTAL INTRAORAL CAMERA MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 28 MEXICO DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 29 MEXICO DENTAL INTRAORAL CAMERA MARKET, BY TECHNOLOGY, 2020-2029 (VOLUME)

TABLE 30 MEXICO DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 31 MEXICO DENTAL INTRAORAL CAMERA MARKET, BY PRODUCT, 2020-2029 (VOLUME)

TABLE 32 MEXICO DENTAL INTRAORAL CAMERA MARKET, BY SOFTWARE, 2020-2029 (USD MILLION)

TABLE 33 MEXICO DENTAL INTRAORAL CAMERA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 MEXICO DENTAL INTRAORAL CAMERA MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 35 USA DENTAL INTRAORAL CAMERA MARKET, 2020-2029 (USD MILLION)

TABLE 36 CANADA DENTAL INTRAORAL CAMERA MARKET, 2020-2029 (USD MILLION)

TABLE 37 MEXICO DENTAL INTRAORAL CAMERA MARKET, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN DEMAND FOR DENTAL INTRAORAL CAMERA ARE EXPECTED TO DRIVE THE NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 USB CAMERA IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET

FIGURE 14 NORTH AMERICA AGING POPULATION (IN MILLIONS)

FIGURE 15 AGING POPULATION IN THE U.S. (IN MILLIONS)

FIGURE 16 MEDICAL TOURISM BY THE CANADIAN POPULATION

FIGURE 17 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY TECHNOLOGY, 2021

FIGURE 18 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY TECHNOLOGY, 2021-2029 (USD MILLION)

FIGURE 19 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 20 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 21 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY PRODUCT, 2021

FIGURE 22 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY PRODUCT, 2021-2029 (USD MILLION)

FIGURE 23 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 24 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 25 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY SOFTWARE, 2021

FIGURE 26 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY SOFTWARE, 2021-2029 (USD MILLION)

FIGURE 27 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY SOFTWARE, CAGR (2022-2029)

FIGURE 28 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY SOFTWARE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY APPLICATION, 2021

FIGURE 30 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY APPLICATION, 2021-2029 (USD MILLION)

FIGURE 31 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 32 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 33 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY END USER, 2021

FIGURE 34 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 35 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY END USER, CAGR (2022-2029)

FIGURE 36 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: SNAPSHOT (2021)

FIGURE 38 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY COUNTRY (2021)

FIGURE 39 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY COUNTRY (2022 & 2029)

FIGURE 40 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY COUNTRY (2021 & 2029)

FIGURE 41 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 42 NORTH AMERICA DENTAL INTRAORAL CAMERA MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.