North America Dexa Equipment Market

Market Size in USD Million

CAGR :

%

USD

326.37 Million

USD

604.09 Million

2024

2032

USD

326.37 Million

USD

604.09 Million

2024

2032

| 2025 –2032 | |

| USD 326.37 Million | |

| USD 604.09 Million | |

|

|

|

|

North America Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Size

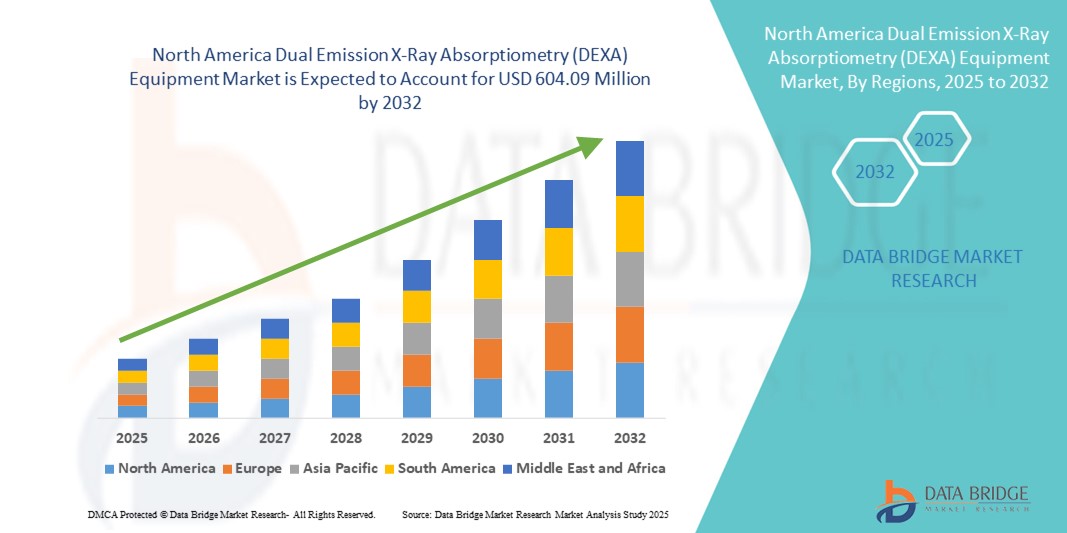

- The North America dual emission X-Ray absorptiometry (DEXA) equipment market size was valued at USD 326.37 million in 2024 and is expected to reach USD 604.09 million by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of osteoporosis and other bone-related disorders, the rising aging population, and heightened awareness about early bone health diagnostics. These trends are driving the deployment of dual emission X-Ray absorptiometry (DEXA) equipment across hospitals, diagnostic centers, and specialty clinics in North America

- Furthermore, rising consumer and clinical demand for precise bone density measurement, body composition analysis, and fracture risk assessment—particularly among postmenopausal women and elderly patients—is establishing DEXA equipment as critical diagnostic tools in preventive healthcare. Technological advancements in imaging resolution, reduced scan times, and integration with electronic health records (EHRs) are further accelerating the adoption of DEXA equipment, thereby significantly boosting the industry's growth

North America Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Analysis

- Dual Emission X-Ray Absorptiometry (DEXA) Equipment is witnessing robust adoption across North America, driven by rising prevalence of osteoporosis, increasing geriatric population, and growing focus on preventive healthcare. In 2024, North America accounted for 45.0% of the global DEXA Equipment market, supported by advanced diagnostic infrastructure, favorable reimbursement policies, and widespread clinical application in hospitals, imaging centers, and outpatient facilities

- The market shift towards portable and digital DEXA systems is accelerating, due to increasing demand for point-of-care diagnostics, ease of use in non-hospital settings, and rising preference for compact, mobile solutions. Moreover, the region's focus on integrated health monitoring—particularly in primary care, sports medicine, and obesity clinics—is reshaping procurement trends. Outpatient and ambulatory centers represented 62.8% of total DEXA equipment installations in North America in 2024, with growth projected as healthcare delivery becomes more decentralized

- U.S. dominated the North America dual emission X-Ray absorptiometry (DEXA) equipment market, accounting for the largest revenue share of 78.35% in 2024. This dominance is attributed to a high incidence of bone-related disorders, widespread adoption of preventive screening protocols, and the presence of leading imaging equipment manufacturers. In addition, strong demand for body composition analysis in fitness and wellness sectors continues to expand the market

- Canada is expected to be the fastest growing country in the North America dual emission X-Ray absorptiometry (DEXA) equipment market, registering a CAGR of 10.00% from 2025 to 2032. This growth is driven by increased government investment in diagnostic imaging, rising awareness of age-related bone health, and expanding availability of mobile screening programs in remote and underserved areas

- The Central DEXA segment dominated the North America dual emission X-Ray absorptiometry (DEXA) equipment market with a 64.3% revenue share in 2024, owing to its high accuracy in measuring bone mineral density at critical fracture-prone sites such as the spine and hip. It is widely used in hospitals and diagnostic centers for comprehensive osteoporosis screening and clinical decision-making

Report Scope and Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Segmentation

|

Attributes |

Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Trends

Rising Demand Driven by Osteoporosis Management and Body Composition Analysis

- A significant and accelerating trend in the Dual Emission X-Ray Absorptiometry (DEXA) Equipment market is the growing demand for early diagnosis and management of osteoporosis and other metabolic bone diseases, particularly among aging populations across North America, Europe, and parts of Asia-Pacific. DEXA remains the gold standard for bone mineral density (BMD) assessment, helping clinicians detect fractures and bone loss at an early stage

- Healthcare systems are increasingly integrating DEXA scans into routine screening protocols for postmenopausal women, elderly patients, and individuals undergoing long-term corticosteroid therapy. This shift is driven by rising awareness of preventive healthcare and the economic burden of fracture-related hospitalizations

- In March 2024, Hologic Inc. introduced an upgraded DEXA scanner with enhanced resolution and faster scan times, equipped with AI-powered diagnostic assistance to support clinicians in identifying subtle bone density changes and body composition metrics with greater precision

- Sports medicine and bariatric clinics are also fueling demand for advanced DEXA systems that can assess lean mass, fat distribution, and visceral fat levels, offering detailed body composition analysis to support athletic performance, obesity treatment, and weight management programs

- The expanding role of telehealth and remote diagnostics is pushing manufacturers to develop compact, portable DEXA systems suitable for use in outpatient settings, mobile clinics, and rural healthcare facilities. These devices are becoming crucial tools in broadening access to preventive bone health screenings

- With increasing focus on clinical efficiency and radiation safety, modern DEXA machines are being designed with low-dose imaging capabilities, automated workflow features, and seamless EHR integration, allowing hospitals and diagnostic centers to improve patient throughput while minimizing exposure risk

- Leading companies such as GE Healthcare, Hologic Inc., and DMS Imaging are investing in AI-enhanced imaging software, user-friendly interfaces, and cloud-based data analytics to differentiate their offerings and cater to a growing customer base that includes hospitals, specialty clinics, and academic research institutions

North America Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Dynamics

Driver

Growing Demand Due to Expanding Preventive Healthcare and Diagnostic Precision

- The increasing emphasis on early disease detection, preventive healthcare, and diagnostic accuracy is fueling the growth of the Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market. These machines offer unmatched precision in measuring bone mineral density (BMD) and body composition, making them essential for hospitals, diagnostic centers, specialty clinics, and sports medicine facilities

- For instance, in March 2024, several leading healthcare providers in the U.S. and Canada integrated AI-enhanced DEXA systems to improve osteoporosis screening and metabolic health assessments. This shift is enabling clinicians to detect bone loss and obesity-related risks earlier, while also supporting personalized treatment planning

- DEXA systems are increasingly being used beyond traditional bone health diagnostics. Their ability to provide detailed fat, lean mass, and visceral fat measurements makes them valuable in managing obesity, sarcopenia, and other metabolic disorders—especially in bariatric and geriatric care settings

- The rising patient demand for comprehensive health assessments and the growing use of DEXA in sports science and rehabilitation centers are further driving adoption. These systems support athletic performance tracking, injury recovery monitoring, and body composition optimization

- Investments in next-gen DEXA equipment—including portable models, IoT-enabled data integration, AI-powered analytics, and EHR connectivity—are accelerating market expansion, particularly as healthcare providers aim to improve diagnostic workflows, reduce scan times, and increase throughput in high-volume settings

Restraint/Challenge

High Equipment Costs and Limited Operator Training

- The relatively high initial investment required for DEXA systems remains a restraint, particularly for small and mid-sized clinics or rural healthcare facilities. High-end DEXA scanners can range from USD 20,000 to USD 100,000+, depending on features such as whole-body composition analysis and imaging software—making ROI a critical consideration

- For instance, while advanced DEXA machines offer precision diagnostics and multi-application capabilities, their high cost can deter adoption in emerging markets or underfunded public health systems

- Another challenge is the lack of trained personnel in operating and interpreting DEXA scans in some regions. Without adequate knowledge of calibration, patient positioning, and scan interpretation, facilities may underutilize equipment or generate inconsistent results

- Furthermore, regulatory variations and reimbursement limitations in certain countries pose hurdles to widespread deployment, especially in preventive screening programs

- To overcome these barriers, manufacturers are focusing on cost-effective compact models, intuitive software interfaces, virtual training modules, and partnerships with academic medical centers. These initiatives aim to enhance accessibility, support clinical education, and foster broader adoption across both developed and developing healthcare ecosystems

North America Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Scope

The market is segmented on the basis of product type, application, and end users.

- By Product Type

On the basis of product type, the North America Dual Emission X-Ray Absorptiometry (DEXA) Equipment market is segmented into Central DEXA and Peripheral DEXA. The Central DEXA segment dominated the market with a 64.3% revenue share in 2024, owing to its high accuracy in measuring bone mineral density at critical fracture-prone sites such as the spine and hip. It is widely used in hospitals and diagnostic centers for comprehensive osteoporosis screening and clinical decision-making.

The Peripheral DEXA segment is expected to register the fastest CAGR of 10.4% from 2025 to 2032, driven by increasing demand for portable and cost-effective solutions for preliminary screening in clinics, pharmacies, and mobile health units.

- By Application

On the basis of application, the market is segmented into body composition analysis, fracture diagnosis, bone densitometry, and fracture risk assessment. Bone densitometry dominated the application segment with a 46.7% share in 2024, supported by its standard use in diagnosing osteoporosis and assessing bone loss in elderly and at-risk populations. Its adoption is particularly strong in women's health and geriatrics departments.

Body Composition Analysis is projected to be the fastest-growing segment, with a CAGR of 11.1% from 2025 to 2032, due to increasing awareness of metabolic health, obesity management, and sports medicine applications. The integration of DEXA with fitness and wellness programs is expanding its use beyond clinical diagnostics.

• By End Users

On the basis of end users, the market is segmented into hospitals, clinics, mobile health centres, and others. Hospitals held the largest market share of 52.5% in 2024, attributed to the presence of advanced diagnostic infrastructure, skilled professionals, and routine bone health assessments as part of general and specialized care. High patient footfall and reimbursement support also drive adoption in this segment.

Mobile Health Centres are expected to witness the fastest growth, registering a CAGR of 10.8% from 2025 to 2032, as they enhance accessibility to bone screening services in remote and underserved areas. Government health programs and mobile diagnostic initiatives are expanding their reach across North America.

North America Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Regional Analysis

- The North America Dual Emission X-Ray Absorptiometry (DEXA) Equipment market accounted for 38.00% of the global market revenue in 2024, driven by the growing prevalence of osteoporosis, increasing focus on preventive healthcare, and expanding use of body composition analysis in clinical and wellness settings. The region benefits from a well-established healthcare infrastructure, favorable reimbursement landscape, and rising demand for non-invasive diagnostic imaging tools across hospitals, outpatient centers, and specialized diagnostic clinics

- The widespread increase in age-related bone disorders, rise in obesity rates, and growing awareness about musculoskeletal health are key factors propelling market demand. Moreover, the integration of DEXA equipment in sports medicine, physical therapy, and wellness programs has expanded the technology’s reach beyond traditional osteoporosis diagnostics

- Technological advancements—including portable DEXA devices, digital imaging capabilities, cloud-based analytics, and AI-assisted scan interpretation—are further accelerating adoption, especially among ambulatory care units, community health centers, and fitness-focused clinics aiming to provide point-of-care bone and body composition assessments

U.S. Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Insight

The U.S. dual emission x-ray absorptiometry (DEXA) equipment market dominated, accounting for the largest revenue share of 78.35% in 2024. This dominance is attributed to a high incidence of bone-related disorders, widespread adoption of preventive screening protocols, and the presence of leading imaging equipment manufacturers. Additionally, strong demand for body composition analysis in fitness and wellness sectors continues to expand the market. Growth is also supported by the implementation of national bone health initiatives and the increasing use of DEXA technology in bariatric clinics, sports facilities, and research institutions focusing on metabolic health.

Canada Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market Insight

The Canada dual emission x-ray absorptiometry DEXA equipment market accounted for 17.9% of the North America market share in 2024 and is projected to register the fastest CAGR of 10.00% from 2025 to 2032. This growth is driven by increased government investment in diagnostic imaging, rising awareness of age-related bone health, and expanding availability of mobile screening programs in remote and underserved areas. Canada’s healthcare system is increasingly prioritizing non-invasive, early-stage diagnosis tools, making DEXA a key technology in osteoporosis management and chronic disease monitoring. The expansion of telehealth and mobile imaging services is further accelerating access to bone density and body composition testing across provincial health networks.

North AmericaDual Emission X-Ray Absorptiometry (DEXA) Equipment Market Share

The Dual Emission X-Ray Absorptiometry (DEXA) Equipment market industry is primarily led by well-established companies, including:

- Hologic, Inc. (U.S.)

- GE HealthCare (U.S.)

- BeamMed Ltd. (Israel)

- DMS Imaging (France)

- Swissray Global Healthcare Holding, Ltd. (Switzerland)

- OSG Corporation (Japan)

- Medonica Co., Ltd. (South Korea)

- Nanoomtech Co., Ltd. (South Korea)

- Furuno Electric Co., Ltd. (Japan)

- Hitachi, Ltd. (Japan)

- Toshiba Corporation (Japan)

- Diagnostic Medical Systems Group (France)

- Nordic Bioscience (Denmark)

- Xingaoyi Medical Equipment Co., Ltd. (China)

- Beijing Manson Technology Co., Ltd. (China)

- Osteosys Co., Ltd. (South Korea)

- Sunlight Medical Ltd. (Israel)

- Compumedics Limited (Australia)

- Shenzhen XRAY Electric Co., Ltd. (China)

- Scanflex Healthcare AB (Sweden)

Latest Developments in North America Dual Emission X-Ray Absorptiometry (DEXA) Equipment Market

- In May 2025, SimonMed Imaging, a major outpatient imaging provider based in Scottsdale, Arizona, launched a new advanced DEXA scanning service that offers dual functionality—measuring both bone mineral density (BMD) and bone quality. The upgrade enhances early detection of osteoporosis by providing deeper insights into bone strength, beyond traditional BMD readings

- In 2024, companies such as Echolight Medical and GE Healthcare rolled out compact, portable DEXA solutions aimed at improving access to bone health diagnostics in rural clinics, outpatient centers, and mobile screening units. These devices are designed to be more affordable and easily deployable in underserved areas.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.