North America Diagnostic Imaging Equipment Market

Market Size in USD Billion

CAGR :

%

USD

4.34 Billion

USD

6.89 Billion

2024

2032

USD

4.34 Billion

USD

6.89 Billion

2024

2032

| 2025 –2032 | |

| USD 4.34 Billion | |

| USD 6.89 Billion | |

|

|

|

|

Diagnostic Imaging Equipment Market Size

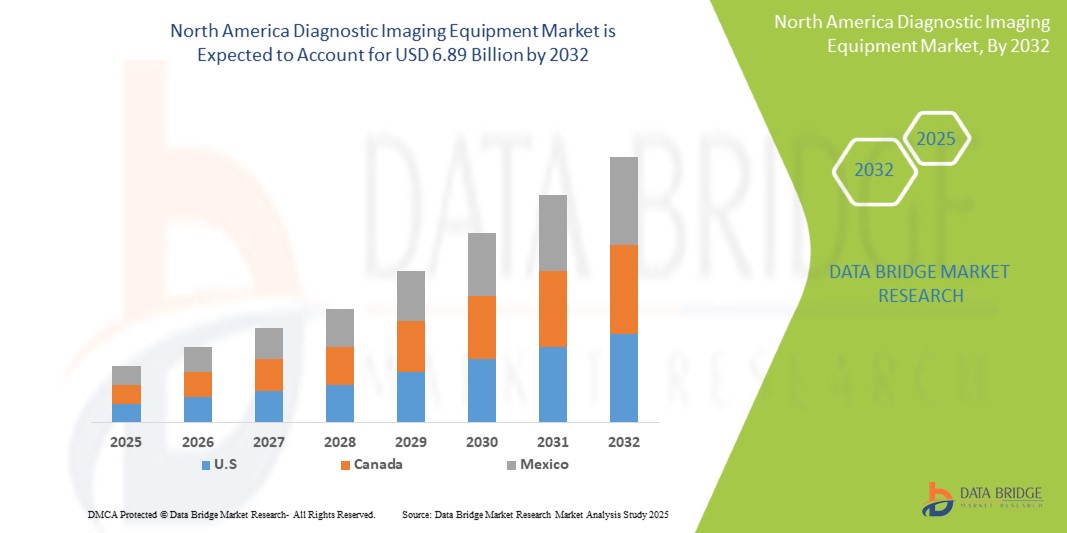

- The North America Diagnostic Imaging Equipment market size was valued at USD 4.34 billion in 2024 and is projected to reach USD 6.89 billion by 2032, exhibiting a CAGR of 6.56% during the forecast period of 2025-2032.

- Furthermore, the increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders, which necessitate early and accurate diagnosis, is establishing diagnostic imaging equipment as crucial tools in patient care and management.

- These converging factors are accelerating the adoption of diagnostic imaging equipment, thereby significantly boosting the industry's growth in the region.

Diagnostic Imaging Equipment Market Analysis

- Diagnostic imaging equipment, offering non-invasive visualization of internal body structures, are increasingly vital components of modern healthcare across various settings due to their ability to improve disease detection, guide treatment, and enhance overall patient outcomes.

- The escalating demand for diagnostic imaging equipment is primarily fueled by the demographic shift towards an older population, the rising incidence of chronic diseases, the active lifestyle of many individuals leading to injuries, and the continuous innovation in imaging technology offering better clinical outcomes.

- The U.S. dominates the Diagnostic Imaging Equipment market with the largest revenue share of 45.25% in 2025, due to well-established healthcare infrastructure, high healthcare expenditure, and the presence of leading medical device manufacturers.

- The X-ray Systems segment is expected to dominate the Diagnostic Imaging Equipment market with a market share of 28.3% in 2025, due to their widespread use in various applications, cost-effectiveness, and continuous technological advancements.

Report Scope and Diagnostic Imaging Equipment Market Segmentation

|

Attributes |

Diagnostic Imaging Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diagnostic Imaging Equipment Market Trends

“Integration of Artificial Intelligence and Machine Learning”

- A significant trend in the North America diagnostic imaging equipment market is the increasing integration of artificial intelligence (AI) and machine learning (ML) algorithms. These technologies are enhancing image quality, speeding up image interpretation, and assisting in disease detection and diagnosis.

- For instance, AI-powered solutions are being developed for automated lesion detection in oncology, quantification of cardiac function in cardiology, and rapid analysis of neurological scans, leading to improved diagnostic accuracy and efficiency.

- Furthermore, the use of AI in optimizing imaging protocols and reducing radiation dose is gaining traction, addressing key concerns for patient safety and workflow efficiency.

- The seamless integration of advanced imaging technologies with surgical planning and navigation systems is also enhancing the accuracy and efficacy of complex procedures.

Diagnostic Imaging Equipment Market Dynamics

Driver

“Technological Advancements and Product Innovations”

- Continuous technological advancements and product innovations are significant drivers for the heightened demand for diagnostic imaging equipment. Manufacturers are consistently introducing new generations of devices with improved image resolution, faster scanning times, reduced radiation exposure, and enhanced analytical capabilities.

- For instance, the development of 3T and 7T MRI systems offers superior image clarity for neurological and musculoskeletal imaging. Similarly, iterative reconstruction techniques in CT scanners significantly reduce radiation dose without compromising image quality.

- As these cutting-edge technologies become more widely available and their clinical benefits are demonstrated, the demand for upgrades and new installations of diagnostic imaging equipment is expected to increase substantially.

- Furthermore, the growing adoption of hybrid imaging modalities, such as PET/CT and SPECT/CT, which combine anatomical and functional imaging, is contributing to increased market growth.

Restraint/Challenge

“High Cost of Advanced Equipment and Installation”

- The relatively high cost of some advanced diagnostic imaging equipment, particularly MRI systems, CT scanners, and PET/CT scanners, can pose a significant challenge to broader market access.

- For instance, the initial capital expenditure for acquiring a high-end MRI or CT scanner can be substantial, potentially limiting their adoption, especially for smaller hospitals or diagnostic centers with stringent budget constraints.

- Additionally, the cost of installation, maintenance, and the need for specialized infrastructure (e.g., shielded rooms for MRI) further contribute to the overall expenditure, making it a considerable investment for healthcare providers.

- Addressing these cost and installation challenges through flexible financing options, rental agreements, and the development of more affordable, yet effective, imaging solutions will be crucial for ensuring wider accessibility to advanced diagnostic imaging. While efforts are underway to improve cost-effectiveness and optimize resource utilization, these issues remain significant considerations for market growth.

Diagnostic Imaging Equipment Market Scope

The market is segmented on the basis of product type, application, and end-user.

By Product Type

On the basis of product type, the diagnostic imaging equipment market can be segmented into X-ray systems, CT scanners, MRI systems, ultrasound systems, nuclear imaging systems, and others. The X-ray systems segment dominates the largest market revenue share of 45.25% in 2025 due to advancements in magnetic field strength and applications.

The CT scanners segment is anticipated to witness the fastest growth rate of 11.7% from 2025 to 2032. due to its superior imaging capabilities, rapid scan times, and broad clinical applications. The rising demand for early and accurate diagnosis of complex conditions such as cancer, cardiovascular diseases, and trauma injuries is driving market growth.

By Application

On the basis of application, the market is segmented into cardiology, oncology, neurology, orthopedics, gastroenterology, and others. The cardiology segment dominates the largest market revenue share in 2025 due to the increasing incidence of cancer and the critical role of imaging in diagnosis and staging.

The oncology segment is expected to witness the fastest CAGR from 2025 to 2032 due to the rising cancer burden and the critical need for early, accurate tumor detection and monitoring. Diagnostic imaging plays a vital role in cancer staging, treatment planning, and response assessment, driving consistent demand across healthcare settings.

By end-user

On the basis of end-user, the market is segmented into hospitals, diagnostic centers, ambulatory surgical centers, research & academic institutions, and others. The hospitals segment dominates the largest market revenue share in 2025 due to their specialized focus, efficiency, and growing patient preference for outpatient services.

The diagnostic centers segment is expected to witness the fastest CAGR from 2025 to 2032 due to increasing patient preference for specialized, accessible, and cost-effective imaging services outside hospital settings. These centers offer shorter wait times, faster reporting, and a wide range of advanced imaging modalities, driving higher patient volumes.

Diagnostic Imaging Equipment Market Regional Analysis

- The U.S. dominates the Diagnostic Imaging Equipment market with the largest revenue share of 45.25% in 2025, driven by a large and aging population, high rates of chronic diseases, well-established healthcare infrastructure with favorable reimbursement policies, and a strong focus on early diagnosis.

- This strong market position is further supported by the presence of major medical device companies and continuous advancements in imaging technology.

Canada Diagnostic Imaging Equipment Market Insight

The Canada Diagnostic Imaging Equipment market captured a significant revenue share within North America in 2025, driven by an aging population and increasing awareness of advanced diagnostic procedures. Government initiatives to improve healthcare access and the rising demand for minimally invasive procedures are contributing to market expansion.

Mexico Diagnostic Imaging Equipment Market Insight

The Mexico Diagnostic Imaging Equipment market captured a notable revenue share within North America in 2025, due to increasing healthcare expenditure and a growing awareness of advanced diagnostic solutions. The rising incidence of chronic diseases and the need for improved healthcare infrastructure are driving demand for diagnostic imaging equipment.

Diagnostic Imaging Equipment Market Share

The Diagnostic Imaging Equipment industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Canon Medical Systems Corporation (Japan)

- Fujifilm Holdings Corporation (Japan)

- Hologic, Inc. (U.S.)

- Carestream Health (U.S.)

- Shimadzu Corporation (Japan)

- Esaote S.p.A. (Italy)

- Toshiba Corporation (Japan)

- Samsung Medison (South Korea)

- Hitachi, Ltd. (Japan)

- NeuroLogica Corporation (U.S.)

- Analogic Corporation (U.S.)

- Pie Medical(Netherlands)

Latest Developments in North America Diagnostic Imaging Equipment Market

- In June 2023, GE HealthCare announced the FDA approval and product launch of Sonic DL, a deep learning-enabled technology developed to significantly augment image generation in MRI.

- In May 2023, Koninklijke Philips N.V. announced the launch of the Philips CT 3500, a high-end CT system targeting the requirements of routine radiology and high-volume screening programs.

- In February 2023, Boston Imaging (Samsung Medison Co., Ltd.) launched the Hera W10 Elite, the exclusive model of the Hera platform for obstetrics & gynecology, which provides clinicians a powerful Artificial Intelligence (AI) tools and clinical applications to enhance the diagnostic experience.

- In January 2023, Pie Medical Imaging launched CAAS Qardia 2.0, a new version of its echocardiography software platform. The platform offers Artificial Intelligence (AI) driven workflows for clinical measurements. It also offers in-hospital deployment as zero-footprint solution, which can be accessed from a personal computer within the hospital network via the web browser.

- In November 2022, Siemens Healthineers launched Magnetom Viato Mobile. It is a mobile MRI unit with 1.5 T, and its latest MRI scanner is optimized for mobile use and features a patient bore of 70 cm.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.