North America Digital Farming Software Market

Market Size in USD Billion

CAGR :

%

USD

3.14 Billion

USD

8.18 Billion

2025

2033

USD

3.14 Billion

USD

8.18 Billion

2025

2033

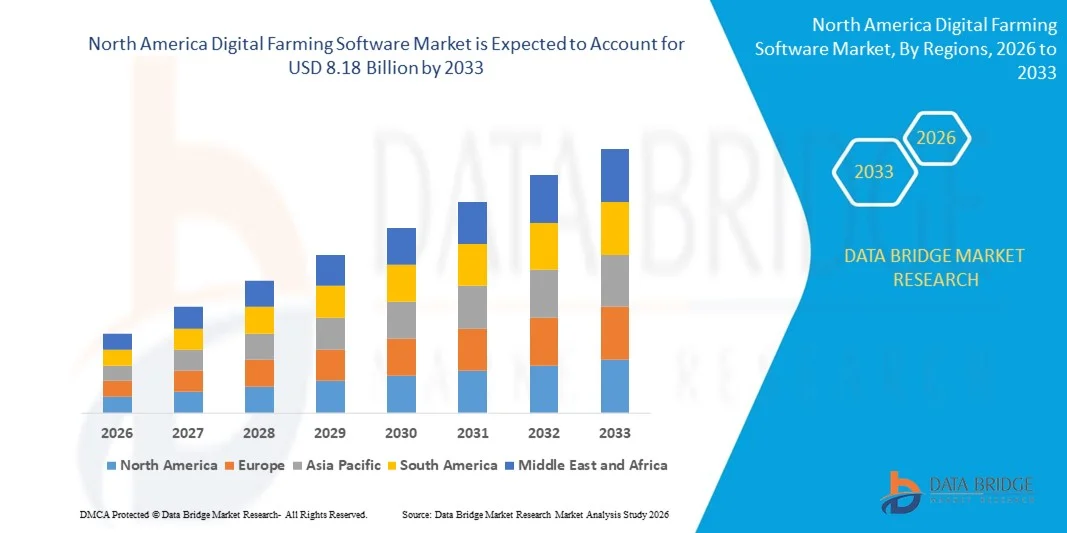

| 2026 –2033 | |

| USD 3.14 Billion | |

| USD 8.18 Billion | |

|

|

|

|

North America Digital Farming Software Market Size

- The North America digital farming software market size was valued at USD 3.14 billion in 2025 and is expected to reach USD 8.18 billion by 2033, at a CAGR of 12.7% during the forecast period

- The market growth is largely fueled by the rising adoption of precision agriculture and smart farming practices, driven by the need to increase agricultural productivity, optimize resource usage, and address food security challenges through data-driven solutions

- Furthermore, increasing integration of advanced technologies such as IoT, AI, machine learning, and satellite imagery into farming operations is enabling real-time monitoring, predictive analytics, and automation, accelerating the shift toward digital farming

North America Digital Farming Software Market Analysis

- Digital farming software comprises tools and platforms that collect, analyze, and visualize farm data to support decision-making in crop management, soil monitoring, irrigation, and resource planning. These solutions enhance efficiency, sustainability, and profitability across various agricultural activities

- The demand for digital farming software is primarily fueled by growing pressure to improve crop yields, rising concerns over climate change impacts, and increasing government support for smart agriculture initiatives, especially in emerging markets

- U.S. dominated the digital farming software market in 2025, due to early adoption of precision agriculture technologies, high penetration of smart farming solutions, and strong investments in agri-tech innovation

- Canada is expected to be the fastest growing region in the digital farming software market during the forecast period due to increasing adoption of precision agriculture, government initiatives promoting smart farming, and rising focus on sustainable crop management

- Software segment dominated the market with a market share of 58.5% in 2025, due to the increasing deployment of data-driven platforms that provide actionable insights for crop planning, yield estimation, and resource allocation. These solutions support farmers in decision-making through predictive analytics and historical trend analysis, thereby enhancing productivity and profitability

Report Scope and Digital Farming Software Market Segmentation

|

Attributes |

Digital Farming Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America Digital Farming Software Market Trends

Growing Adoption of Precision Agriculture Solutions

- The digital farming software market is expanding rapidly as more producers embrace precision agriculture tools to improve farm productivity, resource efficiency, and data-driven decision-making. Farmers and agribusinesses are leveraging software to manage crop cycles, irrigation, pest control, and equipment deployment, driving overall sector modernization

- For instance, major market players such as Trimble and John Deere have developed advanced digital farming platforms that integrate sensor networks, GPS-guided equipment, and real-time analytics, enabling users to optimize inputs and yields across large and small-scale operations

- Key innovations include cloud-based solutions, seamless mobile applications, and the integration of AI and machine learning for farm automation, resulting in better cost savings, targeted resource use, and improved outcomes for diverse crops and livestock

- The rise of IoT-connected devices and big data analytics is further accelerating the development of comprehensive farm management systems, allowing producers to monitor crop and soil health, forecast weather, and automate critical tasks remotely

- Governments are actively supporting smart farming adoption through subsidies, digital infrastructure investments, and partnerships with technology vendors to boost food security and sustainability in high-growth regions

- The increasing need to address climate change and adapt to unpredictable weather patterns is driving demand for precision technology that minimizes waste and environmental impact, making digital farming software a core enabler of resilience and risk mitigation across the agricultural value chai

North America Digital Farming Software Market Dynamics

Driver

Growing Need for Sustainable Agriculture

- Growing global demand for food, concerns about environmental impact, and shifting consumer preferences for traceable, sustainable products are fueling the adoption of digital farming software that optimizes resource use and lowers chemical and water inputs

- For instance, leading firms such as Climate FieldView and Granular (a Corteva Agriscience company) are partnering with progressive farms to implement digital solutions for real-time monitoring of soil health, targeted irrigation, and variable-rate fertilization, directly supporting sustainability goals and compliance initiatives

- These platforms enable data-driven transparency and accountability, helping farmers meet regulatory requirements and access new markets, such as organic and eco-certified produce

- Integration of sustainability metrics, carbon accounting, and advanced reporting within digital farming tools allows businesses to measure and reduce their ecological footprint while maintaining profitability and yield

- Government programs and industry coalitions are increasingly mandating or incentivizing sustainable practices, making digital farming software an essential tool for compliance, risk reduction, and market competitiveness

Restraint/Challenge

High Initial Investment

- The high upfront costs associated with deploying comprehensive digital farming solutions—including hardware (sensors, drones), software licensing, and workforce training—present a significant barrier, especially for small- and medium-sized growers

- For instance, some producers hesitate to adopt advanced platforms from companies such as Trimble or John Deere due to costs related to equipment integration, software customization, and managing technology updates

- Limited access to capital and uncertainties around short-term returns on investment can delay digital transformation projects, particularly in regions with lower average farm income or fragmented land holdings

- Interoperability issues with legacy systems and the need for ongoing technical support and updates add to the total cost of ownership, making adoption more difficult for less-resourced operations

- Despite the long-term efficiency and sustainability gains, market growth may be tempered in certain segments until more affordable or scalable solutions are developed and accessible financing options become widespread

North America Digital Farming Software Market Scope

The market is segmented on the basis of component, technology, and application.

- By Component

On the basis of component, the digital farming software market is segmented into software and services. The software segment dominated the largest market revenue share of 58.5% in 2025, attributed to the increasing deployment of data-driven platforms that provide actionable insights for crop planning, yield estimation, and resource allocation. These solutions support farmers in decision-making through predictive analytics and historical trend analysis, thereby enhancing productivity and profitability. The adoption of comprehensive farm management software is accelerating due to its ability to centralize data from multiple sources, streamline operations, and comply with regulatory requirements.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for consulting, integration, and maintenance support. As farms embrace digital transformation, the need for tailored services to optimize software deployment and ensure seamless connectivity across devices is becoming critical. Furthermore, agronomic advisory services and real-time support for troubleshooting and calibration are gaining traction, particularly among small and medium-sized farms with limited in-house expertise.

- By Technology

On the basis of technology, the market is segmented into remote sensing, guidance technology, variable rate technology, machine learning, wireless connectivity, and others. The remote sensing segment held the largest revenue share in 2025, driven by its critical role in monitoring crop health, detecting anomalies, and managing inputs based on satellite or UAV imagery. The ability to assess vast farmland areas with high accuracy makes remote sensing invaluable for large-scale farms aiming for resource-efficient operations. It enables early detection of pest infestations, nutrient deficiencies, and water stress, supporting timely interventions.

Machine learning is projected to register the fastest CAGR from 2026 to 2033, as the industry shifts toward predictive and prescriptive analytics. Machine learning algorithms enhance yield forecasts, automate image recognition for plant diseases, and optimize irrigation schedules based on real-time sensor data. Its adaptive learning capability continuously improves system accuracy, enabling hyper-personalized recommendations. As data volumes increase, machine learning is emerging as the cornerstone for autonomous, intelligent farming ecosystems.

- By Application

On the basis of application, the market is segmented into drone analytics, precision farming, agriculture robots, livestock monitoring, greenhouse management, supply chain management, financial management, and others. The precision farming segment led the market share in 2025, owing to its widespread use in optimizing field-level management through variable input application, GPS-based guidance, and automated machinery. Growers increasingly rely on precision farming software to enhance yield while reducing costs, supported by detailed geospatial analytics and historical yield maps. This segment continues to dominate due to its broad applicability across row crops, permanent crops, and horticulture.

Drone analytics is anticipated to witness the fastest growth from 2026 to 2033, driven by the rising deployment of UAVs for aerial scouting, mapping, and real-time surveillance. Drone-captured imagery provides high-resolution insights into plant health, pest activity, and irrigation coverage, enabling rapid and data-informed decisions. Coupled with AI-powered analysis, drone analytics platforms are transforming field assessments from manual inspections to automated, scalable intelligence tools, significantly improving operational agility and efficiency.

North America Digital Farming Software Market Regional Analysis

- U.S. dominated the digital farming software market with the largest revenue share in 2025, driven by early adoption of precision agriculture technologies, high penetration of smart farming solutions, and strong investments in agri-tech innovation

- Widespread utilization of digital farming software across large-scale farms, agribusiness enterprises, and agricultural cooperatives, supported by advanced IT infrastructure, high internet connectivity, and strong awareness of data-driven farming practices, continues to sustain robust demand across the agricultural value chain

- The strong presence of major market players such as John Deere, Trimble Inc., and Climate LLC, along with continuous advancements in AI-based analytics, farm management platforms, and connected equipment solutions, reinforces the U.S. leadership position

Canada Digital Farming Software Market Insight

Canada is projected to register the fastest CAGR in the North America digital farming software market from 2026 to 2033, supported by increasing adoption of precision agriculture, government initiatives promoting smart farming, and rising focus on sustainable crop management. For instance, Canadian farmers and agribusinesses are increasingly deploying farm management and analytics platforms to improve productivity across large acreage farms. Growing investments in agri-tech startups, expansion of digital infrastructure in rural areas, and rising demand for climate-resilient farming solutions are accelerating market growth, positioning Canada as the fastest-growing country in the region.

Mexico Digital Farming Software Market Insight

Mexico is expected to grow steadily from 2026 to 2033, driven by gradual adoption of digital farming tools, increasing mechanization in agriculture, and growing focus on improving crop yields and resource efficiency. Expansion of commercial farming, rising use of mobile-based farm management applications, and improving access to digital technologies are supporting consistent market demand. Strengthening collaboration with North American agri-tech providers and increasing awareness of precision agriculture benefits are contributing to stable growth of the digital farming software market throughout the forecast period.

North America Digital Farming Software Market Share

The digital farming software industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- CropX Inc. (U.S.)

- NETAFIM (Israel)

- PrecisionHawk, Inc. (U.S.)

- eAgroop, Lda (Portugal)

- EZ Lab srl (Italy)

- Ag Leader Technology (U.S.)

- Accenture (Ireland)

- Infosys Limited (India)

- FarmFacts GmbH (Germany)

- Yara (Norway)

- Luda.Farm AB (Sweden)

- Trimble Inc. (U.S.)

- Farmer's Business Network, Inc. (U.S.)

- DJI (China)

- Pix4D SA (Switzerland)

- Agremo (Croatia)

- Farmers Edge Inc. (Canada)

- BASF (Germany)

- Raven Industries, Inc. (U.S.)

- AGCO Corporation (U.S.)

- Gamaya (Switzerland)

- DRAGONFLY IT (Canada)

- BayWa AG (Germany)

- Syngenta (Switzerland)

- Field Margin Ltd. (U.K.)

- AeroVironment, Inc. (U.S.)

- Deere & Company (U.S.)

Latest Developments in North America Digital Farming Software Market

- In March 2024, TELUS Agriculture & Consumer Goods, a Canada-based digital farming software provider, acquired U.K.-based Proagrica to strengthen its market position by expanding agronomic expertise and enhancing platform capabilities. This strategic move supports improved customer digitization, stronger data interoperability, and advanced analytics, enabling farmers and agribusinesses to make more informed decisions. The acquisition reinforces TELUS Agriculture’s role as a comprehensive provider in the digital farming software market

- In June 2022, U.S.-based agri-tech firm Cropin launched Cropin Cloud, the first purpose-built industry cloud for agriculture, setting a benchmark for AI-driven agricultural intelligence. The platform enables large-scale data processing, predictive insights, and secure collaboration for agribusinesses and governments. This launch enhanced operational efficiency across farming value chains and strengthened Cropin’s positioning as a technology leader in digital farming software

- In September 2020, Raven Industries, Inc. introduced Raven Autonomy to optimize precision agriculture operations through its VSN connected technology ecosystem. The solution supports automated field operations, improving productivity and reducing labor dependency for farmers. This product launch expanded Raven’s technology portfolio and contributed to revenue growth through advanced autonomous farming solutions

- In January 2020, CropX Inc. announced the acquisition of CropMetrics, a cloud-based precision irrigation tools provider, to expand its digital agronomy offerings. The integration combined in-soil sensing data with farm management analytics and decision-support tools, enabling more accurate irrigation and resource optimization. This acquisition strengthened CropX’s market presence and enhanced its value proposition for data-driven farming

- In August 2023, John Deere launched its upgraded Operations Center with enhanced digital farming software features focused on real-time machine data integration and farm analytics. The platform supports seamless connectivity between equipment, agronomic data, and farm management workflows, improving operational transparency for farmers. This development strengthened John Deere’s digital ecosystem strategy and accelerated adoption of connected farming solutions across global markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Digital Farming Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Digital Farming Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Digital Farming Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.