North America Din Rail Power Supply Market

Market Size in USD Million

CAGR :

%

USD

299.80 Million

USD

391.74 Million

2024

2032

USD

299.80 Million

USD

391.74 Million

2024

2032

| 2025 –2032 | |

| USD 299.80 Million | |

| USD 391.74 Million | |

|

|

|

|

North America DIN Rail Power Supply Market Size

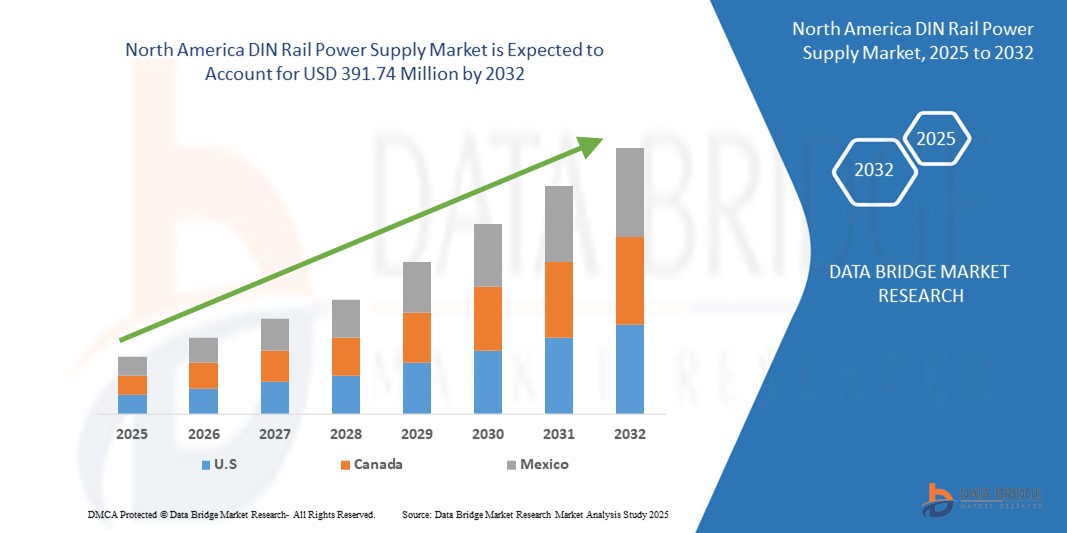

- The North America DIN rail power supply market size was valued at USD 299.80 million in 2024 and is expected to reach USD 391.74 million by 2032, at a CAGR of 3.40% during the forecast period

- The market growth is largely fuelled by the rising adoption of industrial automation and control systems, increasing demand for reliable and efficient power solutions across manufacturing sectors, and growing integration of advanced technologies in electrical infrastructure

- The rising focus on energy efficiency and compact power solutions further supports market expansion

North America DIN Rail Power Supply Market Analysis

- The market is experiencing steady growth driven by the growing use of DIN rail power supplies in automation, process control, and industrial applications due to their compact design, modularity, and ease of installation

- Manufacturers are increasingly focusing on innovation, such as the development of high-efficiency, smart power supplies with remote monitoring capabilities, to meet evolving customer requirements

- U.S. DIN rail power supply market held the largest market revenue share in 2024, fueled by a robust manufacturing sector and high industrial automation adoption. Demand for reliable, energy-efficient, and compact power distribution systems is rising across commercial, industrial, and enterprise applications

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America DIN rail power supply market due to increasing adoption of industrial automation and supportive government policies

- The electrical components segment held the largest market revenue share in 2024, driven by their essential role in ensuring consistent power delivery and operational reliability across automation and industrial systems. Electrical components remain the backbone of DIN rail installations, making them highly demanded in power-intensive environments

Report Scope and North America DIN Rail Power Supply Market Segmentation

|

Attributes |

North America DIN Rail Power Supply Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America DIN Rail Power Supply Market Trends

Shift Toward Energy-Efficient And Compact DIN Rail Power Supplies

- The growing adoption of energy-efficient DIN rail power supplies is transforming the market as industries prioritize reducing energy consumption and operational costs. Compact and modular designs are becoming increasingly popular, allowing manufacturers to optimize space in control panels while maintaining performance. This trend supports sustainability initiatives and reduces long-term expenses

- Rising demand from automation-driven industries, including manufacturing, utilities, and transportation, is accelerating the adoption of advanced power supplies with higher efficiency ratings. Their ability to reduce heat loss and improve overall system reliability is making them an essential component in modern industrial setups

- Affordability and ease of integration are also boosting the use of compact DIN rail power supplies in small and mid-sized enterprises. These solutions provide reliable voltage stabilization while minimizing installation complexity, which is particularly important for facilities with limited technical resources

- For instance, in 2023, several automation firms reported enhanced productivity after upgrading to high-efficiency, compact DIN rail power supplies that reduced energy waste and improved panel space utilization. The upgrades also aligned with regional green energy regulations

- While the adoption of compact and energy-efficient solutions is rising, their long-term impact depends on continuous innovation, cost-effectiveness, and compatibility with diverse industrial applications. Manufacturers must emphasize R&D and tailor products for region-specific energy standards to fully capitalize on this demand

North America DIN Rail Power Supply Market Dynamics

Driver

Rising Industrial Automation And Growing Demand For Reliable Power Systems

- The increasing penetration of automation in industries such as manufacturing, oil & gas, and transportation is driving the demand for reliable DIN rail power supplies. These devices ensure uninterrupted operation of critical control systems, enhancing productivity and reducing downtime

- Industries are becoming more aware of the risks associated with unstable power, including equipment damage, safety issues, and productivity losses. As a result, investment in durable and efficient power supplies is accelerating across both large and mid-scale enterprises

- Public and private investments in smart factories and digital infrastructure are further strengthening the role of DIN rail power supplies. From robotics to monitoring equipment, demand for stable and regulated power continues to grow

- For instance, in 2022, several governments introduced funding programs to support industrial automation projects, which significantly increased the adoption of DIN rail power supplies across the manufacturing sector

- While industrial automation and rising reliability needs are boosting growth, sustained adoption requires continuous product innovation, cost-efficiency, and seamless compatibility with evolving automation technologies

Restraint/Challenge

High Initial Costs And Limited Adoption In Small-Scale Applications

- The relatively high upfront cost of advanced DIN rail power supplies, especially high-efficiency and programmable models, poses a challenge for small and mid-sized enterprises. Many businesses still prefer low-cost alternatives despite reduced efficiency and shorter lifespans

- In underdeveloped or rural industrial areas, there is limited awareness and technical expertise to operate and maintain advanced DIN rail power systems. Lack of trained personnel and supporting infrastructure reduces adoption in such regions

- Supply chain disruptions and inconsistent availability of key components further restrict market penetration. Smaller industries often face delays in sourcing reliable products, which discourages widespread usage

- For instance, in 2023, several small manufacturers across region reported difficulties in adopting DIN rail power supplies due to high capital costs and long lead times, highlighting the market’s accessibility gap

- While technological advancements continue to improve product quality, addressing cost barriers and ensuring accessibility will be crucial. Market stakeholders must focus on modular, cost-effective solutions and localized distribution networks to unlock broader adoption

North America DIN Rail Power Supply Market Scope

The market is segmented on the basis of components, phase type, current type, power, shape type, application, weight range, and end use.

- By Components

On the basis of components, the North America DIN rail power supply market is segmented into electrical components, IT, distribution boxes, machines, and cabinets. The electrical components segment held the largest market revenue share in 2024, driven by their essential role in ensuring consistent power delivery and operational reliability across automation and industrial systems. Electrical components remain the backbone of DIN rail installations, making them highly demanded in power-intensive environments.

The IT segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing integration of digital control systems and data-driven infrastructure in industrial environments. The rising demand for reliable power in IT cabinets and server setups positions this segment as a rapidly growing contributor to the regional market.

- By Phase Type

On the basis of phase type, the North America DIN rail power supply market is segmented into single-phase, three-phase, and two-phase. The three-phase segment held the largest revenue share in 2024, fueled by its high efficiency and suitability for heavy industrial loads. Its ability to deliver stable and continuous power makes it the preferred choice for manufacturing and automation sectors.

The single-phase segment is expected to witness the fastest growth rate from 2025 to 2032, largely driven by its widespread application in residential setups, small businesses, and light industrial systems. The affordability and ease of installation of single-phase DIN rail power supplies support their growing adoption across North America.

- By Current Type

On the basis of current type, the North America DIN rail power supply market is segmented into AC and DC. The AC segment held the largest market revenue share in 2024 due to its dominance in powering industrial equipment, factory automation systems, and grid-connected infrastructures. Its compatibility with traditional energy systems ensures strong and sustained demand.

The DC segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rise of renewable energy systems, electric vehicles, and battery-powered applications. The growing shift toward decentralized power and digital infrastructure strengthens the demand for DC-based DIN rail solutions.

- By Power

On the basis of power, the North America DIN rail power supply market is segmented into less than 900 Watt and more than 900 Watt. The less than 900 Watt segment held the largest market revenue share in 2024, as compact and low-power DIN rail supplies are widely used in control panels, automation processes, and smaller-scale industrial environments. Their affordability and versatility drive high adoption.

The more than 900 Watt segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by rising demand from energy-intensive industries such as oil & gas, chemical, and power generation. The need for high-capacity, durable, and efficient solutions supports the growth of this segment across North America.

- By Shape Type

On the basis of shape type, the North America DIN rail power supply market is segmented into hat-shaped and U-shaped. The hat-shaped segment accounted for the largest revenue share in 2024, driven by its widespread use in industrial cabinets and ease of integration with existing setups. Hat-shaped DIN rails are considered the industry standard, ensuring consistency across applications.

The U-shaped segment is expected to witness the fastest growth rate from 2025 to 2032, favored for its lightweight design and suitability in specialized enclosures. Its rising popularity in compact automation systems supports its growth trajectory in niche applications.

- By Application

On the basis of application, the North America DIN rail power supply market is segmented into automation, industrial control, and process control. The industrial control segment held the largest revenue share in 2024 due to extensive use in regulating power supply across production and assembly lines. Industrial control solutions ensure operational efficiency, making them indispensable in the North America industrial landscape.

The automation segment is expected to witness the fastest growth rate from 2025 to 2032, boosted by the increasing adoption of smart factories and Industry 4.0 practices. Rising investment in robotics, IoT-enabled systems, and digitalized manufacturing processes is fueling this segment’s rapid expansion.

- By Weight Range

On the basis of weight range, the North America DIN rail power supply market is segmented into more than 15 GMS and less than 15 GMS. The more than 15 GMS segment accounted for the largest revenue share in 2024, owing to their robustness and higher durability in demanding industrial conditions. Heavier units are preferred in high-load applications requiring long service life.

The less than 15 GMS segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the demand for lightweight, space-saving solutions in compact control systems. Their portability and efficiency make them increasingly popular in modern automation setups.

- By End Use

On the basis of end use, the North America DIN rail power supply market is segmented into chemical, power & energy, oil & gas, medical, and enterprise. The power & energy segment held the largest market revenue share in 2024, driven by the sector’s reliance on stable and continuous energy management systems. DIN rail power supplies play a key role in supporting critical power infrastructure across the region.

The medical segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for reliable power solutions in diagnostic equipment, patient monitoring systems, and laboratory automation. Increasing healthcare digitization in North America further strengthens this segment’s growth.

North America DIN Rail Power Supply Market Regional Analysis

- U.S. DIN rail power supply market held the largest market revenue share in 2024, fueled by a robust manufacturing sector and high industrial automation adoption. Demand for reliable, energy-efficient, and compact power distribution systems is rising across commercial, industrial, and enterprise applications

- Advanced industrial infrastructure and ongoing digital transformation are key growth drivers. Rising government support for energy-efficient industrial practices is further boosting market demand.

- Automation in process control, smart factories, and modernization of legacy facilities are creating opportunities for high-performance DIN rail power solutions. The presence of leading manufacturers and technological innovations continues to strengthen market dominance

Canada DIN Rail Power Supply Market

The Canada DIN rail power supply market is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding industrial projects and increasing adoption of renewable energy solutions. Rising modernization of manufacturing facilities and small-scale industrial setups is fueling market demand. Automation adoption, smart energy management, and integration of efficient power distribution systems are key growth factors. Government incentives and funding for industrial energy efficiency projects are supporting market expansion. Growing awareness of cost savings and operational efficiency through advanced DIN rail power systems is contributing to market growth. Increased investment in digitalized manufacturing infrastructure further strengthens demand for reliable and compact power solutions.

North America DIN Rail Power Supply Market Share

The North America DIN rail power supply industry is primarily led by well-established companies, including:

- Acopian Technical Company (U.S.)

- TRC Electronics, Inc. (U.S.)

- NOARK Electric North America (U.S.)

- Advanced Energy Industries, Inc. (U.S.)

- Powerbox (U.S.)

- Power-One, Inc. (U.S.)

- SolaHD (U.S.)

- Astrodyne TDI (U.S.)

- Bel Power Solutions (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.