North America Dish Antennas Market

Market Size in USD Billion

CAGR :

%

USD

2.13 Billion

USD

3.70 Billion

2024

2032

USD

2.13 Billion

USD

3.70 Billion

2024

2032

| 2025 –2032 | |

| USD 2.13 Billion | |

| USD 3.70 Billion | |

|

|

|

|

Dish Antennas Market Size

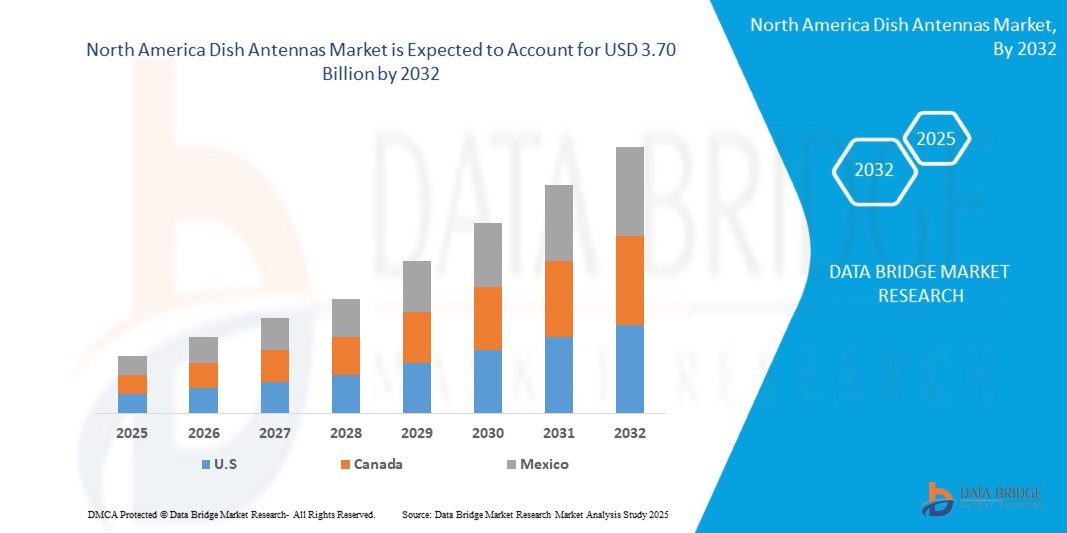

- The North America Dish Antennas Market size was valued at USD 2.13 billion in 2024 and is expected to reach USD 3.70 billion by 2032, at a CAGR of 7.14% during the forecast period

- This growth is primarily driven by the increasing penetration of high-speed internet and the proliferation of connected home ecosystems across the United States and Canada. The rise in over-the-air (OTA) content consumption and cord-cutting trends is leading to a renewed interest in advanced dish antennas capable of supporting HD and 4K transmissions. As consumers seek cost-effective alternatives to cable and satellite subscriptions, dish antennas are witnessing a significant resurgence in demand.

- Moreover, the growing integration of dish antennas with smart home technologies and IoT-based media systems is fostering their adoption in both residential and commercial sectors. Consumers are increasingly demanding compact, easy-to-install, and multifunctional antennas that not only receive signals but also integrate with smart TVs, home automation platforms, and voice assistants for enhanced user experience and control.

- Additionally, the expansion of 5G infrastructure and increased investments in broadcasting technology upgrades across North America are further reinforcing the role of modern dish antennas in supporting seamless communication and content delivery. The market is also benefiting from government initiatives focused on rural broadband access, which are enabling broader deployment of satellite-based and hybrid antenna solutions in underserved areas.

Dish Antennas Market Analysis

- Dish Antennas, which enable high-definition signal reception and integration with digital home entertainment and communication systems, are becoming increasingly essential in both residential and commercial environments across North America. Their ability to support over-the-air (OTA) broadcasts, satellite communications, and smart system connectivity positions them as key components in the evolution of connected homes and intelligent infrastructure.

- The rapid adoption of smart home technologies, such as voice-controlled systems, integrated home networks, and streaming services, is significantly driving the demand for advanced Dish Antennas in the region. Consumers are seeking versatile, cost-effective, and easy-to-install antenna solutions that enhance content accessibility while aligning with modern design and performance expectations.

- Furthermore, the market is witnessing robust growth due to increasing concerns over media access affordability, the trend of cord-cutting from traditional cable networks, and the desire for uninterrupted signal reception in both urban and rural areas. These preferences are propelling the transition towards next-generation digital antennas that support 4K, 5G, and hybrid broadcasting technologies.

- U.S. leads the North America Dish Antennas Market, accounting for the largest revenue share of 73.01% in 2024, which represents the most mature and dynamic market in the region. The U.S. dominance is attributed to early and widespread adoption of smart home technologies, high consumer spending capacity, and the presence of major technology innovators and satellite communication providers.

- Reflector Antennas held the largest market share at 63.65% in 2024, primarily due to their wide usage in broadcasting, satellite communication, and defense applications.

Report Scope and Dish Antennas Market Segmentation

|

Attributes |

Dish Antennas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dish Antennas Market Trends

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- With increasing crime rates and heightened security awareness across North America, especially in urban centers of the U.S. and Canada, homeowners and businesses are proactively investing in enhanced security solutions.

- Dish antennas are becoming a central component in smart security systems, enabling real-time signal reception and transmission for cameras, access control, and alarm systems.

- According to 2024 data, more than 65% of newly constructed homes in the U.S. are integrated with smart home systems, many of which require dish antennas for satellite TV, broadband, and integrated automation.

- For instance, In April 2024, Onity, Inc. (Honeywell International Inc.) upgraded its Passport IoT locking solution with advanced sensors and remote communication capabilities, all of which rely on satellite-linked data transfer—a key function supported by dish antennas.

- The shift toward DIY smart home setups and interoperable ecosystems (Amazon Alexa, Google Home) further enhances demand for easy-to-install, compact dish antennas.

Dish Antennas Market Dynamics

Driver

“High Demand from Broadcasting and Satellite Communication Applications”

- North America remains a global hub for broadcasting, satellite TV, and streaming services, with companies like DIRECTV, Dish Network, and SiriusXM relying heavily on satellite-based communication, which depends on dish antennas.

- For instance, In 2024, more than 78% of U.S. households had access to satellite-based media services. The growing demand for high-definition content (4K, 8K) requires C-band and Ku-band dish antennas with greater bandwidth and precision.

- Dish antennas are also widely used in remote and rural broadband deployments via companies like Starlink, especially in underserved regions of northern Canada and interior U.S.

- The increasing need for reliable, weather-resilient connectivity in broadcasting has made C-band antennas a preferred choice due to their performance in adverse conditions.

Restraint/Challenge

“High Cost of Installation and Maintenance for Advanced Systems”

- Despite their growing utility, the cost associated with high-precision dish antennas remains a significant barrier, particularly for small enterprises and budget-conscious homeowners.

- Advanced dish antennas, especially those designed for multi-frequency operations or high-altitude use, require professional installation, precise alignment, and periodic calibration, raising the total cost of ownership.

- In addition, the infrastructure required for large ground stations—including concrete pads, rotator mounts, and signal boosters—adds to capital expenditure.

- For instance, a commercial-grade Ka-band dish antenna installation can cost between USD 25,000–100,000, depending on size and features. This restricts adoption in price-sensitive sectors like education, non-profit media, or rural small businesses.

Dish Antennas Market Scope

The North America Dish Antennas Market is segmented on the basis of antenna type, wireless network, component, frequency, antenna size, application, and end use.

- By Antenna Type

The market is segmented into reflector antennas, aperture antennas, and wire antennas. Reflector Antennas held the largest market share at 63.65% in 2024, primarily due to their wide usage in broadcasting, satellite communication, and defense applications. Their high directional gain and ability to focus signals efficiently make them the preferred choice for both terrestrial and space-based communications.

Aperture Antennas accounted for 22.13% of the market, favored for high-frequency and radar applications. Their compact size and efficient beamforming capabilities are ideal for airborne and shipborne systems, especially in defense and marine applications..

- By Wireless Network

The market is segmented into licensed and unlicensed networks. Licensed Wireless Networks dominated the segment with 68.27% market share in 2024, driven by extensive adoption across defense, aerospace, and broadcasting sectors. These networks offer interference-free communication, crucial for mission-critical operations and regulated spectrum usage.

Unlicensed Wireless Networks held 31.63%, supported by rising adoption in consumer applications like home satellite TV and local broadcasting. Their cost-efficiency and ease of deployment have led to increased usage in non-critical communication environments.

- By Component

The market is segmented into reflectors, feed horn, feed network, LNB converter, multiplexers, encoders, and others. Reflectors accounted for 42.58% of the component segment in 2024, driven by their pivotal role in shaping and directing signals in satellite TV dishes and deep-space antennas. Their dominance stems from widespread residential usage and institutional deployments (NASA, DoD).

Low Noise Block (LNB) Converters held 21.84%, essential for down-converting high-frequency satellite signals to lower frequencies for receiver compatibility. Their efficiency in improving signal clarity makes them integral to modern satellite communication.

- By Frequency

The market is segmented into X band, C band, L and S band, VHF/UHF band, K/Ka/Ku band, and others. C Band led the frequency segment with 35.89% share in 2024, owing to its superior performance in adverse weather and increasing demand for satellite TV and data services, especially across the U.S. and Canada.

K/Ka/Ku Band followed with 29.33%, driven by rising deployment in high-throughput satellite communications, offering higher data rates suitable for broadband, enterprise, and mobility applications.

- By Antenna Size

The market is segmented into small-sized dish, medium-sized dish, and large-sized dish. Large-Sized Dishes captured the largest share of 44.76% in 2024, particularly for space and ground station communications. Their capability to support long-range, high-capacity links is vital for space exploration, military, and scientific missions.

Medium-Sized Dishes held 34.02%, commonly used in commercial broadcasting and mobile communication hubs. Their balanced size-performance ratio supports scalable deployments in both urban and remote locations.

- By Application

The market is segmented into marine, land, space, and airborne. Land Applications dominated with 53.27% market share in 2024, primarily due to increasing deployment for television broadcasting, broadband, and navigation across urban and rural areas in North America.

Space Applications held 23.65%, fueled by growing investments in satellite launches and Earth observation missions. Agencies like NASA and private space firms are key contributors to this segment.

- By End Use

The market is segmented into aerospace and defense, media and entertainment, and industrial. Media and Entertainment remained the largest segment at 47.22% in 2024, driven by continued demand for satellite television, live broadcasts, and streaming services. Consumer preference for high-definition and uninterrupted content is bolstering this segment.

Aerospace and Defense accounted for 36.26%, driven by increasing investment in radar surveillance, secure communication systems, and military-grade satellite tracking across the U.S. and Canada.

Dish Antennas Market Regional Analysis

- The United States leads the North America Dish Antennas Market, accounting for the majority of the region's 74.21% revenue share in 2024, driven by its advanced technological infrastructure and high demand for satellite-based communication systems in residential, defense, aerospace, and media sectors.

- Home automation and security applications are at the forefront of dish antenna adoption in the U.S., where tech-savvy consumers increasingly prefer smart home solutions that include satellite TV, broadband, and integrated control over lighting, surveillance, and appliances. Dish antennas play a critical role in enabling high-quality reception and communication for these services.

- The country’s strong ecosystem of smart home technology providers (such as Google Nest, Amazon Alexa, and Ring) accelerates demand for dish antennas that seamlessly integrate with other smart devices, creating unified and efficient living environments.

- The U.S. government and defense agencies, including the Department of Defense and NASA, are major buyers of high-performance, large-dish antennas used in aerospace missions, satellite communication, and radar tracking, significantly boosting industrial demand.

- High disposable incomes, infrastructure investments, and broadband penetration (over 90% household access in 2024) support widespread dish antenna deployment in both urban and remote areas. Additionally, rural broadband programs and satellite internet expansions by providers like SpaceX’s Starlink have amplified demand for reliable and weather-resistant dish antennas across underserved regions.

- In commercial sectors, especially broadcasting and telecommunications, dish antennas remain crucial for media transmission, live coverage, and satellite uplink/downlink activities, with key players like Dish Network and DIRECTV continuing to drive large-scale deployments.

Dish Antennas Market Share

The Dish Antennas industry is primarily led by well-established companies, including:

- MTI Wireless Edge Ltd.(Israel)

- Helander(United States)

- Airbus S.A.S.(France)

- Honeywell International Inc.(United States)

- Mitsubishi Electric Corporation (Japan)

- Global Invacom (Singapore)

- Infinite Electronics International, Inc.(United States)

- C-COM Satellite Systems Inc.(Canada)

- Radio Frequency Systems(Germany)

- Eyecom Telecommunications Group(United States)

- Cobham Limited(United Kingdom)

- L3Harris Technologies, Inc.(United States)

- CPI International(United States)

- Eravant (United States)

- mWAVE Industries LLC (A Subsidiary of Alaris Holdings)(United States)

- Ventev (United States)

- Challenger Communications(United States)

Latest Developments in North America Dish Antennas Market

- In April 2024, C-COM Satellite Systems Inc., a leading Canadian provider of mobile auto-deploying satellite antenna systems, announced the successful testing of its next-generation electronically steerable flat panel antenna in partnership with the University of Waterloo. This breakthrough technology aims to deliver high-speed satellite internet access in remote and mobile environments, significantly expanding market opportunities in sectors like emergency response, defense, and rural broadband across North America. The development highlights C-COM’s role in driving innovation in the evolving mobile satellite communications landscape.

- In March 2024, L3Harris Technologies, Inc., a major U.S.-based defense contractor, secured a multi-million-dollar contract with the U.S. Space Force for the supply of high-gain dish antennas used in deep space tracking and surveillance. This contract emphasizes the growing demand for advanced satellite communication technologies in the defense sector, reinforcing L3Harris’s leadership in high-performance antennas tailored for strategic military operations across North America.

- In February 2024, Global Invacom Group, a global provider of satellite communications equipment, expanded its U.S. operations with a new manufacturing facility in Texas. The facility is aimed at scaling up production of parabolic and flat panel antennas to meet increasing regional demand from telecom and media companies, especially in response to rising consumption of satellite-based video streaming and broadcasting services.

- In January 2024, Eravant, a California-based manufacturer of millimeter-wave components and subsystems, launched a new line of compact, high-frequency dish antennas for use in 5G and aerospace applications. These antennas are designed to support next-gen communication infrastructures, meeting the demands of data-intensive networks while enabling satellite uplinks with minimal interference—key for urban and airborne deployments.

- In December 2023, Challenger Communications, a U.S. supplier of satellite antennas and ground station solutions, announced the delivery of a large aperture satellite dish system to a government contractor for use in national defense telemetry and tracking systems. This development reflects increasing government investments in secure and reliable satellite ground systems, reinforcing Challenger’s presence in the high-specification defense and aerospace segments of the North America dish antennas market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Dish Antennas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Dish Antennas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Dish Antennas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.