North America Disinfectant Wipes Market

Market Size in USD Billion

CAGR :

%

USD

3.92 Billion

USD

6.02 Billion

2024

2032

USD

3.92 Billion

USD

6.02 Billion

2024

2032

| 2025 –2032 | |

| USD 3.92 Billion | |

| USD 6.02 Billion | |

|

|

|

|

Disinfectant Wipes Market Size

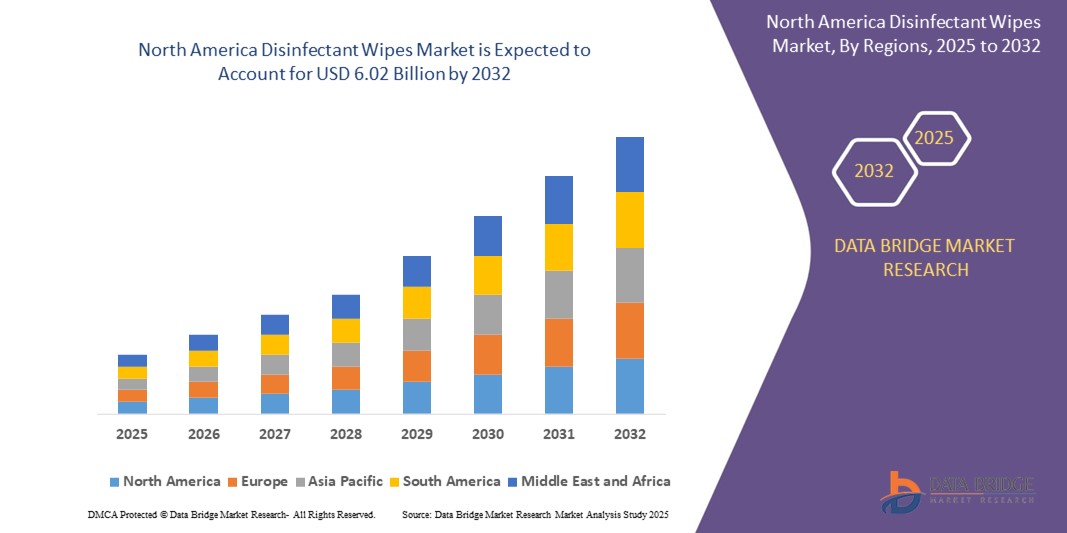

- The North America disinfectant wipes market size was valued at USD 3.92 billion in 2024 and is expected to reach USD 6.02 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by heightened hygiene awareness post-COVID-19 and the increasing adoption of disinfectant wipes across healthcare, commercial, and residential settings as a convenient and effective solution for surface-level infection control

- Furthermore, rising consumer demand for ready-to-use, portable, and skin-safe disinfection products is establishing disinfectant wipes as a preferred alternative to liquid sanitizers and sprays. These converging factors are accelerating the use of disinfectant wipes in high-touch environments, thereby significantly boosting the industry's growth

Disinfectant Wipes Market Analysis

- Disinfectant wipes are pre-saturated towelettes infused with antimicrobial agents designed to eliminate bacteria, viruses, and fungi from hard and soft surfaces. They offer fast, residue-free cleaning and are widely used in healthcare facilities, households, schools, offices, and public transportation

- The escalating demand for disinfectant wipes is primarily driven by increasing infection prevention protocols, growing consumer inclination toward hygienic and convenient cleaning methods, and the expansion of eco-friendly and biodegradable product options across the market

- U.S. dominated disinfectant wipes market with a share of 30.58% in 2024, due to strong demand across healthcare, residential, and commercial cleaning applications. The widespread adoption of disinfectant wipes in hospitals, offices, schools, and households, along with heightened hygiene awareness post-pandemic, has firmly established the U.S. as the regional leader

- Canada is expected to be the fastest growing region in the disinfectant wipes market during the forecast period due to rising demand in healthcare, childcare, and public facilities

- Alcohol segment dominated the market with a market share of 42.5% in 2024, due to its quick action, ease of evaporation, and effectiveness against a wide array of pathogens. Alcohol-based wipes are widely preferred in medical, consumer, and office settings due to their convenience, non-residual properties, and compliance with infection control practices in high-touch environments

Report Scope and Disinfectant Wipes Market Segmentation

|

Attributes |

Disinfectant Wipes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Disinfectant Wipes Market Trends

“Increasing Hygiene Awareness”

- A significant and accelerating trend in the disinfectant wipes market is the heightened awareness of hygiene and infection prevention among both consumers and businesses, especially following the COVID-19 pandemic

- For instance, the demand for disinfectant wipes has surged in healthcare, commercial, and residential settings, with hospitals, clinics, offices, and households relying on these products for quick and effective surface cleaning to minimize the risk of infections and cross-contamination

- The introduction of eco-friendly and biodegradable disinfectant wipes is gaining traction, as consumers and organizations seek sustainable alternatives that reduce environmental impact without compromising efficacy

- Major cities and densely populated regions are witnessing increased adoption of disinfectant wipes, driven by public health campaigns and the need to maintain cleanliness in high-traffic areas such as public transport, schools, and retail spaces

- The market is also seeing innovation in product formulations, packaging, and distribution channels, with manufacturers focusing on convenience, portability, and compliance with evolving regulatory standards to meet diverse end-user needs

- Companies are investing in marketing and education initiatives to reinforce the importance of regular disinfection, further supporting the continued growth and mainstream acceptance of disinfectant wipes across various sectors

Disinfectant Wipes Market Dynamics

Driver

“Increasing Use of Disinfectant Wipes for Commercial Applications”

- The expanding use of disinfectant wipes in commercial applications is a major driver for market growth, as businesses prioritize hygiene to protect employees, customers, and operational continuity

- For instance, industries such as healthcare, hospitality, food service, and transportation are adopting disinfectant wipes for routine cleaning of high-touch surfaces, equipment, and communal areas to comply with strict health and safety regulations

- The rise in hospital-acquired infections and the need for stringent infection control measures in medical facilities have led to widespread use of disinfectant wipes in surgical units, patient rooms, and public waiting areas

- Retailers, gyms, and office buildings are increasingly providing disinfectant wipes for customer and staff use, reinforcing public confidence in shared spaces and supporting business recovery post-pandemic

- The convenience, speed, and proven efficacy of disinfectant wipes make them indispensable tools for commercial cleaning protocols, driving sustained demand across multiple industries

- As the commercial sector continues to grow and evolve, the integration of disinfectant wipes into standard operating procedures is expected to remain a key market driver

Restraint/Challenge

“Side Effects of Using Disinfectant Wipes”

- The potential side effects associated with frequent use of disinfectant wipes present a significant challenge for the market, as concerns about skin irritation, allergic reactions, and respiratory issues may deter some users

- For instance, the chemical agents in certain disinfectant wipes, such as quaternary ammonium compounds and alcohols, can cause dryness, dermatitis, or sensitization with repeated exposure, particularly among healthcare workers and cleaning staff who use these products extensively

- Improper use or overuse of disinfectant wipes can also lead to the buildup of chemical residues on surfaces, which may pose health risks, especially in sensitive environments such as childcare centers or food preparation areas

- Growing consumer awareness of these risks, along with regulatory scrutiny of chemical ingredients, is prompting manufacturers to develop safer, skin-friendly, and hypoallergenic formulations to address user concerns

- The challenge of balancing effective disinfection with user safety and comfort is driving ongoing research and product innovation in the market, as companies seek to maintain efficacy while minimizing adverse effects

Disinfectant Wipes Market Scope

The market is segmented on the basis of product type, usability, packaging, material type, levels of disinfection, flavor, type, end-use, and distribution channel.

- By Product Type

On the basis of product type, the disinfectant wipes market is segmented into chlorine compounds, quaternary ammonium, oxidizing agents, phenol, alcohol, iodine compounds, aldehydes, chlorhexidine gluconate, and others. The alcohol segment accounted for the largest revenue share of 42.5% in 2024, owing to its quick action, ease of evaporation, and effectiveness against a wide array of pathogens. Alcohol-based wipes are widely preferred in medical, consumer, and office settings due to their convenience, non-residual properties, and compliance with infection control practices in high-touch environments.

The quaternary ammonium segment is projected to register the fastest growth rate from 2025 to 2032, driven by its broad-spectrum antimicrobial activity, compatibility with a wide range of surfaces, and minimal odor. This compound is extensively used in hospital-grade disinfectants, where efficacy and surface safety are key. In addition, increasing adoption in residential and commercial cleaning products is supporting segment dominance.

- By Usability

On the basis of usability, the market is bifurcated into disposable and non-disposable disinfectant wipes. The disposable segment led the market in 2024, driven by its hygienic single-use nature, which minimizes cross-contamination and aligns with infection control standards. Growing use in healthcare facilities and public spaces is also accelerating demand for disposable variants.

The non-disposable segment is anticipated to witness the fastest CAGR during the forecast period, propelled by rising environmental concerns and the increasing development of reusable disinfectant wipe products. These are particularly gaining momentum among eco-conscious consumers and businesses seeking sustainable sanitation solutions.

- By Packaging

On the basis of packaging, the market is segmented into flatpack, canister, and others. The canister segment dominated the market in 2024 due to its convenience, durability, and suitability for use in healthcare, fitness centers, and office environments. Canisters offer longer shelf life and allow easy dispensing, making them the preferred format for bulk use.

The flatpack segment is expected to grow at the fastest pace through 2032, as its compact and portable design appeals to on-the-go consumers. This packaging type is especially popular in personal care and travel-use cases where ease of carrying and disposal is prioritized.

- By Material Type

On the basis of material type, the market is segmented into textile fiber wipes, virgin fiber wipes, advanced fiber wipes, and others. The virgin fiber wipes segment captured the largest share in 2024 due to their high absorbency, strength, and purity, which are critical for consistent disinfection efficacy. These wipes are frequently used in critical healthcare settings where quality assurance is paramount.

Advanced fiber wipes are projected to exhibit the highest CAGR from 2025 to 2032, driven by innovations in multilayered and nanotechnology-infused materials that improve microbial kill rates, durability, and compatibility with various disinfectant formulations. These are increasingly adopted in high-risk environments such as ICUs and pharmaceutical labs.

- By Levels of Disinfection

On the basis of levels of disinfection, the market is categorized into high, intermediate, and low. The high-level disinfection segment held the largest revenue share in 2024, driven by increased demand in critical care environments such as operating rooms, isolation wards, and laboratories. These wipes are essential for eliminating resilient pathogens, including spores and viruses, ensuring stringent infection control.

The intermediate-level disinfection segment is expected to grow at the fastest rate from 2025 to 2032 due to its versatility and cost-efficiency across healthcare, commercial, and educational facilities. These wipes strike a balance between efficacy and surface compatibility, making them suitable for routine cleaning of high-touch areas.

- By Flavor

On the basis of flavor, the market is segmented into lavender & jasmine, lemon, citrus, coconut, and others. The lemon segment led the market in 2024, favored for its fresh scent and strong consumer association with cleanliness. Lemon-flavored wipes are widely used in residential and commercial spaces due to their broad appeal and ability to neutralize odors.

Lavender & jasmine is anticipated to witness the fastest growth over the forecast period, propelled by rising consumer preference for soothing, aromatherapeutic fragrances. This trend is especially prominent in lifestyle-oriented segments such as gyms, salons, and personal care, where sensory experience adds value to hygiene products.

- By Type

On the basis of type, the disinfectant wipes market is segmented into bactericidal, virucidal, sporicidal, tuberculocidal, fungicidal, and germicidal. The bactericidal segment dominated the market share in 2024 due to its universal application in day-to-day cleaning routines and surface disinfection. Bactericidal wipes are essential for controlling common healthcare-associated infections (HAIs) and are widely accepted in both residential and institutional settings.

The virucidal segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by increased awareness following global viral outbreaks and the emphasis on antiviral surface disinfection protocols. Demand for virucidal wipes is also growing in transport and public facilities, where infection risks are high and rapid action is necessary.

- By End-Use

On the basis of end-use, the market is segmented into healthcare, commercial, industrial kitchen, transportation industry, optical industry, electronic & computer industry, and others. The healthcare segment held the dominant revenue share in 2024, driven by strict infection control regulations and consistent demand across hospitals, clinics, and diagnostic centers. These environments require frequent, effective surface disinfection to maintain hygiene and prevent cross-contamination.

The transportation industry is expected to register the highest growth rate during the forecast period, with rising investments in hygiene maintenance across airlines, railways, and public transit systems. Post-pandemic consumer expectations for cleanliness and safety continue to drive the adoption of disinfectant wipes for high-contact surfaces in travel environments.

- By Distribution Channel

On the basis of distribution channel, the market is divided into direct tenders and retail sales. The direct tenders segment captured the largest market share in 2024, supported by bulk procurement from hospitals, government bodies, and corporate buyers seeking standardized infection prevention supplies. These contracts ensure stable supply chains and are often backed by long-term vendor relationships.

The retail sales segment is forecasted to grow at the fastest CAGR from 2025 to 2032, driven by increasing consumer awareness and demand for at-home sanitation products. The availability of disinfectant wipes through supermarkets, pharmacies, e-commerce platforms, and convenience stores makes them highly accessible to end users.

Disinfectant Wipes Market Regional Analysis

- U.S. dominated the disinfectant wipes market with the largest revenue share of 30.58% in 2024, driven by strong demand across healthcare, residential, and commercial cleaning applications. The widespread adoption of disinfectant wipes in hospitals, offices, schools, and households, along with heightened hygiene awareness post-pandemic, has firmly established the U.S. as the regional leader

- Increasing preference for convenient, ready-to-use sanitation products, especially in high-touch environments, is fueling continued market expansion. Regulatory emphasis on infection control and the presence of established brands offering advanced antimicrobial formulations further boost product penetration

- The strong presence of key manufacturers, well-developed retail distribution channels, and ongoing innovations in biodegradable and skin-safe wipe formulations reinforce the U.S. as the dominant market for disinfectant wipes in North America

Canada Disinfectant Wipes Market Insight

Canada is projected to record the fastest CAGR in the North America disinfectant wipes market from 2025 to 2032, driven by rising demand in healthcare, childcare, and public facilities. Increasing awareness around personal hygiene, infection prevention, and eco-friendly product use is driving market growth. Supportive government regulations and the shift toward locally produced, sustainable disinfection solutions are further propelling the Canadian market forward

Mexico Disinfectant Wipes Market Insight

The Mexico disinfectant wipes market is expected to experience steady growth between 2025 and 2032, supported by expanding healthcare infrastructure, rising consumer awareness, and increasing use of disinfectant wipes in industrial and hospitality sectors. Growth is also bolstered by the expansion of domestic manufacturing capabilities and Mexico’s strategic role in regional exports and cross-border supply chains

Disinfectant Wipes Market Share

The disinfectant wipes industry is primarily led by well-established companies, including:

- GOJO Industries, Inc. (U.S.)

- PDI, Inc. (U.S.)

- Ecolab (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

- KCWW (Kimberly-Clark Worldwide, Inc.) (U.S.)

- Parker Laboratories, Inc. (U.S.)

- Dreumex (Netherlands)

- Seventh Generation Inc. (U.S.)

- STERIS plc (Ireland)

- S.C. Johnson & Son Inc. (U.S.)

- The Claire Manufacturing Company (U.S.)

- Schülke & Mayr GmbH (Germany)

Latest Developments in North America Disinfectant Wipes Market

- In March 2024, Ecolab, a company known for its sustainability efforts and products for water, hygiene, and infection prevention, has been recognized as one of the World’s Most Ethical Companies by Ethisphere, a respected organization setting ethical business standards. This marks Ecolab's 18th consecutive year receiving the award since it was first introduced in 2007. This will strengthen the company’s credibility in the market

- In February 2022, Reckitt Benckiser Group plc, known for brands such as Lysol and Dettol, and Diversey Holdings, Ltd., a leading company in hygiene and cleaning solutions, have teamed up for a distribution collaboration. This collaboration aims to make reliable hygiene solutions more widely available to businesses, ensuring the safety of staff, clients, and customers by preventing the spread of illness-causing germs

- In June 2020, Reckitt Benckiser Group plc. Announced that its brand Lysol started the Healthy Schools Program in order to reach classroom students in the U.S. mostly affected areas due to COVID-19 in order to prevent the additional spread of the pandemic. This initiative by the company has increased its credibility in the market

- In November 2020, SC Johnson announced that it has been recognized as the ISSA 2020 Hygieia Network Member of the Year for the resources and efforts provided by the company to foster women’s career in cleaning industry. This recognition received by the company has increased its credibility in the market

- In May 2022, GOJO Industries, Inc., known for its PURELL products, has introduced PURELL Healthcare Surface Disinfecting Wipes, expanding its range of surface hygiene solutions. These wipes offer strong effectiveness in killing germs and provide reassurance to users, combining powerful performance with peace of mind. This has enhanced the product portfolio and added up in the total revenue of the company

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.