North America Distributed Antenna System Das Market

Market Size in USD Billion

CAGR :

%

| 2023 –2030 | |

|

|

|

|

|

|

Supply Chain Ecosystem Analysis now part of DBMR Reports

Market Size in USD Billion

| 2023 –2030 | |

|

|

|

|

|

|

North America Distributed Antenna System (DAS) Market, By Offering (Components, Services), Coverage (Indoor, Outdoor), Ownership (Carrier, Neutral-Host, Enterprise), Technology (Carrier Wi-Fi, Small Cells), User Facility (>500K FT2, 200K-500K FT2, <200K FT2), Vertical (Commercial, Public Safety) – Industry Trends and Forecast to 2030.

The growth in communication technology that has led to lesser power-consuming network devices, advancement of high-speed connectivity and more substantial connectivity coverage have enhanced the market for DAS systems. Furthermore, AT&T invested around USD 85 million to increase wireless coverage and capacity In January 2020. This has offered better coverage and major growth for the entire Miami area. It has aided the company to offer a better customer experience which has augmented its retention rate.

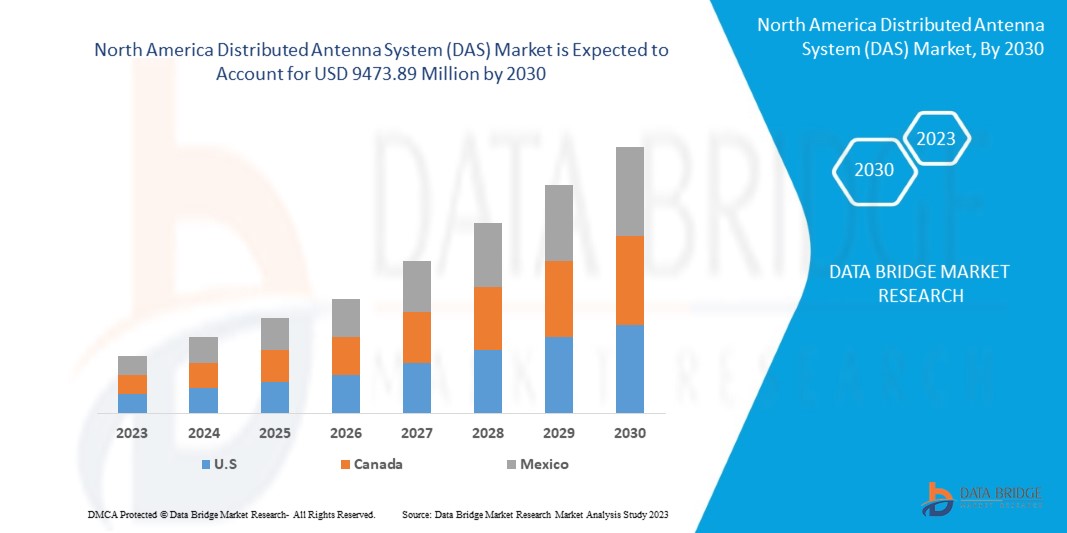

Data Bridge Market Research analyses that the distributed antenna system (DAS) market was valued at USD 3745.33 million in 2022 and is expected to reach the value of USD 9473.89 million by 2030, at a CAGR of 12.30% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Offering (Components, Services), Coverage (Indoor, Outdoor), Ownership (Carrier, Neutral-Host, Enterprise), Technology (Carrier Wi-Fi, Small Cells), User Facility (>500K FT2, 200K-500K FT2, <200K FT2), Vertical (Commercial, Public Safety)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America

|

|

Market Players Covered

|

Corning Incorporated (U.S.), CommScope, Inc. (U.S.), Comba Telecom Systems Holdings Ltd. (China), Hughes Network Systems, LLC (U.S.), Symphony Technology Solutions, Inc. (U.S.), BTI wireless (U.S.), Betacom (U.S.), Zinwave (U.K.), ATC IP LLC (U.S.), HUBER+SUHNER (Switzerland), CenRF Communications Limited (China), Decypher (U.S.), Fixtel Services Australia (Australia), RFI Technology Solutions (Australia), SKYCOMMS AUS (Australia), Cobham Wireless (U.K.), Advanced RF Technologies, Inc. (U.S.), AT&T (U..S), Boingo Wireless, Inc. (U.S.), Anixter Inc. (U.S.), Westell Technologies, Inc. (U.S.), Dali Wireless (U.S.), JMA Wireless (U.S.), and GALTRONICS (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Distributed antenna system (DAS) is a collection of antennas that are physically separated and dispersed over a specific geographic area. With the aid of an antenna, the digital signal is converted into RF and back into digital to deliver the cellular signal. In places such as sports stadiums, music halls and auditoriums that rarely utilize devices with wireless network services, a distributed antenna system (DAS) is installed to provide additional network capacity and coverage. Either indoors or outdoors are used to deploy a distributed antenna system (DAS) network. The system includes number of hardware elements, including radio units, head-end units, and antenna, that provide excellent efficiency.

Drivers

Growing demand for cellphones and the swiftly rising subscribers of cellular networks are major factors expected to drive the market's growth. Significant advancements in cellphones have encouraged network service providers to deliver seamless coverage. This has become difficult, particularly with existing macrocell base stations. A per the survey from Cisco, the demand for the cellphone connections and devices are anticipated to rise to 13.1 billion in 2023 from USD 8.8 billion in 2018 globally.

Growing smartphone consumption, digitalization, and the techno-savvy population are surging the growth of the marketare surging the market by creating demand for the advanced network connectivity solution. Increasing usage of mobile data on the devices is driving the market growth because it provides the advanced service network businesses. Providers are progressively adopting distributed antennas systems (DAS), which is boosting the service adoption and penetration of the market. For instance, As per the Cisco mobile data traffic survey, the world will account for a compound annual growth rate of 46 percent from 2017 to 2022. This data traffic is growing almost 7-fold in the upcoming years due to increasing devices and connections.

Opportunities

The internet services are emerging to provide advanced solutions such as enhanced coverage, faster connectivity and others which opens immense and new opportunities for the market to upsurge its footprint in the 5G services. The 5G network services are provided with 3600MHz bands. A 3600 MHz 5G band is supported by the distributed antenna system (DAS) components to varying degrees. Hence, 5G distributed antenna system (DAS) is becoming the new and ample opportunity for the market to launch new offerings and develop advanced solutions. Some major market players have already developed the solution for instance, SOLiD System Company introduced a new distributed antenna systems (DAS) solution for 5G technology in January 2019. Company has introduced this solution for wireless coverage to support 5G through a Verizon VZTUF XIII, a 5G Solutions Platform. Such advancement in technology in the distributed antennas systems (DAS) offering is generating a strong opportunity for the company to maintain their position in the market.

Restraints

Asa result of improved connection of distributed antenna system (DAS), it is distributed antenna system (DAS) is becoming more common, mainly for in-building applications. The distributed antenna system (DAS) provided a strong commercial option for augmenting network connectivity, but there are still some technical issues to be overcome. With the high speed band, more antennas offer superior coverage but are more costly and have a bigger visual impact. The solution is offered by market players, although there are numerous limitations or restrictions, such as upgradeability, backhaul, and others. These technical complications are surging the system's cost and creating complexity for the users.

This distributed antenna system (DAS) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the distributed antenna system (DAS) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

The distributed antenna system (DAS) market was considerably affected by COVID-19 because approximately every nation chose to shut down all manufacturing facilities save those involved in producing necessities. To stop the spread of COVID-19, the government has implemented a number of stringent measures, including halting the manufacturing and sale of non-essential commodities and obstructing international trade. The only company handling this pandemic situation is the essential services that are permitted to open and conduct business as usual. Manufacturers are taking a number of strategic actions to recover from COVID-19. The participants are engaged in a variety of research and development projects to advance the distributed antenna system's technology. With this, the companies will release sophisticated and precise controllers on the market.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

The distributed antenna system (DAS) market is segmented based on the offering, coverage, ownership, technology, user facility and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

Coverage

Ownership

Technology

User Facility

Vertical

The distributed antenna system (DAS) market is analyzed and market size insights and trends are provided by country, offering, coverage, ownership, technology, user facility and vertical as referenced above.

The countries covered in the distributed antenna system (DAS) market report are report U.S., Canada and Mexico in North America.

The U.S. dominates the market because of the maximum use of smartphones. Several countries adopt 5G services in areas such as autonomous driving, AR/VR, and the traffic per smartphone, increasing the demand for the distributed antenna system (DAS). Canada is likely to hold second position due to completion of 5G trials with the increasing smart infrastructural building in many countries.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

The distributed antenna system (DAS) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to distributed antenna system (DAS) market.

Some of the major players operating in the distributed antenna system (DAS) market are:

SKU-

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Distributed Antenna System Das Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Distributed Antenna System Das Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.