North America Drug Device Combination Market

Market Size in USD Billion

CAGR :

%

USD

13.56 Billion

USD

31.02 Billion

2025

2033

USD

13.56 Billion

USD

31.02 Billion

2025

2033

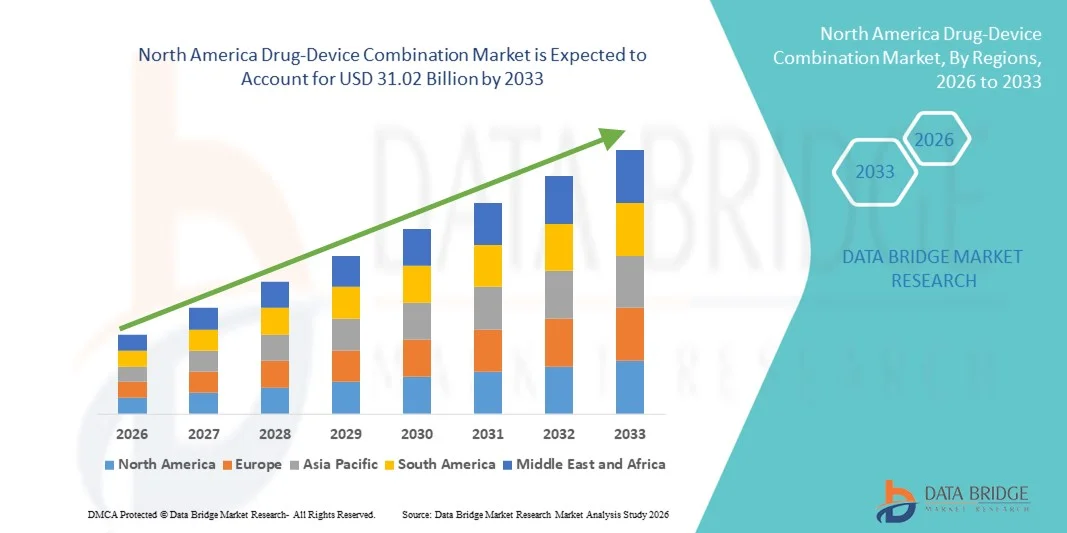

| 2026 –2033 | |

| USD 13.56 Billion | |

| USD 31.02 Billion | |

|

|

|

|

North America Drug-Device Combination Market Size

- The North America drug-device combination market size was valued at USD 13.56 billion in 2025 and is expected to reach USD 31.02 billion by 2033, at a CAGR of 10.9% during the forecast period

- The market growth is largely fueled by advancements in integrated therapeutic systems, growing prevalence of chronic diseases, and a robust healthcare infrastructure that supports the adoption of innovative drug‑delivery solutions such as drug‑eluting stents, transdermal patches, and auto‑injectors across clinical and home care settings

- Furthermore, increasing patient demand for efficient, safe, and user‑friendly therapies combined with supportive regulatory frameworks and rising investments from pharmaceutical and medtech companies are positioning drug‑device combination products as essential tools in modern disease management, thereby significantly boosting industry growth

North America Drug-Device Combination Market Analysis

- Drug‑device combination products, integrating pharmaceuticals with medical devices such as auto‑injectors, inhalers, and transdermal patches, are becoming essential components of modern healthcare delivery in both clinical and home settings due to their enhanced therapeutic efficacy, ease of administration, and improved patient adherence

- The rising demand for drug‑device combinations is primarily driven by the increasing prevalence of chronic diseases, growing focus on patient-centric care, and a preference for self-administered therapies that reduce hospital visits and improve treatment outcomes

- The United States dominated the North America drug‑device combination market with the largest revenue share of 89.2% in 2025, supported by advanced healthcare infrastructure, early adoption of innovative drug‑delivery technologies, and strong R&D investments from both established pharmaceutical and medtech companies, with widespread adoption of auto-injectors, inhalers, and other combination products fueled by regulatory support and technological innovations

- Canada is expected to be the fastest-growing country in the North America market during the forecast period due to increasing healthcare spending, rising awareness of self-administered therapies, and expanding access to modern medical technologies

- Auto-injector segment dominated the market with a share of 38.9% in 2025, driven by its convenience, safety, and widespread use in managing chronic conditions such as diabetes, allergies, and multiple sclerosis

Report Scope and North America Drug-Device Combination Market Segmentation

|

Attributes |

North America Drug-Device Combination Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Drug-Device Combination Market Trends

Enhanced Convenience Through Smart and Connected Drug Delivery

- A significant and accelerating trend in the North America drug‑device combination market is the increasing integration of digital health technologies, connected devices, and patient monitoring systems with drug delivery solutions, enhancing convenience, adherence, and real-time monitoring in both clinical and home settings

- For instance, smart insulin pens and auto-injectors now connect to mobile apps to track doses, schedule reminders, and share adherence data with healthcare providers, improving therapy management for chronic disease patients

- Connected devices enable features such as dose pattern recognition, predictive adherence alerts, and personalized therapy guidance. For instance, some smart inhalers use sensors and analytics to optimize patient inhalation technique and notify caregivers if unusual usage patterns are detected

- The seamless integration of drug‑device combinations with patient apps and healthcare platforms facilitates centralized management of multiple therapies, allowing clinicians and patients to monitor medication adherence, health outcomes, and therapy effectiveness from a single interface

- This trend towards more intelligent, connected, and patient-centric drug-delivery systems is reshaping expectations for therapy management. Consequently, companies such as Ypsomed and BD are developing digital auto-injectors and connected drug devices with adherence tracking, cloud-based data sharing, and remote monitoring capabilities

- The demand for smart, connected drug‑device combinations is growing rapidly across both hospital and home care settings, as patients and healthcare providers increasingly prioritize convenience, safety, and personalized therapy optimization

- Advancements in AI-driven predictive analytics for connected drug devices are allowing healthcare providers to anticipate potential complications, optimize dosage schedules, and improve treatment outcomes

North America Drug-Device Combination Market Dynamics

Driver

Rising Demand Due to Chronic Disease Prevalence and Patient-Centric Care

- The increasing prevalence of chronic diseases such as diabetes, asthma, and autoimmune disorders, combined with a shift toward patient-centric healthcare, is a significant driver for heightened adoption of drug‑device combination products

- For instance, in March 2025, BD announced the launch of a connected auto-injector platform that integrates sensor-based monitoring to improve adherence and track therapy outcomes, reflecting how innovation drives market growth

- As patients seek convenient, safe, and self-administered therapies that reduce hospital visits and improve treatment outcomes, drug-device combination products offer advanced features such as digital reminders, adherence tracking, and remote monitoring

- Furthermore, the growing adoption of telehealth services and digital health monitoring is making connected drug-device products an integral component of home-based care, offering seamless integration with patient management systems

- The convenience of self-administered therapies, remote monitoring, and app-based adherence tracking are key factors propelling adoption across hospitals, clinics, and home care settings. The trend toward patient empowerment and the availability of user-friendly devices further contribute to market growth

- For instance, partnerships between pharmaceutical companies and tech firms are accelerating the development of smart combination devices, expanding their reach in hospitals and home care

- Patient preference for devices that reduce errors, improve compliance, and provide real-time data to clinicians is driving the adoption of connected drug‑device combinations across North America

Restraint/Challenge

High Cost and Regulatory Compliance Complexity

- Concerns regarding the regulatory complexity of drug‑device combinations and high initial costs pose a significant challenge to broader market adoption. As these products combine drugs with devices, compliance with multiple regulatory frameworks can delay product approvals

- For instance, lengthy FDA approval processes for novel auto-injectors and smart inhalers have caused some delays in market entry, making it challenging for smaller innovators to compete

- Addressing these regulatory and cost challenges through streamlined approvals, cost-effective design, and adherence to quality standards is crucial for encouraging wider adoption. Companies such as Ypsomed and Sanofi emphasize regulatory compliance and safety in their product development

- In addition, the relatively high price of advanced smart drug-device systems compared to traditional drug delivery methods can be a barrier for cost-sensitive patients and smaller healthcare providers. While basic devices are becoming more accessible, premium features such as digital connectivity or real-time monitoring often carry a higher price tag

- Overcoming these challenges through regulatory guidance, patient education on device benefits, and the development of more affordable and scalable solutions will be vital for sustained growth in the North America drug‑device combination market

- For instance, variations in state-level healthcare policies and reimbursement rates can limit the adoption of high-cost drug-device combinations, creating uncertainty for manufacturers and providers

- Cybersecurity and data privacy concerns related to connected drug-device systems, including the risk of unauthorized access or data breaches, remain a persistent challenge that companies must address to build consumer and provider trust

North America Drug-Device Combination Market Scope

The market is segmented on the basis of product, application type, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into auto-injector, microneedle patch, digital pill, smart inhaler, drug delivery hydrogels, drug-eluting lens, and others. The Auto-Injector segment dominated the market with the largest revenue share of 38.9% in 2025, driven by its widespread use in chronic disease management such as diabetes, allergies, and autoimmune disorders. Auto-injectors offer convenience, safety, and precise dosing, reducing the risk of administration errors. They are highly favored in both hospital and home care settings due to their ease of use, portability, and compatibility with connected mobile applications for dose tracking. The strong presence of established manufacturers such as BD and Ypsomed further strengthens this segment. Moreover, patient preference for self-administered therapies and regulatory support for auto-injector adoption have contributed to sustained market leadership.

The Microneedle Patch segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing research and development in painless, minimally invasive drug delivery technologies. Microneedle patches provide improved patient compliance, reduced pain, and controlled release of medications, making them attractive for vaccines, insulin, and biologics. For instance, pilot studies in the U.S. have shown high adoption potential among pediatric and geriatric populations. Their compatibility with wearable devices and potential for integration with digital monitoring systems further supports growth. The growing investment in next-generation transdermal delivery and favorable reimbursement policies are also driving expansion.

- By Application Type

On the basis of application, the market is segmented into orthopedic diseases, respiratory diseases, diabetes, oncology, cardiovascular diseases, and others. The Diabetes segment dominated the market with the highest revenue share in 2025 due to the high prevalence of diabetes in North America and the critical need for precise, self-administered drug delivery solutions. Products such as insulin auto-injectors and smart pens are widely adopted in both home and clinical care settings. These devices offer convenience, accuracy, and integration with mobile apps for dose monitoring and adherence tracking. The continuous innovation in insulin delivery systems, along with patient education and awareness programs, reinforces market dominance. The segment also benefits from strong regulatory support and insurance coverage, which encourages wider use.

The Oncology segment is expected to witness the fastest growth from 2026 to 2033, driven by the development of targeted, self-administered drug-device combinations such as wearable infusion pumps and smart injection systems. For instance, connected oncology devices allow real-time monitoring of therapy adherence, dose adjustments, and remote data sharing with healthcare providers. Increasing cancer incidence, rising demand for home-based treatments, and supportive R&D initiatives are fueling rapid adoption. The integration of digital health technologies with oncology drug delivery ensures enhanced patient safety, personalized therapy, and improved outcomes.

- By End User

On the basis of end user, the market is segmented into clinics, hospitals, home care settings, ambulatory care centers, and others. The Hospitals segment dominated the market with the largest revenue share in 2025, due to their capability to adopt and implement advanced drug-device combination products for in-patient care and chronic disease management. Hospitals benefit from access to trained staff, infrastructure for connected devices, and the ability to manage complex therapies such as oncology infusions and auto-injectors. The adoption is further driven by partnerships with pharmaceutical and medtech companies to provide integrated care solutions. Hospitals also serve as critical points for data collection, adherence monitoring, and patient education. For instance, U.S. hospitals widely implement connected auto-injectors and smart inhalers in both acute and long-term care settings.

The Home Care Settings segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising preference for self-administered therapies and remote patient monitoring solutions. Home-based auto-injectors, microneedle patches, and digital pills provide convenience, safety, and adherence tracking. For instance, smart insulin pens and connected inhalers enable patients to manage chronic conditions without frequent hospital visits. Increasing telehealth adoption, wearable integration, and aging populations preferring at-home treatment further accelerate growth. The availability of patient-friendly devices with digital support features also drives the expansion of this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The Direct Tender segment dominated the market with the largest revenue share in 2025, driven by hospitals, clinics, and large healthcare providers purchasing drug-device combination products in bulk directly from manufacturers. This channel ensures cost efficiency, reliable supply, and timely access to advanced therapies. It is particularly important for high-value products such as auto-injectors, smart inhalers, and oncology infusion devices. For instance, major hospital networks in the U.S. frequently engage in direct tender agreements for connected drug-device products to streamline procurement and inventory management. Direct engagement with manufacturers also allows customization, regulatory compliance, and technical support for complex devices.

The Retail Sales segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing availability of consumer-friendly drug-device combinations through pharmacies, online platforms, and specialized medical retailers. For instance, smart auto-injectors and microneedle patches are increasingly accessible for home use via retail channels. The convenience of purchasing over-the-counter or prescription devices, combined with digital support and mobile app integration, drives adoption. Expanding pharmacy networks, e-commerce penetration, and patient preference for self-administered therapies contribute to rapid growth in this channel.

North America Drug-Device Combination Market Regional Analysis

- The United States dominated the North America drug‑device combination market with the largest revenue share of 89.2% in 2025, supported by advanced healthcare infrastructure, early adoption of innovative drug‑delivery technologies, and strong R&D investments from both established pharmaceutical and medtech companies

- Patients and healthcare providers in the region highly value the convenience, accuracy, and safety offered by drug-device combination products such as auto-injectors, smart inhalers, and connected insulin pens, which enhance adherence and treatment outcomes

- This widespread adoption is further supported by favorable regulatory frameworks, increasing prevalence of chronic diseases, high healthcare spending, and the growing preference for self-administered and connected therapies, establishing drug-device combination products as essential solutions across hospitals, clinics, and home care settings

U.S. Drug-Device Combination Market Insight

The U.S. drug‑device combination market captured the largest revenue share of 89.2% in 2025 within North America, fueled by advanced healthcare infrastructure, high prevalence of chronic diseases, and rapid adoption of connected drug delivery technologies. Patients and healthcare providers increasingly prioritize safe, accurate, and self-administered therapies such as auto-injectors, smart inhalers, and digital insulin pens. The growing trend of home-based care, coupled with telehealth adoption and mobile app integration for adherence tracking, further propels market growth. Moreover, strong R&D investments, regulatory support, and the presence of major pharmaceutical and medtech companies continue to expand the market’s reach.

Canada Drug‑Device Combination Market Insight

The Canada drug‑device combination market is expected to grow at a notable CAGR during the forecast period, driven by increasing awareness of chronic disease management, government healthcare initiatives, and rising adoption of smart drug delivery systems. Canadian patients value the convenience, safety, and real-time monitoring offered by connected auto-injectors, microneedle patches, and smart inhalers. The market is also supported by a technologically inclined population, efficient healthcare infrastructure, and favorable reimbursement policies. Hospitals and home care settings are increasingly integrating connected devices to optimize therapy adherence and patient outcomes.

Mexico Drug‑Device Combination Market Insight

The Mexico drug‑device combination market is poised for steady growth, fueled by rising healthcare expenditure, growing prevalence of diabetes and cardiovascular diseases, and increasing awareness of self-administered therapies. Patients and providers are adopting digital pills, microneedle patches, and auto-injectors for their ease of use, improved safety, and potential integration with mobile monitoring platforms. The expansion of private healthcare facilities and telemedicine services is further supporting market adoption. Moreover, government programs promoting access to innovative drug delivery solutions are expected to enhance the penetration of drug-device combination products across clinical and home care settings.

North America Drug-Device Combination Market Share

The North America Drug-Device Combination industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BD (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Novartis AG (Switzerland)

- Novo Nordisk A/S (Denmark)

- Sanofi (France)

- Eli Lilly and Company (U.S.)

- GSK plc (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Terumo Corporation (Japan)

- West Pharmaceutical Services, Inc. (U.S.)

- Bayer AG (Germany)

- Merck KGaA (Germany)

- B. Braun SE (Germany)

- WuXi AppTec Co., Ltd. (China)

- Meril Life Sciences (India)

- Dr. Reddy’s Laboratories Ltd. (India)

What are the Recent Developments in North America Drug-Device Combination Market?

- In October 2025, Chiesi USA announced acceptance of its New Drug Application (NDA) by the U.S. FDA for a triple‑combination inhaler for maintenance treatment of asthma. The single inhaler triple therapy (three actives in one device) already marketed in nearly 50 countries represents a significant expansion of combination inhaled therapies into the U.S. pending approval

- In May 2025, the U.S. FDA approved Amneal Pharmaceuticals’ self‑administered migraine treatment, Brekiya, delivered via a pre‑filled auto‑injector. The device‑based therapy requires no refrigeration or assembly and allows patients to inject the single‑dose treatment directly into the thigh, improving ease of use for acute migraine sufferers. The drug was expected to be available in the U.S. by the second half of the year

- In March 2025, the U.S. FDA expanded the approved use of ARS Pharmaceuticals’ allergic reaction nasal spray, Neffy, for patients weighing 15–30 kg. Neffy is a needle‑free alternative to traditional epinephrine auto‑injectors such as EpiPen, designed for rapid treatment of anaphylaxis; the approval broadened the patient population and was expected to accelerate prescriptions especially as school season approached

- In February 2025, the U.S. FDA approved Supernus Pharmaceuticals’ drug‑device combination Onapgo for treating movement‑related symptoms in Parkinson’s disease. Onapgo delivers the therapeutic agent continuously under the skin, offering a more convenient alternative to frequent injections and concluding a multi‑year development cycle after earlier regulatory setbacks

- In August 2024, the U.S. FDA approved ARS Pharmaceuticals’ Neffy nasal spray as the first needle‑free emergency treatment for severe allergic reactions (anaphylaxis) in adults and children ≥30 kg, providing a non‑injectable alternative to epinephrine auto‑injectors. This marked a significant expansion of drug‑device combination options in acute care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.