North America Drug Safety Solutions And Pharmacovigilance Market

Market Size in USD Billion

CAGR :

%

USD

2.04 Billion

USD

5.75 Billion

2025

2033

USD

2.04 Billion

USD

5.75 Billion

2025

2033

| 2026 –2033 | |

| USD 2.04 Billion | |

| USD 5.75 Billion | |

|

|

|

|

North America Drug Safety Solutions And Pharmacovigilance Market Size

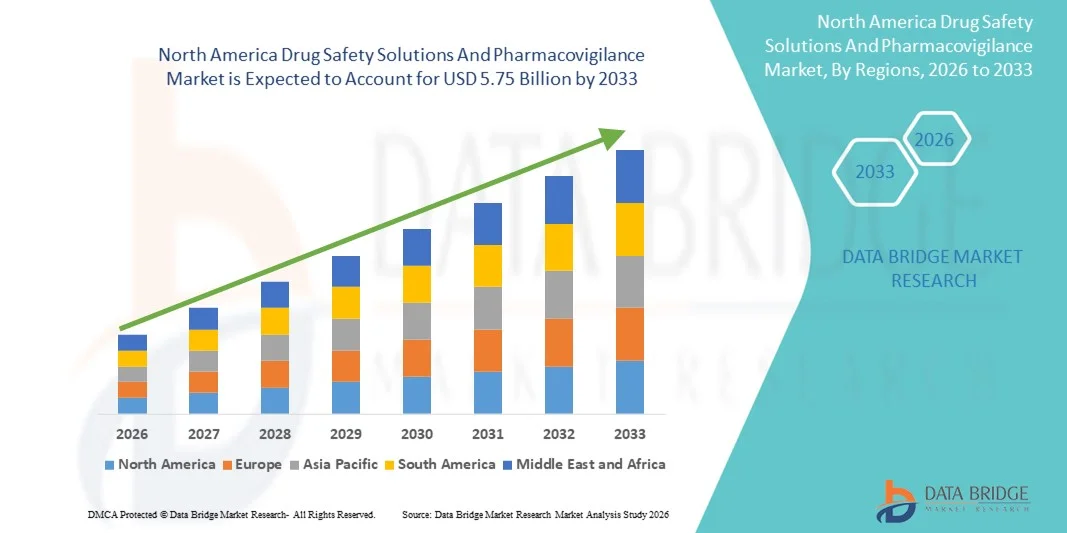

- The North America drug safety solutions and pharmacovigilance market size was valued at USD 2.04 billion in 2025 and is expected to reach USD 5.75 billion by 2033, at a CAGR of 13.85% during the forecast period

- The market growth is largely fueled by increasing regulatory compliance requirements, rising adoption of digital tools in clinical trials, and growing awareness of patient safety and risk management in the pharmaceutical industry

- Furthermore, the expanding use of real-world evidence, big data analytics, and AI-driven pharmacovigilance platforms is enabling more efficient monitoring of drug safety and adverse events. These converging factors are accelerating the uptake of Drug Safety Solutions and Pharmacovigilance solutions, thereby significantly boosting the industry's growth

North America Drug Safety Solutions And Pharmacovigilance Market Analysis

- Drug Safety Solutions and Pharmacovigilance are increasingly critical in ensuring patient safety, monitoring adverse drug reactions, and maintaining compliance with stringent regulatory standards across the pharmaceutical and biotechnology industries

- The growing demand is driven by the adoption of digital pharmacovigilance platforms, AI and machine learning for adverse event prediction, and the integration of real-world evidence into drug safety monitoring. These factors are significantly boosting the uptake of Drug Safety Solutions and Pharmacovigilance globally

- The U.S. dominated the drug safety solutions and pharmacovigilance market with the largest revenue share of approximately 42% in 2025, supported by the presence of leading pharmaceutical companies, advanced regulatory frameworks, and early adoption of AI-based pharmacovigilance solutions

- Canada is expected to be the fastest-growing region during the forecast period, registering a CAGR of 9.8%, driven by increasing healthcare digitization, supportive government policies, and rising investments in clinical trials and drug safety monitoring

- The software segment dominated the largest market revenue share of 61.8% in 2025, driven by the increasing adoption of integrated pharmacovigilance platforms for adverse event reporting, signal detection, and regulatory compliance

Report Scope and Drug Safety Solutions And Pharmacovigilance Market Segmentation

|

Attributes |

Drug Safety Solutions And Pharmacovigilance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

• Oracle Health Sciences (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Drug Safety Solutions And Pharmacovigilance Market Trends

Growing Adoption of Cloud-Based and Integrated Safety Platforms

- A significant and accelerating trend in the global drug safety solutions and pharmacovigilance market is the increasing adoption of cloud-based and integrated safety platforms. These platforms enable seamless collection, processing, and reporting of adverse drug events across multiple regions and regulatory frameworks

- For instance, in June 2023, ArisGlobal launched its cloud-based safety platform, LifeSphere Safety, offering real-time adverse event reporting, automated signal detection, and compliance management across global regulatory standards. This launch reflects the shift towards centralized, scalable, and interoperable pharmacovigilance systems

- Modern pharmacovigilance platforms integrate electronic health records (EHRs), clinical trial data, and post-marketing surveillance information to provide actionable insights for risk management

- The integration of advanced analytics and machine learning algorithms allows for early detection of safety signals, reducing time-to-action for potential drug risks

- The trend is further supported by regulatory authorities emphasizing real-time and transparent reporting for patient safety, prompting companies to adopt more efficient and compliant solutions

- In addition, the scalability of cloud solutions enables pharmaceutical companies of all sizes to implement robust pharmacovigilance processes without significant infrastructure investment

North America Drug Safety Solutions And Pharmacovigilance Market Dynamics

Driver

Regulatory Pressure and Increasing Drug Development Activities

- The increasing complexity of regulatory compliance and pharmacovigilance requirements worldwide is a major driver for market growth. Regulatory authorities such as the FDA, EMA, and PMDA mandate stringent reporting of adverse drug reactions, driving demand for automated and standardized solutions

- For instance, in March 2024, IQVIA expanded its safety and pharmacovigilance services in Europe to support pharmaceutical companies in meeting EMA guidelines on periodic safety update reports (PSURs) and risk management plans (RMPs)

- Rapid growth in drug development pipelines, especially for biologics and specialty drugs, increases the need for robust post-marketing safety monitoring solutions

- Pharmaceutical companies are investing in centralized safety databases to manage data from clinical trials, post-marketing surveillance, and patient registries

- Cloud-based pharmacovigilance systems improve collaboration between global teams, ensuring timely regulatory submissions

- The growing focus on patient-centric care, safety, and risk mitigation further accelerates the adoption of comprehensive pharmacovigilance platforms

Restraint/Challenge

High Implementation Costs and Data Security Concerns

- Despite the benefits, high implementation costs and integration complexity pose challenges for market adoption, particularly for small and mid-sized pharmaceutical companies. Initial investment in advanced software, training, and process redesign can be significant

- For instance, transitioning from legacy safety systems to modern cloud-based platforms may require months of configuration and validation, temporarily slowing internal operations

- Data privacy and cybersecurity concerns also remain a critical restraint, as pharmacovigilance systems handle sensitive patient and clinical data. Breaches can lead to regulatory penalties and reputational damage

- Ensuring compliance with data protection regulations such as GDPR in Europe, HIPAA in the U.S., and other regional laws adds to operational complexity

- Continuous updates, audits, and system validation are necessary to maintain regulatory compliance and avoid potential disruptions in drug safety reporting

- Overcoming these challenges requires strategic investment in secure, scalable solutions, workforce training, and robust IT infrastructure to ensure both compliance and operational efficiency

North America Drug Safety Solutions And Pharmacovigilance Market Scope

The market is segmented on the basis of type, end user, and distribution channel.

- By Type

On the basis of type, the Drug Safety Solutions and Pharmacovigilance market is segmented into software and services. The software segment dominated the largest market revenue share of 61.8% in 2025, driven by the increasing adoption of integrated pharmacovigilance platforms for adverse event reporting, signal detection, and regulatory compliance. Pharmaceutical and biotechnology companies increasingly rely on safety software to automate case intake, data processing, and submission to regulatory authorities such as the FDA and EMA. The growing volume of clinical trial data and post-marketing surveillance activities has intensified the need for centralized safety databases. Software solutions improve operational efficiency, reduce manual errors, and ensure timely compliance with global regulations. Integration with clinical data management and electronic health record systems further supports dominance. Continuous software upgrades aligned with evolving regulatory guidelines also sustain adoption. Large enterprises prefer licensed platforms due to scalability and long-term cost efficiency. As a result, safety software remains the backbone of pharmacovigilance operations globally.

The services segment is expected to witness the fastest CAGR of 13.9% from 2026 to 2033, driven by increasing outsourcing of pharmacovigilance activities to specialized service providers. Pharmaceutical companies are increasingly outsourcing case processing, medical review, and regulatory submissions to reduce operational burden and control costs. The rise in small and mid-sized biotech firms lacking in-house safety expertise further accelerates service demand. Contract safety organizations provide flexibility and access to trained professionals. Services also support compliance across multiple geographies with varying regulatory requirements. Growing drug approvals and post-marketing commitments increase reliance on outsourced safety operations. Consequently, pharmacovigilance services are emerging as a high-growth segment globally.

- By End User

On the basis of end user, the Drug Safety Solutions and Pharmacovigilance market is segmented into biotechnology and pharmaceutical companies, contract research organizations (CROs), hospitals, KPOs/BPOs, and healthcare providers. The biotechnology and pharmaceutical companies segment dominated the largest market revenue share of 48.4% in 2025, owing to stringent regulatory requirements for drug safety monitoring throughout the product lifecycle. These companies conduct extensive clinical trials and post-marketing surveillance, generating large volumes of safety data. Mandatory adverse event reporting and risk management plans drive continuous investment in pharmacovigilance systems. Global drug launches further necessitate centralized safety platforms. Large pharma companies adopt end-to-end solutions to ensure compliance across regions. Increased focus on patient safety and risk mitigation strengthens segment dominance. Continuous pipeline expansion sustains long-term demand for safety solutions within this segment.

The CROs segment is projected to register the fastest CAGR of 14.6% from 2026 to 2033, supported by the growing trend of outsourcing clinical trials and safety monitoring activities. CROs increasingly manage pharmacovigilance operations on behalf of sponsors. Expansion of global clinical research activities fuels safety service demand. CROs provide cost-effective, scalable solutions with regulatory expertise. Smaller pharma companies prefer CROs for end-to-end safety management. Growth in biologics and specialty drugs further supports adoption. As outsourcing penetration increases, CROs emerge as the fastest-growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the Drug Safety Solutions and Pharmacovigilance market is segmented into direct sales and retail sales. The direct sales segment accounted for the largest market revenue share of 67.2% in 2025, driven by the complexity and customization requirements of pharmacovigilance solutions. Software vendors and service providers typically engage directly with pharmaceutical companies to tailor solutions according to regulatory and operational needs. Direct engagement ensures proper implementation, training, and validation. Long-term contracts and enterprise licensing models support revenue stability. Regulatory compliance requirements also favor vendor-client collaboration through direct channels. Large organizations prefer direct procurement for data security and system integration. As a result, direct sales dominate market distribution.

The retail sales segment is expected to grow at the fastest CAGR of 11.8% from 2026 to 2033, driven by increasing availability of modular and cloud-based safety solutions. Smaller biotech firms and healthcare providers prefer off-the-shelf platforms with faster deployment. Subscription-based pricing models enhance affordability. Growth of digital health marketplaces supports accessibility. Retail channels reduce procurement complexity for emerging players. Increasing adoption among small enterprises accelerates growth. Thus, retail sales represent a rapidly expanding distribution channel.

North America Drug Safety Solutions And Pharmacovigilance Market Regional Analysis

- North America dominated the drug safety solutions and pharmacovigilance market with the largest revenue share of approximately 42% in 2025. This leadership is supported by the strong presence of global pharmaceutical and biotechnology companies, a well-established regulatory environment led by agencies such as the U.S. FDA and Health Canada, and early adoption of advanced pharmacovigilance technologie

- The region has witnessed increasing implementation of AI- and machine learning–based drug safety platforms to improve adverse event detection, signal management, and regulatory compliance

- In addition, high R&D spending, extensive clinical trial activity, and a growing focus on post-marketing drug surveillance continue to strengthen market growth across North America

U.S. Drug Safety Solutions and Pharmacovigilance Market Insight

The U.S. drug safety solutions and pharmacovigilance market dominated the North American Drug Safety Solutions and Pharmacovigilance market in 2025, accounting for the majority of the regional revenue share. Growth in the U.S. market is driven by the presence of leading pharmaceutical companies, contract research organizations (CROs), and specialized pharmacovigilance service providers. Strict regulatory requirements for drug approval and post-marketing surveillance, along with the early adoption of AI-driven case processing, real-world evidence analytics, and cloud-based safety databases, are significantly boosting demand. Moreover, the increasing complexity of drug development, biologics, and personalized medicines has intensified the need for robust pharmacovigilance solutions across clinical and commercial stages.

Canada Drug Safety Solutions and Pharmacovigilance Market Insight

Canada drug safety solutions and pharmacovigilance market is expected to be the fastest-growing country in the Drug Safety Solutions and Pharmacovigilance market during the forecast period, registering a CAGR of around 9.8%. This growth is driven by increasing healthcare digitization, supportive government initiatives to enhance drug safety monitoring, and rising investments in clinical trials. The expanding presence of global pharmaceutical companies and CROs in Canada, along with growing adoption of electronic adverse event reporting systems and integrated pharmacovigilance platforms, is further supporting market expansion. In addition, closer alignment with international regulatory standards is encouraging pharmaceutical manufacturers to strengthen their drug safety operations in the country.

North America Drug Safety Solutions And Pharmacovigilance Market Share

The Drug Safety Solutions And Pharmacovigilance industry is primarily led by well-established companies, including:

• Oracle Health Sciences (U.S.)

• IQVIA (U.S.)

• Veeva Systems (U.S.)

• ArisGlobal (U.S.)

• Dassault Systèmes (France)

• Cognizant Technology Solutions (U.S.)

• Wipro (India)

• Tata Consultancy Services – TCS (India)

• Accenture (Ireland)

• Parexel International (U.S.)

• ICON plc (Ireland)

• Labcorp Drug Development (U.S.)

• Medidata Solutions (U.S.)

• Ennov (France)

• EXTEDO (Germany)

• CliniSys (U.K.)

• United BioSource Corporation (U.S.)

Latest Developments in North America Drug Safety Solutions And Pharmacovigilance Market

- In December 2023, Thermo Fisher Scientific launched CorEvidence, a cloud-based data lake platform designed to optimize pharmacovigilance case processing and safety data management by streamlining adverse event management and supporting regulatory requirements for post-authorization safety studies

- In July 2024, Oracle introduced new AI-enhanced capabilities in its Argus and Safety One Intake solutions to help life science organizations manage increasing adverse event workloads, automate safety case processing, enhance global regulatory compliance, and improve data privacy and reporting efficiency. This update reflects the shift toward AI-driven drug safety platforms that support pharmaceutical companies and CROs in meeting evolving regulatory demands

- In April 2024, Qinecsa Solutions acquired Danish-based Insife ApS, strengthening its position as a leading provider of digital pharmacovigilance solutions by combining Qinecsa’s expertise with Insife’s HALOPV platform, enhancing global drug safety data management and pharmacovigilance technology offerings

- In November 2024, Veeva Systems expanded its Vault Safety platform by launching SafetyConnect, enabling unified safety case management across global affiliates with AI-assisted triage and multilingual processing to improve global pharmacovigilance case handling and accelerate report workflows

- In March 2025, ArisGlobal announced a strategic collaboration with IBM to integrate IBM’s AI capabilities with ArisGlobal LifeSphere to accelerate pharmacovigilance case processing and enhance safety data analytics, reflecting growing adoption of AI for more efficient safety monitoring and risk managemen

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.