North America Electronic Components Market

Market Size in USD million

CAGR :

%

USD

83,903.86 million

USD

154,437.42 million

2022

2030

USD

83,903.86 million

USD

154,437.42 million

2022

2030

| 2023 –2030 | |

| USD 83,903.86 million | |

| USD 154,437.42 million | |

|

|

|

|

North America Electronic Components Market Analysis and Size

Increasing demand for smart and miniaturized electronic devices is the major driving factor in the market. Shortage in supply of electronic components can prove to be a challenge however increase in the usage of IoT devices prove to be an opportunity. The rise in metal prices hampers the overall component production costs which can be a restraint for the adoption of electronic components and the challenges faced due to the impact of Covid-19 on the supply chain of the raw materials.

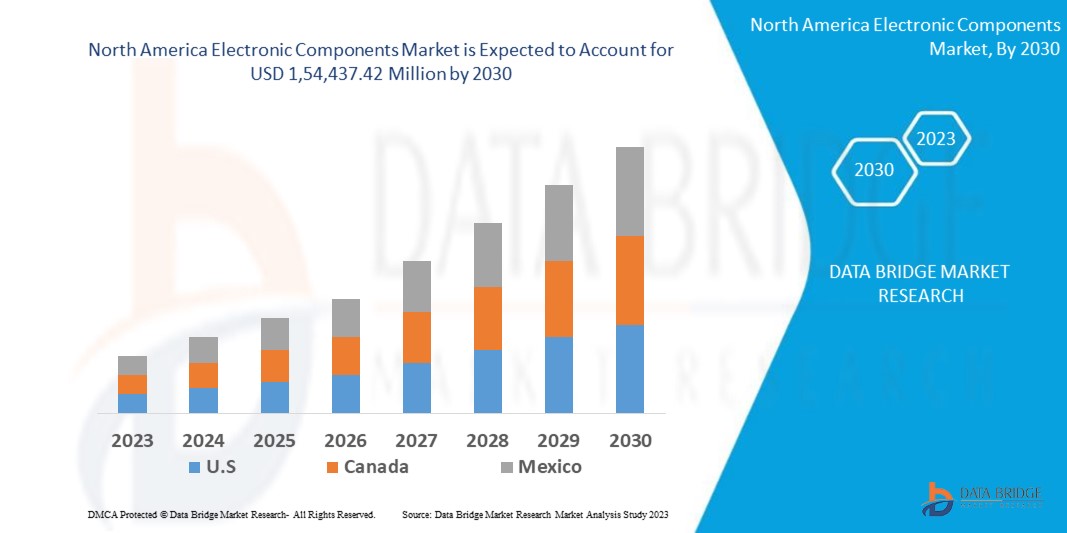

North America electronic components market was valued at USD 83,903.86 million in 2022 and is expected to reach USD 1,54,437.42 million by 2030, registering a CAGR of 8.2 % during the forecast period of 2023 to 2030. “Active” dominates the electronics component market as these components can control and amplify electronic signals, enabling complex functionality, while passive components primarily provide resistance, capacitance, or inductance without active control, limiting their role in electronic circuitry. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

North America Electronic Components Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030S |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component Type (Processors, Motors, Battery, Microcontroller, Integrated Circuits, Circuit Breakers, Transformer, Capacitors, Diodes, Resistors, Inductors, Relays, Switches, Fuse), Commodities Type (Brown Goods, White Goods, Small White Goods), Product Type (Active, Passive, Electromechanical Components), End-Use Type (Consumer Electronics, Networking and Telecommunication, Automotive, Manufacturing, Aerospace and Defense, Healthcare) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Intel Corporation (U.S.), Broadcom (U.S.), Advanced Micro Devices, Inc. (U.S.), Qualcomm Technologies, Inc. (U.S.), Infineon Technologies (Germany), NXP Semiconductors (Netherlands), KYOCERA Corporation (Japan), Texas Instruments Incorporated (U.S.) among others |

|

Market Opportunities |

|

Market Definition

Electronic components are basic building blocks of electronic circuit or electronic system. They control the flow of electron throughout the circuit. They consist of two or more terminals to connect with one another. These components are connected together in electronic board such as printed circuit board to form the electronic circuit. Active, passive and electromechanical are three major types of electronic components. Active components are those which possess the gain and can amplify or energize the electric signal. On the other hand, passive components do not possess gain and cannot amplify or energize the electric signal, they can only attenuate it.

North America Electronic Components Market Dynamics

Drivers

- Increasing Demand for Smart and Miniaturized Electronic Devices

The increasing demand for smart and miniaturized electronic devices is revolutionizing the tech industry. These compact gadgets, often equipped with powerful processing capabilities and wireless connectivity, are driving innovations in fields such as IoT, wearables, and consumer electronics. As consumers seek more portable and efficient solutions, manufacturers are focusing on creating smaller yet smarter devices to meet the evolving needs of the modern world.

- Technological Advancements in Electronic Components

Technological advancements in electronic components and products are driving rapid innovation and reshaping the way we live and work. These developments, such as smaller and more powerful microchips, improved displays, and enhanced connectivity, are enabling the creation of smarter, more efficient, and more capable electronic devices. As technology continues to evolve, we can anticipate even more groundbreaking electronic products that will transform industries and enhance our daily lives.

Opportunity

- Increase in the Usage of IoT Devices

The proliferation of IoT (internet of things) devices is reshaping our interconnected world. With their ability to collect, transmit, and analyze data in real-time, IoT devices are revolutionizing industries such as healthcare, transportation, agriculture, and manufacturing. As their adoption continues to surge, the transformative impact of IoT technology on our daily lives and businesses becomes increasingly evident.

Restraint/Challenge

- Shortage in the Supply of Electronic Components

On the other hand, the shortage in the supply of electronic components has emerged as a significant challenge for industries reliant on technology. With growing demand and disruptions in global supply chains, securing essential electronic components has become increasingly difficult. This shortage has repercussions across various sectors, impacting production schedules, delaying product launches, and driving up costs.

This electronic components market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the electronic components market contact Data Bridge Market Research for an Analyst Brief, Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In September 2020, Advanced Micro Devices, Inc. Ryzen processors are included in chrome books. AMD announced its Ryzen processor series is joining the Chromebook family—Athlon, too. Both APUs (that means CPU and integrated graphics in non-AMD terms) include Radeon Vega integrated graphics and will be found mid-level to high-end Chromebooks with Athlon on the mid-level and Ryzen on the high-end, respectively. The current A6 and A4 series of AMD Chromebooks processors will be entry-level from here on out. This expansion with chrome book has made integrated graphics available at a low-cost processor

- In December 2019, Broadcom announced that it had delivered the StrataXGS Tomahawk 4 switch series, demonstrating an unprecedented 25.6 Terabits/sec of Ethernet switching performance in a single device— double the bandwidth of any other switch silicon. This enables the next generation of high-throughput, low latency hyper scale networks with 64 ports of 400GbE switching and routing. This collaboration supports the scaling requirements of modern data center networks. This provides the company with exponential growth in the market

North America Electronic Components Market Scope

North america electronic components market is segmented on the basis of components type, commodities type, product type, end-use type. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component Type

- Processors

- Motors

- Battery

- Microcontroller

- Integrated Circuits

- Circuit Breakers

- Transformer

- Capacitors

- Diodes

- Resistors

- Inductors

- Relays

- Switches

- Fuse

Commodities Type

- Brown Goods

- White Goods

- Small White Goods

Product Type

- Active

- Passive

- Electromechanical Components

End-Use Type

- Consumer Electronics

- Networking and Telecommunication

- Automotive

- Manufacturing

- Aerospace and Defense

- Healthcare

North America Electronic Components Market Regional Analysis/Insights

North America electronic components market is analysed and market size insights and trends are provided by components type, commodities type, product type, end-use type as referenced above.

The countries covered in the North America electronic components market report are U.S., Canada, and Mexico in North America

U.S. dominates the electronic components market in North America as increase in research on new electronic technologies and technological advancement is boosting the market growth in the country.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Electronic Components Market Share Analysis

North America electronic components market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the company's focus related to the North America electronic components market.

Some of the major players operating in the North America electronic components market are:

- Intel Corporation (U.S.)

- Broadcom (U.S.)

- Advanced Micro Devices, Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Infineon Technologies (Germany)

- NXP Semiconductors (Netherlands)

- KYOCERA Corporation (Japan)

- Texas Instruments Incorporated (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Electronic Components Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Electronic Components Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Electronic Components Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.