North America Emollient Esters Market

Market Size in USD Million

CAGR :

%

USD

117.48 Million

USD

159.10 Million

2024

2032

USD

117.48 Million

USD

159.10 Million

2024

2032

| 2025 –2032 | |

| USD 117.48 Million | |

| USD 159.10 Million | |

|

|

|

|

North America Emollient Esters Market Analysis

The North America emollient esters market includes the production and use of esters derived from fatty acids and alcohols that are primarily used in personal care and cosmetic products to improve skin feel, texture, and moisture retention. These emollient esters are also utilized in hair care products, sunscreens, and makeup for their ability to soften and condition the skin and hair. The demand for emollient esters is rising due to the growing consumer preference for natural and sustainable beauty products. The market is primarily driven by the increasing demand for high-quality, multifunctional, and eco-friendly formulations. Key trends include the shift towards bio-based emollient esters, and the growing adoption of these ingredients in premium and organic cosmetic products, as well as the development of multi-functional esters that offer both emollient and skin-conditioning properties.

North America Emollient Esters Market Size

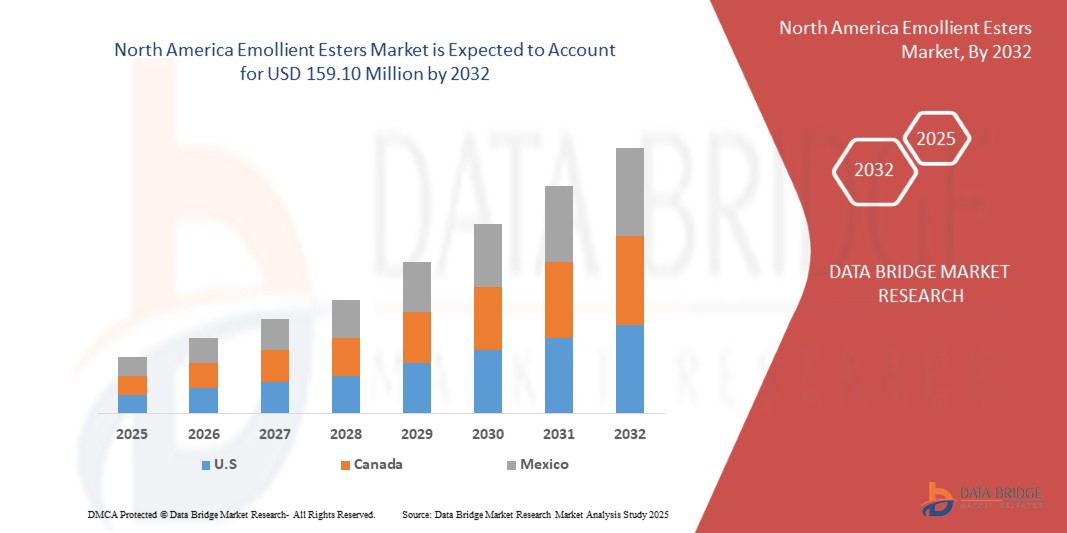

The North America emollient esters market is expected to reach USD 159.10 million by 2032 from USD 117.48 million in 2024, growing with a substantial CAGR of 3.97% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

North America Emollient Esters Market Trends

“Expanding Pharmaceutical and Dermatology Applications”

Pharmaceutical companies are using emollient esters in topical medications, wound care products, and transdermal drug delivery systems. They enhance the spreadability and penetration of active ingredients, making treatments more effective. In dermatology, these esters are found in creams, lotions, and serums, offering benefits such as long-lasting moisturization and skin barrier protection. These ingredients help improve the texture and absorption of skincare and medical formulations. Their ability to provide hydration and a smooth feel makes them valuable in products for dry skin, eczema, and other skin conditions.

The demand for natural and sustainable ingredients is also driving the use of bio-based emollient esters. These eco-friendly options appeal to consumers looking for safer and greener skincare solutions. As a result, manufacturers are focusing on plant-derived esters that provide the same benefits as synthetic alternatives.

For instance,

- Hydrofil Emollient, available on 1mg, is a paraben-free moisturizer designed to provide deep hydration and improve skin barrier function. Its emollient ester-based formulation enhances spreadability and absorption, making it effective for dry skin conditions

Overall, the growing demand for polyester in the American apparel and textile industries is driven by its versatility, affordability, and ability to adapt to changing consumer preferences. This trend positions polyester as a critical material in supporting innovation and growth within the North America emollient esters market.

Report Scope and Market Segmentation

|

Attributes |

Emollient Esters Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Kao Corporation (Japan), Hefei TNJ Chemical Industry Co., Ltd. (China), PHOENIX CHEMICAL, INC (U.S.), ZhiShang Chemical (China), Rxchemicals.com (U.S.), Suriachem Sdn. Bhd. (Malaysia), Haihang Industry (China), ATAMAN KIMYA (Turkey), Matangi Industries (India), EMCO DYESTUFF (India), SIHAULI CHEMICALS PRIVATE LIMITED (India), Baoran (China), Mohini Organics Pvt. Ltd. (India), and Gravity Chemicals (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Emollient Esters Market Definition

The North America emollient esters market includes the production and use of esters derived from fatty acids and alcohols that are primarily used in personal care and cosmetic products to improve skin feel, texture, and moisture retention. These emollient esters are also utilized in hair care products, sunscreens, and makeup for their ability to soften and condition the skin and hair.

North America Emollient Esters Market Dynamics

Drivers

- Expanding Pharmaceutical and Dermatology Applications

Pharmaceutical companies are using emollient esters in topical medications, wound care products, and transdermal drug delivery systems. They enhance the spreadability and penetration of active ingredients, making treatments more effective. In dermatology, these esters are found in creams, lotions, and serums, offering benefits such as long-lasting moisturization and skin barrier protection. These ingredients help improve the texture and absorption of skincare and medical formulations. Their ability to provide hydration and a smooth feel makes them valuable in products for dry skin, eczema, and other skin conditions.

The demand for natural and sustainable ingredients is also driving the use of bio-based emollient esters. These eco-friendly options appeal to consumers looking for safer and greener skincare solutions. As a result, manufacturers are focusing on plant-derived esters that provide the same benefits as synthetic alternatives.

With ongoing research and innovation, emollient esters are being developed for new applications, including anti-aging treatments and advanced drug formulations. Their role in improving product performance and consumer experience ensures continued growth in the pharmaceutical and dermatology sectors.

India's pharmaceutical industry, the world's largest generic drug provider, is projected to reach US$ 130 billion by 2030. It supplies over 50% of North America vaccine demand and 40% of generic demand in the US. The sector has grown at a 9.43% CAGR over nine years.

For instance,

Hydrofil Emollient, available on 1mg, is a paraben-free moisturizer designed to provide deep hydration and improve skin barrier function. Its emollient ester-based formulation enhances spreadability and absorption, making it effective for dry skin conditions

Esteem Industries highlights the role of emollients and conditioners in personal care formulations. Their emollient esters enhance moisturization, texture, and spreadability in skincare and haircare products. These ingredients improve absorption and provide a smooth, non-greasy feel, showcasing their importance in dermatological and cosmetic applications for enhanced consumer experience

Emollient esters enhance skincare and pharmaceutical formulations by improving hydration, absorption, and texture. They are widely used in topical medications, wound care, and dermatology products. Growing demand for natural, sustainable ingredients is driving innovation in bio-based esters. Their expanding applications ensure continued growth in pharmaceutical and dermatology industries.

Growing Demand for Personal Care and Cosmetics

One major driver is the increasing preference for natural and sustainable ingredients. Many brands are switching to bio-based emollient esters to meet eco-conscious consumer expectations. In addition, the rise of skincare trends such as "skinimalism" (minimalist skincare) and clean beauty has fueled demand for lightweight and multifunctional ingredients, making emollient esters essential in product formulations. These key ingredients help make skincare and beauty products smoother, softer, and more luxurious. As consumers seek high-performance, non-greasy, and long-lasting formulations, the demand for emollient esters is rising.

The booming e-commerce sector is also playing a role in expanding access to personal care products worldwide. With influencers and beauty bloggers driving consumer choices, products with superior texture and skin feel—achieved using emollient esters—are gaining popularity. Moreover, as awareness of skin health increases, consumers are looking for products with moisturizing and barrier-enhancing properties, which emollient esters provide.

In regions such as Asia-Pacific, where beauty and skincare routines are deeply ingrained in culture, demand for innovative, fast-absorbing, and high-performance formulations continues to grow. In addition, the male grooming sector is expanding, further driving demand for lightweight, non-greasy products, where emollient esters excel.

With rising disposable incomes, evolving beauty trends, and a shift toward sustainable formulations, the demand for emollient esters in personal care and cosmetics will continue its upward trajectory.

India's cosmetics industry is projected to reach US$ 20 billion by 2025, growing at a 25% CAGR. This surge is driven by rising disposable incomes, urbanization, and a shift towards specialized products such as organic and herbal cosmetics. International brands are expanding their presence, intensifying market competition.

For instance,

In February 2025 an article published by NYP Holdings, Inc. highlighted the growing demand for emollient esters in luxury skincare, as seen in Guerlain Abeille Royale Youth Watery Oil Serum. This product reflects consumer preference for lightweight, nourishing formulations with superior absorption, reinforcing the market shift toward high-performance, sustainable, and non-greasy ingredients

In February 2025 an article published by NYP Holdings, Inc. highlighted the rising demand for emollient esters in premium skincare, as seen in Medik8 products, which are known for their lightweight, hydrating formulas. Consumers increasingly seek high-performance, non-greasy ingredients for superior skin nourishment, driving market growth

The growing personal care and cosmetics industry is driving demand for emollient esters, valued for their smooth, non-greasy feel. trends such as clean beauty, skinimalism, and e-commerce growth fuel this rise. increasing sustainability focus, expanding male grooming, and Asia-Pacific's beauty culture further boost market growth, ensuring continued demand.

Opportunities

- Rising Demand for Biodegradable and Sustainable Cosmetic Ingredients

The emollient esters market is experiencing strong growth due to the rising demand for biodegradable and sustainable cosmetic ingredients such as LexFeel N5 INOLEX, Sensolene Hallstar and Lipex SheaLight AAK. Consumers are increasingly looking for eco-friendly skincare and personal care products as awareness of environmental issues grows. This shift is driving cosmetic manufacturers to replace synthetic ingredients with natural, plant-based alternatives that are biodegradable and sustainable.

Emollient esters, known for their moisturizing and skin-softening properties, are widely used in lotions, creams, serums, and sunscreens. With stricter regulatory guidelines and bans on certain synthetic compounds, companies are innovating bio-based emollients that offer the same performance while being environmentally friendly. Ingredients derived from coconut oil, jojoba oil, and shea butter are gaining popularity.

In addition to environmental concerns, clean beauty trends are also influencing market growth. Consumers prefer paraben-free, sulfate-free, and silicone-free formulations, further boosting demand for plant-derived emollients. Brands that emphasize transparency, sustainability, and ethical sourcing are gaining a competitive edge.

Moreover, major cosmetic companies such as L’Oréal, Unilever, Estée Lauder and Procter & Gamble are investing in green chemistry to develop high-performance, biodegradable esters that ensure product stability and luxurious skin feel without harming the ecosystem. This trend is expanding the market scope, encouraging collaborations between cosmetic brands and raw material suppliers.

As sustainability remains a key priority, the emollient esters market is set for continuous growth, driven by evolving consumer preferences, regulatory pressures, and technological innovations in natural ingredient formulation.

For instance,

- According to C and A Healthcare Pvt Ltd, Possum's Body Lotion - Coconut & Vanilla contains shea butter, coconut oil, and vitamin E, highlighting the growing trend of bio-based emollients in skincare. This product exemplifies the shift towards natural, eco-friendly formulations, aligning with the increasing consumer demand for sustainable and moisturizing ingredients in lotions, creams, and personal care products

- According to Vanalaya, its Cocoa Butter & Shea Butter Moisturizing Lotion contains shea butter, coconut oil, and vitamin E, reflecting the growing demand for bio-based emollients in skincare. This product showcases the shift toward natural, eco-friendly formulations, catering to consumers seeking sustainable, deeply moisturizing ingredients in personal care products

In September 2024, a story published by Condé Nast highlighted the rise of upcycled beauty products, which use ingredients such as apple peels and coffee grounds, reflecting the growing demand for biodegradable and sustainable cosmetics. This trend is driving brands to adopt eco-friendly formulations, aligning with consumer preferences for natural, plant-based alternatives in skincare and personal care products

The emollient esters market is growing due to rising demand for biodegradable, plant-based cosmetic ingredients. Consumers prefer eco-friendly, clean beauty products, driving innovation in bio-based emollients from sources such as coconut and jojoba oil. Regulatory pressures and green chemistry advancements further boost market expansion and industry collaborations.

- Innovation in Multifunctional Esters

As consumers demand high-performance skincare products moisturizer, sunscreen and cleanser others, cosmetic brands such as L’Oréal, Unilever, Estée Lauder and Procter & Gamble are incorporating versatile emollient esters that provide moisturization, texture enhancement, and sensory appeal in a single ingredient.

Multifunctional esters improve skin hydration, spreadability, and product stability, making them essential in lotions, serums, sunscreens, and hair care formulations. Manufacturers are developing bio-based esters that not only replace synthetic alternatives but also deliver antioxidant, anti-aging, and UV protection properties. This innovation allows brands to create clean-label, high-efficacy products that meet growing consumer expectations for sustainable and multifunctional beauty solutions.

In addition, the rise of hybrid skincare and makeup products has further fueled demand for multifunctional esters. LexFeel N5 INOLEX, Sensolene (Hallstar, Lipex SheaLight AAK, ECOCERT-Certified Coco-Caprylate/Caprate and Heliofeel Lucas Meyer Cosmetics esters help in formulating long-lasting, lightweight, and non-greasy products while maintaining natural, eco-friendly credentials. With increasing regulatory restrictions on silicones and petrochemical-based emollients, green chemistry advancements are driving the adoption of plant-derived, biodegradable esters that offer similar or superior performance.

The ongoing R&D in ester technology is expanding market potential by enabling customized formulations tailored to specific skin types and consumer needs. As innovation continues, multifunctional emollient esters are set to play a key role in shaping the future of sustainable, high-performance personal care products, making them a lucrative opportunity for industry growth.

For instance,

- In April 2024, an article published by Advancion Corporation stated that its new bio-based multifunctional amino alcohol enhances skin hydration, spreadability, and product stability in lotions, serums, sunscreens, and hair care products. With antioxidant, anti-aging, and UV protection properties, this innovation supports clean-label, high-efficacy formulations, meeting consumer demand for sustainable and multifunctional beauty solutions in personal care products

- In February 2025, an article published by Dotdash Meredith stated that Versed Skincare launched the Skin Solution Multi-Serum Skin Tint, a hybrid product combining serum, foundation, and SPF 40. This innovation reflects the growing demand for multifunctional esters, enabling long-lasting, lightweight, and eco-friendly formulations that align with consumer preferences for sustainable, high-performance beauty products

According to Ruby’s Organics, its Moisturizing Primer features a silicone-free, antioxidant-rich formula with hyaluronic acid and bakuchiol, providing hydration while prolonging makeup wear. This product exemplifies the shift toward plant-derived, biodegradable esters, catering to consumer demand for eco-friendly, multifunctional beauty solutions in skincare and makeup formulations

The emollient esters market is growing due to multifunctional esters that enhance moisturization, stability, and sensory appeal in cosmetics. Rising demand for sustainable, high-performance formulations is driving innovation in bio-based, biodegradable esters. Advancements in green chemistry and hybrid skincare trends are expanding market opportunities for eco-friendly personal care products.

Restraints/Challenges

- Intense Competition From Alternative Emollients

As the demand for natural, sustainable, and high-performance skincare ingredients grows, various alternative emollients such as plant-based oils, butters, and silicone substitutes are gaining traction in the beauty and personal care industry.

Many cosmetic brands such as L’Oréal, Unilever, Estée Lauder and Procter & Gamble are experimenting with bio-based oils such as argan, jojoba, and coconut oil, which offer similar moisturizing and skin-conditioning properties as emollient esters. In addition, new-age plant-derived silicones and synthetic-free emollients are emerging as viable replacements for traditional ester-based formulations, appealing to brands focused on clean beauty and transparency.

Another challenge comes from cost-effectiveness and performance efficiency. Some alternative emollients provide enhanced stability, improved skin feel, and better penetration, making them attractive options for formulators. Moreover, with regulatory restrictions on certain ester compounds and growing consumer awareness about ingredient safety, brands are actively looking for non-toxic, allergen-free alternatives.

To maintain market relevance, emollient ester manufacturers are investing in research and innovation, focusing on biodegradable, multifunctional esters that provide better absorption, longevity, and eco-friendly benefits. Strategic collaborations with cosmetic brands, alongside the development of customized solutions for different skin types, can help counterbalance the competitive pressure.

As alternative emollients continue to evolve, the emollient esters market must adapt by enhancing performance, sustainability, and versatility to secure long-term market growth.

For instance,

- In February 2025, an article published by Dotdash, Meredith highlighted that Sofie Pavitt’s Omega Rich Moisturizer features argan and jojoba oils, offering deep hydration while remaining non-comedogenic. This product exemplifies the growing use of bio-based oils as alternatives to emollient esters, aligning with the clean beauty trend and consumer demand for natural, skin-conditioning ingredients in skincare formulations

- According to SOCRI S.r.l., SILGREEN is a 100% plant-derived silicone alternative that offers a dry, silky texture without synthetic silicones. This innovation reflects the rising demand for synthetic-free emollients, providing a sustainable, eco-friendly solution for cosmetic formulations while aligning with the clean beauty movement and consumer preference for natural ingredients

The emollient esters market faces growing competition from alternative emollients such as plant-based oils and silicone substitutes, affecting market share. With cost-efficiency, performance advantages, and regulatory shifts, brands seek non-toxic, sustainable alternatives. To stay competitive, manufacturers focus on biodegradable, multifunctional esters, innovation, and strategic collaborations for long-term growth.

- Complex Regulatory Compliance

The emollient esters market faces a significant challenge due to complex regulatory compliance, which creates high barriers for new entrants. Governments and regulatory bodies worldwide have strict guidelines on ingredient safety, environmental impact, and product labeling, making it difficult for new companies to enter the market.

One of the biggest hurdles is ingredient approval. Emollient esters used in skincare and personal care products must meet stringent safety standards set by organizations such as the FDA (U.S.), REACH (Europe), and other North America regulatory agencies. These approvals require extensive testing, documentation, and compliance with evolving regulations, leading to delays and increased costs for new businesses.

Another challenge is sustainability and environmental impact regulations. Many countries are enforcing restrictions on synthetic ingredients, microplastics, and non-biodegradable compounds, pushing companies to invest in eco-friendly alternatives. However, developing biodegradable, plant-based esters that meet performance standards while complying with regulations requires significant research and development (R&D) investments, making it harder for smaller players to compete.

In addition, regulations related to labeling, marketing claims, and product transparency are becoming stricter. Brands must accurately disclose ingredients, sustainability claims, and product efficacy, ensuring compliance with clean beauty standards and consumer safety laws. Any non-compliance can lead to product recalls, fines, or bans, posing a risk to new entrants.

For instances,

- In February 2022, according to the U.S. FDA, cosmetic products and ingredients (except color additives) do not require premarket approval. However, companies must ensure product safety, meeting stringent standards. This regulatory requirement increases testing, documentation, and compliance costs, posing challenges for new businesses entering the emollient esters market and the broader skincare industry

- According to an article published by the Financial Times, the European Chemicals Agency (ECHA) found that many cosmetics sold in the European Union contain toxic substances such as PFAS, leading to stricter regulations. This shift forces companies to invest in biodegradable, plant-based alternatives, increasing R&D costs and making market entry more challenging for smaller players

Strict regulatory compliance in the emollient esters market creates high barriers for new entrants. Ingredient approvals, sustainability regulations, and strict labeling laws demand extensive testing and R&D investments. Non-compliance risks fines or bans, making it crucial for companies to prioritize regulatory expertise, eco-friendly innovation, and transparency to compete effectively.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

North America Emollient Esters Market Scope

The market is segmented on the basis of product, purity, form, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Isopropyl Myristate

- Isopropyl Myristate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Isopropyl Myristate, By Grade

- Isopropyl Palmitate

- Isopropyl Palmitate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Isopropyl Palmitate, By Grade

- Methyl Myristate

- Methyl Myristate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Methyl Myristate, By Grade

- Methyl Palmitate

- Methyl Palmitate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Methyl Palmitate, By Grade

- Methyl Laurate

- Methyl Laurate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Methyl Laurate, By Grade

- Myristyl Myristate

- Methyl Myristate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Methyl Myristate, By Grade

- Caprylic / Capric Triglyceride

- Caprylic / Capric Triglyceride, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Caprylic / Capric Triglyceride, By Grade

- Octyl Myristate

- Octyl Myristate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Octyl Myristate, By Grade

- Octyl Palmitate

- Octyl Palmitate, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Octyl Palmitate, By Grade

- Other

- Other, By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Other, By Grade

Purity

- Less Than 99%

- Greater Than 99%

Form

- Liquid

- Dry

Application

- Cosmetics and Personal Care

- Cosmetics and Personal Care, By Application

- Lotions

- Sun Cream

- Makeup

- Body Washes

- Deodorants

- Others

- Cosmetics And Personal Care, By Product

- Isopropyl Myristate

- Caprylic / Capric Triglyceride

- Isopropyl Palmitate

- Octyl Palmitate

- Octyl Myristate

- Methyl Laurate

- Methyl Palmitate

- Methyl Myristate

- Myristyl Myristate

- Other

- Cosmetics and Personal Care, By Application

- Hair Care Products

- Hair Care Products, By Application

- Shampoos

- Conditioners

- Serums

- Hair Masks

- Others

- Hair Care Products, By Product

- Caprylic / Capric Triglyceride

- Isopropyl Myristate

- Isopropyl Palmitate

- Octyl Palmitate

- Octyl Myristate

- Methyl Laurate

- Methyl Palmitate

- Methyl Myristate

- Myristyl Myristate

- Other

- Hair Care Products, By Application

- Pharmaceuticals

- Pharmaceuticals, By Application

- Topical Medications

- Oral Pharmaceuticals

- Pharmaceuticals, By Product

- Caprylic / Capric Triglyceride

- Isopropyl Myristate

- Caprylic / Capric Triglyceride

- Isopropyl Palmitate

- Methyl Laurate

- Octyl Palmitate

- Octyl Myristate

- Methyl Myristate

- Methyl Palmitate

- Myristyl Myristate

- Other

- Pharmaceuticals, By Application

- Food Industry

- Food Industry, By Application

- Emulsifyers

- Flavouring Agents

- Food Preservatives

- Enzymes

- Nutraceuticals

- Probiotics

- Others

- Food Industry, By Product

- Caprylic / Capric Triglyceride

- Isopropyl Myristate

- Methyl Laurate

- Octyl Palmitate

- Methyl Palmitate

- Methyl Myristate

- Octyl Myristate

- Isopropyl Palmitate

- Myristyl Myristate

- Other

- Food Industry, By Application

- Others

- Others, By Product

- Caprylic / Capric Triglyceride

- Isopropyl Myristate

- Isopropyl Palmitate

- Octyl Palmitate

- Octyl Myristate

- Methyl Laurate

- Methyl Palmitate

- Methyl Myristate

- Myristyl Myristate

- Other

- Others, By Product

North America Emollient Esters Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product, purity, form, and application as referenced above.

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate the market due to its large consumer base, advanced manufacturing capabilities, and significant technological advancements. The government's strategic policies and investments in infrastructure and innovation further solidify its Europe market influence. In addition, China's Europe trade dominance through initiatives such as the Belt and Road Initiative expands its economic reach.

U.S. is the fastest-growing country in the market, driven by increasing consumer demand for personal care and cosmetic products, driven by rising disposable incomes and a growing middle class. In addition, the shift towards natural and organic ingredients in beauty products is boosting the market. Furthermore, advancements in formulation technologies and the popularity of skincare routines are contributing to market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Emollient Esters Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Emollient Esters Market Leaders Operating in the Market Are:

- Kao Corporation (Japan)

- Hefei TNJ Chemical Industry Co., Ltd. (China)

- PHOENIX CHEMICAL, INC (U.S.)

- ZhiShang Chemical (China)

- Rxchemicals.com (U.S.)

- Suriachem Sdn. Bhd. (Malaysia)

- Haihang Industry (China)

- ATAMAN KIMYA (Turkey)

- Matangi Industries (India)

- EMCO DYESTUFF (India)

- SIHAULI CHEMICALS PRIVATE LIMITED (India)

- Baoran (China)

- Mohini Organics Pvt. Ltd. (India)

- Gravity Chemicals (India)

Latest Developments in North America Emollient Esters Market

- In February 2023, Kao announces the launch of Bioré UV Aqua Rich Airy Hold Cream, a new skincare product offering high-level UV protection. This cream is designed to protect the skin from sun damage while providing a lightweight, breathable feel, making it ideal for everyday use without heaviness. The key benefit is its ability to deliver effective sun protection while keeping the skin feeling fresh and comfortable. Exclusively available at selected outlets, the product offers an advanced sun care solution that combines both protection and comfort, catering to consumers seeking lightweight, high-performance skincare.

- In February 2023, Kao announces a new global campaign for Bioré UV, in collaboration with K-pop group Stray Kids, titled "SUNLIGHT IS YOUR SPOTLIGHT." The campaign aims to raise awareness about the importance of sun protection while promoting Bioré UV products. It encourages people to embrace sun care as part of an active lifestyle, highlighting the brand’s effective UV protection. The key benefit of this campaign is educating consumers on the significance of skincare and UV protection in daily routines, using the influence of Stray Kids to reach a wider, global audience.

- In August 2022, Kao announces its acquisition of Bondi Sands, an Australian brand renowned for its self-tanning and sun care products. This acquisition aims to expand Kao’s presence in the global skincare and sun care market, enhancing its portfolio with high-quality tanning solutions. The key benefit of this acquisition is the addition of Bondi Sands’ popular products, allowing Kao to better cater to consumers seeking sun-kissed skin and effective sun protection. This move strengthens Kao's position in the growing self-tanning and sun care segments, providing more options for skincare enthusiasts worldwide.

- In November 2023, Haihang Industry participated in Chemspec Europe 2024, held at the Düsseldorf Exhibition Center in Germany from June 19th to 20th. This event marked the 37th International Exhibition for Fine and Specialty Chemicals. At Booth No. C17, Haihang showcased over 60 of their latest chemical products, including cosmetic ingredients, biocide raw materials, pigment and dye raw materials, and intermediate products. During the exhibition, Haihang hosted 89 customers, providing product brochures, souvenirs, and customer gifts to showcase their industry expertise and commitment to quality service, fostering strong business relationships. They engaged with peers from the global chemical industry, exploring the latest market trends and technological advancements.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VALUE CHAIN ANALYSIS: NORTH AMERICA EMOLLIENT ESTERS MARKET

4.6 VENDOR SELECTION CRITERIA

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 GO TO MARKET STRATEGY

4.9 IMPORT EXPORT SCENARIO

4.9.1 OVERVIEW

4.9.2 PRODUCTION AND EXPORT DYNAMICS

4.9.2.1 ASIA-PACIFIC: THE PRODUCTION HUB

4.9.2.2 EXPORT TRENDS

4.9.3 CONSUMPTION AND IMPORT DYNAMICS

4.9.3.1 NORTH AMERICA AND EUROPE: THE MAJOR CONSUMERS

4.9.3.2 IMPORT TRENDS

4.9.4 KEY TRADE FLOWS

4.9.5 CHALLENGES AND OPPORTUNITIES

4.9.5.1 CHALLENGES

4.9.5.2 OPPORTUNITIES

4.9.6 CONCLUSION

4.1 IMPACT OF TRADE POLICIES ON THE EMOLLIENT ESTERS MARKET

4.10.1 COMPLEX SUPPLY CHAINS AND NORTH AMERICA TRADE DEPENDENCIES

4.10.1.1 TARIFFS, IMPORT DUTIES, AND THEIR IMPLICATIONS

4.10.1.2 REGULATORY CHALLENGES AND ENVIRONMENTAL COMPLIANCE

4.10.1.3 SHIFTING CONSUMER PREFERENCES AND MARKET ADAPTATION

4.10.1.4 STRATEGIC RESPONSES AND COMPETITIVE LANDSCAPE

4.10.2 FUTURE OUTLOOK AND CONCLUSION

4.11 IMPACT OF TRADE POLICIES ON THE EMOLLIENT ESTERS MARKET

4.11.1 COMPLEX SUPPLY CHAINS AND NORTH AMERICA TRADE DEPENDENCIES

4.11.2 TARIFFS, IMPORT DUTIES, AND THEIR IMPLICATIONS

4.11.3 REGULATORY CHALLENGES AND ENVIRONMENTAL COMPLIANCE

4.11.4 SHIFTING CONSUMER PREFERENCES AND MARKET ADAPTATION

4.11.5 STRATEGIC RESPONSES AND COMPETITIVE LANDSCAPE

4.11.6 FUTURE OUTLOOK AND CONCLUSION

4.12 MANUFACTURING PATTERNS IN THE NORTH AMERICA EMOLLIENT ESTERS MARKET: TRENDS, CHALLENGES, AND INNOVATIONS

4.12.1 INTRODUCTION

4.12.1.1 NORTH AMERICA MANUFACTURING LANDSCAPE: KEY REGIONS AND PLAYERS

4.12.2 MANUFACTURING PROCESSES AND TECHNOLOGIES

4.12.3 RAW MATERIAL SOURCING AND SUPPLY CHAIN DYNAMICS

4.12.4 INNOVATIONS AND MARKET TRENDS

4.12.5 CONCLUSION

4.13 PRICING ANALYSIS

4.14 PROFIT MARGIN ANALYSIS

4.14.1 MARKET SIZE AND GROWTH

4.14.2 REVENUE STREAMS

4.14.3 COST STRUCTURE

4.14.4 REGIONAL PROFITABILITY

4.14.5 COMPETITIVE LANDSCAPE

4.14.6 REGULATORY IMPACT

4.15 RAW MATERIAL COVERAGE OF EMOLLIENT ESTERS

4.16 SUPPLY CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 LOGISTIC COST SCENARIO

4.16.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.17 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS IN EMOLLIENT ESTERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANDING PHARMACEUTICAL & DERMATOLOGY APPLICATIONS

6.1.2 GROWING DEMAND FOR PERSONAL CARE & COSMETICS

6.1.3 RISING DISPOSABLE INCOME & CHANGING LIFESTYLES

6.2 RESTRAINTS

6.2.1 VARIATIONS IN RAW MATERIAL PRICES AFFECT THE STABILITY OF PRODUCTION COSTS

6.2.2 STRINGENT REGULATORY POLICIES RESTRICT PRODUCT FORMULATIONS AND APPROVALS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR BIODEGRADABLE AND SUSTAINABLE COSMETIC INGREDIENTS

6.3.2 INNOVATION IN MULTIFUNCTIONAL ESTERS ENHANCES MARKET GROWTH POTENTIAL

6.4 CHALLENGES

6.4.1 INTENSE COMPETITION FROM ALTERNATIVE EMOLLIENTS AFFECTS MARKET SHARE

6.4.2 COMPLEX REGULATORY COMPLIANCE INCREASES BARRIERS FOR NEW ENTRANTS

7 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 ISOPROPYL MYRISTATE

7.2.1 ISOPROPYL MYRISTATE, BY GRADE

7.3 ISOPROPYL PALMITATE

7.3.1 ISOPROPYL PALMITATE, BY GRADE

7.4 METHYL MYRISTATE

7.4.1 METHYL MYRISTATE, BY GRADE

7.5 METHYL PALMITATE

7.5.1 METHYL PALMITATE, BY GRADE

7.6 METHYL LAURATE

7.6.1 METHYL LAURATE, BY GRADE

7.7 MYRISTYL MYRISTATE

7.7.1 MYRISTYL MYRISTATE, BY GRADE

7.8 CAPRYLIC / CAPRIC TRIGLYCERIDE

7.8.1 CAPRYLIC / CAPRIC TRIGLYCERIDE, BY GRADE

7.9 OCTYL MYRISTATE

7.9.1 OCTYL MYRISTATE, BY GRADE

7.1 OCTYL PALMITATE

7.10.1 OCTYL PALMITATE, BY GRADE

7.11 OTHERS

7.11.1 OTHERS, BY GRADE

8 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PURITY

8.1 OVERVIEW

8.2 LESS THAN 99%

8.3 GREATER THAN 99%

9 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

10 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 COSMETICS AND PERSONAL CARE

10.3 HAIR CARE PRODUCTS

10.4 PHARMACEUTICALS

10.5 FOOD INDUSTRY

10.6 OTHERS

11 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 EMOLLIENT ESTERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 KAO CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 HEFEI TNJ CHEMICAL INDUSTRY CO.,LTD.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 PHOENIX CHEMICAL, INC

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ZHISHANGCHEM

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 RXCHEMICALS.COM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ATAMAN KIMYA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BAORANCHEMICAL

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EMCO DYESTUFF

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ESTEEM INDUSTRIES PRIVATE LIMIT

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 GRAVITY CHEMICALS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 HAIHANG INDUSTRY

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT NEWS

14.12 MOHINI ORGANICS PVT. LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MATANGI INDUSTRIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 SIHAULI CHEMICALS PRIVATE LIMITED.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SURIACHEM SDN.BHD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 TABLE 1 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 2 REGULATORY COVERAGE

TABLE 3 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 4 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 5 NORTH AMERICA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 6 NORTH AMERICA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 7 NORTH AMERICA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 8 NORTH AMERICA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 9 NORTH AMERICA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 NORTH AMERICA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 11 NORTH AMERICA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 12 NORTH AMERICA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 13 NORTH AMERICA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 14 NORTH AMERICA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 15 NORTH AMERICA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 16 NORTH AMERICA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 17 NORTH AMERICA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 18 NORTH AMERICA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 19 NORTH AMERICA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 20 NORTH AMERICA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 21 NORTH AMERICA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 22 NORTH AMERICA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 23 NORTH AMERICA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 24 NORTH AMERICA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 25 NORTH AMERICA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 26 NORTH AMERICA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 27 NORTH AMERICA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 28 NORTH AMERICA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 29 NORTH AMERICA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 30 NORTH AMERICA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 NORTH AMERICA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 32 NORTH AMERICA OTHERS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 33 NORTH AMERICA OTHER IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 34 NORTH AMERICA OTHERS IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 35 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 36 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 37 NORTH AMERICA LESS THAN 99% IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 38 NORTH AMERICA LESS THAN 99% IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 NORTH AMERICA GREATER THAN 99% IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 40 NORTH AMERICA GREATER THAN 99% IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 41 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 42 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 43 NORTH AMERICA LIQUID IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 44 NORTH AMERICA LIQUID IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 45 NORTH AMERICA LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 46 NORTH AMERICA DRY IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 47 NORTH AMERICA DRY IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 48 NORTH AMERICA DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 49 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 50 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 51 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 52 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 53 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 54 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 56 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 57 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 58 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 59 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 60 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 61 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 62 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 63 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 64 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 65 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 66 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 67 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 68 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 69 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 70 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 71 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 72 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 73 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 74 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 75 NORTH AMERICA OTHERS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (USD)

TABLE 76 NORTH AMERICA OTHERS IN EMOLLIENT ESTERS MARKET, BY REGION, 2018-2032 (TONS)

TABLE 77 NORTH AMERICA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 78 NORTH AMERICA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 79 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY COUNTRY, 2018-2032 (USD)

TABLE 80 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 81 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 82 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 83 NORTH AMERICA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 84 NORTH AMERICA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 85 NORTH AMERICA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 86 NORTH AMERICA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 87 NORTH AMERICA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 88 NORTH AMERICA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 89 NORTH AMERICA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 90 NORTH AMERICA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 91 NORTH AMERICA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 92 NORTH AMERICA OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 93 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 94 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 95 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 96 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 97 NORTH AMERICA LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 98 NORTH AMERICA DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 99 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 100 NORTH AMERICA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 101 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 102 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 103 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 104 NORTH AMERICA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 105 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 106 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 107 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 108 NORTH AMERICA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 109 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 110 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 111 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 112 NORTH AMERICA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 113 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 114 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 115 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 116 NORTH AMERICA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 117 NORTH AMERICA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 118 NORTH AMERICA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 119 U.S. EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 120 U.S. EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 121 U.S. ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 122 U.S. ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 123 U.S. METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 124 U.S. METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 125 U.S. METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 126 U.S. MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 127 U.S. CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 128 U.S. OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 129 U.S. OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 130 U.S. OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 131 U.S. EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 132 U.S. EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 133 U.S. EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 134 U.S. EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 135 U.S. LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 136 U.S. DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 137 U.S. EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 138 U.S. EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 139 U.S. COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 140 U.S. COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 141 U.S. COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 142 U.S. COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 143 U.S. HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 144 U.S. HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 145 U.S. HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 146 U.S. HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 147 U.S. PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 148 U.S. PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 149 U.S. PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 150 U.S. PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 151 U.S. FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 152 U.S. FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 153 U.S. FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 154 U.S. FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 155 U.S. OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 156 U.S. OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 157 CANADA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 158 CANADA EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 159 CANADA ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 160 CANADA ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 161 CANADA METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 162 CANADA METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 163 CANADA METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 164 CANADA MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 165 CANADA CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 166 CANADA OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 167 CANADA OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 168 CANADA OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 169 CANADA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 170 CANADA EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 171 CANADA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 172 CANADA EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 173 CANADA LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 174 CANADA DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 175 CANADA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 176 CANADA EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 177 CANADA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 178 CANADA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 179 CANADA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 180 CANADA COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 181 CANADA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 182 CANADA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 183 CANADA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 184 CANADA HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 185 CANADA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 186 CANADA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 187 CANADA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 188 CANADA PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 189 CANADA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 190 CANADA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 191 CANADA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 192 CANADA FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 193 CANADA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 194 CANADA OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 195 MEXICO EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 196 MEXICO EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 197 MEXICO ISOPROPYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 198 MEXICO ISOPROPYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 199 MEXICO METHYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 200 MEXICO METHYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 201 MEXICO METHYL LAURATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 202 MEXICO MYRISTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 203 MEXICO CAPRYLIC / CAPRIC TRIGLYCERIDE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 204 MEXICO OCTYL MYRISTATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 205 MEXICO OCTYL PALMITATE IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 206 MEXICO OTHER IN EMOLLIENT ESTERS MARKET, BY GRADE, 2018-2032 (USD)

TABLE 207 MEXICO EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (USD)

TABLE 208 MEXICO EMOLLIENT ESTERS MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 209 MEXICO EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 210 MEXICO EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (TONS)

TABLE 211 MEXICO LIQUID IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 212 MEXICO DRY IN EMOLLIENT ESTERS MARKET, BY FORM, 2018-2032 (USD)

TABLE 213 MEXICO EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 214 MEXICO EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 215 MEXICO COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 216 MEXICO COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 217 MEXICO COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 218 MEXICO COSMETICS AND PERSONAL CARE IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 219 MEXICO HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 220 MEXICO HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 221 MEXICO HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 222 MEXICO HAIR CARE PRODUCTS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 223 MEXICO PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 224 MEXICO PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 225 MEXICO PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 226 MEXICO PHARMACEUTICALS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 227 MEXICO FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 228 MEXICO FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 229 MEXICO FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 230 MEXICO FOOD INDUSTRY IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 231 MEXICO OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (USD)

TABLE 232 MEXICO OTHERS IN EMOLLIENT ESTERS MARKET, BY PRODUCT, 2018-2032 (TONS)

List of Figure

FIGURE 1 NORTH AMERICA EMOLLIENT ESTERS MARKET

FIGURE 2 NORTH AMERICA EMOLLIENT ESTERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA EMOLLIENT ESTERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA EMOLLIENT ESTERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA EMOLLIENT ESTERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA EMOLLIENT ESTERS MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA EMOLLIENT ESTERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA EMOLLIENT ESTERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA EMOLLIENT ESTERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA EMOLLIENT ESTERS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA EMOLLIENT ESTERS MARKET: SEGMENTATION

FIGURE 12 TEN SEGMENTS COMPRISE THE NORTH AMERICA EMOLLIENT ESTERS MARKET, BY PRODUCT

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING AWARENESS OF SUSTAINABLE MATERIALS IS EXPECTED TO DRIVE THE NORTH AMERICA EMOLLIENT ESTERS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE ISOPROPYL MYRISTATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA EMOLLIENT ESTERS MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS OF THE NORTH AMERICA EMOLLIENT ESTERS MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA EMOLLIENT ESTERS MARKET

FIGURE 24 NORTH AMERICA EMOLLIENT ESTERS MARKET: BY PRODUCT, 2024

FIGURE 25 NORTH AMERICA EMOLLIENT ESTERS MARKET: BY PURITY, 2024

FIGURE 26 NORTH AMERICA EMOLLIENT ESTERS MARKET: BY FORM, 2024

FIGURE 27 NORTH AMERICA EMOLLIENT ESTERS MARKET: BY APPLICATION, 2024

FIGURE 28 NORTH AMERICA EMOLLIENT ESTERS MARKET: SNAPSHOT (2024)

FIGURE 29 NORTH AMERICA EMOLLIENT ESTERS MARKET: COMPANY SHARE 2024 (%)

North America Emollient Esters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Emollient Esters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Emollient Esters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.