North America Endotoxin And Pyrogen Testing Market

Market Size in USD Billion

CAGR :

%

USD

1,262.52 Billion

USD

2,628.58 Billion

2025

2033

USD

1,262.52 Billion

USD

2,628.58 Billion

2025

2033

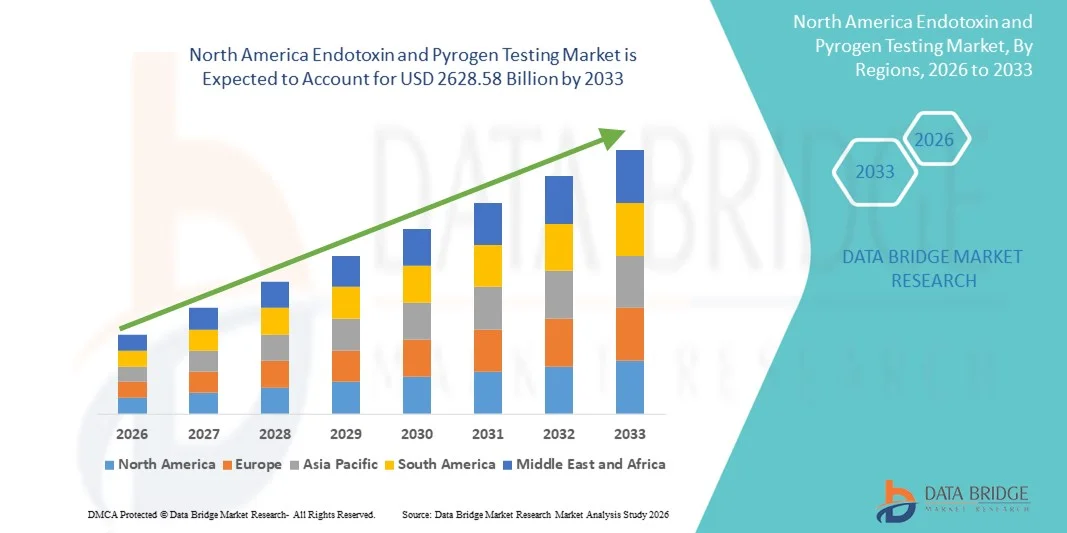

| 2026 –2033 | |

| USD 1,262.52 Billion | |

| USD 2,628.58 Billion | |

|

|

|

|

North America Endotoxin and Pyrogen Testing Market Size

- The North America endotoxin and pyrogen testing market size was valued at USD 1262.52 billion in 2025 and is expected to reach USD 2628.58 billion by 2033, at a CAGR of9.60% during the forecast period

- The market growth is largely fueled by the increasing emphasis on patient safety, stringent regulatory requirements, and rising quality control standards across pharmaceutical, biotechnology, and medical device manufacturing, leading to greater adoption of reliable endotoxin and pyrogen testing solutions in both clinical and industrial settings

- Furthermore, growing demand for rapid, accurate, and compliant testing methods—along with advancements in recombinant and alternative pyrogen testing technologies—is positioning endotoxin and pyrogen testing as a critical component of modern quality assurance systems, thereby significantly boosting the industry’s overall growth

North America Endotoxin and Pyrogen Testing Market Analysis

- Endotoxin and pyrogen testing solutions play a critical role in ensuring the safety of pharmaceutical products, biologics, and medical devices, as they help detect harmful bacterial toxins that can cause adverse patient reactions, making them an essential part of quality control and regulatory compliance in both clinical and industrial environments

- The growing demand for endotoxin and pyrogen testing is primarily driven by stricter regulatory guidelines, increasing production of injectable drugs and biologics, and rising awareness regarding patient safety, along with a gradual shift toward advanced and animal-free testing methods such as recombinant factor C (rFC) assays

- The U.S. dominated the endotoxin and pyrogen testing market with the largest revenue share of approximately 41.8% in 2025, driven by its strong pharmaceutical and biotechnology manufacturing ecosystem, high concentration of FDA-regulated facilities, robust R&D investments, and widespread adoption of advanced endotoxin and pyrogen testing technologies across drug, biologics, and medical device production

- Canada is expected to be the fastest growing country in the endotoxin and pyrogen testing market during the forecast period, registering an estimated CAGR of around 7.9%, supported by expanding biologics and vaccine manufacturing capacity, increasing government support for life sciences, rising outsourcing to contract testing organizations, and growing alignment with global quality and safety regulatory standards

- The Large Group segment dominated the market with a revenue share of 48.3% in 2025, driven by established healthcare institutions and large pharmaceutical organizations that require bulk procurement to meet high-volume testing demands

Report Scope and Endotoxin and Pyrogen Testing Market Segmentation

|

Attributes |

Endotoxin and Pyrogen Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

• Charles River Laboratories (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Endotoxin and Pyrogen Testing Market Trends

Rising Adoption of Advanced Endotoxin and Pyrogen Detection Methods

- A significant and accelerating trend in the Endotoxin and Pyrogen Testing market is the increasing adoption of advanced detection methods, including rapid microbiological testing and recombinant factor C (rFC) assays, to improve testing accuracy and turnaround time

- For instance, in 2023, several pharmaceutical manufacturers in Brazil expanded the use of recombinant factor C–based endotoxin testing to comply with global regulatory expectations while reducing reliance on traditional LAL testing

- Laboratories across the region are focusing on improving testing efficiency and sensitivity to ensure product safety in pharmaceuticals, biologics, and medical devices

- The shift toward alternative and sustainable testing methods is also gaining traction due to ethical concerns and regulatory encouragement

- This trend is reshaping quality control practices in South America, supporting safer drug production and export readiness for international markets

North America Endotoxin and Pyrogen Testing Market Dynamics

Driver

Growing Pharmaceutical and Biologics Manufacturing Activities

- The steady expansion of pharmaceutical, biotechnology, and medical device manufacturing activities across South America, in alignment with global production trends, is a key driver accelerating demand for endotoxin and pyrogen testing solutions

- For instance, in 2024, a leading Brazilian biologics manufacturer expanded its in-house endotoxin testing capabilities to support large-scale production of injectable vaccines and biosimilars intended for both domestic use and international markets

- Globally harmonized regulatory requirements emphasizing sterility assurance and patient safety mandate routine endotoxin and pyrogen testing throughout drug development, clinical manufacturing, and commercial production stages

- Increasing public and private investments in healthcare infrastructure, life sciences research, and localized pharmaceutical manufacturing across emerging and developed economies are further strengthening the demand for reliable and validated testing solutions

- The rising export of pharmaceutical and biologic products from North America to regulated markets such as North America and Europe necessitates strict compliance with international quality and safety standards, thereby reinforcing the adoption of endotoxin and pyrogen testing protocols

Restraint/Challenge

High Testing Costs and Limited Technical Expertise

- The high capital and operational costs associated with advanced endotoxin and pyrogen testing systems continue to pose a significant restraint, particularly for small- and mid-sized laboratories in North America and other cost-sensitive regions globally

- For instance, several contract testing laboratories in Argentina have reported delays in adopting rapid and alternative testing technologies due to budget constraints, high equipment costs, and ongoing maintenance expenses

- A limited availability of skilled and trained professionals capable of performing, validating, and interpreting complex endotoxin and pyrogen tests further restricts broader market penetration

- Differences in regulatory enforcement and testing guidelines across countries create challenges in achieving standardized testing practices, especially for manufacturers operating across multiple global markets

- Overcoming these challenges through the development of cost-effective testing solutions, expanded workforce training initiatives, and greater international regulatory harmonization will be essential to support sustained growth of the global endotoxin and pyrogen testing market

North America Endotoxin and Pyrogen Testing Market Scope

The market is segmented on the basis of product type, test type, application, method, mode of purchase, end product, and end user.

- By Product Type

On the basis of product type, the Endotoxin and Pyrogen Testing market is segmented into detection kits & reagents, instruments, systems and softwares, endotoxin testing services, and consumables & accessories. The detection kits & reagents segment dominated the largest market revenue share of 41.6% in 2025, primarily due to its essential and recurring usage across pharmaceutical, biotechnology, and medical device manufacturing processes. These products are required at multiple stages including raw material testing, in-process quality checks, and final product release testing. Regulatory authorities mandate validated kits and reagents, ensuring consistent demand regardless of production scale. The high frequency of testing in sterile manufacturing environments further increases consumption volumes. Detection kits are comparatively cost-effective, making them accessible to both large and small laboratories. Continuous innovation improving sensitivity and specificity strengthens adoption. Compatibility with multiple testing methods enhances flexibility. Global expansion of injectable drug manufacturing supports demand growth. Rising biologics production also contributes significantly. Established supplier networks ensure uninterrupted availability. Strong regulatory dependence secures long-term dominance.

The systems and softwares segment is anticipated to witness the fastest growth at a CAGR of 19.1% from 2026 to 2033, driven by the rapid adoption of laboratory automation and digital compliance tools. Pharmaceutical manufacturers increasingly prioritize automated solutions to minimize human error and improve testing efficiency. Software platforms support data integrity, audit trails, and regulatory documentation. Integration with LIMS systems enhances operational transparency. Growing emphasis on smart laboratories accelerates adoption. Large manufacturers invest heavily in digital transformation. Automation reduces turnaround time for batch release. Regulatory inspections increasingly favor digital records. Cloud-based systems improve scalability. Demand is especially strong among CMOs. Rising investment in advanced quality systems supports sustained growth.

- By Test Type

On the basis of test type, the Endotoxin and Pyrogen Testing market is segmented into Limulus Amoebocyte Lysate (LAL) test, TAL test, monocyte activation test (MAT), rabbit pyrogen test, and recombinant factor C (RFC) assay. The LAL test segment held the largest market revenue share of 47.3% in 2025, owing to its long-standing regulatory acceptance across the U.S., Europe, and Asia. The test is widely used for injectable drugs, vaccines, and implantable medical devices. Its proven reliability and sensitivity drive continued preference. Availability in gel clot, chromogenic, and turbidimetric formats enhances versatility. Pharmaceutical companies rely on LAL for routine batch testing. Established protocols reduce validation complexity. Strong historical data supports compliance. Supplier availability ensures consistent access. High familiarity among laboratory professionals strengthens dominance. Cost-effectiveness compared to newer methods aids adoption. Global harmonization of standards supports usage.

The recombinant factor C (RFC) assay segment is expected to grow at the fastest CAGR of 22.6% from 2026 to 2033, fueled by the global shift toward animal-free testing methods. Ethical concerns regarding horseshoe crab harvesting drive adoption. Regulatory agencies increasingly support alternative methods. RFC offers higher specificity and reproducibility. Reduced variability improves result consistency. Biopharmaceutical manufacturers prefer RFC for advanced therapies. Improved assay performance increases confidence. Technological advancements enhance sensitivity. Sustainability initiatives accelerate demand. Growing regulatory endorsements strengthen adoption. Expansion of biologics pipelines supports growth. Long-term ecological benefits reinforce market acceptance.

- By Application

On the basis of application, the Endotoxin and Pyrogen Testing market is segmented into pharmaceutical manufacturing, medical device manufacturing, raw materials production, and packaging manufacture. The pharmaceutical manufacturing segment dominated the market with a revenue share of 44.8% in 2025, driven by strict sterility and endotoxin control requirements. Endotoxin testing is mandatory throughout drug development and commercialization. High production volumes increase testing frequency. Growth in injectable and biologic drugs sustains demand. Regulatory inspections enforce compliance. Batch release protocols require validated testing. Expansion of global pharmaceutical manufacturing facilities boosts adoption. Continuous process monitoring increases test usage. Strong regulatory oversight ensures sustained dominance. Large-scale operations drive volume demand. Investment in quality assurance strengthens usage.

The medical device manufacturing segment is projected to grow at the fastest CAGR of 19.8% from 2026 to 2033, due to rising production of implantable and invasive devices. Increased regulatory scrutiny mandates pyrogen testing. Global expansion of medical device exports fuels demand. Growth in minimally invasive procedures supports market expansion. Higher patient safety standards drive testing adoption. Emerging markets increase manufacturing capacity. Regulatory harmonization improves compliance requirements. Advanced materials require rigorous testing. Growing orthopedic and cardiovascular device markets support growth. Increased outsourcing to CMOs accelerates testing demand. Innovation in device design enhances testing complexity.

- By Method

On the basis of method, the Endotoxin and Pyrogen Testing market is segmented into gel clot endotoxin test, chromogenic endotoxin test, and turbidimetric endotoxin test. The gel clot endotoxin test segment accounted for the largest revenue share of 39.5% in 2025, due to its simplicity and regulatory acceptance. The method requires minimal instrumentation. It is cost-effective for routine testing. Widely used in small and mid-sized laboratories. Qualitative results meet basic compliance needs. Long validation history supports trust. Easy interpretation strengthens adoption. Suitable for low-volume testing. Minimal training requirements benefit labs. Consistent performance ensures reliability. Broad regulatory recognition sustains dominance.

The chromogenic endotoxin test segment is expected to grow at the fastest CAGR of 20.9% from 2026 to 2033, driven by demand for quantitative and high-sensitivity testing. Pharmaceutical companies prefer precise endotoxin measurement. Automation compatibility enhances throughput. Suitable for complex biologics. Improved accuracy supports regulatory compliance. High reproducibility reduces variability. Increasing biologics production accelerates adoption. Integration with automated systems boosts efficiency. Advanced formulations require sensitive detection. Growth in large-scale manufacturing supports demand. Technological improvements enhance performance.

- By Mode of Purchase

On the basis of mode of purchase, the Endotoxin and Pyrogen Testing market is segmented into Large Group, Mid and Small Group, and Individual. The Large Group segment dominated the market with a revenue share of 48.3% in 2025, driven by established healthcare institutions and large pharmaceutical organizations that require bulk procurement to meet high-volume testing demands. Large groups benefit from long-term supplier contracts, economies of scale, and streamlined validation processes. Centralized quality control operations and continuous production cycles necessitate frequent testing. Strong regulatory compliance and routine audits reinforce testing adoption. High investment capacity enables access to advanced testing technologies. Integration with internal laboratories enhances efficiency and accuracy. The segment also sees consistent demand from multinational companies with global operations. Established SOPs and quality management systems strengthen dominance.

The Individual segment is expected to witness the fastest CAGR of 19.4% from 2026 to 2033, driven by growing adoption among small biotech firms, startups, and research institutes. Individuals increasingly seek outsourcing options to reduce capital expenditure. The rising number of clinical trials conducted by smaller entities fuels demand. Adoption is accelerated by flexible service models and on-demand testing. Increased regulatory awareness ensures compliance-driven testing. Expansion of biologics and cell & gene therapy pipelines in small organizations supports growth. Access to digital ordering and streamlined reporting enhances appeal. Emerging markets and startup growth further contribute to market expansion. Individual clients often leverage CRO/CMO services, boosting testing frequency.

- By End Product

On the basis of end product, the Endotoxin and Pyrogen Testing market is segmented into Vaccines and/or Cell & Gene Therapy (CGT), Biologics, Injectables, and Others. The Biologics segment dominated the market with a revenue share of 42.6% in 2025, supported by the widespread use of biologics in therapeutic applications and stringent regulatory requirements for sterility and endotoxin testing. Large-scale production of monoclonal antibodies, recombinant proteins, and therapeutic enzymes drives routine testing. Regulatory audits and quality assurance programs ensure frequent testing cycles. High investment in R&D and clinical trials reinforces demand. The presence of leading biotech manufacturers facilitates adoption of advanced testing methods. Biologics production requires robust quality control frameworks to prevent contamination. Established infrastructure in North America and Europe strengthens dominance. Partnerships with contract testing organizations expand reach. Market adoption is further enhanced by increasing awareness of biologics safety.

The Vaccines and/or Cell & Gene Therapy (CGT) segment is anticipated to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by the accelerated development of novel vaccines and advanced cell & gene therapies. Global health initiatives, pandemic preparedness, and rising immunization programs increase testing demand. CGT products require highly sensitive endotoxin testing due to complex manufacturing processes. Expansion of personalized medicine and targeted therapies fuels adoption. Outsourcing to CROs and specialized labs ensures compliance. Regulatory focus on advanced therapy medicinal products boosts growth. Innovation in mRNA and viral vector technologies drives volume. Emerging biotech companies actively seek high-throughput testing solutions. Increasing funding for vaccine R&D supports market expansion. Adoption of automated and rapid testing platforms accelerates efficiency.

- By End User

On the basis of end user, the Endotoxin and Pyrogen Testing market is segmented into pharmaceutical companies, biotechnology companies, biomedical companies, medical device companies, CROs, and CMOs. Pharmaceutical companies dominated the market with a revenue share of 45.7% in 2025, owing to extensive internal quality control operations. Large manufacturing volumes increase testing needs. Regulatory audits require frequent validation. Investment in in-house laboratories strengthens dominance. Continuous production cycles drive demand. High compliance standards necessitate routine testing. Expansion of biologics pipelines supports usage. Strong financial capacity enables adoption of advanced tests. Global presence increases testing scale. Established quality frameworks reinforce dominance.

The CRO and CMO segment is anticipated to grow at the fastest CAGR of 21.7% from 2026 to 2033, driven by increasing outsourcing trends. Pharmaceutical companies seek cost optimization. Outsourced testing improves efficiency. CMOs expand global capacity. Regulatory compliance drives service demand. Small biotech firms rely on CROs. Specialized expertise enhances adoption. Contract manufacturing growth accelerates testing volumes. Flexible service models attract clients. Expansion in emerging markets supports growth. Rising clinical trial activity increases demand.

North America Endotoxin and Pyrogen Testing Market Regional Analysis

- North America dominated the endotoxin and pyrogen testing market with a steadily expanding revenue share in 2025, driven by the growing pharmaceutical and biotechnology manufacturing base across the region, along with increasing regulatory emphasis on product safety and quality compliance

- Pharmaceutical and medical device manufacturers in North America are increasingly adopting endotoxin and pyrogen testing to comply with international standards such as USP, EP, and JP, particularly for injectable drugs, biologics, and implantable medical devices

- Market growth is further supported by rising healthcare expenditure, expansion of contract testing laboratories, and increasing investments in quality control infrastructure, positioning endotoxin and pyrogen testing as a critical component for ensuring patient safety across the region

U.S. Endotoxin and Pyrogen Testing Market Insight

The U.S. endotoxin and pyrogen testing market dominated the endotoxin and pyrogen testing market in North America with the largest revenue share of approximately 41.8% in 2025, driven by its strong pharmaceutical and biotechnology manufacturing ecosystem, high concentration of FDA-regulated facilities, robust R&D investments, and widespread adoption of advanced endotoxin and pyrogen testing technologies across drug, biologics, and medical device production. Manufacturers increasingly rely on endotoxin and pyrogen testing to meet international compliance standards, ensuring safety for injectable drugs, biologics, and implantable devices. Rising demand for vaccines and biologics further fuels testing adoption. The U.S. market benefits from advanced laboratory infrastructure, high-quality reagent and instrument supply, and collaboration with global CROs. Automated testing platforms and digital data management improve accuracy and reduce human error. Investments in high-sensitivity assay technologies and chromogenic, gel-clot, and recombinant testing methods strengthen reliability. The market also sees growth from contract testing organizations catering to multiple pharmaceutical and biotechnology companies. Regulatory enforcement ensures consistent adoption of standardized testing protocols, reinforcing the U.S. as the key revenue contributor in North America.

Canada Endotoxin and Pyrogen Testing Market Insight

Canada endotoxin and pyrogen testing market is expected to be the fastest-growing country in North America’s endotoxin and pyrogen testing market during the forecast period, registering an estimated CAGR of 7.9%. Growth is driven by expanding biologics and vaccine manufacturing capacity, increasing government support for life sciences, rising outsourcing to contract testing organizations, and growing alignment with global quality and safety regulatory standards. The expansion of domestic manufacturing capabilities for biosimilars, vaccines, and parenteral drugs accelerates adoption of endotoxin and pyrogen testing solutions. Canadian pharmaceutical and biotechnology companies are investing in automated and high-sensitivity testing platforms. Enhanced compliance with FDA, EMA, and Health Canada guidelines ensures consistent adoption of standardized testing protocols. Partnerships with international CROs and CMOs provide access to advanced testing technologies. The increasing focus on patient safety, quality assurance, and laboratory automation further supports growth. Continuous innovation in assay methods, digital reporting, and workflow management improves efficiency and accuracy. Canada’s life sciences initiatives and investments in R&D infrastructure position it as a high-growth market within North America’s endotoxin and pyrogen testing sector.

North America Endotoxin and Pyrogen Testing Market Share

The Endotoxin and Pyrogen Testing industry is primarily led by well-established companies, including:

• Charles River Laboratories (U.S.)

• Lonza Group (Switzerland)

• Thermo Fisher Scientific (U.S.)

• Merck KGaA (Germany)

• Associates of Cape Cod (U.S.)

• WuXi AppTec (China)

• Eurofins Scientific (Luxembourg)

• BioMérieux (France)

• ToxinSensor (U.S.)

• Hyglos GmbH (Germany)

• Fujifilm Wako Chemicals (Japan)

• GenScript Biotech (China)

• Seikagaku Corporation (Japan)

• Pacific BioLabs (U.S.)

• Cambrex Corporation (U.S.)

• SGS SA (Switzerland)

• Kinetic-QCL (U.S.)

• Nelson Laboratories (U.S.)

• RANDOX Laboratories (U.K.)

• Creative Diagnostics (U.S.)

Latest Developments in North America Endotoxin and Pyrogen Testing Market

- In April 2021, Associates of Cape Cod, Inc. launched its PyroSmart NextGen recombinant LAL reagent, a sustainable bacterial endotoxin testing product designed to improve assay consistency while reducing reliance on animal-derived materials

- In June 2021, the European Pharmacopoeia Commission announced a regulatory move toward eliminating the rabbit pyrogen test from the Ph. Eur. within five years, recommending alternatives such as the Monocyte Activation Test (MAT) to comply with evolving standards

- In January 2024, FUJIFILM Wako Chemicals USA Corporation upgraded its Limulus Amebocyte Lysate (LAL) reagent portfolio to deliver increased sensitivity and reduced variability, enhancing the reliability of endotoxin testing in parenteral drugs and medical devices

- In February 2024, Charles River Laboratories introduced enhanced Monocyte Activation Test (MAT) platforms with automation integration, increasing throughput and reproducibility for pyrogen detection workflows in biologics and cell therapy testing

- In March 2024, Lonza Group expanded its endotoxin and pyrogen testing offerings by launching a new recombinant Factor C (rFC)-based assay kit, aligning with industry trends toward animal-free, sustainable testing methods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.