North America Enzyme Immunoassay Eia Reagents And Devices Market

Market Size in USD Million

CAGR :

%

USD

129.65 Million

USD

246.16 Million

2024

2032

USD

129.65 Million

USD

246.16 Million

2024

2032

| 2025 –2032 | |

| USD 129.65 Million | |

| USD 246.16 Million | |

|

|

|

|

Enzyme Immunoassay (EIA) Reagents and Devices Market Size

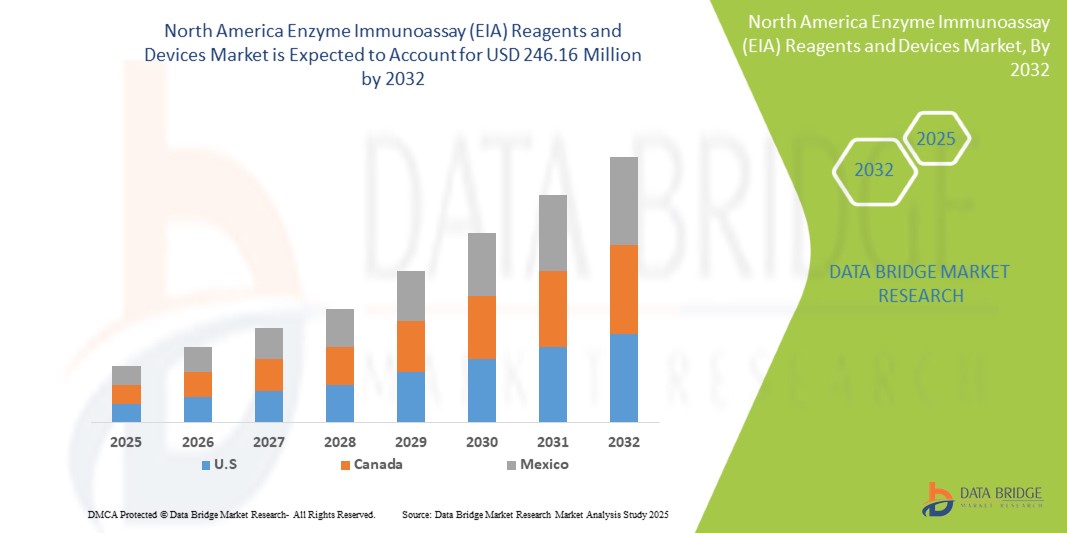

- The North America Enzyme Immunoassay (EIA) Reagents and Devices Market size was valued at USD 129.65 million in 2024 and is expected to reach USD 246.16 million by 2032, at a CAGR of 9.0% during the forecast period

- The market growth is largely driven by the increasing prevalence of infectious and chronic diseases, the expanding use of EIA technologies in diagnostics, and rising demand for early disease detection across healthcare facilities and laboratories.

- Furthermore, advancements in assay sensitivity, automation of laboratory workflows, and the integration of AI in diagnostic platforms are accelerating the adoption of EIA reagents and devices across North America. These factors are significantly contributing to market expansion.

Enzyme Immunoassay (EIA) Reagents and Devices Market Analysis

- EIA reagents and devices play a crucial role in detecting antibodies or antigens in samples, making them essential tools in disease surveillance, clinical diagnostics, pharmaceutical research, and food safety testing. Their non-radioactive nature and high throughput capabilities continue to make them the preferred choice in modern laboratories.

- The demand for EIA-based diagnostics is being bolstered by the increasing burden of diseases such as cancer, HIV, hepatitis, and autoimmune disorders, alongside the growing focus on preventive healthcare and population screening programs.

- U.S. dominates the Enzyme Immunoassay (EIA) Reagents and Devices market with the largest revenue share of 35.01% in 2025, owing to advanced healthcare infrastructure, rising healthcare expenditure, early adoption of novel diagnostic technologies, and the presence of leading market players in the region. The U.S. is particularly witnessing substantial growth in EIA applications within hospital labs and academic institutions, driven by innovations in multiplex assays and lab automation.

- Canada is projected to be the fastest-growing country in the Enzyme Immunoassay (EIA) Reagents and Devices market during the forecast period, supported by increasing investments in healthcare infrastructure, growing awareness about early disease detection, and a rising patient population.

- The Enzyme immunoassays segment is expected to dominate the Enzyme Immunoassay (EIA) Reagents and Devices market with a market share of 43.1% in 2025, driven by its widespread use in diagnostics due to high sensitivity, specificity, and cost-effectiveness.

Report Scope and Enzyme Immunoassay (EIA) Reagents and Devices Market Segmentation

|

Attributes |

Enzyme Immunoassay (EIA) Reagents and Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Enzyme Immunoassay (EIA) Reagents and Devices Market Trends

“Automation and AI Transforming EIA Diagnostics”

- A significant and accelerating trend in the North America Enzyme Immunoassay (EIA) Reagents and Devices Market is the deepening integration with artificial intelligence (AI), cloud-based platforms, and automated laboratory systems, dramatically enhancing the speed, accuracy, and convenience of diagnostic processes.

- For instance, leading diagnostic platforms now leverage AI-driven image recognition and data analytics to improve the interpretation of EIA results, allowing for real-time diagnostic decisions and remote data access through integrated lab information systems (LIS).

- AI integration in EIA workflows enables smarter, more predictive diagnostics, including automated flagging of abnormal results, tracking assay performance over time, and optimizing reagent usage based on historical trends. Furthermore, automation reduces human error, improves sample throughput, and supports high-volume testing environments.

- The seamless integration of EIA systems with digital diagnostic ecosystems and electronic medical records (EMR) platforms facilitates centralized patient data management, enabling clinicians to access lab results, generate reports, and initiate follow-ups from a unified interface.

- This trend toward more intelligent, automated, and interconnected diagnostics is reshaping user expectations in both clinical and research settings. Consequently, companies such as Bio-Rad Laboratories and Thermo Fisher Scientific are investing in AI-enhanced EIA analyzers.

- The demand for EIA systems with integrated AI, automation, and digital connectivity is rapidly growing across hospitals, reference labs, and research institutions, as healthcare providers prioritize precision, efficiency, and real-time decision-making capabilities.

Enzyme Immunoassay (EIA) Reagents and Devices Market Dynamics

Driver

“Growing Need for Early Disease Detection and Laboratory Efficiency”

- The increasing burden of chronic and infectious diseases, along with a heightened focus on early and accurate diagnosis, is a key driver of demand for EIA reagents and devices across North America.

- For instance, in April 2024, Thermo Fisher Scientific expanded its automated EIA system portfolio with integrated multiplexing features, allowing simultaneous detection of multiple biomarkers—significantly improving laboratory efficiency and diagnostic accuracy.

- As healthcare systems prioritize value-based care and preventative screening, EIA platforms offer cost-effective, scalable, and high-sensitivity solutions for mass testing and population health monitoring.

- Furthermore, the push for automation and standardization in clinical laboratories is making EIA systems increasingly indispensable, with integration into broader laboratory information systems (LIS) and electronic health record (EHR) platforms enhancing data traceability and compliance.

- The ability to deliver high-throughput, rapid results with minimal hands-on time is making EIA solutions highly attractive to labs under pressure to handle increasing testing volumes, especially during public health emergencies and routine screening initiatives.

Restraint/Challenge

“Data Integrity and High Setup Costs for Advanced Systems”

- Concerns related to data integrity, system calibration, and standardization pose challenges for the widespread adoption of advanced EIA platforms, especially in smaller laboratories or low-resource settings.

- For instance, inconsistencies in assay performance across batches or difficulties in validating multiplex assays can lead to hesitancy among users, particularly where clinical decisions depend on precise quantification.

- Addressing these challenges requires robust quality control, rigorous assay validation protocols, and ongoing operator training. Leading companies are increasingly offering cloud-based QC monitoring tools and automated calibration checks to mitigate such risks.

- Additionally, the high initial investment required for advanced EIA analyzers, particularly those with automation and AI capabilities, can be a barrier to entry for smaller healthcare facilities or research institutions with limited budgets.

- While operational costs decrease over time through efficiency gains and reduced error rates, the upfront capital expenditure may delay adoption for some users. Expanding access through leasing models, bundled reagent contracts, and government-funded diagnostics programs will be crucial for broader market penetration.

Enzyme Immunoassay (EIA) Reagents and Devices Market Scope

The market is segmented on the basis of Technology, Product, Application, End users.

By Technology (Enzyme immunoassays, Fluorescent immunoassays, Chemiluminescence immunoassays and Radioimmunoassay), Product (Analyzers and Reagents), Application (Oncology, Infectious diseases, Cardiology, Bone and mineral, Endocrinology, Autoimmunity, Toxicology, Hematology and Neonatal screening), End users (Hospitals, Laboratories, Academics and Pharmaceutical industries)

- By Technology

On the basis of Technology, the Enzyme Immunoassay (EIA) Reagents and Devices market is segmented into Enzyme immunoassays, Fluorescent immunoassays, Chemiluminescence immunoassays and Radioimmunoassay. The Enzyme immunoassays segment dominates the largest market revenue share of 43.1% in 2025, driven by its high sensitivity, cost-effectiveness, and widespread application in clinical diagnostics and research laboratories.

The Radioimmunoassay segment is anticipated to witness the fastest growth rate of 21.7% from 2025 to 2032, fueled by its exceptional sensitivity in detecting low-abundance biomarkers and its continued use in hormone and oncology diagnostics.

- By Product

On the basis of Product, the Enzyme Immunoassay (EIA) Reagents and Devices market is segmented into Analyzers and Reagents. The Analyzers held the largest market revenue share in 2025 of, driven by their critical role in automating immunoassay processes, improving throughput, and ensuring accurate and reproducible diagnostic results across high-volume clinical laboratories.

The Reagents segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its recurring demand in diagnostic workflows, expanding test menu availability, and essential role in ensuring assay sensitivity and specificity.

- By Application

On the basis of Application, the Enzyme Immunoassay (EIA) Reagents and Devices market is segmented into Oncology, Infectious diseases, Cardiology, Bone and mineral, Endocrinology, Autoimmunity, Toxicology, Hematology and Neonatal screening. The Oncology held the largest market revenue share in 2025, driven by the increasing prevalence of cancer, the growing demand for early detection biomarkers, and advancements in targeted therapies that rely on precise diagnostic testing.

The Endocrinology is expected to witness the fastest CAGR from 2025 to 2032, favored for its growing demand in the diagnosis and monitoring of hormone-related disorders, such as diabetes, thyroid diseases, and adrenal conditions, alongside advances in personalized medicine.

- By End User

On the basis of end user, the Enzyme Immunoassay (EIA) Reagents and Devices market is segmented into Hospitals, Laboratories, Academics and Pharmaceutical industries. The Hospitals segment accounted for the largest market revenue share in 2024, driven by the increasing volume of diagnostic tests, the need for advanced diagnostic tools in patient care, and the growing adoption of automated EIA systems for faster and more accurate results.

The Laboratories segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for high-throughput testing, advancements in laboratory automation, and the growing focus on research and diagnostic applications.

Enzyme Immunoassay (EIA) Reagents and Devices Market Regional Analysis

- U.S. dominates the Enzyme Immunoassay (EIA) Reagents and Devices market with the largest revenue share of 35.01% in 2024, driven by the growing demand for advanced diagnostic tools in hospitals, research laboratories, and healthcare settings, alongside increasing awareness and adoption of high-performance diagnostic technologies.

- The country’s strong healthcare infrastructure, increased funding for healthcare innovation, and the rising demand for early disease detection and precision medicine are key factors contributing to the market’s dominance.

- Additionally, the U.S. leads in the development and implementation of AI-driven EIA platforms, further enhancing the efficiency and accuracy of diagnostic testing.

U.S. Enzyme Immunoassay (EIA) Reagents and Devices Market Insight

In 2025, the U.S. held the largest share of 35.01% in North America's Enzyme Immunoassay (EIA) Reagents and Devices market, driven by the rapid adoption of advanced diagnostic technologies in clinical and research settings. The rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders significantly fuels demand for EIA solutions. Additionally, the U.S. healthcare system's emphasis on early detection, personalized medicine, and laboratory automation supports market growth, with increasing adoption of multiplex EIA assays and integrated automated platforms further boosting demand for EIA reagents and devices.

Canada Enzyme Immunoassay (EIA) Reagents and Devices Market Insight

The Canada Enzyme Immunoassay (EIA) Reagents and Devices market is expected to witness significant growth during the forecast period, driven by rising investments in healthcare innovation, the expansion of research institutions, and a growing focus on early-stage disease detection. The increasing adoption of high-sensitivity immunoassays in hospitals and diagnostic centers is expected to contribute to the market’s expansion.

Additionally, Canada’s strong healthcare policies, public health initiatives, and focus on personalized medicine are driving the uptake of EIA-based diagnostic solutions. As the demand for precise and rapid diagnostics grows, Canada is positioning itself as a key player in the North American EIA market.

Mexico Enzyme Immunoassay (EIA) Reagents and Devices Market Insight

The Mexico Enzyme Immunoassay (EIA) Reagents and Devices market is projected to grow at a significant CAGR from 2025 to 2032, primarily driven by an expanding healthcare infrastructure, increased government healthcare spending, and the rising burden of chronic diseases.

Mexico is increasingly adopting EIA technologies for diagnostic purposes in both public and private healthcare sectors, including hospitals and clinics. The growing emphasis on affordable diagnostics, coupled with the demand for innovative healthcare solutions, is expected to foster the market’s growth. As healthcare access improves and awareness of early-stage disease detection rises, the EIA market in Mexico is expected to see substantial expansion.

Enzyme Immunoassay (EIA) Reagents and Devices Market Share

The Enzyme Immunoassay (EIA) Reagents and Devices industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc.

- Roche Diagnostics Corporation

- MilliporeSigma (a business of Merck Group)

- Quidel Corporation

- Ortho Clinical Diagnostics

- Beckman Coulter Life Sciences

- Fisher Scientific (part of Thermo Fisher Scientific)

Latest Developments in North America Enzyme Immunoassay (EIA) Reagents and Devices Market

- In April 2023, Thermo Fisher Scientific announced the launch of a new line of enzyme immunoassay kits designed to improve diagnostic accuracy in detecting rare diseases. The kits utilize advanced biotechnological innovations to offer faster results and enhanced reliability in clinical testing. This development solidifies Thermo Fisher's leadership in the EIA reagents and devices market, reinforcing its commitment to advancing healthcare diagnostics in North America.

- In March 2023, Abbott Laboratories introduced a groundbreaking immunoassay platform, the ARCHITECT i1000SR, which offers a highly efficient and automated solution for clinical laboratories. This system significantly reduces turnaround times and increases the accuracy of test results for a variety of infectious diseases and chronic conditions. Abbott’s continuous innovation in EIA technologies is reshaping the diagnostic landscape in North America.

- In February 2023, Bio-Rad Laboratories expanded its immunoassay offerings by launching an innovative line of EIA reagents tailored for high-throughput research applications. This new product line is designed to streamline research workflows and improve assay reproducibility, catering to the increasing demand for robust diagnostic solutions in academic and commercial laboratories across North America.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.