North America Ethylene Vinyl Alcohol Copolymer Evoh Packaging Films Market

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

1.92 Billion

2024

2032

USD

1.32 Billion

USD

1.92 Billion

2024

2032

| 2025 –2032 | |

| USD 1.32 Billion | |

| USD 1.92 Billion | |

|

|

|

|

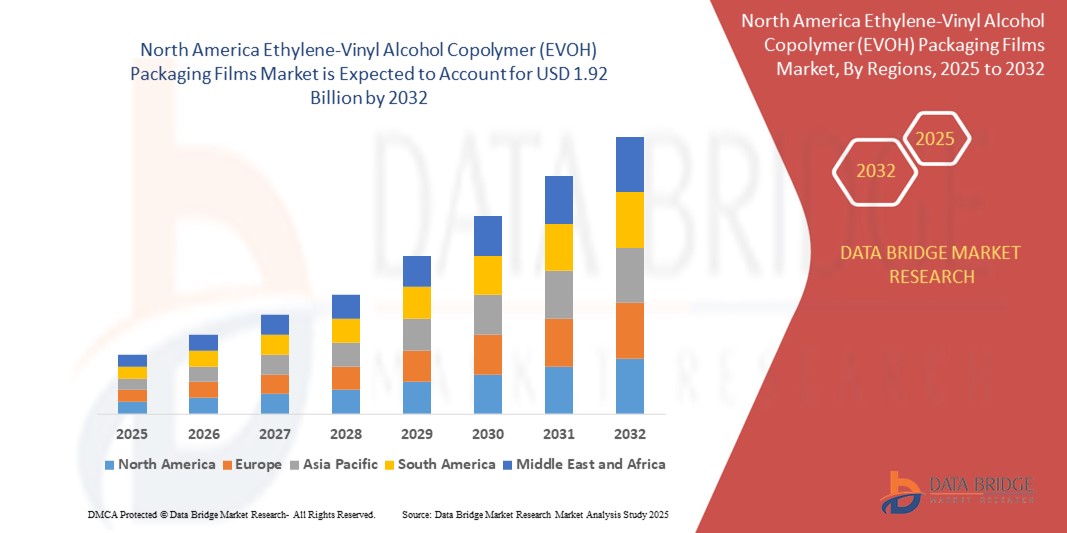

What is the North America Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market Size and Growth Rate?

- The North America ethylene-vinyl alcohol copolymer (EVOH) packaging films market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 1.92billion by 2032, at a CAGR of 4.81% during the forecast period

- EVOH film for packaging has antistatic properties which ensures that dust particles in the atmosphere do not settle down on the packaging to prevent fungal growth that spoils the natural aroma and taste of products in the container

- Due to heightened awareness regarding cleanliness to limit the spread of the virus the demand for packaging that maintains hygiene of products placed in the container is expected to rise. This in turn is expected to surge the demand for EVOH film in the packaging market

What are the Major Takeaways of Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market?

- The rising demand for organic products that do not make use of any synthetic elements and are perishable is expected to drive the demand for EVOH films for packaging. In addition, EVOH is resistant to oil and organic solvents which makes it the right choice to store edibles and food items for longer duration

- Unsuch as PVDC, EVOH films do not contain any harmful elements such as chlorine, metals, and dioxins, which may cause endocrinological disorders in humans and also harm the surroundings. Therefore, EVOH films are environment-friendly and a recyclable product that causes very little harm to the environment. These nature-friendly properties of EVOH packaging films will drive the demand for the material and will boost the market

- U.S. dominated North America’s ethylene-vinyl alcohol copolymer (EVOH) packaging films market with a 54.6% share, driven by surging demand from the food and pharmaceutical sectors due to its superior oxygen and aroma barrier properties

- Canada’s ethylene-vinyl alcohol copolymer (EVOH) packaging films market is witnessing steady growth, supported by increasing demand for clean-label packaged foods, pharmaceutical safety standards, and the country's emphasis on recyclable and multilayer packaging solutions

- The Ethylene Content (Mol%) 29–35 segment dominated the market with the largest revenue share of 33.4% in 2024, due to its optimal oxygen barrier performance, wide compatibility with multilayer structures, and cost-effectiveness in food packaging applications

Report Scope and Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market Segmentation

|

Attributes |

Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market?

Barrier Innovation and Eco-Conscious Design Fuel EVOH Packaging Films Growth

- A key trend in the EVOH packaging films market is the shift toward multi-layer flexible packaging that combines superior oxygen barrier properties with recyclability and biodegradability

- Manufacturers are developing mono-material and bio-based EVOH blends to meet sustainability targets and comply with stringent packaging waste regulations

- Companies such as Kuraray, Mitsubishi Chemical, and Coveris are investing in R&D for high-performance EVOH films with enhanced clarity, heat resistance, and compatibility with PE and PP structures

- Advanced EVOH films are being designed for active and intelligent packaging, enabling applications in food safety monitoring and shelf-life extension through integration of antimicrobial or freshness sensors

- As brands pivot to circular packaging models, sustainable EVOH solutions are enabling a balance between performance, cost-efficiency, and environmental compliance

What are the Key Drivers of Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market?

- Growing demand for high-barrier films in food and pharmaceutical packaging is a major driver, particularly in preserving flavor, aroma, and nutritional quality

- Rising preference for vacuum and modified atmosphere packaging (MAP) across meat, dairy, and ready-to-eat segments is boosting EVOH adoption

- For instance, Schur Flexibles and ProAmpac have introduced EVOH-based films designed for meat trays, pouch laminates, and lidding applications to ensure freshness and reduce food waste

- Regulatory pressures such as E.U.'s Single-Use Plastics Directive and increased demand for BPA-free, non-toxic films are propelling the use of EVOH in eco-compliant solutions

- Increased usage of EVOH films in medical and personal care packaging for their chemical resistance, transparency, and sterility is widening the market scope

Which Factor is challenging the Growth of the Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market?

- The high production cost of EVOH resins and multilayer co-extrusion processes increases final packaging cost, challenging penetration in cost-sensitive regions

- Recycling incompatibility of traditional multi-layer EVOH structures with existing waste streams limits large-scale circularity and invites sustainability concerns

- According to a 2023 report by the Flexible Packaging Association (FPA), only 15% of multilayer films containing EVOH are currently recyclable using available technologies

- Fluctuating raw material prices and reliance on ethylene feedstocks can lead to supply chain instability, especially in regions with limited local resin production

- Addressing cost optimization, enhancing monomaterial compatibility, and developing EVOH recovery technologies are essential for long-term market scalability

How is the Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market Segmented?

The market is segmented on the basis of ethylene content, application, and end-use.

- By Ethylene Content

On the basis of ethylene content, the ethylene-vinyl alcohol copolymer (EVOH) packaging films market is segmented into Ethylene Content (Mol%) Below 29, Ethylene Content (Mol%) 29–35, Ethylene Content (Mol%) 35–38, Ethylene Content (Mol%) 38–44, and Ethylene Content (Mol%) Above 44. The Ethylene Content (Mol%) 29–35 segment dominated the market with the largest revenue share of 33.4% in 2024, due to its optimal oxygen barrier performance, wide compatibility with multilayer structures, and cost-effectiveness in food packaging applications.

The Ethylene Content (Mol%) Above 44 segment is expected to witness the fastest growth, driven by its enhanced flexibility, improved processability, and application in advanced medical and cosmetic packaging.

- By Application

On the basis of application, the market is segmented into PE/TIE/EVOH/TIE/PE, PAT/PE/TIE/EVOH/TIE/EVA, PE/TIE/EVOH/TIE/EVA, PE/TIE/PA/EVOH/PA/TIE/PE, PA/EVOH/PA/TIE/LONMER, and PA/EVOH/PA/TIE/PE. The PE/TIE/EVOH/TIE/PE structure held the dominant revenue share of 29.7% in 2024, favored for its cost-efficiency, high oxygen barrier, and extensive use in food and pharmaceutical packaging.

The PE/TIE/PA/EVOH/PA/TIE/PE segment is gaining momentum due to its superior mechanical strength and resistance, making it suitable for vacuum and retort pouch applications.

- By End-Use

On the basis of end-use, the market is segmented into Food, Personal Care & Cosmetics, Household, Pharmaceutical, Industrial, and Others. The Food segment dominated the market with a leading revenue share of 41.9% in 2024, supported by the growing need for extended shelf-life, aroma preservation, and sustainable alternatives to traditional plastic films.

The Pharmaceutical segment is projected to expand rapidly due to stringent drug packaging regulations and the increasing need for contamination-free, multi-layer protective films.

Which Region Holds the Largest Share of the Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market?

- U.S. dominated North America’s ethylene-vinyl alcohol copolymer (EVOH) packaging films market with a 54.6% share, driven by surging demand from the food and pharmaceutical sectors due to its superior oxygen and aroma barrier properties

- Increased preference for sustainable, multi-layer packaging in processed food, along with robust pharmaceutical exports and compliance requirements, further reinforced the U.S. market’s leadership

- In addition, the presence of leading packaging manufacturers such as Sealed Air, Amcor, and Winpak, along with a well-established recycling infrastructure, continues to boost market innovation and adoption

Canada Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market Insight

In Canada, the EVOH packaging films market is experiencing steady momentum, fueled by the increasing demand for clean-label packaged foods, pharmaceutical safety standards, and the country's emphasis on recyclable and multilayer packaging solutions. Rising consumer awareness of food safety and extended shelf-life, along with a growing shift towards eco-friendly materials in urban centers such as Toronto and Vancouver, is encouraging domestic adoption.Furthermore, support from government sustainability programs and strategic investments by companies such as Cascades and TC Transcontinental are propelling local production capacity.

Mexico Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market Insight

In Mexico, the EVOH packaging films market is expanding at a gradual pace, supported by the rising middle-class population, food retail modernization, and increased pharmaceutical distribution across public and private sectors. Demand is rising for packaged ready-to-eat meals and healthcare products with longer shelf life, particularly in urban regions such as Mexico City, Guadalajara, and Monterrey. In addition, the influx of foreign investments and OEM partnerships, coupled with cost-effective EVOH film imports, is facilitating supply chain improvements and price accessibility.

Which are the Top Companies in Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market?

The ethylene-vinyl alcohol copolymer (EVOH) packaging films industry is primarily led by well-established companies, including:

- Schur Flexibles Holding GesmbH (Austria)

- Coveris (U.K.)

- Mitsubishi Chemical Holdings Corporation (Japan)

- KURARAY CO., LTD. (Japan)

- KUREHA CORPORATION (Japan)

- Arkema (France)

- Chang Chun Group (Taiwan)

- ProAmpac (U.S.)

- MULTIFLEX FOLIEN GMBH & CO. KG (Germany)

- Vishakha Polyfab Pvt Ltd (India)

- International Plastic Engineering Co., Ltd (China)

- Verpackungen GmbH (Germany)

- Shpusite Packaging Materials (Shanghai) Co., Ltd (China)

- Plastissimo Film Co., Ltd (China)

- Zhongsu New Materials Technology (Hangzhou) Co., Ltd (China)

What are the Recent Developments in North America Ethylene-Vinyl Alcohol Copolymer (EVOH) Packaging Films Market?

- In April 2022, Kuraray Co., Ltd has been included in the ESG (environmental, social and governance) investment indexes: FTSE Blossom Japan Sector Relative Index designed by the North America index provider FTSE Russell.This makes the company a constituent of all of the ESG investment indexes for Japanese stocks adopted by Japan’s Government Pension Investment Fund (GPIF). This sustainability initiative will increase company reputation in the market

- In February 2022, Arkema acquired Ashland’s Performance Adhesives business, which is a first-class leader in high performance adhesives in the U.S. This operation is a major step in Arkema’s strengthening its Adhesive Solutions segment. This acquisition will bring more opportunity for the company and increases its market growth

- In December 2021, Mitsubishi Chemical Holdings Corportion is recognized as a North America leader in sustainable water management and has been awarded a position on the year’s Water A List, which is the highest rating in the CDP Water Security 2021.The Water A List is comprised of 118 companies out of a total of 12,000 surveyed around the world. This enhances the company’s image in the North America market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Ethylene Vinyl Alcohol Copolymer Evoh Packaging Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Ethylene Vinyl Alcohol Copolymer Evoh Packaging Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Ethylene Vinyl Alcohol Copolymer Evoh Packaging Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.