North America Explosion Proof Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.01 Billion

USD

4.24 Billion

2024

2032

USD

3.01 Billion

USD

4.24 Billion

2024

2032

| 2025 –2032 | |

| USD 3.01 Billion | |

| USD 4.24 Billion | |

|

|

|

|

North America Explosion-Proof Equipment Market Size

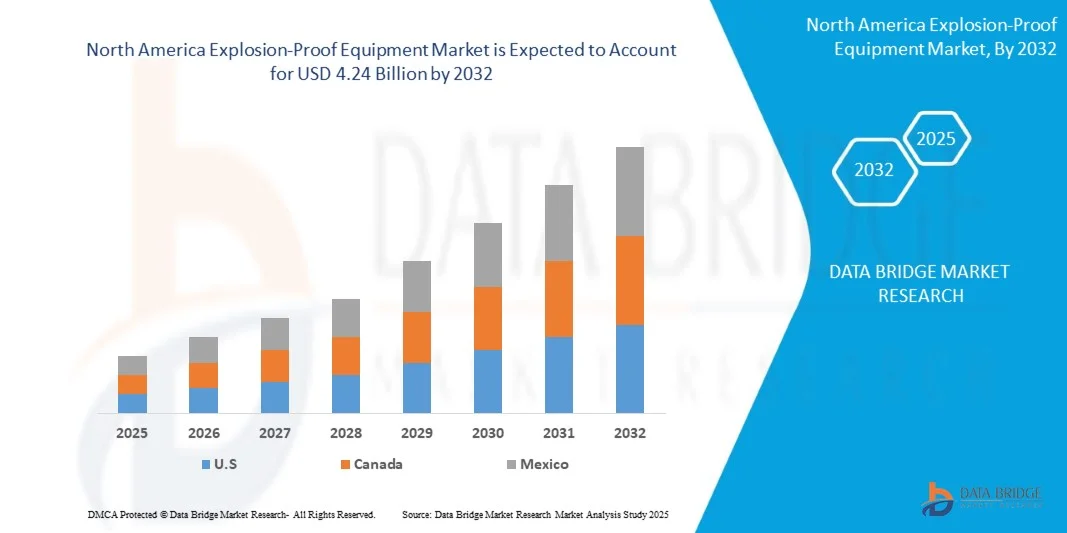

- The North America Explosion-Proof Equipment Market size was valued at USD 3.01 billion in 2024 and is expected to reach USD 4.24 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fuelled by the increasing demand for safety solutions in hazardous industrial environments, such as oil & gas, mining, and chemical processing

- Rising government regulations focusing on worker safety and industrial explosion prevention are further accelerating the adoption of explosion-proof equipment across the region

North America Explosion-Proof Equipment Market Analysis

- The rising demand for advanced protective solutions in industries such as oil & gas, chemicals, pharmaceuticals, and manufacturing is driving market expansion

- In addition, continuous technological innovations in explosion-proof lighting, control panels, and communication systems are enhancing operational safety and efficiency in hazardous work environments

- U.S. explosion-proof equipment market captured the largest revenue share in North America in 2024, fueled by the increasing implementation of industrial safety protocols and the presence of numerous oils & gas, chemical, and manufacturing facilities

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America Explosion-Proof Equipment Market due to increasing investments in mining, chemical processing, and energy sectors, coupled with rising awareness of industrial safety and adoption of smart, IoT-enabled explosion-proof solutions

- The hardware segment held the largest market revenue share in 2024, driven by the widespread deployment of certified enclosures, sensors, and control panels across industrial facilities. Hardware solutions form the backbone of industrial safety systems and are critical for preventing accidents in hazardous environments

Report Scope and North America Explosion-Proof Equipment Market Segmentation

|

Attributes |

North America explosion-proof equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America Explosion-Proof Equipment Market Trends

“Rise of Smart Explosion-Proof Solutions in Industrial Safety”

- The growing adoption of smart explosion-proof equipment is transforming industrial safety by enabling real-time monitoring and predictive maintenance. These systems allow for early detection of hazardous conditions, minimizing downtime and preventing accidents. Companies are increasingly integrating AI-driven analytics to predict potential failures, while cloud-based platforms help in centralizing safety data for multiple facilities

- The demand for automated and IoT-integrated explosion-proof devices is increasing across sectors such as oil & gas, chemicals, and mining, supporting safer operations and operational efficiency. These devices help in reducing human error, ensure faster response to hazardous events, and improve compliance with safety standards across complex industrial sites

- The development of modular and scalable equipment solutions is making installation and maintenance easier, reducing operational costs and enhancing workplace safety. These solutions allow easy retrofitting into existing systems, provide flexibility for expansion, and lower downtime during equipment upgrades

- For instance, in 2024, several petrochemical plants in the U.S. deployed IoT-enabled explosion-proof sensors across processing units, resulting in early detection of gas leaks and a reduction in safety incidents. The deployment also enabled continuous monitoring, predictive alerts, and improved reporting to regulatory authorities

- While smart explosion-proof solutions are improving hazard prevention and operational reliability, their effectiveness depends on continuous technological innovation, proper employee training, and adherence to regulatory standards. Companies must also focus on data security and system integration to maximize the benefits of smart safety solutions

North America Explosion-Proof Equipment Market Dynamics

Driver

“Increasing Industrial Safety Regulations and Focus on Worker Protection”

- Stringent safety regulations from authorities such as OSHA and NEC are driving the adoption of explosion-proof equipment to prevent workplace accidents and ensure compliance. Organizations are implementing stricter safety audits, upgrading older equipment, and investing in certified safety systems to meet regulatory requirements

- Industrial operators are prioritizing worker safety and risk mitigation, leading to higher demand for certified explosion-proof lighting, control panels, and monitoring systems. This shift is also influenced by insurance requirements, stakeholder expectations, and the rising cost of workplace accidents and downtime

- In addition, advancements in sensor technology, real-time monitoring, and automation are encouraging companies to invest in reliable explosion-proof solutions that reduce operational hazards. Predictive maintenance, remote monitoring, and automated alerts are further increasing equipment adoption and operational efficiency

- For instance, in 2023, several manufacturing facilities in North America upgraded their control rooms and hazardous zones with flameproof enclosures and smart monitoring systems, resulting in improved safety compliance. These upgrades also enhanced data collection for preventive maintenance and reduced emergency response times

- While regulatory support and technological progress are key drivers, ongoing investment in innovation and employee training is essential for maximizing safety benefits. Companies are increasingly partnering with technology providers to develop customized solutions for complex industrial environments

Restraint/Challenge

“High Capital Investment And Maintenance Requirements”

- The high initial cost of advanced explosion-proof equipment limits adoption among small and medium-sized industrial operators, making large-scale deployment challenging. The expense includes equipment purchase, installation, certification, and integration into existing safety systems, which can be prohibitive for smaller enterprises

- In addition, specialized installation and ongoing maintenance require trained personnel, adding to operational expenses and limiting accessibility for smaller facilities. Continuous monitoring, periodic testing, and compliance audits further increase operational complexity and cost for maintaining high safety standards

- Supply chain and logistical challenges for equipment, components, and replacement parts in remote industrial sites can delay implementation and maintenance schedules. Dependence on specialized suppliers, longer lead times, and regional availability issues can disrupt project timelines and increase total costs

- For instance, in 2023, several chemical processing plants reported delays in equipment installation due to limited availability of certified explosion-proof components and trained service providers. These delays impacted project schedules, increased labor costs, and temporarily exposed facilities to higher safety risks

- While equipment reliability and performance continue to improve, addressing cost and maintenance challenges is critical for broader market penetration and sustained growth. Companies are exploring leasing models, modular solutions, and local service partnerships to make high-quality safety equipment more accessible to a wider range of operators

North America Explosion-Proof Equipment Market Scope

The market is segmented on the basis of offering, temperature class, zone, and connectivity servic

• By Offering

On the basis of offering, the explosion-proof equipment market is segmented into hardware, software, and services. The hardware segment held the largest market revenue share in 2024, driven by the widespread deployment of certified enclosures, sensors, and control panels across industrial facilities. Hardware solutions form the backbone of industrial safety systems and are critical for preventing accidents in hazardous environments.

The software segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of IoT-enabled monitoring platforms, predictive maintenance tools, and cloud-based analytics. Software solutions enhance the efficiency of explosion-proof systems by providing real-time alerts, centralized control, and data-driven insights for proactive hazard management

• By Temperature Class

On the basis of temperature class, the market is segmented into T1 to T6. The T4 segment held a significant share in 2024, driven by its suitability for a wide range of industrial applications with moderate surface temperature limits. T4-rated devices are commonly deployed in chemical, oil & gas, and manufacturing sectors due to their reliability and safety compliance.

The T6 segment is expected to witness robust growth from 2025 to 2032, driven by the demand for equipment capable of operating in highly sensitive zones with very low maximum surface temperatures. T6-rated explosion-proof devices are preferred in applications requiring the highest safety standards, particularly in mining and hazardous chemical processing environments

• By Zone

On the basis of zone, the market is segmented into Zone 0 to Zone 22. The Zone 1 segment accounted for the largest share in 2024, driven by its use in areas where explosive gas atmospheres are likely to occur during normal operations. These zones cover most industrial plants and facilities with flammable gases or vapors.

The Zone 0 segment is expected to witness the fastest growth during the forecast period, driven by the increasing need for safety solutions in highly hazardous environments where explosive atmospheres are continuously present. Zone 0-rated equipment ensures maximum protection and compliance with stringent industrial safety regulations

• By Connectivity Service

On the basis of connectivity service, the market is segmented into wired and wireless. The wired segment held the largest market share in 2024, driven by its reliability, stable data transmission, and suitability for critical industrial operations where uninterrupted connectivity is essential

The wireless segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing deployment of IoT-enabled explosion-proof devices, remote monitoring solutions, and smart safety systems. Wireless connectivity enables flexible installation, real-time alerts, and easier integration with centralized safety management platforms

North America Explosion-Proof Equipment Market Regional Analysis

- U.S. explosion-proof equipment market captured the largest revenue share in North America in 2024, fueled by the increasing implementation of industrial safety protocols and the presence of numerous oils & gas, chemical, and manufacturing facilities

- Companies are prioritizing the enhancement of workplace safety through certified flameproof devices and IoT-enabled monitoring solutions

- The growing trend of industrial automation, combined with demand for real-time hazard detection and predictive maintenance systems, is further propelling market growth

- Moreover, the integration of explosion-proof systems with smart industrial platforms is significantly contributing to the market's expansion

Canada Explosion-Proof Equipment Market Insight

The Canada explosion-proof equipment market is expected to witness steady growth from 2025 to 2032, driven by investments in mining, oil sands, and chemical processing industries requiring high safety standards. The adoption of advanced monitoring systems and IoT-enabled protective devices is increasing, supported by government safety regulations. Industrial operators in Canada are focusing on reducing accident risks and operational downtime, which further boosts the adoption of explosion-proof equipment

North America Explosion-Proof Equipment Market Share

The North America explosion-proof equipment industry is primarily led by well-established companies, including:

- R. STAHL Inc. (U.S.)

- RAE Systems (Honeywell) (U.S.)

- Intertek Group PLC (U.S.)

- Adalet Inc. (U.S.)

- EX Industries (U.S.)

- Larson Electronics LLC (U.S.)

- Miretti Americas (U.S.)

- North American Industries (NAI) (U.S.)

- MSA Safety Incorporated (U.S.)

- Applus+ QPS (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Explosion Proof Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Explosion Proof Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Explosion Proof Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.