North America Extrusion Machinery Market

Market Size in USD Billion

CAGR :

%

USD

3.01 Billion

USD

4.22 Billion

2024

2032

USD

3.01 Billion

USD

4.22 Billion

2024

2032

| 2025 –2032 | |

| USD 3.01 Billion | |

| USD 4.22 Billion | |

|

|

|

|

North America Extrusion Machinery Market Size

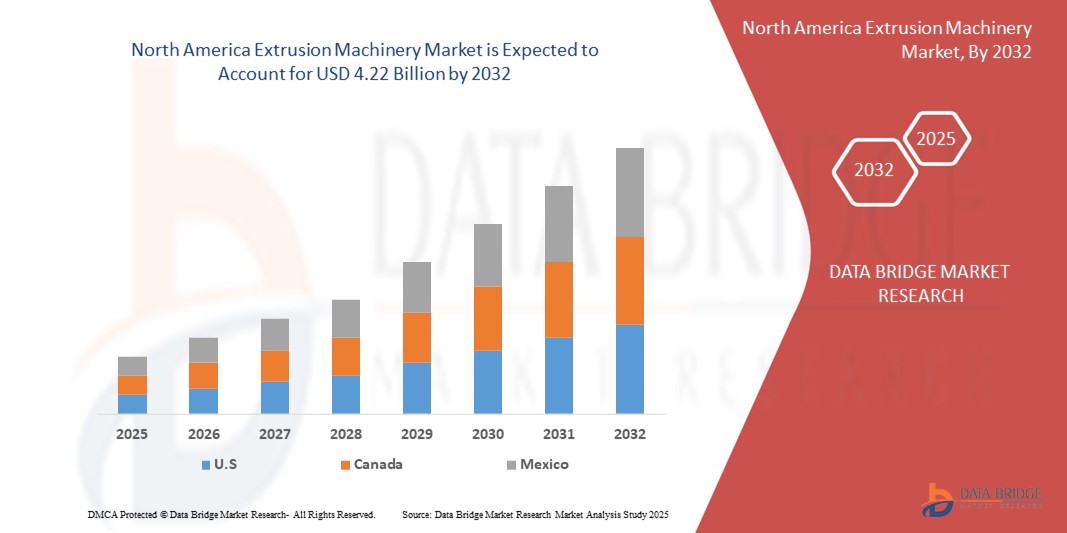

- The North America extrusion machinery market size was valued at USD 3.01 billion in 2024 and is projected to reach USD 4.22 billion by 2032, growing at a CAGR of 4.30% during the forecast period from 2025 to 2032.

- The market growth is driven by increasing demand from the automotive, packaging, and construction industries, along with advancements in extrusion technologies aimed at enhancing efficiency and product quality.

- Additionally, growing emphasis on lightweight materials and sustainable manufacturing processes is encouraging the adoption of advanced extrusion machinery, thereby propelling market expansion across North America.

North America Extrusion Machinery Market Analysis

- Extrusion machinery, essential for shaping materials by forcing them through a die to create continuous profiles, plays a crucial role in manufacturing industries such as plastics, metals, and food processing, enabling high efficiency and precision in producing complex shapes and consistent product quality.

- The growing demand for extrusion machinery is driven by expanding applications across automotive, construction, packaging, and consumer goods sectors, coupled with technological advancements such as automation, energy-efficient designs, and real-time monitoring systems enhancing production capabilities.

- The U.S. led the extrusion machinery market in 2024, driven by rapid industrialization, a booming food processing sector, rising demand for innovative and customized products, and strong investments in advanced manufacturing capabilities and infrastructure.

- Canada is emerging as a key player in the extrusion machinery market, fueled by technological advancements, increasing demand for processed and packaged foods, a robust industrial framework, and growing investments in automation and efficient production processes.

- The Direct Extrusion segment dominated the market with the largest market revenue share of 48.6% in 2024, attributed to its widespread use across a range of industries including construction, consumer goods, and automotive.

Report Scope and Market Segmentation

|

Attributes |

Extrusion Machinery Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America North America Extrusion Machinery Market Trends

Automation and Energy-Efficient Technologies Driving Innovation

- A major and accelerating trend in the North America extrusion machinery market is the growing integration of automation and energy-efficient technologies aimed at improving operational efficiency, reducing production costs, and minimizing environmental impact. This shift is driven by the region’s focus on sustainable manufacturing and advanced production capabilities.

- For instance, leading manufacturers are adopting Industry 4.0 principles, incorporating IoT-enabled monitoring systems and predictive maintenance tools into extrusion machinery. These advancements allow real-time data collection, improved process control, and reduced downtime, resulting in higher productivity and operational reliability.

- Energy efficiency is also becoming a key differentiator, with many companies developing extrusion systems that consume less power while maintaining high output. Electric drive systems and optimized barrel and screw designs are increasingly being adopted to reduce energy consumption and material waste during production.

- The integration of smart automation and control systems allows manufacturers to achieve greater precision, faster changeovers, and enhanced customization of extruded products, catering to the diverse needs of sectors like packaging, automotive, and construction.

- This trend is reshaping manufacturing strategies across North America, prompting companies to upgrade existing equipment or invest in next-generation extrusion lines with advanced controls and efficiency-focused designs.

- As industries continue to seek more sustainable and intelligent production solutions, the demand for extrusion machinery equipped with automation, digital control, and energy-saving features is rapidly increasing, driving innovation and competitiveness in the North American market.

North America North America Extrusion Machinery Market Dynamics

Driver

Rising Demand for Lightweight Materials and Industrial Automation

- The growing demand for lightweight and durable materials, particularly in the automotive, construction, and packaging industries, is a major driver fueling the growth of the extrusion machinery market in North America. These industries are increasingly turning to extruded components to improve fuel efficiency, structural performance, and product sustainability.

- For instance, the rising use of plastic and aluminum extrusions in vehicle manufacturing to reduce overall weight and meet emissions regulations has prompted significant investment in high-performance extrusion machinery.

- Simultaneously, the push toward industrial automation and smart manufacturing is driving the adoption of advanced extrusion technologies. Automation features such as computerized control systems, real-time monitoring, and predictive maintenance are helping manufacturers enhance production efficiency, reduce labor costs, and improve product consistency.

- Additionally, the integration of Industry 4.0 technologies, including IoT-enabled systems and digital twins, is enabling greater operational transparency and remote control of extrusion processes, further accelerating adoption across North American industries.

- These advancements, combined with the region’s strong manufacturing base and government support for industrial innovation, are positioning extrusion machinery as a vital asset in modern production environments, particularly among companies seeking to improve output and sustainability.

Restraint/Challenge

High Capital Investment and Operational Complexity

- One of the primary challenges facing the North American extrusion machinery market is the high capital investment required for acquiring, installing, and maintaining advanced extrusion equipment. These machines often demand significant upfront costs, making them less accessible for small and medium-sized enterprises (SMEs) with limited budgets.

- In addition, the complexity of extrusion systems—particularly those integrated with automation, precision controls, and multi-layer capabilities—requires skilled operators and technical expertise. This presents a barrier in regions or industries facing labor shortages or lacking workforce training infrastructure.

- Operational inefficiencies caused by improper setup or inadequate training can lead to increased material waste, downtime, and reduced machine lifespan.

- For instance, companies transitioning to new extrusion technologies often encounter a steep learning curve, requiring additional time and investment in employee training and system calibration.

- Furthermore, maintenance and repair of high-end extrusion systems can be expensive, especially when specialized parts or technical support are needed, adding to total cost of ownership.

- Addressing these challenges through modular machinery designs, user-friendly interfaces, accessible financing options, and comprehensive technical support services will be critical for expanding market access and adoption across the region.

North America Extrusion Machinery Market Scope

The market is segmented on the basis of type, product type, process output, and end use.

- By Type

On the basis of type, the extrusion machinery market is segmented into Direct Extrusion, Indirect Extrusion, and Hydrostatic Extrusion.

The Direct Extrusion segment dominated the market with the largest market revenue share of 48.6% in 2024, attributed to its widespread use across a range of industries including construction, consumer goods, and automotive. This type enables continuous, high-volume production and is compatible with a broad variety of materials, particularly metals and plastics. Its simpler operation and higher material efficiency also contribute to its cost-effectiveness in mass manufacturing.

The Hydrostatic Extrusion segment is projected to witness the fastest CAGR from 2025 to 2032, driven by growing demand in aerospace and medical sectors where precision and high surface finish are essential. Its ability to extrude hard and brittle materials under high pressure without material cracking is a key driver for its increasing adoption.

- By Product Type

On the basis of product type, the extrusion machinery market is segmented into Single-Screw Extruders, Twin-Screw Extruders, and Others.

The Single-Screw Extruders segment led the market with the largest market share of 54.3% in 2024, owing to its extensive use in plastic processing, including film, sheet, pipe, and profile manufacturing. These machines are preferred for their cost efficiency, low maintenance requirements, and high throughput in standard processing tasks. Their simpler configuration makes them ideal for continuous, uniform output in high-volume production environments.

The Twin-Screw Extruders segment is expected to record the fastest growth from 2025 to 2032, driven by rising demand in specialty applications such as food extrusion, compounding, and pharmaceuticals. Their superior mixing capabilities, enhanced heat control, and ability to handle multiple materials simultaneously contribute to their growing popularity in advanced and customized manufacturing processes.

- By Process Output

On the basis of process output, the extrusion machinery market is segmented into Plastic, Metal, Rubber, and Others.

The Plastic segment dominated the market with the largest revenue share of 57.8% in 2024, supported by the growing use of plastic in packaging, construction, automotive components, and consumer products. The rise of plastic recycling technologies and demand for lightweight materials in manufacturing further drive this segment’s dominance. Plastic extrusion machinery is also widely adopted due to its cost-effectiveness, scalability, and compatibility with a wide range of polymers.

The Metal segment is anticipated to witness the fastest CAGR from 2025 to 2032, propelled by increasing applications in automotive lightweighting, aerospace components, and infrastructure. Advancements in metal forming technologies and rising investments in high-strength materials are contributing to the segment’s rapid growth across both developed and emerging markets.

- By End Use

On the basis of end use, the extrusion machinery market is categorized into Construction, Consumer Goods, Automotive, Food and Beverage, Health Care, Aerospace & Defense, and Others.

The Construction segment accounted for the largest market share of 31.4% in 2024, driven by rising infrastructure development, urbanization, and demand for energy-efficient building materials such as insulation, window frames, and plastic piping. The extrusion process offers consistent quality, scalability, and material efficiency, making it ideal for large-volume construction applications.

The Food and Beverage segment is projected to be the fastest-growing from 2025 to 2032, owing to increased demand for processed and convenience foods. Technological innovations in food-grade extrusion machinery—particularly twin-screw extruders—allow for enhanced control over texture, shape, and nutritional content, driving adoption among food manufacturers seeking product innovation and production efficiency.

North America Extrusion Machinery Market Regional Analysis

- The U.S. extrusion machinery market captured the largest revenue share of 79% in 2024 within North America, driven by a robust manufacturing ecosystem and ongoing investments in automation and advanced production technologies

- The country’s growing demand for extruded materials in industries such as construction, automotive, packaging, and food processing is fueling consistent market growth. The adoption of smart manufacturing, along with sustainability-focused innovations like energy-efficient machinery and recycled material extrusion, continues to expand market potential

- Additionally, the U.S. benefits from a strong presence of both domestic and international machinery manufacturers, making it a key hub for technology integration and large-scale industrial applications

Canada Extrusion Machinery Market Insight

The Canada extrusion machinery market is poised to grow at a notable CAGR during the forecast period, supported by increasing industrial automation, demand for processed food products, and infrastructure development. Technological advancements and the integration of Industry 4.0 solutions into manufacturing are enhancing productivity and operational efficiency across Canadian facilities. The food and beverage industry, in particular, is seeing rising adoption of extrusion technologies for snack production and packaging applications. Canada's strong industrial infrastructure, skilled labor force, and favorable government policies aimed at boosting local manu

Mexico Extrusion Machinery Market Insight

The Mexico extrusion machinery market is experiencing steady growth, supported by the country’s expanding manufacturing sector, favorable trade agreements, and cost-competitive labor force. Rising demand for extruded plastics and metals in automotive components, consumer goods, and building materials is fueling investment in modern machinery. Mexico’s strategic location and integration into North American supply chains also make it an attractive destination for multinational manufacturers. As industrial automation gains momentum, the adoption of flexible and energy-efficient extrusion systems is expected to rise, particularly in export-driven industries.

North America Extrusion Machinery Market Share

North America Extrusion Machinery Market Leaders Operating in the Market Are:

- Davis Standard (U.S.)

- Coperion GmbH (Germany)

- Milacron, LLC (An Operating Company Of Hillenbrand) (U.S.)

- Leistritz Extrusionstechnik GmbH (Germany)

- NFM/Welding Engineers, Inc. (U.S.)

- Gneuß Kunststofftechnik GmbH (Germany)

- Reifenhauser (Germany)

- " TECNOMATIC SRL" (Italy)

- KraussMaffei (Germany)

- Kabra ExtrusionTechnik Ltd. (India)

- Nordson Corporation (U.S.)

Recent Developments in Global Extrusion Machinery Market

- In May 2023, Davis-Standard LLC, a global leader in extrusion and converting technology, announced the expansion of its manufacturing facility in Suzhou, China, to meet growing regional demand. This strategic move enhances the company’s production capabilities and supports faster delivery times for its extrusion systems across Asia. The expansion reflects Davis-Standard’s commitment to strengthening its global footprint and catering to the surging need for advanced, energy-efficient extrusion solutions in high-growth markets.

- In April 2023, KraussMaffei Group introduced a new high-performance twin-screw extrusion line designed for processing biodegradable polymers. The innovation aims to support the shift towards sustainable production in the plastics industry. By enabling efficient processing of eco-friendly materials, KraussMaffei reinforces its leadership in green manufacturing technologies and responds to increasing environmental regulations and customer demand for sustainable packaging solutions.

- In March 2023, Reifenhäuser Group launched the Evolution Ultra Flat Plus system, an upgrade to its successful extrusion technology that improves film flatness and thickness tolerance. This development enables enhanced material efficiency and print quality, catering to high-performance packaging requirements. The new system demonstrates the company's focus on continuous innovation and optimizing operational efficiency for film producers worldwide.

- In February 2023, Milacron, a Hillenbrand company, announced a strategic partnership with a major Southeast Asian manufacturer to co-develop customized extrusion lines for the region's growing construction and infrastructure sectors. This collaboration aims to deliver cost-effective, high-output solutions adapted to regional material and climate requirements, enhancing Milacron’s position in emerging markets.

- In January 2023, Bausano, an Italian extrusion machinery manufacturer, unveiled its next-generation Smart Energy System at ArabPlast 2023. The new technology improves energy efficiency by optimizing heating systems in plastic extrusion processes. This launch underlines Bausano’s commitment to sustainability and technological innovation, offering manufacturers lower operating costs while meeting global energy-saving standards.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Extrusion Machinery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Extrusion Machinery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Extrusion Machinery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.