North America Facial Cleanser Market

Market Size in USD Billion

CAGR :

%

USD

4.75 Billion

USD

6.99 Billion

2024

2032

USD

4.75 Billion

USD

6.99 Billion

2024

2032

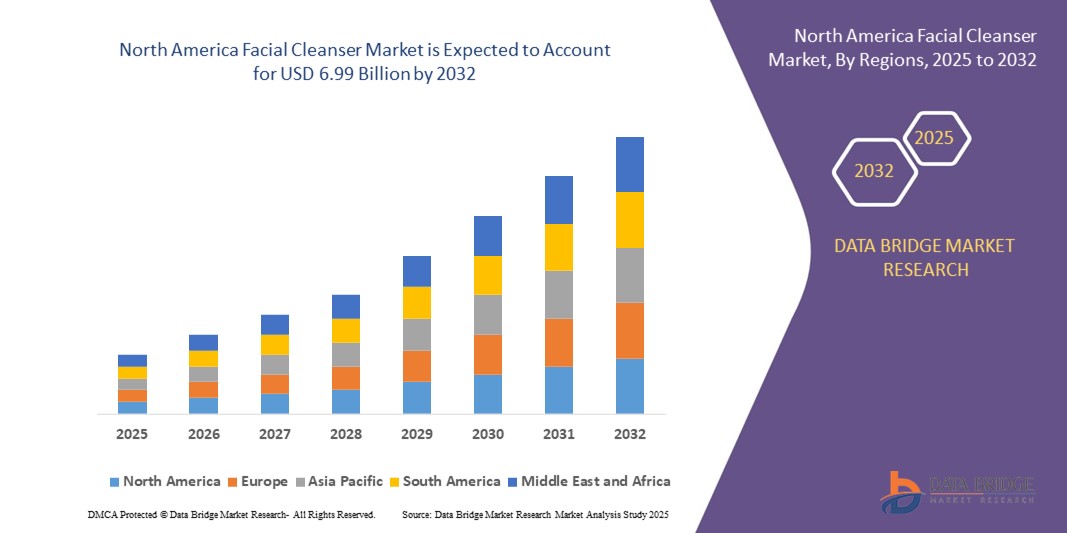

| 2025 –2032 | |

| USD 4.75 Billion | |

| USD 6.99 Billion | |

|

|

|

|

North America Facial Cleanser Market Size

- The North America facial cleanser market size was valued at USD 4.75 billion in 2024 and is expected to reach USD 6.99 billion by 2032, at a CAGR of 4.95% during the forecast period

- The market growth is largely fueled by rising consumer awareness regarding personal hygiene, increasing adoption of skincare routines, and the growing preference for natural and organic ingredients.

- Increasing demand for premium and multifunctional facial cleansers that address concerns such as acne, aging, and sensitive skin is further supporting market expansion

North America Facial Cleanser Market Analysis

- The North America facial cleanser market is experiencing steady growth due to rising consumer awareness about skincare, increased focus on personal hygiene, and growing demand for natural and organic ingredients

- Innovation in product formulations, including multifunctional cleansers targeting acne, aging, and sensitive skin, is driving consumer adoption

- U.S. facial cleanser market captured the largest revenue share of 82% in 2024 within North America, fueled by the growing trend of personalized skincare and the adoption of multi-benefit and natural formulations

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America facial cleanser market due to rising adoption of natural and organic skincare products, increasing e-commerce penetration, and growing interest in personalized and professional-grade facial cleansers

- The Foaming Facial Cleanser segment held the largest market revenue share in 2024, driven by its effective removal of dirt, makeup, and excess oil, making it highly preferred for daily skincare routines. Foaming cleansers also provide a refreshing feel, gentle exfoliation, and suitability for normal to oily skin types, enhancing their adoption among residential users and professional skincare facilities

Report Scope and North America Facial Cleanser Market Segmentation

|

Attributes |

North America Facial Cleanser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Organic and Natural Facial Cleansers |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Facial Cleanser Market Trends

Rising Preference for Natural and Organic Facial Cleansers

- The increasing consumer shift toward natural and organic facial cleansers is transforming the skincare landscape by encouraging chemical-free and plant-based formulations. These products provide gentler cleansing solutions suitable for sensitive skin, reducing irritation and promoting skin health. This trend is resulting in higher adoption of clean-label skincare among millennials and Gen Z consumers

- The demand for multifunctional cleansers that combine cleansing, exfoliating, and moisturizing benefits is accelerating the launch of innovative formulations. Consumers are seeking products that save time and simplify skincare routines, particularly in fast-paced urban environments. The trend is further supported by growing awareness through social media and influencer campaigns

- The rising interest in environmentally friendly and cruelty-free products is driving companies to develop sustainable packaging and formulations. Biodegradable packaging, refillable containers, and plant-derived ingredients are increasingly preferred, enhancing brand reputation while promoting eco-conscious consumer behavior

- For instance, in 2023, several North American skincare brands reported increased sales of organic facial cleansers after launching biodegradable packaging and plant-based ingredient formulations. Consumers responded positively, leading to higher repeat purchases and brand loyalty

- While trends toward natural and multifunctional products are boosting market growth, continued innovation, consumer education, and affordability remain critical. Companies must focus on research and development to introduce safe, effective, and environmentally responsible facial cleansers

North America Facial Cleanser Market Dynamics

Driver

Increasing Consumer Awareness of Skin Health and Wellness

• Growing awareness of skin health and preventive care is pushing consumers to prioritize high-quality facial cleansers as part of their daily skincare routine. Consumers are seeking products that protect against pollution, UV damage, and skin aging, driving demand for advanced formulations with antioxidants, vitamins, and natural extracts

• The rise of social media, influencer endorsements, and online skincare tutorials is educating consumers about product benefits, encouraging informed purchase decisions. This has boosted the adoption of premium facial cleansers across both urban and suburban regions

• Retailers and skincare brands are increasingly offering personalized skincare solutions and diagnostic tools, enabling consumers to select products tailored to their skin type and concerns. This personalized approach is expanding market penetration and enhancing customer satisfaction

• For instance, in 2022, several North American e-commerce platforms reported increased engagement with virtual skin analysis tools, resulting in higher sales of cleansers customized for individual skin types. These digital solutions allowed consumers to make informed purchasing decisions, enhancing satisfaction and brand loyalty while boosting overall market revenues

• While awareness and personalized solutions drive the market, affordability, accessibility, and product efficacy remain key considerations for sustained consumer adoption. Brands are increasingly investing in online consultations, AI-driven recommendations, and targeted promotions to ensure consumers receive products that match their specific skincare needs, fostering long-term engagement and repeat purchases

Restraint/Challenge

High Prices of Premium and Specialized Cleansers Limiting Widespread Adoption

• The high cost of premium, organic, and multifunctional facial cleansers limits accessibility for price-sensitive consumers. Many small-scale buyers continue to prefer mass-market cleansers due to budget constraints, restricting overall market growth. This has led brands to explore value-based packaging and mid-tier options to attract a broader consumer base while maintaining premium quality perception

• In some regions, limited availability of specialized cleansers, especially those containing organic or rare botanical ingredients, reduces consumer access. Retail and distribution constraints further compound the challenge. In addition, supply chain disruptions and sourcing difficulties for exotic ingredients add pressure on brands to maintain consistent product availability

• Competition from private-label and generic brands offering affordable alternatives creates pressure on established premium brands to balance pricing with quality and innovation. This trend encourages innovation in formulation efficiency, multi-benefit products, and cost-optimized production while preserving brand reputation

• For instance, in 2023, market surveys revealed that over 60% of consumers in mid-income brackets opted for mass-market facial cleansers over premium organic options due to cost considerations. Many brands responded by introducing smaller pack sizes or trial kits to increase accessibility and encourage sampling of premium products

• While product innovation and premium offerings are growing, addressing pricing and distribution challenges remains essential for broader market penetration and long-term growth. Companies must invest in localized production, e-commerce channels, and promotional strategies to make high-quality facial cleansers more attainable across diverse consumer segments

North America Facial Cleanser Market Scope

The market is segmented on the basis of product type, source, packaging type, skin type, application, price range, age group, cost, target customer, end use, and distribution channel.

- By Product Type

On the basis of product type, the North America facial cleanser market is segmented into Foaming Facial Cleanser, Gel Facial Cleanser, Cream & Lotion Facial Cleanser, Oil Facial Cleanser, No Foam Cleanser, Micellar Water, Bar Facial Cleanser, Solvent Facial Cleanser, Collagen Type Cleanser, Cleansing Cotton Pads, and Others. The Foaming Facial Cleanser segment held the largest market revenue share in 2024, driven by its effective removal of dirt, makeup, and excess oil, making it highly preferred for daily skincare routines. Foaming cleansers also provide a refreshing feel, gentle exfoliation, and suitability for normal to oily skin types, enhancing their adoption among residential users and professional skincare facilities.

The Gel Facial Cleanser segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its lightweight, non-greasy formulation and deep-cleansing properties, making it ideal for acne-prone and sensitive skin. Gel-based cleansers are particularly popular for their ease of application, quick absorption, and compatibility with smartphone-based skincare apps and personalized routines.

- By Source

On the basis of source, the market is segmented into Synthetic and Natural/Herbal. The Natural/Herbal segment held the largest market revenue share in 2024, driven by rising consumer preference for chemical-free and organic skincare, coupled with the increasing popularity of plant-based ingredients such as aloe vera, chamomile, and green tea extracts. Natural/Herbal cleansers are particularly favored for their mild formulations and suitability for sensitive skin.

The Synthetic segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its cost-effectiveness, stable formulations, and wide availability across mass-market and online channels. Synthetic cleansers are increasingly being enhanced with advanced functional ingredients, driving adoption among price-conscious and performance-seeking consumers.

- By Packaging Type

The market is segmented into Bottles and Jars, Tubes, Dispenser, Pouches, Blisters and Strip Packs, and Others. The Bottles and Jars segment dominated in 2024, supported by convenience of storage, repeat usability, and compatibility with different product viscosities.

The Tubes and Dispensers segment is expected to witness the fastest growth from 2025 to 2032, driven by hygiene advantages, portability, precise dosage control, and rising preference among premium and travel-friendly product users.

- By Skin Type

Segmentation based on skin type includes Combination Skin, Oily Skin, Neutral Skin, Dry Skin, Sensitive Skin, Mixed Skin, and Others. The Sensitive Skin segment held the largest market revenue share in 2024 due to rising awareness about skin allergies, irritation, and the need for gentle cleansing formulations.

The Oily Skin segment is expected to witness the fastest growth rate from 2025 to 2032, driven by urban consumer concerns over acne, excess sebum, and the growing availability of deep-cleansing, oil-controlling products in online and offline retail channels.

- By Application

The market is segmented into Moisturizing, Skin Whitening, Oiliness, Anti-Aging, Blackheads, Dark Spots, Repair, Dryness, and Others. The Moisturizing segment dominated in 2024, fueled by strong consumer focus on hydration, skin maintenance, and daily skincare routines.

The Anti-Aging segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand from aging populations, rising skincare awareness, and the introduction of multi-functional cleansers that combine hydration with anti-aging benefits.

- By Price Range

Segmentation based on price includes Mass and Premium. The Mass segment held the largest market share in 2024, driven by affordability, wide availability, and suitability for everyday use across households.

The Premium segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising disposable income, lifestyle-driven purchasing, and the increasing popularity of luxury and multi-benefit facial cleansers.

- By Age Group

The market is segmented into 20’s and 30’s, 40’s, Less than 20 Years, and 50’s+. The 20’s and 30’s age group dominated the market in 2024, driven by higher skincare awareness, disposable income, and preventive skincare habits.

The 40’s age group is expected to witness the fastest growth rate from 2025 to 2032, due to increasing focus on anti-aging, repair, and specialized skincare routines among mid-aged consumers.

- By Cost

Segmentation based on cost includes Less than 25 USD, 25 – 50 USD, 51 – 100 USD, 101 – 250 USD, and More than 250 USD. Products priced between 25 – 50 USD held the largest market share in 2024, driven by affordability, quality, and the availability of multifunctional ingredients such as hyaluronic acid, vitamin C, and antioxidants.

The 51 – 100 USD segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising demand for premium and specialized formulations that provide multiple skincare benefits.

- By Target Customer

The market is segmented into Female and Male. The Female segment dominated in 2024, owing to higher product usage, brand awareness, and engagement with skincare routines.

The Male segment is expected to witness the fastest growth rate from 2025 to 2032, driven by lifestyle changes, grooming trends, and targeted marketing campaigns promoting male-focused facial cleansers for oil control, acne prevention, and convenience.

- By End Use

Segmentation based on end use includes Household/Retail, Parlor, Modelling and Fashion Agencies, Movies and Entertainment, Media Houses, and Others. Household/Retail dominated in 2024, supported by convenience, variety, and easy accessibility through supermarkets, pharmacies, and online platforms.

The Parlor and Modelling Agencies segment is expected to witness the fastest growth from 2025 to 2032, fueled by the demand for professional-grade, specialized, and high-performance facial cleansers for sensitive or photo-ready skin.

- By Distribution Channel

The market is segmented into Offline and Online. Offline retail dominated in 2024, due to long-standing consumer habits, in-person product trials, and the presence of supermarkets, pharmacies, and specialty stores.

The Online segment is expected to witness the fastest growth rate from 2025 to 2032, driven by e-commerce penetration, digital marketing campaigns, subscription models, and influencer-led promotions that target tech-savvy and convenience-oriented consumers.

North America Facial Cleanser Market Regional Analysis

- The U.S. facial cleanser market captured the largest revenue share of 82% in 2024 within North America, fueled by the growing trend of personalized skincare and the adoption of multi-benefit and natural formulations

- Consumers are increasingly prioritizing gentle, effective cleansers suitable for combination, sensitive, and oily skin types

- The rise of e-commerce platforms, subscription-based beauty boxes, and targeted digital marketing further drives the market

- Moreover, the integration of advanced ingredients such as hyaluronic acid, vitamin C, and probiotics into facial cleansers is significantly contributing to market expansion

Canada Facial Cleanser Market Insight

The Canada facial cleanser market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer interest in natural and organic skincare products. The market growth is supported by rising awareness about skin hydration, anti-aging, and acne prevention, along with growing adoption of premium skincare products in urban centers. Consumers are also attracted to convenient packaging types such as tubes and dispensers, as well as eco-friendly and sustainable product options.

North America Facial Cleanser Market Share

The North America facial cleanser industry is primarily led by well-established companies, including:

- Procter & Gamble (U.S.)

- Johnson & Johnson (U.S.)

- Estée Lauder Companies (U.S.)

- Coty Inc. (U.S.)

- Revlon (U.S.)

- Mary Kay Inc. (U.S.)

- Colgate-Palmolive (U.S.)

- Avon Products (U.S.)

- e.l.f. Beauty (U.S.)

- Dr. Dennis Gross Skincare (U.S.)

Latest Developments in North America Facial Cleanser Market

- In August 2023, according to article by iCliniq, the field of skincare has experienced progress in delivery systems aimed at enhancing the penetration and absorption of ingredients. Unlikely traditional formulations that often remained on the skin's surface, limiting their effectiveness, the advent of advanced technologies has enabled the encapsulation of active ingredients. This innovation facilitates their journey into deeper layers of the skin. Examples of these delivery systems include liposomes, nanoparticles, and microencapsulation, all contributing to the heightened efficacy of skincare products

- In July 2021, according to an article by Elsevier B.V., the function of cosmetic products is undergoing rapid transformation in our society, as their utilization is progressively recognized as a vital aspect of personal well-being. This underscores the importance of thoroughly examining the incorporation of nanoparticles (NPs) in cosmetics. The objective of this study is to provide a thorough and critical review, delving into the implications of employing nanomaterials in advanced cosmetic formulations. The focus is on highlighting the positive outcomes stemming from the widespread use of nanotechnology in next-generation products, despite prevailing biases against its application in the cosmetic industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.