North America Fishery And Aquaculture Market

Market Size in USD Billion

CAGR :

%

USD

7.29 Billion

USD

12.15 Billion

2024

2032

USD

7.29 Billion

USD

12.15 Billion

2024

2032

| 2025 –2032 | |

| USD 7.29 Billion | |

| USD 12.15 Billion | |

|

|

|

|

North America Fishery and Aquaculture Market Size

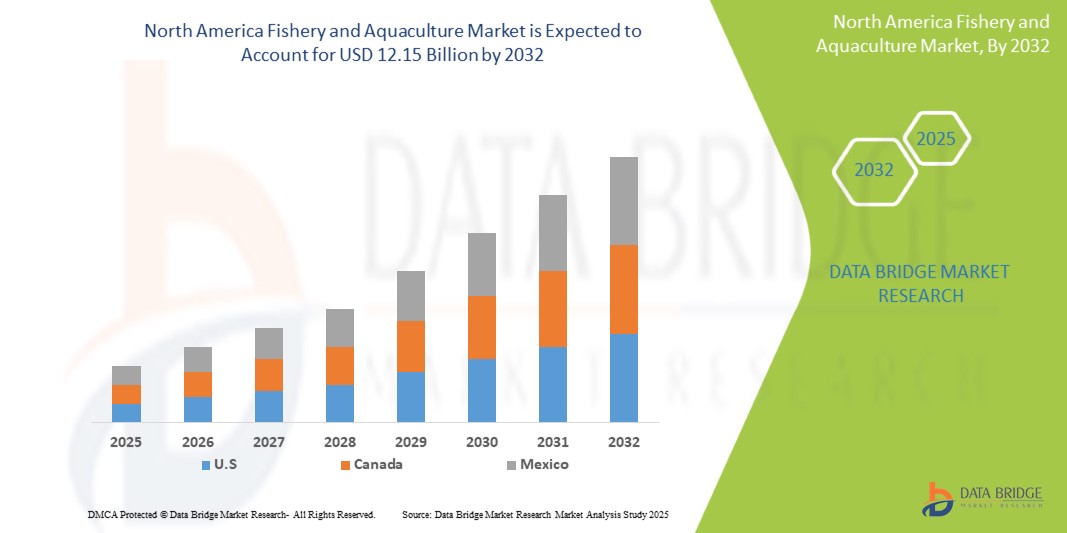

- The North America Fishery and Aquaculture Market size was valued at USD 7.29 billion in 2024 and is expected to reach USD 12.15 billion by 2032, at a CAGR of 6.8% during the forecast period

- The North America Fishery and Aquaculture Market is driven by rising North America seafood demand, population growth, advancements in aquaculture technology, and increasing health awareness

- Sustainable practices, government support, and expanding export opportunities further boost market growth and attract significant investment in the sector

North America Fishery and Aquaculture Market Analysis

- The North America Fishery and Aquaculture Market is a vital segment of the North America food and agriculture industry, encompassing the breeding, harvesting, and processing of aquatic organisms including fish, shellfish, and seaweed. It serves as a major source of protein and livelihood, particularly in coastal and developing regions. The market includes wild capture fisheries and aquaculture (fish farming), with the latter gaining prominence due to overfishing concerns and sustainability demands

- Market players are focusing on technological innovations such as recirculating aquaculture systems (RAS), selective breeding, and disease management to enhance productivity and environmental efficiency. These advancements are critical in meeting the rising North America demand for seafood, driven by population growth, urbanization, and shifting dietary preferences toward high-protein, low-fat food options

- U.S. region is projected to dominate the North America Fishery and Aquaculture Market with market share of 64.68% in 2025 and is expected to grow with highest CAGR, during the forecast period, driven by its large coastline, favorable climatic conditions, government support, and high domestic consumption

- The Aquafeed segment is expected to lead the North America Fishery and Aquaculture Market by 2025, accounting for the largest share 60.03%. due to its scalability, sustainability potential, and ability to meet consistent demand. This segment is increasingly influenced by consumer preference for traceable, eco-labeled, and farmed seafood products, reinforcing its role in North America food security

Report Scope and North America Fishery and Aquaculture Market Segmentation

|

Attributes |

North America Fishery and Aquaculture Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America Fishery and Aquaculture Market Trends

Innovation in Functional Aquaculture Products and Personalized Nutrition

- The North America Fishery and Aquaculture Market is experiencing a notable transformation as demand rises for functional seafood products and personalized nutrition tailored to individual health needs, dietary lifestyles, and sustainability preferences

- This trend is pushing producers to move beyond traditional offerings and develop enriched aquaculture products containing omega-3 fatty acids, probiotics, collagen, and other bioactive ingredients that promote heart health, brain function, immunity, and overall wellness

- For instance, companies are innovating with fortified fish feed and controlled farming methods that enhance nutritional profiles of farmed species like salmon, tilapia, and shrimp—making them more appealing to health-conscious consumers

- A growing interest in plant-based aquafeed, algae-derived ingredients, and antibiotic-free aquaculture is reinforcing this trend, aligning with clean-label and eco-conscious consumer demands

- The rise of personalized nutrition in the seafood sector is also fueled by advancements in AI and genomics, enabling tailored dietary solutions that incorporate specific seafood types or nutrients for individual health goals

- This reflects a broader consumer shift toward preventive healthcare, clean-label transparency, and nutrient-dense food sources, positioning functional aquaculture as a critical contributor to modern, health-aligned diets

North America Fishery and Aquaculture Market Dynamics

Driver

Rising North America Demand for Sustainable and Protein-Rich Food Sources

- As North America populations grow and incomes rise, particularly in emerging markets, seafood consumption is accelerating due to its high protein content, low-fat profile, and essential nutrients like omega-3s

- Aquaculture has emerged as the fastest-growing source of animal protein, supported by technological advancements that enable efficient, large-scale fish farming with minimal environmental impact

- Consumers are increasingly seeking sustainably sourced and certified seafood products, prompting major retailers and brands to invest in traceable, eco-labeled aquaculture supply chains

- In January 2025, according to a report by the North America Aquaculture Alliance, over 55% of seafood consumed now originates from aquaculture, reflecting its rising dominance and reliability compared to wild-capture fisheries

- Furthermore, companies are embracing Recirculating Aquaculture Systems (RAS), offshore aquaculture, and AI-based monitoring to improve yields while reducing ecological footprints—key factors in market expansion

- Aquaculture also offers stability in production, avoiding seasonal and overfishing issues that impact wild stocks, making it a more reliable and scalable protein source for the future

Restraint/Challenge

High Operational and Compliance Costs for Small-Scale Aquaculture Producers

- While the demand for premium and sustainable aquaculture products is rising, the cost of meeting quality, safety, and sustainability standards presents significant challenges—especially for small and medium-sized producers

- Expenses include specialized feed, water filtration systems, disease prevention measures, environmental monitoring, labor, and certifications (e.g., ASC, BAP, Organic)

- In September 2024, a study by the World Bank noted that the cost of establishing a mid-scale recirculating aquaculture system could exceed USD 1 million, making it inaccessible to smaller operators without financial backing

- Additionally, frequent regulatory changes around environmental impact, antibiotic use, and animal welfare increase the burden on producers, particularly in regions with limited institutional support

- Technological barriers and a lack of digital infrastructure also hinder the adoption of smart farming tools such as AI monitoring, automated feeding, and precision water quality control.

- These challenges restrict innovation, production scalability, and the ability of smaller players to participate in high-value export markets, leading to market concentration among larger, well-capitalized companies

- Without improved access to financing, training, and government incentives, many small aquaculture businesses risk being left behind in the industry's modernization push

North America Fishery and Aquaculture Market Scope

The market is segmented on the basis of product type, aquaculture production system, environment, application, production sale, category, source, form, function, technology and species

• By Product Type

On the basis of product type, the North America Fishery and Aquaculture Market is segmented into aquafeed and equipment. Aquafeed are expected to dominate the market share 59.37% in 2025 and it is anticipated show the fastest growing during the forecast period. Rising global demand for high-quality, nutrient-rich fish feed is fueling this growth. Innovations in plant-based proteins, probiotics, and functional additives are enhancing fish health, improving growth rates, and promoting sustainable aquaculture practices. These advancements meet the needs of intensive farming systems while aligning with eco-conscious consumer preferences, driving widespread adoption across commercial operations. Regulatory pressure to reduce overfishing and reliance on wild fish for feed ingredients has accelerated the shift toward alternative formulations. Aquafeed manufacturers are investing heavily in R&D to improve digestibility and minimize nutrient runoff, which contributes to water pollution. The integration of digital tools for feed formulation and dosage control is further optimizing efficiency. Equipment, though smaller in share, supports automation in feeding, aeration, and monitoring, especially in smart aquaculture setups.

• By Aquaculture Production System

On the basis of aquaculture production system, the North America Fishery and Aquaculture Market is segmented into water-based systems, land-based systems, recycling systems, integrated farming system and others. Water-Based Systems held the largest share 68.84% in 2025 and it is anticipated show the fastest growing during the forecast period. This segment includes ponds, tanks, and offshore cages that utilize natural water bodies for fish farming. These systems are favored for their cost-effectiveness, scalability, and ability to provide natural rearing environments. With manageable water quality control and lower infrastructure costs, they attract significant investment from commercial operators. Their adaptability to various species and regions supports high yields, making them a preferred choice for sustainable and large-scale aquaculture expansion. Ponds remain the most common method in developing countries due to low entry barriers and use of existing water resources. Coastal nations are increasingly investing in offshore cage systems to reduce environmental impact and increase production capacity. Government subsidies and public-private partnerships are supporting the modernization of traditional water-based farms. These systems benefit from natural water exchange, reducing the need for artificial filtration.

• By Environment

On the basis of environment, the North America Fishery and Aquaculture Market is segmented into fresh water, marine water and brackish water. Fresh Water held the largest share 55.49% in 2025 and it is anticipated show the fastest growing during the forecast period. This growth is driven by the abundance of inland water resources such as rivers, lakes, and reservoirs, particularly in developing regions. Freshwater systems face fewer technical challenges compared to marine or brackish environments, making them accessible and cost-effective. Species like tilapia, carp, and catfish thrive in these conditions and are widely consumed locally. The low operational costs, coupled with strong domestic demand and government support, make freshwater aquaculture a key contributor to food security and rural livelihoods. China, India, and Egypt are leading producers, leveraging vast river basins and irrigation networks. Smallholder farmers often integrate fish farming with rice cultivation, boosting productivity per unit area. Recirculating systems are being adopted in freshwater farms to conserve water and improve biosecurity.

• By Application

On the basis of application, the North America Fishery and Aquaculture Market is segmented into adult, juvenile and larva. Adult held the largest share 73.29% in 2025 and it is anticipated show the fastest growing during the forecast period. This dominance is due to high consumer demand for mature, market-ready fish suitable for direct consumption and export. Adult fish are typically sold whole or processed, making them the primary revenue source in aquaculture. Efficient feeding strategies, optimized health management, and improved breeding techniques ensure high survival rates and optimal weight gain. Large-scale producers focus on this stage to maximize profitability, making it the most economically significant phase in the aquaculture value chain. The grow-out phase (adult stage) accounts for over 70% of total production costs, emphasizing the need for efficiency. Automated feeding systems and oxygen monitoring are widely used to support rapid growth. Disease outbreaks at this stage can lead to massive losses, prompting investment in vaccines and biosecurity.

• By Production Scale

On the basis of production scale, the North America Fishery and Aquaculture Market is segmented into large-scale, medium-scale, small-scale. Large-Scale held the highest share 49.49% in 2025 and it is anticipated show the fastest growing during the forecast period. These operations benefit from industrial automation, advanced monitoring systems, and integrated supply chains that ensure consistent production and quality control. Large farms achieve economies of scale, reducing per-unit costs and increasing profitability. They are increasingly adopting smart farming technologies for feeding, water management, and disease prevention. With rising seafood demand in the Middle East and Africa, large-scale producers are well-positioned to meet market needs efficiently and sustainably, attracting significant private and public investment. Multinational corporations and agribusinesses are entering the sector, bringing capital and expertise.

• By Category

On the basis of category, the North America Fishery and Aquaculture Market is segmented into conventional and organic. Conventional held the highest share 86.83% in 2025 and it is anticipated show the fastest growing during the forecast period. It remains the preferred method due to lower initial investment, established farming practices, and widespread availability of inputs like feed and seed. While concerns about environmental impact persist, conventional systems are highly productive and accessible, especially in rural and developing regions. Most producers rely on this model due to limited access to organic certification or advanced technologies. Its familiarity and scalability make it the backbone of the regional aquaculture industry, supporting food supply and economic development. Conventional farming often uses chemical treatments and antibiotics, raising concerns about residue and antimicrobial resistance.

• By Source

On the basis of source, the North America Fishery and Aquaculture Market is segmented into plant-based and animal-based. Plant-Based held the highest share 60.11% in 2025 and it is anticipated show the fastest growing during the forecast period. This growth is driven by the need for sustainable alternatives to fishmeal and fish oil, which are resource-intensive and environmentally taxing. Ingredients such as soy, algae, corn, and pulses provide essential proteins and nutrients while reducing reliance on wild-caught fish. Plant-based feeds also align with eco-friendly and ethical aquaculture practices, appealing to environmentally conscious consumers and regulators. Ongoing research into alternative proteins continues to enhance feed efficiency and fish health, boosting adoption across the industry. Microalgae and insect meal are being blended with plant proteins to improve amino acid profiles. Genetic modification and fermentation technologies are being used to develop high-protein crops tailored for aquafeed. Feed conversion ratios (FCR) have improved significantly with optimized plant-based formulations.

• By Form

On the basis of form, the North America Fishery and Aquaculture Market is segmented into dry, wet form, moist form. Dry held the highest share 55.79% in 2025 and it is anticipated show the fastest growing during the forecast period. It is preferred for its long shelf life, ease of storage, and resistance to spoilage, making it ideal for large-scale operations. Dry feeds offer precise nutrient formulation, ensuring consistent feeding and optimal fish growth. They are compatible with automated feeding systems, reducing labor costs and feed wastage. Their durability during transportation and handling makes them suitable for remote and commercial farms alike. As modern aquaculture becomes more mechanized, dry feed remains the most practical and efficient feeding solution. Extrusion technology allows the production of floating, sinking, or slow-sinking pellets tailored to species behavior. This form minimizes water pollution by reducing disintegration. In contrast, wet and moist feeds are more perishable and require cold storage, limiting their use. Dry feed dominates in shrimp, tilapia, and catfish farming, which are high-volume sectors.

• By Function

On the basis of function, the North America Fishery and Aquaculture Market is segmented into fishery and aquaculture rational value, energy booster, improve digestibility, feed preservation, cytotoxic management and others. national value emphasizes cost-efficiency, resource optimization, and return on investment in aquaculture operations. Producers prioritize methods that maximize output while minimizing input costs and environmental impact. This includes efficient feeding, disease prevention, and yield optimization strategies. By balancing economic and ecological goals, rational value supports long-term profitability and sustainability. It appeals to both smallholders and commercial farms seeking resilient, scalable, and financially viable aquaculture models in competitive markets. The concept integrates lifecycle cost analysis, feed conversion ratios, and mortality rates into decision-making.

• By Technology

On the basis of technology, the North America Fishery and Aquaculture Market is segmented into conventional fishery & aquaculture and smart fishery & aquaculture. Conventional Fishery & Aquaculture held the highest share 72.90% in 2025 and it is anticipated show the fastest growing during the forecast period. These methods include traditional wild capture, pond farming, and cage culture, which remain dominant due to low technological barriers and widespread adoption. They support rural employment and local food security across the Middle East and Africa. Despite environmental challenges, conventional systems are trusted and well-understood by producers. While smart aquaculture is emerging, the high cost and complexity of digital tools limit their reach, allowing conventional practices to maintain their lead in the near term. Artisanal fishers and small-scale farmers rely on generational knowledge and low-cost inputs. Over 90% of aquaculture in Africa and South Asia is conducted using conventional methods.

• By Species

On the basis of species, the North America Fishery and Aquaculture Market is segmented into fish, crustaceans and mollusks. Fish held the highest share 60.47% in 2025 and it is anticipated show the fastest growing during the forecast period. Fish such as tilapia, salmon, catfish, and carp are the most farmed due to their fast growth, high consumer acceptance, and adaptability to various farming systems. They serve as a primary source of affordable animal protein, especially in developing regions. Increasing demand for seafood, coupled with overfishing of wild stocks, has accelerated aquaculture production. Fish farming supports food security, export revenues, and economic development, making it the cornerstone of the global aquaculture industry. Tilapia is popular in Africa and the Americas for its hardiness and low-cost feed requirements. Salmon farming in Norway and Chile drives high-value exports to North America.

North America Fishery and Aquaculture Market Regional Analysis

- U.S. dominates the North America Fishery and Aquaculture Market with the largest revenue share 64.68% in 2025, due to its advanced fishing technologies, strong regulatory frameworks, and well-established seafood processing infrastructure. High domestic demand for sustainable and locally sourced seafood further supports market growth

- The country also invests heavily in research and development to improve aquaculture efficiency and environmental sustainability

- Strategic coastal access, government initiatives, and private sector involvement enhance production capabilities. In addition, increasing health awareness among consumers boosts the demand for protein-rich fish and seafood products across the nation

Canada North America Fishery and Aquaculture Market Insight

The Canada North America Fishery and Aquaculture Market captured a revenue share of over 25.20% within North America in 2025, Canada is the driven by vast freshwater resources, government subsidies, and a strong domestic seafood market. Technological advancements, large-scale fish farms, and a growing export industry make it a central hub for North America aquaculture supply.

North America Fishery and Aquaculture Market Share

The North America Fishery and Aquaculture Market is primarily led by well-established companies, including:

- Pentair (U.S.)

- CPI Equipment Inc. (Canada)

- Alltech (U.S.)

- Kemin Aqua Science (U.S.)

- Syndel (Canada)

- Dura-Tech Industrial and Marine Limited (Canada)

- Fluval (Canada)

- Innovasea Systems, Inc. (U.S.)

- Deep Trekker Inc. (Canada)

- Lifegard Aquatics (U.S.)

- In-Situ Inc (U.S.)

- Integrated Aqua Systems, Inc. (U.S.)

Latest Developments in North America Fishery and Aquaculture Market

- In May, 2025, Wildtype received regulatory clearance from the U.S. FDA to sell its cultivated coho salmon in the United States. It became the first start-up allowed to market cell-cultured seafood in the country—now featured in select restaurants

- In July 2025, Norway’s Grieg Seafood announced the sale of its salmon-farming operations in Canada to Cermaq. The move marks a strategic restructuring, as the company continues focusing on its core operations in Norway, British Columbia, and Shetland

- In June 2024, Huon Aquaculture announced plans for an AU$110 million Recirculating Aquaculture System (RAS) facility at Whale Point, Tasmania, with construction set to begin in early 2025. Once operational, it will rank among the largest RAS facilities in the Southern Hemisphere, enabling land-based salmon farming for up to 60% of the fish’s lifecycle by 2027.

- In April 2023 Japanese company Nissui (Nippon Suisan Kaisha) launched its first commercial land-based shrimp farm in Ei, Kagoshima, and is planning a land-based mackerel farm slated to begin operations in 2026, signaling its shift toward more sustainable aquaculture

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.1.1 COMPETITIVE RIVALRY – HIGH

4.1.2 THREAT OF NEW ENTRANTS – MODERATE TO HIGH

4.1.3 BARGAINING POWER OF BUYERS – HIGH

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.5 THREAT OF SUBSTITUTES – MODERATE

4.2 PATENT ANALYSIS

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 LICENSING AND COLLABORATIONS

4.2.4 REGION PATENT LANDSCAPE

4.2.5 IP STRATEGY AND MANAGEMENT

4.3 VALUE CHAIN

4.3.1 NORTH AMERICA FISHERY AND AQUACULTURE MARKET VALUE CHAIN

4.3.2 PRODUCTION:

4.3.3 PROCESSING:

4.3.4 MARKETING/DISTRIBUTION:

4.3.5 BUYERS:

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 HATCHERIES AND FISH SEED SUPPLIERS

4.4.2 FISH FARMERS / AQUACULTURE PRODUCERS

4.4.3 CAPTURE FISHERIES (WILD CATCH)

4.4.4 FEED PRODUCERS

4.4.5 PROCESSORS

4.4.6 PACKAGERS

4.4.7 DISTRIBUTORS / WHOLESALERS

4.4.8 EXPORTERS

4.4.9 RETAIL CHANNELS

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5.1 VERTICAL INTEGRATION FOR SUPPLY CHAIN EFFICIENCY

4.5.2 SUSTAINABLE AQUACULTURE CERTIFICATIONS AND ECO-LABELING

4.5.3 STRATEGIC MERGERS AND ACQUISITIONS

4.5.4 INVESTMENT IN R&D AND BIOTECHNOLOGICAL ADVANCEMENTS

4.5.5 EXPANSION INTO NUTRITION

4.5.6 INNOVATION AND SMART AQUACULTURE

4.5.7 PUBLIC-PRIVATE PARTNERSHIPS AND GOVERNMENT COLLABORATIONS

4.6 RAW MATERIAL SOURCING IN THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET

4.6.1 OVERVIEW OF RAW MATERIALS IN AQUACULTURE

4.6.2 SOURCING OF AQUAFEED RAW MATERIALS

4.6.2.1 Protein and Amino Acid Sources

4.6.2.2 Lipid Sources

4.6.2.3 Functional Additives and Micronutrients

4.6.3 RAW MATERIALS IN AQUACULTURE EQUIPMENT MANUFACTURING

4.6.3.1 Polymer Materials

4.6.3.2 Metal Components

4.6.3.3 Sensor and Electronic Inputs

4.6.4 RAW MATERIAL INPUTS FOR PHARMACEUTICALS AND HEALTH MANAGEMENT

4.6.4.1 Active Pharmaceutical Ingredients (APIs)

4.6.4.2 Excipients and Carriers

4.6.4.3 Diagnostic Reagents

4.6.5 SOURCING OF WATER TREATMENT AND BIOSECURITY INPUTS

4.6.5.1 Disinfectants and Oxidizing Agents

4.6.5.2 Mineral and pH Modifiers

4.6.5.3 Biological Agents

4.6.6 SUPPLY CHAIN CONSIDERATIONS AND CHALLENGES

4.6.6.1 Globalization and Regional Dependencies

4.6.6.2 Sustainability and Ethical Sourcing

4.6.6.3 Quality Assurance and Traceability

4.6.7 CONCLUSION

4.7 BRAND OUTLOOK

4.8 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.8.1 JOINT VENTURES

4.8.2 MERGERS AND ACQUISITIONS

4.8.3 LICENSING AND PARTNERSHIP

4.8.4 TECHNOLOGY COLLABORATIONS

4.8.5 STRATEGIC DIVESTMENTS

4.8.6 NUMBER OF PRODUCTS IN DEVELOPMENT

4.8.7 STAGE OF DEVELOPMENT

4.8.8 TIMELINES AND MILESTONES

4.8.9 INNOVATION STRATEGIES AND METHODOLOGIES

4.8.10 RISK ASSESSMENT AND MITIGATION

4.8.11 FUTURE OUTLOOK

4.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.9.1 PRODUCT QUALITY AND FRESHNESS

4.9.2 PRICE COMPETITIVENESS AND VALUE

4.9.3 SUSTAINABILITY AND CERTIFICATIONS

4.9.4 AVAILABILITY AND SUPPLY RELIABILITY

4.9.5 TECHNOLOGICAL INTEGRATION AND TRANSPARENCY

4.9.6 BRAND REPUTATION AND CONSUMER PREFERENCES

4.1 IMPACT OF ECONOMIC SLOWDOWN ON MARKET NORTH AMERICA FISHERY AND AQUACULTURE MARKET

4.10.1 IMPACT OF PRICE

4.10.2 IMPACT ON SUPPLY CHAIN

4.10.3 IMPACT ON SHIPMENT

4.10.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.10.5 CONCLUSION

4.11 OVERVIEW OF TECHNOLOGICAL ANALYSIS.

4.11.1 DATA ANALYTICS AND ARTIFICIAL INTELLIGENCE (AI)

4.11.2 THE INTERNET OF THINGS (IOT) AND SENSOR TECHNOLOGY

4.11.3 AUTOMATION AND ROBOTICS

4.11.4 BLOCKCHAIN FOR TRACEABILITY AND SUPPLY CHAIN MANAGEMENT

4.11.5 CONCLUSION:

4.12 IMPORT EXPORT SCENARIO

4.13 PRODUCTION CONSUMPTION ANALYSIS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.3.1 COMPLIANCE AND COST EFFICIENCY

5.3.2 SUSTAINABILITY PRACTICES

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.5.3 IMPACT ON PRICES

5.6 REGULATORY INCLINATION

5.6.1 GEOPOLITICAL SITUATION

5.6.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.6.2.1 FREE TRADE AGREEMENTS

5.6.2.2 ALLIANCES ESTABLISHMENTS

5.6.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.6.4 DOMESTIC COURSE OF CORRECTION

5.6.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.6.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

5.7 CONCLUSION

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 POPULATION GROWTH IS ACCELERATING SEAFOOD DEMAND

7.1.2 TECHNOLOGICAL ADVANCES IN AQUACULTURE SYSTEMS ADOPTION

7.1.3 CONSUMER PREFERENCE SHIFTING TOWARD HEALTHFUL PROTEINS

7.1.4 TECHNOLOGICAL IMPROVEMENTS IN COLD CHAIN LOGISTICS AND DISTRIBUTION

7.2 RESTRAINTS

7.2.1 COST VOLATILITY FOR FEED AND PRODUCTION OPERATIONS

7.2.2 INCREASING REGULATORY REQUIREMENTS FOR MARKET COMPLIANCE

7.3 OPPORTUNITIES

7.3.1 EXPANSION OF SUSTAINABLE AND ECO-FRIENDLY PRACTICES

7.3.2 INNOVATION IN VALUE-ADDED SEAFOOD PRODUCT OFFERINGS

7.3.3 GROWING MARKET ACCESS IN EMERGING ECONOMIES

7.4 CHALLENGES

7.4.1 CLIMATE CHANGE IS DISRUPTING MARINE ECOSYSTEMS STABILITY

7.4.2 DISEASE OUTBREAKS HEAVILY IMPACTING FARMED SPECIES

8 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 AQUAFEED

8.3 EQUIPMENT

9 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM

9.1 OVERVIEW

9.2 WATER-BASED SYSTEMS

9.3 LAND-BASED SYSTEMS

9.4 RECYCLING SYSTEMS

9.5 INTEGRATED FARMING SYSTEM

9.6 OTHERS

10 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT

10.1 OVERVIEW

10.2 FRESH WATER

10.3 MARINE WATER

10.4 BRACKISH WATER

11 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ADULT

11.3 JUVENILE

11.4 LARVA

12 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE

12.1 OVERVIEW

12.2 LARGE-SCALE

12.3 MEDIUM-SCALE

12.4 SMALL-SCALE

13 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY

13.1 OVERVIEW

13.2 CONVENTIONAL

13.3 ORGANIC

14 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SOURCE

14.1 OVERVIEW

14.2 PLANT-BASED

14.3 ANIMAL-BASED

15 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FORM

15.1 OVERVIEW

15.2 DRY

15.3 WET FORM

15.4 MOIST FORM

16 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION

16.1 OVERVIEW

16.2 FISHERY AND AQUACULTURE RATIONAL VALUE

16.3 ENERGY BOOSTER

16.4 IMPROVE DIGESTIBILITY

16.5 FEED PRESERVATION

16.6 CYTOTOXIC MANAGEMENT

16.7 OTHERS

17 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 CONVENTIONAL FISHERY & AQUACULTURE

17.3 SMART FISHERY & AQUACULTURE

18 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SPECIES

18.1 OVERVIEW

18.2 FISH

18.3 CRUSTACEANS

18.4 MOLLUSKS

19 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY REGION

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

20 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 SKRETTING

22.1.1 COMPANY SNAPSHOT

22.1.2 COMPANY SHARE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENT

22.2 ALLTECH

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENT

22.3 PENTAIRAES

22.3.1 COMPANY SNAPSHOT

22.3.2 COMPANY SHARE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 RECENT DEVELOPMENT

22.4 KEMIN INDUSTRIES, INC.

22.4.1 COMPANY SNAPSHOT

22.4.2 COMPANY SHARE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT DEVELOPMENT

22.5 CORBION

22.5.1 COMPANY SNAPSHOT

22.5.2 RECENT FINANCIALS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 AKVA GROUP ASA

22.6.1 COMPANY SNAPSHOT

22.6.2 REVENUE ANALYSIS

22.6.3 PRODUCT PORTFOLIO

22.6.4 REC.ENT DEVELOPMENTS/NEWS

22.7 AQ1 SYSTEMS PTY LTD

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT UPDATES

22.8 AQUABYTE

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 AQUACULTURE EQUIPMENT LTD

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS/NEWS

22.1 ASAKUA

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS/NEWS

22.11 BAADER

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENT

22.12 BHUVAN BIOLOGICALS

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS/NEWS

22.13 CAGE EYE

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENT

22.14 CPI EQUIPMENT INC

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS/NEWS

22.15 DEEP TREKKER INC.

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENT

22.16 DURA TECH INDUSTRIAL & MARINE LIMITED

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENTS/NEWS

22.17 ERUVAKA TECHNOLOGIES

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENT

22.18 FAIVRE SASU

22.18.1 COMPANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENTS/NEWS

22.19 FISHFARMFEEDER

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 FISH TREATMENT

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENT

22.21 FLUVAL

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 GAEL FORCE GROUP LIMITED

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS/NEWS

22.23 GAMAKATSU CO., LTD.

22.23.1 COMPANY SNAPSHOT

22.23.2 PRODUCT PORTFOLIO

22.23.3 RECENT DEVELOPMENT

22.24 GILIOCEAN TECHNOLOGY

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS/NEWS

22.25 GROWEL

22.25.1 COMPANY SNAPSHOT

22.25.2 PRODUCT PORTFOLIO

22.25.3 RECENT DEVELOPMENT

22.26 HESY AQUACULTURE B.V.

22.26.1 COMPANY SNAPSHOT

22.26.2 PRODUCT PORTFOLIO

22.26.3 RECENT DEVELOPMENTS/NEWS

22.27 HIPRA, S.A.

22.27.1 COMPANY SNAPSHOT

22.27.2 PRODUCT PORTFOLIO

22.27.3 RECENT DEVELOPMENT

22.28 HUNG STAR ENTERPRISE CORP.

22.28.1 COMPANY SNAPSHOT

22.28.2 PRODUCT PORTFOLIO

22.28.3 RECENT DEVELOPMENTS/NEWS

22.29 IMENCO AQUA AS

22.29.1 COMPANY SNAPSHOT

22.29.2 PRODUCT PORTFOLIO

22.29.3 RECENT DEVELOPMENT

22.3 INNOVASEA SYSTEMS INC.

22.30.1 COMPANY SNAPSHOT

22.30.2 PRODUCT PORTFOLIO

22.30.3 RECENT DEVELOPMENT

22.31 IN- SITU INC.

22.31.1 COMPANY SNAPSHOT

22.31.2 PRODUCT PORTFOLIO

22.31.3 RECENT DEVELOPMENT

22.32 INTEGRATED AQUA SYSTEMS, INC

22.32.1 COMPANY SNAPSHOT

22.32.2 PRODUCT PORTFOLIO

22.32.3 RECENT DEVELOPMENTS/NEWS

22.33 INTERNATIONAL HEALTHCARE

22.33.1 COMPANY SNAPSHOT

22.33.2 PRODUCT PORTFOLIO

22.33.3 RECENT DEVELOPMENTS/NEWS

22.34 INVE AQUACULTURE

22.34.1 COMPANY SNAPSHOT

22.34.2 PRODUCT PORTFOLIO

22.34.3 RECENT DEVELOPMENT

22.35 KAI CHUANG MARINE INTERNATIONAL

22.35.1 COMPANY SNAPSHOT

22.35.2 PRODUCT PORTFOLIO

22.35.3 RECENT DEVELOPMENT

22.36 LIFEGARD AQUATICS

22.36.1 COMPANY SNAPSHOT

22.36.2 PRODUCT PORTFOLIO

22.36.3 RECENT DEVELOPMENT

22.37 LINN GERATEBAU

22.37.1 COMPANY SNAPSHOT

22.37.2 PRODUCT PORTFOLIO

22.37.3 RECENT DEVELOPMENTS/NEWS

22.38 MUSTAD FISHING

22.38.1 COMPANY SNAPSHOT

22.38.2 PRODUCT PORTFOLIO

22.38.3 RECENT DEVELOPMENT

22.39 NANRONG SHANGHAI CO., LTD.

22.39.1 COMPANY SNAPSHOT

22.39.2 PRODUCT PORTFOLIO

22.39.3 RECENT DEVELOPMENT

22.4 NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED

22.40.1 COMPANY SNAPSHOT

22.40.2 PRODUCT PORTFOLIO

22.40.3 RECENT DEVELOPMENTS/NEWS

22.41 NIREUS

22.41.1 COMPANY SNAPSHOT

22.41.2 PRODUCT PORTFOLIO

22.41.3 RECENT DEVELOPMENT

22.42 PHARMAQ AS (SUBSIDIARY OF ZOETIS INC.)

22.42.1 COMPANY SNAPSHOT

22.42.2 PRODUCT PORTFOLIO

22.42.3 RECENT DEVELOPMENT

22.43 PIONEER GROUP

22.43.1 COMPANY SNAPSHOT

22.43.2 PRODUCT PORTFOLIO

22.43.3 RECENT DEVELOPMENT

22.44 PROTEON PHARMACEUTICALS S.A.

22.44.1 COMPANY SNAPSHOT

22.44.2 PRODUCT PORTFOLIO

22.44.3 RECENT DEVELOPMENT

22.45 PT JALA AKUAKULTUR LESTARI ALAMKU

22.45.1 COMPANY SNAPSHOT

22.45.2 PRODUCT PORTFOLIO

22.45.3 RECENT DEVELOPMENT

22.46 SAGAR AQUACULTURE PVT LTD

22.46.1 COMPANY SNAPSHOT

22.46.2 PRODUCT PORTFOLIO

22.46.3 RECENT DEVELOPMENT

22.47 SINO-AQUA CORPORATION

22.47.1 COMPANY SNAPSHOT

22.47.2 PRODUCT PORTFOLIO

22.47.3 RECENT DEVELOPMENTS/NEWS

22.48 SREEMA’S FEEDS

22.48.1 COMPANY SNAPSHOT

22.48.2 PRODUCT PORTFOLIO

22.48.3 RECENT DEVELOPMENT

22.49 SRR AQUA SUPPLIERS LLP

22.49.1 COMPANY SNAPSHOT

22.49.2 PRODUCT PORTFOLIO

22.49.3 RECENT DEVELOPMENTS/NEWS

22.5 SYNDEL

22.50.1 COMPANY SNAPSHOT

22.50.2 PRODUCT PORTFOLIO

22.50.3 RECENT DEVELOPMENTS/NEWS

22.51 THAI UNION FEEDMILL PUBLIC COMPANY LIMITED.

22.51.1 COMPANY SNAPSHOT

22.51.2 REVENUE ANALYSIS

22.51.3 PRODUCT PORTFOLIO

22.51.4 RECENT DEVELOPMENT

22.52 VAKI AQUACULTURE SYSTEMS LTD. (SUBSIDIARY OF MERCK & CO., INC. )

22.52.1 COMPANY SNAPSHOT

22.52.2 PRODUCT PORTFOLIO

22.52.3 RECENT DEVELOPMENT

22.53 VAXXINOVA INTERNATIONAL BV

22.53.1 COMPANY SNAPSHOT

22.53.2 PRODUCT PORTFOLIO

22.53.3 RECENT DEVELOPMENTS/NEWS

22.54 VERAMARIS

22.54.1 COMPANY SNAPSHOT

22.54.2 PRODUCT PORTFOLIO

22.54.3 RECENT DEVELOPMENT

22.55 VIJAYA SARADHI FEEDS

22.55.1 COMPANY SNAPSHOT

22.55.2 PRODUCT PORTFOLIO

22.55.3 RECENT DEVELOPMENT

22.56 IAERATOR (ZHEJIANG FORDY IMP. & EXP. CO.,LTD.)

22.56.1 COMPANY SNAPSHOT

22.56.2 PRODUCT PORTFOLIO

22.56.3 RECENT DEVELOPMENT

23 QUESTIONNAIRE

24 RELATED REPORTS

List of Table

TABLE 1 PATENT BY COUNTRY

TABLE 2 APPLICANTS OF PATENTS

TABLE 3 INVENTORS OF PATENTS

TABLE 4 IPC CODES OF PATENTS

TABLE 5 PUBLICATION OF PATENTS YEARLY

TABLE 6 BRAND OUTLOOK: KEY COMPANIES IN THE NORTH AMERICA FISHERY AND AQUACULTURE EQUIPMENT MARKET

TABLE 7 REGULATORY COVERAGE

TABLE 8 COST OF FEED AND PRODUCTION OPERATIONS

TABLE 9 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 11 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 12 NORTH AMERICA AQUAFEED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA AQUAFEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA INTEGRATED FARMING SYSTEM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA OTHERS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA FRESH WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA MARINE WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA BRACKISH WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA ADULT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA JUVENILE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA LARVA IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA LARGE-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA MEDIUM-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA SMALL-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA CONVENTIONAL IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA ORGANIC IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA PLANT-BASED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA ANIMAL-BASED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA DRY IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA WET FORM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA MOIST FORM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA FISHERY AND AQUACULTURE RATIONAL VALUE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA ENERGY BOOSTER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA IMPROVE DIGESTIBILITY IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA FEED PRESERVATION IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA CYTOTOXIC MANAGEMENT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA OTHERS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA CONVENTIONAL FISHERY & AQUACULTURE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA SMART FISHERY & AQUACULTURE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA FISH IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (THOUSAND METRIC TONS)

TABLE 95 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 96 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 98 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 99 NORTH AMERICA AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NORTH AMERICA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 NORTH AMERICA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 NORTH AMERICA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 NORTH AMERICA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 NORTH AMERICA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 NORTH AMERICA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 130 NORTH AMERICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 NORTH AMERICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 NORTH AMERICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 134 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 135 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 136 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 137 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 138 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 139 NORTH AMERICA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 141 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 142 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 143 NORTH AMERICA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 NORTH AMERICA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 NORTH AMERICA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.S. FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 148 U.S. FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 149 U.S. AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.S. LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 U.S. ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 U.S. MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.S. PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 U.S. EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 U.S. CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.S. WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.S. WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.S. FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 U.S. MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 U.S. SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.S. SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 U.S. FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 U.S. OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 U.S. CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 U.S. UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 U.S. AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 U.S. FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 180 U.S. WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 U.S. LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 U.S. RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 U.S. FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 184 U.S. FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 U.S. FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 186 U.S. FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 187 U.S. FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 188 U.S. FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 189 U.S. DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 U.S. FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 191 U.S. FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 192 U.S. FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 193 U.S. FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 U.S. CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 U.S. MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 CANADA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 CANADA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 198 CANADA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 199 CANADA AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 CANADA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 CANADA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 CANADA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 CANADA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 CANADA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 CANADA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 CANADA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CANADA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 CANADA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 CANADA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 CANADA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 CANADA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 CANADA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 CANADA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CANADA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 CANADA EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 CANADA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 CANADA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 CANADA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 CANADA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 CANADA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 CANADA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 CANADA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 CANADA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 CANADA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 CANADA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 CANADA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 CANADA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 CANADA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 230 CANADA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 CANADA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 CANADA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 CANADA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 234 CANADA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 235 CANADA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 236 CANADA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 237 CANADA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 238 CANADA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 239 CANADA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 CANADA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 241 CANADA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 242 CANADA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 243 CANADA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 CANADA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 CANADA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 MEXICO FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 MEXICO FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 248 MEXICO FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 249 MEXICO AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 MEXICO FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 MEXICO LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 MEXICO BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 MEXICO AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 MEXICO AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 MEXICO VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 MEXICO TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 MEXICO PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 MEXICO ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 MEXICO ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 MEXICO FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 MEXICO CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 MEXICO PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 MEXICO ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 MEXICO MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 MEXICO PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 MEXICO EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 MEXICO CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 MEXICO WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 MEXICO WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 MEXICO FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 MEXICO MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 MEXICO SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 MEXICO SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 MEXICO FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 MEXICO OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 MEXICO CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 MEXICO UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 MEXICO AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 MEXICO FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 280 MEXICO WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 MEXICO LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 MEXICO RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 MEXICO FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 284 MEXICO FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 285 MEXICO FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 286 MEXICO FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 287 MEXICO FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 288 MEXICO FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 289 MEXICO DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 MEXICO FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 291 MEXICO FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 292 MEXICO FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 293 MEXICO FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 MEXICO CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 MEXICO MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA FISHERY AND AQUACULTURE MARKET

FIGURE 2 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 TWO SEGMENTS COMPRISE THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE (2024)

FIGURE 13 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: STRATEGIC DECISIONS

FIGURE 14 POPULATION GROWTH ACCELERATING SEAFOOD DEMAND IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET FROM 2025 TO 2032

FIGURE 15 THE AQUAFEED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET IN 2025 & 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 PATENT BY COUNTRIES

FIGURE 18 FISHERY AND AQUACULTURE MARKET VALUE CHAIN ANALYSIS

FIGURE 19 FISHERY AND AQUACULTURE MARKET SUPPLY CHAIN ANALYSIS

FIGURE 20 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: NORTH AMERICA FISHERY AND AQUACULTURE MARKET

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA FISHERY AND AQUACULTURE MARKET

FIGURE 23 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2024

FIGURE 24 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY AQUACULTURE PRODUCTION SYSTEM, 2024

FIGURE 25 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY ENVIRONMENT, 2024

FIGURE 26 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2024

FIGURE 27 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY PRODUCTION SCALE, 2024

FIGURE 28 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY CATEGORY, 2024

FIGURE 29 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY SOURCE, 2024

FIGURE 30 NORTH AMERICA FISHERY AND AQUACULTURE MARKET, BY FORM, 2024

FIGURE 31 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY FUNCTION, 2024

FIGURE 32 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY TECHNOLOGY, 2024

FIGURE 33 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: BY SPECIES, 2024

FIGURE 34 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: SNAPSHOT 2024

FIGURE 35 NORTH AMERICA FISHERY AND AQUACULTURE MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.