North America Flame Retardant Thermoplastics Market

Market Size in USD Billion

CAGR :

%

USD

1.89 Billion

USD

6.03 Billion

2024

2032

USD

1.89 Billion

USD

6.03 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 6.03 Billion | |

|

|

|

|

Flame Retardant Thermoplastics Market Size

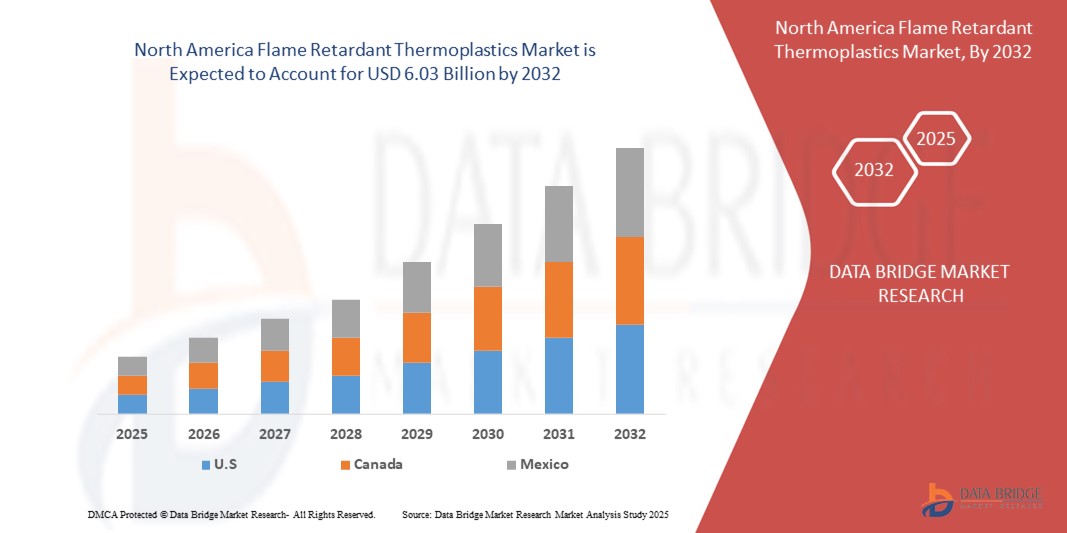

- The North America Flame Retardant Thermoplastics market size was valued at USD 1.89 billion in 2024 and is expected to reach USD 6.03 billion by 2032, at a CAGR of 5.4% during the forecast period

- The market growth is largely fueled by increasing fire safety regulations, demand for lightweight materials, and rising industrial and construction activities.

- Furthermore, expanding automotive and electronics sectors, growing awareness of fire hazards, rising investments in infrastructure, and increasing demand for eco-friendly, durable, and efficient flame retardant materials. These trends are accelerating the adoption of colorant solutions, thereby significantly boosting the industry's growth across North America.

Flame Retardant Thermoplastics Market Analysis

- Flame Retardant Thermoplastics are becoming essential in industries such as automotive, electronics, construction, and textiles across the North America due to their enhanced fire safety, durability, and regulatory compliance.

- The rising demand for Flame Retardant Thermoplastics is primarily driven by increased safety regulations, growing infrastructure development, and a shift towards sustainable and bio-based flame retardant materials.

- U.S. leads the North America market with an estimated revenue share of around 56.71% in 2024, owing to significant industrial growth, expanding construction projects, and increased adoption of advanced flame retardant technologies.

- U.S. is expected to be the fastest growing market in the region during the forecast period, with a CAGR of approximately 6.8%, supported by industrial diversification, expanding manufacturing sectors, and rising awareness of fire safety standards.

- The Polyamide segment is projected to hold a significant share of approximately 24.45% in 2024, driven by its excellent mechanical strength, high heat resistance, and widespread use in automotive and electrical applications.

Report Scope and Flame Retardant Thermoplastics Market Segmentation

|

Attributes |

Flame Retardant Thermoplastics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flame Retardant Thermoplastics Market Trends

“Sustainability and Advanced Formulations Transforming Flame Retardant Thermoplastics Market in North America”

- A prominent trend shaping the North America Flame Retardant Thermoplastics market is the rising focus on sustainability, fire resistance, and regulatory compliance across major sectors including construction, automotive, aerospace, and electrical & electronics. Stricter fire safety standards and sustainability mandates are prompting the development of non-halogenated, eco-friendly thermoplastics.

- For instance, companies like DuPont and Celanese are introducing recyclable, halogen-free flame retardant compounds that meet UL94 V-0 ratings and contribute to reduced environmental impact. These materials are increasingly adopted in electric vehicle components and building insulation systems.

- Market leaders such as Dow and SABIC are leveraging bio-based feedstocks, advanced compounding technologies, and low-emission processing methods to meet evolving consumer and industrial preferences. Their innovations include thermoplastics with high thermal stability, low toxicity, and minimal environmental footprint.

- There is a clear industry shift toward phosphorus-, nitrogen-, and mineral-based flame retardant systems as alternatives to traditional brominated variants, driven by health and environmental concerns. These advanced formulations are being prioritized in electronics housings, wire and cable insulation, and transportation interiors.

- Collaboration between U.S.-based research institutions, industry players, and regulatory bodies like the EPA and UL is accelerating innovation in performance-enhanced and sustainable flame retardants. Government funding and private investment in green material development are further reinforcing this transformation.

- As industries adopt circular economy principles and carbon-neutral goals, demand for high-performance, durable, and sustainable flame retardant thermoplastics is projected to grow rapidly. Companies pioneering in green chemistry and regulatory-aligned innovation will likely secure leadership positions in the North American market.

Flame Retardant Thermoplastics Market Dynamics

Driver

“Rising Demand for Fire-Safe and Environmentally Compliant Thermoplastic Solutions”

- The increasing emphasis on stringent fire safety codes and growing environmental regulations across North America is a primary driver boosting demand for sustainable and compliant Flame Retardant Thermoplastics across industries such as construction, automotive, and electronics.

- For example, in 2024, DuPont introduced a new line of halogen-free flame retardant materials tailored for EV battery casings and high-voltage components, aligning with both UL94 V-0 fire standards and sustainability benchmarks in the U.S. and Canada.

- As fire incidents in residential, commercial, and industrial infrastructures remain a significant concern, governments are tightening building codes and product safety standards, mandating the use of flame-retardant thermoplastics in insulation, wiring, and panels.

- Additionally, growing corporate ESG commitments and federal green initiatives—such as the U.S. Infrastructure Investment and Jobs Act—are encouraging manufacturers to adopt low-toxicity, recyclable, and energy-efficient materials in compliance with evolving safety and environmental norms.

- Leading producers like BASF, LANXESS, and Celanese are investing in phosphorus-, nitrogen-, and mineral-based flame retardant technologies, which not only meet regulatory compliance but also reduce the carbon footprint of end-use applications.

- This widespread regulatory shift, combined with increasing consumer awareness around material safety, is accelerating the transition to high-performance, environmentally responsible flame retardant thermoplastics throughout North America’s value chain.

Restraint/Challenge

“Regulatory Complexity and High Compliance Costs”

- The intricate and continuously evolving regulatory landscape in North America poses a substantial challenge for Flame Retardant Thermoplastics manufacturers. The presence of differing fire safety codes, chemical regulations (like TSCA and Proposition 65), and environmental compliance mandates across the U.S., Canada, and Mexico complicates standardization and operational efficiency.

- For instance, while the U.S. Consumer Product Safety Commission pushes for phasing out halogenated flame retardants in consumer products, Canada's stringent CEPA requirements and Mexico’s evolving NOM standards present additional layers of compliance. This inconsistency raises risks and costs for companies operating across borders.

- Adhering to these regulations often demands extensive investment in toxicological testing, third-party certifications (e.g., UL94, RoHS), and product reformulations to replace legacy additives like brominated retardants. These measures escalate R&D and manufacturing expenses, affecting product affordability and margins.

- Major players such as BASF and DuPont are allocating significant resources toward regulatory adaptation and sustainable innovation. However, smaller manufacturers often face limited technical and financial capabilities, making it difficult to comply without compromising profitability or market reach.

- These regulatory obligations, while essential for public health and environmental protection, can slow product development cycles, increase barriers to entry, and impede regional supply chain agility. Addressing these constraints will require policy harmonization, clearer guidance, and collaborative initiatives to build industry-wide compliance resilience.

Flame Retardant Thermoplastics Market Scope

The market is segmented on the basis of type, product, form, coating, and application.

- By Type

On the basis of type, the North America Flame Retardant Thermoplastics market is segmented into Polyamide, Acrylonitrile Butadiene Styrene (ABS), Polycarbonate, Polycarbonate/ABS Blends, Polypropylene, Polyphenylenoxide, and PBT/PET (Thermoplastic Polyesters). The Polyamide segment is projected to hold the largest market share of approximately 24.45% in 2025, driven by its excellent mechanical strength, heat resistance, and high demand in automotive and electronics industries.

The ABS segment follows with an estimated 18.99% market share, benefiting from its impact resistance and wide usage in consumer electronics and appliances.

- By Product

On the basis of product, the market is segmented into Halogenated and Non-Halogenated Flame Retardant Thermoplastics. The Non-Halogenated segment is expected to dominate the market with an estimated share of 58.91% in 2025, owing to growing regulatory restrictions on halogenated additives and rising environmental and health concerns.

The Halogenated segment, although declining, maintains a 45.66% share, primarily due to its cost-effectiveness and strong flame retardancy in legacy applications.

- By Form

On the basis of form, the market is segmented into Amorphous Polymers and Crystalline Polymers. Crystalline Polymers are projected to lead with a market share of approximately 60.87% in 2025, driven by superior structural rigidity and thermal performance, making them suitable for industrial, construction, and automotive applications.

Amorphous Polymers, which offer excellent clarity and impact resistance, hold the remaining 39.11% share and are preferred in electronics and consumer goods.

- By Coating

On the basis of coating, the market is segmented into Brominated Flame Retardants, Phosphorus Flame Retardants, Antimony Trioxide, and Alumina Trihydrate. Phosphorus Flame Retardants are anticipated to dominate with a market share of about 38.56% in 2025, driven by their effectiveness in non-halogenated systems and compliance with environmental regulations.

Brominated Flame Retardants follow with an estimated 30.95% share, supported by strong legacy demand in electronics despite environmental concerns.

- By Application

On the basis of application, the market is segmented into Construction, Electrical and Electronics, Industrial, Oil and Gas, Pharmaceutical, Agriculture, and Transportation. The Electrical and Electronics segment leads with an estimated market share of 34.55% in 2025, driven by the growing demand for fire-safe wiring, connectors, and housings.

Construction holds a substantial 23.41% share, owing to regional investments in infrastructure and urban development.

Flame Retardant Thermoplastics Market Country Analysis

U.S. Flame Retardant Thermoplastics Market Insight

The United States dominates the North American Flame Retardant Thermoplastics market due to its advanced manufacturing base, stringent fire safety regulations (such as NFPA standards), and growing demand from the automotive, aerospace, and electronics sectors. The increasing adoption of non-halogenated, eco-friendly materials in line with federal environmental mandates and green building certifications like LEED is accelerating the shift toward high-performance, sustainable thermoplastics. Significant R&D investments by U.S.-based chemical giants and government-backed innovation programs are further fueling market development.

Canada Flame Retardant Thermoplastics Market Insight

Canada's market is witnessing steady growth, driven by infrastructure modernization, energy-efficient building initiatives, and robust regulations under the Canadian Environmental Protection Act (CEPA). Flame Retardant Thermoplastics are increasingly used in construction materials, consumer electronics, and transportation components to meet national fire resistance and environmental standards. The Canadian government’s push for greener materials and product safety, coupled with rising investment in public infrastructure and housing, is enhancing market penetration across sectors.

Mexico Flame Retardant Thermoplastics Market Insight

Mexico is emerging as a fast-growing market in North America, fueled by the expansion of automotive manufacturing, industrial electronics, and export-driven production facilities. The government's focus on aligning with U.S. and international fire safety norms through updated NOM standards is prompting higher demand for compliant flame-retardant materials. Additionally, foreign investments in Mexico’s electronics and construction sectors are boosting the adoption of thermoplastics with advanced flame-retardant properties, supporting the country’s position as a key regional manufacturing hub.

Flame Retardant Thermoplastics Market Share

The Flame Retardant Thermoplastics industry is primarily led by well-established companies, including:

- SABIC (Saudi Arabia)

- Covestro AG (Germany)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Solvay (Belgium)

- EMS-CHEMIE HOLDING AG (Switzerland)

- Mitsubishi Engineering-Plastics Corporation (Japan)

- LOTTE Chemical CORPORATION (South Korea)

- LATI Industria Termoplastici S.p.A. (Italy)

- Idemitsu Kosan Co.,Ltd. (Japan)

- Radici Partecipazioni SpA (Italy)

- Trinseo (U.S.)

- LG Chem (South Korea)

- TORAY INDUSTRIES, INC. (Japan)

- LANXESS (Germany)

- RTP Company (U.S.)

- Dow (U.S.)

- BASF SE (Germany)

- PMC Group, Inc. (U.S.)

- DSM (Netherlands)

- DuPont (U.S.)

- Asahi Kasei Corporation (Japan)

Latest Developments in North America Flame Retardant Thermoplastics Market

- On January 14, 2021, BASF SE, in collaboration with CoHaMa Co., Ltd., introduced non-halogen flame-retardant TPU hand straps for use in rail transportation and aerospace applications.

- In October 2019, SONGWON unveiled a new line of flame retardants designed to be halogen-free, aligning with growing industry demand for safer, more environmentally friendly fire protection solutions

- In September 2019, ICL-IP announced plans to expand production capacity of FR1025, its eco-friendly polymeric flame retardant, by approximately 50% to meet growing demand from customers in Asia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Flame Retardant Thermoplastics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Flame Retardant Thermoplastics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Flame Retardant Thermoplastics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.