North America Flexible Hybrid Electronics Fhe Productions Market

Market Size in USD Million

CAGR :

%

USD

841.91 Million

USD

1,559.50 Million

2024

2032

USD

841.91 Million

USD

1,559.50 Million

2024

2032

| 2025 –2032 | |

| USD 841.91 Million | |

| USD 1,559.50 Million | |

|

|

|

|

North America Flexible Hybrid Electronics (FHE) Production Market Size

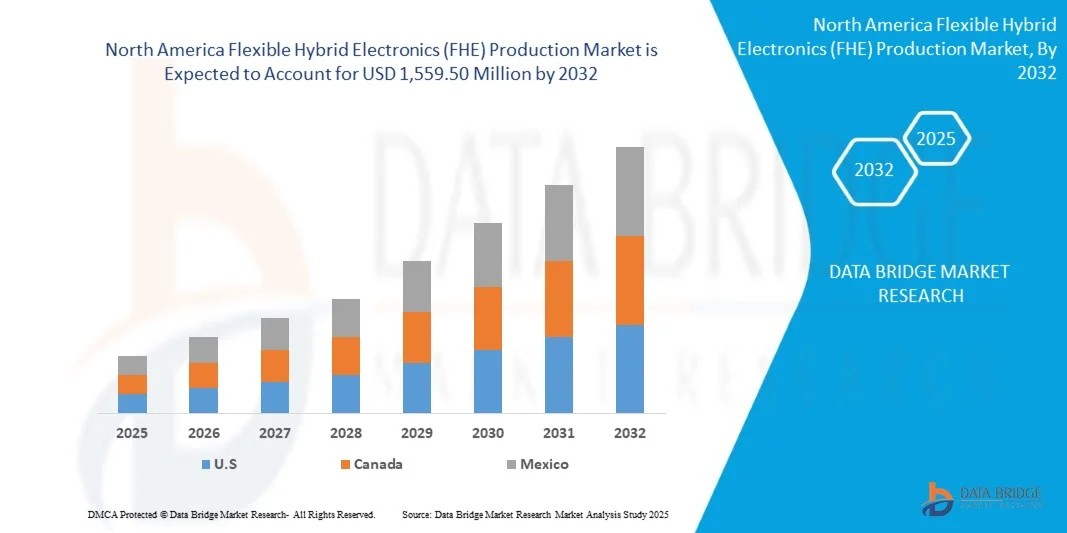

- The North America Flexible Hybrid Electronics (FHE) Production Market is expected to reach USD 1,559.50 million by 2032 from USD 841.91 million in 2024, growing with a substantial CAGR of 8.1% in the forecast period of 2025 to 2032

- The North America Flexible Hybrid Electronics (FHE) Production Market is experiencing strong growth, driven by rising demand across industries such as healthcare, consumer electronics, automotive, and packaging. FHE technology combines the advantages of printed electronics with flexible substrates, enabling lightweight, durable, and multifunctional devices for applications like wearable sensors, smart packaging, and flexible displays.

- Market expansion is supported by increasing automation, miniaturization trends, and investments in research and development aimed at improving performance, reliability, and scalability. Additionally, growing industrialization, government support for advanced manufacturing, and the emergence of cost-effective production solutions from regional manufacturers are enhancing North America competitiveness. As a result, FHE production is becoming a key enabler of next-generation electronic devices and smart manufacturing systems.

North America Flexible Hybrid Electronics (FHE) Production Market Analysis

- North America and Asia-Pacific are the leading markets for flexible hybrid electronics (FHE) production, driven by rapid industrialization, growing adoption of automation, and increasing demand for high-precision manufacturing solutions across sectors such as healthcare, electronics, automotive, and packaging.

- Flexible hybrid electronics (FHE) technologies play a vital role in enhancing efficiency, precision, and sustainability in production processes, enabling manufacturers to meet strict quality standards while minimizing material wastage and operational costs. Their integration into smart manufacturing aligns with North America shifts toward digitalization, energy efficiency, and environmentally responsible production.

- The United States, Canada, and Mexico remain prominent contributors to North America FHE market growth due to robust industrial infrastructure, advanced R&D capabilities, and continuous innovation in materials, design, and flexible circuitry. These countries are at the forefront of developing next-generation FHE systems featuring precision printing, automated quality control, and seamless Industry 4.0 integration.

- In 2025, Asia-Pacific is expected to sustain a strong growth trajectory, supported by large-scale investments in industrial modernization, government initiatives promoting sustainable manufacturing, and expansion of smart electronics production facilities. North America continues to emphasize energy-efficient technologies and automation upgrades, ensuring consistent demand for advanced FHE production systems throughout the forecast period.

Report Scope and North America Flexible Hybrid Electronics (FHE) Production Market Segmentation

|

Attributes |

North America Flexible Hybrid Electronics (FHE) Production Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

North America Flexible Hybrid Electronics (FHE) Production Market Trends

“Advancements in Conductive Materials”

- Flexible hybrid electronics (FHE) productions are ongoing innovation in silver, copper, and carbon-based conductive inks is improving electrical conductivity, flexibility, and printability, enabling more efficient and durable FHE components.

- New materials such as graphene, nanowires, and conductive polymers are being utilized to create stretchable, transparent circuits ideal for wearables, medical sensors, and flexible displays.

- Advances in formulation are improving adhesion and thermal stability of conductive materials on flexible substrates like PET, PI, and TPU, ensuring long-term performance and reliability.

- Manufacturers are shifting toward low-cost, recyclable, and water-based conductive materials to reduce environmental impact and support sustainable production practices in FHE manufacturing.

North America Flexible Hybrid Electronics (FHE) Production Market Dynamics

Driver

“Rising demand for wearable and portable devices”

- The rising demand for wearable and portable devices is propelling the growth of flexible hybrid electronics (FHE) production.

- Wearable technologies such as smartwatches, fitness trackers, medical monitoring patches, augmented reality (AR) glasses, and flexible displays require components that are lightweight, thin, and bendable, characteristics that conventional rigid electronics cannot offer.

- FHE, which seamlessly integrates printed electronics with traditional semiconductor devices on flexible substrates, provides the ideal technological foundation for such applications.

- Therefore, as consumers increasingly seek multifunctional, durable, and comfortable wearables, manufacturers are turning to FHE to enable advanced design flexibility and improved user experience.

- For Instances, In September 2025, according to the Government of India, Press Information Bureau, in Q2 2025, India overtook China to become the top smartphone exporter to the United States. Smartphone exports by India surpassed INR 1 lakh crore in just the first five months of FY 2025-26- a 55% jump over the same period last year.

Opportunities

“Expanding Automotive and Aerospace Sector”

- The expanding automotive and aerospace sectors are creating substantial opportunities for flexible hybrid electronics (FHE) productions, driven by the increasing demand for lightweight, compact, and energy-efficient electronic systems.

- There is a growing need for electronic components that deliver high performance while withstanding complex mechanical and environmental conditions as both industries undergo rapid technological transformation, embracing electrification, digitalization, and automation.

- FHE, which integrates printed electronics with traditional semiconductor functionality on flexible substrates, offers an ideal solution for meeting these evolving design and performance requirements.

- In the automotive industry, FHE is enabling the development of smart surfaces, in-mold electronics, flexible lighting systems, pressure and temperature sensors, and lightweight battery management circuits that contribute to vehicle efficiency and driver safety.

For Instances,

- In May 2023, according to European Automobile Manufacturers' Association (ACEA), 85.4 million motor vehicles were produced around the world in 2022, an increase of 5.7% compared to 2021.

- In April 2025, according to India Brand Equity Foundation, a Trust established by the Department of Commerce, Ministry of Commerce and Industry, Government of India, automobile exports rose 19% in FY25 to over 5.3 million units, led by robust demand for passenger vehicles, two-wheelers, and commercial vehicles.

- In August, 2025, VinFast inaugurated its Rs. 16,000 crore (USD 1.87 billion) EV assembly plant in Thoothukudi, Tamil Nadu, its first outside Vietnam, aiming to make the city a South Asian export hub with an initial capacity of 50,000 vehicles annually, scalable to 1.5 lakh units.

- In February 2025, according to General Aviation Manufacturers Association, Airplane shipments in 2024, when compared to 2023, saw piston airplane deliveries increase 4.2%, with 1,772 units.

Restraint/Challenge

“Complex supply chain and material availability”

- A complex supply chain and limited material availability significantly hinder the large-scale production and adoption of flexible hybrid electronics (FHE), despite the technology’s vast potential across multiple industries.

- FHE manufacturing requires a diverse range of advanced materials including flexible substrates, conductive inks, stretchable adhesives, encapsulation films, and miniaturized semiconductor components that must be precisely integrated to achieve the desired performance and reliability.

- However, many of these specialized materials are not yet produced at scale or are available only through a limited number of suppliers, leading to supply complexity and increased production lead times.

- The dependence on niche raw material providers and specialized fabrication equipment adds complexity to the value chain, making coordination between suppliers, manufacturers, and integrators challenging.

For Instances,

- In April 2022, according to U.S. International Trade Commission, as of 2022, Ukraine supplies an estimated 50 percent of neon worldwide essential for chip manufacturing, and production.

- In August 2023, the Panama Canal Authority reduced maximum ship weights and daily ship crossings in a bid to conserve water. These measures include reducing the number of daily crossings and tightening restrictions on ship weight and draft.

North America Flexible Hybrid Electronics (FHE) Production Market Scope

The North America Flexible Hybrid Electronics (FHE) Production Market is segmented into manufacturing process, materials, end user.

• By Manufacturing Process

On the basis of Manufacturing Process, the North America flexible hybrid electronics (FHE) productions market is segmented into substrate preparation, printing conductive traces, printing/depositing dielectric and insulating layers, component placement (pick-and-place), interconnection & bonding, encapsulation/protection, testing & quality assurance, and cutting/shaping/final assembly. In 2025, the printing conductive traces segment is expected to dominate the market with 22.78% market share.

The printing conductive traces segment is also expected to register the highest CAGR of 8.7% due to its central role in enabling electrical functionality across a wide range of flexible devices. Conductive trace printing forms the backbone of FHE manufacturing, allowing the integration of electronic circuits onto flexible substrates such as polyimide, PET, and PEN.

• By Material

On the basis of Material, the North America flexible hybrid electronics (FHE) productions market is segmented into substrate materials, conductor materials, adhesives & die attach materials, encapsulation & protective materials, insulating & dielectric materials, and stretchable or emerging materials. In 2025, substrate materials segment is expected to dominate the market with 31.16% market share.

Substrate materials segment is also expected to register the highest CAGR of 8.3% due to its fundamental importance in determining the overall performance, flexibility, and durability of electronic components. Substrates act as the foundational layer upon which conductive traces, sensors, and active components are printed or integrated, making them critical to the efficiency and reliability of FHE devices.

• By End user

On the basis of End-User, the North America flexible hybrid electronics (FHE) productions market is segmented into healthcare & medical, consumer electronics, automotive, industrial & robotics, retail & logistics, telecommunications, aerospace & defence, textiles & fashion, energy & utilities, education & research, and others. In 2025, the healthcare & medical sector segment is expected to dominate the market with 21.29% market share.

Healthcare & medical sector segment is also expected to register the highest CAGR of 9.0% due to the rapid integration of flexible and wearable electronic technologies in medical diagnostics, monitoring, and therapeutic applications. FHE enables the development of lightweight, biocompatible, and highly flexible devices that can conform to the human body, making them ideal for continuous health monitoring and personalized care. The rising demand for wearable health sensors, smart patches, implantable devices, and remote patient monitoring systems is driving significant investment in this sector.

North America Flexible Hybrid Electronics (FHE) Production Market Regional Analysis

The United States is expected to dominate the North America Flexible Hybrid Electronics (FHE) Production Market due to rising exports, low-cost manufacturing, and increasing investment in automated and semi-automated presses drive market growth. Urbanization and growing consumer demand for customized textiles further support regional expansion.

U.S. North America Flexible Hybrid Electronics (FHE) Production Market Insight

The U.S. North America Flexible Hybrid Electronics (FHE) Production Market is experiencing strong growth, driven by rising demand for advanced, lightweight, and energy-efficient electronic solutions across healthcare, defense, automotive, and consumer electronics sectors. The country’s robust R&D ecosystem, supported by initiatives from organizations like NextFlex, is accelerating innovation in flexible sensors, wearable devices, and smart packaging. Increasing adoption of Industry 4.0 technologies and automation in manufacturing enhances production efficiency and precision. Additionally, collaborations between material developers, research institutions, and electronics manufacturers are fostering advancements in conductive materials and flexible substrates, positioning the U.S. as a North America leader in FHE technology innovation and commercialization.

Canada North America Flexible Hybrid Electronics (FHE) Production Market Insight

The Canada North America Flexible Hybrid Electronics (FHE) Production Market is gaining momentum, driven by the country’s growing focus on advanced manufacturing, sustainable technologies, and innovation in flexible electronic solutions. Canadian companies are increasingly investing in R&D to develop flexible sensors, smart packaging, and wearable medical devices, supported by government initiatives promoting digitalization and green technology adoption. Collaboration between research institutions, start-ups, and established manufacturers is enhancing material innovation and production capabilities. With strong demand from healthcare, aerospace, and consumer electronics sectors, Canada is emerging as a key contributor to the North American FHE ecosystem, emphasizing efficiency, sustainability, and high-performance manufacturing.

North America Flexible Hybrid Electronics (FHE) Production Market Insight

The North America Flexible Hybrid Electronics (FHE) Production Market is witnessing steady growth, fueled by advancements in smart manufacturing, automation, and demand for lightweight, flexible electronic components across industries such as healthcare, automotive, aerospace, and consumer electronics. The region benefits from strong R&D investments, government support, and collaboration between technology firms, research institutions, and manufacturing companies. The United States leads the market, supported by initiatives like NextFlex, while Canada is emerging as a key innovation hub focusing on sustainable and high-performance materials. Increasing adoption of Industry 4.0 practices and expansion of production facilities are further strengthening North America’s position.

North America Flexible Hybrid Electronics (FHE) Production Market Share

The flexible hybrid electronics (FHE) production industry is primarily led by well-established companies, including:

- American Semiconductor, Inc. (United States)

- Elephantech Inc. (Japan)

- DoMicro B.V. (Netherlands)

- Panasonic Corporation of North America (United States)

- Molex (United States)

- InnovaFlex (Canada)

- CMTC (California Manufacturing Technology Consulting) (United States)

- ALMAX (United States)

- Jabil Inc. (United States)

- Tapecon, Inc. (United States)

- In2tec (United Kingdom)

Latest Developments in North America Flexible Hybrid Electronics (FHE) Production Market

- In August 2024, Tapecon Inc., a leader in custom converting, printing, and advanced manufacturing, has partnered with CondAlign AS, a Norwegian deep-tech firm specializing in anisotropic conductive films. Under this collaboration, Tapecon becomes the exclusive Value-Added Reseller for CondAlign’s E-Align products across the U.S. and Canada. The E-Align technology enhances electronic connectivity and thermal management through particle alignment within a polymer matrix, offering high flexibility and performance for applications in IoT, smart cards, and medical devices.

- In October 2024, In2tec showcased its Flexi-hibrid technology as a sustainable alternative to conventional resin PCBA, offering material cost savings and recyclable polyester substrates. They highlighted advanced 3D circuitry with capacitive touch, illuminated surfaces, and haptic feedback, aiding automotive manufacturers in meeting net-zero targets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

5 TECHNOLOGY MATRIX

5.1 COMPANY COMPARATIVE ANALYSIS

5.2 NEW BUSINESS & EMERGING BUSINESS — REVENUE OPPORTUNITIES & FUTURE OUTLOOK

5.2.1 NEAR-TERM (2025–2028): SCALING THROUGH MATERIALS AND PILOT MANUFACTURING

5.2.2 MID-TERM (2028–2031): PENETRATION INTO DEFENSE, AUTOMOTIVE, AND HEALTHCARE DOMAINS

5.2.3 LONG-TERM (2031–2035): SMART SURFACE INTEGRATION AND SUSTAINABLE ELECTRONICS

5.2.4 STRATEGIC OUTLOOK

5.3 PENETRATION AND GROWTH PROSPECT MAPPING

5.3.1 EXECUTIVE SUMMARY

5.3.2 PENETRATION MATRIX (CURRENT STATE VS NEAR-TERM GROWTH POTENTIAL)

5.3.3 SEGMENT-LEVEL GROWTH PROSPECTS & DRIVERS

5.3.4 REGIONAL OPPORTUNITY HEATMAP

5.3.5 TECHNOLOGY & SUPPLY-CHAIN READINESS MAPPING

5.3.6 BARRIERS TO PENETRATION

5.3.7 GROWTH ENABLERS & MARKET CATALYSTS

5.4 VALUE CHAIN ANALYSIS

6 REGULATION STANDARDS

6.1 INTRODUCTION

6.2 PRODUCT CODES

6.3 CERTIFIED MANUFACTURING STANDARDS

6.4 ENVIRONMENTAL & CHEMICAL COMPLIANCE

6.5 SAFETY AND WORKPLACE STANDARDS

6.6 TESTING, CERTIFICATION & PRODUCT SAFETY

6.7 TRANSPORTATION & STORAGE REGULATIONS

6.8 HAZARD IDENTIFICATION & LABELING

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING DEMAND FOR WEARABLE AND PORTABLE DEVICES

7.1.2 INTEGRATION OF IOT AND SMART SYSTEMS IN INDUSTRIES

7.1.3 GOVERNMENT AND INDUSTRY INVESTMENTS IN ELECTRONICS

7.1.4 INCREASING HEALTHCARE SPENDING IN EMERGING ECONOMIES

7.2 RESTRAINTS

7.2.1 HIGH INITIAL PRODUCTION AND DEVELOPMENT COSTS

7.2.2 COMPLEX SUPPLY CHAIN AND MATERIAL AVAILABILITY

7.3 OPPORTUNITIES

7.3.1 EXPANDING AUTOMOTIVE AND AEROSPACE SECTOR

7.3.2 GROWING INVESTMENT IN 5G INFRASTRUCTURE

7.3.3 GROWING GOVERNMENT INITIATIVES PROMOTING DIGITALIZATION

7.4 CHALLENGES

7.4.1 INTELLECTUAL PROPERTY (IP), TESTING, AND CERTIFICATION HURDLES

7.4.2 COMPETITION FROM TRADITIONAL RIGID ELECTRONICS

8 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS

8.1 OVERVIEW

8.2 PRINTING CONDUCTIVE TRACES

8.2.1 SCREEN PRINTING

8.2.2 INKJET PRINTING

8.2.3 AEROSOL JET PRINTING

8.3 SUBSTRATE PREPARATION

8.3.1 SURFACE TREATMENT

8.3.2 CLEANING

8.3.3 CUTTING OR COATING

8.4 INTERCONNECTION & BONDING

8.4.1 FLIP-CHIP BONDING

8.4.2 WIRE BONDING

8.4.3 ANISOTROPIC CONDUCTIVE FILMS (ACF)

8.4.4 Z-AXIS ADHESIVES

8.5 ENCAPSULATION / PROTECTION

8.5.1 LAMINATION

8.5.2 CONFORMAL COATING

8.5.3 SPRAY COATING OR DIP COATING

8.6 TESTING & QUALITY ASSURANCE

8.6.1 ELECTRICAL TESTING

8.6.2 MECHANICAL TESTING

8.6.3 ENVIRONMENTAL TESTING

8.6.4 VISUAL INSPECTION

8.7 CUTTING / SHAPING / FINAL ASSEMBLY

8.8 COMPONENT PLACEMENT (PICK-AND-PLACE)

8.9 PRINTING / DEPOSITING DIELECTRIC & INSULATING LAYERS

9 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: BY MATERIAL

9.1 OVERVIEW

9.2 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

9.3 SUBSTRATE MATERIALS

9.4 CONDUCTOR MATERIAL

9.5 ADHESIVES & DIE ATTACH MATERIALS

9.6 ENCAPSULATION & PROTECTIVE MATERIALS

9.7 INSULATING & DIELECTRIC MATERIALS

9.8 STRETCHABLE OR EMERGING MATERIALS

9.9 NORTH AMERICA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.9.1 POLYIMIDE (PI)

9.9.2 POLYETHYLENE TEREPHTHALATE (PET)

9.9.3 POLYETHYLENE NAPHTHALATE (PEN)

9.9.4 THERMOPLASTIC POLYURETHANE (TPU)

9.9.5 OTHERS

9.1 NORTH AMERICA CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.10.1 SILVER NANOPARTICLES / SILVER INKS

9.10.2 COPPER INKS / COPPER NANOWIRES

9.10.3 CARBON-BASED INKS (GRAPHENE, CARBON BLACK)

9.10.4 GOLD NANOPARTICLES

9.10.5 OTHERS

9.11 NORTH AMERICA ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.11.1 EPOXY ADHESIVES

9.11.2 ACRYLIC ADHESIVES

9.11.3 SILICONE ADHESIVES

9.11.4 OTHERS

9.12 NORTH AMERICA ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.12.1 SILICONE COATINGS

9.12.2 POLYURETHANE

9.12.3 EPOXY ENCAPSULANTS

9.12.4 UV-CURABLE POLYMERS

9.13 NORTH AMERICA INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.13.1 POLYIMIDE FILMS

9.13.2 PHOTOIMAGEABLE DIELECTRICS (PID)

9.13.3 UV-CURABLE DIELECTRIC INKS

10 FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER

10.1 OVERVIEW

10.2 HEALTHCARE & MEDICAL SECTOR

10.2.1 HEALTHCARE & MEDICAL SECTOR, BY TYPE

10.2.1.1 MEDICAL DEVICE MANUFACTURERS

10.2.1.2 WEARABLE HEALTH TECH COMPANIES

10.2.1.3 HOSPITALS AND CLINICS

10.2.1.4 HOME HEALTHCARE PROVIDERS

10.2.2 HEALTHCARE & MEDICAL SECTOR, BY TYPE

10.2.2.1 PRINTING CONDUCTIVE TRACES

10.2.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.2.2.3 TESTING & QUALITY ASSURANCE

10.2.2.4 PRINTING/DEPOSITING DIELECTRIC AND INSULATING LAYERS

10.2.2.5 ENCAPSULATION / PROTECTION

10.2.2.6 SUBSTRATE PREPARATION

10.2.2.7 INTERCONNECTION & BONDING

10.2.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.3 CONSUMER ELECTRONICS

10.3.1 CONSUMER ELECTRONICS, BY TYPE

10.3.1.1 ELECTRONICS OEMS (E.G., SAMSUNG, APPLE, SONY)

10.3.1.2 WEARABLE TECH STARTUPS

10.3.1.3 SMART HOME DEVICE COMPANIES

10.3.2 CONSUMER ELECTRONICS, BY TYPE

10.3.2.1 PRINTING CONDUCTIVE TRACES

10.3.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.3.2.3 SUBSTRATE PREPARATION

10.3.2.4 ENCAPSULATION / PROTECTION

10.3.2.5 INTERCONNECTION & BONDING

10.3.2.6 PRINTING/DEPOSITING DIELECTRIC AND INSULATING LAYERS

10.3.2.7 TESTING & QUALITY ASSURANCE

10.3.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.4 AUTOMOTIVE

10.4.1 AUTOMOTIVE, BY TYPE

10.4.1.1 AUTOMOTIVE OEMS

10.4.1.2 TIER-1 SUPPLIERS

10.4.1.3 EV BATTERY MANUFACTURERS

10.4.1.4 OTHERS

10.4.2 AUTOMOTIVE, BY TYPE

10.4.2.1 PRINTING CONDUCTIVE TRACES

10.4.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.4.2.3 TESTING & QUALITY ASSURANCE

10.4.2.4 ENCAPSULATION / PROTECTION

10.4.2.5 PRINTING/DEPOSITING DIELECTRIC AND INSULATING LAYERS

10.4.2.6 SUBSTRATE PREPARATION

10.4.2.7 INTERCONNECTION & BONDING

10.4.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.5 INDUSTRIAL AND ROBOTICS

10.5.1 INDUSTRIAL AND ROBOTICS BY TYPE

10.5.1.1 INDUSTRIAL AUTOMATION COMPANIES

10.5.1.2 ROBOTICS STARTUPS

10.5.1.3 IOT SOLUTION PROVIDERS

10.5.1.4 SMART PACKAGING MANUFACTURERS

10.5.2 INDUSTRIAL AND ROBOTICS BY TYPE

10.5.2.1 PRINTING CONDUCTIVE TRACES

10.5.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.5.2.3 TESTING & QUALITY ASSURANCE

10.5.2.4 SUBSTRATE PREPARATION

10.5.2.5 INTERCONNECTION & BONDING

10.5.2.6 ENCAPSULATION / PROTECTION

10.5.2.7 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.5.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.6 AEROSPACE & DEFENCE

10.6.1 AEROSPACE & DEFENCE BY TYPE

10.6.1.1 DEFENSE CONTRACTORS

10.6.1.2 AEROSPACE COMPANIES

10.6.1.3 SPACE AGENCIES

10.6.1.4 MILITARY THOUSAND UNITS

10.6.2 AEROSPACE & DEFENCE BY TYPE

10.6.2.1 TESTING & QUALITY ASSURANCE

10.6.2.2 PRINTING CONDUCTIVE TRACES

10.6.2.3 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.6.2.4 INTERCONNECTION & BONDING

10.6.2.5 ENCAPSULATION / PROTECTION

10.6.2.6 SUBSTRATE PREPARATION

10.6.2.7 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.6.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.7 TELECOMMUNICATIONS

10.7.1 TELECOMMUNICATIONS, BY TYPE

10.7.1.1 5G MODULES & ANTENNAS

10.7.1.2 OPTICAL TRANSCEIVERS

10.7.1.3 SMALL CELLS & REPEATERS

10.7.1.4 ROUTERS & SWITCHES

10.7.1.5 OTHERS

10.7.2 TELECOMMUNICATIONS, BY TYPE

10.7.2.1 PRINTING CONDUCTIVE TRACES

10.7.2.2 SUBSTRATE PREPARATION

10.7.2.3 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.7.2.4 INTERCONNECTION & BONDING

10.7.2.5 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.7.2.6 ENCAPSULATION / PROTECTION

10.7.2.7 TESTING & QUALITY ASSURANCE

10.7.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.8 RETAIL AND LOGISTICS

10.8.1 RETAIL AND LOGISTICS, BY TYPE

10.8.1.1 RETAIL CHAINS

10.8.1.2 LOGISTICS AND COURIER SERVICES

10.8.1.3 COLD CHAIN MANAGEMENT PROVIDERS

10.8.2 RETAIL AND LOGISTICS, BY TYPE

10.8.2.1 PRINTING CONDUCTIVE TRACES

10.8.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.8.2.3 TESTING & QUALITY ASSURANCE

10.8.2.4 SUBSTRATE PREPARATION

10.8.2.5 ENCAPSULATION / PROTECTION

10.8.2.6 INTERCONNECTION & BONDING

10.8.2.7 PRINTING/DEPOSITING DIELECTRIC AND INSULATING LAYERS

10.8.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.9 TEXTILES & FASHION

10.9.1 TEXTILES & FASHION, BY TYPE

10.9.1.1 SMART CLOTHING BRANDS

10.9.1.2 E-TEXTILE DEVELOPERS

10.9.1.3 SPORTSWEAR COMPANIES

10.9.2 TEXTILES & FASHION, BY TYPE

10.9.2.1 PRINTING CONDUCTIVE TRACES

10.9.2.2 ENCAPSULATION / PROTECTION

10.9.2.3 SUBSTRATE PREPARATION

10.9.2.4 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.9.2.5 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.9.2.6 TESTING & QUALITY ASSURANCE

10.9.2.7 INTERCONNECTION & BONDING

10.9.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.1 ENERGY & UTILITIES

10.10.1 ENERGY & UTILITIES, BY TYPE

10.10.1.1 RENEWABLE ENERGY COMPANIES

10.10.1.2 SMART GRID SOLUTION PROVIDERS

10.10.1.3 UTILITY METER MANUFACTURERS

10.10.2 ENERGY & UTILITIES, BY TYPE

10.10.2.1 PRINTING CONDUCTIVE TRACES

10.10.2.2 TESTING & QUALITY ASSURANCE

10.10.2.3 ENCAPSULATION / PROTECTION

10.10.2.4 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.10.2.5 SUBSTRATE PREPARATION

10.10.2.6 INTERCONNECTION & BONDING

10.10.2.7 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.10.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.11 EDUCATION & RESEARCH

10.11.1 EDUCATION & RESEARCH, BY TYPE

10.11.1.1 UNIVERSITIES & RESEARCH LABS

10.11.1.2 GOVERNMENT R&D AGENCIES

10.11.1.3 TECHNOLOGY INCUBATORS

10.11.2 EDUCATION & RESEARCH, BY TYPE

10.11.2.1 PRINTING CONDUCTIVE TRACES

10.11.2.2 TESTING & QUALITY ASSURANCE

10.11.2.3 SUBSTRATE PREPARATION

10.11.2.4 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.11.2.5 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.11.2.6 ENCAPSULATION / PROTECTION

10.11.2.7 INTERCONNECTION & BONDING

10.11.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.12 OTHERS

10.12.1 OTHERS, BY TYPE

10.12.1.1 PRINTING CONDUCTIVE TRACES

10.12.1.2 TESTING & QUALITY ASSURANCE

10.12.1.3 SUBSTRATE PREPARATION

10.12.1.4 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.12.1.5 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.12.1.6 ENCAPSULATION / PROTECTION

10.12.1.7 INTERCONNECTION & BONDING

10.12.1.8 CUTTING / SHAPING / FINAL ASSEMBLY

11 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 TAPECON INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 CMTC

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 IN2TEC

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ALMAX

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ELEPHANTECH INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 AMERICAN SEMICONDUCTOR INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 DOMICRO BV

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 INNOVAFLEX

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 JABIL INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 MOLEX

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 PANASONIC CORPORATION OF NORTH AMERICA

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

List of Table

TABLE 1 TECHNOLOGY MATRIX

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 NEW & EMERGING BUSINESS REVENUE OPPORTUNITIES AND FUTURE OUTLOOK

TABLE 4 REGIONAL REGULATORY COMPARISON FOR FLEXIBLE HYBRID ELECTRONICS (FHE)

TABLE 5 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 7 NORTH AMERICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 10 NORTH AMERICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 13 NORTH AMERICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 16 NORTH AMERICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 19 NORTH AMERICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 22 NORTH AMERICA CUTTING / SHAPING / FINAL ASSEMBLY IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA COMPONENT PLACEMENT (PICK-AND-PLACE) IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA PRINTING / DEPOSITING DIELECTRIC & INSULATING LAYERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA CONDUCTOR MATERIAL IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA ADHESIVES & DIE ATTACH MATERIALS IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA ENCAPSULATION & PROTECTIVE MATERIALS IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA INSULATING & DIELECTRIC MATERIALS IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA STRETCHABLE OR EMERGING MATERIALS IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 72 NORTH AMERICA

TABLE 73 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 75 NORTH AMERICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 77 NORTH AMERICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 79 NORTH AMERICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 81 NORTH AMERICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 83 NORTH AMERICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 85 -NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 -NORTH AMERICA CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 -NORTH AMERICA ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 -NORTH AMERICA INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 -NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 -NORTH AMERICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 -NORTH AMERICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 -NORTH AMERICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 -NORTH AMERICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 -NORTH AMERICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 -NORTH AMERICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 -NORTH AMERICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 -NORTH AMERICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 -NORTH AMERICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 -NORTH AMERICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 -NORTH AMERICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 -NORTH AMERICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 115 -U.S. PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 116 -U.S. PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 117 -U.S. SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 -U.S. SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 119 -U.S. INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 120 -U.S. INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 121 -U.S. ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 -U.S. ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 123 -U.S. TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 124 -U.S. TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 125 -U.S. FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 126 -U.S. SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 -U.S. CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 -U.S. ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 -U.S. ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 -U.S. INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 -U.S. FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 132 -U.S. HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 -U.S. HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 -U.S. CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 -U.S. CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 -U.S. AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 -U.S. AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 -U.S. INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 -U.S. INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 -U.S. AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 -U.S. AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 -U.S. TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 -U.S. TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 -U.S. RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 -U.S. RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 -U.S. TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 -U.S. TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 -U.S. ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 -U.S. ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 -U.S. EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 -U.S. EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 -U.S. OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 154 -CANADA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 155 -CANADA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 156 -CANADA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 157 -CANADA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 -CANADA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 159 CANADA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 160 -CANADA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 161 -CANADA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 -CANADA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 163 CANADA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 164 -CANADA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 165 -CANADA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 -CANADA CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 -CANADA ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 -CANADA INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 -CANADA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 -CANADA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 -CANADA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 -CANADA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 -CANADA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 -CANADA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 -CANADA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 -CANADA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 -CANADA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 -CANADA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 -CANADA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 -CANADA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 -CANADA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 -CANADA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 -CANADA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 -CANADA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 -CANADA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 -CANADA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 -CANADA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 -CANADA OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 194 -MEXICO FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 195 -MEXICO PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 196 -MEXICO PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 197 -MEXICO SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 -MEXICO SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 199 -MEXICO INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 200 -MEXICO INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 201 -MEXICO ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 -MEXICO ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 203 MEXICO TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 204 -MEXICO TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 205 -MEXICO FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 -MEXICO CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 -MEXICO ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 -MEXICO INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 -MEXICO FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 -MEXICO HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 -MEXICO CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 -MEXICO AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 MEXICO TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MEXICO ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 -MEXICO ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MEXICO EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 MEXICO EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MEXICO OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: TYPE TIMELINE CURVE

FIGURE 11 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: SEGMENTATION

FIGURE 13 EIGHT SEGMENTS COMPRISE THE NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS (2024)

FIGURE 14 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 RISING DEMAND FOR WEARABLE AND PORTABLE DEVICES IS EXPECTED TO DRIVE THE NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 PRINTING CONDUCTIVE TRACES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET IN 2025 & 2032

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 COMPANY EVALUATION QUADRANT

FIGURE 20 DROC ANALYSIS

FIGURE 21 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: BY MANUFACTURING PROCESS, 2024

FIGURE 22 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: BY MATERIAL, 2024

FIGURE 23 FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: BY END USER, 2024

FIGURE 24 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET SNAPSHOT

FIGURE 25 NORTH AMERICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: COMPANY SHARE 2024 (%)

North America Flexible Hybrid Electronics Fhe Productions Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Flexible Hybrid Electronics Fhe Productions Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Flexible Hybrid Electronics Fhe Productions Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.