North America Flexible Packaging Market

Market Size in USD Billion

CAGR :

%

USD

45.35 Billion

USD

73.97 Billion

2024

2032

USD

45.35 Billion

USD

73.97 Billion

2024

2032

| 2025 –2032 | |

| USD 45.35 Billion | |

| USD 73.97 Billion | |

|

|

|

|

North America Flexible Packaging Market Size

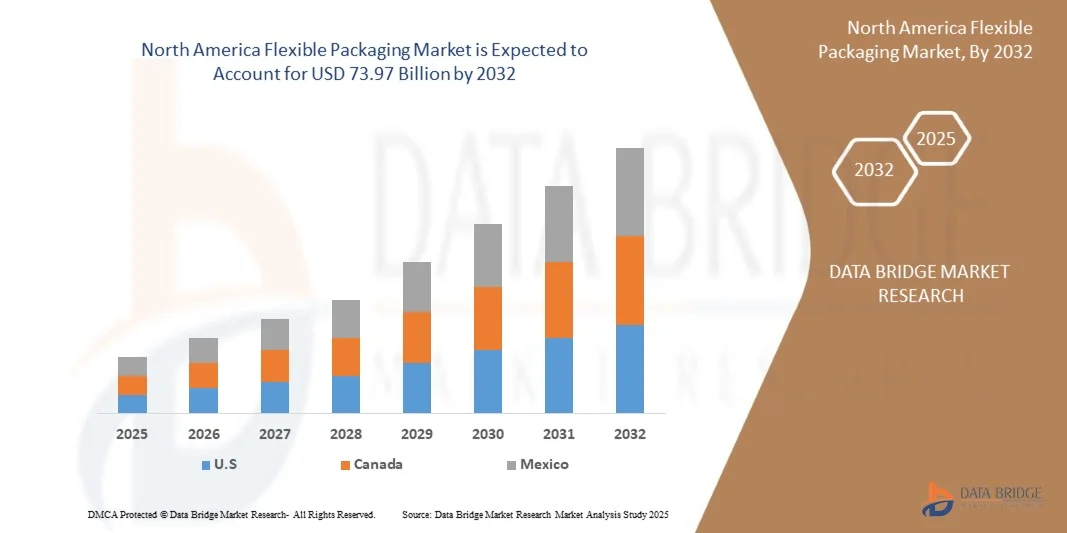

- The North America flexible packaging market size was valued at USD 45.35 Billion in 2024 and is expected to reach USD 73.97 Billion by 2032, at a CAGR of 6.7% during the forecast period

- Growing demand from the food & beverage sector is a major factor driving demand across the region

- Advancements in smart and active packaging enhancing product shelf life and consumer experience is further strengthening market reach

North America Flexible Packaging Market Analysis

- Flexible packaging is packaging made from pliable materials such as films, foils, or paper that can easily change shape to protect, store, and transport products.

- The flexible packaging market is primarily driven by the rising demand for convenience, lightweight design, extended shelf life, e-commerce growth, sustainability trends, cost-effectiveness, and technological innovations in materials and printing

- Rising demand for sustainable and recyclable flexible packaging presents a significant growth opportunity, as consumers and regulators increasingly favor eco-friendly solutions across food, and beverage sector.

- North Ameruca dominates the flexible packaging market, supported by rapid urbanization and rising disposable incomes in countries like U.S. canada are increasing demand for packaged food and beverages, boosting the flexible packaging market.

- In 2025, the pouches segment is expected to dominate the market with 43.98% market share due to its lightweight, resealable design, superior barrier properties, versatility across liquid and solid foods, extended shelf life, portability, and convenience for storage, transportation, and retail display. Their ability to maintain product freshness and consumer-friendly usability makes them the most preferred choice across North America food and beverage packaging applications.

- The U.S. flexible packaging market is poised to grow at the fastest CAGR of approximately 6.5% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing demand for packaged and processed foods. Growth is also supported by expanding e-commerce and retail channels, adoption of lightweight, convenient, and sustainable flexible packaging formats, and investments by regional manufacturers in innovative printing and barrier technologies to meet consumer and regulatory requirements.

Report Scope and North America Flexible Packaging Market Segmentation

|

Attributes |

North America Flexible Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, Porter analysis, raw material coverage, climate change scenario, market entry strategies, supply chain analysis, technological advancements, pricing analysis, vendor selection criteria, cost analysis breakdown, and industry ecosystem analysis. |

Flexible Packaging Market Trends

“Sustainable & Recyclable Flexible Packaging”

- In the food & beverage sector, there’s a strong shift toward flexible packaging solutions that emphasise sustainability, recyclability and circular‑economy thinking.

- Brands are increasingly using mono‑material films (single polymer rather than multi‑layer laminates) to simplify recycling and reduce complexity.

- There is rising adoption of bio‑based, compostable or paper‑based flexible packaging especially for dry foods and snacks, to reduce reliance on fossil‑based plastics.

- Marketing and regulatory pressure: Governments are setting targets (e.g., single‑use packaging must be recyclable/compostable) and consumers expect eco‑friendly credentials.

- Lightweight flexible packaging reduces material use, shipping weight/volume and carbon footprint compared to rigid alternatives an advantage in food & drink logistics. inside-packaging.

- Flexible packaging formats (like stand‑up pouches, spouted pouches) dominate for convenience and adaptability, making the sustainable versions particularly impactful. Feeding Trends

- Barrier performance improvements (for moisture, oxygen, light) are being matched with sustainable choices, meaning brands don’t have to sacrifice shelf‑life or product integrity when going greener.

Flexible Packaging Market Dynamics

Driver

Growing Demand from The Food & Beverage Sector

- The food and beverage sector continues to drive substantial demand for flexible packaging due to its excellent barrier properties, extended shelf life, and cost-effectiveness. The increasing consumption of ready-to-eat meals, snacks, and on-the-go foods, especially in emerging economies such as India, China, and Brazil, is contributing to market growth. Flexible packaging formats like pouches, wraps, and sachets are favored for their convenience, lightweight design, and reduced material usage compared to rigid alternatives. Additionally, the expansion of e-commerce grocery deliveries and adoption of sustainable packaging practices by food brands are accelerating the shift toward recyclable and bio-based flexible materials. This growing reliance on flexible packaging is expected to continue fueling North America market expansion in the coming years.

- For instance, as highlighted by the Packaging Machinery Manufacturers Institute (PMMI) in June 2025, 68% of beverage companies anticipate moderate to significant increases in packaging machinery investments, with nearly 90% planning purchases. This investment drive is spurred by rising consumer demand for on-the-go drinks and increased use of flexible packaging formats.

- In May 2025 the Indian firm Jindal Poly Films Limited announced an investment of USD 84.34 million to expand its BOPP, PET and CPP film capacity at its Nashik facility, specifically to support growth in key sectors including food and beverage flexible packaging.

- The escalating demand from the food and beverage sector is a key driver for the flexible food packaging market. Rising consumer preference for convenience, on-the-go consumption, and product freshness is compelling manufacturers to adopt innovative and sustainable packaging solutions. As a result, F&B demand not only fuels market growth but also accelerates the development of flexible formats tailored to diverse product types and regulatory standards.

Restraint/Challenge

Fluctuating Raw Material Prices

- Fluctuating raw material prices remain a critical challenge for the North America flexible packaging market. Variations in the cost of polymers such as polyethylene, polypropylene, and PET can significantly influence production expenses, profit margins, and pricing strategies. These fluctuations are often driven by North America supply-demand imbalances, energy price volatility, and geopolitical factors, compelling manufacturers to adopt strategic sourcing, alternative materials, and cost-management measures. As a result, raw material price instability continues to shape operational decisions and competitiveness within the industry.

- For instance, In August 2025, Castrol India experienced a 5.1% increase in second-quarter profit, reaching USD 29,400, driven by consistent demand for its automobile and industrial lubricants. Revenue from operations rose by 7.1% to 14.97 billion, supported by a near 5% increase in India's retail vehicle sales during the quarter. However, total expenses grew by 6.6%, largely due to a 3.2% rise in raw material costs, highlighting the impact of fluctuating raw material prices on production costs and profit margins.

- Fluctuating raw material prices continue to pose a significant challenge for the flexible packaging industry, directly affecting production costs, profit margins, and pricing strategies. Variability in the costs of polymers, paper, and other essential inputs forces manufacturers to implement strategic sourcing, adopt alternative materials, and optimize supply chains. These fluctuations not only influence short-term profitability but also shape long-term operational and investment decisions, emphasizing the need for resilience and proactive cost management in a dynamic North America market

Flexible Packaging Market Scope

The market is segmented on the basis of product, material, end use industry, and technology.

By product

On the basis of product, the market is segmented into pouches, bags and sacks, tubes, liners, sachets and stick packs, labels, tapes, films, and wraps. In 2025, pouches dominate the North America flexible packaging market with a market share of 43.98% due to its lightweight, resealable design, superior barrier properties, versatility across liquid and solid foods, extended shelf life, portability, and convenience for storage, transportation, and retail display. Their ability to maintain product freshness and consumer-friendly usability makes them the most preferred choice across North America food and beverage packaging applications.

Moreover, this segment is further projected to register the highest CAGR of 6.7% during the forecast period of 2025 to 2032, owing to the increasing demand for single-serve, ready-to-eat meals, and on-the-go snacks, rising urbanization, convenience-focused lifestyles, e-commerce packaging needs, innovative pouch designs, and adoption by emerging food brands for cost-effective, sustainable, and visually appealing packaging solutions.

By material

On the basis of material, the market is segmented into plastic, paper, metal, inorganic oxides, adhesives and coatings, and others. In 2025, plastic dominates the North America market with a market share of 69.45% owing to its durability, flexibility, lightweight nature, cost-effectiveness, superior moisture and oxygen barrier properties, compatibility with various printing and laminating technologies, and ability to preserve product quality, shelf life, and appearance across different food and beverage applications worldwide.

Moreover, the paper segment is further projected to register the highest CAGR of 6.5% during the forecast period of 2025 to 2032. The high growth is mainly due to rising sustainability trends, consumer preference for recyclable or biodegradable materials, government regulations on single-use plastics, increasing adoption of paper-based pouches and wraps, and growing eco-conscious packaging initiatives by North America food and beverage brands.

By End Use Industry

On the basis of end use industry, the market is segmented into food and beverage. In 2025, food dominates the market with a market share of 83.60% due to high North America consumption of packaged foods, rising demand for convenience and ready-to-eat products, urban lifestyles, longer shelf-life requirements, increasing retail distribution, and preference for safe, hygienic, and visually appealing packaging formats.

Furthermore, this segment is expected to witness the fastest growth of 6.5% during the forecast period, due to expanding processed and packaged food markets, rising disposable incomes, adoption of single-serve and snack formats, rising e-commerce food sales, increasing awareness about food preservation, and the need for sustainable, convenient, and portable packaging solutions.

By Technology

On the basis of technology, the market is segmented into flexography, rotogravure, digital, and others. In 2025, flexography dominates North America flexible packaging market with a market share of 47.51% as it offers high-speed, cost-efficient printing on various substrates, consistent color quality, adaptability for flexible films, scalability for large production runs, superior ink adhesion, minimal setup time, and capability to deliver vibrant, high-resolution designs for branding and product appeal.

Furthermore, this segment is anticipated to witness the fastest growth of 6.7% during the forecast period. The growth of this segment is mainly due to the advancements in automation, improved plate-making technologies, digital hybrid integration, demand for high-quality, short-run prints, sustainability-driven ink innovations, ability to customize packaging quickly, and increased adoption by brands seeking visually attractive, efficient, and cost-effective printing solutions.

North America Flexible Packaging Market Regional Analysis

- U.S. dominated the flexible packaging market with the large revenue share of 68.64%, driven by rapid urbanization and rising disposable incomes in countries like China and India are increasing demand for packaged food and beverages, boosting the flexible packaging market.

- Expansion of e-commerce and modern retail channels in the Asia-Pacific region is driving the adoption of convenient, lightweight, and durable flexible packaging solutions.

- Growing awareness of food safety, longer shelf-life requirements, and increasing use of ready-to-eat and processed food products are further fueling market growth, contributing to the region’s large revenue share.

U.S. Flexible Packaging Market Insight

The U.S. flexible packaging market accounted for a significant share within North America in 2024, due to its strong consumer demand for convenience foods, increasing adoption of ready-to-eat and on-the-go products, and growing e-commerce packaging requirements. Additionally, advancements in sustainable and recyclable packaging solutions, coupled with high investments by leading manufacturers in innovative flexible formats, have reinforced market dominance and supported consistent growth across food, beverage, and personal care segments.

The Major Market Leaders Operating in the Market Are:

- PROAMPAC (U.S.)

- AMCOR PLC (Switzerland)

- GOGLIO SPA (Italy)

- GRAPHIC PACKAGING HOLDING COMPANY (U.S.)

- CONSTANTIA FLEXIBLES (Austria)

- ALTANA (Germany)

- SONOCO PRODUCTS COMPANY (U.S.)

- FLAIR FLEXIBLE PACKAGING CORPORATION (U.S.)

- MONDI (U.K.)

- WESTROCK COMPANY (U.S.)

- TRANSCONTINENTAL INC. (Canada)

- WIPAK GROUP (Finland)

- SEALED AIR (U.S.)

- BBC CELLPACK PACKAGING (Switzerland)

- SCHUR FLEXIBLES (Austria)

- COVERIS (Austria)

- HUHTAMÄKI (Finland)

- BISCHOF + KLEIN SE & CO. KG (Germany)

- SÜDPAC (Germany)

Latest Developments in North America Flexible Packaging Market

- In September, Sealed Air introduced the AUTOBAG 850HB Hybrid Bagging Machine, designed for fulfillment operations that use either paper or poly mailers. The machine provides flexibility to run both substrate types, helping customers streamline equipment needs and support curb-side recyclable formats.

- In September 2025, Graphic Packaging, along with Henkel Adhesive Technologies and Kraton Corporation, formed a strategic partnership to develop next-generation sustainable packaging solutions. This collaboration focuses on aligning innovation with circular economy principles, accelerating the shift to more sustainable, high-performing materials. The partnership aims to drive sustainable progress in the packaging industry through combined expertise and resources.

- In July, BBC Cellpack Packaging enhanced its production capabilities at its Lauterecken (Germany) site with the installation of a BOBST EXPERT CI flexo press featuring eleven printing units. The investment enables faster job changeovers, reduced waste, and greater versatility across recyclable and sustainable flexible packaging, strengthening the company’s presence in confectionery, dry foods, and personal care segments.

- In August 2024, ACTEGA introduced the YUNICO technology platform, a water-based coating solution designed to enhance the sustainability of food packaging. This platform enables the dispersion of highly customizable compounds, providing barrier properties, recyclability, and adhesion in packaging materials. YUNICO aligns with ALTANA's commitment to sustainable packaging solution.

- In August 2023, Amcor acquired Phoenix Flexibles, a Gujarat-based company generating approximately USD 20 million in annual revenue from flexible packaging solutions for food, home care, and personal care sectors. This acquisition enhances Amcor's capacity in the high-growth Indian market and introduces advanced film technologies, enabling local production of sustainable packaging solutions.

- In April, Huhtamaki expanded its flexible packaging portfolio with the launch of its next-generation mono-material films under the blueloop platform. The new range, made from PE and PP, delivers full recyclability and high product protection, addressing the demand for sustainable flexible solutions across food and personal care markets. This innovation reflects Huhtamaki’s focus on circular packaging solutions and its long-term commitment to reducing plastic waste through material innovation.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FLEXIBLE PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MATERIAL TIMELINE CURVE

2.1 MARKET END USE INDUSTRY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATIONS

4.4 RAW MATERIAL COVERAGE

4.4.1 POLYETHYLENE (PE)

4.4.2 POLYPROPYLENE (PP)

4.4.3 POLYETHYLENE TEREPHTHALATE (PET)

4.4.4 ALUMINUM FOIL

4.4.5 PAPER & CELLULOSIC MATERIALS

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTICS COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 PRODUCTION CAPACITY OVERVIEW OF THE FLEXIBLE PACKAGING MARKET

4.7 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7.1 HIGH-PERFORMANCE BARRIER FILMS AND NANOCOMPOSITE STRUCTURES

4.7.2 MONO-MATERIAL INNOVATIONS FOR CIRCULARITY

4.7.3 DIGITAL PRINTING AND SMART CONVERTING TECHNOLOGIES

4.7.4 BIO-BASED AND COMPOSTABLE POLYMER DEVELOPMENT

4.7.5 SMART AND FUNCTIONAL PACKAGING INTEGRATION

4.7.6 ADVANCED SEALING AND FORMING MECHANISMS

4.7.7 AUTOMATION, ROBOTICS, AND AI-ENABLED MANUFACTURING

4.7.8 RECYCLING-COMPATIBLE ADHESIVES AND COATINGS

4.7.9 DATA-DRIVEN DESIGN AND LIFECYCLE ANALYTICS

4.7.10 TOWARD A SMART, CIRCULAR FUTURE

4.8 VENDOR SELECTION CRITERIA

4.8.1 MATERIAL AND PRODUCT PORTFOLIO BREADTH

4.8.2 TECHNOLOGICAL CAPABILITY AND INNOVATION READINESS

4.8.3 SUSTAINABILITY AND REGULATORY COMPLIANCE

4.8.4 MANUFACTURING CAPACITY AND NORTH AMERICA FOOTPRINT

4.8.5 QUALITY ASSURANCE AND CERTIFICATION STANDARDS

4.8.6 CUSTOMIZATION AND DESIGN FLEXIBILITY

4.8.7 SUPPLY CHAIN TRANSPARENCY AND TRACEABILITY

4.8.8 COST COMPETITIVENESS AND TOTAL VALUE PROPOSITION

4.8.9 DIGITAL INTEGRATION AND AFTER-SALES SUPPORT

4.8.10 REPUTATION, STRATEGIC PARTNERSHIPS, AND MARKET ENDORSEMENT

4.8.11 SUMMARY

4.9 PRICING ANALYSIS

5 REGULATION COVERAGE

5.1 PRODUCT CODE

5.1.1 INDIAN STANDARD (IS) CODES

5.1.2 INTERNATIONAL STANDARD CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.3.1 MATERIAL HANDLING & STORAGE

5.3.2 TRANSPORT & PRECAUTIONS

5.3.3 HARAD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FROM THE FOOD & BEVERAGE SECTOR

6.1.2 SUSTAINABILITY AND ECO-FRIENDLY MATERIAL INNOVATIONS

6.1.3 COST-EFFECTIVENESS AND VERSATILE DESIGN FEATURES

6.1.4 EXPANSION OF E-COMMERCE AND HOME DELIVERY SERVICES

6.2 RESTRAINS

6.2.1 FLUCTUATING RAW MATERIAL PRICES AFFECTING PRODUCTION COSTS AND PROFIT MARGINS

6.2.2 LIMITED RECYCLING INFRASTRUCTURE HINDERING CIRCULAR ECONOMY AND SUSTAINABILITY GOALS

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN SMART AND ACTIVE PACKAGING ENHANCING PRODUCT SHELF LIFE AND CONSUMER EXPERIENCE

6.3.2 RISING ADOPTION IN THE HEALTHCARE AND PHARMACEUTICAL SECTOR

6.3.3 EMERGING MARKETS DRIVING CONSUMPTION GROWTH THROUGH RISING DISPOSABLE INCOME AND CHANGING CONSUMER PREFERENCES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL AND REGULATORY PRESSURES SHAPING PACKAGING DESIGN AND SUSTAINABILITY PRACTICES

6.4.2 TECHNOLOGICAL BARRIERS IN RECYCLING MULTI-LAYER FILMS

7 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 POUCHES

7.3 BAGS AND SACKS

7.4 FILMS AND WRAPS

7.5 TUBES

7.6 SACHETS & STICK PACKS

7.7 LINERS

7.8 LABELS

7.9 TAPES

8 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.3 PAPER

8.4 METAL

8.5 ADHESIVE AND COATINGS

8.6 INORGANIC OXIDES

8.7 OTHERS

9 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 FLEXOGRAPHY

9.3 ROTOGRAVURE

9.4 DIGITAL

9.5 OTHERS

10 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY END USE

10.1 OVERVIEW

10.2 FOOD

10.3 BEVERAGE

11 NORTH AMERICA FLEXIBLE PACKAGING MARKET BY REGIONS

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA FLEXIBLE PACKAGING MARKET: COMPANY LANDSCAPE

12.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 WESTROCK COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 AMCOR PLC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 GRAPHIC PACKAGING INTERNATIONAL, LLC (SUBSIDIARY OF A. R. PACKAGING SOLUTIONS)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 SEALED AIR

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 HUHTAMÄKI OYJ

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ALTANA

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BBC CELLPACK PACKAGING

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 BISCHOF+KLEIN SE & CO. KG

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 CONSTANTIA FLEXIBLES

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 COVERIS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 FLAIR FLEXIBLE PACKAGING CORPORATION.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 GOGLIO SPA

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MONDI.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 PROAMPAC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SCHUR

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SONOCO PRODUCTS COMPANY

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 SÜDPACK

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 WIPAK

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 NORTH AMERICA POUCHES IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 3 NORTH AMERICA BAGS AND SACKS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 4 NORTH AMERICA FILMS AND WRAPS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA TUBES IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA SACHETS & STICK PACKS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 7 NORTH AMERICA LINERS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA LABELS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA TAPES IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA PLASTIC IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA PAPER IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA METAL IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA ADHESIVE AND COATINGS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA INORGANIC OXIDES IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA FOOD IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA BEVERAGE IN FLEXIBLE PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 28 U.S. FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 29 U.S. FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 30 U.S. FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 31 U.S. FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 U.S. FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 33 CANADA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 34 CANADA FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 35 CANADA FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 36 CANADA FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 CANADA FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 38 MEXICO FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 39 MEXICO FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 40 MEXICO FLEXIBLE PACKAGING MARKET, BY END USE, 2018-2032 (USD MILLION)

TABLE 41 MEXICO FOOD IN FLEXIBLE PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 42 MEXICO FLEXIBLE PACKAGING MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA FLEXIBLE PACKAGING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLEXIBLE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLEXIBLE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLEXIBLE PACKAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLEXIBLE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLEXIBLE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FLEXIBLE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FLEXIBLE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FLEXIBLE PACKAGING MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA FLEXIBLE PACKAGING MARKET: MATERIAL TIMELINE CURVE

FIGURE 11 NORTH AMERICA FLEXIBLE PACKAGING MARKET: END USE INDUSTRY COVERAGE GRID

FIGURE 12 NORTH AMERICA FLEXIBLE PACKAGING MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY END USE INDUSTRY (2024)

FIGURE 14 NORTH AMERICA FLEXIBLE PACKAGING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWING DEMAND IN FODD & BEVERAGE SECTOR IS EXPECTED TO DRIVE THE NORTH AMERICA FLEXIBLE PACKAGING MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 END USE INDUSTRY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLEXIBLE PACKAGING MARKET IN 2025 & 2032

FIGURE 18 ASIA-PACIFIC IS EXPECTED TO BE THE DOMINANT AND FASTEST GROWING REGION IN THE NORTH AMERICA FLEXIBLE PACKAGING MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 19 ASIA PACIFIC IS THE FASTEST-GROWING REGION FOR THE NORTH AMERICA FLEXIBLE PACKAGING MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 20 PESTEL ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 NORTH AMERICA FLEXIBLE PACKAGING MARKET, 2024-2040, AVERAGE SELLING PRICE (USD/KG)

FIGURE 23 DROC ANALYSIS

FIGURE 24 NORTH AMERICA FLEXIBLE PACKAGING MARKET, BY PRODUCT, 2024

FIGURE 25 NORTH AMERICA FLEXIBLE PACKAGING MARKET: BY MATERIAL, 2024

FIGURE 26 NORTH AMERICA FLEXIBLE PACKAGING MARKET: BY TECHNOLOGY, 2024

FIGURE 27 NORTH AMERICA FLEXIBLE PACKAGING MARKET: BY END USE, 2024

FIGURE 28 NORTH AMERICA FLEXIBLE PACKAGING MARKET SNAPSHOT

FIGURE 29 NORTH AMERICA FLEXIBLE PACKAGING MARKET: COMPANY SHARE 2024 (%)

North America Flexible Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Flexible Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Flexible Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.