North America Flooring Materials Market

Market Size in USD Billion

CAGR :

%

USD

360.70 Billion

USD

610.54 Billion

2024

2032

USD

360.70 Billion

USD

610.54 Billion

2024

2032

| 2025 –2032 | |

| USD 360.70 Billion | |

| USD 610.54 Billion | |

|

|

|

|

North America Flooring Materials Market Size

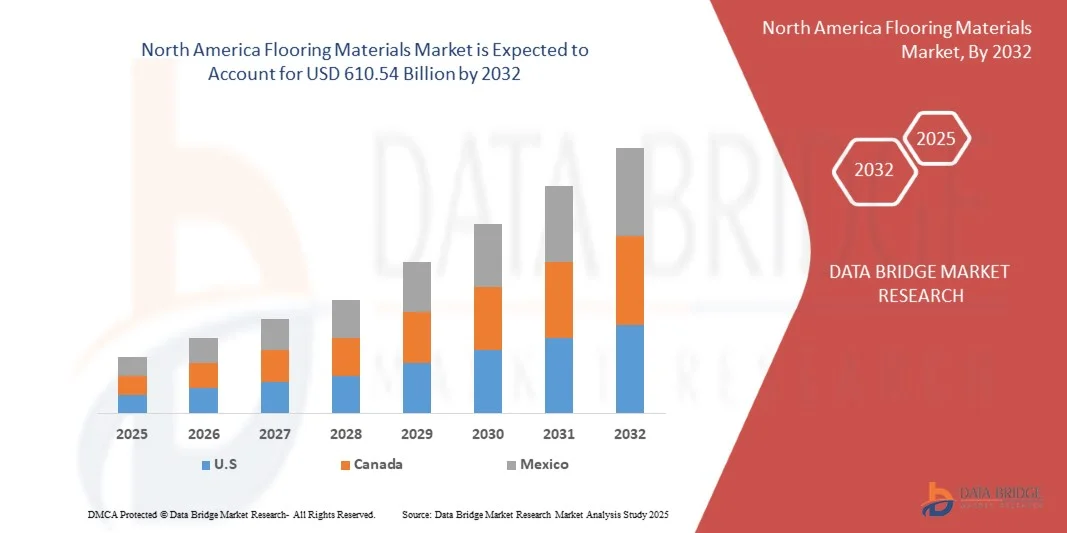

- The North America Flooring Materials Market size was valued at USD 360.70 billion in 2024 and is projected to reach USD 610.54 billion by 2032, growing at a CAGR of 6.80% during the forecast period

- The market expansion is primarily driven by rising construction activities, renovation trends, and increased investments in residential and commercial infrastructure across the region

- Additionally, consumer preferences are shifting towards durable, sustainable, and aesthetically pleasing flooring solutions, such as luxury vinyl tiles and engineered wood, fueling demand and accelerating market growth

North America Flooring Materials Market Analysis

- Flooring materials, encompassing products such as hardwood, vinyl, laminate, carpet, and tiles, are essential components in both residential and commercial construction due to their functional durability, aesthetic appeal, and ability to meet varied design and performance needs

- The growing demand for flooring materials is primarily driven by a surge in remodeling activities, increasing urbanization, and rising consumer interest in sustainable and low-maintenance flooring solutions

- U.S. dominated the flooring materials market with the largest revenue share of 37% in 2024, supported by strong construction spending, evolving interior design trends, and increased adoption of premium and eco-friendly flooring options, especially in the U.S., where LVT and engineered wood are experiencing notable demand in both new builds and renovations

- Canada is anticipated to be the fastest-growing region in the flooring materials market during the forecast period, propelled by rapid urban development, expanding middle-class populations, and growing infrastructure investments

- The non-resilient flooring segment dominated the market with the largest revenue share of 47.8% in 2024, driven by strong demand for ceramic tiles and hardwood due to their long-lasting durability, aesthetic value, and suitability for high-traffic areas.

Report Scope and North America Flooring Materials Market Segmentation

|

Attributes |

Flooring Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Flooring Materials Market Trends

“Enhanced Performance Through Smart Materials and Sustainable Innovation”

- A significant and accelerating trend in the North America Flooring Materials Market is the increased incorporation of smart materials and sustainable technologies, transforming both the performance and environmental footprint of modern flooring solutions. This shift reflects growing consumer demand for eco-conscious, high-performance products that align with evolving interior design and sustainability standards.

- For Instance, Mohawk Industries has introduced flooring lines featuring proprietary technologies such as “Air.o,” a hypoallergenic carpet designed for improved indoor air quality, and “RevWood,” which combines the visual appeal of hardwood with enhanced water resistance. Similarly, Shaw Industries offers bio-based resilient flooring options that are Cradle to Cradle Certified®, emphasizing both innovation and sustainability.

- Smart flooring materials now include features like improved sound absorption, thermal insulation, anti-microbial surfaces, and even embedded sensors for commercial applications—capable of tracking foot traffic or environmental changes in retail and healthcare settings. These advancements not only enhance comfort and durability but also improve overall indoor environmental quality.

- Sustainable innovations such as recycled content, low-VOC adhesives, and water-based finishes are becoming standard among leading manufacturers. Many companies are investing in circular manufacturing practices, where materials are designed for reuse or recycling at the end of their life cycle, significantly reducing landfill waste.

- This trend toward smarter, more environmentally responsible flooring is also being driven by green building certifications like LEED and WELL, pushing manufacturers to develop solutions that contribute to energy efficiency and healthier interiors. Companies such as Interface and Forbo are at the forefront, offering carbon-neutral or even carbon-negative flooring products.

- The demand for advanced, sustainable flooring is rapidly rising in both residential and commercial construction as architects, designers, and homeowners seek to combine aesthetics, performance, and environmental responsibility—setting new benchmarks for the future of flooring in North America.

North America Flooring Materials Market Dynamics

Driver

“Growing Demand Driven by Construction Boom and Interior Design Trends”

- The surge in residential and commercial construction, along with increasing consumer interest in modern and functional interiors, is a significant driver for the expanding demand in the North America Flooring Materials Market. Renovation projects, urbanization, and changing lifestyle preferences are reshaping how consumers and businesses approach flooring.

- For Instance, in March 2024, Shaw Industries announced the expansion of its sustainable LVT (luxury vinyl tile) line tailored for high-traffic commercial applications, in response to increased demand from the hospitality and healthcare sectors. Strategic product launches like these are helping key players capture market share amid evolving construction and design trends.

- Consumers are prioritizing flooring options that offer not only durability and visual appeal but also ease of maintenance and environmental friendliness. This has led to a surge in demand for products like luxury vinyl, engineered hardwood, and sustainable laminate. These materials offer practical benefits while aligning with the latest aesthetics and eco-conscious values.

- Additionally, the popularity of open-concept living and minimalist design has increased the demand for continuous flooring surfaces that provide a clean, cohesive look. This trend is particularly prevalent in urban homes, retail spaces, and office environments where flooring plays a key role in defining the spatial experience.

- Technological advances in digital printing, waterproof coatings, and quick-installation systems have made it easier for homeowners and professionals to choose, install, and maintain modern flooring products. The rise of DIY home improvement culture, supported by tutorials and design visualization tools, further propels this growth across residential and light commercial segments.

Restraint/Challenge

“Fluctuating Raw Material Costs and Environmental Compliance Pressures”

- One of the primary challenges facing the North America Flooring Materials Market is the volatility in raw material prices, particularly for components like PVC, adhesives, resins, and wood, which directly impact production costs and pricing strategies. Sudden cost spikes can strain manufacturer margins and affect affordability for end consumers.

- For instance, ongoing geopolitical tensions and global supply chain disruptions have resulted in unpredictable pricing for imported materials, creating pressure across the entire value chain. These fluctuations are especially challenging for manufacturers reliant on petroleum-based inputs or international suppliers.

- In parallel, stricter environmental regulations regarding emissions, waste management, and the use of volatile organic compounds (VOCs) are increasing compliance burdens. Flooring manufacturers must invest in cleaner production technologies and sustainable sourcing practices to meet both regulatory requirements and growing consumer expectations.

- Companies such as Interface and Forbo have responded by pioneering low-carbon, circular flooring products, but smaller players may struggle to make similar transitions due to cost and infrastructure limitations.

- Balancing affordability, compliance, and sustainability continues to be a complex challenge. Without adequate investment in innovation and supply chain resilience, these factors could hinder widespread adoption, particularly in price-sensitive market segments or regions with slower construction activity.

- Overcoming these barriers will require collaborative efforts across the industry—through supply chain diversification, product innovation, and transparent environmental reporting—to support long-term market growth and consumer trust.

North America Flooring Materials Market Scope

The market is segmented on the basis of type, material type, distribution channel, and end use.

• By Type

On the basis of type, the North America flooring materials market is segmented into resilient flooring, non-resilient flooring, and soft covering. The non-resilient flooring segment dominated the market with the largest revenue share of 47.8% in 2024, driven by strong demand for ceramic tiles and hardwood due to their long-lasting durability, aesthetic value, and suitability for high-traffic areas. Non-resilient options are often preferred in both residential and commercial settings for their premium look and performance.

The resilient flooring segment is projected to grow at the fastest CAGR of 6.9% from 2025 to 2032, fueled by the rising adoption of luxury vinyl tiles (LVT), rubber, and linoleum. These materials offer superior flexibility, water resistance, and ease of installation, making them increasingly popular in healthcare, education, and hospitality sectors where hygiene, comfort, and safety are key considerations.

• By Material

Based on material, the market is segmented into vinyl, linoleum, rubber, carpet, ceramic tiles, wood, laminate, and others. The ceramic tiles segment held the largest market revenue share of 29.4% in 2024, attributed to its widespread use in kitchens, bathrooms, and commercial buildings. Ceramic tiles are valued for their durability, moisture resistance, and vast design options, making them a reliable choice for both aesthetic and functional purposes.

The vinyl segment is expected to grow at the fastest CAGR of 7.4% from 2025 to 2032, supported by increasing demand for luxury vinyl tiles (LVT) and planks in both new construction and renovation projects. Vinyl flooring is cost-effective, easy to maintain, and now offers high-end visual finishes resembling wood or stone, making it attractive for homeowners and developers seeking performance with design flexibility.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into retail stores, online platforms, specialty stores, and others. The retail stores segment dominated the market with the largest revenue share of 52.1% in 2024, reflecting continued consumer preference for physical product evaluation, professional advice, and in-store installation services. Large home improvement chains and regional flooring retailers remain the primary channels for both residential and commercial buyers.

The online platforms segment is forecasted to register the fastest CAGR of 8.3% between 2025 and 2032, as digital transformation accelerates across the construction and home improvement industries. E-commerce platforms provide broader access to flooring materials, virtual visualization tools, and direct delivery, appealing especially to DIY consumers and price-sensitive buyers. Growth is also supported by an expanding presence of online-exclusive flooring brands and customization options.

• By End-Use

On the basis of end-use, the market is segmented into residential, commercial, industrial, institutional, and others. The residential segment held the largest market share of 44.6% in 2024, driven by strong demand from new housing developments, remodeling projects, and growing interest in interior aesthetics. The rising popularity of home improvement trends, coupled with investments in energy-efficient and smart homes, contributes to sustained residential demand for flooring upgrades across various material types.

The commercial segment is expected to grow at the fastest CAGR of 7.1% from 2025 to 2032, supported by construction in retail, office, and hospitality spaces. This growth is underpinned by the demand for durable, visually appealing, and easy-to-maintain flooring solutions. Additionally, sectors such as healthcare and education are increasingly investing in hygienic, slip-resistant flooring materials that meet regulatory standards while offering design flexibility.

North America Flooring Materials Market Regional Analysis

- U.S. dominated the flooring materials market with the largest revenue share of 37% in 2024, driven by robust residential and commercial construction activities, along with growing interest in renovation and interior design upgrades

- Consumers in the region prioritize flooring solutions that offer durability, aesthetic appeal, and sustainability, with rising demand for advanced materials like luxury vinyl tiles (LVT), engineered hardwood, and eco-friendly laminates

- This widespread adoption is further fueled by high disposable incomes, increasing awareness of green building standards, and a strong presence of key manufacturers offering innovative, low-maintenance, and high-performance flooring products tailored to North American design preferences and climate conditions

Canada North America Flooring Materials Market Insight

Canada is experiencing steady growth in the flooring materials market, supported by rising residential construction and commercial infrastructure developments. The country’s emphasis on sustainable building practices has led to increased adoption of eco-friendly resilient flooring products like cork and linoleum. Harsh climatic conditions drive demand for durable and insulating flooring options. Additionally, government incentives for green building certifications encourage the use of innovative flooring materials. The expanding real estate sector, combined with consumer preference for stylish yet functional flooring, is fueling growth in both urban and suburban areas throughout Canada.

Mexico North America Flooring Materials Market Insight

Mexico’s flooring materials market is poised for significant growth, fueled by rapid urbanization and expanding commercial infrastructure. Increasing foreign investment in industrial and retail construction projects is boosting demand for cost-effective and durable flooring solutions such as ceramic tiles and vinyl composites. Additionally, growing awareness around aesthetics and interior design in residential developments supports the uptake of laminate and engineered wood flooring. The country’s improving economic outlook and rising disposable incomes further enhance market prospects. Moreover, initiatives to modernize housing and commercial spaces with quality materials are expected to drive continued adoption of advanced flooring products across Mexico.

North America Flooring Materials Market Share

The Flooring Materials industry is primarily led by well-established companies, including:

- Mohawk Industries, Inc. (U.S.)

- Shaw Industries Group, Inc. (U.S.)

- TARKETT S.A. (France)

- Armstrong Flooring, Inc. (U.S.)

- Forbo Flooring Systems (Netherlands)

- Gerflor (France)

- Interface, Inc. (U.S.)

- Beaulieu International Group (Belgium)

- Toli Corporation (Japan)

- Milliken & Company (U.S.)

- Congoleum (U.S.)

- Flowcrete (U.K.)

- James Halstead (U.K.)

- The Dixie Group (U.S.)

- Victoria PLC (U.K.)

- Mannington Mills, Inc. (U.S.)

- Swiss Krono (Switzerland)

- LX Hausys (South Korea)

- Parador GmBH (Germany)

- MBB - Ihr Bodenausstatter GmbH (Germany)

- Altro Limited (England)

- Welspun Group (India)

- Avant Holding (UAE)

- Twintec Group Limited (Germany)

- Mirage (Canada)

- Kajaria Ceramics (India)

- Engineered Floors (U.S.)

What are the Recent Developments in North America Flooring Materials Market?

- In April 2023, Mohawk Industries, Inc., a global leader in flooring solutions, launched a new line of eco-friendly luxury vinyl tiles (LVT) designed to meet the growing demand for sustainable and durable flooring in North America. This initiative highlights Mohawk’s commitment to innovation and environmental responsibility, addressing consumer preferences for resilient, stylish, and low-maintenance flooring options in both residential and commercial sectors. By leveraging advanced manufacturing technologies, Mohawk aims to strengthen its market presence and respond to evolving trends in green building and interior design.

- In March 2023, Shaw Industries Group, Inc., based in the U.S., introduced an enhanced range of engineered hardwood floors with superior scratch resistance and waterproof capabilities, specifically targeting the fast-growing home renovation market. This product innovation underscores Shaw’s focus on combining aesthetics with functionality, offering consumers durable, attractive flooring solutions that cater to busy households. The launch reinforces Shaw’s leadership in delivering versatile flooring products that meet contemporary lifestyle demands.

- In March 2023, Tarkett S.A., a major European player with a strong footprint in North America, expanded its resilient flooring portfolio by introducing new vinyl composite tiles (VCT) that feature improved sustainability credentials and enhanced design options. The initiative supports Tarkett’s global strategy to promote circular economy principles while providing commercial and institutional customers with high-performance, eco-conscious flooring solutions. This move aligns with increasing regulatory emphasis on green construction standards across North America.

- In February 2023, Armstrong Flooring, Inc. announced a strategic partnership with leading homebuilders in the U.S. to integrate its innovative laminate and resilient flooring products into new residential developments. This collaboration aims to accelerate the adoption of durable, cost-effective flooring options that offer easy installation and long-term performance. Armstrong’s commitment to enhancing home value and occupant comfort through advanced flooring technologies is expected to bolster its market share in the competitive North American landscape.

- In January 2023, Forbo Flooring Systems, a global flooring manufacturer headquartered in the Netherlands with a growing North American presence, unveiled its latest line of sustainable linoleum flooring designed for commercial and educational facilities. The product features enhanced durability, natural materials, and low environmental impact, catering to customers’ rising demand for green building materials. Forbo’s focus on innovation and sustainability positions the company as a key contributor to the evolution of the North America Flooring Materials Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Flooring Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Flooring Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Flooring Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.