North America Foot And Ankle Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.10 Billion

USD

3.50 Billion

2024

2032

USD

2.10 Billion

USD

3.50 Billion

2024

2032

| 2025 –2032 | |

| USD 2.10 Billion | |

| USD 3.50 Billion | |

|

|

|

|

Foot and Ankle Devices Market Size

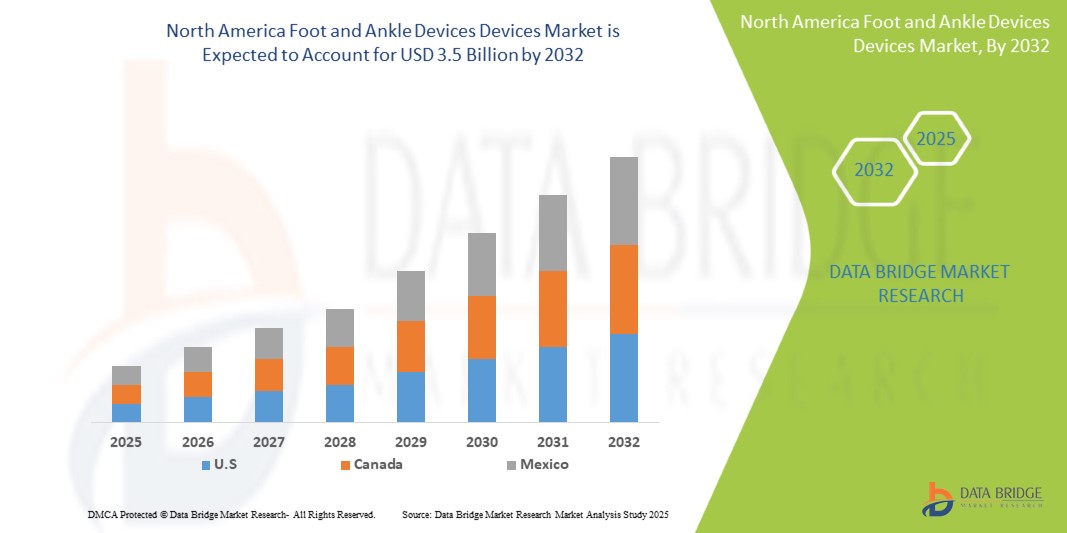

- The North America Foot and Ankle Devices market size was valued at USD 2.1 billion in 2024 and is expected to reach USD 3.5 billion by 2032, at a CAGR of 6.5% during the forecast period of 2025-2032.

- An Aging Population with Active Lifestyles: As the population ages, there's a corresponding increase in age-related degenerative conditions like arthritis and osteoporosis, directly contributing to a higher demand for foot and ankle devices for pain management and mobility restoration. Many seniors are also maintaining active lifestyles, leading to a greater incidence of foot and ankle injuries.

- Rising Burden of Diabetes and Associated Complications: The escalating prevalence of diabetes in North America directly fuels the need for specialized foot and ankle devices. Diabetic neuropathy and peripheral artery disease often lead to severe foot complications, including ulcers and amputations, necessitating advanced devices for wound care, offloading, and deformity correction.

- These converging factors are accelerating the adoption of foot and ankle devices, thereby significantly boosting the industry's growth in the region.

Foot and Ankle Devices Market Analysis

- Foot and ankle devices are becoming increasingly crucial in modern orthopedic care, providing essential support, correction, fixation, and replacement solutions for a wide array of musculoskeletal conditions. These devices are vital across both hospital and ambulatory settings, significantly improving patient mobility, reducing pain, and enhancing their overall quality of life.

The escalating demand for foot and ankle devices is primarily fueled by:

-

- Rising Incidence of Complex Foot and Ankle Trauma: An increase in high-energy trauma (e.g., motor vehicle accidents, industrial mishaps) and sports-related injuries, particularly those involving the foot and ankle, necessitates advanced fixation and reconstructive solutions.

- Growing Prevalence of Chronic Conditions with Specific Foot & Ankle Manifestations: Beyond general diabetes and arthritis, specific complications like diabetic foot ulcers, charcot arthropathy, and severe osteoarthritis of the ankle are driving the need for specialized devices for deformity correction, joint preservation, and limb salvage.

- Technological Innovations in Implant Design and Materials: Continuous advancements, such as the development of 3D-printed patient-specific implants, bioabsorbable fixation devices, and advanced total ankle replacement systems, are offering better clinical outcomes, reducing recovery times, and expanding the indications for surgical intervention.

- The U.S. dominates the North America Foot and Ankle Devices market, holding the largest revenue share of 85.5% in 2025. This strong position is attributed to its well-established and extensive healthcare infrastructure, substantial healthcare expenditure, and the significant presence of leading global medical device manufacturers who actively invest in R&D and product innovation within the region.

- The Orthopedic Implants segment is expected to dominate the Foot and Ankle Devices market with a market share of 31.82% in 2025. This dominance is driven by the high volume of reconstructive procedures for complex fractures and deformities, combined with the increasing adoption of advanced plating systems, screws, and intramedullary nails that offer stable fixation and promote early mobilization.

- Report Scope and Foot and Ankle Devices Market Segmentation

|

Attributes |

Foot and Ankle Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Foot and Ankle Devices Market Trends

“Increasing Adoption of Minimally Invasive and Robotic Surgery”

- A significant trend in the North America foot and ankle devices market is the growing preference for minimally invasive surgical techniques. These procedures offer critical benefits such as smaller surgical incisions, reduced post-operative pain, accelerated patient recovery times, and shorter hospital stays, directly increasing patient demand and adoption by surgeons.

- For instance, advancements in arthroscopic techniques for ankle instability, impingement, and cartilage repair, along with the development of specialized percutaneous instruments, are expanding the range of foot and ankle conditions that can be treated with less invasive approaches.

- Furthermore, the integration of robotic surgical systems in foot and ankle procedures is gaining traction. These systems offer enhanced precision in bone cuts (e.g., for bunionectomies or total ankle arthroplasty), improved dexterity for complex reconstructions, and superior 3D visualization, potentially leading to improved surgical outcomes and greater adoption for intricate procedures.

- The seamless integration of advanced weight-bearing imaging technologies (like weight-bearing CT scans) with surgical planning and navigation systems is also enhancing the accuracy of implant placement and efficacy of complex deformity corrections in foot and ankle surgeries.

Foot and Ankle Devices Market Dynamics

Driver

“Growing Geriatric Population and Prevalence of Chronic Diseases”

- The increasing proportion of the elderly population in North America, coupled with the rising prevalence of chronic diseases such as diabetes and arthritis, is a significant driver for the heightened demand for foot and ankle devices.

- For instance, the aging population is more susceptible to degenerative joint conditions, fractures, and other foot and ankle ailments requiring surgical intervention or the use of orthotic devices. Similarly, diabetic patients often experience foot complications that necessitate specialized devices for wound care, offloading, and deformity correction.

- As the incidence of these conditions continues to rise, the demand for a wide range of foot and ankle devices, including implants, fixation devices, and orthotics, is expected to increase substantially.

- Furthermore, the growing awareness among patients and healthcare professionals regarding the availability and benefits of advanced foot and ankle treatments is contributing to increased adoption rates.

Restraint/Challenge

“High Cost of Advanced Devices and Reimbursement Issues”

- The relatively high cost of some advanced foot and ankle devices, particularly innovative implants and those used in complex surgical procedures, can pose a significant challenge to broader market access.

- For instance, the cost of ankle replacement devices or patient-specific implants can be substantial, potentially limiting their adoption, especially in healthcare systems with stringent budget constraints. · Additionally, complexities and variations in reimbursement policies across different payers in North America can create uncertainty and delays in the adoption of new and expensive technologies.

- Addressing these cost and reimbursement challenges through value-based care models, cost-effectiveness analyses, and streamlined approval processes will be crucial for ensuring wider patient access to advanced foot and ankle devices.

- While efforts are underway to improve cost transparency and optimize reimbursement pathways, these issues remain significant considerations for market growth.

Foot and Ankle Devices Market Scope

The market is segmented on the basis of type, application, and end-user.

By Type

On the basis of type, the foot and ankle devices market can be segmented into orthopedic implants (plates, screws, rods, wires), internal fixation devices, external fixation devices, soft tissue fixation devices, ankle replacement devices, orthotics & prosthetics, and others. The Orthopedic Implants (plates, screws, rods, wires) are projected to dominate with a market share of 31.82% in 2025, driven by the high volume of trauma and fracture procedures.

Internal Fixation Devices are anticipated to register the fastest CAGR of 12.82% CAGR from 2025 to 2032, supported by innovations in minimally invasive surgical techniques and material advancements that improve healing outcomes.

By Application

On the basis of application, the market is segmented into trauma & fracture fixation, sports injuries, deformity correction, arthritis, diabetic foot, and others. The Trauma & Fracture Fixation segment is projected to dominate with a tentative market share of 28.5% in 2025, driven by the high prevalence of injuries and the critical need for immediate intervention. This segment is anticipated to witness a growth rate of approximately 8.7% CAGR from 2025 to 2032.

Sports Injuries are anticipated to register the fastest CAGR of approximately 7.3% from 2025 to 2032, supported by increasing participation in sports activities and advancements in related surgical techniques.

By End user

On the basis of end-user, the market is segmented into hospitals, ambulatory surgical centers, orthopedic clinics, and others. Hospitals are projected to dominate with a tentative market share of 42.0% in 2025, primarily due to their extensive infrastructure, capacity for complex procedures, and high patient volume.

Ambulatory Surgical Centers are anticipated to register the fastest CAGR of approximately 7.8% from 2025 to 2032, supported by their cost-effectiveness, convenience for patients, and the increasing shift of suitable orthopedic procedures to outpatient settings.

Foot and Ankle Devices Market Regional Analysis

- U.S. dominates the Foot and Ankle Devices market with the largest revenue share of 85.5% in 2024, driven by a large and aging population, high rates of sports-related injuries, and well-established healthcare infrastructure with favorable reimbursement policies.

- This strong market position is further supported by the presence of major medical device companies and continuous advancements in device technology.

U.S. Foot and Ankle Devices Market Insight

U.S. dominates the North America Foot and Ankle Devices market with a projected revenue share of approximately 85.5% in 2025, driven by advanced healthcare infrastructure, high rates of surgical procedures, and the presence of major market players.

Canada Foot and Ankle Devices Market Insight

Canada is expected to capture around 10.5% of the regional market share in 2025, fueled by an aging population, expanding orthopedic care access, and rising demand for minimally invasive solutions.

Mexico Foot and Ankle Devices Market Insight

Mexico accounts for remaining share of the market in 2025, supported by increasing healthcare investment, trauma case burden, and gradual adoption of orthopedic devices.

Foot and Ankle Devices Market Share

The Foot and Ankle Devices industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- DePuy Synthes (U.S.)

- Zimmer Biomet (U.S.)

- Smith+Nephew (U.K.)

- Wright Medical Group N.V. (U.S.)

- Acumed (U.S.)

- Extremity Medical (U.S.)

- Paragon 28 (U.S.)

- Integra LifeSciences (U.S.)

- Colfax Corporation (U.S.)

- Enovis Corporation (U.S.)

- Össur (Iceland)

- Bauerfeind AG (Germany)

- Trilliant Surgical (U.S.)

Latest Developments in North America Foot and Ankle Devices Market

- In March 2025, restor3d announced FDA 510(k) clearance for its Ossera AFX Ankle Fusion System. This breakthrough 3D-printed fusion system incorporates their proprietary TIDAL Technology for optimized osseointegration and biomechanical stability. They also highlighted their Kinos Total Ankle System, a fully personalized total ankle arthroplasty solution designed for precision and surgical efficiency, and the Ossera Wedge Family for corrective foot and ankle procedures, all featuring TIDAL Technology to eliminate graft failure concerns. These products are set for commercial availability in May 2025.

- In April 2025, Medline UNITE announced FDA 510(k) clearance for its REFLEX HYBRID Nitinol Implant System. This innovative system combines the dynamic compression of a nitinol staple with the stability of a locking plate. It's designed for specific procedures like MTP fusions and Lapidus procedures and allows surgeons to achieve intraoperative compression and adjustment, addressing gaps in the current market. Biomechanical testing has shown it provides statistically significant better load to failure and gapping at failure results compared to traditional titanium plate and screw constructs.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.