North America Frozen Fruits And Vegetables Market

Market Size in USD Billion

CAGR :

%

USD

17.79 Billion

USD

29.72 Billion

2025

2033

USD

17.79 Billion

USD

29.72 Billion

2025

2033

| 2026 –2033 | |

| USD 17.79 Billion | |

| USD 29.72 Billion | |

|

|

|

|

North America Frozen Fruit and Vegetable Market Size

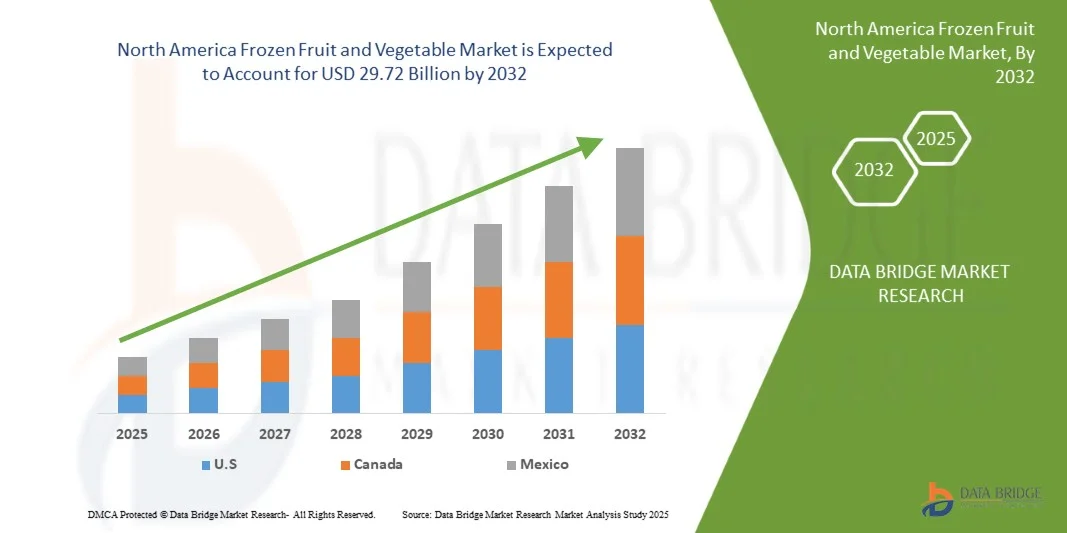

- The North America Frozen Fruit and Vegetable Market was valued at USD 17.79 billion in 2024 and is expected to reach USD 29.72 billion by 2032, at a CAGR of 6.7% during the forecast period

- The market is primarily driven by rising cancer prevalence, increasing healthcare expenditure, and growing awareness of advanced treatment options. Expansion of hospital networks, specialized cancer treatment centers, and improved access to innovative therapies further support market development.

- This growth is driven by factors such as government initiatives promoting early cancer diagnosis, adoption of targeted therapies and immunotherapies, and increasing investments by international and local pharmaceutical companies, which collectively drive the demand and accessibility of oncology drugs across Mexico.

North America Frozen Fruit and Vegetable Market Analysis

- The North America Frozen Fruit and Vegetable Market is experiencing steady growth, driven by growing urbanization and increased adoption of healthy lifestyle, increasing consumption of canned and frozen food, increasing vegan population is expected to drive the market growth, and expansion of convenience stores.

- However, higher amount of vegetable and fruit wastage, lack of cold chain infrastructure remain key restraints, while digitalization of the retail industry, increasing number of initiatives taken by frozen fruit and vegetable manufacturers, increasing demand for fruits and vegetables with longer self-life, advancements in freezing technology to retain the quality of fruits and vegetables present significant growth opportunities

- U.S. is expected to dominate the North America Frozen Fruit and Vegetable Market with the largest revenue share of 75.22% in 2025, supported by its favorable climate for year-round cultivation, strong agricultural infrastructure, high production capacity, and well-established export and distribution networks. Additionally, increasing domestic consumption and growing demand for convenient, healthy food options further bolster U.S.’s market leadership.

- U.S. is expected to be the fastest-growing region in the North America Frozen Fruit and Vegetable Market during the forecast period with a CAGR of 7.1%, fueled by rising consumer demand for convenient and healthy food options, expansion of modern retail chains, increased investment in cold storage and processing facilities, and strong government support for the agribusiness sector.

- The Frozen Vegetable segment is expected to dominate the North America Frozen Fruit and Vegetable Market with a market share of 90.15% in 2025, driven by their wide availability, affordability, longer shelf life, and extensive use in daily meals and foodservice industries. The growing consumer preference for convenient, ready-to-cook, and nutrient-rich food options further supports the segment’s strong market position.

Report Scope and North America Frozen Fruit and Vegetable Market Segmentation

|

Attributes |

North America Frozen Fruit and Vegetable Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Frozen Fruit and Vegetable Market Trends

“Advancements in freezing technology to retain the quality of fruits and vegetables”

- Freezing is one of the oldest and most widely used methods of fruits and vegetable preservation, which allows preservation of taste, texture, and nutritional value in fruits and vegetables better than any other method.

- The freezing process combines the beneficial effects of low temperatures at which microorganisms cannot grow, reduced chemical reactions, and delayed cellular metabolic reactions.

- The frozen fruits and vegetables industry is highly based on modern science and technology. Starting with the first historical development in freezing preservation of fruits and vegetables today, a combination of several factors influences the commercialization and usage of freezing technology. The future growth of frozen fruits and vegetables will mostly be affected by economic and technological factors.

- Isochoric freezing (ICF) is a new cooling technology that allows the storage of Food and vegetables at below-freezing temperatures without the formation of ice in products. The isochoric cooling method (constant volume) represents the standard food refrigeration technology that uses isobaric (constant pressure). ICF is considered a freezing compression method, in which the pressure increases by lowering the temperature below a constant volume

In October 2023, According to a study by the U.S. Department of Agriculture’s Agricultural Research Service (ARS) and the University of California, Berkeley, isochoric freezing retained the cellular structure and color of produce such as tomatoes and blueberries better than traditional freezing methods. Research published in Sustainable Food Technology (2023) further confirmed that ICF can reduce energy use by up to 20% compared to conventional freezing.

- Liquid air is another technology that can cater to the full range of cold chain services – supplying the cold for blast freezing and other forms of food processing, cold storage and transport refrigeration.

In January 2024, Air Products and Chemicals, Inc. and Linde plc announced pilot-scale implementations of liquid-air-based freezing systems to support sustainable cold chain infrastructure in Europe.

Hydro-fluidisation (H.F.) freezing is essentially a form of immersion freezing. It may be considered analogous to liquid impingement freezing.

North America Frozen Fruit and Vegetable Market Dynamics

Driver

“Expansions of convenience stores”

- As remote work has grown in popularity, so has the amount of time people spend at home. As a result, frozen Food, particularly frozen Food that aims toward the convenience and simplicity of convenience stores, is gaining popularity leading to the growth of the frozen fruits and vegetable market.

- When consumers are short on time and ideas, nothing beats going by their neighborhood convenience shop and getting frozen fruits and vegetables. As a result, convenience store sellers keep the frozen food sector on top.

- Also, the convenience store is looking for new opportunities, such as selling frozen veggies and fruits. Furthermore, the expanding selection of frozen fruits and vegetables in convenience stores is projected to increase revenue share shortly.

- Therefore, more than a third of businesses have added freezer space to meet demand. The most significant increases have been seen in frozen fruit, resulting in a major driver of the North America Frozen Fruit and Vegetable Market. In October 2024, 7-Eleven plans to close 444 underperforming stores and shift its focus to high-quality food offerings, including fresh-baked items, self-serve options, and specialty drinks like espresso and lattes.

- In January 2023, Frozen food sales in the U.S. increased by 8.6% in 2022, reaching $72.2 billion. Unit sales remained 5% above pre-pandemic levels, indicating sustained consumer interest in frozen food options.

- In April 2022, according to the Fuels Market News, Prepared food sales, which account for 66.7 percent of foodservice sales dollars, climbed by 25.9 % in 2021 and were 15.2 % higher than in 2019, while frozen dispensed beverage sales increased by 5.8%

Restraint/Challenge

“Higher amount of vegetable and fruit wastage”

- With the increase in population and changing lifestyle, the production and processing of horticultural crops, such as vegetables and fruits, have grown significantly to meet the increasing demands. However, significant losses and waste in the frozen and processing industries are becoming a serious nutritional, economic, and environmental problem.

- Higher production and growth, coupled with a lack of proper handling methods and infrastructure, have led to huge losses and waste of these important food commodities and their components, by-products, and residues.

- Losses and waste occur during all phases of the supply and handling chain, including during harvesting, transport to packinghouses or markets, classification and grading, storage, marketing, processing, and at home before or after preparation.

- In July 2025, the UK's Waste and Resources Action Programme (WRAP) reported that in developed economies, household food waste remains a major issue, with 40% of all apples and 33% of all bagged salad purchased in the UK being thrown away uneaten.

- A March 2024 UNEP report emphasized that food waste from fruits and vegetables contributes significantly to greenhouse gas emissions, with global losses from horticultural crops estimated at around USD 400 billion annually.

North America Frozen Fruit and Vegetable Market Scope

The market is segmented on the basis of type, category, technology, end user and distribution channel.

- By Type

On the basis of Type, North America Frozen Fruit and Vegetable Market is segmented into frozen vegetable, and frozen fruit. In 2025, the Frozen Vegetable segment is expected to dominate the market with a market share of 90.15%, driven by widespread consumption, longer shelf life, ease of storage and preparation, and strong demand from households and the foodservice industry.

Frozen Vegetable is the fastest-growing segment with the highest CAGR of 6.8% in the North America Frozen Fruit and Vegetable Market due to rising consumer demand for convenient, healthy, and ready-to-cook food options, increasing adoption in the foodservice sector, expansion of modern retail chains, and improvements in cold storage and distribution infrastructure.

- By category

On the basis of category, the North America Frozen Fruit and Vegetable Market is segmented into organic and conventional. In 2025, the conventional segment is expected to dominate the market with a market share of 79.97% owing to wider availability, lower cost, established supply chains, and strong consumer preference for affordable and readily accessible frozen produce across households and the foodservice industry.

The organic segment is the fastest growing of CAGR of 7.0% in the North America Frozen Fruit and Vegetable Market due to rising health consciousness among consumers, increasing demand for chemical-free and nutrient-rich produce, expansion of organic farming, and growing availability of organic frozen products in modern retail and online channels.

- By Technology

On the basis of Technology, the North America Frozen Fruit and Vegetable Market is segmented into flash-freezing/ individual quick freezing (IQF), belt freezing, high pressure-assisted freezing, and others, And Others. In 2025, the flash-freezing/ individual quick freezing (IQF) segment is expected to dominate the market with 47.00% market share due to its ability to preserve the natural taste, texture, and nutritional value of fruits and vegetables, high efficiency in processing, and widespread adoption across commercial and industrial food processing facilities.

flash-freezing/ individual quick freezing (IQF) is the fastest-growing segment with a CAGR of 7.0% in the North America Frozen Fruit and Vegetable Market due to its superior ability to preserve freshness, texture, and nutritional content, growing demand from foodservice and retail sectors, increased adoption by manufacturers for convenience products, and advancements in freezing technology that enhance efficiency and product quality.

- By End User

On the basis of End User, the North America Frozen Fruit and Vegetable Market is segmented into Food Service Sector, and Household/Retail Sector. In 2025, the Hospitals segment is expected to dominate the market with 59.41% market share due to rising consumer demand for convenient, ready-to-cook frozen products, increasing availability in supermarkets and online retail channels, and growing awareness of nutritious frozen fruits and vegetables among households.

Household/Retail Sector is the fastest-growing segment with CAGR of 7.1% in the North America Frozen Fruit and Vegetable Market due to increasing consumer preference for convenient, ready-to-cook, and nutritious frozen products, expansion of modern retail and e-commerce channels, rising health consciousness, and growing urbanization that drives demand for time-saving food solutions.

- By Distribution Channel

On the basis of Distribution Channel, the North America Frozen Fruit and Vegetable Market is segmented into Store Based Retailer, and Non-Store Retailers. In 2025, the store based retailers segment is expected to dominate the market with 81.73% market share due to the widespread presence of supermarkets and hypermarkets, consumer preference for physically inspecting products before purchase, well-established supply chains, and strong brand visibility in traditional retail outlets.

The Store Based Retailer segment is the fastest growing segment with CAGR of 7.1% in the North America Frozen Fruit and Vegetable Market due to rapid expansion of modern retail chains, increasing consumer preference for in-store shopping for quality and freshness, greater product visibility and promotions, and the convenience offered by supermarkets and hypermarkets for purchasing frozen fruits and vegetables.

North America Frozen Fruit and Vegetable Market Regional Analysis

- U.S. is expected to dominate the North America Frozen Fruit and Vegetable Market with the largest revenue share of 75.22% in 2025, supported by favorable climate for year-round cultivation, high production capacity, well-established supply chains, strong export infrastructure, and increasing domestic consumption of frozen fruits and vegetables.

- Canada is expected to be one of the fastest-growing region in the North America Frozen Fruit and Vegetable Market during the forecast period with a CAGR of 5.6%, fueled by rising consumer demand for convenient and healthy food options, expansion of modern retail and e-commerce channels, growing investments in cold storage and processing infrastructure, and supportive government initiatives in the agribusiness sector.

U.S. North America Frozen Fruit and Vegetable Market Insight

The U.S. North America Frozen Fruit and Vegetable Market plays a significant role in the North America cancer treatment landscape, fueled by its favorable climate for year-round cultivation, large-scale production capacity, strong distribution networks, growing consumer demand for convenient and healthy food options, and increasing adoption of modern retail and e-commerce channels.

Canada North America Frozen Fruit and Vegetable Market Insight

The Canada North America Frozen Fruit and Vegetable Market is projected to grow steadily, supported by a favorable agricultural environment, strong production and export capabilities, increasing consumer demand for convenient and nutritious frozen products, and expansion of modern retail and cold chain infrastructure.

The Major Market Leaders Operating in the Market Are:

- Grupo Virto (Spain)

- SFI LLC. (China)

- Simplot Company (U.S.)

- Twin City Foods Inc. (U.S.)

- Goya Foods, Inc. (U.S.)

- Alasko Foods Inc. (Canada)

- Ardo (Belgium)

- BC Frozen Foods (Canada)

- Bonduelle (France)

- Bsfoods (Netherlands)

- Capricorn Food Products India Ltd. (India)

- Cascadian Farm Organic (U.S.)

- Conagra Brands, Inc. (U.S.)

- FINDUS SVERIGE AB (Sweden)

- Fruktana (North Macedonia)

- General Mills Inc. (U.S.)

- Hanover Foods (U.S.)

- HEALTHY PAC CORP (U.S.)

- Stahlbush Island Farms (U.S.)

- SunOpta (Canada)

Latest Developments in North America Frozen Fruit and Vegetable Market

- In February 2022, J.R. Simplot Company made a multi-year agreement with the Kraft Heinz Company. This has helped the company to add capacity and distribution capabilities.

- In August 2021, Ardo received the Voka Charter Corporate Sustainability award 2021. This award has helped the company to attract a more customer base.

- In July 2021, Bonduelle expanded its canned and frozen vegetable plant and invested $5 million in expansion operations at its facility in Lebanon, Pa. This has helped the company to increase its production facility.

- In May 2021, Grupo Virto has made 56,000 pallet clad-rack warehouse for frozen products. The new clad-rack warehouse, which covers 11,020 m2 and will be 38 metres high, will have a storage capacity for 56,166 europallets, which will allow Virto Group to have a stock of between 50 and 70 million kilos of frozen products. This has helped the company to expand its storage capacity.

- In 2020, SunOpta announced an expansion in Alexandria in November and invested $26 million in it. This expansion has helped the company to widen its production capacity.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET TYPE COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INDUSTRY RIVALRY

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 ENVIRONMENTAL FACTORS

4.2.6 LEGAL FACTORS

4.3 VENDOR SELECTION CRITERIA

4.4 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 JOINT VENTURES

4.4.1.2 MERGERS AND ACQUISITIONS

4.4.1.3 LICENSING AND PARTNERSHIP

4.4.1.4 TECHNOLOGY COLLABORATIONS

4.4.1.5 STRATEGIC DIVESTMENTS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES AND MILESTONES

4.4.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.4.6 RISK ASSESSMENT AND MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.6 TECHNOLOGICAL ADVANCEMENTS

4.6.1 INDIVIDUAL QUICK FREEZING (IQF) TECHNOLOGY

4.6.2 CRYOGENIC FREEZING TECHNOLOGY

4.6.3 SMART COLD CHAIN MONITORING SYSTEMS

4.6.4 HIGH-PRESSURE PROCESSING (HPP)

4.6.5 MODIFIED ATMOSPHERE FREEZING (MAF)

4.6.6 ADVANCED BLANCHING TECHNIQUES

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT

4.7.2 MANUFACTURING PROCESS

4.7.3 MARKETING AND DISTRIBUTION

4.7.4 END USERS

5 REGULATIONS

5.1 US STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLE

6.1.2 INCREASING CONSUMPTION OF CANNED AND FROZEN FOOD

6.1.3 THE INCREASING VEGAN POPULATION IS EXPECTED TO DRIVE THE MARKET GROWTH

6.1.4 EXPANSIONS OF CONVENIENCE STORES

6.2 RESTRAINTS

6.2.1 HIGHER AMOUNT OF VEGETABLE AND FRUIT WASTAGE

6.2.2 LACK OF COLD CHAIN INFRASTRUCTURE

6.3 OPPORTUNITIES

6.3.1 DIGITALIZATION OF THE RETAIL INDUSTRY

6.3.2 INCREASING NUMBER OF INITIATIVES TAKEN BY FROZEN FRUIT AND VEGETABLE MANUFACTURERS

6.3.3 INCREASING DEMAND FOR FRUITS AND VEGETABLES WITH LONGER SHELF-LIFE

6.3.4 ADVANCEMENTS IN FREEZING TECHNOLOGY TO RETAIN THE QUALITY OF FRUITS AND VEGETABLES

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 HIGH INVESTMENT COST FOR THE PRODUCTION OF CANNED AND FROZEN VEGETABLES AND FRUITS

7 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE

7.1 OVERVIEW

7.2 FROZEN VEGETABLE

7.3 FROZEN FRUIT

7.3.1 BERRIES

7.3.2 PEACH

7.3.3 MANGO

7.3.4 APRICOTS

7.3.5 AVOCADOS

7.3.6 KIWI

7.3.7 PINEAPPLE

7.3.8 POMEGRANATE

7.3.9 APPLE

7.3.10 GRAPES

7.3.11 BANANA

7.3.12 MIXED-FRUITS

7.3.13 FIGS

7.3.14 PLUMS

7.3.15 PEARS

7.3.16 OTHERS (CHERRIES, LYCHEES, PAW PAW)

8 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 ORGANIC

9 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 FLASH-FREEZING/ INDIVIDUAL QUICK FREEZING (IQF)

9.3 BELT FREEZING

9.4 HIGH PRESSURE-ASSISTED FREEZING

9.5 OTHERS

10 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY END USER

10.1 OVERVIEW

10.2 FOOD SERVICE SECTOR

10.2.1 RESTAURANTS

10.3 CAFES

10.3.1 HOTELS

10.3.2 OTHERS

10.4 HOUSEHOLD/RETAIL SECTOR

11 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 STORE BASED RETAILER

11.3 NON-STORE RETAILERS

11.3.1 ONLINE

11.3.2 COMPANY WEBSITE

12 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA FROZEN FRUITS AND VEGETABLES MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 GRUPO VIRTO

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 SFI LLC.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 SIMPLOT COMPANY.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 TWIN CITY FOODS INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 GOYA FOODS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ALASKO FOODS INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ARDO

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 BC FROZEN FOODS.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 BONDUELLE

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 BSFOODS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 CAPRICORN FOOD PRODUCTS INDIA LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 CASCADIAN FARM ORGANIC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 CONAGRA BRANDS, INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 FINDUS SVERIGE AB

15.14.1 COMPANY SNAPSHOT

15.14.2 RECENT DEVELOPMENTS

15.15 FRUKTANA

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 GENERAL MILLS INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 HANOVER FOODS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 HEALTHY PAC CORP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 STAHLBUSH ISLAND FARMS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SUNOPTA

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 52 WEEKS ENDING MAY 30, 2021.

TABLE 2 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (UNITS)

TABLE 4 NORTH AMERICA FROZEN VEGETABLE IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA FROZEN FRUIT IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA BERRIES IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY COUNTRY, 2018-2032 (THOUSAND TONS)

TABLE 17 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 19 NORTH AMERICA FROZEN VEGETABLE IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA FROZEN FRUIT IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA BERRIES IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 30 U.S. FROZEN FRUIT AND VEGETABLE MARKET, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 U.S. FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 33 U.S. FROZEN VEGETABLE IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 U.S. FROZEN FRUIT IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 U.S. BERRIES IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 U.S. FROZEN FRUIT AND VEGETABLE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 37 U.S. FROZEN FRUIT AND VEGETABLE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 38 U.S. FROZEN FRUIT AND VEGETABLE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 39 U.S. FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 40 U.S. RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 41 U.S. FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 42 U.S. STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 43 U.S. NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 44 CANADA FROZEN FRUIT AND VEGETABLE MARKET, 2018-2032 (USD THOUSAND)

TABLE 45 CANADA FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 CANADA FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 47 CANADA FROZEN VEGETABLE IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 CANADA FROZEN FRUIT IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 CANADA BERRIES IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 CANADA FROZEN FRUIT AND VEGETABLE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 51 CANADA FROZEN FRUIT AND VEGETABLE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA FROZEN FRUIT AND VEGETABLE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 54 CANADA RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 55 CANADA FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 56 CANADA STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 57 CANADA NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 58 MEXICO FROZEN FRUIT AND VEGETABLE MARKET, 2018-2032 (USD THOUSAND)

TABLE 59 MEXICO FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MEXICO FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 61 MEXICO FROZEN VEGETABLE IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MEXICO FROZEN FRUIT IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MEXICO BERRIES IN FROZEN FRUIT AND VEGETABLE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MEXICO FROZEN FRUIT AND VEGETABLE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 65 MEXICO FROZEN FRUIT AND VEGETABLE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 66 MEXICO FROZEN FRUIT AND VEGETABLE MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 67 MEXICO FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 68 MEXICO RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MARKET, BY END USER,2018-2032 (USD THOUSAND)

TABLE 69 MEXICO FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 70 MEXICO STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

TABLE 71 MEXICO NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MARKET, BY DISTRIBUTION CHANNEL,2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MARKET TYPE COVERAGE GRID

FIGURE 9 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 TWO SEGMENTS COMPRISE THE NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET BY TYPE – 2032

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLE COUPLED WITH INCREASING DEMAND FOR FRUITS AND VEGETABLES WITH LONGER SHELF-LIFE IS LEADING THE GROWTH OF THE NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET IN 2025 & 2032

FIGURE 16 SUPPLY CHAIN ANALYSIS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET

FIGURE 18 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: BY TYPE, 2024

FIGURE 19 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: BY CATEGORY, 2024

FIGURE 20 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: BY TECHNOLOGY, 2024

FIGURE 21 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: BY END USER, 2024

FIGURE 22 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 23 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MARKET: SNAPSHOT (2024)

FIGURE 24 NORTH AMERICA FROZEN FRUITS AND VEGETABLES MARKET: COMPANY SHARE 2024 (%)

North America Frozen Fruits And Vegetables Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Frozen Fruits And Vegetables Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Frozen Fruits And Vegetables Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.