North America Fuel Tank Market

Market Size in USD Billion

CAGR :

%

USD

2.97 Billion

USD

4.19 Billion

2024

2032

USD

2.97 Billion

USD

4.19 Billion

2024

2032

| 2025 –2032 | |

| USD 2.97 Billion | |

| USD 4.19 Billion | |

|

|

|

|

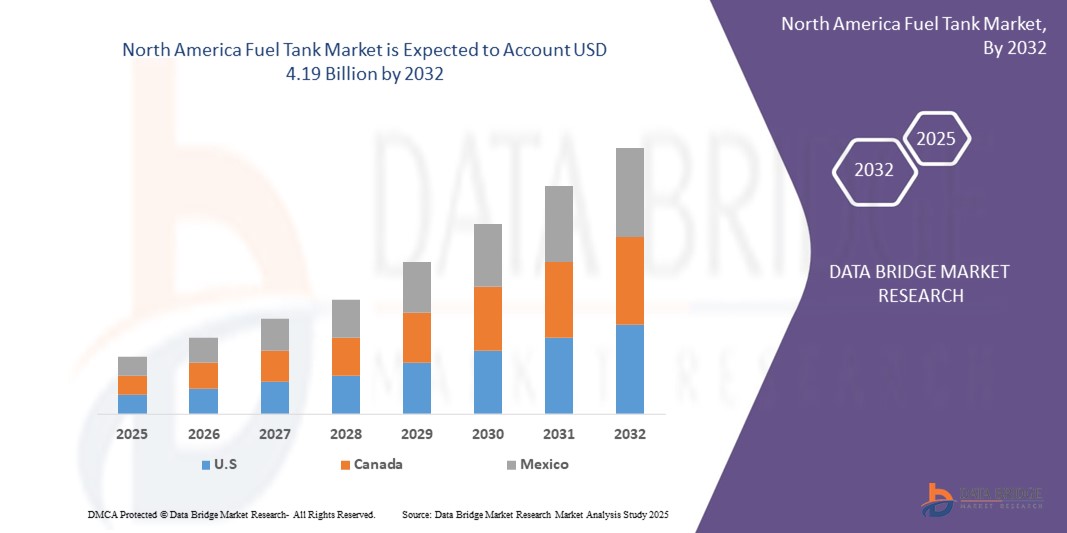

What is the North America Fuel Tank Market Size and Growth Rate?

- The North America fuel tank market size was valued at USD 2.97 billion in 2024 and is expected to reach USD 4.19 billion by 2032, at a CAGR of 4.40% during the forecast period

- In the fuel tank market, technological advancements have revolutionized storage capabilities, enhancing safety, efficiency, and environmental friendliness. These innovations benefit consumers by providing durable tanks with improved fuel economy, reduced emissions, and enhanced corrosion resistance

- As a result, the fuel tank market is experiencing a surge in demand for advanced solutions that meet stringent industry standards while delivering cost-effective performance

What are the Major Takeaways of Fuel Tank Market?

- The demand for lightweight fuel tanks is escalating due to the automotive industry's emphasis on fuel efficiency and emissions compliance. Materials such as plastics, composites, and aluminum are gaining traction for their weight-saving properties

- For instance, the adoption of composite fuel tanks in electric vehicles contributes to extended driving ranges and improved energy efficiency, aligning with environmental regulations

- U.S. dominated the fuel tank market with the largest revenue share of 65.23% in 2024, fueled by the strong presence of leading automakers, high consumer demand for fuel-efficient vehicles, and a robust aftermarket for vehicle components

- Canada’s fuel tank market is witnessing fastest growth, supported by rising vehicle ownership rates and the increasing preference for eco-friendly, lightweight materials in automotive manufacturing

- The 45L - 70L segment dominated the fuel tank market with the largest market revenue share of 46.5% in 2024, driven by its widespread usage in compact cars, sedans, and light commercial vehicles. The standard capacity of 45L - 70L strikes a balance between range and vehicle weight, making it ideal for daily urban commuting and fuel efficiency

Report Scope and Fuel Tank Market Segmentation

|

Attributes |

Fuel Tank Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fuel Tank Market?

“Increased Demand for Lightweight and Advanced Materials”

- A significant trend shaping the global fuel tank market is the growing shift towards lightweight materials such as plastic composites, high-density polyethylene (HDPE), and advanced metal alloys, driven by the automotive industry's focus on enhancing fuel efficiency and reducing vehicle weight

- For instance, leading manufacturers such as TI Fluid Systems are increasingly offering plastic fuel tanks that reduce weight and meet stringent emission standards, contributing to improved vehicle performance

- Plastic Fuel Tanks also offer enhanced design flexibility, allowing for complex shapes that optimize space utilization within vehicles, especially in electric and hybrid models where packaging constraints are critical

- Furthermore, automakers are prioritizing solutions that reduce evaporative emissions and improve fuel system safety. Advanced multi-layer plastic tanks with barrier technologies are becoming more common to meet evolving environmental regulations globally

- This trend toward lightweight, durable, and eco-friendly Fuel Tanks is fundamentally transforming production processes and material selection, with companies such as Kautex and FTS Co., Ltd. at the forefront of innovation in this space

- The market is witnessing strong demand for Fuel Tanks that align with stricter CO₂ emission standards, improved vehicle range, and enhanced durability, particularly across passenger vehicles, commercial fleets, and off-highway applications

What are the Key Drivers of Fuel Tank Market?

- The increasing global vehicle production, especially in emerging economies such as China and India, is a key driver accelerating Fuel Tank demand across automotive and commercial sectors

- For instance, in June 2023, Magna International Inc. announced expanded operations to meet growing OEM requirements for lightweight Fuel Tank solutions in electric and hybrid vehicles, highlighting the surge in demand for advanced tank technologies

- Rising consumer preference for fuel-efficient vehicles, coupled with stringent emission norms by regulatory authorities such as the U.S. EPA and the European Commission, are pushing automakers to adopt lightweight and emission-compliant Fuel Tanks

- The growing adoption of electric and hybrid vehicles is reshaping Fuel Tank designs to accommodate space-saving structures and improve the overall efficiency of fuel systems in hybrid models

- In addition, increasing integration of multi-functional tanks with vapor management, safety features, and advanced materials further contributes to market growth. Commercial fleets, off-highway vehicles, and heavy trucks also exhibit significant demand for high-durability Fuel Tanks that enhance operational reliability

Which Factor is challenging the Growth of the Fuel Tank Market?

- One of the primary challenges faced by the fuel tank market is the rising adoption of battery electric vehicles (BEVs), which eliminate the need for conventional fuel tanks, directly impacting market demand, especially in regions aggressively pursuing zero-emission targets

- For instance, several countries, including Norway, the U.K., and parts of the U.S., have announced timelines for phasing out internal combustion engine vehicles, which may hinder long-term Fuel Tank demand in certain segments

- The high development costs associated with advanced plastic Fuel Tanks, including tooling for complex shapes, multi-layer barrier technologies, and regulatory compliance, can pose barriers for small and medium-sized manufacturers

- Moreover, volatility in raw material prices for plastics and metals adds uncertainty to production costs, impacting profitability, particularly for suppliers heavily reliant on commodity-based inputs

- To overcome these challenges, companies are focusing on innovation in hybrid fuel tank systems, targeting plug-in hybrid vehicles (PHEVs), investing in material R&D, and expanding capabilities in emerging markets where internal combustion vehicles continue to dominate

How is the Fuel Tank Market Segmented?

The market is segmented on the basis of tank capacity, CNG tank type, material type, weight, fuel type, propulsion type, sales channel, and vehicle type.

• By Tank Capacity

On the basis of tank capacity, the fuel tank market is segmented into Less Than 45 L, 45L - 70L, and More Than 70L. The 45L - 70L segment dominated the Fuel Tank market with the largest market revenue share of 46.5% in 2024, driven by its widespread usage in compact cars, sedans, and light commercial vehicles. The standard capacity of 45L - 70L strikes a balance between range and vehicle weight, making it ideal for daily urban commuting and fuel efficiency.

The More Than 70L segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand in SUVs, pickup trucks, and heavy commercial vehicles where extended driving range and operational efficiency are critical. Larger tanks cater to long-distance transportation and off-highway applications, particularly in regions with sparse fueling infrastructure.

• By CNG Tank Type

On the basis of CNG tank type, the market is segmented into Type 1, Type 2, Type 3, and Type 4. The Type 1 segment held the largest market revenue share in 2024 due to its affordability, robustness, and suitability for basic CNG vehicle applications. Type 1 tanks are typically made of steel and are widely used in low-cost, entry-level vehicles.

The Type 4 segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by their lightweight design, higher storage efficiency, and increasing adoption in premium passenger cars and commercial fleets. Type 4 tanks, made entirely of composite materials, significantly reduce vehicle weight, enhancing fuel economy and range.

• By Material Type

On the basis of material type, the fuel tank market is segmented into Plastic, Aluminum, Steel, and Others. The Plastic segment dominated the market with the largest revenue share of 51.8% in 2024, attributed to the growing preference for lightweight, corrosion-resistant, and design-flexible tank materials. Plastic fuel tanks also contribute to improved vehicle efficiency by reducing overall weight.

The Aluminum segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its combination of strength, lightweight properties, and increasing demand in premium vehicles, particularly electric and hybrid models where reducing vehicle mass is a top priority.

• By Weight

On the basis of weight, the fuel tank market is segmented into Less Than 7KG, 7KG to 10KG, and More Than 10KG. The 7KG to 10KG segment held the largest market revenue share in 2024 due to its compatibility with mid-range passenger cars and commercial vehicles, offering an optimal balance of durability and weight.

The Less Than 7KG segment is projected to witness the fastest growth rate from 2025 to 2032, as lightweight tanks gain traction in electric and hybrid vehicles where every kilogram saved contributes to enhanced efficiency and vehicle performance.

• By Fuel Type

On the basis of fuel type, the market is segmented into LPG/CNG, Diesel, and Gasoline. The Gasoline segment dominated the Fuel Tank market with the largest revenue share of 54.3% in 2024, driven by the high global production of gasoline-powered vehicles and continued demand in emerging markets.

The LPG/CNG segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by government incentives promoting cleaner fuel alternatives, growing environmental awareness, and expanding infrastructure supporting LPG/CNG refueling.

• By Propulsion Type

On the basis of propulsion type, the fuel tank market is segmented into Natural Gas, Hydrogen, Internal Combustion Engine (ICE), and Hybrid. The ICE segment accounted for the largest market revenue share in 2024, as conventional internal combustion vehicles still represent the dominant vehicle population globally.

The Hybrid segment is anticipated to grow at the fastest CAGR from 2025 to 2032, reflecting increasing consumer preference for eco-friendly mobility solutions and automaker investments in hybrid powertrain technologies requiring advanced, space-efficient fuel tank systems.

• By Sales Channel

On the basis of sales channel, the fuel tank market is segmented into OEM and Aftermarket. The OEM segment dominated the market with the largest revenue share of 67.9% in 2024, driven by automakers' focus on integrating high-performance, lightweight, and regulatory-compliant fuel tank solutions during vehicle production.

The Aftermarket segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rising vehicle parc, replacement demand for damaged or upgraded tanks, and increasing popularity of performance-enhancing fuel tank solutions among automotive enthusiasts.

• By Vehicle Type

On the basis of vehicle type, the fuel tank market is segmented into Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Hybrid Vehicles. The Passenger Cars segment captured the largest market revenue share of 58.4% in 2024, supported by high global car production volumes, particularly in emerging economies, and consumer preference for fuel-efficient designs.

The Hybrid Vehicles segment is expected to witness the fastest CAGR from 2025 to 2032, driven by surging demand for low-emission vehicles and the need for compact, lightweight fuel tank solutions that optimize space in hybrid powertrains.

Which Region Holds the Largest Share of the Fuel Tank Market?

- U.S. dominated the fuel tank market with the largest revenue share of 65.23% in 2024, fueled by the strong presence of leading automakers, high consumer demand for fuel-efficient vehicles, and a robust aftermarket for vehicle components

- The region benefits from technological advancements in lightweight materials and increasing production of alternative fuel vehicles, including LPG, CNG, and hybrid models

- Furthermore, regulatory policies supporting emissions reduction and fuel efficiency standards are contributing to the adoption of advanced fuel tank solutions across passenger and commercial vehicle segments

Canada Fuel Tank Market Insight

Canada’s fuel tank market is witnessing fastest growth, supported by rising vehicle ownership rates and the increasing preference for eco-friendly, lightweight materials in automotive manufacturing. The country’s strong focus on environmental sustainability and clean energy initiatives, coupled with demand for CNG and hybrid vehicles, is propelling the adoption of advanced fuel tank technologies. Moreover, Canada’s harsh climatic conditions have driven the need for durable, corrosion-resistant fuel tanks across both passenger and commercial vehicle fleets.

Mexico Fuel Tank Market Insight

Mexico’s fuel tank market is expanding significantly, underpinned by the nation’s role as a major automotive manufacturing hub within North America. With several global automakers operating production facilities in Mexico, there is high demand for cost-effective, high-quality fuel tanks for export and domestic consumption. In addition, the growing production of passenger cars and commercial vehicles, along with favorable trade agreements and a skilled workforce, are strengthening Mexico’s position in the regional fuel tank market.

Which are the Top Companies in Fuel Tank Market?

The fuel tank industry is primarily led by well-established companies, including:

- TI Fluid Systems plc (U.K.)

- Yachiyo Industry Co., Ltd. (Japan)

- Magna International Inc. (Canada)

- OPmobility SE (France)

- Unipres Corporation (U.S.)

- Kautex (Germany)

- ContiTech AG (Germany)

- SMA Serbatoi SpA (Italy)

- FTS CO., LTD. (Japan)

- Crefact Co., Ltd. (U.S.)

- Boyd Welding LLC (U.S.)

- Elkamet Kunststofftechnik GmbH (Germany)

- SAG Group (Austria)

- Central Precision Limited (U.K.)

- Arrow Radiators (Melksham) Ltd (U.K.)

- A. KAYSER AUTOMOTIVE SYSTEMS GmbH (Germany)

- PIOLAX, Inc. (Japan)

What are the Recent Developments in North America Fuel Tank Market?

- In June 2021, TI Fluid Systems unveiled innovative fluid handling products tailored for the 2021 Hyundai Santa FE SUV hybrid electric vehicle, emphasizing lightweight solutions to enhance fuel systems. This initiative showcased the company's expertise in optimizing systems, aiming to improve the efficiency of the vehicle's electric mode

- In January 2021, TI Fluid Systems announced the development of a new generation of plastic fuel tank designs specifically engineered to meet stringent pressure demands in hybrid electric vehicles. Collaborating with Volkswagen China, volume production commenced, with the technology implemented in Passat and Magotan plug-in hybrid electric vehicle models

- In October 2020, Plastic Omnium and ElringKlinger, holding 40% and 60% stakes, respectively, forged a strategic agreement to develop and utilize hydrogen-based fuel cell technology jointly. This collaboration aimed to harness the expertise of both companies to advance fuel cell solutions, contributing to the evolution of clean and sustainable energy solutions in the automotive sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.