North America Fuse Market

Market Size in USD Billion

CAGR :

%

USD

1.26 Billion

USD

1.97 Billion

2024

2032

USD

1.26 Billion

USD

1.97 Billion

2024

2032

| 2025 –2032 | |

| USD 1.26 Billion | |

| USD 1.97 Billion | |

|

|

|

|

Fuse Market Size

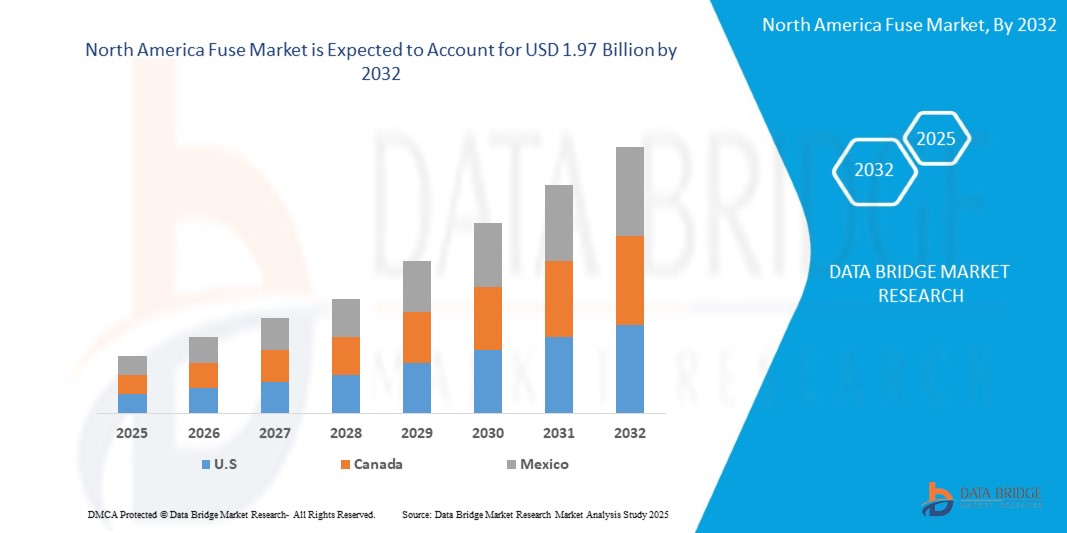

- The North America Fuse market size was valued at USD 1.26 billion in 2024 and is expected to reach USD 1.97 billion by 2032, at a CAGR of 5.97% during the forecast period

- The market expansion in North America is primarily fueled by widespread electrification in residential, commercial, and industrial infrastructure, particularly in the U.S. and Canada. This trend is driven by modernization efforts, grid upgrades, and increased demand for reliable overcurrent protection solutions.

- Additionally, the rapid growth of renewable energy installations, such as solar and wind farms, across states like California, Texas, and Ontario, is creating robust demand for medium- and high-voltage fuses to safeguard energy storage systems and inverters.

Fuse Market Analysis

- Fuses, as essential components for electrical circuit protection, are becoming increasingly critical across North America’s industrial, residential, transportation, and utility sectors. Their importance in protecting electrical systems from overcurrent, short circuits, and equipment damage aligns with the region’s rapid electrification, digital transformation, and infrastructure modernization.

- The growth in fuse demand is primarily driven by the accelerated deployment of renewable energy systems, proliferation of electric vehicles (EVs), and expansion of smart grid and energy-efficient buildings. These sectors require robust and reliable circuit protection to maintain operational integrity and enhance energy management.

- The United States dominates the North America Fuse market, accounting for the largest revenue share of 40.01% in 2025, attributed to widespread smart grid adoption, increasing investments in residential and commercial infrastructure, and a strong push for clean energy. Initiatives such as the Inflation Reduction Act and state-level clean energy mandates are fostering fuse deployment across renewable projects and EV charging stations.

- Canada is anticipated to be the fastest-growing country in the North American Fuse market during the forecast period, fueled by rising demand for grid stability, a surge in EV adoption, and increased industrial electrification. Federal programs like the Smart Renewables and Electrification Pathways (SREP) support advanced electrical infrastructure upgrades, which heavily depend on reliable fuse protection.

- The Low Voltage segment is expected to dominate the regional market with a 45.0% share in 2025, driven by its prevalent application in residential and commercial sectors, including lighting systems, consumer electronics, HVAC units, and small machinery. The increasing retrofitting of aging electrical systems with low-voltage fuse-based protections also contributes to sustained segment dominance.

Report Scope and Fuse Market Segmentation

|

Attributes |

Fuse Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fuse Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A key trend defining the North America Fuse market is the widespread integration of Artificial Intelligence (AI) and voice assistant compatibility with smart home ecosystems like Amazon Alexa, Google Assistant, and Apple HomeKit. These technologies deliver enhanced convenience, personalization, and seamless access control.

- For example, the August Wi-Fi Smart Locks, extensively available across the U.S. and Canada, support all major voice platforms and allow voice-enabled door control. These integrations are becoming a standard expectation for consumers seeking effortless smart home management.

- Level Lock+, distributed in select Apple stores in the U.S., is optimized for Siri and Apple HomeKit, delivering a discreet and secure experience favored by tech-forward consumers and smart home enthusiasts.

- Ultraloq, gaining popularity across North America, features AI-powered adaptive fingerprint readers and intelligent door behavior alerts, offering proactive and personalized security solutions that learn user habits.

- U.S.-based WELOCK has launched new AI-integrated models that auto-lock or unlock based on user proximity and support voice commands, enhancing hands-free security and accessibility for elderly users and busy families

- With consumers increasingly demanding integrated smart home ecosystems, Fuses that work harmoniously with lighting, HVAC, and surveillance systems are gaining momentum, making them a cornerstone in connected home infrastructure

Fuse Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- The increasing urban population, combined with escalating security awareness in North America, is significantly driving Fuse adoption. Both new home constructions and renovation projects across the U.S. and Canada are increasingly integrating smart lock technologies.

- In April 2024, Onity (a Honeywell subsidiary) enhanced its IoT-based Passport smart lock system, strengthening self-storage and residential access control across markets including major urban centers in the U.S. and Canada. The upgrade emphasizes increased security and centralized remote access.

- The DIY smart home trend is accelerating in North America, particularly in suburban and semi-urban regions, where consumers prefer app-based, budget-friendly Fuses with features such as remote access, temporary guest codes, activity monitoring, and scheduled locking.

- Fuse installations are seeing rapid uptake in Airbnb properties, senior living communities, and multi-family housing units, where remote monitoring and access customization are key differentiators. Smartphone-based access logs and integrations with property management platforms enhance operational convenience..

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Despite high adoption rates, cybersecurity concerns remain a critical restraint in the North America Fuse market. The reliance on Wi-Fi and Bluetooth connectivity exposes Fuses to potential hacking and data breaches, particularly in poorly secured networks.

- Multiple IoT security breaches have been reported in North America, sparking concerns across consumer advocacy groups and pushing for stricter regulatory standards at both state and federal levels, especially for devices that store or transmit user location and access data.

- In response, leading companies such as Level Home, August, and Schlage have enhanced their encryption protocols and introduced multi-factor authentication and biometric-based access, actively promoting their compliance with U.S. cybersecurity standards and privacy policies.

- High initial costs continue to deter mass adoption, particularly among low- to middle-income households. While brands like Wyze and Yale offer entry-level smart Fuses, advanced features—like built-in cameras, facial recognition, and remote diagnostics—often come at premium prices.

- To counteract this, North American brands are launching affordable product lines with core functionality, supported by consumer education initiatives around the value of secure smart home technology. This approach aims to strike a balance between cost, security, and usability for wider market penetration.

Fuse Market Scope

The market is segmented on the basis type, voltage, application, and end user.

- By Type

The North America Fuse market is segmented into Power Fuse & Fuse Link, Cartridge & Plug Fuse, Distribution Cutout, and Others.

Power Fuse & Fuse Link dominates the market in 2025, primarily due to its broad application in medium- and high-voltage systems within North America’s industrial plants, utility substations, and renewable integration hubs. These fuses are critical in protecting transformers, switchgears, and capacitor banks across the U.S. power infrastructure and Canadian manufacturing zones.

Cartridge & Plug Fuses continue to see stable demand, especially in residential and legacy small commercial buildings across states like New York, Michigan, and older Canadian provinces, where electrical systems are gradually transitioning but still rely on traditional protection mechanisms.

The Distribution Cutout segment is gaining traction, supported by rural electrification and smart grid modernization projects under U.S. federal infrastructure bills and Canadian regional grid development programs, particularly in states like Texas, Minnesota, and rural areas in British Columbia.

- By Voltage

The market is segmented into Low Voltage, Medium Voltage, and High Voltage.

Low Voltage fuses hold the largest share in 2025, driven by their integral role in residential, retail, and small-scale industrial facilities. The growth of smart homes, IoT-enabled buildings, and commercial electrification across California, Ontario, and the Northeast U.S. underscores their dominance.

Medium Voltage fuses are expected to exhibit the fastest growth during 2025–2032. This surge is linked to increasing investments in renewable projects, grid automation, and substation upgrades, particularly across states like Texas, Arizona, and Quebec, which are expanding wind and solar power capabilities.

High Voltage fuses maintain steady demand, particularly in utility-scale transmission networks and large-scale solar and wind farms across the Midwest U.S., Alberta, and southern states, where long-distance energy transmission and T&D reliability are top priorities.

- By Application

The market is segmented into Residential, Commercial, Industrial, Utilities, and Transportation.

Industrial applications lead the market in 2025, reflecting strict adherence to electrical safety standards in North America’s heavy manufacturing sectors. The Midwestern U.S. and Ontario’s automotive, aerospace, and machinery industries are key adopters of advanced fuse protection.

The Utilities segment is experiencing robust growth, fueled by the modernization of electric grids, DER (Distributed Energy Resource) integration, and the need for smart fault isolation systems across California, Texas, and Nova Scotia.

The Transportation segment is growing due to the rising EV charging infrastructure, electrification of rail lines, and smart transit systems across cities like New York, Toronto, and San Francisco, where fuse reliability is critical in handling high power surges.

- By End User

The market is categorized into Power Distribution, Manufacturing, Automotive, Renewable Energy, and Others.

Power Distribution remains the largest end-user segment, backed by ongoing infrastructure investments in aging utility assets and next-generation substation automation across the U.S. DOE programs and Canadian Smart Grid Funds.

The Automotive segment is among the fastest-growing, driven by the expansion of the EV ecosystem in California, Michigan, and British Columbia, where fuses are vital for battery packs, on-board chargers, and power converters.

Renewable Energy is a key emerging area, with wind and solar installations in Texas, California, and Alberta requiring durable fuse protection for inverters, junction boxes, and DC circuits—ensuring consistent uptime and safety compliance.

- By Application

The Fuse market is further segmented into Commercial, Residential, Industrial, Government Institutions, and Others, reflecting smart access and lock integration applications.

The Residential segment captured the largest revenue share in 2024, fueled by a booming smart home market in North America, especially in cities like Seattle, Austin, and Vancouver. Fuse integration with app-controlled locks, security systems, and home automation hubs has surged due to rising security awareness and convenience preferences.

The Commercial segment is poised for the fastest CAGR from 2025 to 2032, as businesses demand centralized access control, multi-site user management, and automated audit trails. Offices, co-working spaces, and retail chains across New York, Chicago, and Toronto are rapidly adopting cloud-managed fuse and access solutions to streamline operations and improve security.

Fuse Market Regional Analysis

- The North America Fuse market is poised for sustained growth over the forecast period, driven by a surge in grid modernization projects, residential electrification, and increased focus on renewable energy infrastructure. Investments in smart city development and electrical safety regulations are further boosting fuse adoption across the region.

- Rapid urban development in major U.S. and Canadian metropolitan areas such as New York, Los Angeles, Toronto, and Vancouver is fueling the need for smart circuit protection systems in residential towers, office buildings, and infrastructure projects.

- The market also benefits from retrofitting initiatives targeting aging electrical systems in older homes and buildings. These upgrades often integrate smart fuse solutions with IoT connectivity, remote monitoring, and integration into building energy management systems (BEMS).

- North American consumers show a strong preference for UL-listed, CSA-certified, and energy-efficient fuse systems, with an emphasis on cybersecurity, data encryption, and low power consumption—especially important for smart buildings and sensitive facilities.

- Government support through programs like the U.S. Infrastructure Investment and Jobs Act (IIJA) and Canada’s Smart Grid Program are incentivizing fuse deployment in utilities, public buildings, and distributed energy resources.

United States Fuse Market Insight

The U.S. Fuse market represents the largest regional share and is expected to maintain its dominance due to:

- Aggressive deployment of EV infrastructure, with increasing demand for high-voltage and fast-acting fuses in charging stations, power inverters, and battery systems.

- Expanding smart home adoption, with tech-savvy consumers embracing connected fuse solutions for residential energy management, especially in California, Texas, and Florida.

- Stringent National Electrical Code (NEC) compliance requirements and OSHA safety mandates driving commercial and industrial fuse upgrades in factories, warehouses, and hospitals.

- The rise of solar and wind installations across the Midwest and Southwest continues to spur demand for DC-rated and renewable-compatible fuses in inverters and junction boxes.

Canada Fuse Market Insight

The Canadian Fuse market is projected to grow steadily, supported by:

- A growing shift towards energy-efficient residential and commercial buildings, especially in British Columbia, Ontario, and Quebec, where government programs encourage smart electrical upgrades.

- Increasing investments in clean energy projects and smart grid reliability, prompting utilities to integrate advanced fuse technologies for fault isolation and load management.

- A strong emphasis on electrical safety, with CSA Group standards encouraging adoption of certified fuses across industrial and public infrastructure.

- Consumer awareness around data privacy, remote access controls, and low-voltage smart circuit protection is also accelerating adoption in the DIY and professional installation segments.

Fuse Market Share

The Fuse industry is primarily led by well-established companies, including:

- Siemens AG (Germany)

- Eaton Corporation (Ireland)

- ABB Ltd. (Switzerland)

- Schneider Electric SE (France)

- Littelfuse, Inc. (U.S.)

- Mersen S.A. (France)

- Bel Fuse Inc. (U.S.)

- Schurter Holding AG (Switzerland)

- Legrand SA (France)

- General Electric (U.S.)

Latest Developments in North America Fuse Market

- In April 2024, Littelfuse, Inc. announced the expansion of its high-speed fuse product line with the launch of the LSCR Series in North America. These fuses are specifically designed for protecting silicon carbide (SiC) devices in EV chargers and industrial drives. This development supports the region’s growing demand for EV infrastructure protection and efficient power electronics safeguarding.

- In March 2024, Mersen USA introduced its DC fuse solutions optimized for solar PV systems and battery energy storage applications in North America. The new HelioProtection® HP15F series was launched to comply with UL 248-19 and supports enhanced safety in renewable installations, which are expanding rapidly across states like California, Texas, and Arizona.

- In February 2024, Eaton Corporation launched its Bussmann Series NH Fuse Link with Condition Monitoring Capability across North America. The product integrates real-time data tracking, allowing for predictive maintenance in industrial and utility applications. The move aligns with the trend toward smart electrical systems and reinforces Eaton’s push toward digitally enabled circuit protection.

- In January 2024, SCHURTER Inc. launched the ASO 10.3x38 fuse series, targeting the North American solar and DC microgrid market. With higher voltage ratings and compatibility with combiner boxes, this launch supports ongoing efforts to decentralize energy systems in North American commercial and residential zones.

- In December 2023, Bel Fuse Inc. announced a strategic collaboration with a U.S.-based EV OEM to deliver customized high-voltage automotive fuses for use in next-gen EV battery platforms. The collaboration aims to address safety, size, and response time challenges in high-power electric vehicles, positioning Bel Fuse as a key supplier in the North American e-mobility space.

- In November 2023, Cooper Bussmann, a division of Eaton, expanded its UL-listed fuse accessories and holders portfolio for low-voltage applications across North America. The offering targets commercial real estate developments, retail outlets, and small-scale industrial sites, where modular and compact fuse systems are in high demand.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Fuse Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Fuse Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Fuse Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.