North America Gas Equipment Market

Market Size in USD Billion

CAGR :

%

USD

31.43 Billion

USD

53.60 Billion

2025

2033

USD

31.43 Billion

USD

53.60 Billion

2025

2033

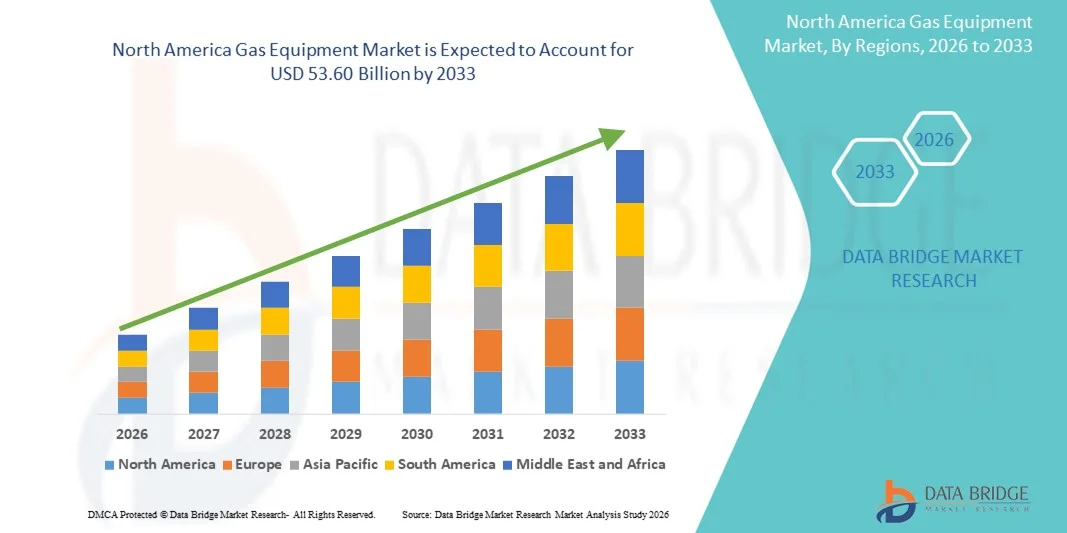

| 2026 –2033 | |

| USD 31.43 Billion | |

| USD 53.60 Billion | |

|

|

|

|

North America Gas Equipment Market Size

- The North America gas equipment market size was valued at USD 31.43 billion in 2025 and is expected to reach USD 53.60 billion by 2033, at a CAGR of 6.90 % during the forecast period

- The market growth is largely fueled by the increasing demand for reliable, energy-efficient, and technologically advanced gas-powered systems across industrial, commercial, and residential sectors, supporting widespread infrastructure modernization and expansion

- Furthermore, rising investments in clean energy transition projects, stricter emission regulations, and the growing use of natural gas as a cleaner alternative to traditional fuels are establishing gas equipment as a critical component in power generation, manufacturing, and utility applications. These converging factors are accelerating the uptake of Gas Equipment solutions, thereby significantly boosting the industry's growth

North America Gas Equipment Market Analysis

- Gas equipment, which includes systems and components used for the production, processing, storage, transmission, and utilization of natural and industrial gases, plays a vital role in supporting modern energy, manufacturing, and utility infrastructure across residential, commercial, and industrial sectors due to its efficiency, reliability, and compliance with environmental standards

- The escalating demand for gas equipment is primarily driven by the growing global energy requirement, the shift toward cleaner fuel alternatives such as natural gas, rapid industrialization, and the expansion of urban infrastructure, along with increasing investments in gas distribution networks

- The U.S. dominated the Gas Equipment market with the largest revenue share of approximately 41.6% in 2025, driven by extensive investments in pipeline expansion, modernization of aging gas infrastructure, rising demand for natural gas in power generation, and strong industrial consumption, supported by the presence of major market players and advanced technological capabilities in gas processing and distribution systems

- Canada is expected to be the fastest-growing country in North America with a projected CAGR of around 7.9% from 2026 to 2033, fueled by increasing investments in LNG export terminals, expansion of cross-border pipeline projects, rising natural gas production, and supportive government initiatives aimed at strengthening energy security and export potential

- The Nitrogen segment dominated the North America Gas Equipment market with a share of about 38.5% in 2025. Nitrogen is the most widely used industrial gas across multiple applications, including food packaging, electronics manufacturing, pharmaceuticals, and metal processing

Report Scope and Gas Equipment Market Segmentation

|

Attributes |

Gas Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Gas Equipment Market Trends

Enhanced Efficiency Through Digital Monitoring & Automation

- A significant and accelerating trend in the global gas equipment market is the increasing integration of digital monitoring systems, automation, and IoT-enabled controls to enhance safety, efficiency, and real-time performance tracking in industrial, commercial, and residential gas applications. These advanced systems allow operators to remotely monitor gas pressure, temperature, and flow levels, helping reduce operational risks and improve overall energy management

- For instance, several modern gas regulators and smart meters are now equipped with embedded sensors that provide live data readings to centralized control panels or mobile applications, enabling faster response to fluctuations or potential leaks. These developments are improving operational reliability across sectors such as oil & gas, manufacturing, power generation, and residential supply networks

- The integration of intelligent monitoring within gas equipment enables predictive maintenance by identifying abnormal patterns in flow or pressure, reducing the risk of sudden equipment failure. Advanced analytics also support more informed decision-making, helping facility managers optimize energy usage while maintaining compliance with regulatory safety requirements

- The seamless connectivity of gas equipment with broader industrial control systems facilitates centralized management of pipelines, storage tanks, burners, valves, and pressure regulators. Through integrated digital platforms, operators can control multiple system components from a single interface, enhancing efficiency, reducing human error, and supporting safer system operations

- This trend towards more automated, data-driven, and interconnected gas systems is reshaping expectations across the energy and industrial sectors. As a result, key manufacturers are focusing on developing next-generation gas equipment with features such as real-time monitoring, automatic shut-off functions, leak detection, and remote diagnostics to meet evolving safety and performance demands

- The demand for advanced gas equipment offering intelligent monitoring, improved efficiency, and enhanced safety functions is increasing rapidly across industrial facilities, utility providers, commercial buildings, and residential settings, as users prioritize both operational reliability and regulatory compliance

North America Gas Equipment Market Dynamics

Driver

Rising Energy Demand and Infrastructure Expansion

- The growing global demand for energy, along with rapid industrialization and urban expansion, is a major driver for the increasing deployment of gas equipment in power plants, manufacturing facilities, commercial buildings, and residential developments. Natural gas continues to be viewed as a relatively cleaner fossil fuel alternative, supporting its widespread adoption across multiple sectors

- For instance, in March 2025, a major infrastructure development initiative in Asia-Pacific announced expanded investments in natural gas distribution networks for urban and semi-urban areas, driving increased demand for pipelines, meters, regulators, and safety valves. Such projects are playing a crucial role in boosting the global gas equipment market

- As governments and private organizations invest in new gas pipeline installations, LNG terminals, and storage facilities, the requirement for advanced gas equipment—including compressors, burners, valves, detectors, and regulators—continues to rise significantly

- Furthermore, the increasing focus on reducing emissions from coal-based power and the transition toward cleaner energy sources has led to greater reliance on natural gas systems, which in turn propels demand for efficient and durable gas equipment

- The modernisation of aging infrastructure, particularly in North America and Europe, along with fast-growing construction and industrial projects in Asia-Pacific and the Middle East, is further contributing to sustained market growth

Restraint/Challenge

Safety Concerns, High Installation Costs, and Regulatory Compliance

- Safety risks associated with gas leakage, explosions, and equipment failure continue to pose a major challenge to the widespread adoption of gas equipment, especially in older buildings and poorly regulated environments. These risks often necessitate strict safety standards, regular maintenance, and high-quality components, increasing overall project complexity

- In addition, the high initial installation and infrastructure development costs for pipelines, monitoring systems, and safety equipment can be a barrier, particularly in developing regions and rural areas. Smaller industries and residential users may hesitate to adopt advanced gas systems due to the upfront investment required

- Stringent government regulations and environmental compliance requirements also pose operational challenges. Manufacturers and operators must meet evolving standards related to emissions, safety, and material quality, which can increase production and implementation costs

- Periodic reports of industrial accidents involving gas leaks or faulty equipment have made some end-users more cautious, emphasizing the need for consistent inspection, skilled maintenance personnel, and technologically advanced safety features

- For instance, on 20 December 2022, a gas pipeline in Chuvashia, Russia (part of the export route from Siberia to Europe) exploded during scheduled maintenance, killing three gas-service workers and injuring another

- This tragic incident underscores the severe safety hazards inherent in gas infrastructure — underscoring how a single failure can lead to loss of life, supply disruption, and increased liability for equipment providers and operators

- Addressing these challenges through improved safety design, affordable technology deployment, skilled workforce development, and regulatory support will be essential for sustaining long-term growth in the Gas Equipment market

North America Gas Equipment Market Scope

The market is segmented on the basis of equipment type, process, gas type, and end-user.

- By Equipment Type

On the basis of equipment type, the North America Gas Equipment market is segmented into Gas Delivery Systems, Gas Regulators, Flow Devices, Purifiers and Filters, Gas Generating Systems, Gas Detection Systems, and Cryogenic Products and Accessories. The Gas Delivery Systems segment dominated the largest market revenue share of approximately 36.8% in 2025. This dominance is mainly attributed to the growing demand for efficient and continuous gas supply in manufacturing industries, research laboratories, and healthcare facilities. Gas delivery systems play a critical role in maintaining stable pressure, purity, and flow of industrial gases in metal fabrication, semiconductor manufacturing, and chemical processing. The increasing investments in industrial automation and advanced production facilities in the U.S. and Canada are further fueling the adoption of high-performance gas delivery systems. Additionally, the expansion of the oil & gas, power generation, and pharmaceutical sectors across North America is boosting the requirement for reliable gas distribution infrastructure. Stringent safety regulations in the region also encourage industries to replace outdated systems with advanced gas delivery units, supporting the growth of this segment. The presence of key market players and continuous technological upgrades is another significant factor strengthening its leadership position.

The Gas Detection Systems segment is expected to witness the fastest CAGR of around 8.9% from 2026 to 2033. This rapid growth is driven by rising concerns related to industrial safety, workplace monitoring, and environmental protection. Governments and regulatory bodies in North America are implementing strict rules for gas leak detection and emission control, particularly in oil & gas, chemical, and mining industries. The increasing occurrence of gas leakage incidents and workplace accidents is pushing industries to adopt advanced detection technologies, including IoT-enabled and real-time monitoring systems. Smart factories and automated plants are integrating gas detection sensors to ensure worker safety and operational continuity. Furthermore, the growing focus on green buildings and indoor air quality monitoring in commercial and residential spaces is also contributing to the expansion of this segment.

- By Process

On the basis of process, the North America Gas Equipment market is segmented into Gas Generation, Gas Storage, Gas Detection, and Gas Transportation. The Gas Storage segment accounted for the largest revenue share of nearly 33.4% in 2025. The dominance of this segment can be attributed to the growing demand for large-scale and secure storage solutions in industries such as oil & gas, healthcare, food & beverage, and metal processing. North America has strong demand for the bulk storage of industrial gases, including oxygen, nitrogen, and hydrogen, for continuous operations. The expansion of LNG terminals and hydrogen storage facilities in the United States has significantly boosted the requirement for advanced gas storage systems. In addition, the strategic gas reserves maintained by the government to ensure energy security contribute to the strong demand for storage infrastructure. Increasing investments in renewable energy storage systems using compressed and liquefied gases further strengthen the position of this segment in the market.

The Gas Detection process is projected to register the fastest CAGR of approximately 9.2% from 2026 to 2033. This growth is supported by heightened awareness regarding worker safety and stringent compliance standards across North America. Industries are increasingly deploying gas detection equipment during production, transportation, and storage to minimize risks associated with leaks and toxic exposure. Advanced sensor technology, wireless connectivity, and AI-based predictive analysis are making modern gas detection systems more efficient and attractive to end-users. Moreover, the rising number of industrial infrastructure projects, including oil refineries, chemical plants, and manufacturing units, is further accelerating the adoption of gas detection processes throughout the region.

- By Gas Type

On the basis of gas, the market is segmented into Nitrogen, Hydrogen, Helium, Oxygen, Carbon Dioxide, and Others. The Nitrogen segment dominated the North America Gas Equipment market with a share of about 38.5% in 2025. Nitrogen is the most widely used industrial gas across multiple applications, including food packaging, electronics manufacturing, pharmaceuticals, and metal processing. In the food & beverage industry, nitrogen is extensively used for modified atmosphere packaging (MAP) to extend shelf life. The electronics sector relies on nitrogen for creating inert environments during sensitive production processes. In the oil & gas industry, nitrogen is used for enhanced oil recovery and pipeline purging. The consistent demand from diverse sectors, coupled with its cost-effectiveness and versatility, has placed nitrogen at the forefront of the market in North America.

The Hydrogen segment is expected to witness the fastest CAGR of nearly 10.3% from 2026 to 2033. This remarkable growth is fueled by rising investments in clean energy and the shift toward a hydrogen-based economy. The increasing adoption of hydrogen as an alternative fuel in transportation, power generation, and industrial processes is accelerating the need for specialized gas equipment. Government initiatives in the U.S. and Canada supporting green hydrogen production and infrastructure development are further strengthening market growth. The expansion of fuel-cell technology and hydrogen refueling stations is also creating significant opportunities for gas equipment manufacturers in this segment.

- By End-User

On the basis of end-user, the market is segmented into Metal Fabrication, Chemicals, Healthcare, Oil & Gas, Food & Beverage, and Others. The Oil & Gas segment held the largest market revenue share of approximately 35.9% in 2025. The North American region, particularly the United States, is one of the world’s leading producers of oil and natural gas. The widespread use of gas equipment in exploration, refining, storage, and transportation drives high demand in this sector. Gas regulators, detectors, compressors, and storage systems are essential for safe and efficient operations. The expansion of shale gas production and LNG export facilities is further strengthening the need for advanced gas equipment. Additionally, strict safety and emission regulations in the oil & gas sector require continuous monitoring and upgrading of gas systems, contributing to the segment's dominance.

The Healthcare segment is anticipated to grow at the fastest CAGR of around 8.6% from 2026 to 2033. The increasing use of medical gases such as oxygen, nitrous oxide, and carbon dioxide in hospitals, clinics, and home-care settings is driving this growth. The rising geriatric population and the prevalence of respiratory disorders are boosting the demand for oxygen therapy equipment. The expansion of hospital infrastructure, along with increased spending on healthcare in North America, is also contributing to the rapid adoption of gas equipment in this sector. Furthermore, the growing number of surgeries and critical care units is continuously increasing the demand for reliable medical gas delivery and monitoring systems.

North America Gas Equipment Market Regional Analysis

- North America dominated the gas equipment market with the largest revenue share in 2025, driven by extensive investments in gas infrastructure development, expansion of natural gas distribution networks, modernization of aging pipeline systems, and increasing demand for natural gas across power generation, industrial manufacturing, and residential heating application

- The region benefits from advanced technological capabilities, a well-established energy sector, and strong government and private sector investments in gas transportation, storage, and monitoring systems, which has significantly increased the adoption of high-performance gas delivery, detection, and regulating equipment

- Rising energy demand, strong industrial output, and the ongoing transition toward cleaner fossil fuels such as natural gas over coal and oil has further strengthened the region’s leadership in the Gas Equipment market

U.S. Gas Equipment Market Insight

The U.S. gas equipment market dominated the gas equipment market with the largest revenue share of approximately 41.6% in 2025 within North America, driven by extensive investments in pipeline expansion, modernization of aging gas infrastructure, rising demand for natural gas in power generation, and strong industrial consumption. The presence of major market players and advanced technological capabilities in gas processing, detection, and distribution systems continues to support sustained market dominance.

Canada Gas Equipment Market Outlook

Canada gas equipment market is expected to be the fastest-growing country in North America, with a projected CAGR of around 7.9% from 2026 to 2033, fueled by increasing investments in LNG export terminals, expansion of cross-border pipeline projects, rising natural gas production, and supportive government initiatives aimed at enhancing energy security and strengthening export potential.

North America Gas Equipment Market Share

The Gas Equipment industry is primarily led by well-established companies, including:

• Air Liquide (France)

• Linde plc (Germany)

• Air Products and Chemicals, Inc. (U.S.)

• Messer Group (Germany)

• Iwatani Corporation (Japan)

• Taiyo Nippon Sanso Corporation (Japan)

• Atlas Copco (Sweden)

• Parker Hannifin Corporation (U.S.)

• Emerson Electric Co. (U.S.)

• Honeywell International Inc. (U.S.)

• The Weir Group plc (U.K.)

• Swagelok Company (U.S.)

Latest Developments in North America Gas Equipment Market

- In October 2021, Air Products announced the development of a $4.5 billion Blue Hydrogen Clean Energy Complex in Louisiana, designed to produce low-carbon hydrogen and capture and sequester carbon dioxide. The project is aimed at supporting industrial and clean-energy demand along the U.S. Gulf Coast and will significantly increase the requirement for hydrogen production, storage, and transmission equipment

- In April 2022, Linde revealed its plan to expand its industrial gas production capacity in La Porte, Texas, effectively doubling merchant liquid production to support rising demand from the chemicals, manufacturing, clean energy, and refining industries across North America

- In May 2022, Air Liquide inaugurated its largest liquid-hydrogen production and logistics facility in North Las Vegas, Nevada, a $250 million investment capable of supplying hydrogen for mobility, electronics, and industrial applications throughout the western United States

- In September 2022, Linde announced the construction of a 35 MW PEM electrolyzer facility in Niagara Falls, New York, which will be used for large-scale green hydrogen production. This marked one of the most significant green hydrogen developments in the U.S. and strengthened domestic demand for specialized electrolyzers and gas processing equipment

- In October 2023, the U.S. government selected multiple regional projects under the Clean Hydrogen Hubs program (H2Hubs), committing billions of dollars toward building hydrogen production, transportation, and storage infrastructure across the country, directly boosting demand for advanced gas equipment in several North American states

- In April 2024, Air Products announced plans to develop a network of commercial hydrogen refueling stations in Alberta, Canada, aimed at supporting hydrogen-powered vehicles and freight corridors between Edmonton and Calgary, strengthening North America’s hydrogen distribution ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.