North America Gene Synthesis Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

7.28 Billion

2024

2032

USD

1.35 Billion

USD

7.28 Billion

2024

2032

| 2025 –2032 | |

| USD 1.35 Billion | |

| USD 7.28 Billion | |

|

|

|

|

North America Gene Synthesis Market Size

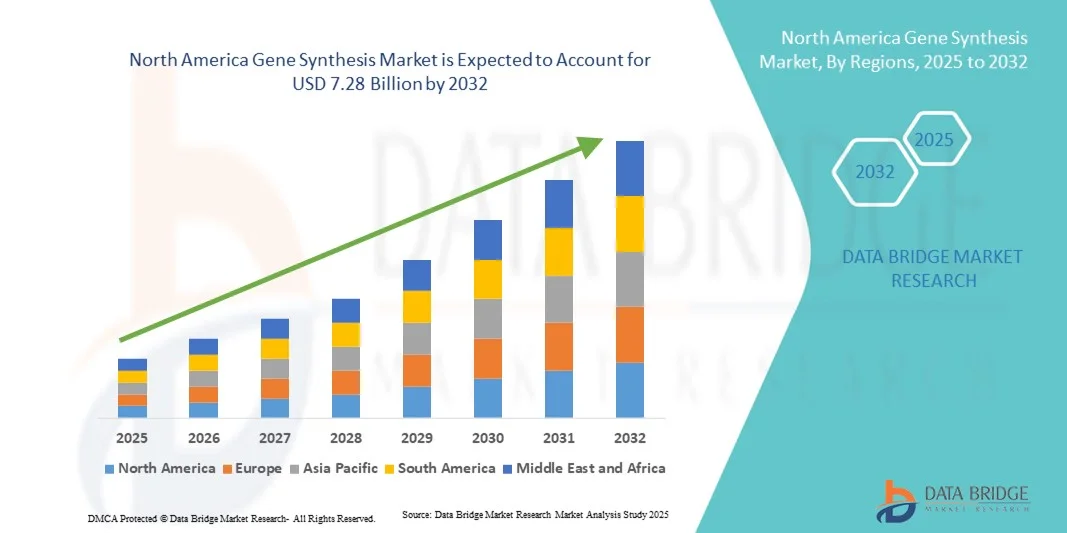

- The North America gene synthesis market size was valued at USD 1.35 billion in 2024 and is expected to reach USD 7.28 billion by 2032, at a CAGR of 23.40% during the forecast period

- The market growth is largely fueled by the rapid advancements in synthetic biology, DNA sequencing technologies, and automation, which have collectively enhanced the speed, accuracy, and cost-efficiency of gene synthesis. This progress has enabled researchers to design and produce complex genetic constructs for applications across pharmaceuticals, biotechnology, and agricultural research

- Furthermore, rising demand for customized genes to support vaccine development, personalized medicine, and gene therapy research is accelerating the adoption of gene synthesis solutions globally. These converging factors are significantly boosting the growth of the Gene Synthesis market, positioning it as a crucial enabler of innovation in genomics, molecular diagnostics, and synthetic biology

North America Gene Synthesis Market Analysis

- The Gene Synthesis market has witnessed significant expansion, primarily fueled by increasing demand for synthetic genes across biotechnology, pharmaceutical, and academic research sectors. Continuous advancements in DNA synthesis technology, automation, and bioinformatics have lowered production costs and turnaround times, enabling faster innovation in vaccines, gene therapy, and biologics development

- The market’s growth is further propelled by the rapid adoption of synthetic biology and precision medicine, as well as the rising need for customized genetic sequences in drug discovery, agricultural biotechnology, and diagnostics

- The U.S. dominated the gene synthesis market with the largest revenue share of 41.6% in 2024, driven by strong R&D investments, a robust presence of key players such as Thermo Fisher Scientific, Twist Bioscience, and GenScript, and widespread applications in genomic research, biopharmaceutical manufacturing, and personalized medicine

- Canada is projected to be the fastest-growing country in the gene synthesis market during the forecast period, with an expected CAGR supported by increasing biotechnology research funding, the rise of synthetic biology startups, and expanding collaborations with leading international biotech firms

- The custom gene synthesis segment dominated the market in 2024 with a share of 52.8%, supported by the rising need for tailor-made DNA sequences in research, vaccine design, and drug discovery

Report Scope and Gene Synthesis Market Segmentation

|

Attributes |

Gene Synthesis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Gene Synthesis Market Trends

Advancements Through AI and Automation Integration

- A significant and accelerating trend in the North America gene synthesis market is the integration of artificial intelligence (AI) and advanced automation technologies to improve the efficiency, accuracy, and scalability of DNA synthesis processes. This convergence is transforming traditional laboratory workflows, enabling faster gene construction, reduced error rates, and greater design flexibility

- For instance, companies such as Twist Bioscience and Thermo Fisher Scientific are implementing AI-driven algorithms to optimize gene sequence design, predict synthesis success rates, and minimize costs. These technologies allow scientists to design complex sequences rapidly and customize them for various applications in synthetic biology, therapeutics, and diagnostics

- AI-enabled automation platforms also assist in error correction and quality validation, ensuring high-fidelity gene constructs. Such automation reduces manual intervention and variability, thereby improving reproducibility and throughput in research and industrial applications

- Automation integration enables real-time monitoring and feedback mechanisms during synthesis, minimizing time delays and improving precision. This also supports large-scale custom DNA manufacturing for pharmaceutical and biotechnology companies involved in genetic engineering and vaccine development

- The integration of robotics with AI-powered analytics is driving laboratories toward fully automated gene synthesis pipelines. For instance, several biotech firms are employing automated liquid-handling systems that interface directly with AI platforms to predict reaction efficiencies and optimize conditions for each gene sequence

- This trend toward intelligent, automated, and high-throughput synthesis is reshaping expectations across the biotech sector. Consequently, companies such as GenScript, Twist Bioscience, and Integrated DNA Technologies (IDT) are expanding their AI-driven gene synthesis platforms to deliver faster turnaround times and cost-effective solutions for research and therapeutic use

- The demand for AI- and automation-integrated gene synthesis is rapidly increasing across research institutions, pharmaceutical companies, and contract manufacturing organizations (CMOs) as they seek to enhance productivity and accelerate innovation in life sciences

North America Gene Synthesis Market Dynamics

Driver

Growing Demand for Synthetic Biology and Personalized Medicine

- The expanding application of synthetic biology and personalized medicine is a major driver for the gene synthesis market’s growth. Gene synthesis enables the creation of customized genetic sequences for use in drug development, vaccine production, and genomic research

- For instance, in March 2024, Twist Bioscience Corporation announced advancements in its synthetic DNA manufacturing capacity to meet the growing global demand for gene-based research and biologics production. Such developments are expected to accelerate market expansion

- The rising prevalence of genetic disorders and cancer is propelling research into personalized therapies, where synthetic genes are designed to target individual patient needs

- In addition, the increasing adoption of synthetic genes in industrial biotechnology—for enzyme production, biofuel generation, and agricultural improvements—is further contributing to market growth

- The convenience of rapid, accurate, and cost-effective gene synthesis allows researchers to bypass traditional cloning methods, accelerating timelines for product development and innovation. The surge in CRISPR and cell therapy research also amplifies demand for high-quality synthetic genes

- Furthermore, the growth of biopharmaceutical R&D, supported by government initiatives and private investments, is fostering an environment conducive to the expansion of the Gene Synthesis market

Restraint/Challenge

High Costs and Technical Complexities in Gene Synthesis Processes

- Despite technological advancements, the high cost associated with gene synthesis remains a key challenge, especially for small laboratories and academic institutions. Complex gene sequences and the need for high accuracy contribute to elevated production expenses

- In addition, technical challenges such as sequence errors, difficulties in synthesizing long DNA fragments, and secondary structure formation continue to hinder efficiency

- For instance, long or repetitive sequences often require multiple synthesis and assembly steps, increasing both time and cost

- Companies are focusing on overcoming these limitations through innovative synthesis chemistries, improved error-correction methods, and automation to reduce operational costs

- Moreover, regulatory complexities related to synthetic gene use in therapeutic and agricultural applications can delay commercialization and increase compliance costs

- Ensuring biosafety and ethical standards in synthetic biology research also remains a growing concern

- Addressing these challenges through advancements in synthesis technologies, economies of scale, and favorable regulatory frameworks will be critical for sustained Gene Synthesis market growth

North America Gene Synthesis Market Scope

The market is segmented on the basis of component, gene type, gene synthesis type, application, method, end user, and distribution channel.

- By Component

On the basis of component, the Gene Synthesis market is segmented into synthesizer, consumables, and software & services. The consumables segment dominated the market with the largest revenue share of 46.5% in 2024, primarily driven by the continuous and recurring demand for essential materials such as reagents, primers, nucleotides, and enzymes used in various synthesis and amplification processes. Consumables are fundamental to every stage of gene construction and testing, making them indispensable in academic, clinical, and industrial laboratories. The growing number of genetic research projects, expansion of synthetic biology applications, and increased focus on precision medicine have significantly fueled demand. Moreover, the rising number of diagnostic tests and gene therapy trials further amplify the consumption of synthesis reagents, contributing to the segment’s market dominance.

The software & services segment is anticipated to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by the increasing utilization of bioinformatics tools and cloud-based design platforms that assist in accurate sequence analysis, optimization, and error minimization. The rise of AI-driven algorithms for automated gene design and synthesis management has accelerated service adoption among research and pharmaceutical institutions. Growing outsourcing of gene synthesis services by smaller labs lacking infrastructure and the integration of digital platforms for data management are further expected to propel this segment’s expansion over the forecast period.

- By Gene Type

On the basis of gene type, the Gene Synthesis market is segmented into standard gene, express gene, complex gene, and others. The standard gene segment dominated the market with a share of 41.3% in 2024, owing to its extensive use in basic molecular biology research, recombinant protein production, and genetic modification studies. Standard genes are cost-effective, reliable, and suitable for cloning and expression systems, making them the preferred choice across academic and industrial research laboratories. The surge in synthetic biology projects and academic funding for gene cloning experiments has strengthened this segment’s leadership. Moreover, increased demand for standard genes in diagnostics and therapeutics development continues to drive market expansion globally.

The complex gene segment is projected to register the fastest CAGR of 20.4% from 2025 to 2032, attributed to advancements in synthesis technologies that enable efficient creation of large, GC-rich, or repetitive DNA sequences. Complex genes play a vital role in next-generation biologics, vaccine development, and metabolic engineering. The increasing adoption of high-fidelity synthesis platforms and error-correction methods has made it feasible to construct intricate sequences with greater accuracy. Rising applications in gene circuit design and precision therapeutics are expected to further accelerate growth in this segment.

- By Gene Synthesis Type

On the basis of gene synthesis type, the Gene Synthesis market is segmented into gene library synthesis and custom gene synthesis. The custom gene synthesis segment dominated the market in 2024 with a share of 52.8%, supported by the rising need for tailor-made DNA sequences in research, vaccine design, and drug discovery. Custom synthesis provides flexibility to design specific gene sequences optimized for various organisms and protein expression systems. The growing trend of precision medicine, increased academic collaborations, and innovations in codon optimization technologies have propelled demand. The convenience of outsourcing custom synthesis to specialized service providers has also contributed to its leading position in the market.

The gene library synthesis segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, driven by the growing adoption of high-throughput screening and protein engineering techniques. Gene libraries enable the study of multiple genetic variants simultaneously, expediting drug discovery and functional genomics research. Advances in automation and chip-based synthesis have made it easier to create vast libraries efficiently and cost-effectively. Increasing research in enzyme optimization and synthetic biology innovations is expected to further support this segment’s robust growth.

- By Application

On the basis of application, the Gene Synthesis market is segmented into synthetic biology, genetic engineering, vaccine design, therapeutic antibodies, and others. The synthetic biology segment dominated the market with the largest share of 39.6% in 2024, driven by increasing investments in the development of engineered organisms, metabolic pathways, and biological circuits. Synthetic biology relies heavily on gene synthesis to design and assemble new biological systems for industrial, pharmaceutical, and agricultural applications. Governments and private entities are heavily funding synthetic biology research, especially for sustainable biomaterial production and biofuel development. The versatility of synthetic biology applications and its integration into the circular bioeconomy continue to reinforce its dominance.

The vaccine design segment is anticipated to record the fastest CAGR of 21.3% from 2025 to 2032, fueled by growing demand for rapid vaccine development platforms and synthetic gene technologies that enable quick response to emerging infectious diseases. Following the success of DNA and mRNA vaccines, many pharmaceutical companies are investing in synthetic gene tools to develop next-generation vaccines. The ongoing evolution of pathogens and global emphasis on pandemic preparedness continue to stimulate demand in this segment. Moreover, government initiatives promoting vaccine R&D and partnerships between biotech firms and public health agencies are accelerating innovation in this area. The integration of AI-driven modeling and automated gene synthesis is further enhancing vaccine design precision and reducing development timelines.

- By Method

On the basis of method, the Gene Synthesis market is segmented into solid-phase synthesis, chip-based, DNA synthesis, and PCR-based enzyme synthesis. The solid-phase synthesis segment held the dominant market share of 44.8% in 2024, owing to its precision, reliability, and scalability for producing long DNA sequences. This technique minimizes contamination risks and allows for automated, parallel synthesis, making it suitable for high-throughput operations in pharmaceutical and research settings. Continuous innovation in oligonucleotide chemistry and purification systems has enhanced yield and accuracy. Its broad applicability across diagnostics, therapeutics, and industrial biotechnology solidifies its leadership position in the market.

The chip-based synthesis segment is projected to grow at the fastest CAGR of 20.9% from 2025 to 2032, as it enables simultaneous production of thousands of oligonucleotides at lower cost and higher speed. This method’s miniaturization capability supports applications in DNA data storage, molecular diagnostics, and high-throughput genomics. The increasing demand for rapid, cost-efficient synthesis platforms in research and bioinformatics further strengthens the outlook for this segment. In addition, advancements in microarray and semiconductor-based synthesis technologies are enhancing scalability and precision in oligo production. Strategic collaborations between biotech firms and technology developers are further driving innovation and accelerating adoption of chip-based synthesis solutions globally

- By End User

On the basis of end user, the Gene Synthesis market is segmented into academic & research institutes, diagnostic laboratories, biotech & pharmaceutical companies, and others. The biotech & pharmaceutical companies segment dominated the market in 2024 with a share of 47.2%, supported by extensive R&D activities in biologics, vaccines, and personalized medicine. These companies rely on synthetic DNA for target validation, gene therapy, and antibody development. Increasing investments in genomics, expansion of biopharma pipelines, and partnerships with synthesis service providers have further boosted adoption. The integration of automation and AI-driven sequence optimization tools is enhancing productivity, sustaining the segment’s dominance.

The academic & research institutes segment is forecasted to register the fastest CAGR of 19.4% from 2025 to 2032, driven by expanding government funding for genomics projects, the growth of molecular biology programs, and accessibility to low-cost gene synthesis services. The rising focus on training and collaborative research in synthetic biology and genetic engineering has encouraged adoption of synthesis technologies across universities and research organizations worldwide. Increasing partnerships between academia and biotech firms for developing customized genes and functional studies are further accelerating demand. Moreover, the establishment of advanced research infrastructures and regional genome innovation hubs is expected to enhance the utilization of gene synthesis tools in academic settings.

- By Distribution Channel

On the basis of distribution channel, the Gene Synthesis market is segmented into direct tender, online distributions, and third-party distributions. The direct tender segment accounted for the largest market share of 49.5% in 2024, as most large-scale laboratories, hospitals, and biopharmaceutical companies prefer long-term procurement contracts for consistent supply and quality assurance. Direct tenders facilitate transparent supplier relationships, reduce costs through bulk purchasing, and ensure reliability in research timelines. The increasing use of centralized purchasing systems in government and institutional projects continues to strengthen this segment’s dominance.

The online distribution segment is estimated to grow at the fastest CAGR of 18.9% from 2025 to 2032, driven by the rapid digitalization of procurement channels and increasing adoption of e-commerce platforms for laboratory supplies. Online systems offer convenience, faster order processing, and real-time delivery tracking. Startups and small research facilities prefer online platforms due to easy access to a wide range of products and competitive pricing, making it one of the most dynamic growth areas in the market. The emergence of specialized biotechnology e-marketplaces offering customized synthesis kits and subscription-based delivery services is further fueling adoption. In addition, enhanced data security measures and integration of AI-driven recommendation systems are improving purchasing efficiency and user experience across online distribution channels.

North America Gene Synthesis Market Regional Analysis

- The Gene Synthesis market in North America accounted for a significant share of the global market in 2024

- Driven by advanced biotechnology infrastructure, high R&D spending, and strong adoption of synthetic biology in pharmaceutical and academic research

- The region’s market growth is further supported by the presence of leading players and government initiatives to promote genetic research and innovation

U.S. Gene Synthesis Market Insight

The U.S. gene synthesis market dominated the gene synthesis market with the largest revenue share of 41.6% in 2024, driven by strong R&D investments, robust presence of key players such as Thermo Fisher Scientific, Twist Bioscience, and GenScript, and widespread applications in genomic research, biopharmaceutical manufacturing, and personalized medicine. Technological advancements in automated DNA synthesis and expanding collaborations between academic institutes and biotech firms have further fueled market growth in the country.

Canada Gene Synthesis Market Insight

Canada gene synthesis market is projected to be the fastest-growing country in the Gene Synthesis market during the forecast period, supported by increasing biotechnology research funding, the rise of synthetic biology startups, and expanding collaborations with leading international biotech companies. Growing investments in life sciences innovation and demand for custom gene synthesis services are expected to accelerate the country’s market growth and strengthen its regional position.

North America Gene Synthesis Market Share

The Gene Synthesis industry is primarily led by well-established companies, including:

• Thermo Fisher Scientific Inc. (U.S.)

• Twist Bioscience Corporation (U.S.)

• GenScript Biotech Corporation (China)

• Integrated DNA Technologies, Inc. (U.S.)

• Boster Biological Technology (U.S.)

• ProteoGenix (France)

• OriGene Technologies, Inc. (U.S.)

• Bio Basic Inc. (Canada)

• ATUM (U.S.)

• Eurofins Genomics (Germany)

• Bioneer Corporation (South Korea)

• Synbio Technologies (U.S.)

• SGI-DNA (U.S.)

• BlueHeron Biotech (U.S.)

• Evonetix Ltd. (U.K.)

• DNA2.0 (U.S.)

• Theragen Bio (South Korea)

• Genewiz (U.S.)

• Takara Bio Inc. (Japan)

• Codex DNA (U.S.)

Latest Developments in North America Gene Synthesis Market

- In May 2023, GenScript Biotech Corporation launched its GenTitan Gene Fragments service, which leverages a chip-based platform for high-throughput synthetic DNA fragment generation, enabling faster research and development for the biotechnology and pharmaceutical sectors

- In November 2023, Twist Bioscience Corporation introduced its Express Genes service, offering rapid gene synthesis (≈ 5–7 business days) using its silicon chip-based platform, thereby reducing turnaround time for custom gene constructs in research and biopharma applications

- In June 2024, GenScript (company) launched its FLASH Gene service, providing sequence-to-plasmid (S2P) gene synthesis with a turnaround of four business days and flat-rate pricing, aimed at accelerating innovation in antibody drug discovery, vaccine R&D, and cell/gene therapies

- In March 2025, Syngoi Technologies and Ribbon Bio GmbH announced a strategic collaboration to produce high-purity synthetic DNA at gram scale for gene therapeutics, combining Syngoi’s large-scale DNA manufacturing capabilities and Ribbon Bio’s algorithm-driven gene synthesis platform

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.