North America Graft Versus Host Disease Gvhd Treatment Market

Market Size in USD Million

CAGR :

%

USD

2.29 Million

USD

3.44 Million

2024

2032

USD

2.29 Million

USD

3.44 Million

2024

2032

| 2025 –2032 | |

| USD 2.29 Million | |

| USD 3.44 Million | |

|

|

|

|

North America Graft-Versus-Host Disease (GVHD) Treatment Market Size

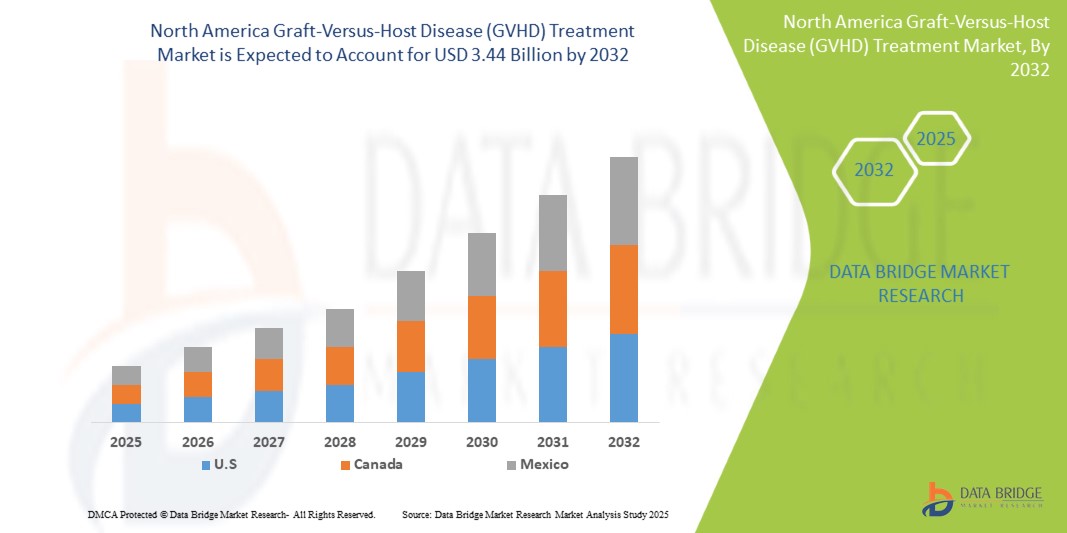

- The North America graft-versus-host disease (GVHD) treatment market was valued at USD USD 2.29 Billion in 2024 and is expected to reach USD 3.44 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.3% primarily driven by the increasing prevalence of obesity

- This growth is driven by factors such as innovations in anti-Graft-Versus-Host Disease (GVHD)medications, growth in bariatric and metabolic surgeries. In addition, the integration of digital health solutions in graft-versus-host disease (GVHD) treatment

North America Graft-Versus-Host Disease (GVHD) Treatment Market Analysis

- The increasing number of stem cell transplantations and the advancements in treatment approaches are some of the major factors driving the market growth

- In addition, development of novel therapies are further propelling the market growth. However, the major restraint that is impacting the market growth is the high cost associated with treatment

- On the other hand, increasing awareness and education about GVHD among healthcare providers, patients, and caregivers are expected to create an opportunity for market growth. However, the risk of infections and other complications is expected to pose a challenge to market growth

- North America remains a dominant region in the North America Graft-Versus-Host Disease (GVHD) Treatment market, supported by well-established healthcare infrastructure, high prevalence rates, and continuous research in weight management solutions

- With a growing emphasis on Graft-Versus-Host Disease (GVHD)management and preventive healthcare, the North America market is witnessing significant investments in novel therapies, medical technologies, and patient-centric solutions, driving overall industry expansion

Report Scope and Graft-Versus-Host Disease (GVHD) Treatment Market Segmentation

|

Attributes |

North America Graft-Versus-Host Disease (GVHD) Treatment Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America.

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Graft-Versus-Host Disease (GVHD) Treatment Market Trends.

“Increasing Incidence of Hematopoietic Stem Cell Transplants (HSCT) ”

- This trend is primarily fueled by the growing prevalence of blood cancers, such as leukemia, lymphoma, and myeloma, which often require HSCT as a treatment option. In addition, other hematological disorders, such as aplastic anemia and certain genetic disorders, also necessitate HSCT for disease management

- As the number of patients undergoing HSCT continues to rise, so does the demand for effective GVHD treatment. GVHD is a common complication of HSCT, occurring when the transplanted donor cells attack the recipient's tissues, leading to potentially severe and life-threatening symptoms. Therefore, the increasing incidence of HSCT directly translates to a higher need for GVHD treatment to manage and mitigate the effects of this complication

For instance,

- In October 2023, as per an article published by Frontiers Media S.A., the number of transplantations is steadily increasing globally, with nearly 20,000 allo-HCT transplants reported by the European Society for Blood and Marrow Transplantation (EBMT) in 2019 and over 9,000 transplants in the United States during the same period, as per the Center for International Blood and Marrow Transplant Research (CIBMTR)

Global Graft-Versus-Host Disease (GVHD) Treatment Market Dynamics

Driver

“Rising Awareness Campaigns and Patient Education ”

- Awareness campaigns and patient education are pivotal in the early detection and treatment of Graft-Versus-Host Disease (GVHD). By specifically targeting healthcare professionals, patients, and caregivers, these initiatives highlight key GVHD symptoms, enabling prompt recognition and timely intervention

- Educated patients and caregivers are more likely to seek medical advice early, preventing the disease from advancing to severe stages. Furthermore, healthcare providers, well-versed in GVHD’s signs and management, can offer more effective care, improving patient outcomes. These targeted efforts are critical in enhancing the overall quality of life for those affected by GVHD.

For instance,

- In August 2023, as per an article published by Fierce Pharma, Soccer legend Mia Hamm has teamed up with Incyte to raise awareness about graft-versus-host disease (GVHD). Hamm shares her personal experience of losing her brother Garrett in 1997 due to complications following a Bone Marrow Transplant (BMT). BMTs, aimed at curing rare bone marrow diseases, carry a major risk of GVHD, where the graft's immune cells attack the recipient's cells. This condition can be challenging to manage post-transplant and, in some instances, can be fatal

- In February 2023, PR Newswire reported that in the U.S., the newly formed GVHD Alliance, consisting of leading transplant organizations, aims to enhance access to resources and support for individuals affected by graft-versus-host disease (GVHD). This alliance has designated February 17 as GVHD Day to raise awareness and support for the GVHD community. Member organizations include the American Society for Transplantation and Cellular Therapy (ASTCT), Be The Match (operated by the National Marrow Donor Program), Blood & Marrow Transplant Information Network (BMT InfoNet), Meredith A. Cowden Foundation, and National Bone Marrow Transplant Link (nbmtLINK). The alliance aims to connect patients with support groups and resources, such as social workers and patient navigators, to help them advocate for treatment and address their concerns

Opportunity

“Market Expansion Through Strategic Initiatives and Partnership ”

- Market expansion through strategic collaboration can be a highly effective approach for companies operating in the GVHD (Graft-versus-Host Disease) treatment market

- As the demand for innovative treatments and comprehensive care solutions for GVHD continues to rise, companies can capitalize on strategic partnerships and collaborations to expand their market presence and offer a diverse product portfolio tailored to meet evolving patient needs. By collaborating with research institutions, academic centers, and biotechnology companies, GVHD market players can access cutting-edge technologies, novel therapeutic approaches, and scientific expertise to advance their product development efforts

- These collaborations enable companies to accelerate the discovery and development of promising GVHD therapies, including personalized cellular therapies, targeted biologic agents, and supportive care interventions

- Moreover, strategic alliances with key opinion leaders and patient advocacy groups facilitate market access and enhance the adoption of new treatments by fostering trust, credibility, and patient engagement

- In March 2021, as per an article published by Bristol Myers Squibb, Bristol Myers Squibb (BMS) and Bluebird Bio have joined forces in a strategic partnership to co-develop Abecma, a first-in-class BCMA-directed personalized immune cell therapy delivered as a one-time infusion for triple-class exposed patients with multiple myeloma. It is a B-cell-Maturation Antigen (BCMA ) antigen receptor T-cell therapy designed specifically for the treatment of Graft-Versus-Host Disease (GVHD). This collaboration capitalizes on Bluebird Bio's profound expertise in cell therapy and BMS's extensive global commercialization capabilities. The goal is to address the unmet medical needs of GVHD patients in the future by advancing innovative treatment options, paving the way for groundbreaking therapies in the GVHD space

- In November 2022, A study by Labiotech UG outlined Novartis made a partnership with Gamida Cell to develop and commercialize omidubicel, an investigational advanced cell therapy, for patients with high-risk hematologic malignancies. Omidubicel is designed to enhance bone marrow transplant outcomes by expanding the availability of stem cells for transplantation. This partnership reflects a strategic initiative to address unmet needs in the hematologic oncology field, with potential applications for GVHD treatment

- Furthermore, market expansion through strategic initiatives allows GVHD market players to diversify their product portfolio and capture a larger share of the GVHD market

Restraint/Challenge

“Stringent Regulations In GVHD Therapies”

- The regulatory guidelines for the GVHD are strict compared to older ones. The manufacturers have to make specific product changes before approval, which is expected to cause delays.

- Stringent regulation presents a significant challenge for the GVHD market in the future. As the field continues to advance with the development of novel therapies and treatment modalities, regulatory authorities impose rigorous standards for safety, efficacy, and quality control

- Meeting these regulatory requirements demands substantial investment in preclinical and clinical development, as well as extensive documentation and data submission for regulatory approval. In addition, the complexity of GVHD, its heterogeneous presentation, and the lack of standardized diagnostic criteria further complicate regulatory evaluation and approval processes

- For instance,

- In April 2023, according to the article published by the FDA, Stem cell research has been legalized in the U.S. However, there are certain restrictions related to its funding. The Center for Biologics Evaluation and Research (CBER) regulates cellular therapy products, human gene therapy products, and certain devices related to cell and gene therapy. While the FDA plays a crucial role in ensuring the safety and efficacy of therapies, the regulatory process can be rigorous and time-consuming. In addition, the FDA's evolving regulatory landscape and stringent post-marketing surveillance requirements necessitate ongoing compliance efforts and may impact the speed at which new therapies reach the market

- Stringent regulation acts as a significant challenge for the GVHD market in the future, impacting product development timelines, costs, and market access

North America Graft-Versus-Host Disease (GVHD) Treatment Market Scope

The market is segmented on the basis of type, product type, absorption site, age group, source, delivery method, gender, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

North America Graft-Versus-Host Disease (GVHD) Treatment market Regional Analysis

“U.S. is the Dominant Region in the Graft-Versus-Host Disease (GVHD) Treatment”

- U.S. leads the North America Graft-Versus-Host Disease (GVHD) Treatment market, driven by a high prevalence of obesity, advanced healthcare infrastructure, and strong adoption of innovative weight management solutions

- The U.S. holds a significant market share due to the rising demand for pharmacological treatments like GLP-1 receptor agonists, bariatric surgeries, and digital weight management platforms

- In additionally, increasing awareness about obesity-related health risks and the growing adoption of AI-driven weight loss programs, telehealth consultations, and non-invasive treatment solutions continue to fuel market expansion in the region

“U.S. is Projected to Register the Highest Growth Rate”

- The U.S. region is expected to witness the highest growth rate in the North America Graft-Versus-Host Disease (GVHD) Treatment market, driven by increasing Graft-Versus-Host Disease (GVHD)prevalence, rising healthcare investments, and growing awareness about weight management solutions

- Countries such as U.S. Canada and Mexico are emerging as key markets due to shifting lifestyle patterns, rising urbanization, and an increasing number of obesity-related health complications

- U.S , with its expanding healthcare infrastructure and growing demand for medical weight loss treatments, remains a crucial market for Graft-Versus-Host Disease (GVHD)management. The country is witnessing increased adoption of pharmacological treatments, bariatric surgeries, and digital weight management programs

North America Graft-Versus-Host Disease (GVHD) Treatment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bristol-Myers Squibb Company (U.S.)

- AbbVie Inc. (U.S.)

- Novartis AG (Switzerland)

- Janssen Global Services, LLC (U.S.)

- Mallinckrodt (U.S.)

- Incyte (U.S.)

- Sanofi (France)

- Alkem Laboratories Ltd. (India)

- Astellas Pharma Inc. (Japan)

Latest Developments in North America Graft-Versus-Host Disease (GVHD) Treatment Market

- In February 2025, The U.S. FDA approved EMBLAVEO (aztreonam and avibactam), the first monobactam/β-lactamase inhibitor combination, to treat complicated intra-abdominal infections (cIAI) in adults with limited treatment options. It targets Gram-negative bacteria, including resistant strains. This approval addresses growing antimicrobial resistance, a significant North America health threat

- In February 2024, Johnson & Johnson, along with its partner Pharmacyclics LLC (an AbbVie Company), has received FDA approval for an expanded label for IMBRUVICA (ibrutinib) in an oral suspension form. This expansion allows for the treatment of adult patients with CLL/SLL, WM, and cGVHD after prior systemic therapy

- In March 2024, Johnson & Johnson has announced the successful completion of its acquisition of Ambrx Biopharma, Inc. This clinical-stage biopharmaceutical company possesses a proprietary synthetic biology technology platform used for designing and developing next-generation antibody drug conjugates (ADCs). This acquisition offers Johnson & Johnson a unique opportunity to create, develop, and market targeted oncology therapies

- In February 2024, AbbVie Inc. and Tentarix Biotherapeutics have announced a partnership to collaboratively discover and develop conditionally-active, multi-specific biologics in the fields of oncology and immunology. This collaboration will leverage AbbVie's extensive experience in these areas alongside Tentarix's proprietary Tentacles platform

- In September 2021, Sanofi has finalized a merger agreement with Kadmon Holdings, Inc., a biopharmaceutical company focused on developing and commercializing innovative therapies for diseases with substantial unmet medical needs. This acquisition aligns with Sanofi's growth strategy for its General Medicines core assets and will promptly incorporate Rezurock (belumosudil) into its transplant portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INCIDENCE OF HEMATOPOIETIC STEM CELL TRANSPLANTS (HSCT)

6.1.2 RISING AWARENESS CAMPAIGNS AND PATIENT EDUCATION

6.1.3 ADVANCEMENTS IN TREATMENT OPTIONS FOR GRAFT-VERSUS-HOST DISEASE (GVHD)

6.2 RESTRAINTS

6.2.1 HIGH COST OF MEDICATIONS AND SUPPORTIVE CARE

6.2.2 DISEASE HETEROGENEITY IN GRAFT-VERSUS-HOST DISEASE (GVHD) IMPLICATIONS FOR TREATMENT AND CLINICAL TRIALS

6.3 OPPORTUNITIES

6.3.1 MARKET EXPANSION THROUGH STRATEGIC INITIATIVES AND PARTNERSHIP

6.3.2 GROWING PIPELINE OF INNOVATIVE DRUGS FOR GVHD TREATMENT

6.3.3 EMPOWERING PATIENT-CENTRIC APPROACH TO GVHD TREATMENT

6.4 CHALLENGES

6.4.1 STRINGENT REGULATIONS IN GVHD THERAPIES

6.4.2 SAFETY CONCERN AND COMPLEXITIES DURING TREATMENT

7 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 CHRONIC GVHD

7.2.1 CORTICOSTEROIDS

7.2.1.1 PREDNISOLONE

7.2.1.2 METHYLPREDNISOLONE

7.2.2 IMMUNOSUPPRESSIVE

7.2.2.1 MYCOPHENOLATE MOFETIL (MMF)

7.2.2.2 METHOTREXATE (MTX)

7.2.2.3 ANTITHYMOCYTE GLOBULIN (ATG)

7.2.2.4 OTHERS

7.2.3 CALCINEURIN INHIBITORS

7.2.4 OTHERS

7.2.5 BRANDED

7.2.5.1 REZUROCK

7.2.5.2 IMBRUVICA

7.2.5.3 JAKAFI

7.2.6 GENERIC

7.3 ACUTE GVHD

7.3.1 CORTICOSTEROIDS

7.3.1.1 METHYLPREDNISOLONE

7.3.1.2 PREDNISOLONE

7.3.2 IMMUNOSUPPRESSIVE

7.3.2.1 MYCOPHENOLATE MOFETIL (MMF)

7.3.2.2 RUXOLITINIB

7.3.2.3 OTHERS

7.3.3 CALCINEURIN INHIBITORS

7.3.3.1 TACROLIMUS (TAC)

7.3.3.2 CYCLOSPORIN (CSA)

7.3.4 OTHERS

7.4 PROPHYLACTIC

7.4.1 CYCLOSPORIN (CSA)

7.4.2 METHOTREXATE (MTX)

7.4.3 TACROLIMUS (TAC)

7.4.4 METHYLPREDNISOLONE

7.4.5 OTHERS

7.4.6 GENERIC

7.4.7 BRANDED

8 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY AGE

8.1 OVERVIEW

8.2 ADULTS

8.3 PEDIATRIC

9 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY GENDER

9.1 OVERVIEW

9.2 FEMALE

9.3 MALE

10 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY METHOD OF ADMINISTRATION

10.1 OVERVIEW

10.2 ORAL

10.3 INTRAVENOUS

10.4 TOPICAL

10.5 OTHERS

11 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TREATMENT

11.1 OVERVIEW

11.2 MEDICATION

11.2.1 CORTICOSTEROIDS

11.2.1.1 METHYLPREDNISOLONE

11.2.1.2 PREDNISOLONE

11.2.2 IMMUNOSUPPRESSIVE

11.2.2.1 MYCOPHENOLATE MOFETIL (MMF)

11.2.2.2 METHOTREXATE (MTX)

11.2.2.3 ANTITHYMOCYTE GLOBULIN (ATG)

11.2.2.4 OTHERS

11.2.3 CALCINEURIN INHIBITORS

11.2.3.1 TACROLIMUS (TAC)

11.2.3.2 CYCLOSPORIN (CSA)

11.2.3.3 OTHERS

11.2.4 BRANDED

11.2.4.1 REZUROCK

11.2.4.2 IMBRUVICA

11.2.4.3 JAKAFI

11.2.4.4 ORENCIA

11.2.4.5 OTHERS

11.2.5 GENERIC

11.3 THERAPY

12 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PUBLIC

12.2.2 PRIVATE

12.3 TRANSPLANT CENTERS

12.4 INSTITUTES

12.5 SPECIALITY CENTERS

13 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

13.3.1 HOSPITAL PHARMACY

13.3.2 RETAIL PHARMACY

13.3.3 ONLINE PHARMACY

13.4 OTHERS

14 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA GRAFT VERSUS HOST DISEASE (GVHD) TREATMENT MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 BRISTOL-MYERS SQUIBB COMPANY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 ABBVIE INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 JANSSEN NORTH AMERICA SERVICES, LLC

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 SANOFI

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS/NEWS

17.5 INCYTE

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ALKEM LABORATORIES LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ASTELLAS PHARMA INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 MALLINCKRODT

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS/NEWS

17.9 NOVARTIS AG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA CORTICOSTEROIDS IN GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ACUTE GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA ACUTE GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA IMMUNOSUPPRESSIVES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA ADULTS IN GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA PEDIATRIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA FEMALE IN GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY REGION, 20218-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA MALE IN GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY METHOD OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA ORAL IN GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA INTRAVENOUS IN GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA TOPICAL IN GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA OTHERS IN GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA THERAPY IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA HOSPITALS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA HOSPITALS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA TRANSPLANT CENTERS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA INSTITUTES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA SPECIALTY CENTERS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA DIRECT TENDER IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA RETAIL SALES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA RETAIL SALES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA OTHERS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA ACUTE GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA IMMUNOSUPPRESSIVES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY METHOD OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA HOSPITALS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA RETAIL SALES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. ACUTE GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. IMMUNOSUPPRESSIVES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY METHOD OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. HOSPITALS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 100 U.S. RETAIL SALES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 105 CANADA CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 106 CANADA MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 112 CANADA CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 CANADA BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 CANADA ACUTE GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 115 CANADA CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 116 CANADA IMMUNOSUPPRESSIVES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 119 CANADA PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 123 CANADA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY METHOD OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 125 CANADA HOSPITALS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 126 CANADA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 127 CANADA RETAIL SALES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 131 MEXICO IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 132 MEXICO CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 133 MEXICO MEDICATION IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 MEXICO BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MEXICO GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 MEXICO CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 137 MEXICO CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 138 MEXICO IMMUNOSUPPRESSIVE IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 139 MEXICO CHRONIC GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MEXICO BRANDED IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MEXICO ACUTE GVHD IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 142 MEXICO CORTICOSTEROIDS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 143 MEXICO IMMUNOSUPPRESSIVES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 144 MEXICO CALCINEURIN INHIBITORS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 145 MEXICO PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 146 MEXICO PROPHYLACTIC IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MEXICO GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 148 MEXICO GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 149 MEXICO GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY METHOD OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 150 MEXICO GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 151 MEXICO HOSPITALS IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 152 MEXICO GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 153 MEXICO RETAIL SALES IN GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: SEGMENTATION

FIGURE 11 THE GROWING NUMBER OF STEM CELL TRANSPLANTATIONS IS DRIVING THE GROWTH OF THE NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET FROM 2025 TO 2032

FIGURE 12 THE TREATMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET IN 2025 AND 2032

FIGURE 13 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 TWO SEGMENTS COMPRISE THE NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET, BY TREATMENT

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET

FIGURE 17 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: BY TYPE, 2024

FIGURE 18 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET: BY AGE, 2024

FIGURE 22 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET: BY AGE, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET: BY AGE, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET: BY AGE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET: BY GENDER, 2024

FIGURE 26 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET: BY GENDER, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET: BY GENDER, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA GRAFT-VERSUS-HOST- DISEASE (GVHD) TREATMENT MARKET: BY GENDER, LIFELINE CURVE

FIGURE 29 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: BY METHOD OF ADMINISTRATION, 2024

FIGURE 30 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: BY METHOD OF ADMINISTRATION, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: BY METHOD OF ADMINISTRATION, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: BY METHOD OF ADMINISTRATION, LIFELINE CURVE

FIGURE 33 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: BY TREATMENT, 2024

FIGURE 34 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: BY TREATMENT, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: BY TREATMENT, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: BY TREATMENT, LIFELINE CURVE

FIGURE 37 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: BY END USER 2024

FIGURE 38 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: END USER, CAGR (2025-2032)

FIGURE 40 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: END USER, LIFELINE CURVE

FIGURE 41 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 42 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 43 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 44 NORTH AMERICA GRAFT-VERSUS-HOST-DISEASE (GVHD) TREATMENT MARKET: DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 45 NORTH AMERICA GRAFT-VERSUS-HOST DISEASE (GVHD) TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 46 NORTH AMERICA GRAFT VERSUS HOST DISEASE (GVHD) TREATMENT MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.