North America Grain Oriented Electrical Steel Market

Market Size in USD Billion

CAGR :

%

USD

3.79 Billion

USD

6.13 Billion

2024

2032

USD

3.79 Billion

USD

6.13 Billion

2024

2032

| 2025 –2032 | |

| USD 3.79 Billion | |

| USD 6.13 Billion | |

|

|

|

|

Grain Oriented Electrical Steel Market Size

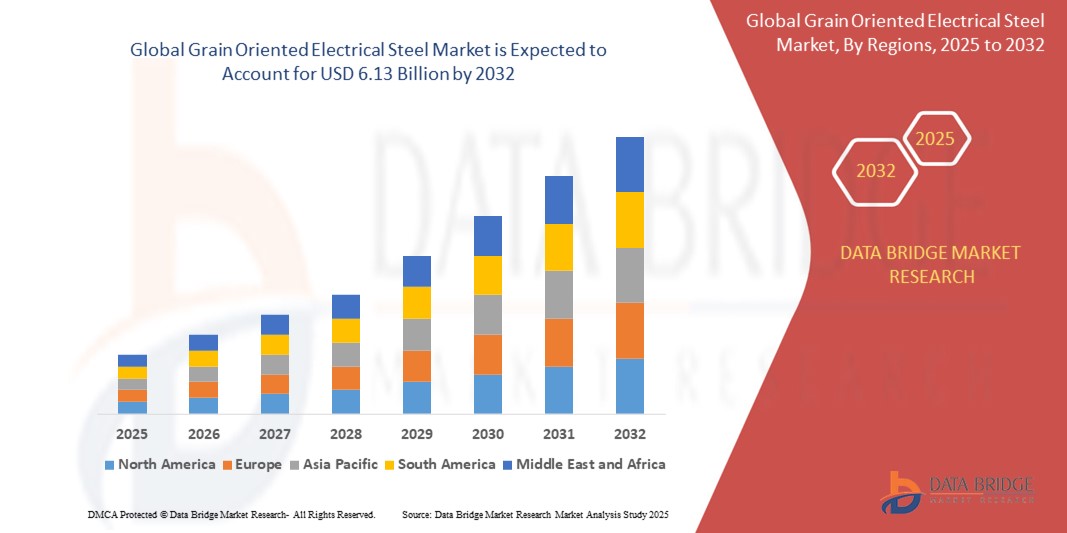

- The North America grain oriented electrical steel market size was valued at USD 3.79 billion in 2024 and is expected to reach USD 6.13 billion by 2032, at a CAGR of 6.2% during the forecast period

- The market growth is driven by increasing demand for energy-efficient transformers and power generation equipment, coupled with advancements in electrical steel manufacturing technologies

- Rising investments in renewable energy projects and the modernization of power grids are further boosting the adoption of grain oriented electrical steel in the region

Grain Oriented Electrical Steel Market Analysis

- Grain oriented electrical steel is a critical material used in the cores of transformers, motors, and generators due to its high magnetic permeability and low core loss, making it essential for efficient energy transmission and distribution

- The market is fueled by the growing need for energy-efficient solutions, increasing electricity consumption, and the expansion of renewable energy infrastructure, particularly in the U.S. and Canada

- The U.S. dominated the North America grain oriented electrical steel market with a revenue share of 65.4% in 2024, driven by its advanced manufacturing base, high demand for transformers in power grids, and strong presence of key industry players. Innovations in high magnetic strength steel and energy-efficient technologies are further propelling market growth

- Canada is expected to be the fastest-growing country in the North America grain oriented electrical steel market during the forecast period, attributed to increasing investments in renewable energy and rising industrial automation

- The Domain Refined segment dominated the largest market revenue share of 45% in 2024, driven by its superior magnetic properties and low core loss, making it ideal for high-efficiency transformers and generators. Its advanced processing techniques enhance energy efficiency, aligning with the increasing demand for sustainable energy solutions

Report Scope and Grain Oriented Electrical Steel Market Segmentation

|

Attributes |

Grain Oriented Electrical Steel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Grain Oriented Electrical Steel Market Trends

“Increasing Adoption of Advanced Manufacturing Techniques and High-Efficiency Materials”

- The North America Grain Oriented Electrical Steel (GOES) market is experiencing a notable trend toward the adoption of advanced manufacturing techniques, such as improved annealing processes and precise grain orientation control, to enhance material efficiency

- These advancements result in GOES with superior magnetic properties, reducing core losses and improving energy efficiency in applications such as transformers and power generators

- Companies are developing domain-refined GOES with low iron loss, which is particularly suited for high-efficiency transformers and motors, driven by the growing demand for sustainable energy solutions

- For instances, innovations such as laser scribing and high-performance coatings are being utilized to minimize hysteresis losses and improve insulation properties, making GOES more appealing for energy and power applications

- This trend enhances the performance of GOES in applications such as wound cores and laminated sheets, catering to the rising need for compact and energy-efficient electrical infrastructure

- The integration of high magnetic strength GOES in electric vehicle (EV) motors and stators is gaining traction, supporting the automotive industry's shift toward electrification

Grain Oriented Electrical Steel Market Dynamics

Driver

“Growing Demand for Energy-Efficient Transformers and Electric Vehicle Infrastructure”

- The increasing need for energy-efficient power distribution systems, driven by rising electricity consumption and renewable energy integration, is a key driver for the North America GOES market

- GOES is critical for manufacturing high-performance transformers, power generators, and motors, offering low core losses and high magnetic permeability, which enhance energy conversion efficiency

- Government initiatives, particularly in the U.S., to modernize electrical grids and promote renewable energy sources such as wind and solar are boosting demand for GOES in transformer and shunt reactor applications

- The rapid growth of the electric vehicle market in North America, especially in the U.S. and Canada, is driving the use of GOES in EV motors and charging infrastructure, where its magnetic properties improve efficiency and reduce energy losses

- The U.S., as the dominating country, benefits from significant investments in energy infrastructure, such as Hitachi Energy’s USD 155 million expansion in North America for transformer production Canada, the fastest-growing country, is seeing accelerated adoption due to its focus on sustainable energy and EV infrastructure development

- The proliferation of smart grid technologies, requiring high-quality GOES for transformers and sensors, further supports market growth by enabling real-time energy monitoring and efficient distribution

Restraint/Challenge

“High Production Costs and Raw Material Price Volatility”

- The high initial investment required for producing GOES, including advanced manufacturing processes and specialized equipment, poses a significant barrier, particularly for smaller manufacturers in emerging markets within North America

- The complexity of producing thin laminations and achieving precise grain orientation increases production costs, limiting scalability for some applications

- Volatility in raw material prices, such as iron ore, silicon, and coal, impacts the cost of GOES production, making it challenging to maintain competitive pricing, especially for offline distribution channels

- Data security concerns related to online distribution channels, where sensitive production and supply chain information is shared, raise risks of breaches and compliance issues with regulations such as GDPR or CCPA

- The fragmented regulatory environment across the U.S. and Canada regarding environmental standards and material sourcing complicates operations for manufacturers, potentially deterring market expansion in cost-sensitive or highly regulated regions

- These challenges are particularly pronounced in applications such as household appliances and building construction, where cost sensitivity and regulatory compliance are significant factors

Grain Oriented Electrical Steel market Scope

The market is segmented on the basis of type, thickness, form, silicone content, distribution channel, application, and end-user.

- By Type

On the basis of type, the North America grain oriented electrical steel market is segmented into Domain Refined, High Magnetic Strength, and Conventional. The Domain Refined segment dominated the largest market revenue share of 45% in 2024, driven by its superior magnetic properties and low core loss, making it ideal for high-efficiency transformers and generators. Its advanced processing techniques enhance energy efficiency, aligning with the increasing demand for sustainable energy solutions.

The High Magnetic Strength segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its growing adoption in high-performance applications such as large power transformers and electric vehicle (EV) motors, driven by advancements in material technology and rising demand for high magnetic flux density.

- By Thickness

On the basis of thickness, the market is segmented into 0.23 MM, 0.27 MM, 0.30 MM, 0.35 MM, 0.5 MM, 0.65 MM, and Others. The 0.23 MM segment is expected to hold the largest market revenue share of 38% in 2024, owing to its widespread use in small transformers, generators, and electric motors, where thin laminations reduce eddy current losses and improve efficiency.

The 0.35 MM segment is projected to experience the fastest growth rate from 2025 to 2032, driven by its increasing application in large generators and motors requiring high magnetic flux density, particularly in power distribution systems and renewable energy infrastructure.

- By Form

On the basis of form, the market is segmented into Laminated Sheets, Wound Sheets, and Punched Sheets. The Laminated Sheets segment is expected to dominate with a market revenue share of 60% in 2024, attributed to its critical role in transformer cores, where thin laminations minimize energy losses and enhance performance.

The Wound Sheets segment is anticipated to witness robust growth from 2025 to 2032, driven by increasing demand for wound cores in distribution transformers and renewable energy applications, where their flexibility and efficiency are highly valued.

- By Silicone Content

On the basis of silicone content, the market is segmented into Below 3% and 3% or More. The 3% or More segment is expected to hold the largest market revenue share of 55% in 2024, due to its enhanced electrical resistivity and reduced core losses, making it the preferred choice for high-efficiency transformers and generators.

The Below 3% segment is expected to grow significantly from 2025 to 2032, driven by its cost-effectiveness and suitability for less demanding applications such as small motors and household appliances, where moderate magnetic properties are sufficient.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online and Offline. The Offline segment is expected to dominate with a market revenue share of 70% in 2024, driven by established supply chains, direct procurement by large manufacturers, and the need for customized solutions in industrial applications.

The Online segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing digitalization of industrial procurement, growing e-commerce platforms, and the convenience of online purchasing for smaller-scale buyers.

- By Application

On the basis of application, the market is segmented into Transformers, Power Generators, Motors, Battery, Shunt Reactor, Wound Cores, and Others. The Transformers segment is expected to hold the largest market revenue share of 50% in 2024, driven by the critical role of grain oriented electrical steel in power, distribution, and small transformers, where its high permeability and low core loss enhance energy efficiency.

The Motors segment is anticipated to experience rapid growth from 2025 to 2032, propelled by the increasing adoption of electric vehicles and high-efficiency motors in industrial applications, supported by advancements in magnetic materials and rising electrification trends.

- By End-User

On the basis of end-user, the market is segmented into Energy and Power, Automotive, Household Appliances, Building and Construction, Aviation, and Others. The Energy and Power segment is expected to dominate with a market revenue share of 48% in 2024, driven by the widespread use of grain oriented electrical steel in transformers and generators for power generation and distribution, particularly in renewable energy systems.

The Automotive segment is expected to witness the fastest growth rate of 7.5% from 2025 to 2032, fueled by the rising demand for electric vehicles, where grain oriented electrical steel is used in high-efficiency motors and charging infrastructure, supported by regulatory pushes for sustainable transportation.

Grain Oriented Electrical Steel Market Regional Analysis

- The U.S. dominated the North America grain oriented electrical steel market with a revenue share of 65.4% in 2024, driven by its advanced manufacturing base, high demand for transformers in power grids, and strong presence of key industry players. Innovations in high magnetic strength steel and energy-efficient technologies are further propelling market growth

- The trend toward sustainable energy solutions and increasing regulations promoting energy efficiency further boost market expansion. The integration of advanced grain oriented electrical steel in transformers and power generators by major manufacturers complements aftermarket demand, creating a robust market ecosystem

Canada Grain Oriented Electrical Steel Market Insight

Canada is expected to witness the fastest growth rate in the North America grain oriented electrical steel market, propelled by rising investments in renewable energy infrastructure and increasing demand for energy-efficient transformers and motors. The country’s focus on vehicle electrification and stringent environmental regulations encourage the adoption of advanced electrical steel grades. In addition, growth in the construction and automotive sectors supports the uptake of grain oriented electrical steel in both OEM and aftermarket applications.

Grain Oriented Electrical Steel Market Share

The grain oriented electrical steel industry is primarily led by well-established companies, including:

- POSCO (South Korea)

- JFE Steel Corporation. (Japan)

- Tempel (U.S.)

- NLMK (Russia)

- UPG Enterprises LLC (U.S.)

- Baosteel Group (China)

- ThyssenKrupp AG (Germany)

- Tata Steel (India)

- ArcelorMittal (Luxembourg)

- NIPPON STEEL CORPORATION (Japan)

- Cleveland-Cliffs Inc. (U.S.)

- Aperam S.A. (Luxembourg)

- Mapes & Sprowl (U.S.)

- Arnold Magnetic Technologies (U.S.)

What are the Recent Developments in North America Grain Oriented Electrical Steel Market?

- In October 2023, U.S. Steel officially opened its non-grain oriented (NGO) electrical steel line at the Big River Steel facility in Osceola, Arkansas. With an annual production capacity of 200,000 tons, this state-of-the-art line produces InduX steel—an ultra-thin, lightweight material tailored for electric vehicle motors, generators, and transformers. The expansion reflects a major domestic investment in advanced steelmaking technologies and supports the growing demand for high-efficiency materials in clean energy applications. While not directly related to grain-oriented electrical steel (GOES), this move signals broader momentum in the U.S. electrical steel market

- In January 2023, the U.S. Department of Energy (DOE) proposed new energy efficiency standards for distribution transformers, aiming to significantly reduce energy losses across the grid. The draft rule suggested that nearly all new transformers should incorporate amorphous steel cores, which offer lower energy losses compared to traditional grain-oriented electrical steel (GOES). This move was driven by supply chain concerns and the need to modernize aging infrastructure, but it sparked debate due to limited domestic production capacity for amorphous steel and potential disruptions to existing GOES-based manufacturing lines. The proposal marked a pivotal shift in the electrical steel market, signaling broader adoption of high-efficiency materials and influencing future transformer designs

- In May 2021, Aperam signed a Share Purchase Agreement to acquire ELG Haniel GmbH from Franz Haniel & Cie. GmbH for an enterprise value of USD 389.13 million. ELG, a global leader in stainless steel and superalloy recycling, operates across 52 locations in 18 countries and processes over 1.3 million tonnes of materials annually. This acquisition placed Aperam at the heart of the circular economy, enhancing its environmental footprint and supporting CO₂ reduction goals. By integrating ELG into a new “Recycling” segment, Aperam strengthened its global supply chain and competitiveness, with potential ripple effects on the North American grain-oriented electrical steel market

- In March 2021, Arnold Magnetic Technologies acquired Ramco Electric Motors, Inc., a manufacturer of stators, rotors, and complete electric motors. This strategic move expanded Arnold’s product portfolio and deepened its relationships across industrial, aerospace, and defense sectors. Ramco’s expertise in electric motor solutions complements Arnold’s engineered magnetic technologies, enabling the combined entity to offer more comprehensive, turnkey systems. The acquisition also positions Arnold to better serve the growing demand for high-efficiency motors, where grain-oriented electrical steel (GOES) plays a vital role in performance and energy savings—especially in North American markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Grain Oriented Electrical Steel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Grain Oriented Electrical Steel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Grain Oriented Electrical Steel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.